The proper asset allocation of stocks and bonds by age is important to achieve financial freedom and stay retired. If you allocate too much to stocks the year before you want to retire and the stock market collapses, then you're screwed. If you allocate too much to bonds over your career, you might not be able to build enough capital to retire at all given you may underperform dramatically.

Just know the proper asset allocation is different for everyone. There is no “correct” asset allocation because everybody has different earnings power, different risk tolerances, and different needs. We are all at different stages of our financial lives. Therefore, know thyself!

Although there might not be a proper asset allocation, there is, however, an optimal asset allocation by age I'd like to share in this post. An optimal asset allocation is where you have greater than a 70% chance of achieving your financial objectives. My recommended asset allocation should be relevant for most financial circumstances.

As someone who worked in finance for 13 years, got my MBA from Berkeley, and has written over 2,500 personal finance articles on Financial Samurai since 2009, the topic of asset allocation is one of the most important. I retired in 2012 at the age of 34, and have relied on a proper asset allocation to generate livable passive income. Now, with two young children and a fellow stay-at-home spouse, our asset allocation is even more important.

Those who do not have a risk-appropriate asset allocation often lose more than they should. And when you lose too much money, you ultimately lose time, the most valuable asset of all.

Proper Asset Allocation And Risk Tolerance

Your asset allocation between stocks and bonds first depends on your risk tolerance. Are you risk averse, moderate, or risk loving? Are young and full of energy? Or are you old and tired as hell?

I'm personally extremely tired due to raising two kids during a pandemic. Therefore, I'm relatively conservative. Besides, after such a huge run in the stock market, I'd like to keep most of the gains during the next correction.

Your asset allocation also depends on the importance of your specific market portfolio. For example, most would probably treat their 401K or IRA as a vital part of their retirement strategy. For most, these retirement accounts will become their largest investment portfolios.

However, those who have taxable investment accounts, rental properties, and alternative assets may not find their stock and bond portfolio as important.

For example, I have roughly 50% of my net worth in real estate because I prefer owning a hard asset that is less volatile, provides shelter, and produces rental income. I then have roughly 30% of my net worth in equities. Volatility is something I do not like.

Finally, the proper asset allocation of stocks and bonds depends on your overall net worth composition. The smaller your stocks and bonds portfolio as a percentage of your overall net worth, the more aggressive your portfolio can be in stocks.

The Proper Asset Allocation Of Stocks And Bonds Analyzed

I ran my current 401K through Empower to see what they thought about what my proper asset allocation is. You should do the same thing since it's free. To no surprise, the below chart is what they came back with.

I essentially have too much concentration risk in stocks and am underinvested in bonds based on the “conventional” asset allocation model for someone my age. To run the same analysis on Personal Capital, simply click the “Investment Checkup” link under the “Investing” tab.

I am going to provide you with five recommended asset allocation models to fit everyone's investment risk profile: Conventional, New Life, Survival, Nothing To Lose, and Financial Samurai.

We will talk through each model to see whether it fits your present financial situation. The proper asset allocation will switch over time of course.

Before we look into each asset allocation model, we must first look at the historical returns for stocks and bonds. The goal of the charts is to give you basis for how to think about returns from both asset classes.

Stocks have outperformed bonds in the long run as you will see. However, stocks are also much more volatile. Armed with historical knowledge, we can then make logical assumptions about the future.

Historical Return For Stocks

To determine the proper asset allocation, take a look at the historical returns for stocks. Stocks generally return around 10% since 1926. Below is a chart that shows the historical returns per year for the S&P 500.

Notes On Stocks

- The 10-year historical average return for the S&P 500 index is roughly 10%. The 60-year average is also about 10%, even after the 38.5% drubbing in 2008. However, there are forecasts for much lower returns going forward mostly due to high valuations.

- The S&P 500 has been volatile over the past 20 years. The golden age was between 1995-1999. 2000-2002 saw three years of double digit declines followed by four years of gains until the economic crisis.

- 2020 was another banner year in the stock market, closing up 18%. 2021 saw the S&P 500 increase by 27%. 2022 closed down about 20%. Then 2023 rebounded by 24%, followed by another 20%+ increase in 2024. In 2025, the S&P 500 briefly returned to a bear market thanks to the traders.

- The 32% correction and rebound in March 2020 was the fastest in history.

- Stock market swings are getting larger over time due to technology. As a result, you will likely see a lot more volatility as trades become crowded. Therefore, if you hate volatility, you may want to invest more in bonds or real estate.

If you're trying to reduce your investment volatility, consider investing in private real estate. Real estate tends to outperform stocks during times of uncertainty and chaos because investors want to own bonds or tangible assets. Stocks inherently have no value and can lose value over night, real estate is much more steady.

You can invest in real estate without the burden of a mortgage or maintenance with Fundrise. With about $3 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate in the Sunbelt, where valuations are lower and yields are higher. The investment minimum is only $10, so it's easy for everybody to dollar-cost average in and build exposure.

Historical Return For Bonds

The proper asset allocation must take into consideration bond returns. The average return for long-term U.S. government bonds is between 5% – 6%.

Bonds and interest rate performance is inversely correlated. Since July 1, 1981, the 10-year bond yield has essentially been going down thanks to technology, information efficiency, and globalization. As a result, the 10-year bond has performed well during this same time period.

However, 2022 saw the worst year for bonds in history with the aggregate bond market down about 14%. Therefore, know that even bonds aren't always a low-risk investment either. Take a look at the historical bond market returns.

Below is a chart that shows asset class real returns by decade.

Notes On Bonds:

* Bonds have never returned more than 20% in one year. The two times the BarCap US Aggregate index came close was in 1991 and in 1995 when inflation was in the high single digits. Inflation is now around 2% and is expected to go higher with so much fiscal stimulus under the Biden administration.

* As of 2025, the 10-year bond yield is hovering at around 4.3%, up from a record-low of 0.51% in August 2020, and down from a high of 5% reached in mid-2022. As inflation declines, so will the 10-year bond yield. As of September 2024, the Fed has embarked on a multi-year rate cut cycle, which should be bullish for real estate.

* Bond funds declined dramatically since the Fed started aggressively hiking rates in 2022. Long-duration bond funds like TLT are down over 40%, which shows the risk of owning bond funds versus buying individual bonds and holding them to maturity. But bonds have now rallied with a decline in interest rates.

Below is another chart from Vanguard that shows the historical returns of a 100% bond portfolio, 20% / 80% stocks / bonds portfolio, and a 30% stocks / 70% bonds portfolio.

See: Historical Returns Of Different Stock And Bond Weightings

Example Of Bonds Outperforming

Take a look at the performance of the Vanguard Long-Term Bond Index Fund (VBLTX) versus the S&P 500 ETF (SPY) since 1999. VBLTX has thoroughly outperformed SPY by an impressive 62%. This chart is obviously pre-pandemic. But it serves to demonstrate the power of bonds when interest rates are declining.

Now of course, not all bond funds are the same. Although VBLTX is considered a reasonable proxy for bonds, other bond funds may not perform as well.

Here is another chart showing the performance of the VBMFX, another Vanguard bond ETF versus VTSMX, a Vanguard S&P 500 ETF. In this scenario, bonds outperformed the stock market from 2001 to about 2013, or 12 years. Since 2013, stocks have outperformed.

Bonds don’t get as much love as stocks because they are considered boring. It’s hard to get rich quick off a bond. But it is possible to see a quick windfall if you pick the right high-flying stock.

Despite the lack of sexiness in bonds, if you’re serious about achieving financial independence or are already financially independent, bonds are an integral part of your portfolio.

Not only do bonds provide solid returns, bonds also offer defensive characteristics when stocks are selling off. Here's a detailed post on how to buy Treasury bonds. When Treasury bonds are yielding over 5%, I find them to be very attractive given the long-term inflation trend is around 2-3%.

Conventional Asset Allocation Model For Stocks And Bonds

The proper asset allocation of stocks and bonds generally follows the conventional model.

The classic recommendation for asset allocation is to subtract your age from 100 to find out how much you should allocate towards stocks. The basic premise is that we become risk averse as we age given we have less of an ability to generate income.

We also don't want to spend our older years working. We are willing to trade lower returns for higher certainty. The following chart demonstrates the conventional asset allocation by age. That said, retirement researchers like Bill Bengen, creator of the 4% Rule, has recommended maintaining a 60/40 stock/bond portfolio in retirement.

Candidates For The Conventional Asset Allocation:

- Believe in conventional wisdom and don't want to overcomplicate things.

- Expect to live to the median age of 78 for men and 82 for women.

- Are not very interested in the stock market, bond market, or economics and would rather have someone manage your money instead.

New Life Asset Allocation Model For Stocks And Bonds

The New Life asset allocation recommendation is to subtract your age by 120 to figure out how much of your portfolio should be allocated towards stocks. Studies show we are living longer due to advancements in science and better awareness about how we should eat.

Given stocks have shown to outperform bonds over the long run, we need a greater allocation towards stocks to take care of our longer lives. Our risk tolerance still decreases as we get older, just at a later stage. While in retirement, ideally, returns are conservative, demonstrate low volatility, and generate steady passive income.

Candidates For The New Life Asset Allocation:

- You plan to live longer than the median age of 79 for men and 82 for women.

- Not that interested in actively managing your own money, but depend on your portfolio to live a comfortable retirement.

- Plan to work until the conventional retirement age of 65, plus or minus 5 years.

- Are a health fanatic who works out regularly and eats in a healthy manner. Sugar is synonymous with poison, while raw is synonymous with utopia.

Survival Asset Allocation Model For Stocks And Bonds

The Survival Asset Allocation model is for those who are risk averse. The 50/50 asset allocation increases the chances your overall portfolio will outperform during a stock market collapse because your bonds will be increasing in value as investors flee towards safety.

Bonds can also rise when stocks rise as you've seen in the historical chart above. During the 2008 Global Financial Crisis, a bond index fund only fell by about 1.5%, while stocks declined by 38%. The worst year ever for bonds was in 1994 when bonds fell 2.9%.

For traditional retirees over the age of 60, the general recommended asset allocation is a 60/40 stocks/bonds portfolio.

Candidates For Survival Asset Allocation:

- Believe the stock market has a higher chance of underperforming bonds, but are not sure given historical data points to the contrary.

- Are within 10 years of full retirement and do not want to risk losing your nest egg.

- Depend on your portfolio to be there for you in retirement due to a lack of alternative income streams.

- Are very wary of the stock market because of all the volatility, scams, and downturns.

- Are an entrepreneur who needs some financial safety just in case your business goes bust.

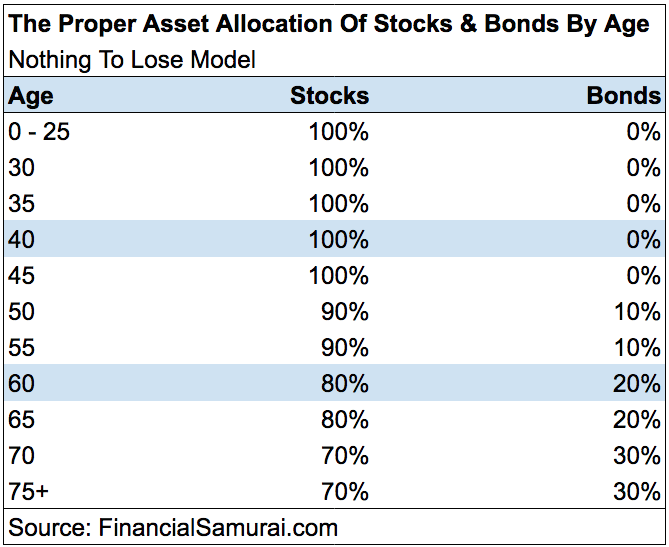

Nothing-To-Lose Asset Allocation Model Of Stocks And Bonds

Given stocks have shown to outperform bonds since 1926, the Nothing-To-Lose Asset Allocation model is for those who want to go all-in on stocks. If you have a long enough time horizon, this strategy might suite you well.

If you also have other income streams, such as rental income, then having a stock-heavy retirement portfolio could be ideal. With other income covering your living expenses, you can afford to take more risk in stocks.

Candidates For The Nothing-To-Lose Asset Allocation:

- You are rich and don't count on your stock portfolio to survive now or in retirement.

- Are poor and are willing to risk it all because you don't have much to risk.

- Have tremendous earnings power that will continue to go up for decades.

- Are young or have an investment horizon of at least 20 more years.

- Believe you are smarter than the market and can therefore choose sectors and stocks which will consistently outperform.

Financial Samurai Asset Allocation Model Of Stocks And Bonds

The Financial Samurai model is a hybrid between the Nothing-To-Lose model and the New Life model. I believe stocks will outperform bonds over the long run, but we'll see continued volatility over our lifetimes. I also believe this is the most proper asset allocation if you consistently read my site.

Specifically, I'm preparing for a new normal of between 7% – 8% returns for stocks (from 8-10% historically). I also expect 2%-4% return on bonds from 4-7% historically. In other words, I believe bonds and stocks are expensive and returns will be structurally lower going forward.

Candidates For The Financial Samurai Asset Allocation:

- Have multiple income streams.

- Is a personal finance enthusiast who gets a kick out of reading finance literature and managing your money.

- Not dependent on your 401k or IRA portfoliso in retirement, but would like it to be there as a nice bonus.

- Enjoys studying macroeconomic policy to understand how it may affect your finances.

- Is an early retiree who won't be contributing as much to their portfolios as before.

- Also invests in real estate to diversify and smooth out the volatility of stocks. Real estate is actually my favorite asset class to build wealth because it is easy to understand, is tangible, provides utility, and has a solid income stream.

- Given a Financial Samurai is a real estate investor, real estate acts as a Bond Plus type of investment. In other words, real estate is defensive during a downturn as more capital goes towards real assets. Real estate also tends to do well as more investors buy bonds, resulting in lower interest rates. At the same time, real estate tends to do well during strong economic growth due to rising rents and rising real estate prices.

The Right Asset Allocation Depends On Your Risk-Tolerance

By providing five different asset allocation models, I hope you are able to identify one that fits your needs and risk tolerance. Don't let anybody force you into an uncomfortable situation.

Ideally, your asset allocation should let you sleep well at night and wake up every morning with vigor. When it comes to investing, you need to calculate your existing investment exposure and invest accordingly.

I encourage everyone to take a proactive approach to their retirement portfolios. Ask yourself the following questions to determine which asset allocation model is right for you.

Questions To Ask To Determine A Better Asset Allocation

- What is my risk tolerance on a scale of 0-10?

- If my portfolio dropped 50% in one year, will I be financially OK?

- How stable is my primary income source?

- How many income streams do I have?

- Do I have an X Factor (ways to make alternative income)?

- What is my Money Strength?

- What is my knowledge about stocks and bonds?

- How long is my investment horizon?

- Where do I get my investment advice and what is the quality of such advice?

Once you've answered these questions, sit down with a loved one to discuss whether there is congruency with your answers and how you are currently investing.

Further, it's important to understand the right order of contributions between your tax-advantaged and taxable investments. You want to take full advantage of your tax-advantaged accounts, while also building up your taxable investments as large as possible. The sooner you want to retire early, the larger your taxable investments should be.

It's important not to overestimate your abilities when it comes to investing. We all lose money eventually, it's just a matter of when and how much. Having a proper asset allocation will improve your odds of building wealth in a risk-appropriate manner over the long term.

Real Estate May Be A Better Alternative To Bonds For Defense And Long-Term Wealth Creation

If you're trying to reduce your investment volatility, consider investing in private real estate instead of bonds. Real estate tends to outperform stocks during times of uncertainty and chaos because investors want to own bonds or tangible assets. Stocks inherently have no value and can lose value over night, real estate is much more steady.

I view real estate more like a bonds plus type of investment, where real estate tends to outperform bonds in a good economic environment, but still generates income and stability in a downturn. Real estate is my favorite asset class for the typical person to build long-term wealth due to increasing rents, increasing property prices, and its less volatile nature.

You can invest in real estate without the burden of a mortgage or maintenance with Fundrise. With about $3 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate in the Sunbelt, where valuations are lower and yields are higher.

The investment minimum is only $10, so it's easy to dollar-cost average in and build exposure. I've personally invested over $300,000 in Fundrise to dampen volatility and earn ore 100% passive income.

Order My New Book: Millionaire Milestones

If you’re ready to build more wealth than 90% of the population, grab a copy of my new book, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones (Amazon link) is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

Recommendation To Build Wealth

To create the proper asset allocation sign up with Empower. It is a free online platform which aggregates all your financial accounts on their Dashboard so you can see where you can optimize.

Before Empower, I had to log into eight different systems to track 28 different accounts to track my finances. Now, I can just log into Empower to see how everything is doing in one place.

Their Investment Checkup tool is also great because it graphically shows whether your investment portfolios are property allocated based on your risk profile. The tool allows you to easily determine the proper asset allocation.

Aggregate all your financial accounts in order to get a good over view of your net worth. Then start building those passive income streams! It only takes a minute to sign up for the free tool.

About the Author:

Sam worked in investing banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $300,000 a year in passive income. His favorite investment today is in real estate crowdfunding.

He spends most of his time playing tennis, taking care of his family, and thinking about the proper asset allocation once a quarter. Financial Samurai was started in 2009. It is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month. Pick up a hard copy of my new WSJ bestseller, Buy This, Not That: How To Spend Your Way To Wealth And Freedom. It's the best personal finance book you'll ever read.

VBXL performance seems wrong?

After 30yrs of investing, I do not think age has any role whatsoever in making an asset allocation decision. I believe that your asset allocation comes down to three primary factors, regardless of how old you are. The factors that I believe matter are the size of the portfolio (in dollars, euros, your own local currency), the annual cash income stream from that portfolio, and the DOLLAR amount (not percentage…) that you are actually comfortable losing/risking/betting.

Anyone who thinks they can tolerate a 25% loss has never had one.

I find it interesting that human behavior is such that we need to relate investing to a nice round number correlated to age when all you really need to know is that you should be mostly a growth investor when young (so that you have enough time to recover capital losses) and a more cautious growth investor when older (whether that means you invest some of the growth in Bonds, CD’s, cash, etc.). Most of us older investors have lived to see a global financial crisis, a pandemic, a dot-com bust, Black Monday, 9/11, and a host of smaller events and if there’s one thing that I’ve learned is that it turns out ok in the end as long as you don’t make emotional based decisions in the moment.

I wish some of these articles would take into consideration those who are divorced and lost a chunk of their portfolio. I have been saving since 1995 have always saved quite a bit. I got divorced in 2017 and lost half my 401.uve been building it back up ever since and I been more aggrwthan most as a reault. Health has not been good even though I’ve always been so active and healthy thanks to a doctor destroying a tendon in my body. So now I’m stuck with having to retire early with less savings due to divorce. I finally got back to 7 figures but I want to retire by 2030 at age 60 and possibly sooner due to my medical situation. I’ve always been 100% equities until 2018 when I started doing a portion in a 2035 target fund and then the last year I was 100% equities again. Right now I am 70/30 even though it’s recommended I do 60/40.

On one hand I need to preserve what I have and if I had my original amount since 1995, I would be 60/40 or 50/50.

Bevause I’m trying to make up for lost wealth in divorces, I’ve been more aggressive. I was thinking of going 75/25. Morningstar advisors and some more progressive advisors suggest 80/20 and 90/10. Some say all equities. A lot of push now is away from bond and into dividend funds. I am a big fan of international funds this year. So I feel people who are divorced are in a unique situation unlike the average person.

In these allocations are “Bonds” something like FUAMX (Fidelity® Intermediate Treasury Bond Index Fund) that only use Treasuries or FXNAX (Fidelity® U.S. Bond Index Fund) that has a mix of corporate and government bonds?

Individual Treasury bonds, municipal bonds, or corporate bonds. You can own a bond fund, however, there is no maturity and you will have to ride its ups and downs.

Is it rational to consider Pension and SS as the fixed components of a portfolio? If yes, how do you !) account for it in asset allocation 2) allocate retirement funds to stocks – 80 to100%?

I stumbled on your Financial Samurai by accident and was impressed by the amount of great information. It’s a very good read.

if you use dividend stocks instead of just using a s&p500 etf or fund for your equity allocation would that allow you to increase your percentage in stocks? Since dividend stocks are more stable and tend to hold up better in a downturn wouldn`t that allow you to go to say 65 or 70 percent equity ? Im 63 years old retired and have a pension and social security so I dont need to dip into my retirement money to much maybe a 4% withdraw rate at 65. Any thoughts or advice on this would be appreciated.I may consider a combination of total stock market etf and dividend stocks for my allocation.

Just wondering – why not you have YT channel? Your posts are great but timely to read.

Retiring. Definitely an opportunity, but it just takes more time and I’m trying to do less, not more. Do you have a YouTube channel?

Can you watch faster than you can read? I can’t.

Awesome job on the breakdown of the bonds! Im definitely more knowledgeable about the mix of bonds and stocks now. Thank you sir.

Hi Sam-

Long time reader and genuinely attribute my success to following a lot of your advice. I am now “struggling” with a “problem” I would love your take on. Simply put, I am 30 years old, married, and we have a $1.5M net worth ($1M investment account, $500K retirement accounts).

Asset allocation:

US Equity Large Cap: $1M

International Equity: $400K

Cash: $100K

After Tax Income: $250k

Expenses: $90K

Although I am doing well, I am worried about a downturn (although I would just keep buying) and am concerned I’m being a “naive millennial” who thinks markets only go up and am taking too much risk.

However, I really see no reason to buy bonds and make 2%.

Should I just keep buying stocks and see where I am in 3-5 years? I don’t plan on having a family or buying a home until 35.

Thanks!

David

For one do your wife no anything about it or no whatever the case might be always talk to your wife about anything cuz if anything happened she would be your backbone she will back you up in anything don’t be selfish and trying to take measures on your own hand the things will not never turn out right

How do we invest or mirror the Vanguard VBTLX Bond index? thx.

No one is home here.

Before you can consider retiring…you need a budget. Only then can you really determine things like “risk tolerance”. Figure at least 2-3% inflation and living until 90. Figure your budget today will double by then. Figure your Social Security will be cut by 10% or more in 2035. Figure your spouse is going to die and take their social security with them. Figure your money will run out if you don’t have at least 1 million in savings and IRAs…minimum. Otherwise, figure your 80s will be spent living in a 10′ x 10′ room staring at a wall where a big screen tv use to be.

Interested in your thoughts on asset allocation for my 83 in-laws. Until very recently, they had 100% of their retirement in equities. We finally convinced my mom-in-law to shift to some value-preserving funds… but their total mix is still over 90% (!) equities. My father-in-law wouldn’t consider anything but aggressive growth equities.

They have modest teacher retirement payments, and Social Security, but are otherwise depending on their IRA savings for continued retirement and ongoing medical care. They’ve been saving using the stock market since the late 70’s in both IRAs and 403(b) plans at various times.

They survived the plunge in 2008 with great angst, and the good fortune of living much longer than average. Unfortunately, my father-in-law has recently gone into memory care for dementia and my mother-in-law has just had a mild heart attack. Even though they seem to have the “Nothing-to-lose” model in mind, they definitely DO have much to lose.

Their children (all are CPAs and two are CFOs for decent sized corporations) are trying to convince my mom-in-law that a mix of no more than 60% equity funds and 40% bond funds or other capital preserving assets would still satisfy their aggressive earning desires but at least keep them away from losses that they don’t have long enough to to live and recover from a big loss. Personally, if I were 83, with nearly 1M in assets, I would have all my assets in something that I would preserve value for my living AND to transfer to the grandkids when I was gone. Not for them, though.

Any suggestions on how we can present a (to me at least) more sane asset allocation for very senior adults?

The asset allocation is all good as bonds are negatively correlated with stocks in general. The correlation could change as the market condition changes. The bonds will reduce the beta weighted delta of your stocks. One could even reduce the volatility or so called standard deviation of the P/L of the stocks/bonds portfolio by adding some negative delta via options to reduce the cost base of your assets. Why not more retirees or would-be retirees are doing that? Wall street’s self-serving and widely perpetuated myths that options are risky is probably the answer.

Hi there,

I am 48, working full time and used to be 100% in stocks/mutual funds. Start investing since 2003, managed 2008 and hold on during the storm, but now at my age, my obligations (has a daughter at univeriaty & son to prepare within 8 years time), I am chicken out with current market turmoil.

Intend to restructure my investing strategy next year. I live in Indonesia where interest rate at 6%, 10 yrs government bonds at 8% and average 20 yrs stock market index at 20%.

Seeking your advice. Thank you

Haha, very true!

This whole conversation started out as you can see, where I have a good friend and daytrader who is trying to time the market downturn using all these principles like Elliot Wave, etc.

Sure, people have made money timing the market but a lot also haven’t! Basically, this is what led to me to the question of whether I should change my allocation (from 100/0 to maybe 80/20) based on my retirement year, etc. and also whether I am still gambling in doing so based on the recent downturns in the market these past few months… It is very hard to predict the market, even if you’re REALLY REALLY GOOD AT IT.

I prefer to keep my money in mostly stock since I have had a good amount of exposure therapy to volatility and the ups and downs. I only rebalance once a year and this is when I typically look at the market :)

-Sean

Cool. So what are the answers to my questions for you?

The answers to your questions :) Sorry for the delayed reply!

1. Working

2. 28 years

3. 2 different streams of revenue, in addition to my market investments of course.

4. Single and no family as of now; if I do decide to have a family it will be around 40-45!

Hello Financial Samurai!

GCC mentions in his path to 100% equities article that in all honesty, as an early retiree ages, almost independent of the market, it is best to have 90/10 or 100/0 stocks as this will help one’s portfolio grow the most (as long as they can withstand the volatility, which is not too hard if you only look at it once a year :) ).

What are your thoughts on this compared to the 80/20 or 70/30 split that you recommend in your portfolio allocation model? When you get up there in age, I can see the portfolio being shifted slightly more to bonds due to healthcare costs and also because you have less years to live… but other than that, I see no reason why 90/10 split shouldn’t be a thing!

Curious as to your thoughts, thanks so much.

-Sean

Hi Sean, I wish GCC and others 100% in equities the best of luck. If they have the risk tolerance to stomach the volatility, go for it. This recent 10% correction in October 2018 is a nice test.

I’ve found that the more you accumulate and the more you don’t want to ever go back to work, the less risk tolerant you will be.

For me, it would be a disaster if I or my wife had to go back to work with our 18 month old boy now. We are committed to being full-time parents until he goes to kindergarten (age 5.5-6) at least.

See: Investment Risk And Return Portfolios For Early Retirees to see the returns

Also, here’s our story on how a jobless family of three survives in San Francisco.

We really don’t want to return to work. Nor do we want to be forced to live overseas to save money. We want as many options as possible!

GL!

Thanks GL!

I totally understand where you’re coming from; typically, for me to avoid volatility I just don’t look at my portfolio :)

But I understand that a 50% crash like in 2008 can sometimes cause people to sell unnecessarily (even though I believe this was a “rare” recession with a crash this large, and from what I know, the market hadn’t dropped this low for that long since Depression era times…).

Regardless of whether 2008 was an outlier or not, it’s true though that even though you accumulate more responsibility, you also accumulate more in terms of wealth? For example, even if you lose 50% of your wealth during a recession, eventually the market comes back up, and an early retiree should still have more than enough in a brokerage account and also in dividends to last him during that period in time without worry? Since you have more years to ride out the volatility too, this is a much different portfolio allocation than someone retiring at 65 of course who has less years and maybe would be content with a 70/30 split.

The more years you ride out your retirement funds, the more they will grow with only nominal market performance. Investing in more stocks (90/10) will be more volatile, but will also increase your returns exponentially compared to a 70/30 split, so it should lessen your worries even more about money!

Again, I ran all of this data in the FireCalc Sim (and accounted for taxes), so this is where I am coming up with the numbers :) For me, I can hedge against the volatility although I can understand not doing so with a family as it will be tougher. I can understand too that if someone early retired at the beginning of a sustained bear market and not a bull, they will need to spend less and save more to ensure that they don’t outlive their funds.

Some pertinent questions to ask you are:

* retired or working

* age

* abilities to make money elsewhere

* number of kids/people to support

I’ve found that everybody 35 and under tend to think they are warren buffet!

I’m 34 and can confirm.

This article is one I will be sharing with my wife. While she is a great saver, she is not patient to have these allocation conversations. I was planning on having another one of these conversations with her soon, and this page saved me a ton of work. Thank you for posting it.

Hi Sam,

Love your blog, super insightful and very helpful. A little about me, just moved back to my Seattle rental from the Bay Area – relevant to your last few blog posts. Anyway, I have a fairly simple retirement strategy, healthy mix of index funds. I was curious from your perspective – the right allocation between US and International. I like your 80% Stocks and 20% Bonds mix above, but I am curious … how would you break up:

Larg Cap

Mid Cap

Small Cap

International

Thoughts?

J.L. Collins would recommend investing 80% in VTSAX (Vanguard Total Stock Market Index Fund) & 20% in VBTLX (Vanguard Total Bond Market Index Fund). Happy investing!!!

Or VT and BIL in the particular percentages based on your own risk profile and age.

Very good article and comments, thank you.

Readying to retire in 1-2 years, I have become very fond of Wade Pfau’s theories and alternatives.

That is …. in its most distilled form, 1-2 years before retirement, decrease your stock allocation to approx. 30% .

Thereafter, increase by 1% per year.

He suggests this so as to not be so stock heav close to retirement in case we run into a down market, thus leaving an investor with limited ability to catch up.

Thanks again,

Frank

Hey Sam

Heard you on my buddy Noah Kagan’s show and decided to come check out your blog. So far, I love it. The only thing I wanted to suggest was that many of us reading have other investments outside of stocks/bonds. I would’ve loved if this post had addressed how much each of these frameworks carry in assets like Real Estate, cryptocurrencies, fiat currencies, etc. In any case, my assistant will be dropping you an email to invite you to come onto our show, Becoming SuperHuman, so hopefully we’ll get a chance to talk more

Hi Jonathan, nice to meet you. I actually go the deepest in real estate on my side, and also talk about private equity and venture debt.

My real estate category for you to check out : https://www.financialsamurai.com/category/real-estate/

Sam

Hi Sam – Where do you see cash fitting into the allocation strategy? I’m a fairly active investor turning 50 this year and unable to continue to contribute to my IRA, but with all of my accounts considered, I should be OK in retirement. Currently I’m 50% stock, 25% cash, 25% bonds. I’d go down to 10% cash and up to 65% stock if the market takes a dive. Thoughts?

Also, something that’s always confused me about the bond ratio is whether it matters what type of bond it is. I have several different types of bond funds in the interest of diversification. Munis in taxable accounts, corporate debt, mortgage/asset backed securities, and treasuries in my IRAs. It seems like whenever anyone is talking about the bond ratio they are assuming a full allocation into treasuries. Can you comment on that for me please?

Thanks!

See Recommended Net Worth Allocation. I like having around 5% of my net worth in cash or CDs.

You should also read: The Case For Bonds: Living For Free And Other Benefits

AFter the Trump victory, I built up a sizaable municipal bond position.

Thank you! :)

Hi Sam – Thank you for taking the time to create such a comprehensive and thoughtful website. It’s been inspiring and motivating, and I’ve been rethinking my portfolio.

What allocation would you recommend for a 40 year old that does not own real estate? I live in NYC and renting is a better option for me than buying, especially with pricing right now. I’m currently Cash 55%, Equities 43%, and Bonds 2%.

I want to stay liquid just in case there may be buying opportunities in the coming years. With that said, I think that a greater exposure to bonds would make sense. But I don’t know how I feel about a such significant increase in bonds given the market today. And I’m unsure about putting more money in an equity index since the broader market has been performing well over the past years.

What you suggest for someone who most likely won’t be able to invest in real estate for at least another three to five years?

Thanks in advance, C

[…] I quit my job a couple years ago to try my hand at entrepreneurship, I’m a relatively risk-averse person because I’ve seen so many fortunes made and lost over the past 15 years. If I was […]

[…] could happen is an obliteration of your downpayment right before you’re ready to buy. The proper asset allocation of stocks and bonds is […]