Ever wonder how multi-millionaires and billionaires avoid paying estate taxes when they die? After all, the current estate tax exemption threshold is only $11.58 million per person in 2020 and every dollar passed down after that is taxed at a 40% rate.

The secret to how America's wealthiest households create dynasties and pay less estate taxes than they should is through the Grantor Retained Annuity Trust, or GRAT.

If a GRAT is set up and executed properly, a significant amount of wealth can move down to the next generation with virtually no estate or gift tax ramifications. Let's explore how this works.

How The Wealthy Save On Estate Taxes

If you are worth hundreds of millions or billions, your estate will far surpass the estate tax exemption amount. As a result, you need to set up a GRAT.

You, the grantor, transfer assets to a trust (GRAT) and retain the right to receive an annuity payment for a term of years. At the end of the term, the assets remaining in the GRAT are distributed to your children (or other beneficiaries).

The transfer to the GRAT will trigger a gift tax event. However, the value of the taxable gift is not the value of the assets transferred to the GRAT. Instead, the gift is reduced by the actuarial value of the annuity you retain.

If the annuity is structured properly, it equals the value of the assets, and there is no gift. This is referred to as a “zeroed-out” GRAT.

Let's look at the annuity interest payment in more detail. This interest payment can be perceived as “the cost” to the Grantor, despite it actually being income given the taxes that must be paid on this annuity payment.

The amount of the annuity payment that is required to be paid to the Grantor during the term of the GRAT is calculated by using an interest rate the IRS determines monthly called the section 7520 rate.

The section 7520 rate for January 2019 is 3.4 percent. It will likely stay between the 3% – 3.6% range so long as the 10-year bond yield remains between 2% – 3.2 percent.

Here is a chart of the historical 7520 rates according to the IRS.

The grantor should set the annuity payment equal to the section 7520 interest rate and no higher because a higher annuity payment simply means more taxable income.

The grantor's goal is to make the spread between the 7520 interest payment and the annual return on the asset getting transferred into the GRAT as high as possible. This spread will ultimately be the value of the tax free gift when the grantor passes away.

The grantor sets up a GRAT because s/he is betting the assets transferred into the GRAT will appreciate in value above and beyond the section 7520 interest rate.

So while the grantor will receive the annuity payments, the beneficiaries of the GRAT will receive the underlying GRAT assets at their value. It's the value of those assets that will appreciate over and above the section 7520 rate.

Avoid Estate Taxes On A Business

Most of the ultra wealth in America are business owners. They either own significant equity in their own business or have equity in other businesses they own as minority investors.

Notice how by the time you get to billionaire status, over 65% of your wealth comes from Business Interests. Those earning less than $100,000 a year have less than 10% of their net worth in Business Interests.

Lesson: Build a business and/or own equity in promising businesses if you want to get really wealthy.

For illustrative purposes, let's say you have an packaging business worth $10 million today and your business's value grows by a rate of 20% above the 7520 rate. In 10 years, the business would be worth $83,211,799.

You would have to pay taxes on roughly $3,600,000 of annuity payments during this time period ($10M X 3.6% 7520 rate X 10 years), which would amount to $1,080,000 in taxes at a 30% effective tax rate.

However, you would also be able to transfer $73,211,799 million in wealth to your heirs estate tax free once the term of the GRAT expires. That would be an estate tax savings of about $29,300,000!

$73 million sounds like a lot of money, and it is. But know that some companies like Uber, Airbnb, Google, Facebook, etc have grow just as quick and with even greater scale.

The early investors and employees at such companies are all worth millions and billions of dollars.

Another Example Of Using A GRAT

You transfer $100 to a two year term GRAT for the benefit of your kids. Based on the 7520 rate you are required to receive an annuity of $52 each year (typically the annuity is graduated so the GRAT has more leverage but ignore that).

Year 1 you receive the $52 annuity payment. Because the GRAT is disregarded for income tax purposes the payment from the GRAT to you is disregarded – no income tax consequences.

If the $52 annuity paid to you isn’t cash or marketable securities it needs to be valued so that the appropriate amount is transferred back to you. At this time say the $100 originally transferred to the GRAT has appreciated to $120. So now there is $68 in the GRAT with one year remaining.

At the end of year two another $52 is transferred back to you and that is the close of the GRAT. The $68 has now appreciated to $75 and there is $23 ($75-$23) to pass to your kids (beneficiaries of the GRAT).

You have a successful GRAT and have transfer $23 of appreciation from your estate to your beneficiaries without using any gift tax exemption. All during the two year term of the GRAT you are paying income tax on any income generated by the GRAT.

So if it is a stock the GRAT receives (Apple for example) the dividends as they hold the stock but you pay tax on them because the GRAT is disregarded for income tax purposes.

However, the GRAT is respected for estate planning purposes and is a separate legal entity. In other words, there is a disconnect between the income tax rules and the estate planning rules which is why the GRAT came into existence.

Therefore, if the security doesn’t pay a dividend then you are transferring stock back to the grantor because that is the only asset the GRAT holds. To the extent the security is marketable (traded on an exchange) then you can value the stock using the mean hi/low on the date the annuity is transferred to the grantor.

If the stock is a private company then a value needs to be assigned to that stock so you know how much needs to be transferred back to the grantor. To the extent the grantor doesn’t have an appraisal on a hard to value asset (i.e. private company stock) then the service could challenge that the amount of private company stock transferred back to the grantor didn’t satisfy the annuity payment in full.

So if you are required to get $52 and you only transferred $40 back to the grantor then you have made a $12 gift to the beneficiaries without knowing it, the amounts are typically 1,000 times this so the devil is in details with a GRAT and it is all based on administering it properly.

Three Negatives Of Using A GRAT

There are three downsides to be aware of when setting up a GRAT:

1) The assets transferred into the GRAT could grow at a rate lower than the section 7520 rate. If this is the case, then the trustmaker/grantor will simply receive back the trust property at its depreciated value and will only be out the legal fees that were paid to set up the GRAT.

2) The trustmaker/grantor could die during the term of the GRAT. If this is the case, then all of the property transferred into the GRAT would revert back into the estate of the trustmaker/grantor and be taxable for estate tax purposes, and the trustmaker/grantor will also be out the legal fees that were paid to set up the GRAT.

3) Of course, there is also the time and money it takes to set up a GRAT with an estate planning attorney. I checked with several estate planning lawyers, and the fees range from as low as $2,000 to $10,000.

Avoid Estate Taxes With The GRAT

If your estate is worth above the Estate Tax Exemption or you think your estate will eventually be worth above the Estate Tax Exemption, then you should absolutely consider setting up a GRAT.

The 7520 interest rate of between 2.5% – 3.6% is not a very high hurdle for most wealthy investors. You can earn a risk free rate of return between 2.5% – 3.5% by investing in Treasuries or AA-rated municipal bonds, for example.

Paying a 40% estate tax on wealth you already paid a high tax rate on is not good estate planning. Your mission should be to always minimize your taxes and maximize the value you get from your wealth.

If your estate far exceeds the estate tax exemption amount, consider spending more of your wealth on yourself, your family, your friends, and others while live. You'll enjoy seeing your wealth help others more if you do.

I'm not an estate planning lawyer so please talk to one if you plan to set up a GRAT. I'm just a financially independent man who has spent hours speaking to my own estate planning lawyer and doing research to best take care of my family.

Invest In Real Estate Like Millionaires And Billionaires

Real estate produces tax-efficient income and has tax-free profits of up to $250,000 / $500,000 for singles / married couples. Further, real estate is a tangible asset that is less volatile and provides utility.

Almost every millionaire and billionaire owns a significant portfolio of real estate. You should consider doing the same.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Keep Track Of Your Growing Estate

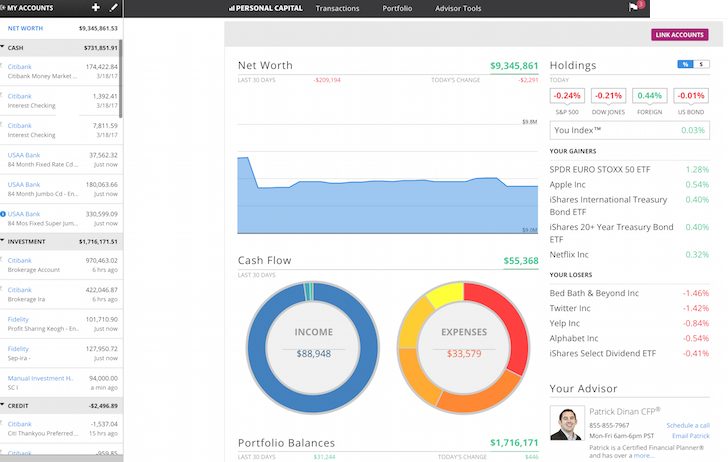

The wealthier you get, the more complicated your estate. The best way to grow your estate is to diligently track your wealth for free with Personal Capital or other free personal finance software that can be used on a laptop or mobile phone.

Before Personal Capital, I had to manually keep track of 40 different financial accounts in an Excel spreadsheet and update them monthly. Such inefficiency was driving me crazy. After I linked all my accounts to Personal Capital's dashboard, everything is now automatically updated.

Besides using their tools to analyze your investments and track your net worth, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms.

It's always good to plan ahead, just like how you are considering planning ahead with a GRAT.

About the Author

Sam worked in investing banking for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $300,000 a year in passive income.

His favorite passive investment is real estate crowdfunding. Sam spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month. You can sign up for his free newsletter here.