The S&P 500 went up a whopping 31% in 2019 after a down year in 2018. Is it time to sell stocks in 2020? I hope you did at the beginning of the year, because the market crashed by 32% in March 2020!

Luckily, you read, How To Predict A Stock Market Bottom Like Nostradamus at the end of March 2020 and made a lot of money.

The question now is whether it's time to sell stocks in 2020 and lock in profits. After all, we can get a risk-free 1.8% return through a 3-month treasury bond or an online savings account thanks to the Fed raising rates multiple times since the end of 2015.

Let's look at the latest stock market indicators and see whether now is the time to sell or at least change our asset allocation from stocks to another asset like real estate.

Is It Time To Sell Stocks In 2020?

1) Massive recovery off its correction lows. The S&P 500 and the NASDAQ are at record highs in 2020. We've now experienced the longest bull market since 1900 with no 20% plus correction. Please see the chart below.

It is logical to conclude that the chances of a correction are coming, and that it's best to take some money off the table.

2) Weak economic estimates. In terms of economic performance, economic data in the U.S. and around the globe has been missing estimates.

3) Federal reserve no longer hiking rates. The main reason why the stock market collapsed in 4Q2018 is because it feared the Fed would raise rates a couple times in 2019. Now the Fed has telegraphed it will no longer raise rates and the stock market recovered.

However, the negative side of the Fed no longer raising rates is slow down fears. The Fed now deems the economy is simply not strong enough to withstand higher rates. The smartest economists in the world are seeing weakness on the horizon.

4) Valuations are rich. At a 31.21X Case Shiller P/E ratio, valuations are rich based on historical averages, especially since earnings are set to slow down to under 7% YoY earnings growth in 2019.

Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio.

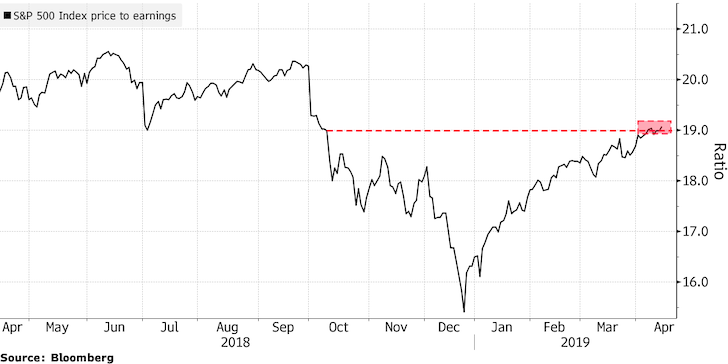

Here is another look at a P/E ratio using the normal way without using average inflation-adjusted earnings from the previous 10 years. it's lower than in 2018, but quickly getting back up there.

Better To Sell Some Stock

Based on the above data points, I think it's best to reduce stock exposure and get more conservative. We can now earn a higher risk-free rate of return thanks to higher interest rates. Further, we've made massive gains in the stock market since 2009.

Your risk exposure to stocks is dependent on age, cash flow, and risk tolerance. Nobody is the same. But overall, I think people should take down their asset allocation by 10% – 20%. In other words, if you're a 35 year old with a 80% exposure to stocks and 20% to bonds, consider reducing your stock allocation down to 60% – 70%.

Another consideration is to go long real estate either through a REIT, through real estate crowdfunding like I have aggressively done, or by buying physical rental property.

Real estate is like a bond that also provides utility in the form of shelter. Real estate was weak in 2018 as well and has yet to rebound as quickly or as aggressively as the S&P 500 in 2019.

As a result, I think there is an opportunity to buy real estate in 2020 and beyond because there is a general tight correlation with real estate and stocks, especially as affordability has increased in 2020 due to lower mortgage rates and lower prices.

Where And What Real Estate To Buy

The obvious question is where and what real estate to buy if one does cash out of stocks.

We should buy what we intimately know and buy in markets that will see the strongest job growth while also having attractive valuations.

I think San Francisco is going to be a long-term winner giving the profitability and growth of tech companies. The median price of SF real estate went down about 11.5% from its early 2018 peak. On a global basis, San Francisco is relatively cheap compared to cities like London and Paris.

Within America, I absolutely believe there's opportunity in the heartland of America where valuations are much lower, but growth in certain cities like Austin, Birmingham, Des Moines, Memphis, Dallas, and Salt Lake City are high as they attract companies and workers away from expensive coastal cities.

Favorite Real Estate Platforms

My favorite real estate crowdfunding platform is Fundrise, founded in 2012. They are the most innovative real estate marketplace with a strong management team and carefully vetted real estate deals. They are also the inventor of the eREIT asset class that has provided a steady 6% – 8% dividend, depending on which eREIT you choose.

My second favorite real estate crowdfunding platform is CrowdStreet. Their deals are mostly for accredited investors. CrowdStreet is great because they are focused on secondary cities with higher cap rates, lower valuations, and higher potential growth. The future of remote is work, due to technology and capital will flow towards the heartland of America.

Both platforms are free to sign up and explore. After selling my SF rental property in 2017 for 30X gross earnings, I reinvested $550,000 of the proceeds in real estate crowdfunding and have earned income passively since. It's great to make money passively now that I'm a dad.

Please due your due diligence carefully as all investments cary risk. My goal is to make my wealth last as long as possible. Taking profits in stocks, which can sometimes go down in value violently and investing in real estate, where valuations are more stable is my favorite way to grow wealth.

Related:

Is It Time To Sell Stocks In 2019

How To Predict A Stock Market Bottom Like Nostradamus

Housing Market Predictions For 2021+

About the Author:

Sam worked in investing banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.