A Grantor Retained Annuity Trust or GRAT is a way to transfer future gains tax-free to your heirs. If you're blessed with a lot of assets, setting up a GRAT may save you millions in estate taxes.

As responsible parents, my wife and I set up a revocable living trust. In case of our untimely demise, our children will be protected and taken care of. Going through public probate court is not only a hassle, but a violation of our financial privacy.

When I asked my centi-millionaire buddy what type of estate planning he does, since his net worth is well over the estate tax exemption amount per person of $13.99 million, he said a main strategy he uses is the Grantor Retained Annuity Trust or GRAT.

If the GRAT is set up and executed properly, a significant amount of wealth can move down to the next generation with virtually no estate or gift tax ramifications.

Let's learn how a GRAT works with a couple of examples that show how millions of dollars can be saved in estate taxes.

How Does A GRAT Work?

You, the grantor, transfer assets to a trust (GRAT) and retain the right to receive an annuity payment for a term of years. At the end of the term, the assets remaining in the GRAT are distributed to your children (or other beneficiaries).

The transfer to the GRAT will trigger a gift tax event. However, the value of the taxable gift is not the value of the assets transferred to the GRAT. Instead, the gift is reduced by the actuarial value of the annuity you retain.

If the annuity is structured properly, it equals the value of the assets, and there is no gift. This is referred to as a “zeroed-out” GRAT.

The amount of the annuity payment that is required to be paid to the grantor during the term of the GRAT is calculated by using an interest rate the IRS determines monthly called the section 7520 rate.

The section 7520 rate for January 2021 is 0.6 percent. The global pandemic led rates to drop significantly in 2020. But the section 7520 rate has increased a lot since then given elevated inflation and multiple hikes in interest rates. As of December 2024, the interest rate is 5.04%. See the latest interest rates from the IRS here.

Here is a chart of the historical annuity payments from the IRS.

GRAT Set Annuity Payment = Section 7520 Rate

The grantor should set the annuity payment equal to the section 7520 interest rate and no higher because a higher annuity payment simply means more taxable income.

The grantor's goal is to make the spread between the 7520 interest payment and the annual return on the asset getting transferred into the GRAT as high as possible. This spread will ultimately be the value of the tax-free gift when the grantor passes away.

The grantor sets up a GRAT because s/he is betting the assets transferred into the GRAT will appreciate in value above and beyond the section 7520 interest rate.

So while the grantor will receive the annuity payments and pay taxes on those payments, the beneficiaries of the GRAT will receive the underlying GRAT assets at their value. It's the value of those assets that will appreciate over and above the section 7520 rate.

A GRAT Example Using A Home

My buddy set up a GRAT to pass his home to his kids. He put his then $10 million home into a GRAT in 2010 when his kids were in elementary school.

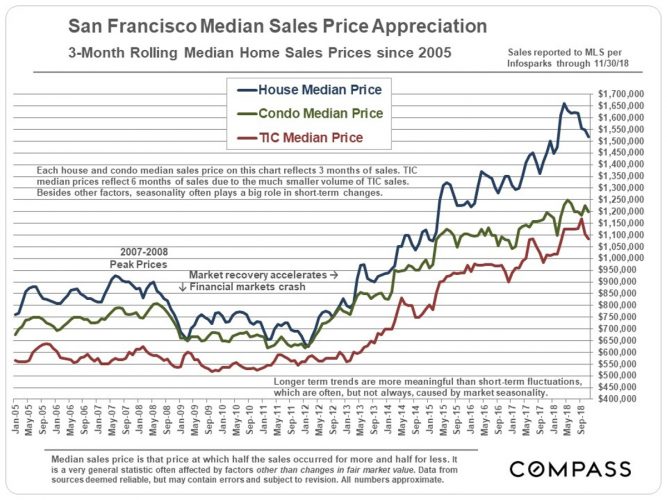

At the time, the 7520 rate was 2%. He made a bet that San Francisco real estate would appreciate quicker than the 2% annual annuity payment.

Given the historical annual appreciation of San Francisco real estate has been closer to 8% a year, my friend made a wise move. Check out the appreciation chart since 2010.

When I spoke with him in 2019, his $10 million home was worth closer to $18 million, which is indeed about a 8% compound annual rate of appreciation.

Essentially, he has been gifting his kids 5% – 6% of appreciated value each year on average since 2010, or roughly $5 – $5.5 million worth of estate value tax-free for a $2 – $2.2 million tax savings.

There's no free lunch. But there is $1-$1.2 million in estimated estate tax savings in this example. The longer the appreciation time period over the 7520 rate, the greater the tax savings.

Note: This info is based on what my buddy has told me. The bottom line is that a GRAT is an effective wealth transfer strategy to transfer appreciation out of a person’s estate. I can't vouch for his numbers. See in the comments section a good GRAT example from Mark, a CPA who works in estate planning.

A GRAT Can Hold Virtually Any Asset Type

In addition to potentially high performing real estate, virtually any type of asset can be transferred into a GRAT which you think will outperform the annuity interest rate over the long term.

A stock portfolio could easily be another example given the S&P 500 has historically returned much higher than the section 7520 rate. But let's talk about transferring a high growth business into a GRAT instead.

One popular option is to transfer non-voting stock in a closely-held business to the GRAT while retaining all (or a controlling interest in) the voting shares. This works particularly well with S-Corporation stock and pre-IPO company shares expected to do well.

We know from the net worth composition by wealth chart the richer you are, the larger the Business Interests percentage is to your overall net worth. By the time you're a billionaire, your net worth is comprised mostly of Business Interests.

A GRAT Example Using A Private Business

For example, I could transfer Financial Samurai into a GRAT and put it in my son's name. Given he's too young to know anything about online media, he'll get non-voting stock, and I would retain control of the business until he's old enough to understand and want someday to take over the business.

Based on history, I shouldn't have a problem outperforming the latest 7520 rate of the GRAT by a wide margin.

For illustrative purposes, let's say Financial Samurai is worth $10 million today and the business grows in value by 20% a year above a 7520 rate of 3.6% for 10 years. In 10 years, the business would be worth $83,211,799.

I'd have to pay taxes on roughly $3,600,000 of annuity payments during this time period ($10M X 3.6% X 10 years), which would amount to $1,080,000 in taxes at a 30% effective tax rate.

However, I would be able to transfer $73,211,799 million in wealth to my son and other heirs estate tax-free once the term of the GRAT expires. That would be an estate tax savings of about $29,300,000!

Obviously, growing the value of an already established small business by 20% a year over the 7520 rate of 2% – 4% is no small feat. But it's always good to think big.

With enough discipline, creativity, and courage, anything is possible. Pumped to start a business yet? Makes me want to start another!

More Reasons To Consider A GRAT

Another reason for establishing a GRAT is if you foresee a sale of your business at a big premium in the next few years.

The big premium could be from you undervaluing the value of your business in your estate or through a true market valuation multiple expansion from an interested suitor.

Note: the GRAT is considered a “grantor-type trust” by the IRS. Thus, the tax on any income generated on such a trust is your individual responsibility.

This can enhance trust performance because trust income is not required to be used to pay the taxes on its generated income.

In addition to setting up a GRAT for your children, you might even want to set up a SLAT for your spouse. A SLAT is Spousal Lifetime Access Trust. It is a irrevocable trust where assets get transferred in and all appreciation of such assets are not subject to taxes either.

The Downside Of Using A GRAT

There are three downsides to using a GRAT:

1) The assets transferred into the GRAT could grow at a rate lower than the section 7520 rate. If this is the case, then the trustmaker/grantor will simply receive back the trust property at its depreciated value and will only be out the legal fees that were paid to set up the GRAT.

2) The trustmaker/grantor could die during the term of the GRAT. If this is the case, then all of the property transferred into the GRAT would revert back into the estate of the trustmaker/grantor and be taxable for estate tax purposes, and the trustmaker/grantor will also be out the legal fees that were paid to set up the GRAT.

3) Finally, setting up a GRAT takes research, time, and money. The estate attorney I use charges a couple thousand dollars to set up a GRAT. But as a percentage cost to your estate, it's likely not that much.

Who Is The GRAT Best For?

The GRAT is great for those who have estates or anticipate having estates greater than the current and expected estate tax exemption amount.

Below is the historical gift tax exemption amount per person and its corresponding estate tax rate. As you can see, the Estate Tax Exemption is at an all-time high while the Estate Tax Rate is close to its historical lows. The estate tax exemption is now $13.99 million per person for 2025.

If you expect to die with less than the estate tax exemption amount, it may be better to just create a revocable living trust instead.

If you, the grantor believes the asset transferred into the GRAT will outperform the section 7520 interest rate, that you will live to see the end of the term of the GRAT, and that you will not need the gifted property later in life to pay for living expenses or long-term care, then setting up a GRAT should be a good move.

GRAT Laws Could Change

Just know that the laws can change in the future. For example, President Obama sought to weaken GRATs as an estate reduction tool in his budget proposals throughout his time in office, but failed. The Tax Cut And Jobs Act should theoretically keep the rules in place until December 31, 2025. With Trump back as president in 2025, the GRAT's popularity among high-net worth individuals will likely continue.

The next time you talk to your estate planning attorney, ask him or her about the GRAT. Show them this article and ask them to poke holes at my examples. Then come back and share your wisdom.

When it comes to estate planning, you need to speak with a professional. The only way to benefit is to learn and take action.

Related: Three Things I Learned From My Estate Planning Attorney Everyone Should Do

Recommendation For All Parents

If there's one thing the pandemic has taught us, it's that life is not guaranteed. We must do everything we can to protect our children while they are still dependents.

As a result, please get life insurance. Not only should you get enough life insurance to cover your liabilities, your life insurance term should last long enough to get them through college.

The best place to get life insurance is through PolicyGenius. PolicyGenius will help you find the best plan for the lowest price tailored to your needs. PolicyGenius provides free, no-obligation quotes so you can get the best rate.

After eight years of owning life insurance, my wife decided to check on PolicyGenius for free to see if should could do better. Lo and behold, my wife was able to double her life insurance coverage for less money. All this time, she thought she was getting the best deal with her existing carrier.

Click on the life insurance calculator below to get your own quotes on Policy Genius today.

If you don't have life insurance, please get life insurance before you need to. Life insurance gets more expensive the older you get. If you get sick, depending on the severity of your sickness, you might not be able to qualify.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Great info on GRAT!

Who is the attorney that sets up your GRAT?

The biggest issue I see with the SF home in a GRAT strategy is the potential to trigger a real estate tax reassessment on the property. Real bummer if your tax basis goes from $10Mm to $18MM based on the transfer. For those not in CA; Prop 13 allows assessments to rise by no more than 2 percent per year until the next sale.

Having a large estate is a great problem to have that is reflected by your hard work!

Have you looked into other options such as FLP where you discount your share to your heirs as limited partners which may be an easier solution than GRAT?

How do you choose an attorney to design a qualified GRAT and how do you decide which format—a serial GRAT or a singular one—when there is a married couple in community property state but one of the couple has a much larger share of the assets in an IRA?

We have a CPA financial advisor and have created an Insurance Trust that we fund with tax-free gifts each year for our two adult children…but we also have assets at current estate threshold…

A point of clarification on the GRAT and another example:

You transfer $100 to a two year term GRAT for the benefit of your kids. Making numbers up……but based on the 7520 rate you are required to receive an annuity of $52 each year (typically the annuity is graduated so the GRAT has more leverage but ignore that).

Year 1 you receive the $52 annuity payment. Because the GRAT is disregarded for income tax purposes the payment from the GRAT to you is disregarded – no income tax consequences. If the $52 annuity paid to you isn’t cash or marketable securities it needs to be valued so that the appropriate amount is transferred back to you. At this time say the $100 originally transferred to the GRAT has appreciated to $120. So now there is $68 in the GRAT with one year remaining.

At the end of year two another $52 is transferred back to you and that is the close of the GRAT. The $68 has now appreciated to $75 and there is $23 ($75-$23) to pass to your kids (beneficiaries of the GRAT)….yay you have a successful GRAT and have transfer $23 of appreciation from your estate to your beneficiaries without using any gift tax exemption. All during the two year term of the GRAT you are paying income tax on any income generated by the GRAT. So if it is a stock (i.e.) Apple the GRAT receives the dividends as they hold the stock but you pay tax on them because the GRAT is disregarded for income tax purposes.

However, the GRAT is respected for estate planning purposes and is a separate legal entity….there is a disconnect between the income tax rules and the estate planning rules which is why the GRAT came into existence.

So if the security doesn’t pay a dividend then you are transferring stock back to the grantor because that is the only asset the GRAT holds. To the extent the security is marketable (traded on an exchange) then you can value the stock using the mean hi/low on the date the annuity is transferred to the grantor. If the stock is a private company then a value needs to be assigned to that stock so you know how much needs to be transferred back to the grantor….to the extent the grantor doesn’t have an appraisal on a hard to value asset (i.e. private company stock) then the service could challenge that the amount of private company stock transferred back to the grantor didn’t satisfy the annuity payment in full.. So if you are required to get $52 and you only transferred $40 back to the grantor then you have made a $12 gift to the beneficiaries without knowing it…the amounts are typically 1,000 times this so the devil is in details with a GRAT and it is all based on administering it properly.

This makes a lot more sense but also directly contradicts much of Sam’s math so hopefully he updates his article for the benefit of those who don’t read the comments. It wouldn’t make much sense to only have the trust pay out the expected interest and allow all the principal to go to the heirs tax free.

Is the 7520 rate for the GRAT determined and fixed at the time you create it or does it float with the new numbers published each month? If people who set one up in 2012/2013 got to lock in that low 1.x% rate for the duration of the GRAT they could have made a lot of tax free money for their kids.

The 7520 rate utilized for the GRAT is based on when the assets are transferred to the GRAT. Yes, we were in a period of historically low interest rates making this and many of the estate planning strategies based on the rates more appealing due to a lower hurdle rate.

In the case of your friend who put their house in a GRAT where does the income for the annuity payment come from? Reverse mortgage?

To a few of Sam’s points: Among estate freezing techniques (methods for removing asset values from an estate and getting the asset value and growth in value of the asset to heirs) the GRAT is codified by the IRS making it a blue chip strategy. Other methods used commonly, such as sales to a defective trust, work well, are flexible and may remove more value from the estate but rely on IRS private letter rulings which the people in the industry do but is riskier to defend. The GRAT is a more conservative strategy.

And–to reduce risk of premature death resulting in asset values reverting to the estate, use short term GRATS and link them, called serial GRATs. Instead of GRATting Financial Samurai to Sam’s son using one GRAT over 10 years, he could do it with 2x five year GRATs, or 5x two year GRATs. Term life insurance is also used with GRAT planning to guarantee a certain value will be passed to heirs even in the case of an unexpected passing.

Great tip on Serial GRATing! More flexibility too in case of a business sale. Will discuss with my estate planning.

What is your background?

Hi – Tom – is there anyway to set up a GRAT, have the asset be transferred over to the beneficiaries at the end of term with all the tax benefits discussed in this article, but yet the grantor continues to receive the cash flows or annuity from the asset?

So in Sam’s buddy’s case, at the end of the GRAT, is there any way for his buddy to still get the rental income from the $18 million home after the house has been transferred to his kids?

Hi Sport of Money, thanks for your follow up. I don’t know how you could do what you suggest using a GRAT. The trust created by the GRAT is irrevocable and assets contributed to it are owned by the trust for the benefit of trust beneficiaries. That’s its purpose–transfer assets to heirs in a tax efficient way. A GRAT is not designed to provide ongoing income to the grantor after the term of the GRAT ends. Plus–income received by the grantor on assets contributed to an irrevocable trust (and therefore no longer owned by the grantor) could be viewed by the IRS as an incident of ownership which could in their view draw those assets back into the estate.

Your question is what makes estate planning interesting! There is possibly a way to do what you ask, I just don’t know it. It’s also possible someone creative and talented might disagree with me and find a way to make a GRAT work for you. There are other planning strategies that might accommodate your idea, I thought about them awhile and did brief research and couldn’t come up with a way. But keep asking around.

Thanks for explaining GRATs in such detail! I read about them once before and was completely confused. Now I can actually grasp how they work and why people use them. It’s pretty fascinating how many different ways there are to get tax savings if you go about it right. Really shows that knowledge truly is power and a means to grow wealth.

What level of net worth do you feel this would be a worthwhile vehicle to explore?

I am currently in the process of trying to start an estate plan and appreciate all the help you have given with potential items to look for.

The GRAT is great for those who have estates or anticipate having estates greater than the current and expected estate tax exemption amount.

Although it is at $11.4M per person now, it could go way down after 2025.

Very nice article! Thanks for all your financial wisdom over the years. You have been an invaluable resource in how to best manage personal wealth. Keep it up!!

Great article – was not familiar with this vehicle.

Appreciate all the articles and good information you pass along. Keep up the great work, it motivates and helps a lot of people. I have several buddies who now subscribe and we discuss your articles at the gym.