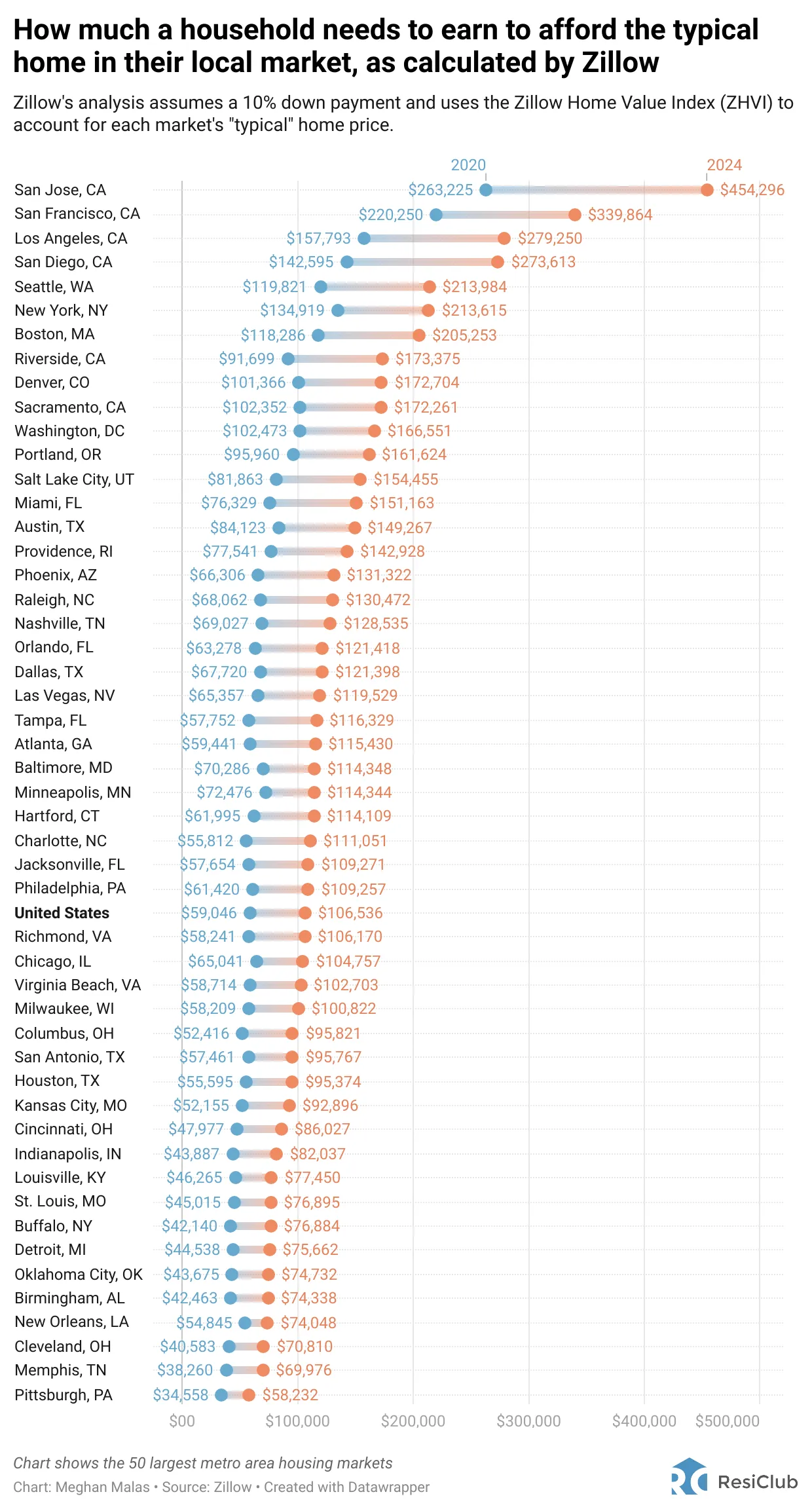

In order to raise a family in an expensive coastal city like San Francisco or New York, you may now have to make roughly $350,000 a year. Shocking, I know! But inflation is a killer for families who have to pay for housing, private school tuition, college tuition, healthcare, food and more.

You can certainly raise a family earning less. But, it won't be easy if your goal is to save for retirement, save for your child's education, own your home, and actually retire by a reasonable age.

A middle class lifestyle is a reasonable ask. But thanks to inflation, a middle class lifestyle has gotten a lot more expensive. The median net worth for the middle class has stayed flat for years at about $87,140 according to the latest Consumer Finance Survey by the Federal Reserve. Yet, prices for things such as housing and college tuition has risen tremendously.

About half of the U.S. population lives on the coasts. Therefore, this post is directly for folks who need to live on the coasts because of their jobs, schools, or families.

Who Makes $350,000 A Year?

Before we look at how quickly $350,000 can be spent by a family of four, let's go through a list of various workers and combinations that make $350,000 a year.

* A Bay Area Rapid Transit janitor who makes $234,000 + $36,000 in benefits marries a Bay Area Rapid Transit elevator technician who makes over $250,000 in salary and benefits.

* Starting total compensation packages for recent college graduate employees at Facebook, Google, Airbnb, and Apple range from $120,000 – $150,000. By the time these employees turn 35, their total compensation alone, can easily surpass $350,000.

* A 30-year-old first-year Associate in banking earns $150,000 in base salary plus $20,000 – $100,000 bonus on average. After five more years of experience, a total compensation of $350,000 should be achievable.

* A 26-year-old first year big law associate makes $180,000 base + $20,000 sign on bonus. By the end of their 7th year many are making over $350,000.

* A 42-year-old college professor at UC Berkeley makes $235,000 on average and $279,000 at Columbia and NYU.

* The average specialist doctor finishing his or her fellowship at age 32 makes $300,000. After several years in the business, $350,000 is not unheard of.

The permutations of people making $350,000 goes on and on. Many professionals, if they aren't there now, will get to such a level of income eventually. This is especially true if they team up with someone else.

Living A Middle Class Lifestyle On $350,000 A Year

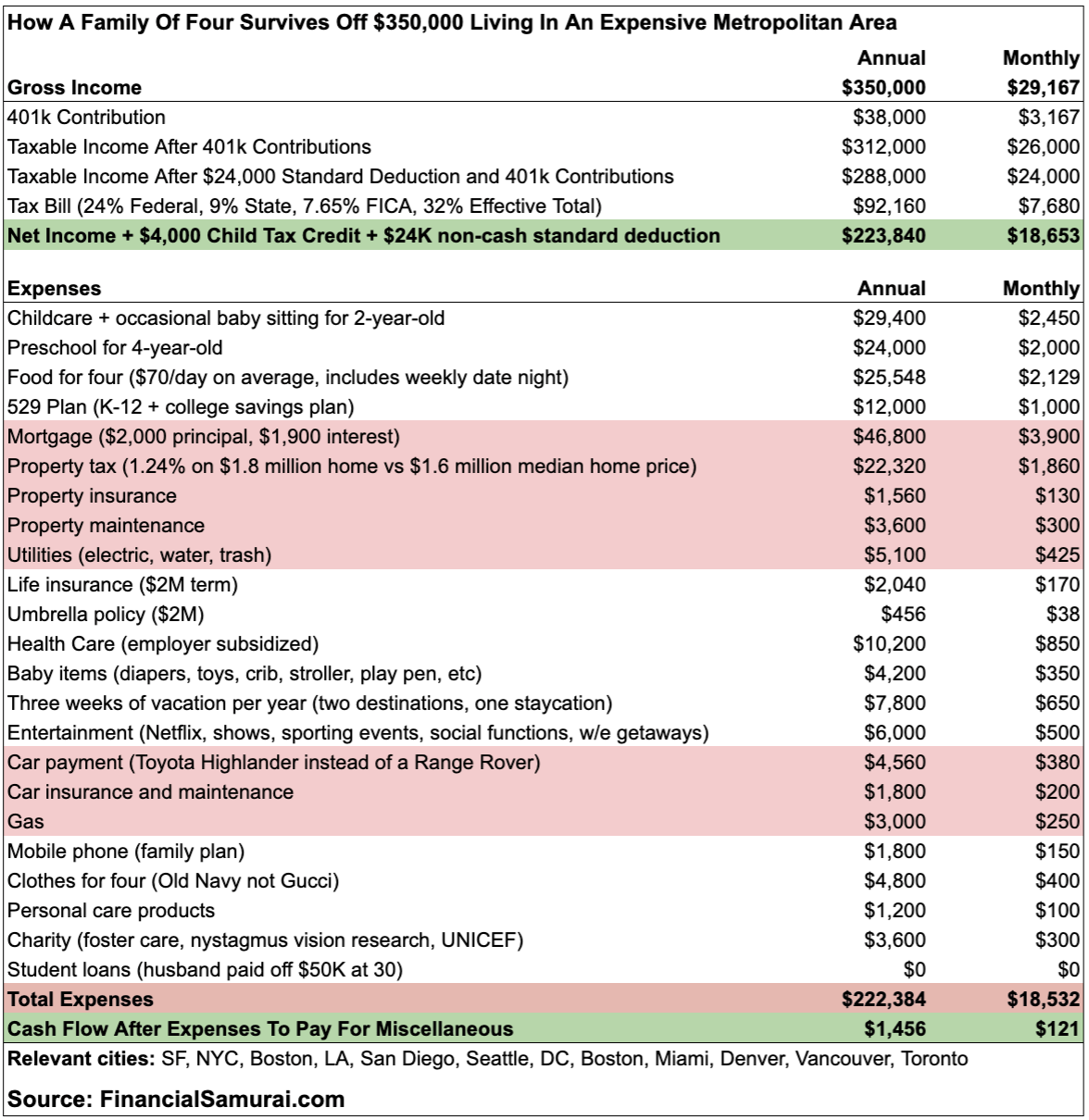

Below is the budget of a dual-income earning household with two kids. The budget is vetted by thousands of readers on Financial Samurai who also raise families in expensive coastal cities like San Francisco, LA, NYC, Boston, and Washington D.C.

Gross Income Review

In order to make $350,000 a year, both of these parents have to work. Each parent puts away $19,000 in their respective 401(k)s for a combined $38,000 a year. After getting their standard $24,000 deduction from several years ago, they pay $92,160 in total taxes and are left with $221,840. In 2024, the standard deduction is now $14,600 per person.

Because this couple earns less than $400,000, they can now receive a $2,000 per child tax credit. In the past, married couples who earned more than $110,000 were no longer eligible for a child credit. Given this couple has two children, they get a $4,000 credit.

Expenses Review

Childcare ($2,450/month): There's no getting around this expense when both parents are working. Their childcare center costs $2,200 a month for full-time care. The couple then spends an extra $250 a month for some babysitting help so they can go out by themselves.

Preschool ($2,000/month): The second child goes to preschool full-time. $2,000/month does not include the suggested $3,000 per child donation the school asks each year to help fund their new construction. The parent's ultimate plan is to send each of their children to private grade school. This costs ~$35,000 from K-8 and ~$45,000 from 9-12.

Food ($2,129/month): It makes little sense to spend hours cooking when you're already tired and want to reserve your remaining energy for taking care of your kids. Food is the sneakiest expense that adds up huge over time.

Mortgage ($46,800): Although the payment is $3,900 a month for a $900,000 mortgage at 3.25%, $2,000 of it goes towards paying down principal and building net worth. Therefore, this couple is increasing their net worth by about $24,000 a year.

Their $1.8 million assessed home has 2,200 square feet, four bedrooms, and three bathrooms on a 3,000 square foot lot. But it's nothing fancy since the median price for a home ins $1.6 million.

Here's an example of a typical $1.855M home in Golden Gate Heights, one of San Francisco's best kept secret neighborhoods where homes have panoramic ocean views. As you can see from the picture, the house only has 1,288 square feet of living space, two bedrooms and one bathroom.

The $10,000 SALT cap deduction for individuals and married couples hurts homeowners in expensive real estate markets. Property tax on a $1.8M assessed house alone is roughly $22,320. Then the couple is also paying ~$25,000 in state income taxes.

When you add on property tax, property maintenance, and insurance, it costs this family over $75,000 a year in housing costs. In 2024, property bidding wars are back as the economy is strong and the stock market is at all-time highs. Hence, this house above would probably sell for more than $2 million today.

Vacation ($7,800/year): Three weeks of vacation a year is reasonable for the typical American household. By law, every country in the EU has at least four weeks of paid vacation days. Meanwhile, Brazil has 41 paid vacations days a year.

Car Payment ($380/month): When you have little ones, all you want to do is protect them from harm. You may be the best driver in the world. But, one distracted driver reading a text message cold cause a serious accident. No longer do you feel comfortable driving a compact city car while transporting your family. Instead, you want a larger vehicle that has the highest safety rating.

Baby/Toddler Things ($380/month): You can spend as little or as much as you want on your baby. But this family buys disposable diapers, tons of baby proofing material, lots of educational toys, the best car seat, and two strollers.

Entertainment ($500/month): Date night can easily cost $200 an outing for two once you include tickets to a ball game or a off-Broadway show and transportation. Entertainment also includes the cost of sporting equipment, memberships, Netflix, cable, internet, and more.

College savings ($1,000/month): According to the College Board, the average cost of tuition and fees for the 2019-2020 school year is $10,400 for state residents at public colleges and $26,290 for out-of-state students. The average private school tuition is over $36,000. In 14-16 years, college tuition will likely be double today's averages.

Final Cash Flow Review

The end result is annual cash flow of only $1,456. That can be spent in a hurry as things always pop up. Despite such little cash flow, this household is building roughly $63,000 in illiquid net worth each year by paying down their mortgage and contributing to their 401(k)s.

Unfortunately, despite making $350,000 a year, this couple will be unable to retire before 60. They are not building an after-tax investment portfolio to generate passive income. They can't withdraw from their 401(k) before age 59.5 without a 10% penalty, nor can they rent out their home for income given that's their primary residence.

In order for this couple to achieve financial independence, they need to accumulate a net worth equal to at least 25X annual expenses or 20X annual gross income.

In other words, this couple needs to amass a net worth of between $5.5 – $7 million if their income and expenses remain unchanged. Tough to do with such little in savings each year.

Recommendations For A Better Life

If you are one of the many families struggling to get ahead in an expensive city on a high salary, here are five suggestions:

1) Limit your household income up to the 24 percent marginal tax bracket after all deductions. In 2024, a married couple can earn up to $383,900 and pay a 24% marginal federal income tax rate. Any dollar after $383,900 is taxed 8% higher, at a 32% marginal federal income tax rate.

If you are feeling overly stressed at work and want to spend more time with your children, consider working less if you're making more than the 24% marginal tax bracket income threshold. Not only might your stress decline, you will be able to reduce childcare expenses.

2) Stop wanting an upper middle-class lifestyle. It's worth sacrificing your lifestyle in the short-term for long-term gain. By renting a more modest home for $4,000 a month, this family will free up $27,000 a year in cash flow. By sending their oldest to public elementary school, this family will gain another $24,000 a year in cash flow. An additional $51,000 a year in cash flow is huge when coupled with $38,000 a year in 401(k) contributions.

3) Build an after-tax investment portfolio. Earning passive investment income is the key to financial freedom. Using conventional rules, you can't live off your 401(k) or IRA until 59.5. Here is my ranking of the best passive income investments today so you can retire sooner, rather than later.

4) Move away to a cheaper city. Once you've accumulated enough capital, consider relocating to a lower cost area. Thanks to technology, there is a multi-decade demographic trend towards living in the heartland where property prices and rents are much cheaper. Make your dollars go farther through geoarbitrage. Unfortunately, if you're a minority, it's harder to just pick up and relocate to a non-coastal city due to a lack of diversity.

5) Know your finances inside and out. The people who get in trouble don't stay on top of their finances each week. They wake up 10 years from now and wonder where all their money went. In the past, an excel spreadsheet was fine. Now, there are plenty of free financial tools out there to use to not only track your finances, but x-ray your investment portfolios for excessive fees and keep you on track to reach your retirement cash flow goals.

Invest In Real Estate To Build More Wealth

To invest in real estate without all the hassle and unexpected costs, check out Fundrise. Fundrise offers funds that mainly invest in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher. The firm manages over $3.5 billion in assets for over 500,000 investors looking to diversify and earn more passive income.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside due to higher growth rates. You can build your own select real estate portfolio with Crowdstreet.

I've personally invested $954,000 in private real estate since 2016 to diversify my holdings, take advantage of demographic shifts toward lower-cost areas of the country, and earn more passive income. We're in a multi-decade trend of relocating to the Sunbelt region thanks to technology. Both platforms are sponsors and Financial Samurai is a six-figure investor in Fundrise funds.

Making $350,000 a year might sound like a lot, but it will go quickly raising a family in an expensive city. We all deserve to live a middle-class lifestyle. Unfortunately, we've first got to sacrifice more than ever to live one today.