If you want to be happy, don't make over $400,000 a year at your job. It usually requires long hours and lots of stress to make over $400,000 a year. In addition, you'll have to pay a 35% federal marginal income tax rate.

Any envy you may have about people making high incomes is often misplaced. Earning multiple six-figures doesn't just come to you. You've got to really work for it!

I'm sure some of you who don't make over $400,000 a year think you'll happily go through a lot of suffering to make such an elevated income. My hope is that you actually do so you can realize making a top 1% income or even a top 0.1% income is not very fulfilling.

I'm also sure some of you who are currently making over $400,000 a year are happy with your current situation. I mean, who cares about finding love or spending time with your kids when you can make so much money! Zoom calls 8X a day for the win!

For the disbelievers out there who think it's worthwhile to make $400,000+ from a day job, let me share some insightful feedback from a recent Goldman Sachs analyst survey about their well-being.

Experiencing The Grind At Goldman Sachs

This analyst well-being survey hits home because my first job out of college was at Goldman Sachs in 1999. I worked in the International Equities department on the 49th floor of 1 New York Plaza.

The firm had just gone public, making many of the partners deca-millionaires. I lasted for two years as an analyst before getting the boot. Luckily, I found a job at a competitor in San Francisco before the boot hit my ass. Less than 20% of my analyst class was left after the 2000 dotcom bubble burst.

Curiously, the investment banking industry is still one of the most sought-after industries for college and business school graduates. I would have thought that with stiff competition from big tech and startups, the demand to join banking had faded.

Over the years, I've seen the banking industry relax its dress code, forbid working on Saturdays, provide more free perks, and focus more on mental health.

I used to regularly get in by 5:30 am and not leave until 7:00 pm in order to eat some free cafeteria food. I thought the difficult work conditions would have changed. Apparently not!

Investment Banking Analyst Compensation

In 2021, after tremendous pushback from analysts, Goldman Sachs’s first-year analysts received a bump in base pay from $85,000 to $110,000; second-year analysts $95,000 to $125,000; and first-year associates $125,000 to $150,000. These base salaries for analysts is pretty standard across all firms today.

Most first-year analysts will receive a year-end bonus in the range of $50,000-$80,000. Top performers could get a bonus as high as $100,000. Therefore, the all-in compensation for a 23-year-old first-year analyst ranges between $160,000 – $220,000 in 2023.

Ah hah! No wonder why demand to work in investment banking continues to be so high. Investment banks can still compete quite effectively against tech giants such as Facebook and Google. However, most startups are not the main competitors for talent.

As we know, joining a startup usually makes you poorer rather than richer given most startups go nowhere. You're just being tricked into making a fortune at a startup because the media loves to only highlight the winners. Banking money is closer to guaranteed money.

Besides, if you've just spent $150,000 going to business school and given up two years' worth of salary, joining a fledgling startup is hard when you could immediately earn $200,000+ in banking.

With such high expectations, no wonder why Millennials think they need to earn $525,000 to be happy.

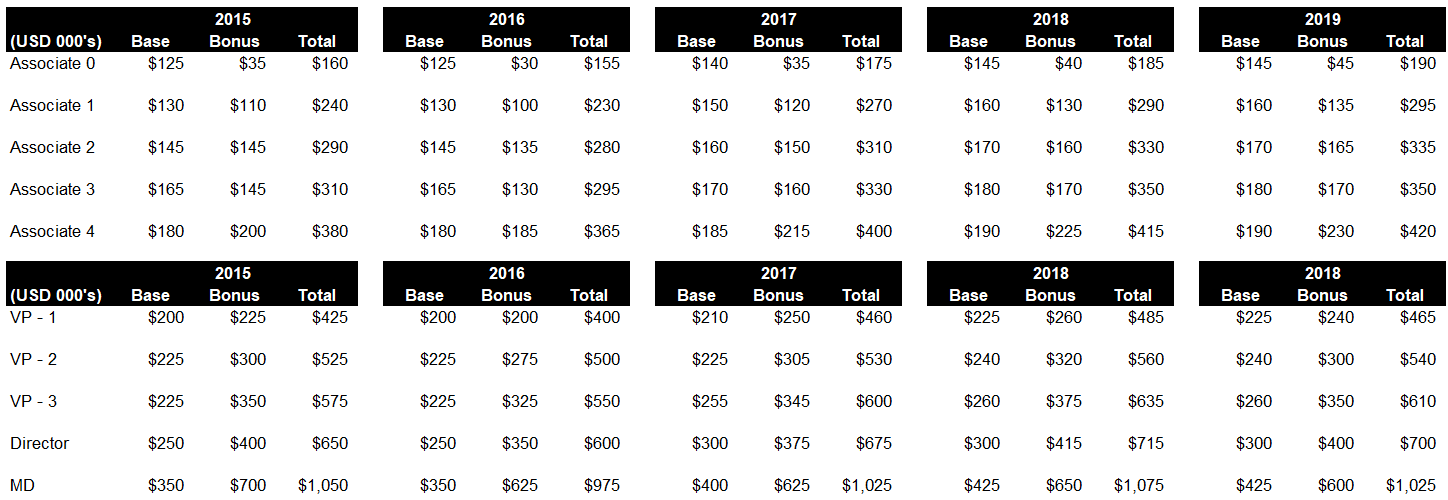

Investment Banking Compensation Chart

Here is a historical investment banking compensation chart from 2015 – 2019. In 2024, the compensation figures are about 10% higher than the 2019 figure. The IPO market has been shutdown since 2022 but is gradually opening up.

Perhaps most college graduates would say that making $160,000 – $220,000 after one full year is worth any amount of pain and suffering.

By the time these first-year analysts turn 30, if they survive, they will all likely be earning over $400,000 a year. Banking employees are the perfect target for President Biden's potential tax increases. And don't think for one second it's only a coincidence Biden makes $400,000 a year as president.

Let's take a look at the survey results of Goldman Sachs' first-year analysts.

Goldman Sachs Misery Survey

One of the biggest misunderstandings some people have about those who make multiple-six figures is they work regular 9-5 hours. In reality, to get on track to make over $400,000 a year by age 30, you will have to work far more hours than the average person.

Therefore, let's take a look at the average number of hours a Goldman Sachs analyst works in the investment banking division according to the survey. This survey and its subsequent media coverage was a large reason why base salaries increased for investment banking analysts during the pandemic.

Hours Worked A Week On Average

Working 98 hours a week on average means working 14-hour days on average. Since Goldman has a no-work-on-Saturday policy, this means analysts are really working closer to 16 hours a day on average.

That is one brutal workweek! These analysts would laugh at anybody working only 40 hours a week and complaining why they can't get ahead. Further, average hours worked a week in America is only about 34!

The 98 hours a week is also on par with the number of hours a stay-at-home parent to a baby or infant works a week. However, for the stay-at-home parent, the stakes are much higher. One look away could mean disaster for the child. At least with the banking analyst's day, they can go get lunch. Or you can shoot the breeze at the physical or virtual water cooler.

The 5 hours of sleep a night average isn't such a big deal. I've been averaging 5-5.5 hours of sleep a night since 1999. After my son was born in 2017, I began waking up between 4 am – 5 am to write in peace before starting the long day of childcare. However, I do take 30 – 45 minute siestas after lunch at least three times a week.

Bottom line: If you want to make multiple six-figures a year for years, you will likely have to work double-digit hour days. Otherwise, your colleague and your competition will pass you by. Working on Wall Street is a pressure-cooker! Go in with your eyes wide open.

Goldman Sachs Analysts Physical And Mental Health

This part of the survey is where I'm most disappointed in the treatment of the analysts. Because the banking business is booming, analysts are working like crazy. However, their physical and mental health is suffering.

Going from a mental health score of 8.8 to 2.8 is shocking. Meanwhile, seeing your physical health decline from 9.0 to 2.3 must mean that you are gaining weight and feeling lots of chronic pain.

My first two years at Goldman Sachs walloped my physical health. I gained 10-15 lbs, had intense allergies, chronic back pain, and plantar fasciitis! WTF?! The happiness of getting a job offer from Goldman went away within the first three months.

I was constantly berated by one of my VPs, Mark W, for not doing something correctly or not knowing something. One day, he yelled, “Even a dog could do this!”

I remember being so stressed that I forgot how to do basic division when asked. When Mark W asked me to crunch some numbers in my head, I froze. I told him I'd be right back. He was miffed. During that time, I ran upstairs to the 50th floor of 1 New York Plaza and asked my Harvard graduate classmate Samir how to do the calculation. Samir eventually went into medicine and became a doctor.

I'm sure many of us have experienced a decline in our mental health since the global pandemic began. Combining the global pandemic with poor treatment at work makes a terrible combination.

The Sacrifice May Not Be Worth It

Bottom line: If you want to make over $400,000 a year, you will likely have to sacrifice your mental and physical health for years. Remember, your competitors are all gunning for you. If you suffer long enough, you will probably make a lot of money. However, you might be losing months or even years off your life. Or you are hurting the quality of your life down the road.

Related: The Health Benefits Of Early Retirement Are Priceless

Goldman Sachs Analyst Quotes

Here is actually the first slide I saw when the survey came out. The selected quotes from various analysts seemed so extreme that I initially found them hard to believe. They felt like Goldman Sachs was punking us, like an April Fool's joke or something.

The two quotes that stood out to me are:

“I've been through foster care and this is arguably worse…”

“Being unemployed is less frightening to me than what my body might succumb to if I keep up this lifestyle.”

Based on this feedback, it is understandable why so many first and second-year banking analysts don't make it to Associate, let alone until 30+ in this business.

For me, I just wanted to last three years as a financial analyst in order to be considered for Associate. However, after two years, I didn't make the cut. It was only through great luck that I found a new job with a promotion to Associate at a competitor in San Francisco.

Getting Out Of New York City Was A Good Move

Once I got to San Francisco in 2001, life got so much better! The economic environment here was more diverse. There were also a lot more outdoor activities to do given the temperature is mild all year.

One of the first things I did after arriving was go to Golden Gate Park and beat drums in a circle like the hippies once did. Various aromas wafted in the air as we jammed to improvised beats. It was nice to be surrounded by people other than gung-ho finance professionals.

At the same time, I knew that if I could last for at least 10 years, I would accumulate enough money where I wouldn't have to work again. Therefore, I gutted it out until 2012 before negotiating a severance to be free.

Bottom line: What doesn't kill you will likely make you stronger. I attribute being able to regularly go from 5 am – 8 pm (until the kids sleep) due to my 13-years working in banking. If you work in banking, management consulting, or big law, you will likely develop sufficient endurance that will help you succeed in your next endeavor. You will also appreciate how much easier life is doing almost anything else compared to banking.

Make Over $400,000 A Year To See What It's Like

Although I don't recommend making over $400,000 a year for longer than 10 years due to health reasons, I do recommend trying to make over $400,000 for at least a couple of years. This way, you will gain more perspective. You might even become more empathetic towards those who can't seem to get ahead making $500,000+. Who am I kidding? Probably not.

The first year you make over $400,000, you will feel proud of your accomplishments. You might even tell your friends, which is a big no-no. With so much pride, you'll want to see if you can replicate the results for a second year.

After three-to-five years of making over $400,000 a year, you will begin to wear out. The novelty of making a high income will no longer be there. If you've saved and invested aggressively during this time, you will naturally start thinking about doing something else more enjoyable.

Related: Your X-Factor Is Key To Being Happy, Rich, And Free

The Ideal Household Income

Taking things down a notch might seem strange. However, $300,000 – $350,000 a year is all a family of four needs to live a comfortable middle-class lifestyle, even in an expensive big city. When you're tired of grinding double-digit hours a day, it's only natural to want to relax more.

At $300,000 – $350,000 a year, you won't be targeted for further income tax hikes while your mental and physical health suffers. You'll pay a reasonable marginal federal income tax rate as a married couple. You can buy a regular 3-4-bedroom home to provide for your two children. Saving for retirement should be no problem. Meanwhile, at least one parent will also have more time to spend with the children.

If you're really unhappy making over $400,000, I'd ask your boss if you can take a pay cut in exchange for doing less work. If you're the boss or partner making over $400,000, I'd raise prices to the point where demand drops by at least 10% to free up more time.

Finally, it's obviously easier to make $300,000 – $350,000 a year with two working parents than one. However, there are also challenges to be had with regards to childcare. At some point, you will appreciate the value of your time more than the value of money.

Related: Overcoming The Downer Of No Longer Making Maximum Money

Think About How Much Happier Your Children Will Be Too

If you give up on trying to make over $400,000+ a year, you might also reduce the amount of stress you put on yourself as a parent and on your children. The desire to make over $400,000+ a year can often manifest itself in higher expectations for your children. If you are not careful, you might ruin your child's childhood and your relationship with your child.

Part of the reason why some children study so hard is so that they can get great grades in order to get into the best university possible. The ultimate goal is to land a prestigious job and one day also make lots of money. After all, that's what mom and dad may have done. Therefore, they don't want to disappoint you.

Unfortunately, getting into highly-ranked universities and landing high-paying jobs is more competitive than ever. Instead of getting into U Penn, they get into Penn State. A fine school. But is it fine enough if they spent $500,000 of their parent's money on private grade school?

Tremendous Pressure On Your Children

As a result, many children suffer from intense pressure. Some children resort to destructive behavior that could lead to rebellion or worse.

If parents could be more chill, children could perhaps have a better childhood. Parents could also be more OK with saving money sending their kids to public school and so forth.

Can you imagine how much better life would be if kids went to school for the pure sake of learning and not for getting the highest grades and test scores possible? Children and parents would be happier if the expectations weren't joining Goldman or McKinsey or bust.

See: What If You Go To Harvard And End Up A Nobody?

Make Money With Your Investments Instead

As I gear up to return to the early retirement lifestyle once everybody I know is fully inoculated, I'm focused on saving and investing as much money as possible until that time comes.

Not only is investment income taxed at a lower rate than W2 income, investment income also takes little-to-no effort to generate. This double win is great for your health and freedom!

Fingers crossed President Biden doesn't also raise the long-term capital gains and dividend tax rates. However, it seems like Americans who weren't eligible to receive any stimulus benefits since the pandemic began will be asked to continue helping out our fellow citizens. After all, debt must eventually be paid back.

Regardless of future tax initiatives, not only will I try and build more passive income, I'll also find a way to make my active income more passive as well. This will entail finding someone capable to do more of the heavy-lifting at Financial Samurai.

The pandemic has helped some of us focus on building more wealth given fewer outlets of distraction. However, as the global economy reopens, spending more time enjoying life should be priority #1!

Related post: Why The Smartest Countries Are Not The Happiest

Break Out Of The Middle Class By Order My New Book: Millionaire Milestones

If you are ready to build more wealth than 90% of the population, grab a copy of my new book, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

Stay On Top Of Your Money

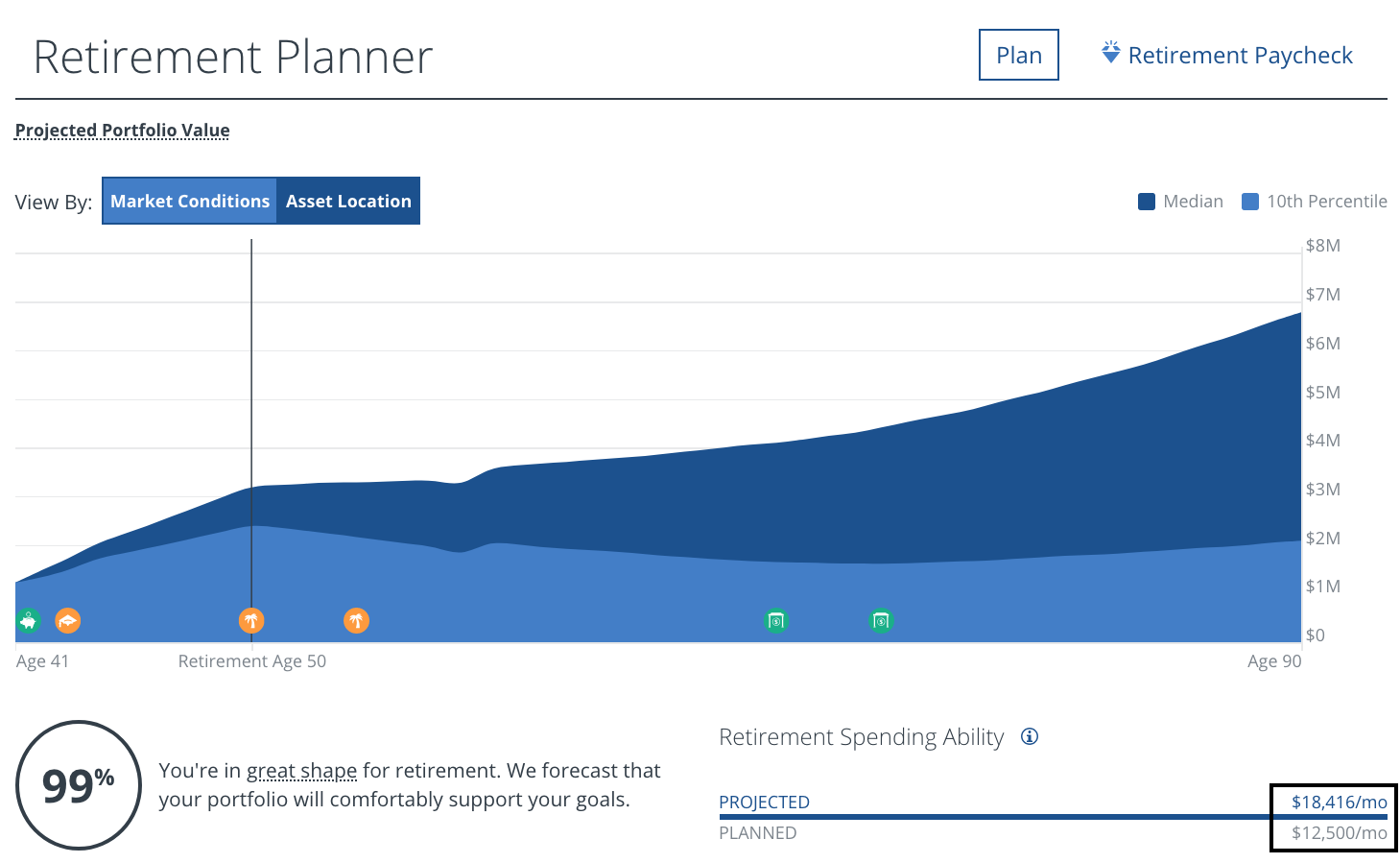

Track your net worth for fee with Empower. I've been using Empower's free financial tools to optimize my wealth since 2012. It's the best free money management tool on the web.

Just link up all your financial accounts to measure your cash flow and x-ray your portfolio for excessive fees. You can even calculate your retirement income and more.

Get you finances right the first time around. There's no rewind button in life. Once you do, you can focus on the other things that truly matter in your life.

Empower's Free Retirement Planner

Favorite Passive Income Investment

The one investment that has helped me escape investing banking the most is real estate. Real estate is my favorite investment because it is a tangible asset that provides utility and generates income.

Today, my real estate portfolio generates over $100,000 in passive income out of roughly $275,000 total. As inflation increases, so will my rental income and property values over time.

Take a look at Fundrise, my favorite private real estate investing platform. Fundrise has been around since 2012 and now manages over $3.5 billion for over 500,000 investors. Most of their funds' investments are in residential and industrial property in the Sunbelt region, where valuations are lower and yields tend to be higher.

I've personally invested $954,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. Earning income 100% passively is the way to go!

Fundrise is an exclusive sponsor of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds.

Reader Questions

Readers, is making over $400,000 a year worth it? How have you managed to balance your health and desire to make as much money as possible? What were some ways in which you were able to let go of a high income? Any Goldman Sachs employees out there?

For more insights into Wall Street compensation and working at Goldman Sachs, here's a podcast interview I did with Jamie Fiore Higgins. She worked at Goldman for 18 years and was an MD for four years before she left. You can subscribe to my Apple and Spotify podcasts by clicking the links.

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

This story is completely fabricated. Also, trying to say being a stay at home parent is just as demanding is utterly hilarious.

You think the feedback from the annual GS analyst survey are fabricated? I can put you in touch with them if you want. Maybe you have never worked in an intense industry like banking before?

The truely smart ones, struggle for ~10 years, while saving ~70% of their income and then get out. It is a great way for those with nothing to get established and get ahead. Personally I managed 15 years before getting out – 15 years instead of 10, only because I was not smart enough in the early days with money management and investing. Or maybe it took me a while to extract myself from the golden handcuffs (see below). I have 2 observations about the “human condition” that is sad:

First are those who seem unable to get out – addicted to the money and caught by the golden handcuffs – as eventually they realise their mental and physical health is poor and worse still their best years have passed them by. By the time they realise it is normally too late. Sad.

Second are those who look on with envy and ignorance thinking they have somehow been hard done by because they never managed $200k – $400k a year while working ~35 hours a week and spending weekends and evenings with their friends/family and at the pub or whatever. This is the human condition where our situation is always the fault of someone else, and most are unable to look inward (where the solutions and problems lie). Also sad.

Investment Banking is only one way to make $400K per year. Tech is another path but I have no first hand experience. It feels like working for Apple or Google would be less of a grind.

I do have experience being a Fortune 50 corporate cog at Director or VP level. When I left 10 years ago my compensation was $250K. Had I stayed I’d probably be at $400K. The work was 60 hours a week, Monday through Friday, some evenings but no weekends. It was worth the tradeoffs but I was lucky enough to get laid off and found something much easier and lucrative–real estate investing.

Sam,. Once again, good article on pertinent topic about the “costs” of maintaining a $400,k /yr income. You reference earning $170,000 /yr from $380,000 real estate sales investments,”

Today, my real estate portfolio generates over $170,000 in passive income out of roughly $380,000 total. “.

How are you generating almost 50% annual returns ? It’s not just through passive crowdfunding or your rental properties, is it?

Is that $170,000 / yr , net after all expenses or a gross number? Thanks for your response and insight. Happy writing and best regards,

RH

No, he’s saying of his $380,000 income each year, $170,000 is from real estate. The other $210,000 comes from other sources.

Sam has shared earlier that he invested over $800,000 with Fundrise, and over the years probably more there and with CrowdStreet. Plus he owns at least one rental property and is collecting rent on that.

So I think you are misunderstanding the math here.

My real estate rental income and distributions account for about 50% of my estimated annual passive/semi-passive income.

As I invest more in private real estate funds, the annual distributions will be more lumpy. Rental income has also grown over time due to inflation and economic growth. But it is more predictable.

The $170,000 a year is gross, before taxes. Thx

average starting salary for an engineering major is ~$70K plus ~15% bonus. almost all other professions have similar salary/bonus ratio. why investment banking analyst earn 100% as a bonus? why labor laws both federal and state are violated by this practice of making people work 100+ hours a week and none of the investment banks is punished for this? why the insiders just quit or perpetuate this practice? stop pretending you do/did it for you kids! Change the system!

What are your thoughts about making over $400K and working 40 hours a week?

It is quite common for dual income household employees at FAANG companies and similar level tech companies to be making $300-500K each, with great WLB.

Do you think the taxation still outweighs the benefit?

Pretty good combo, especially if the work is interesting and not that stressful. Could be the ideal amount actually given your taxes won’t be going up.

See: https://www.financialsamurai.com/living-a-middle-class-lifestyle-on-300000-year-expensive-city/

I personally have a goal of consistently earning $300,000 a year in investment income to raise two kids and enable both parents not to need day jobs.

Hi Sam, would you work more years in Investment Banking industry had the personal income tax rate been lower?

I live in Quebec Canada where federal + provincial tax rate hits maximum of 54.75% for anyone earning an annual salary of 214K. I never had an ambition to earn lots of money. I enjoy my insurance actuary job in a big corporation. I started at 55K (20% average tax rate), 10 work years + 2 years mat leave + 0.5 yr vacation later, I am making 135K at 33% average tax rate. I work the same hours 37.5 per week, I get more challenging tasks but I also gain more experience to do them. Overall, I am very happy with work life balance. I will probably work another 15 years in this industry until my parents are too old to take care of themselves. If I don’t need to care for elderly parents, I can see myself enjoying this career until I hit the government retirement age.

I have friends who chose to move to U.S. for money. They made 1.5 times my starting salary with lower tax rate. They now earn about double my salary. The ones who moved south right after school were a lot happier at their higher American salary compared to the ones who moved south after they had 1-2 kids.

I have a cousin who moved to the U.S.A. in his late 30s. His family after-tax earnings were not enough to cover a family of 4 expenses and retirement savings. So he moved to Washington D.C. where his wife and he got their salary doubled from 150K CAD to 300K USD. They were only happier in the first three months. Then their happiness level dropped significantly because they don’t have relatives to help them out with the kids and they were both working 55+ hours a week compared to 35-40 hours a week back in Canada.

Good article, Sam. I would say all applies if you’re working a w-2 job. I would never want to make $400k per year working for someone else and get raked over the coals in taxes every pay period. I think if you’re going to work for someone else, keep your income to $150k or less as a w-2 employee.

I remember my days in sales and making $150k and being pissed at how much was taken out for federal/state/payroll/SS/Medicare etc. every pay period. I can only imagine what $400k annual salary looks like every two weeks pay period.

5 years ago I left my w-2 job and started my own niche executive recruiting firm for the industry I had spent 20 years working in. Last year I made $648k and on track to do the same this year if not more. I roughly work about 10-12 hours a day and run the business entirely by myself.

With this new Biden plan to raise taxes on earners making $400k and over, I’d really like to hear some strategies on what to do if those plans come to fruition for us business owners. I run an s-corp so I can choose to take more in distribution and pay myself less in wages as a strategy, or spend every dollar above $400k on business expenses thus being taxed only on everything below $400k. I could also hire some people, though I don’t feel I have the patience to manage anymore.

Would love to hear your thoughts

This is actually a very timely article. While not in IB, I am in a similar situation – I am a Sales Manager at a software company – lot’s of travel, very high stress with your entire year coming down to 1 or 2 large deals, good pay. I have been at my current company for about 11 years and in this role for the last nine. When I first started here, I was doing inside sales and making about $150k. The role was very low pressure and I enjoyed prospecting/cold calling so it was great. Like any inside sales person, moving up to an outside sales role was the goal and the main motivation was money as our outside reps are targeted at $350k-$450k.

Cut to now, I have been doing this job for nine years, have been making great money (over $500k most years) but really dislike what I do. At the same time I am very grateful for the opportunity that I have and the financial situation that I am in as I know many people would trade places with me in a second. I feel obligated to stay where I am for a few reasons – 1. As I said, I know that I am lucky to be where I am and leaving would feel like me quitting or being weak; 2. I have a family (wife and two young kids) and I am the sole breadwinner so making sure my family is in strong financial situation is really important to me; 3. My entire life has been in sales so if I leave I feel like going somewhere else would just be more of the same and not any improvement in quality of life.

The question that I ask myself often is – if my sons wanted to do my job, what advice would I give them? I tell myself that I would say – do something that you really like. Yet here I am not following my own advice…

I hear you. At some point in our lives, we must accept that this is our role in taking care of our family. Or, we must take a tremendous leap of faith and risk a lot.

I left the grind five years before we had our first child. It was much easier to do so when it was just me and my wife.

But maybe there’s a way for you to enjoy your job more and travel less if you focus on making $300,000 instead? Just set expectations with management.

I am in a similar situation. Are you in a high cost of living location? Not sure how much over $500 you are making but i feel that a single bread winner $400 to $550 per year income, with a family, in a high cost of living region, has a unique catch. If you allow your lifestyle to inflate with your ‘peers’ you can easily be left under saving/investing and end up in the high income low net worth category and tethered to your job. There is also this element of ‘one more bonus’ syndrome where you continue to press on year after year. I would like to start my own business in a specific field/industry for which i have a lot of interest but the risk of leaving my solid job considering i have no other income streams feels financially irresponsible considering my children are still young.

We live in the Boston area so yes, we are in a higher cost location. Thankfully, we are pretty frugal. I do agree with what you said above with the whole – “one more bonus” mentality.

I have thought a lot about buying a business. I grew up in family where my parents ran their own business and I worked for them up through college. I spend a lot of time on bizbuysell seeing what’s out there. One of my younger brothers was working for a hedge fund in Boston and decided to open a business a couple of years ago. The covid pandemic definitely hit him hard but he made it though and is in a pretty good position right now.

The idea of building something that my kids could take over one day (if they want to) is very attractive. At the same time, it is obviously a huge risk and I don’t know if I am willing to take that leap.

JRB3, good highlight. I’m in the same boat and not spending all that cash can be hard. My plan is not to let lifestyle creep spend that income. Save then do something else, let your investments pay you then ‘retire’ and do a job you want to do. At this income you’ve probably already maxed your 529 (we contributed $150k this year (to an existing $50k) to be done here while kids are still elementary age). Retirement is nearly funded now at 44. House is paid. Just don’t spend it all (or divorce).

I like to to golf sometimes, do I join a country club, hell no, just make a tee time. Private school, hell no, move in the right neighborhood for public (you can afford the right neighborhood).

I’ve also changed roles within the same company every few years to keep things interesting, just starting a 2 year intl assignment moving in summer. If you’re great, your company will accommodate you.

My plan is to work at a winery (own it, not likely) or beer garden in the next 5-10 years cause it’ll be fun and 0 stress.

Yes, I keep telling myself that if I can make 10 more years, at the rate we are currently saving, we’ll be in a position to do whatever we want (within reason). Right now we have a net worth of about $3 million. If we keep saving, I keep putting the max in my 401k w equal company match, in 10 years, we could be over $5 million if the market is reasonable (6% or so). At that point, I would not want to retire but I could definitely afford to take a step back in terms of pay and stress and basically get a job that I enjoy that pays the bills and has decent benefits.

I have always wanted to be a financial advisor as it is something I believe I would really enjoy. Maybe that could be my second act…?

I like how you’re focusing on 10 years. Because truly, I think the secret to a success career, business, anything is sticking with things for at least 10 years. Check out this post.

Appreciate your writing, as always. The part that either makes me laugh or cry is my wife and I are finally at that number, after repaying student loans, and both building successful businesses. We just added on to our house after living here for 14 years. It just seems insane to punish us after 20 years of busting our tails to get to this point.

We make 1M-ish combined- its true that the incremental happiness we realized on the journey from $200k to $1m kept diminishing but I’d still say its still positive!

And to the point – it wasn’t increasing savings that brought us more enjoyment, but increased spending!

We used to spend 50% of our 200k income (around 100k a year) and now we spend maybe 200k a year – a lot of it on services (child care, cleaning services, ordering food, shopping at fancier grocery stores, fun vacations, gifts).

I did work in investment banking, at Goldman Sachs, as a matter of fact! And it certainly was pretty awful . But I considered it kind of like a short term boot camp to leverage and go do anything else one day, but with a nice cushion of money and no b school debt!

I’d advise any smart young person to front load their “pain” and do it with intention. Just focus on that one thing and don’t even try to have a life or balance. Dig in and do it. Give it three years and then bounce! Find love, travel, do yoga, exercise, have your kids! Just keep in mind you’re only doing that crazy job for a little while and it doesn’t feel as endless and horrible.

The thing with these intense and often high paying jobs is that the skills and endurance you learn will always come in handy whatever you choose next. Now, I just don’t feel as frazzled and tired as some others do in my current job. Nothing is ever as bad as it was back when I was 24 with 4 hours of sleep and a crappy boss threw a keyboard at me for making a mistake on a pitch deck!!

Front loading is a great concept and something I would recommend and will try to instill in my children. I pounded the pavement for a long time. Now I’m in my 40s and I have the drive to keep going but the energy just isn’t there (may be a component of the job just not leaving enough time to exercise and sleep appropriately for my age). Luckily/due to those efforts I could quit if I wanted to, but I still like the money and some aspects of the job. If the tax situation changes I’ll just have to change my payment structure for delayed comp or get paid more. Otherwise…..may hang it up. But the bottom line is I’m glad and fortunate I crammed in the work early. I frankly sometimes feel bad, for my former self. I get the feeling I’m basically sailing off the work I put in early. And I know if I had to do it again at this age I couldn’t do it.

A lot of this is tongue in cheek as one cannot always choose the hours needed on a job, an example, a group medical practice, requires all partners to work the same hours.

However, since I started investing two years ago in multiple assets, without the support of my family, who only know “regular” jobs and the stock market, I’ve done damn well.

I forwarded your article to them as they are tired of my using the words, “passive income”. Maybe now, they will believe in me a teeny tiny bit.

What kind of assets are you investing in for passive income?

Hello Sam! I am a huge fan of your blog and find your posts so insightful and inspiring. I hope you’ll run for President one day! I will offer to run your campaign.

Tiny quibble: Over the years, I have noticed that your views on work are heavily influenced by your having worked in a brutal industry which demands 12-hour days for years on end. I can completely understand how it was a terrible situation, and it would also make me hate working.

My husband and I each make about $300,000 working in jobs that we really like. We both work at corporations in a legal department. (We’re both regulatory lawyers.) It’s really interesting and challenging, and the work-life balance is great. It’s pretty much 9 to 5 (Mon to Fri), with the occasional time that requires more. Our employers really focus on the culture and making it a pleasant place to work.

We are pondering early retirement (early 50’s now and kids are in college), but we like our jobs and so we are kind of reluctant to leave. (Part of it may be that we’ve lost some of our creativity about what to do with our time, since we’ve been office workers for 25 years.) Our health is good, and so perhaps we’ll retire now to do a bunch of bucket-list travel, and then perhaps find something else to do work-wise where we are our own bosses.

So I think it is possible to work in a corporation, and find it enjoyable. But granted, I can imagine that being my own boss would be even more cool, if I could get the courage to take the leap.

Hello! If you and your husband each are making $300,000 a year and enjoying it, then more power to you guys! This post is really for those people who make over $400,000 a year and hate their jobs but can’t seem to take it down a notch.

This post is also for those who make less than $400,000 a year and feel envy or jealousy or hate towards those who do. I just want people to step back and realize that the grass is not always greener on the other side.

After over a year of the pandemic, I hope people focus on doing things that matter that they actually enjoy.

Thank you Sam! Good points! Your posts are very helpful, and I truly hope you’ll continue offering your insights for years to come. I personally feel like I have received a college education in personal finance just from reading your blog for several years.

The thing about this is this is known going into it. When I looked at IB in college (which was almost 20 years ago), that was one of the things constantly beat into your head: You will work your ass off for a few years but will be paid accordingly.

For people not in this world or other “high flying” industries such as high finance, management consulting or Big Law, this may seem like a shock, but the reason you are paid so much is because the job SUCKS. Everyone wants to be in these industries because of the crazy money, but there is a reason they have so much turnover. From personal experience/my friend group, you usually last 3-5 years and then peace out. Its not usually enough to retire, but its enough to pay off your loans, buy a house, and give your retirement a massive leg up compared to your peers. With the money you’ve earned, you are then free to go to a job you actually want.

It is an expectations game. Which is one of the reasons why I initially thought the quotes from the analyst were not real. Before joining these industries, we all know the work hours are brutal. But it seems like they might have become more brutal over time? Or, we have changed our expectations On one brutal really is. That said, 98 hours a week of work is damn brutal!

My starting salary as a Big 6 consultant in 1993 was $35K–no bonuses offered. Less than 20 years later, in my final year in corporate America, I broke $400K, but it was not repeatable. I was laid off and my package included severance, vacation pay out, and a single lot of options. That was my last paycheck because I semi-retired at that point.

I had not even heard of the consulting profession until 3 months before graduating from college. I was in for a rude awakening when my first project had me working 100+ hours per week, 7 days a week, doing the most menial of of jobs (e.g., photo copying, reconciling numbers, assembling binders, etc.).

I developed strategies to gradually reduce my hours worked while steadily increasing my pay. During my last year as a corporate employee I was only working 30 hours per week.

Since I started my semi-retirement, I work 10 to 20 hours per week, make negative income (by design) through real estate losses, but have increased my net worth at a faster rate than when I was fully employed.

Sounds like a pretty good journey! Yes, one of the downsides of making a high income as they become more of a target during difficult times. If you are not generating way more revenue than you Cost, then you tend to be one of the first on the chopping blocks. That’s what happens to managing directors during the downturn in banking.

What I always keep in mind is Bill Gates and Warren Buffett were able to be home to have supper with their kids and my father was the same. Now of course people can be out of town but the norm was being home. I think you hit it on the head about what you do your kids will want to try to achieve as well.

Now I always try to do well at work and I have had many promotions yet, I am no where near the $400k. My salary is about $140k and I get pension and a number of other perks but I am also home for supper every day. Further, I don’t have to travel, even before the pandemic. In Edmonton, my salary is above average and so that makes a huge difference.

A piece of advice that I received before accepting one of my promotions was wait until your kids are older before moving into management. I didn’t take the advice but I would recommend either doing all the hard work like you did before kids or finding an above average job that allows you flexibility to be with your family. As once your family grows up you will not get that time back. Therefore, think hard about your family before taking a job.

Our society is so out of whack in this way. We should prioritize being home AND excelling at our jobs. If Bill Gates and Warren Buffett can do it, we call can.

I left my job as a CEO, because while divesting our business to another Public company, I was forced to get on a plane last minute to fly to New York City to meet with potential buyers several times. My kids were small. They were usually sick. My wife was miserable.

I saw the writing on the wall. I could continue to try to keep up with this crazy lifestyle and continue to make more money, or I could call it quits and build a happy life with what I already have.

So glad I left the grind! I agree, and emphasize that you don’t need to be working more than 40 hours to be effective in your job. If you work for someone that doesn’t prioritize family, get the heck out of there!

It’s funny how children can be our greatest financial motivators and also our greatest reasons for taking it down a notch.

Good point about being home in time to spend dinner with the kids. But I think Warren and Bill were very wealthy even as children. With the ability to hire help, or be a stay at home parent, with so much wealth, I think they have different lifestyles than many of us.

Been in tech my entire career and have survived everything described in this article. At one point, I could only count how many hours of sleep I was getting (4-5 hours a day) because I lost track of how many hours I was working including Sat/Sun. The damage to my health is immeasurable, I’m sure.

But the point I will stress here is about our kids. I have spent many hours thinking about how I worked really hard in high school to work really hard in college to work really hard in my job. The point of that was to provide a good life for myself and my family. So do I want my children to suffer in the same way I did? Probably not. I realize the trade off in providing them a “good life” is the risk they will not be as motivated as I was. But if I’m able to enjoy life with my children, I think I’m ok with that.

Thanks for sharing Mary.

Good thought highlighting the ends, to provide a good life for yourself and your family.

It’s really tricky regarding how much of a good life we should provide for our kids. The last thing we want is to spoil them rotten and take away all their motivation and self-esteem.

Open dialogue, explaining why things are, and providing perspective is a must!

Related:

The Dangers Of Messing Up Our Kids As FIRE Parents

A Massive Generational Wealth Transfer Means Everything Will Be OK

I am 71 and work. Last year I earned more than $400,000. In April I am spending some of the money to fly my wife, a son, his wife and my two grandchildren first class to a four star resort for a week. If I did not have these people in my life, the money would sit in an account and mean nothing.

At my age, I only spend money so my family gets to play. Families can’t afford to play like this. I have worked my whole live and what makes it worth it is the fun my money buys for my family.

If you earn this much money or more, I suggest you use the money so the family can play. Your spouse and children get no pleasure from your $70,000 car or truck. They would have a great time spending the money on fun. Trust me. When your children are adults, you want them to say we sure had fun with our parents.

I’ve made a pretty good spectrum of salaries in my life. My first “career” job salary (not bagging groceries as a kid) was over $150k out of school. I took that up to over $400k before quitting and doing my own thing. Since being on my own I’ve had several years that were seven figures. There are a couple of nuances to what Sam is saying. I think he left out one very important one though (I’ll explain below).

I completely agree that making over $400k a year brings almost zero additional happiness. I can make a solid argument up to $350k. After that I think you are inevitably competing with your neighbors (regardless of what you tell yourself). There are exceptions if you love your job, blah blah, blah, but we are talking generalities here. The artist making $10,000,000 a year or more painting in a French villa is obviously not what we are talking about. He or she should clearly not quit at $400,000 or dial back. Neither should Tom Brady.

For the rest of us though, there is a second and very important part to this conversation. Making over $400k a year doesn’t buy additional happiness UNLESS you are broke. Sam is so far removed from this problem he may not remember (I barely do myself). But, I have doctor friends that make over $500k a year and spend it all. They might have some equity in their home, but they are cash poor for sure. Those folks actually do gross more “happiness” from making over $400k because they define happiness based on “stuff” and competing with neighbors. When they go from $400k to $600k they are actually (temporarily) happier.

Sadly I know above from experience. I was not “happy” with $400k a year until I had a few million in the bank as a buffer and pushed my core spending below $250k a year. So, personally, I would say that if you have a solid nest egg, don’t spend more than 80% of what you make, then…and only then…does breaching $400k make little sense (again, unless you love what you do and money is not the point).

Awwww…poor paper chasing finance grads :) According to an article I just read on CNN treating their entry level analysts like objects “… is something that our leadership team and I take very seriously,” CEO David Solomon said in a voice message sent to staff on Sunday.

LOL what a bunch of B.S. Interesting to get your take on working in the finance industry…it reminds me of the tech industry in some ways although I’d argue my RSUs did better over the last year.

When I made over $400K living in a small town in the rural south and maybe working about 45 hours a week counting commute I actually felt pretty lucky. But I also had a fun engineering job with lots of room for creativity and not a financial banking grind of an existence. I won a lot of tennis tournaments and ran 15 marathons while doing that job, and never felt short of time. I wasn’t working any harder than when I made $60,000 because I had lots of people I could delegate the work too. I retired before the Trump tax cuts so that was bad timing but at least I did get all three of the stimulus payments since my 2019 tax return slid in just under the allowable.

That’s amazing ! What city in the south and what do you do for a living ?

I think everyone has different thresholds of work / life balance and comfortable living perspectives that vary greatly based on metro. I have found that once you hit around the 30s+% tax brackets, it strongly incentivizes you to pursue additional income streams that can be treated more favorably tax-wise i.e. at long term gains. It will be truly painful if long terms gains tax brackets are increased accordingly, which I’m sadly sure they will. I’m also bracing myself for some sort of tax structure to be imposed on Roths.

I think you are raising your kids wrong if money is all you care about. Have some perspective- there is a whole wide worlds out there that is safe, fun, enlightening and enriching outside of your high-paid NY and SF bubbles. Maybe show your kids that instead of just accumulating wealth and paying half a million for their private school, they might turn out to be more well-rounded and balanced humans :)

[hope you approve this comment, differing viewpoints are good for a healthy conversation]

I’m glad you agree with me. As my title and post says, it’s not worth studying so hard, working so hard, putting yourself through so much stress to try to make over $400,000 a year. Try it for several years to see what it’s like, but change if you are not happy. I live what I believe I left work at 34 in 2012.

How about you? What industry do you work in and did you pass the $400,000 dollar a year mark and realize it was not worth it as well?

It’s always great to hear reader stories.

I’m 36 working in finance in Canada. This article really hit home. As I’ve seen my personal income now surpass $300k this last year I don’t find my happiness has actually gone up anymore.

My wife and I are big savers. We try to save about 40% of our gross income each month…the other 40% to taxes. Not always possible but it’s a good target to push us.

Hoping to FIRE in the next 5 years. Your articles continue to inspire us.

Thanks for all that you do Sam.

New grad working in tech as a software engineer chiming in.

My compensation is comparable to investment banking analyst and IB hours are not worth it. After tax, rent, student loans, you’re not really saving much to invest.

Luckily, I only do 40 hours and my manager is way chiller than the a$$hole you will meet in IB.

I still work long hours as I am spending the other 40 hours grinding on a business and it’s way more rewarding. Upside is unlimited. The work is much strategic/opportunistic than formatting pitch books

The ideal combo is work in tech and grow a business on the side. Invest your savings in BTC.

You don’t need buyside exit opportunity or MBA to reach the high life.

I’m a small time real estate investor, with 5 properties in metro Seattle/ PNW, I’ve got net $4M in investments. I have a simple life, don’t spend much, and have other assets which provide income, although I’m more comfortable with the additional rental income.

I’m retiring at age 70, to a less active role. Locally, I’ve hired Property Managers, which has worked out for me.The properties are all single residences or duplexes made from single residences.

But – Washington state is hostile to Landlords, with a new state law in process which will take away control of our property. Also, there is the WA Estate Tax which hits my estate at my death if assets are over $2.1 M. So, I’m planning to move to another state, eying states which are, naturally, low taxes and enable Landlords to control their property.

But, I would prefer to get out of the Landlord industry, and find another means of generating income as I age, since the US has responded to the pandemic by reducing Landlord ability to maintain cash flow in order to keep people from homelessness. I understand the societal dilemma, but want to re-position myself so I’m in a different industry — one which is not held hostage — not held responsible for a problem of the entire society.

I’ve been advised that the standard procedure for leaving my presence in WA is to use IRS 1031 exchange as I sell my present real estate holdings and buy equivalent rental real estate. That enables me to move to a state which is less restrictive of Landlords — but doesn’t enable me to get out of the industry and re-invest my equity to create income elsewhere.

Do you know of other legal methods which according to the IRS would avoid taxes on selling Rental Property? Real estate values have increased considerably in metro Seattle, so there would be considerable increase in values on each property.

I’d like to use this opportunity to tell you how useful I have found your blog these past few years,

and thank you for your thoughts. I can only hope you keep it up, tempted as you are to move on. I find you a unique voice. Regards, Ed

Ed, I don’t have a good direct answer to your question, but I wanted to give you a quick heads up on your plan. I live in a state that would be considered very landlord friendly. But, I live in a city in that state that is similar to Seattle. So, as you plan for the future, I would advise you to look at the current landlord rules (and past COVID landlord rules) at the city level and not just state level.

The one relevant thought I did have is that you may be able to sell all of your property at once and do a 1031 exchange into a diversified real estate fund. There are some good private options these days for accredited investors (which you would qualify as of course). Not my thing, so I don’t know much about it, but might be worth looking into if you want to avoid the management drama of individual dwellings. You can often invest in commercial real estate projects like hotels and office space that would not be subject to the landlord rules that you are concerned about. In fact, this idea could be an option even in Seattle where those new rules likely don’t apply to commercial holdings. Best of luck to you!

I feel sorry for you. I never thought America would get to the point it would upend 100 years of contract law and confiscate millions of homes, but it did. I see it as a sign of things to come. No one will be responsible for the contacts they sign or the debts they take on. Student debt is the next thing to be nationalized. Sadly this will end up being more of a grab for corporate landlords/Blackstone/invitation homes as it was in ‘08. One of the reasons people like to do business in America is a stable legal system. That’s gone after this lease confiscation. Is anyone pretending many of those take advantage of the situation vultures are going to pay back a year and a half of rent anymore?

I don’t have any investment bankers in my social circle but I do have a fair amount of small business owners. Construction, sheet metal, orchard owners, freight broker and convenience store owners to name a few. All of them worked hard and even stressed more in their 20”s and 30”s. Now most are coasting in their 40”s and 50”s. They all make over 400k and they have a good work/life balance. None of these people are Ivy League or anything close. Half didn’t go to college. The one thing that sets them apart is that they own the business, not work for it.