Ever wonder how extremely wealthy people pass down their fortunes without paying any taxes? Look no further than the Grantor Retained Annuity Trust, or GRAT for short.

If a GRAT is set up and executed properly, a significant amount of wealth can move down to the next generation with virtually no estate tax or gift tax ramifications.

But to first set up a Grantor Retained Annuity Trust, you must first understand how it works and who should set one up.

How Does A Grantor Retained Annuity Trust Work?

A Grantor Retained Annuity Trust is great for those who have estates or plan to have estates valued greater than the current and expected estate tax exemption amount.

First, the grantor, (you), transfers assets to a trust (GRAT). Next, you retain the right to receive an annuity payment for a certain number of years (the term). At the end of the term, any remaining assets are distributed to your kids. You can also designate other beneficiaries if you wish.

A gift tax event is triggered upon assets getting transferred to the GRAT. But, the value of the taxable gift is not the value of the assets transferred to the GRAT. Instead, the gift is reduced by the actuarial value of the annuity you retain.

You want to make sure the annuity is structured properly. If it equals the value of the assets, there is no gift. This is what's known as a “zeroed-out” Grantor Retained Annuity Trust.

Related: A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

Grantor Retained Annuity Trust Interest Payment

Let's look at the annuity interest payment in more detail. This interest payment can be perceived as “the cost” to the Grantor, despite it actually being income given the taxes that must be paid on this annuity payment.

The IRS uses Section 7520 rates, which change every month, that determine how you calculate the required annuity payments to the Grantor during the term of the GRAT.

The 7520 rate must be higher than the risk-free rate of return, otherwise everybody would simply take advantage of this arbitrage.

Here is a chart of the historical 7520 rates according to the IRS. You can see how rates significantly dropped due to the global pandemic. You can check the latest IRS 7520 rates here.

The grantor should use an annuity payment equal to the section 7520 interest rate. Otherwise, using a higher rate means more taxable income.

Ideally, a grantor should try to make the spread between the 7520 interest payment and the annual return on the GRAT asset as high as possible. This spread impacts the value of the tax free gift upon the Grantor's death.

After all, you want to setup a Grantor Retained Annuity Trust if you believe the transferred assets will appreciate well beyond the Section 7520 rate.

The grantor receives the annuity payments, and the GRAT beneficiaries will receive the GRAT assets at their value. That's why your predictions of the assets value is key.

Using A GRAT To Transfer Property

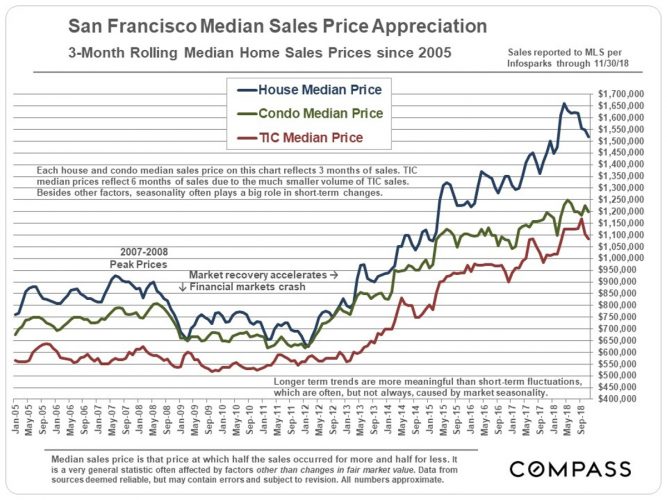

Using a GRAT to transfer future appreciation value of a property estate-tax free is one of the popular reasons why the super wealthy use a GRAT.

Expensive coastal cities such as New York City, San Francisco, Seattle, Los Angeles, and San Diego have had a history of price appreciate at 2-6X the national rate of housing appreciation of 2% in the past.

Take San Francisco, for example. Since 2012, San Francisco home prices have appreciated about 8% a year and are now double the value as of 2020. There's no reason to believe San Francisco property prices won't continue to outperform the national price appreciation average due to all the money and innovation in the SF Bay Area.

If you had put a $10 million mansion into a GRAT in 2010, you would be able to gift roughly $4 million worth of value to your heirs estate tax free. Here's the math:

- 7520 rate = 2% in 2010

- Annual annuity payment = $200,000 and up to $360,000 a year as the 7520 rate changes

- Total annuity payments over 10 years = $2,500,000. Tax on such payments at a 30% effective rate is $750,000.

- $10 million mansion now is worth $18 million, growing at an 8% compound annual growth rate.

- The Grantor gifts an average of 5% a year in value for free to his children once the GRAT is over. 5% comes from the 8% annual compound growth rate minus 3%, the average 7520 rate.

- The heirs receive an $18 million mansion in their name without having to pay any estate taxes.

Injecting A Business Into A Grantor Retained Annuity Trust

There is a correlation with the amount of wealth one has, and the percentage of a business ownership that makes up their net worth. Notice how the blue segment grows the wealthier a person gets in the net worth composition chart below.

The centimillionaires and billionaires of the world all use the GRAT to pass on their fortunes to their heirs with minimal estate taxes.

Think about the growth of companies like Amazon, Facebook, and Netflix since their respective founding. All of these companies grew at rates much quicker than the 7520 rate required by the GRAT.

For illustrative purposes, let's say you have an online business worth $10 million today and your business's value grows by a rate of 20% above the 7520 rate. In 10 years, the business would be worth $83,211,799.

You would have to pay taxes on roughly $3,600,000 of annuity payments during this time period ($10M X 3.6% 7520 rate X 10 years), which would amount to $1,080,000 in taxes at a 30% effective tax rate.

However, you would also be able to transfer $73,211,799 million in wealth to your heirs estate tax free once the term of the GRAT expires. That would be an estate tax savings of about $29,300,000!

Obviously, this scenario is quite optimistic. But you need to have optimism if you want to grow your wealth to the next level.

Undervaluing A Business In A GRAT

Another common use for a Grantor Retained Annuity Trust is if you plan to sell your business for a big premium in the next few years. One of the strategies a lot of estate planning lawyers use is to purposefully undervalue a business to minimize estate taxes.

It's the same concept with undervaluing your house so that you pay less ongoing property taxes. By selling your business for a true market value, you will earn a lot of money but have to pay a lot of taxes. But with a GRAT, your tax liability gets significantly reduced.

Below is another graphical example of using a GRAT for a business owner. My example is pretty clean cut. This example has a little more complexity.

Negatives Of Using A GRAT

By now, I hope you will agree that using a GRAT is a wonderful opportunity to save on estate taxes. However, there are three downsides to be aware of.

1) Asset performance is unpredictable. Thus, your GRAT assets may perform lower than the IRS section 7520 rates. If this happens, the grantor simply gets the trust asset back at its depreciated value. The lost costs are the legal fees paid to set up the Grantor Retained Annuity Trust.

2) You as Grantor could pass away during the GRAT's term. If so, the property transferred into the Grantor Retained Annuity Trust would revert back into your estate. It would be taxable for estate tax purposes, and of course you'd also have lost out on the GRAT's setup legal fees.

3) Time and money. Grantor Retained Annuity Trusts are complex. It takes time to research how they work and determine if it's a good fit for you. Estate Lawyers also charge a lot of money per hour (ex. $300/hour) so it could easily cost several thousand to setup.

I checked with several estate planning lawyers, and the fees range from as low as $2,000 to $10,000.

Historical Gift And Estate Tax Limits

Below are the historical gift tax exemption amounts per person.

And here are the historical estate tax exemption amounts per person. You can see we are at all time highs. For 2024, the estate tax limit per person is $13.6 million.

Should You Set Up A Grantor Retained Annuity Trust?

If you, the grantor believes the property transferred into the GRAT will outperform the section 7520 interest rate, that you will live to see the end of the term of the GRAT, and that you will not need the gifted property later in life to pay for living expenses or long-term care, then setting up a GRAT may be a good move.

There are many ways to save on taxes. A Grantor Retained Annuity Trust so happens to be one of the best ways for the ultra wealthy or the most financially bullish to save on estate taxes. You never hear about the GRAT because only about 1% of American households pay estate taxes.

But the more you know, the better your financial situation will be. I am not an estate planning lawyer, however, so please consult with one if you decide to go with a GRAT. But once you talk to a lawyer, I'm sure you will like what they have to say. Who knows, a GRAT could save you millions in estate taxes.

Related: Multi-Year Guarantee Annuities For Retirement

Recommendation To Build Your Estate

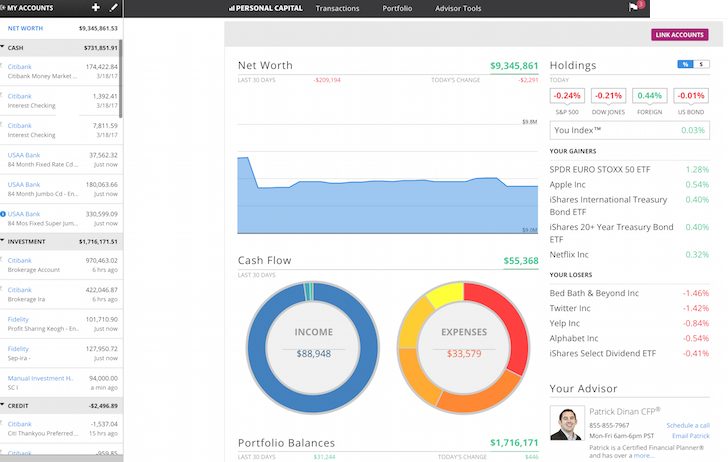

The wealthier you get, the more complicated your estate. The best way to grow your estate is to track it diligently with a free, award-winning personal finance tool called Empower.

Before Empower, I had to manually keep track of 40 different financial accounts in an Excel spreadsheet and update them monthly. After I linked all my accounts to Personal Capital's dashboard, it does the updates automatically for me.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. It's always good to plan ahead, just like how you are considering planning ahead with a GRAT.

About the Author:

Sam worked in investment banking for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley.

In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income thanks to his new passive investments in Fundrise, a real estate crowdfunding company.

He spends time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.