Let's look at the historical bond versus stock performance from 1999 – 2019. This 20-year period was a highly volatile one. So was 2020, with the S&P 500 correcting by 32% in March only to close the year up 165.

Investing in bonds is an integral part of a well-diversified portfolio. The older, richer, and more risk-averse you are, the higher your bond weighting should be.

Bonds don't get as much love as stocks because they are considered boring. It's hard to get rich quick off a bond with an average return of only ~5.3% a year. But it is possible to see a quick windfall if you pick the right high-flying stock.

What investors may not realize is that bonds not only provide stable income, bonds have actually performed quite well compared to stocks since 1999.

In 2020, bonds rocketed higher due to massive uncertainty in the economy and the stock market due to the coronavirus pandemic. Below is an example of various bond performance during the height of he volatility in 2020.

Historical Bond Versus Stock Performance

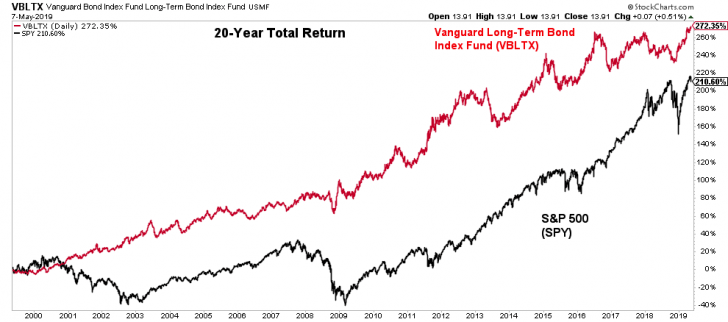

Take a look at the 20-year total return of the Vanguard Long-Term Bond Index Fund (VBLTX) versus the S&P 500 Index ETF (SPY). VBLTX is considered a proxy for the entire US bond market. The ETF has about $11.5 billion in assets and a 3% yield as of 1H2020.

As you can see from the chart, sometime around 2001, VBLTX started to outperform the S&P 500 and it never stopped outperforming. The historical bond versus stock performance perception is always skewed towards stocks outperforming for some reason.

The total return for VBLTX from 1999 – 2019 was 272% versus only 210% for SPY. While VBLTX's outperformance is surprising, what's even more surprising is the magnitude of the outperformance of 62%.

Of course, using a different bond investment may yield different results. If you use VBMFX (bonds) and VTSMX (stocks), bonds outperformed the stock market from 2001 to about 2013, or 12 years. Since 2013, stocks have outperformed.

In other words, bonds outperformed stocks about a 2:1 ratio during this 20-year time period. The historical bond versus stock performance perception should slowly tilt more favorably towards stocks.

Looking at the above chart should actually make stock investors hesitant to put more into stocks versus bonds. The old adage of buying low and selling high holds true.

Worst Year Of Performance For Stocks And Bonds

In addition to bonds providing a steady return and steady income stream, bonds are also far less volatile as you can tell from the chart above.

Once you've amassed enough money to not have to work a day job, one of your key objectives is to put your money on autopilot so you can live your best life without having to worry about money.

Below highlights the worst year for bonds was a 2.9% decline in 1994. The worst year for stocks was a 38% decline in 2008.

A negative 2.9% loss as the worst year means that bonds performed better than negative 2.9% in 2008, the worst financial crisis year in modern history. After adding back the interest payment, VBLX was only down about 1.5% in 2008. I'm sure everybody can sleep well at night only losing 1.5% in the worst financial crisis in modern history.

If you've already won the financial game, you should really appreciate the peace of mind and the higher certainty of getting a 4% – 6% return rather than shooting to try and get a 10%+ return while potentially risking losing 10%+ as well.

Let's say you have a $3 million net worth and happily live off $100,000 a year. If you can get a highly probably $120,000 – $180,000 a year before taxes investing all your money in bonds, why wouldn't you? You have already decided $100,000 is what it takes to make you happy.

Making potentially $300,000 won't make you happier by investing all in stocks. But if you lost $300,000 and now have a portfolio of $2,700,000, you might start getting unhappy because it took you years to accumulate $300,000 in investments. You don't want to risk your freedom by having to go back to work.

Interest Rate Risk Is Overblown

Ever since I started working in finance in 1999 there's been a plethora of warnings about interest rates going up by overpaid Wall Street economists and strategists. And if interest rates go up, bond prices get hit. Yet, interest rates continue to defy forecasts and move down.

I will reiterate my strong belief that interest rates in America will stay low for the rest of our working lifetimes.

There is no reversing technology that allows information to flow instantaneously to make better macroeconomic decisions.

It will take beyond our lifetimes for the US dollar to lose its stranglehold as the world's most sovereign currency.

Foreign entities that try to aggressively unwind US Treasuries will suffer self-inflicted wounds to the rest of their US asset portfolio.

Thanks to globalization and immigration, we have successfully imported deflation to make our goods and services more affordable. Electronic goods and manual labor have never been cheaper.

The only real inflationary concern left for consumers is healthcare costs. Looking at how unfit our nation has become, something has to give. College tuition is out of control too, but the internet is making education free so I'm not as concerned.

Below is the conventional asset allocation model for stocks and bonds by age. To learn about different asset allocation models based on your risk tolerance or lifestyle I've suggested more in this article.

Take Advantage Of Lower Rates

An increase in bond prices over time is also a reminder of a decrease in interest rates over time. The better bonds perform in any given year, the lower interest rates go.

The 10-year yield is still under 1.5% in 2021. As a result, everybody should be refinancing their mortgages and other debt.

A refinance boom makes it easier to afford real estate meaning that incremental demand is entering the real estate market. The real estate market is also a vital part of the American economy, which means the chance of a housing bust and a recession declines as credit gets cheaper.

If you've been looking to refinance or purchase a property, now is the time to check for the latest rates online with Credible. They have one of the largest online lending marketplaces today. It's free and easy to get a free quote to see how much you can save.

I refinanced my expiring 5/1 ARM in 2019 to a new 7/1 ARM at a rate of only 2.75% all fees baked in + $2,200 in credit. That's right, no fees to refinance plus money that will be used towards paying down my new loan!

In 2020, I got a new 7/1 ARM jumbo mortgage to buy a new home for only 2.125% with minimal fees. And in 2021, you can continue to get a great rate. The 30-year fixed rate and 15-year fixed rate look especially attractive.

If you haven't refinanced recently, I highly suggest you check the latest lates with Credible. Credible has quality lenders all competing for your business so you can get the best rate possible, with no-obligations.

Investing In Bonds Is Important

Making money through bonds while also increasing your cashflow by refinancing your mortgage are two reasons why bond investing is so important. When you can combine making money with saving money, you have hit a personal finance jackpot.

If you can also hold onto your property for the long term, you should also see an appreciation in your property's value as more buyers enter the market. Mortgage rates and lending standards are key determinants to the price of homes, along with job growth and demographic trends.

The last thing you want to do is be a renter who does not invest in bonds or stocks or any investment that tends to appreciate over time. You will eventually experience a triple loss as asset prices will likely run away from you.

Refinance Your Expensive Debt

With rates so low, you should highly consider refinancing your expensive student loan, mortgage, or credit card debt with Credible. Credible is a top lending marketplace that provides real quotes, all in one place. They have highly qualified lenders competing for your business. It is the efficient way to get the best deal out there.

About the Author: Sam worked in investing banking for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income largely thanks to real estate crowdfunding.

He spends time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month. Historical bond versus stock performance will continue to change over time.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.