If healthcare in America weren’t so egregiously expensive, more people would retire earlier and live better, happier lives. We’re one of the few countries in the world where affordable healthcare is tied to employment, making financial independence that much harder to achieve.

Given the high cost of coverage, before you decide to retire early by choice, try to negotiate a severance package and use your final year of work to get in the best shape of your life. Think of it as investing in your future health dividends. The stronger and healthier you are, the less likely you’ll need to rely on costly medical care. In addition, the longer you can stretch your freedom dollars.

For background, I helped kickstart the modern-day FIRE movement in July 2009 with the launch of this site. In 2012, I retired at 34 from my investment banking career at GS and CS, and now have two young children and a wife who retired in 2015 at 35. I am the USA TODAY bestselling author of Millionaire Milestones, and have yet to return to full-time employment since. Join 60,000+ others and subscribe to my free weekly newsletter if you want to achieve financial freedom sooner, rather than later.

My Decision To Voluntarily Retire Early While Considering Healthcare Costs

When I voluntarily retired in 2012, one of my biggest concerns was figuring out how to pay for healthcare. For 13 years, my employers had subsidized a portion of my premiums through a group plan. Instead of paying $850 a month for coverage, I was only paying around $375 toward the end.

So when I left work, after my 6 months of 100% subsidies healthcare ran out as part of my severance package, I faced an $850 monthly bill as a healthy 34-year-old who barely used the system. It felt excessive and I needed a plan.

At the time, I asked my 31-year-old wife not to YOLO her career away with me. Instead, I encouraged her to embrace equality and keep working another three years to ensure my risky move wouldn’t put our household in financial jeopardy. Thankfully, she agreed.

During that time, she maintained her employer-sponsored healthcare plan, which also covered me. Many of her colleagues had family coverage anyway, so joining her plan was perfectly normal.

Our Cost For Healthcare Is Expensive

In 2015, at age 34, we finally initiated the process of engineering her own layoff as a high-performer to receive a severance package. We knew we’d lose our healthcare subsidy and have to pay about $1,680 a month, but this was a conscious choice we made in exchange for freedom. It felt wrong to manipulate our income just to qualify for government healthcare subsidies when we could afford to pay full price.

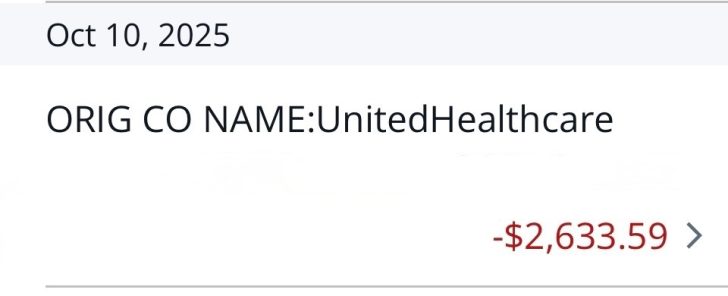

Today, for our household of four, we pay $2,633.59 a month in unsubsidized premiums for a Silver plan, not even a Gold or Platinum plan. $2,633.59 doesn't sound affordable to me, despite the government calling it the “Affordable Care Act.” Next year, our monthly premium is expected to jump to $3,000. But the way the system works is that those who make more than 400% of the Federal Poverty Limit subsidize those who do not.

In essence, we have a high deductible health insurance plan. I'm hoping my new investment in value stock UnitedHealthcare will help us pay for our premiums in the future. UNH certainly makes a fortune from us and will likely continue to make a fortune from so many of its clients.

In 2026, our monthly healthcare premiums are expected to go up to $3,000 / month for our family of four. Nuts!

Plenty of Millionaire Early Retirees Get Subsidies

The reality is, plenty of early retirees take advantage of healthcare subsidies—even if they’re millionaires or multi-millionaires. Some even brag about it online. That’s always rubbed me the wrong way, because I doubt the government’s intent was to subsidize the top 6% of wealth holders. Or maybe it was so our politicians are mostly millionaires.

For example, let’s say you have a $2 million portfolio generating $80,000 a year in income. As dual unemployed parents (DUPs) with two children, your household income is around 250% of the Federal Poverty Level (FPL), which qualifies you for heavy healthcare subsidies. Remember, subsidies extend all the way up to 400% of the FPL.

That means a household with a $5 million growth-stock-heavy portfolio earning only a 1.3% dividend yield—roughly $65,000 a year—would sit around 210% of the FPL and qualify for a 90%+ discount on healthcare premiums. Instead of a family of 4 paying $3,000 a month, they’d pay just $300 a month or less. Pretty incredible!

The Debate in Congress Over Extending Healthcare Subsidies

Congress is currently debating whether to extend the enhanced healthcare subsidies for households earning above 400% of the Federal Poverty Level. Democrats want to make the temporary expansion permanent, while Republicans prefer reverting to the original rules.

The American Rescue Plan Act of 2021, under the Democrats, temporarily raised the value of the premium tax credits and expanded eligibility beyond 400% of FPL. These “enhanced” subsidies capped a household’s premium costs at 8.5% of income.

Then, in 2022, the Inflation Reduction Act, under the Democrats, extended those enhanced subsidies through 2025. Now they’re set to expire at the end of 2025 under the Trump administration.

According to the Congressional Budget Office, extending these enhanced subsidies would cost about $350 billion over 10 years, or $35 billion a year. Not great given the size of the existing budget deficit.

Costs Reverting Back To The Old Trajectory

Without the extension, the average 60-year-old couple making $85,000 a year (just over 400% of FPL) would see premiums jump by $1,900 a month, or nearly $23,000 a year in 2026, according to KFF. If true, that is an egregious amount to pay under the “Affordable Care Act.” However, that also means the 60-year-old couple has had at least $91,200 in healthcare subsidies since the American Rescue Plan Act of 2021 passed.

If that $91,200 in healthcare subsidies was saved or invested since 2021, as all renters say they do to justify not buying a primary residence, they have enough to pay for the next four years of higher healthcare premiums. At least, that's how personal finance enthusiasts think.

Fighting to Keep Subsidies for Early Retiree Millionaires Feels Off

But doesn't arguing for more healthcare subsidies for millionaires feel a little off to you? If you make $85,000 a year as a retired couple, that means your pension or investments are worth $2,125,000 at a 4% safe withdrawal rate! Most people would argue you'll be alright, especially if you have no debt. And if you're an early retiree with that type of net worth, then receiving subsidies seems completely strange.

CNBC recently profiled a “early retiree” couple, Bill (61) and Shelly (59), who will earn $127,000 a year in pension income in 2026—above the 400% FPL threshold. Their premiums would rise from $442 a month to $1,700, which sounds more realistic than KFF's above estimate. That’s painful, but they’ve also enjoyed roughly $70,000 in enhanced premium tax credits since 2021.

Still, a $127,000 pension is worth roughly $3.2 million in annuity value at a 4% rate of return. Should the ACA really be subsidizing retirees with multimillion-dollar pensions and portfolios? Resources should focus on those without six-figure pensions or significant savings. You know, the ~85% of Americans who don't have lifetime pensions.

No one in America should have to suffer through a health crisis simply because they can’t afford care. Healthcare is a basic right, not a privilege. Therefore, redirecting healthcare subsidies toward the lower middle class and poor makes far more logical sense.

Capitalize The Value Of Your Pension And Investment Income

Now I’m starting to wonder — do the average American, financial reporter, or politician not know how to capitalize the value of an income stream to determine its true worth? We do this all the time in finance, and on Financial Samurai. Simply take a reasonable rate of return or withdrawal rate—say 4% or 5%—and divide your pension or investment income by that number.

Let’s find out the capitalized value of a pension based on various Federal Poverty Level (FPL) income limits for a family of four:

- $31,200 (100% of FPL): $624,000 – $780,000 pension value. You’ll likely qualify for 100% subsidies and pay 0% of your income toward healthcare premiums.

- $43,056 (138% of FPL): $861,120 – $1,076,400 pension value. You’ll likely pay 0–2% of income toward premiums after subsidies — roughly $0 to $50/month for a Silver plan in many states.

- $46,800 (150% of FPL): $936,000 – $1,170,000 pension value. You’ll likely pay 1–2% of income, or about $0 to $80/month for a Silver plan.

- $62,400 (200% of FPL): $1,248,000 – $1,560,000 pension value. Expect to pay 2–2.5% of income, roughly $50 to $100/month.

- $78,000 (250% of FPL): $1,560,000 – $1,950,000 pension value. You’ll likely pay around 4% of income, or $180–$220/month.

- $93,600 (300% of FPL): $1,872,000 – $2,340,000 pension value. You’ll likely pay about 6% of income, or $300–$350/month for a Silver plan.

- $124,800 (400% of FPL): $2,496,000 – $3,120,000 pension value. You’ll likely pay up to 8.5% of income, or roughly $450–$550/month for a Silver plan.

If you have a lifetime pension or passive investment income that generates $31,200 a year or more (100% of FPL), you're doing pretty well compared to the average worker or retiree. Hence, to pay little-to-nothing towards the healthcare system seems off.

Adapting to the System Of Embracing The Wealthy

That said, we should look at this debate as a reflection of the times and adapt accordingly. Just as we practice identity diversification depending on who’s in power, we can lean into our wealth when the government decides to subsidize the wealthy.

If the government wants to hand out healthcare subsidies to six-figure pensioners and multi-millionaires, then the rational economist says: take the free money. After all, most politicians are over 40 and already wealthy, so it’s only natural they design policies that benefit their own demographic.

However, political winds always shift. When they do, and policymakers refocus on helping the true middle class and poor, it’ll once again be time for the wealthy to pay full freight.

Will Continue To Pay Full Freight To Help America

With our current level of passive income, we’ll never qualify for healthcare subsidies. Our household expenses are also too high to purposefully lower our income at the moment. And that’s probably how it should be. For the greater good of society!

In the meantime, I’ll keep doing my best to stay in shape so I can subsidize and make room for those who can’t or won’t. Just as it’s a privilege to pay taxes to support those who pay less or none at all, it’s also a privilege to be healthy enough to help offset the costs for those who aren’t.

Readers, do you think the government should be fighting to provide healthcare subsidies for the wealthy? Or is it irresponsible to extend these enhanced tax credits given our massive budget deficit? Where should we draw the line when it comes to offering healthcare subsidies?

Recommendation To Protect Your Loved Ones

Besides regularly working out and eating healthy to extend your life, you should also get an affordable term life insurance policy to protect your loved ones.

Both my wife and I got matching 20-year term policies through Policygenius. Simply input your information and you’ll receive real quotes from vetted life insurance carriers within minutes. If you have debt and dependents, getting life insurance is one of the most responsible things you can do.

Subscribe To Financial Samurai

Pick up a copy of my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth than 94% of the population and break free sooner. As you can tell from my post, the government loves millionaires by showering them with healthcare subsidies.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here.

Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.

The whole health care system from insurance to health providers is broken in the US. The costs are astronomical compared to any other industrialized nation. The fact that health care in the US is almost 50% higher as a percent of GDP than all other industrialized nations tells you that is inefficient and just broken.

I don’t get a subsidy and don’t expect one. I will pay $2,200 per month for 2 people in our high 50’s for a bronze plan than has a huge deductable and virtually no coverage in Florida. I have it just because it would pay for 100% of any emergency room or hospital stay.

Looking at the plans this past weekend, I was floored at the costs. They have gone up 30% year over year. It is just a sad commentary on our country.

I have zero concerns with healthcare subsidies for the wealthy. Just like I have no concerns with giving the “lazy” people on the couch who can work Medicaid. I’d much rather have universal healthcare for everyone. It’s insane there is such a thing as going into bankruptcy because of medical debt. The fact that this blog writes about the cost of healthcare and it is a huge issue for making the decision to retire early or start your own business reinforces how backwards we are. I know universal healthcare will mean more taxes, probably on the wealthy. Tackling why healthcare is so expensive will need to be handled in parallel.

Not saying right or wrong. But if you retire and live a modest lifestyle, under the income threshold, and get ACA subsidies, I can’t blame them for choosing to live a modest lifestyle.

If you choose to live a lavish lifestyle, above income threshold, that is your choice, also. You don’t get ACA subsidies.

It is a personal choice.

Great article Sam! I’m assuming you will also be forgoing any Social Security income if you are eligible? I understand that you probably paid into the FICA system (6.8% each for your and your employer) just like early retirees paid into the Medicare and Medicare surcharge taxes that fund the ACA. But it just doesn’t seem fair that retirees with over $100k in income should receive Social Security. Besides, taxes pay for all sorts of other subsidies I don’t think are fair. And by continuing to pay your full retirement freight it will certainly help America!

Of course! Double it to 15.3% if you are self-employed.

It’s all about paying taxes to help our country thrive, given 40% of Americans don’t pay any income taxes.

And it’s also about exercising and eating as healthy as possible to reduce the burden on the healthcare system for those who cannot or don’t want to.

I plan to keep on publishing for free on Financial Samurai until I can no longer write. Financial freedom for all!

I agree that we need a healthcare system that charges based on ability to pay and not earned income – seems like the right kind of taxation would help. It also means the bill needs to be a bit larger than current subsidized plans, so people do consider what they eat and to exercise. It is a personal and socially moral responsibility to consider what one consumes.

But I see a larger concern – the lack of the individual mandate. Millions of healthy Americans choose to forego insurance because the Supreme Court shredded the law. Besides providing money to ACA the mandate would have lowered (did) costs and even provided more competition by incentivizing individual insurers to go into more markets.

If healthcare is a right, we all bear responsibility to protect that right; and that means paying now, for what is needed later, paying for others, as they will pay for you when (not if) unwell.

You are 100% correct on the mandate.

I totally agree. There needs to be some common sense reforms made to the subsidies in the ACA. People who can afford to retire early because of good pensions and/or investments can certainly afford to pay full price for their premiums. Reserve the subsidy help for the people who really need it. Perhaps then, there won’t be the criticism we currently see.

Good article, Sam. I agree that early retirees should not get subsidies. And really, if anyone should, it’s families who are struggling, who actually have children, are lower income, and have jobs. But that’s if anybody should.

And to those saying folks like Warren Buffett should pay more in taxes – maybe, but that’s not going to move the needle much. The real issue is spending. Your tax base is very limited, but the government raises the debt ceiling every time they vote on it. Spending is unlimited. Difficult choices are going to be made in our lifetime, or something is going to give economically.

We should be prioritizing a couple of things as Americans: freedom, family, resilience, what is pure, honest, and good. We might not agree on the specifics, but I left it pretty broad. Read the founding documents of America – they laid out a pretty good plan.

You make good points. It seems like there needs to be some way to distinguish between middle class folks and those who have wealth to cover it but still benefit. 400% of FPL is not a lot of income for a working family of four and what I’ve read suggests people in that category are large. Letting enhanced subsidies lapse might affect early retirees but there’s a broad swath of people for whom it would just mean no retirement, spending 30% of income on health insurance, etc.

Same time as someone who would unfairly benefit from subsidies / hopes to FIRE, the options sure do suck. Need the super HDHP with HSA option!

Greetings Sam,

Really enjoy and appreciate your newsletters and articles. And this one and the “Millionaire Early Retirees…” article really hit nail on the head. Something didn’t feel quite right about the fight to let the enhanced healthcare subsidies expire (as intended) or make them permanent, suspecting that subsidies were going to some wealthy folks. But hadn’t taken the time to delve into the facts and figures.

Using the Bill & Shelly example of a $1,700 per month premium and applying the 8.5% cap on premium costs, a couple would get a subsidy on income up to $240,000 per year. That just seems crazy! ESPECIALLY if that income is derived not from working but from investments.

Well done Sam. Keep up the good work!

I understand why tax subsidies for the relatively rich could rub one wrong and a rich citizen could feel the urge to have their government take more from them to give to folks with less, but that socialist urge should be lessened by the greater total tax dollars wealthier people contribute in many other areas – especially income, property, and even cap gains, not to mention the extra cash richer people pay for optional health care not covered by insurance. And hey, that optional healthcare spend creates jobs for not-rich people!

I wouldn’t vote for wealthy people getting tax-funded healthcare subsidies any more than I’d vote for them getting food stamps/SNAP. However, I certainly wouldn’t expect wealthy people to feel guilty for getting a relatively minor tax break like this in our current tax system given that they already contribute many more tax dollars per capita than poorer people. For example, many FS readers pay far more in taxes each year than 400% of the Federal Poverty Level (FPL).

Furthermore, focusing on $35B a year (0.5% of the 6.8 Trillion fed spend in 2024) for enhanced healthcare subsidies for people making over 400% of FPL smells like a political red herring, especially when the vast majority of people getting any of that subsidy are more likely to be the 60 yr old couple making $85k/yr, not the evil influencer with millions in liquid investments who is gaming the system.

The solution to this relatively minor issue seems easy: Simply phase it out over the next few years and cut the subsidy first for those at the highest income level. Then, hey, elected officials, try moving on to budget issues that meaningfully move the needle!

Too funny. Billy’s and Shelly’s dependency is showing, again. Democratic policies produce only moral hazard with lots of collateral damage.Charity is an act of free will and driven by compassion. Welfare is forced seizure of assets and redistributed to dubious recipients.

If you want the costs to increase in an industry, petition the government to get involved.

Thank you Sam for posting this.

We don’t need to subsidize early retirees off the back of working families.

Also if Warren Buffet paid more in taxes, that would make the government richer not anyone else. The only way to make the middle class richer with taxes is to have them pay less of them.

Bottom line health insurance is not insurance, it’s cost sharing. The costs are out of control. People are way too sick for no good reason.

At this point Sam’s best investment is his tennis playing, which adds 10 years (actual study on this – any racket sport) and will reduce healthcare utilization.

Personally I powerlift – strength training is more important than cardio, it’s efficient use of time, and I measure my strength increases over time as part of my strength “portfolio”. I built a hobby app to track my strength like I track my finances, free for anyone to use. http://Www.powerliftcalc.com. Watching my one rep max increase over time is very satisfying, and it helps that strangers think I played in the NFL

Even subsidized healthcare is out of control. Best bet is to get as healthy and strong as possible to avoid having to use the system. We work 40 hours a week for money, what is 3-5 hours a week to get strong and healthy, and therefore avoiding having to spend said money during our later years? Given the catastrophic cost of healthcare I assume I’m getting paid hundreds of dollars in saved future income per strength training session.

Again thanks Sam for staying non political but pointing out huge flaws in the politicians thinking on subsidies

This is a topic I have been spending alot of time on as I plan on retiring in a few years at the age of 55 from the fire service. I am really just treating this like one would with any of their other assets. Don’t you want to keep your taxes to a minimum? Don’t you want to pay the lowest possible cap gains? Why do we think Roth accounts are so popular? 401k’s? How about 529’s? Why are no income tax states so popular with retirees? It’s all a similar game. This game is keeping your MAGI as low as possible. It’s not too difficult with some advance planning and a good mix of account types. This website pushed me to focus a good amount of assets in an after tax brokerage which has huge advantages for the purposes of the ACA. Of course it all depends upon your required expenses that you need to service in retirement. The expiration of the ENHANCED subsidies is simply a return to the way it was 4 years ago (as you pointed out). This should not be a surprise to any one, it has always been temporary so those folks in this situation should have been planning for it all along. I just don’t understand the complaining about something you know far ahead of time. I believe the FPL brackets are pretty generous IMO and I don’t really feel sorry for anyone above the 400% especially that silly example of the couple with $127k in pensions who are chillin at the beach in the photo.

Hi Sam, I’m not sure I’m following the rationale. Sam, you are arguing individuals should self assess their asset balances and pay what they consider is fair for health insurance. The biggest issue is that healthcare in the US is not a free market so all of the costs are very high. It is a monopoly/oligopoly. There are constraints on the number of providers (health providers, insurance), and competition via patents. I would encourage you to look into Sean Mullaney’s YouTubes. You can structure your investments to support generous spending and still receive tax credits to reduce your premiums. The counter-argument will lead you into the abyss. The country runs a large debt and deficit. I don’t think you would suggest putting everything in tbills to support the deficit. Thanks for considering.

Warren Buffet is probably the best example of an individual complaining about the system yet taking full advantage. He often claims his secretary pays a higher percentage of her income in taxes than he does but he never offers to send a check to the Treasury to make up the difference. Is it any wonder millionaires are willing to accept a subsidy? Notice how the Republicans are not even mentioning this but rather focus on healthcare for illegals.

Great discussion!

Hey – how much deduction from Fed & state taxes do you get for all your healthcare costs (including premiums)

I’m close to early retirement, so the Health care expense is a bit scary. Wondering if the deductibility softens the blow.

The deduction is based on your marginal tax rate. So it’s better than nothing!

I am amazed that neither you Sam nor any of the commenters here even approach the neighborhood of the true problem, if you think high health care costs for non-W2 corporate wage earners are a problem: in the US, MDs, nurses, and hospital employees make integer multiples of those professions anywhere else in the world. And I’ll wager good money no one here knows that Congress sets the number of residency spots available across all accredited US med schools and they haven’t raised the limit for a couple decades. Healthcare costs are fundamentally dictated by the AMA cartel.

After the UH CEO was gunned down David Brooks on PBS Newshour went totally ballistic that Friday, noting that the vast majority have no clue that UH runs a 6% operating margin . As he pointed out then, the real cost drivers are doctors and hospitals. We’re fortunate the fruits of our pharma and biotech research hit our shelves first. And insurance companies have by far been the major beneficiaries of ACA.

So for the socialists here who want a European system you better start working on a grass roots movement to legislate a 50% reduction in doctor and nurse compensation and hospital prices.

Healthcare in America is not a right enumerated in the BOR – it’s a financial responsibility in the American Emersonian system. If you want cheaper healthcare , go get a job . Our friend just “retired” selling their Los Gatos house and moving full time to their Newport Beach bungalow, and instead of relying on subsidies until 65 quickly landed a job at a local school that at 30 hours-/week provides full CA teacher health benefits. She said after 5 years vesting she’ll even get a $500/mo pension, and it’s a mile walk down the beach from her pad to the school.

I’ll work until 65 solely to get cheap 1st class healthcare with HSA (HDHP PPO), plus I’m in the middle of the AI software revolution so things are very interesting and lucrative right now.

Amazing isn’t it? More power to you for willing to work until 65. I would simply rather invest in AI and do other things than work until that late.

In fact, I’m on the golf course right now! Just did another three put to my dismay. Otherwise, I would be paring the last three holes.

You “wrote the book”. My insurance is really good and unavailable in ACA, so as a private consumer it would cost me $50K/yr for me and my wife. Tech sales work is fun and great $/hour worked compared to FSI so I’ll continue until I’m no longer wanted.

Tech sales might definitely pay more than writing on FS / hour. Then again, maybe not. It is definitely a blessing to enjoy what you do.

Is there a net worth target you’re shooting for before retiring or doing something else?

I just got back from playing 27 holes of golf. First time ever. I don’t recommend it! So tired and need to soak in the hot tub.

I meant compared to your high stress FSI job that you engineered your layoff from. The life you painted sounded horrible – at that age I was living in Hermosa Beach after college partying my ass off. Kudos to you for buckling down and creating a net worth early enough that enabled FIRE. My portfolio needs another 5 years of compounding to get to my target but in those 5 years I’ll also be able to stuff a bunch of cash into my Roth 401k. Plus being in the middle is AI software development (cybersecurity focused) is intellectually stimulating , which you get from your writing. I also enjoy the camaraderie of interacting with my big customers in Silicon Valley and our small team of developers at our Santana Row office – keeps me young.

I used to play 27 at Boulder Ridge all the time (Bay Club was a great deal – you belong, correct?). Watch out for golfers elbow – foam roller it out if you do. Still looking for a club to join down here in South OC.

Keep up the good work .

Ah, gotcha!

Yes, the banking world is tough and lots of high pressure. There were certainly fun and exhilarating times, moving markets, traveling to boondoggle conferences, and helping take companies public. But it wasn’t fun during the global financial crisis, and it got boring after 13 years. Same old thing.

I will happily never play another 27 again. It was a fluke to be offered 18 free holes 30 minutes after we did 9. For $146/round with a residence card ($225/round without) is not worth it to this frugal chap!

All the frontline workers (health care providers) don’t think they are overpaid. On the other hand, they feel they are underpaid for the amount of work they do. the type of training they have to go through and all the hoops they have to jump to keep themselves credentialed, licensed, etc. and so burned out. UH operating at 6% margins is not really the doctors’ problems, either, it is the whole intricacies of malpractice and over regulations and so many middle layers of admin crap. The legislators always take one case to the extremes and make some new laws and then more and more and more and now even the simplest thing could not be done without layers of crap. Everybody is running around like crazy and busy as hell in US health care and the output is pathetic. People’s health does not get better by interacting with health care systems or and insurance companies, it gets worse because it is so complicated and makes people so angry. Even those early retirees with millions, they are still average people and I don’t see a problem giving them subsidies. Really it is the top 0.1% vs. the 99.9%, or top 0.01% vs. 99.99%.

I see a huge problem: I don’t want to pay for their subsidies. And you can’t deny medical professionals here are wildly overpaid COMPARED to any other developed country. The “reasons” are why healthcare is so expensive . Cartels are virtually unbreakable so don’t expect any big change unless Congress grows some balls and installs price controls on all medical services.But it would be nice if the media was honest and discussed the role of healthcare compensation as a major driver of costs.

Healthcare professionals are not overpaid in the US because no other developed countries would charge such high tuitions for training. These days young doctors come out of residency with a studnet loan as big as a morgage, and they are becoming employees not owning their clinics like decades ago. The health care cost grows so much faster than Healthcare professionals’ pay, but the compensation for CEOs or those in power also grow exponentially. The issue is not the individuals but the institutions including medical schools, hospitals, insurance companies, corporations, politicians, lobby groups, lawyers, etc. that become too powerful, too greedy, too complicated and no way to fix. People no longer interact with individuals that could provide some health care but a monstrous Healthcare system. You don’t want to pay the subsidy but you are willing to work and enrich the billionaires in charge.

Med school tuition is a huge problem for those that have tot take out loans. My friend paid $500K for his daughter’s med school so she’ll be debt free. I think only the wealthy should pursue med school so we don’t have to tax all Americans just to help young MDs pay back their loans.

Why would the wealthy pursue medical schools after all? Overwork and underpaid and early burnout? Tax dollars should go to whoever willing to pursue this profession and help them out. A lot of people complain no access to quality health care providers, but if you ask them to help the young entering the pipelines, there are a lot of excuses, not my problem, they should choose something they could afford, blablabla. Typical American short sighted thinking, only self relevant outcome based without looking at the big picture. No wonder the country is gong down hill. But it is still America enough resources for whoever could figure it out.

I agree with April. If you want talented physicians who are well trained, then we need to support their training. I personally find it offensive and scary to think that the medical profession would only be open to those self funded from wealthy backgrounds. Your parents bank accounts would not be a good metric for evaluating those most suited to the field of medicine. Most children of physicians having seen the sacrifice up front are discouraged from going into medicine. Bright students have much more lucrative avenues to pursue. Healthcare is not expensive primarily due to physician salaries which are only 15% of total healthcare costs. By the way computer engineers make much more in the US than UK. If we want to pay doctors like the NHS, maybe we should make medical education free and also mandate all other professions like computer programmers match the pay in London which can be 50% to 75% less than the Bay Area

That’s preposterous as the barriers to entry if you’re not black or Hispanic are enormous. It’s by far the most competitive admissions process in all of the American university system. My friend’s daughter had to sweat out a wait list with the most impeccable credentials possible. Perhaps the example of a close family member is more appropriate: this person got into the top residency program on the west coast and was named chief resident in this formerly high paying specialty. This residency occurred during the Obama administration, and this individual elected to not practice and instead go work in the medical device field to make more than a post-ACA specialist. Still paying med school loans .

My friend’s daughter graduated summa in biochem from the top public university in the country and wants to work at a research hospital, the lowest paying rung for an MD. Her parents have the money and prepaid all her tuition at a premier east coast private med school. Her parents will subsidize her until she no longer needs the help. We need more high achieving children of the wealthy so we have a generation of doctors that aren’t frazzled and distracted by their med school debt.

The high achieving children of the “wealthy” who are willing to pursue medicine are heavily Asians, or kids from immigrant highly educated families. With the current immigrant policies and anti-non-white people atmosphere in the US, I doubt that would happen.

This girl is white from a very wealthy very white zip code but many of her classmates are Indian (full or half)

And WAY more women than men.

Price controls will make it worse. The supply will drop even more and quality with it. The answer is to break down some of the artificial barriers to entry (the ones that don’t help)

What artificial barriers? Like Congress limiting the residency spots? Like the AMA cartel?

Yes, if they are doing that, they should stop. So half of what you’re saying is a great idea, and half of it is a terrible idea. Eliminate the things that are making costs go up, but don’t introduce price controls. Because if you do the good half but add price controls, you don’t solve anything. The price controls will just destroy quality and supply.

I don’t agree with everything you said, but your best point in this comment is with regards to the supply of doctors. The medical profession is severely supply-constrained.

Doctors and hospitals are the key cost drivers. Either control them or apply supply side economics to create more and bring down prices. But the AMA cartel has to be broken first. U til one can understand where the costs come from and how to navigate them your just on a quixotic quest wishing and going Congress will do something

Thanks for the extensive details and examples. I sure hope they can come to a consensus soon so we can move forward. The overall healthcare system in the US is so inherently flawed and won’t be fixed this year. Gosh I don’t even know if it could be fixed in five or ten years. But we definitely need positive change. Healthcare expenses are a top 3 expense in retirement and it takes a lot of planning and saving to afford care. What an unfortunate reality we have to budget for, not only for ourselves but often for our aging parents as well.

It’s interesting that we argue over who should and shouldn’t get subsidies but completely miss the larger issue. Congress is doing NOTHING to lower the cost of healthcare. Why do they continue to allow pharmaceutical companies to gouge the American public with skyrocketing prices for drugs that have been in the market for decades….. insulin and Humira, I’m looking at you.

Why do so many people need these drugs! That’s the real problem.

While I’m not supporter of a wealth tax for various sorts of reasons, an income taxation system and or subsidies based on income is inherently problematic. When we evaluate companies we never look at just income statement, the balance sheet is equally important. Not sure what the solution is, maybe we just have to accept this as part of the unavoidable leakage.

An asset test would be sensible, similar to what’s in place for other needs-based programs like Medicaid and food stamps.

That being said, millionaires feeling bad about taking subsidies really comes down to your view on the purpose of government. Is the government there just for things like national defense, foreign relations and (maybe) some basic safety net? Or is it there for the broader advancement of the welfare of a society (all people)? I’m closer to the latter than the former.

As you’ve pointed out yourself (often taking a lot of criticism from online trolls), being a millionaire doesn’t always mean you can afford the type of lifestyle that’s historically been associated with that in people’s minds.

This article underscores the shame and insanity that the wealthiest country in world history does not have universal healthcare. We seem to accept this passively like sheep or fools. Vote out those politicians who are against universal healthcare!

Yes, it’s a great idea until you figure out how to pay for it. This will get worse with time as demographics change and fewer young people are around to subsidize it with their (usually) good health. Americans not taking care of themselves also becomes as issue as that is increasing with time as well. So good luck with that.

There are ways to pay for it, considering the wealth of the corporations, the the top 10%, top 1%, top .1%. But there’s a lack of will, politicians are in the pockets of their benefactors. Just googling “ways to pay for universal healthcare” will result in a number of policy ideas. But I do agree that the obesity and poor health is a drag on the system. But that is *not* a good reason to deny folks healthcare.

They need to bring back catastrophic plans. Most of us early retirees can cover the daily/yearly stuff. It’s just the unknown cancer/heart attack that would be nice to have covered…..even if we had to pay the first 25-50k.

I totally agree. Catastrophy insurance is what we really need to prevent bankruptcy. B/c goodness knows the cost of major surgery and other procedures could cost enormous fortunes.

The Bronze plans under the ACA basically are catastrophic plans. The problem is, they are still very expensive without subsidies. My bronze plan for my wife and I, which has a $15,000 family deductible and $20,000 out of pocket maximum, will be going from (before any subsidies) $1633/mo to $2331/mo per the letter I received yesterday from the insurer. That’s about a 43% increase. I am no fan of the ACA, but there aren’t many alternatives for early retirees. It wasn’t my decision to make healthcare subsidies part of the income tax system, but since it is, as a CPA you can bet I’m not going to think twice about optimizing my cost. That said, I’m not in favor of extending the enhanced subsidies. But if Congress is dumb enough to extend them I’m sure going to take them.

I agree that facilitating early retirement isn’t the best rallying cry to justify financial sacrifice for our country. What about the people that do not have healthcare through their work and are generating their income through earned income and not through passive income? Do we want to take away their subsidies? Perhaps we do, but let’s not pretend that the debate is only related to early retirees.

Would you propose subsidies have wealth limitations and not just income limitations? Wealth limitations are definitely a bit trickier to implement.

In the back of my mind, I’ve always wondered if the “promise” of ROTH accounts would ever be somehow changed/compromised. I wouldn’t be surprised if one day ROTH distributions are still counted as income for certain calculations (subsidies, SSI tax calculations), even if the withdrawals themselves still aren’t taxed as income.

Of course Roths will be taxed. If you’re deemed privileged enough I’m sure they’ll be confiscated altogether.

They want your money so they will simply take it. They used to at least pay lip service to honoring promises. But those days seem to be well behind us.

Interesting take and definitely something many early retirees struggle with. What’s your take on the various ACA plan options available?