Fundrise is my favorite private real estate investing platform. They specialize in Sunbelt residential and industrial real estate. The company began in 2012 and has grown exponentially. Fundrise has surpassed $7 billion in total asset transaction value and now has over 400,000 active investors. This article takes a deep-dive look at Fundrise's historical performance and Fundrise returns overall.

What's great about Fundrise is that it is a vertically integrated real estate investing platform. This means that it sources its deals, manages its properties, and raises its own funds. As a result, there is more operational efficiency investing in Fundrise versus other platforms, which act as middlemen. Fundrise has consistently been a pioneer in the space with its eREIT products and Opportunity Funds.

For background, I have personally invested $953,000 in private real estate funds and individual deals since 2016. I've shared my key takeaways after investing in private real estate for over five years. And my Fundrise returns and private real estate returns overall have been very positive.

In addition, I started Financial Samurai in 2009. This site is now one of the largest independently owned personal finance sites with about one million organic pageviews a month. I spent 13 years working in investment banking. And real estate accounts for about half of my current $350,000 annual earnings in passive investment income.

Now, let's dive into the details of recent and historical Fundrise returns.

Fundrise Returns Compared To Stocks And Public REITs

One of the main reasons why I invest in Fundrise and other private real estate investments is due to lower volatility, potential outperformance, diversification, and 100% passive income and distributions.

Public REITs can be highly volatile and actually declined more than the S&P 500 during the March 2020 stock market meltdown. In the 2022 bear market, public REITs also underperformed the S&P 500. As a result, investing in public REITs is not a good way to minimize portfolio volatility.

Fundrise is preferable and their performance proves it. Here are the latest Fundrise returns.

Fundrise Returns 2023

Here are the Fundrise returns through September 29, 2023. The Fundrise Flagship Fund is down 6.7%, outperforming the Vanguard REIT ETF, VNQ, down 30.2%.

However, the Fundrise Income Fund is up 10.2% given higher lending rates.

Performance has picked up through December 2023, and real estate prices look to rebound in 2024 as the Fed cuts rates and the S&P 500 potentially returns to all-time highs.

Fundrise Returns 2022

In 2022, Fundrise returned 1.5% overall compared to -25.10% for Public REITs, -18.11for Public Stocks net of dividends, and -11.99% for Bonds net of coupon payments.

2022 was clearly a difficult year for risk assets overall. However, Fundrise overall significantly outperformed due to:

- Lower leverage (40% LTV vs. 70%+ other funds)

- A concentration of single-family and multi-family property, which outperformed other commercial real estate

- A concentration of properties in the Sunbelt / Heartland, which saw strong rent growth

Fundrise Returns In 2021 And Prior Years

In 2021, Fundrise returns were 22.99% versus 39.88 for Public REITs and 28.71% for the S&P 500.

In 2020, Fundrise returns were 7.31% versus negative 5.86% for Public REITs and 18.4% for the S&P 500.

Before the pandemic in 2019, Fundrise returns were 9.16% versus 28.07% for Public REITs and 31.49 for the S&P 500. Fundrise underperformed the S&P 500 because the S&P 500 went up a significant amount. However, Fundrise still returned a stable 9.16%. If you don't like volatility, Fundrise is a good investment option.

Fundrise Returns During Bear Markets

If you notice from the Fundrise returns chart, Fundrise tends to significantly outperform during bear markets. A return of 5.4% through Q3 2022 versus a negative 23.87% return in stocks is an astounding 29.27% outperformance.

A return of 1.5% for the entire 2022 is over a 26% outperformance versus Public REITs and a 20% outperformance over the S&P 500.

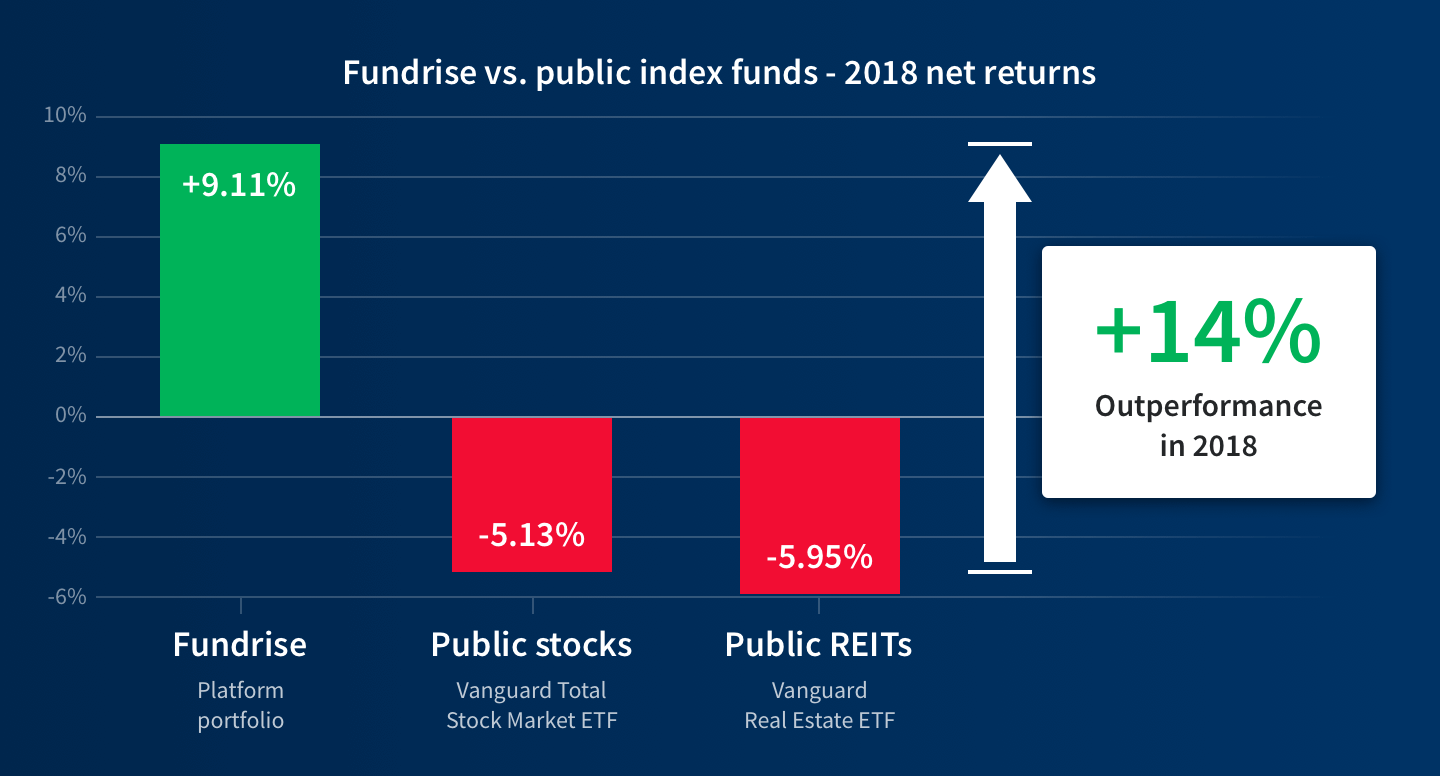

In 2018, Fundrise returns were a strong 8.81% versus negative 4.10 for Public REITs and -4.38% for the S&P 500. Therefore, investing in Fundrise has proven to be a good way to diversify your portfolio during downturns.

The main reasons why Fundrise outperforms during bear markets are as follows:

- Invest in undervalued properties in the Sunbelt

- Buy and hold properties for rental income, which is much stickier

- Buy and rehabilitate properties to boost property values and rents

- Experienced management team that is able to identify strong buying opportunities

- Fundrise is easily able to raise funds to purchase properties with cash

- However leverage

As a early retiree who is focused on generating 100% passive income so I can raise my children and do what I want, Fundrise helps fill my investing needs. I'm not looking for aggressive returns. Instead, I'm looking for stable returns no matter the economic environment.

I'm a strong believer in investing in the heartland of America. Work from home is here to stay post pandemic. Further, technology and the internet is only getting better and more efficient. As a result, more people will logically relocate away from high-cost areas of the country to low-cost areas of the country.

Investing in heartland / sunbelt real estate is a long-term, multi-decade trend I want to be a part of. Other savvy investors also believe in this trend, which is why a tremendous amount of capital has gone inland.

My Fundrise Returns After 5+ Years

After publishing my piece on investing in long-term trends in the heartland, I decided to invest in the Fundrise Heartland eREIT fund at the end of 2016. The Heartland eREIT focuses on a balanced approach of acquiring both debt and equity investments in commercial real estate assets located primarily in the Midwest region.

Here are my Fundrise returns as of 4Q 2022:

- 2017: 8.1%

- 2018: 5.7%

- 2019: 7.3%

- 2020: 8.1%

- 2021: 41.7%

- 2022: 10.2%

- All time – 12.6% (annually)

2021 was clearly a banner year with a 41.7% increase because so many people relocated to the heartland. Once the pandemic began, droves of people relocated away from expensive coastal cities to the midwest region.

Such robust returns will unlikely happen again. But this massive return shows how patiently investing and waiting can pay off big. It often takes time for investors to recognize a trend. To make outsized returns, you've got to take an earlier leap of faith.

I'm also pleased my Fundrise portfolio was up 10.2% for 2022 while the S&P 500 was down over 18%. This is exactly the type of outperformance I was hoping for when I first invested. I want investments that zig when my stocks zag. The current dividend is about 2%.

For more details, please read our extensive Fundrise Review and Fundrise Overview.

Fundrise Historical Performance Data

You can also check out Fundrise's historical performance directly on their site. Given Fundrise has many diversified funds, each client's returns will be different. However, overall, you can see Fundrise returns in aggregate.

Below is a chart that shows the real-time returns of Fundrise client accounts. It is updated daily and displays over 435,000 accounts. As an investor, you want to invest for as long as possible to let compounding work in your favor.

Fundrise offers a few different plans or portfolios based on your goals. You can invest for income, growth, or a combination of both. Additionally, each investor’s portfolio will differ because of the timing of when they started investing.

As you look at the historical Fundrise returns, please remember that your returns will vary. During a bull market, growth funds will tend to outperform income funds. During a bear market, balanced and income funds will tend to outperform growth funds.

Historical Fundrise Returns And Charts for 2019 And 2018

Here are some additional graphics and data points on Fundrise returns from 2018 and 2019.

The stock market was extremely volatile in 2018, correcting by almost 20% in the fourth quarter alone after a 10% correction in February. It's a curious case when stocks tend to take the stairs up, but the elevator down.

In comparison, Fundrise investments are much more stable because they are based on real assets that generate rental income.

During the 2008-2009 financial crisis, my property rents remained unchanged because my tenants signed a one year lease.

By the time the financial crisis was over, my tenants were on month-to-month contracts. Since they didn't lose their jobs, my rental income continued as usual until I raised the rent by 5% – 8% in 2011.

Compare this steady comparison to a 35% – 40% correction in the S&P 500 and a massive cutting of dividends, my real estate portfolio provided a much more stable and stress free investment.

From the beginning, Fundrise has leveraged technology to enable investors to purchase real assets directly, at lower costs, closer to true intrinsic values, and as a result generate higher potential yields.

Fundrise Five-Year Net Returns 2014-2018

The Fundrise platform achieved, on average, a 10.79% net annualized return over the five years from 2014-2018, more than 2.75% higher than either the Vanguard Total Stock Market ETF or the Vanguard Real Estate ETF during the same time period.

See the chart below for more details.

As you can see from the chart, Fundrise returns have been much more stable than returns from public stocks and public REITs.

As we all know, past performance is not indicative of future results. It is up to the Fundrise asset management team to highlight and invest in properties at reasonable prices in a more difficult return situation. Here is another historical chart of Fundrise's performance versus the stock market and Vanguard Real Estate ETF.

By generating a strong 6-year return, Fundrise took a huge step forward in proving out what they have believed for so long: that a model of individuals diversifying into real estate through a direct, low-cost technology platform is a superior investment alternative to owning only publicly traded stocks and bonds.

Please note that publicly-traded REITs were MORE volatile (declined more) when stocks plummeted in March 2020. Getting real estate diversification through REITs doesn't work, at least not recently.

2015 Performance Data

The below chart compares the performance between real estate and the S&P 500 as of the end of 2015. I was surprised to see such massive outperformance by the FTSE NAREIT ALL REITs asset class. But I supposed it made sense because after the NASDAQ bubble burst in March 2000, real estate started taking off partly because the Fed aggressively lowered interest rates, and partly because equity investors looked at hard assets to park their money.

Here's another chart highlighting Fundrise's 2015 returns versus the S&P 500, NAREIT Composite Index, and NASDAQ. With my personal investment return goal of 3X the risk-free rate of return (10-year bond yield), anything above 6% looks attractive, depending on risk.

The approximate 13% net average annual return for 2015 is representative of the aggregate historical operating results from 2015 for 43 individual investments offered under Reg D. Their eREIT model gives all investors access to a diversified pool of quality commercial real estate. In their first full quarter of operations the Income eREIT earned an approximate 9.7%.

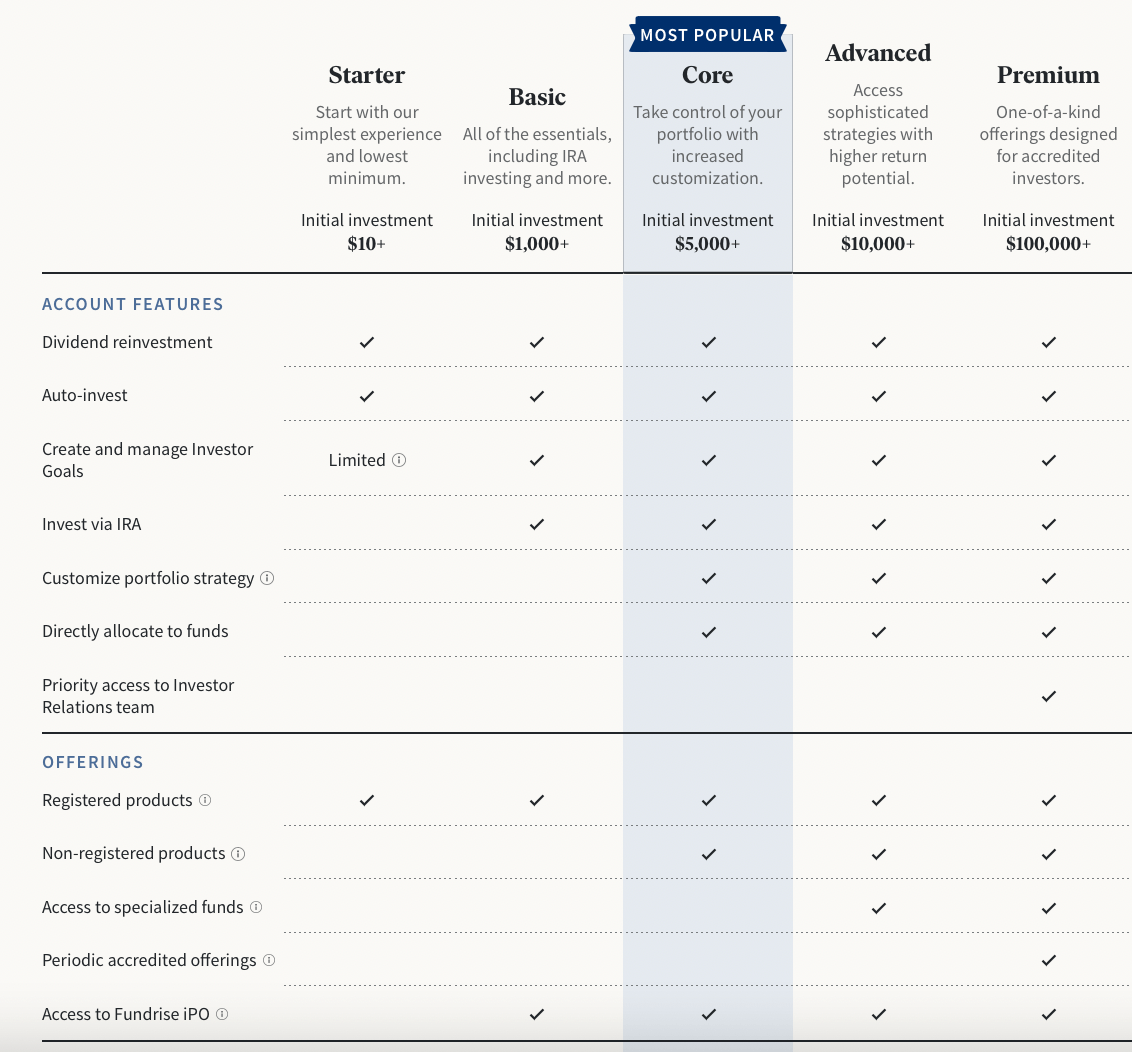

Fundrise Plans and Portfolios

Fundrise has changed the way they offer their portfolios. In the past, you could invest in funds that invested by region. But as Fundrise has grown, they decided to offer funds based on investment objectives. Below are the five fund offerings. You can click the image to learn more.

- Starter – For those just starting off, the Starter portfolio is the most straightforward portfolio. You can invest with as little as $10.

- Basic – For those who want to invest with $1,000 or more, go with the Basic. You can invest using an IRA and more.

- Core Strategy – If you want to invest at least $5,000, this offers increased customization. It's the most popular of the five account types.

- Advanced – If you have at least $10,000 to invest and are looking for income and higher returns, this portfolio is most suitable.

- Premium – If you are an accredited investor with at least $100,000 to invest, this portfolio offers both growth and income. It has the most account features and offerings.

You can learn more about these strategies at Fundrise’s website.

Common Questions Asked About Fundrise

What is the management fee?

The annual advisory fee is 0.15% and annual asset management fee is up to 0.85%. These fees are at least 50% lower than traditional private real estate investment funds.

How long should I invest in a Fundrise fund?

The recommended investment time frame is five years or longer. Long-term investor enables investors to earn compound returns. Therefore, please invest only with money you don't need for five years.

Does Fundrise pay a dividend?

Yes, Fundrise investors receive dividends quarterly, assuming the portfolio produces the cash to support dividends. Balanced and Income portfolios pay dividends. Investors can obtain the dividends as cash or have them automatically reinvested. In general, I recommend reinvesting dividends.

How is Fundrise taxed?

Dividends earned from Fundrise investments are taxed as ordinary income, which is true for all REITs.

What is the minimum investment amount?

$10. Fundrise used to have a minimum investment amount of $1,000, then $500, and now only $10. The reason Fundrise can offer institutional quality access for such a low minimum is due to its technology and scale.

How are dividends and returns taxed?

You will receive a 1099-DIV tax form. The income and returns are taxed as ordinary income.

How risky is Fundrise?

Based on my experience, Fundrise is less risky than stocks and public REITs. You can see the performance numbers for yourself above. Fundrise is much less volatile than stocks and public REITs as well.

Invest In Only High Quality Investments

I'm bullish on the heartland of America. I believe there will be a multi-decade migration trend towards the heartland due to the desire for both companies and employees to lower costs.

For example, Google is spending $13 billion to build new data centers and offices in Nevada, Ohio, Texas, and Nebraska. The company also doubled its workforce in Virginia, providing greater access to Washington, D.C., with a new office and more data center space, and expanded its New York campus at Hudson Square.

There is no reason that expensive cities such as San Francisco, Seattle, Los Angeles, and New York City should have a monopoly on tech innovation. When you've got to pay $4,500 a month to rent a two bedroom apartment, living in San Francisco and paying San Francisco wages becomes uncompetitive.

I personally sold my expensive San Francisco rental property for 30X annual rent ($2,740,000) in 2017 and reinvested $550,000 of the $1,800,000 in proceeds in real estate crowdfunding.

As a busy father, I don't have the time nor the patience to manage physical real estate anymore. I'd much rather earn rental income passively in a much more diverse portfolio instead.

With the Fed hiking rates and unloading their balance sheets, growth is expected to slow in the US economy. Therefore, I highly encourage investors to focus on real estate investments with low valuations and high net rental yields. Most of these investments I've found are in the heartland.

Open An Account With Fundrise For The Long Term

My experience investing with Fundrise has been great so far. I have followed them since 2015 and have watched them innovate and grow.

With an over $7 billion real estate portfolio, Fundrise has grown into one of the largest private real estate investing platforms. As a result, they can use their brand and capital to potentially purchase more deals at favorable prices.

Plus, with a 10-year track record of operation, Fundrise is here to stay. I've spoken to Ben Miller, the CEO and co-founder of Fundrise multiple times. I'm impressed with his ability to invest prudently in various economic environments.

Ben has always been more cautious and measured than most CEOs, which is exactly what I want. There are plenty of CEOs and investors who are cheerleaders and permabulls, which can be dangerous.

If you're looking for alternative investments away from stocks, bonds and public REITs, and to earn less volatile returns passively, explore all that Fundrise has to offer.

Fundrise has democratized access to commercial real estate that was once only accessible to ultra high net worth individuals or institutional investors. Take advantage of innovation and technology. Please do your own due diligence before making any investments.

Fundrise is a sponsor of Financial Samurai and Financial Samurai has invested over $134,000 in Fundrise funds. Sunbelt real estate has lower valuations and higher yields. It is a great way to diversify away from expensive San Francisco real estate, where Sam owns multiple properties.

Financial Samurai is one of the largest independently-owned personal finance sites in the world. It was started in 2009 to help readers slice through money's mysteries. Sam is a 26-year financial veteran who writes from firsthand experience. He has invested $810,000 in private real estate since 2016.