After some debate between paying by cash or by credit card, I decided to pay $750 in cash to fix my car fan instead of paying $1,004 with a credit card to get points and peace of mind.

By paying $750 cash, I'd save $254 and still get a one-year warranty and receipt. By paying $1,004 with a credit card, I'd only get 1,004 Chase points. This is equivalent to about $10 – $30, depending on how I use them.

The savings difference should make paying by cash a no brainer. However, I always like the convenience of paying by credit card along with its accompanying purchase protection.

I've bought some bad products or paid for some bad service before. Once you pay by cash, it's harder to get your money back. The huge benefit of using a credit card is fraud protection. You can get your money back while they investigate. And this in turn helps prevent that same scammer from victimizing others.

How much would you be willing to pay to have someone fight to get your money back? I'm forever appreciative of a large financial institution for crediting me back $2,000 after my kidnapping in Beijing. If I was just carrying around $2,000 and had it stolen, I'd be SOL.

Evaluate The Reputation Of The Vendor

One of the things I love about the internet is the ability to review a vendor based on honest customer feedback. If the vendor averages 4-5 stars on Yelp, with over 100 reviews, chances are high they are good.

Before the internet, you might only be able to get a couple of word of mouth recommendations. Now, you can review dozens of nuanced reviews all in one place and make an informed decision.

My auto service shop had 79 reviews and an average 5-star rating on Yelp. I don't think I've ever seen a vendor average 5- stars with over 50 reviews before. There's always someone who has a problem who drops a 1 or a 2-star review.

When I spoke to the owners in person, I decided that they and the reviews were legit. I asked them to go ahead and order the fan. Then I told them I'd come back in a couple weeks to do the work. In the meantime, I wrote a post to hear your thoughts.

Roll The Dice With Cash

Paying with cash is always a slight gamble. But I figured the gamble was worth a 25% savings. There were so many positive vendor reviews online and my conversation with the owners went well.

The owners aren't going to close up shop for a measly $750. They've got a lease they're paying and a reputation to protect. They also want to win over my business for the long term.

If they screwed me they'd risk getting a very bad review. It seemed unlikely they would take my $750 and not perform the car service. They told me to pay after the work was performed after all. Although there was still a risk they may not honor the one-year warranty if something were to happen.

But it was clear to me they'd do a great job in order to win me as a long-term customer. Besides, you don't want to screw over a blogger with his own platform right?

Considerations Before Paying By Cash Or Credit

Besides the vendor's online reputation and the desire to win repeat business, here are some things you should consider before deciding whether to pay by cash or credit.

7 Important Considerations:

- Amount being paid – The greater the amount, the more you should consider paying by credit card. Over $10,000 starts getting a little dicey if you have a choice of paying by credit card. There's a reason why escrow companies exist when buying or selling a home.

- Ability to disappear – Evaluate how easy is it for the vendor to take your money and never be seen again. The harder it is for the vendor to disappear, the more confident you should be to pay by cash.

- Ability to write a review – If you can't write a review of the vendor because it is too new or not established, then you will be more inclined to pay by credit card.

- Ability to pay in increments – If you can cut up your cash payments by work progress, it may be better to pay in cash to save money. For example, I paid my landscapers 20% of our contract price after they performed 20% of the work. I kept on paying in 20% increments until the job was done.

- Ability to film the vendor – Getting filmed on camera is tricky, but if the vendor allows you to do so when discussing the contract and making a payment, you should have more confidence paying by cash.

- The type of vendor – When you have a service job, it's easier to pay by cash to save money. Examples include cleaners, landscapers, unlicensed contractors, and movers. It's hard to pay for things you buy online with cash.

- The ability to do the work yourself – If you can repair the job if it goes wrong, then you might be inclined to take more risk by paying cash. If you can easily find someone else to do the job for you, same thing.

Free Sign Up Bonus Cash Is Nice Too

What this exercise has also reminded me is that I should also take advantage of the occassional credit card signup reward. After all, you can save money by paying by cash and save money by getting free cash as well.

I've had my Chase Ink Business Cash credit card for over 10 years now. For new cardholders, it offers $500 cash back after $3,000 in purchases and 5% cash back on the first $25,000 spent on office supplies, cable, phone, and internet services. But I've already blown way past the initial limits since 2009, and therefore, only get 1% cash back on all purchases now.

After doing some research, I realized I could switch my business credit card to the Chase Ink Business Unlimited credit card with no annual fee. The card also offers $500 cash back after $3,000 in purchases. But instead of just 1% cash back on all purchases, it offers 1.5% cash back. So I signed up. I've easily got $3,000 on business expenses I need to spend within three months.

Optimize Your Credit Cards For The Most Rewards

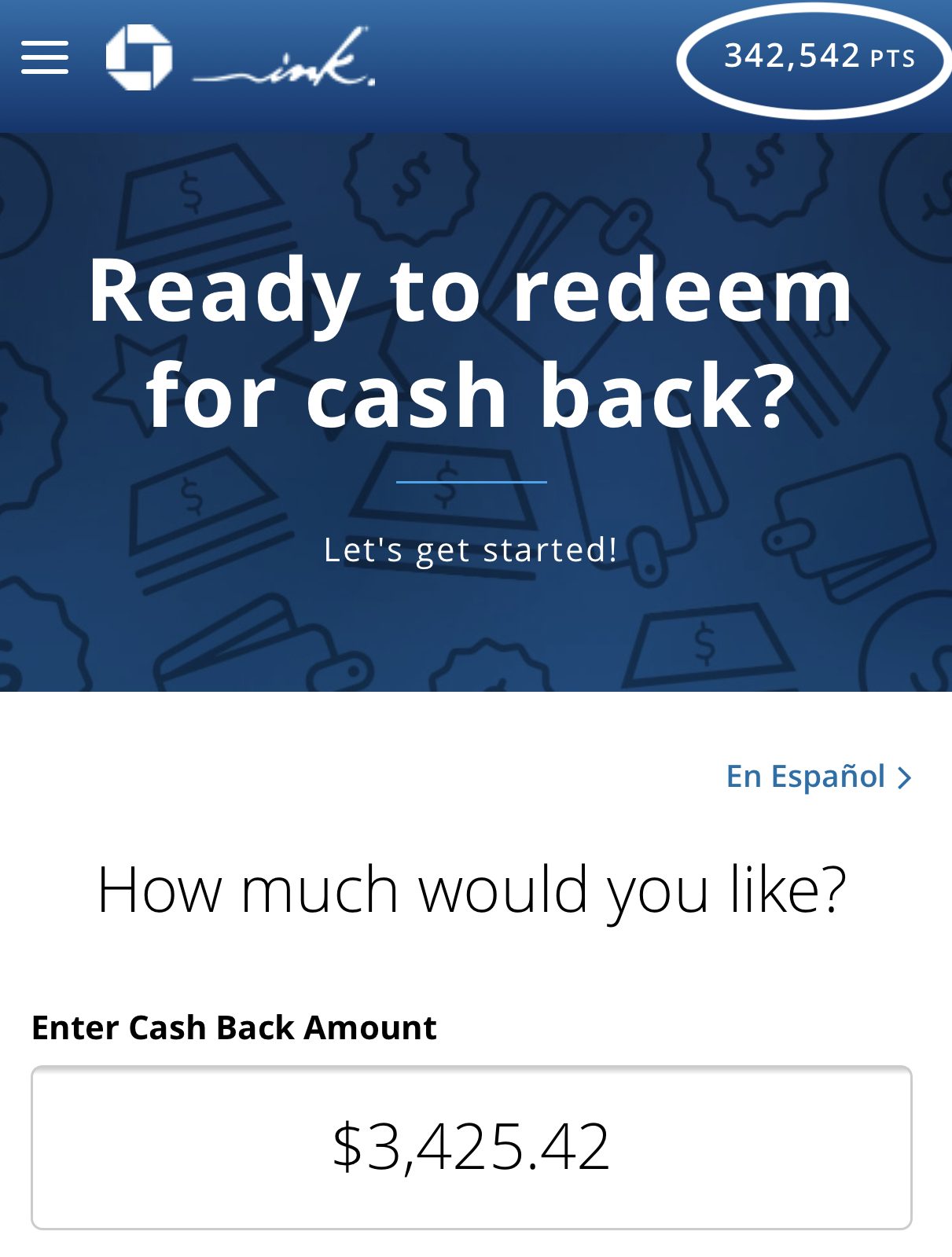

A 50% increase in my cash back percentage is significant. For example, I currently have 342,542 Chase points worth $3,425.52 in cash back.

If I had used a Chase Ink Business Unlimited credit card, I would have a whopping 513,813 points, worth $5,138.13 in statement credit. Or, I could have used those 513,813 points to buy two round trip tickets for my parents to San Francisco from Hawaii and have credit for eight more round-trip tickets for my family.

I'm surprised I didn't bother looking for a better business credit card earlier. But I'm also not surprised since I let 342,452 points accumulate over the years and not bother checking until I wrote this post. Better late than never.

Note: Besides paying cash to fix a car to get a better deal, the same can be said for paying cash to buy a house. You'll save even more money if you can. Here are some of my thoughts for selling stock to pay cash for a house. There are lots of considerations.

Cash Back Rewards

For personal use, I also have a Chase Sapphire Preferred credit card. But as stay at home parents to a rambunctious toddler, we are no longer frequent fliers. Therefore, we may just switch to the Chase Freedom Unlimited card. It has no annual fee, offers a $150 sign-up bonus after spending just $500 in the first three months, and offers 1.5% unlimited cash back on everything.

If you can save money by paying in cash to a reputable vendor, do it. If you can get free money paying by credit card for something that can only be paid by credit card (like everything online), do it too.

Winning both ways feels good!

Now if only there was a way to get a cash discount on everything we purchase online without a transaction fee. Now that would be a true game changer!

Readers, what are some other things you are able to pay cash for in order to save money? What are some things you exclusively like to pay with a credit card? To get more great articles and insights sign up for the free Financial Samurai newsletter.

Disclosure: Financial Samurai has partnered with CardRatings for our coverage of credit card products. Financial Samurai and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I have never used a credit card, except to rent cars.

For the majority of people in my country and most other european countries I imagine, this post would be very strange. It sounds like Americans use their credit cards a lot. 99 % of the time the majority of people around me pay by debit card.

We do, and using a credit card all the time is a no brainer, if we do not carry a revolving credit card balance. The revolving credit card balances were Americans screw themselves.

Ha ” ability to film while talking out the contract.”

If some one asked me to film our negotiation or contract especially if it was for less than $1k, I wouldn’t do the work. Hell I’d walk away from them instantly. It’s like threatening to litigate before you even have a deal or the work has been done.

And It says more about the untrust worthiness of the filmer than it does of the other person. Like when a boyfriend is jealous and is always accusing the other partner of cheating on him, well it’s often because HE is cheating on the partner and knows how easy it is.

If you can’t read the person and can’t speak clearly as to what you want done and what you expect in the offer YOU have the problem. No amount of film will fix it.

Fascinating response. The workers who worked on my landscaping project agreed to be filmed That I paid him X amount of cash for why am out of work. Everything worked out in the end and we were both happy.

Right on! If anyone asked to film me for anything ever I would immediately walk away from them and end all future contact. I am not a porn star and this is not the Truman show.

I use Citi Double Cash back card. You receive 1% back on the purchase and 1% when it paid for, always pay statement balance in full. If you apply the cash back to your next months statement that will lower the yield to slightly less than 2% and you have to wait another to receive the rebate. No limit on annual purchases.

American Express has a new business card with a cash rebate of 2% and it is credited to the next months statement, which slightly lowers the yield and you wait another month. If purchases exceed $50,000 in a year the rebate goes to 1%.

Neither card has an annual fee.

Nice! Sounds like a new brainer to take advantage of that cash discount. I would have done the same. I’ve saved on payments with some small business owners by paying cash for things like home repairs and installs before. If they’re reputable and offer, I’ll take it.

Offering this large of a cash discount is not in the best interest of the business unless the owner is keeping your sale off the books. Credit card swipe fees are around 3%, and the business gets the cash deposited within a day.

He could have created a cash invoice for you to use as a receipt, then: voided the transaction in the Point-of-Sale system, adjusted out the inventory used, and pocketed your cash.

He keeps all your cash tax free and gets to take a loss on the inventory to lower his tax bill.

Unless you’re comfortable working with a business owner who is evading taxes I’d suggest avoiding someone whose offer is “too good to be true”.

How can you tell whether a business is evading taxes or not? What they are doing is up to them.

Agreed.

And sometimes it has nothing to do with evading taxes–sometimes its just about cash-flow. And for cash-flow reasons alone, a deep discount for cash may absolutely be in the best interest of the business.

Without knowing or seeing the financials or business plan of the company, there are a whole lot of assumptions that need made to make a call on their best interests.

Regardless, 99.9% of what we spend every year is on the credit card. I’m not sure where I even shop or buy things that would offer a cash discount, but I should maybe start looking…

The easiest place to start looking as any transaction where are you can look the person in the face And the person is also the business owner.

Trust me, I look at and document every transaction, but 99.9% of them are made at large retailers; maybe I don’t shop at small businesses enough… Even if I gathered all our small business spending that may present an opportunity, we are talking a minimal amount of spending at a potentially nominal discount–looking for fractions of fractions gets expensive.

Other than auto shops, do you have any other recommendations for more regular expenditures?

Any vendor who’s offering more than the token 3-5% or so discount for cash is passing along some of the benefits of dishonest business practices. When I’ve successfully negotiated using cash, I’m quite sure its because they are doing a combination of 1) Not paying sales tax 2) Hiring undocumented workers and paid them in cash 3) Avoiding taxes on business profits/income.

Honest question–why would someone quite sure of a company’s unethical and immoral business practices conduct business there?

Is the few percent worth perpetuating a “quite sure” problem?

You can tell when they’re willing to drop their prices by 25% if a customer pays Cash instead of Credit. When a customer pays on Credit the cash is deposited into their business account the next day.

The only differences for the business owner between Cash & Credit are a 2% – 3.5% swipe fee, and the remote possibility of a chargeback. Combined, those expenses are not even remotely close to 25%.

The only other difference… Cash is untraceable.

In my experience, that cash discount (25%+) is not common. Is that something you see often? Or maybe at certain types of businesses?

I used to love shopping for frivolous stuff just for the heck of it. Then one day, I wanted to change my spending habits and started using cash especially when I caught myself buying expensive clothes and accessories. Somehow it hurt more paying cash than it is to swipe a credit card so I continued doing it… until it hurt so much that I stopped haha. I wrote about how to save money without budgeting today! Check it out :)) would love to guest post in your blog someday if you want to add a woman/mom’s perspective to your site.

I guess I am almost the opposite in that if the amount is larger, the more times I ask if they give discount for cash. These cash discounts sometimes exceed the savings they get from not going through a credit card company (I have gotten 5-7% discounts and I think credit card service charges are 3%).

I figure that they give you the extra premium in discount since the cash is had right away and do not have to deal with a 3rd party.

Yeah, that makes sense too. I paid my landscapers about $25,000 in cash to save money. But I pay them it in installments based on the amount of work they did. You just have to be more careful and really get a feeling of how trustworthy people are.

In the past, for a smaller purchase (less than $500) I would do cash if I trusted the vendor and get 5% or more discount (I want a discount for credit card fees plus cash back I was going to get). Oftentimes, I get 3.5% discount since the vendor may pay only 1.5% fee. They are often willing to match to the cash back I get on the card to get cash. Only a fool would think they are fully reporting their income/sales tax liability. You get this type of deal with small business owners with limited locations. Corporations and online, forget about it. Today, I rarely do this because I deal mainly with firms that won’t take cash. That has shifted my thinking to what card gives me the best deal for that type of vendor. Now, I get 2-5% back generally by taking that approach e.g. Amazon credit card used only for Amazon purchases.

There is a new practice gaining popularity among vendors called surcharging. Watch your invoices carefully on credit card payments and look for a surcharge or transaction fee. Sellers are now allowed to pass on their credit card charges to their customers, rather than pay for it themselves.

I was approached about investing in a company that writes the software to process these transaction fees on invoices. I didn’t invest in the company but in my due diligence, I did discover there are multiple companies already doing this and vendors are signing up. It is still very early but appears to be a trend that has legs. There is no risk to the vendor as they simply share in the savings with the company setting this up for them on their cash registers.

In my research, I spoke with one small restaurant owner who said he has processed thousands of transactions and only one customer has even noticed the surcharge. This can add as much as 4 to 5% to a bill as vendors not only cover their credit card fees but also take an extra cut. Imagine the profitability to the bottom line of companies that do numerous transactions per day.

If this really does take off, cash will become an even better option since they have no legal way to charge for this if you are paying cash. The owner I spoke to only adds the fee to the invoice for those people paying with a credit card. Legally, all they have to do is post a small sign at the register that says they participate in surcharging for credit cards and they have to have a line item on the invoice that states something like “transaction fee.”

It is my understanding that this is a state by state thing. Some allow it, others do not. I wonder if franchisers would put a stop to this if they feel customer heat.

https://usa.visa.com/dam/VCOM/download/merchants/surcharging-faq-by-merchants.pdf

So while paying cash can be great for specific discounts, I would argue that paying with a credit card *tends* to be better.

1) As you note, the credit card can offer traceability/fraud protection.

2) There’s a guaranteed 1-2% back on each purchase (cash/rewards points).

That said, I would definitely agree that if a vendor is willing to offer 3% or more off of the original purchase price and appears to be fairly reputable, then paying cash would be the way to go.

In this case paying cash is a no brainer but many times, I still believe that credit card payments offer a superior return. Especially if the vendor does not offer a substantial discount (eg >3%) for paying cash.

I’m very careful with my points and always convert them at more than 3c per point (cash back is not profitable enough for me), so I pay credit whenever I can.

You should look into this more carefully, especially if you want advertise credit cards. The benefits are much higher than what you think.

Indeed. Using points as statement credit is usually the least best deal. But it is also a good default usage of points. Nothing wrong with not buying something you don’t need and paying down debt. I do mention the alternative of using my points for 10 roundtrip flights to Honolulu/SF.

I have endless topics on credit cards coming up. And one of them will be on optimizing your rewards points. How and what do you do to get 3 cents per point, and what do you buy with it? What cards are your favorite? Thanks for sharing your knowledge.

My wife and I have three credit cards, Chase Reserve, Chase Freedom Unlimited and Chase Ink. We allocate the expenses to each card depending on where the reward points can be maximized, ie restaurant/ travel to the Reserve, everyday expenses to Freedom and cable, utilities and (small) business expenses to the Ink. I also try to maximize other bonus categories but I do not go crazy.

I estimate that our $100k yearly spending translates in approx. 200k points, ie a 2.0% return, already better than the 1.5% cash back.

Then I find the best redemptions for vacation in terms of flights and hotel accommodations and often convert those points to a 5-7cents per dollar. For example, with 240k points we fly every summer to Europe with Lufhthasa. 4 tickets cost $5-6k.

That’s why 3% is my minimum threshold to pay cash.

Ultimately, we value vacations very much and the four of us have been able to do amazing vacations at a fraction of the cost. It’s a lot of work, but I estimate that by doing it I give myself a $10k equivalent raise after tax thanks to the credit cards savings.

Sounds like a great plan to me! For the scope of this post, and I have been written about the various strategies for maximizing one’s rewards points. But I will in the future.

I like the Chase reserve card, but I don’t like the annual fee. We no longer travel that much, so it’s not worth it to us. Also, we are focused on our business expenses.

Being able to save 25% by paying with cash to fix my car, and then writing off the expense is a double win. But I’ve got a lot of upcoming business expenses that can only be paid with credit card.

Do you have a business as well, which is why you use the Ink card?

Once my wife quit her daily office job to take care of our twin boys, she free lanced for a while but then I was able to increase my salary and cover for the missing income. So now the business income and expenses are basically zero or negative. But we kept the credit card for the points. Utilities, gas, office supplies pay, if I’m not mistaken 5x in terms of points.

Why are you discounting the amount owed by paying cash? Most vendors do not give discount for cash payments.

Not sure I understand your question based on the stance I’ve taken in this post. If you can elaborate, that would be great. thanks