June 13, 2020 Update: Is it time to sell stocks in 2019? This was an absolute spot on call to sell stocks after the 2019 rally. I then proceeded to call the stock market bottom in March 2020 too. Stay cautious out there in stock land folks! Focus on buying steady real estate instead.

The S&P 500 is on a tear in 2019, up 13% just in the first quarter alone. After a dismal 2018, the S&P 500 has rebounded by ~23% from its Dec 24, 2018 low.

The question now is whether it's time to sell stocks in 2019 and lock in profits. After all, we can get a risk-free 2.4% return through a 3-month treasury bond or an online savings account thanks to the Fed raising rates multiple times since the end of 2015.

Let's look at the latest stock market indicators and see whether now is the time to sell or at least change our asset allocation from stocks to another asset like real estate.

Is It Time To Sell Stocks In 2019?

1) Massive recovery off its correction lows. My House Fund, consisting of stocks and bonds, went from about $1.95 million down to $1.7 million during the 2018 correction (-13%) and now is back up to $2.1 million (+23%) for a $400,000 swing. I'm sure many of you have seen similar percentage magnitudes of recovery if you calculate recent trough to peak levels in your portfolio.

2) Weak economic estimates. In terms of economic performance, economic data in the U.S. and around the globe has been missing estimates.

3) Federal reserve no longer hiking rates. The main reason why the stock market collapsed in 4Q2018 is because it feared the Fed would raise rates a couple times in 2019. Now the Fed has telegraphed it will no longer raise rates and the stock market recovered.

However, the negative side of the Fed no longer raising rates is slow down fears. The Fed now deems the economy is simply not strong enough to withstand higher rates. The smartest economists in the world are seeing weakness on the horizon.

4) Valuations are rich. At a 31.21X Case Shiller P/E ratio, valuations are rich based on historical averages, especially since earnings are set to slow down to under 7% YoY earnings growth in 2019.

Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio.

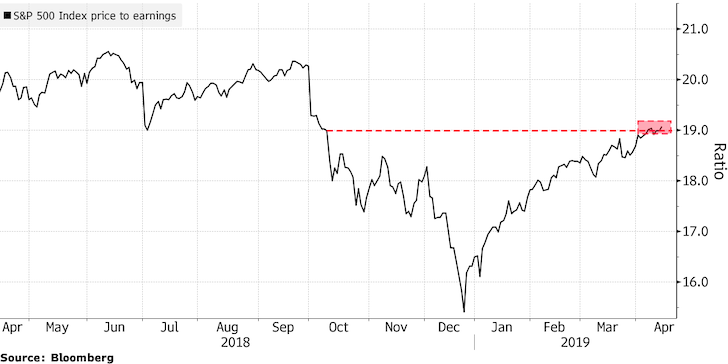

Here is another look at a P/E ratio using the normal way without using average inflation-adjusted earnings from the previous 10 years. it's lower than in 2018, but quickly getting back up there.

Better To Sell Some Stock

Based on the above data points, I think it's best to reduce stock exposure and get more conservative. We can now earn a higher risk-free rate of return thanks to higher interest rates. Further, we've made massive gains in the stock market since 2009.

Your risk exposure to stocks is dependent on age, cash flow, and risk tolerance. Nobody is the same. But overall, I think people should take down their asset allocation by 10% – 20%. In other words, if you're a 35 year old with a 80% exposure to stocks and 20% to bonds, consider reducing your stock allocation down to 60% – 70%.

Another consideration is to go long real estate either through a REIT, through real estate crowdfunding like I have aggressively done, or by buying physical rental property.

Real estate is like a bond that also provides utility in the form of shelter. Real estate was weak in 2018 as well and has yet to rebound as quickly or as aggressively as the S&P 500 in 2019. Yet I think this is an opportunity because real estate tends to track the performance of the S&P 500, just with a 6-8 month lag.

Related: How to Predict A Stock Market Bottom

Where And What Real Estate To Buy

The obvious question is where and what real estate to buy if one does cash out of stocks.

We should buy what we intimately know and buy in markets that will see the strongest job growth while also having attractive valuations.

I think San Francisco is going to be a long-term winner giving the profitability and growth of tech companies. The median price of SF real estate went down about 11.5% from its early 2018 peak. On a global basis, San Francisco is relatively cheap compared to cities like London and Paris.

Within America, I absolutely believe there's opportunity in the heartland of America where valuations are much lower, but growth in certain cities like Austin, Birmingham, Des Moines, Memphis, Dallas, and Salt Lake City are high as they attract companies and workers away from expensive coastal cities.

Best Real Estate Platform

My favorite real estate crowdfunding platform is Fundrise, founded in 2012. They are the most innovative real estate marketplace with a strong management team and carefully vetted real estate deals. They are also the inventor of the eREIT asset class that has provided a steady 6% – 8% dividend, depending on which eREIT you choose.

Both platforms are free to sign up and explore. After selling my SF rental property in 2017 for 30X gross earnings, I reinvested $550,000 of the proceeds in real estate crowdfunding and have earned income passively since. It's great to make money passively now that I'm a dad.

Please due your due diligence carefully as all investments cary risk. My goal is to make my wealth last as long as possible. Taking profits in stocks, which can sometimes go down in value violently and investing in real estate, where valuations are more stable is my favorite way to grow wealth.

Related posts:

Is It Time To Sell Stocks In 2020?

2021 Stock Market and Real Estate Market Outlook

About the Author:

Sam worked in investing banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month. Time to sell stocks in 2019 is a Financial Samurai original.