If you've got a pension, count yourself as one of the lucky ones. A pension is more valuable than you realize. With a pension, you won't be forced to lower your safe withdrawal rate in retirement like those of use who don't have pensions. This post will help you calculate the value of a pension.

Pensions, also known as Defined Benefit plans, have become rarer as companies force their employees to save for themselves mainly through a 401k, 457, 403b, Roth 401(k) or IRA. These savings vehicles are also known as Defined Contribution plans.

But as we all know, the maximum amount you can contribute to a 401(k) or IRA is $23,500 or $7,000, respectively for 2025. Even if you max out your 401(k) for 33 consecutive years starting today, it's unlikely your 401(k) or IRA's value will match the value of a pension.

401(k) Isn't As Good As Having A Lifetime Pension

Take a look at my latest 401k savings potential chart. After 33 years of maximum contributions, I estimate you'll have between $568,000 – $1,800,000 in your 401k, depending on performance.

$1,800,000 sounds like a lot, but in 33 years, $1,800,000 will buy just $678,000 worth of goods and services today using a 3% annual inflation rate. However, inflation shot up to 9% in 2022 and is still hovering about 3.5% today.

If you live for 20 after your last 401(k) maximum contribution, you'll only be able to spend $33,900 a year in today's dollars until the money runs out. $33,900 is not bad, but it's not like you're living it up after sacrificing your life for decades at a job you didn't love.

Given the power of inflation, to neither max out your 401(k) nor invest an additional 20%+ of your after-tax income if you don't have a pension is risky. When it comes to your money, it's always better to end up with too much than too little.

How To Calculate The Value Of A Pension

The best way to calculate the value of a pension is through a simple formula I've come up with. For background, I worked in finance from 1999 – 2012, got my MBA from UC Berkeley, retired in 2012 at age 34, and have written over 2,500 personal finance articles on Financial Samurai since 2009. I'm also the author of the upcoming bestselling book, Millionaire Milestones: Simple Steps to Seven Figures.

I live what I write and speak as an early retiree since 2012. Money is too important to not take seriously.

The value of a pension = Annual pension amount divided by a reasonable rate of return multiplied by a percentage probability the pension will be paid until death as promised.

For example, here is an example of how to calculate a pension with the following data:

Average income over the last four years: $90,000

Annual pension: $67,500

A reasonable rate of return divisor: 2.55%

Percentage probability of pension being paid until death: 95%

Value of pension = ($67,500 / 0.0255) X 0.95 = $2,514,706

One can argue my formula for calculating the value of a pension is overstated. After all, the pension's value is dependent on the terminal value, and we all eventually die. Therefore, if you are particularly pessimistic, you can apply a discount to the final calculation.

For example, if you are a pessimistic person in poor health, perhaps you multiply the final value of the pension by 50%. In this case, a $2,514,706 pension goes down to about $1,250,000.

If you have a pension, your goal is to live as long and healthy a life as possible! The longer you live, the greater the value of your pension. This means eating better, exercising, and having a good social network of friends.

How Do Pensions Work?

Most pensions start paying out at a certain age and continue paying out until death. The amount of pension you receive is determined by years of service, age in which you elect to start collecting, and usually the average annual income over your last several years of service.

If you don't know how to calculate the expected monthly or annual payment of your pension, just ask human resources to provide details.

To calculate the value of your pension involves figuring out your annual pension payment, a reasonable rate of return divisor, and a realistic expected chance of payment until the end. After all, your company could go bankrupt and welch on all its pension promises.

Deciding on a reasonable rate of return divisor is subjective. The safest divisor to use is the 10-year government bond yield, which currently hovers around 4%. In other words, one can reasonably expect to earn 4% each year on his or her investments given the 10-year government bond yield is guaranteed.

One could use a more aggressive reasonable rate of return, such as 10%, to reflect a historical annual return of the stock market. However, the higher your divisor, the lower the value of your pension ironically, because it requires less capital to generate your pension income when things are booming.

Pensions Have Become Much More Valuable

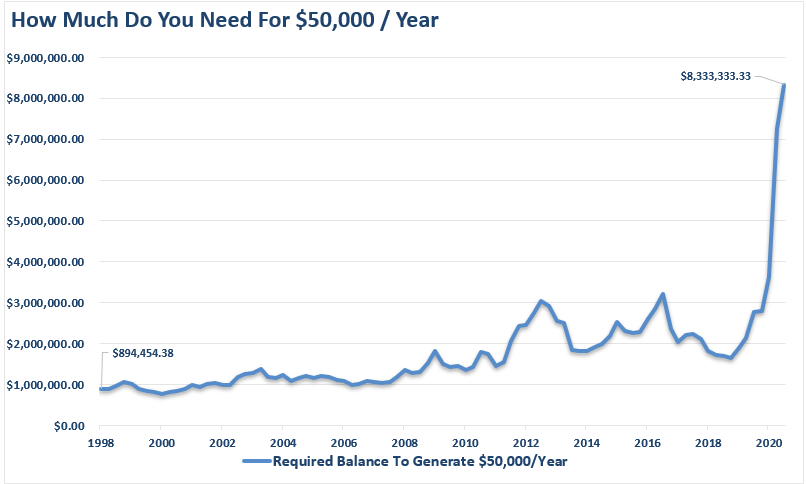

Given interest rates collapsed in 2020, it took more capital to generate the same amount of risk-adjusted returns/income. Therefore, the value of a pension went WAY UP because the value of cash flow has gone way up.

Just take a look at this chart regarding how much more capital is needed to generate $50,000 a year in income. Therefore, the proper safe withdrawal rate should be lower the it was in the past.

Thankfully, interest rates have ticked up from their 2020 lows, making generating passive income easier. However, the higher interest rates go, the more headwind stocks and real estate generally have.

We're now in a situation where the Fed continues to hike rates aggressively to combat inflation. In fact, patient investors can now earn over 5% in risk-free Treasury bonds. The rates likely won't last, which reminds us of how fluid economics and investments are.

Let's calculate the value of various pensions below.

Pension Value Example 1: Police Officer Retiring After 25 Years Of Service

Here is the example again of how to calculate the value of a pension with some commentary after.

Average income over the last four years: $90,000

Annual pension: $67,500

A reasonable rate of return divisor: 2.55%

Percentage probability of pension being paid until death: 95%

Value of pension = ($67,500 / 0.0255) X 0.95 = $2,514,706

Well how about that! After 30 years of service, this police officer will have a pension worth roughly $2,514,706 on top of whatever other assets he has accumulated. Not bad for someone who made a decent, but unspectacular $90,000 year for the last four years of his career.

Let's say this police officer joined the force at age 20. He's still young enough to start another career making additional money on top of his $60,000 pension. Talk about the perfect early retirement plan to pursue your passions without fear.

Pension Value Example #2: Foreign Service Officer Retiring After 30 Years Of Service

Let's say you started in the foreign service before 1986 and finally want to retire. Congrats! You will have a nice pension for life waiting for you.

Average income over the last three years: $120,000

Annual pension: $85,000

A reasonable rate of return divisor: 3%

Percentage probability of pension being paid until death: 100%

Value of pension = ($85,000 / 0.03) X 1 = $2,833,333

I use a 100% probability of the pension being paid until death because the payer is the federal government. This figure is also subjective, but I believe the federal government will honor their promises to older employees. They're just cutting pension benefits for newer employees.

Different Rates Of Returns Change Pension Values

If I used 2.55% as the reasonable rate of return divisor, the value of this retired foreign service officer's pension jumps to $3,333,333. The reason is because an investor needs to invest $3,333,333 in capital to generate $85,000 in annual income when the rate of return is only 2.55%.

Let's say the rate of return was 50%, the value of the pension/capital required is only $170,000. But who on Earth can reliably generate a 50% annual return each year forever? Nobody.

Thankfully, for retirees, interest rates have increased dramatically since the Fed began hiking rates in 1Q 2022. As a result, it's easier to generate passive income now through stocks, bonds, and real estate. But ironically, the value of your pension goes down in a higher interest rate environment.

For example, in 2024, the risk-free rate is around 4.1%. As a result, the value of the pension above declines to $2,073,170 ($85,000 / 0.041) versus $2,833,333 when the reasonable rate of return divisor was 3%.

Note for foreign service officers: For those of you who start the foreign service after 1986, you receive 1.7 percent of your salary for the first 20 years and 1 percent for each additional year. Therefore, 30 years only gets you 44 percent of your salary equal to a pension. However, at least you can still have 401(k) matching and collect Social Security.

Pension Value Example #3: Public School Teacher Retiring After 30 Years

Average income over the past four years: $72,000

Annual pension: $43,000

A reasonable rate of return divisor: 2.55%

Percentage probability of pension being paid until death: 75%

Value of pension = ($43,000 / 0.0255) X 0.8 = $1,349,019

Although this public school teacher wasn't earning a huge amount, she gets to retire with a $36,000 annual pension that is worth over $1,000,000. Using an 75% payment probability seems reasonable.

Most pensions also have an inflation adjuster built in order to keep up with inflation. Although sometimes, the inflation adjustments don't keep up.

Here's a chart I put together highlighting the values of a $35,000 and $50,000 pension (in the range of the most common pension amounts). As the rate of return goes higher, the value of your pension goes lower. Bond values work in a similar fashion as interest rates go higher and vice versa.

Thanks to the craziness of the pandemic, the 10-year bond yield has declined to under 1%. Therefore, the value of your pension has gone way up. You want to hold onto your cash cows for as long as possible. Your reasonable return of return divisor should be lowered to 1% – 2% in this low interest rate environment.

A Pension's Value Is Subjective

Obviously, my calculation is simplistic because we all die at some point. My calculation is based on cash flow into perpetuity. To counteract the perpetuity, I assign a Probability of Payout percent. Further, we all won't have surviving spouses to continue receiving the pension long after we're gone.

You're free to lower the Probability of Payout percentage to account for shorter lifespans or a more pessimistic life outlook. You can also call the Probability of Payout the Pension Discount Rate if you wish.

Just remember that value is subjective. Once we're dead, what does anything really matter? There's no longer a need to earn any money for ourselves. Given most pensions continue to pay out to a surviving spouse, s/he is covered until death as well.

What this article and my calculation attempts to do is provide an easy way for all pensioners to assign a real value to their pensions. I also want to give pensioners hope that their financial situation isn't as dire as expected if they are comparing themselves to private sector workers or my average net worth for the above average person chart.

Cherish Your Valuable Pension

All three individuals with pensions above are millionaires due to their long-term dedication and pensions. Even if you were only receiving a $15,000 a year pension, it's still worth more than $500,000 a year using a 2.55% divisor and 90% payout probability.

Given the median net worth in America is around $100,000, we can conclude that anybody with a pension is considered very well off. Less than 20% of Americans have pensions in the new decade.

Live As Long As Possible To Increase Your Pension's Value

There's one key variable that I haven't discussed, and that's a pension owner's lifespan. Unfortunately, the foreign service officer with a pension worth $2,833,333 can't sell his pension to anybody for that amount. Nor does the pension keep paying out after death.

Although, in some cases, a pension can keep paying out to a surviving spouse. The reality is one's pension value fades as the owner inches closer towards the end.

Therefore, it behooves every pension owner to live as long and healthy of a life as possible to maintain the value of his/her pension. The same logic goes for anybody with passive income, including social security. The richer you are, the healthier you should try to be!

The value of your pension is subjective. You could even multiply your annual pension amount by the average P/E multiple of the S&P 500 to come up with its value. There are many variables and variable amounts to consider.

Just know that your pension has tremendous value, just like your Social Security, the nation's pension plan. If your pension plan has a high cost of living adjustment rate, then your pension is worth even more.

If you feel your net worth is lacking based on my charts for the average net worth for above average people, simply calculate the value of your pension using my formula. The results will likely surprise you.

Invest In Real Estate For More Income

Given the value of cash flow has gone way up, it is wise to invest in assets that generate income. The best type of income-generating asset regular people can invest in is real estate.

Investing in real estate is like getting a pension because real estate tends to produce a steady income stream that gets more valuable over time. Inflation helps left the value of real estate and rents.

Take a look at Fundrise, my favorite real estate crowdfunding platform available for all investors. You can invest in a diversified real estate fund that primary investments in the heartland where valuations are cheaper and rental yields are higher. Fundrise manages over $3 billion from over 380,000 investors.

My other favorite real estate platform for accredited investors is CrowdStreet. CrowdStreet focuses on individual commercial real estate projects in 18-hour cities such as Charleston and Memphis. With higher cap rates and potentially higher growth rates due to demographic shifts to lower-cost areas of the country, CrowdStreet is very interesting.

I've personally invested $954,000 total in real estate crowdfunding to generate more diversified passive income. So far so good as my passive income hits roughly $300,000 a year. Real estate is the ultimate inflation hedge and beneficiary.

Both platforms are sponsors of Financial Samurai and Financial Samurai is a $300,000+ investor in Fundrise.

Order My New Book: Millionaire Milestones

If you’re ready to build more wealth than 90% of the population and retire well, grab a copy of my new book, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, writing about finance, and surpassing a $20 million net worth, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

Stay On Top Of Your Finances

The best way to grow your net worth is to track your net worth. I've been using Empower's free financial tools and app to optimize my wealth since 2012. It is the best free money management tool on the web.

Link up all your financial accounts to analyze your wealth. Start by measuring your cash flow. Then x-ray your portfolio for excessive fees. The best feature is the retirement planner.

There's no rewind button in life. Even if you have a valuable pension, it's important to continue staying on top of your finances. Do your best to optimize the wealth you have now.

Last Word On Pensions

Note: Pensions are most common in the following fields: military, government, education, gas and electric, insurance, and health services. Having a pension is likely winning the lottery. Enjoy it for the rest of your life! Most people are not so lucky.

In a low-interest rate environment, a pension's value has increased significantly. Calculate the value of your pension and make the best career decision possible. Although pension payouts are declining, they are still quite valuable. Don't underestimate public service jobs and other jobs with pensions!

About Financial Samurai

For more nuanced personal finance content, join 65,000+ others and sign up for my free weekly newsletter. I've been helping people achieve financial freedom since 2009. You can also sign up here to get my posts sent to your inbox each time they come out.

Financial Samurai is the #1 personal finance site on the web with over one million visitors a month. Everything is written based off firsthand experience. I worked in banking for 13 years, got my MBA from Berkeley in 2006, and retired in 2012 at the age of 34 with a $3 million net worth. Despite not having a pension, I've been able to generate over $300,000 a year in passive investment income to enjoy my retirement and freedom.

How To Calculate The Value Of A Pension is a FS original post. Your pension is worth more than you think. If you are one of the ~15% of working Americans who will receive a pension, count yourself as one of the lucky ones!

I can purchase up to 4 years of service to count toward my pension percentage at retirement. This translates into approximately a 12 percent benefit with the dollar amount based upon my pre-retirement income. Retiring early and receiving an 82 percent pre-retirement salary sounds much more desirable than 70 percent, but at what cost? The purchase of the credit is required to be cost-neutral for the organization so I predict that it will be fairly expensive. Is it better to invest the money or take the additional 12% for the life of the pension?

Hey there Financial Samurai is there any way I could get you to do a valuation of a pension plan. I’m not having much success with other sites and everything you are saying makes complete sense. Would definitely appreciate your help

I agree with your request. Financial Samurai makes alot of sense and I wish there were a way to contact him directly and/or pay for specific services like you request. I too, have a Defined Contribution pension which my wife does also separately…and we are retired and currently draw monthly and are still 60 years of age. We soon will have social security questions/decisions to answer. And not all financial platforms are capable of providing feedback regarding overall net worth when pensions are included. Financial Samurai might be missing a revenue stream. ha.

Hi Will,

I’m always reading the comments across all my 2,200+ posts actually. What’s up?

You can check out my Personal Finance Consulting page if you’re interested in connecting this way. I just don’t advertise it because the demand is more than I can comfortably handle.

https://www.financialsamurai.com/career-personal-finance/

Cheers

Rather than try to come up with your own fancy guestimate, why not just price a Single Premium Immediate Annuity (SPIA) using one of the many calculators online to get the present value of the pension.

Many of these calculators allow you to include a survivorship for a spouse and a COLA % along with ages to match how your individual pension is set up.

An example would be a teacher is receiving a $48,000 pension, with a historical COLA of about 1.5% and wants selects a 50% survivorship benefit for her husband should she die first.

If her husband wants to match this exactly, he could go to blueprintincome.com/ and enter their ages, 4000/mo, 2% COLA, 50% first death and would be able to purchase that for about $830,000 using monies from his 401k or IRA.

You’re welcome to do that and nobody’s stopping you or anybody. What people are looking for is a simple estimate with some logical explanations as to why.

I don’t think most people know what an annuity is, how it works, how to use that calculator, and how to price a pension out.

What brought you to my site?

Stupid question from a financial neophyte: why use a reasonable rate of return in this equation? Don’t most people spend their pension as it’s received?

I was a school teacher. I’m afraid people are going to read this an be even more upset with police officers and school teachers. The fact however that is not stated here, is that I was required to pay in approx. 6.8% of my income each year into my pension. Required! That’s good in the long run, but it certainly made my small paycheck even smaller. The school then paid in (matched) the same. Then, If I would have died before drawing on my pension, all of the money the school put in (matched) would be taken back and never given to the living family members. Huge gamble. Each of my 3 kids started out in their first job after college making more than I did after working 20 years in teaching. There is definitely good and bad and both sides need to be examined equally.

I don’t know where you got your figures or how you learned to figure pension, but you are insane! First I worked a very good paying job for 30 years with GM. My pension is 16,000 a year, I know of nobody with a 60 to 80 thousand dollar a year pension!!!!! You calculate a pension like it is savings! You are living off that pension, by the way never goes up so you are losing not gaining every year because of inflation! Give me a 2 million dollar 401K pension any day over a 16,000 dollar a year pension! I could stick that 401k in a CD and make 3 times what I draw!

I have a $75,000 pension that is indexed to inflation after working for my local utility company for 35 years.

Instead of us being insane, maybe you just have not seen or understood the world enough. But at this age, it’s too late for you. But getting educated is not too late for your children and grandchildren.

Don’t let them make the same mistake you made. Have you tried even calculating the value of your pension based on the suggestions in this post?

A military pension for a retired career officer can be $50k or more with a COLA. Some airline pilots have pensions topping $130k/year. Now you know people who have such pensions.

I just retired last year at 55 years old. I worked in public service in NYS for 36 years. My pension is 75K per year. This is quite common for those of us that had six figure incomes. Much more common than most think.

Hi Mike. This is Danny P. from NYSED. I’m 20+ years w/ SED and I’ll be 56 in August w/ 21 years. I’m not at the 6-figure pay rate, but I, too, have been thinking of possibly going for an early retirement.

Hi Sam,

Regarding pension valuations, the mortality tables provided by the Social Security office can be a convenient tool regarding the estimated future number of payments received. Since these tables adjust for age, it will effectively revalue the pension each year.

Also, for pensions with an inflation adjustment, the TIPS yield arguably provides a better discount rate than nominal treasuries.

As a hopeful military retiree, I use a simple PV formula in Excel with these variables to calculate the pension value.

The other option is to plug your estimated annual payment into an annuity calculator. This is likely a closer approximation as those insurance companies benefit from pooling, similar to pension issuers. The result will be a much lower PV than calculating a pension value using treasury yields as the discount rate.

Using my estimated military pension of $9,108 per month in 2034, the PV utilizing a TIPS yield of 2.11% is $2M. Using Schwab’s annuity estimator, it would only cost $1.2M to buy that annuity today (with the same starting period). In reality, the annuity is even cheaper as it is a true Joint-life annuity. The military provides the spouse with only 55% of the original pension value when the service member dies (just to show her that the government always gets the last laugh).

Sam,

I am a regular reader and get your Sunday’s newsletter. I do not understand why you utilize 2.55% as your denominator for the calculation of the net worth of a pension. I worked part-time at the VA as part of a prior academic medicine appointment, and accumulated about 15 yrs of service in FERS, which gave me a calculated pension of about $20,400. I also contributed to their TSP (401K equivalent). I have seen some calculators valuing pensions using 6.67%, partly because they incorporated actuarial data into the denominator and used a historically higher bond return.

Best,

Jose

It’s just one option of many in the chart. With rates and inflation higher, a higher percentage is now more appropriate.

Example #2 is not realistic and should be edited as it’s not the case for the vast majority of people in the Foreign Service, specialists and generalists, across all agencies. Most people in the Foreign Service face Time in Class (TIC) as well as Time in Service (TIS). Only very few specialist categories are exempt from both TIC and TIS. Almost everyone is out by age 65 as we are mandatorily retired for age, with very few exceptions. We cannot join before age 18 and time working as an EFM in the Overseas Seasonal Hire Program (ages 16 to 21) does not count towards thee Service Computation Date. The vast majority join the FS after age 22. While it’s technically possible for someone to join the FS at age 18 and retire at age 65, the chance of them hitting a TIC or TIS or just wanting to retire after age 50 or joining the FS after age 22 is very, very high–leaving almost no one left in the example you describe above. Therefore, almost no one would have joined the Foreign Service in 1986 and still be in the FS as of 2023. Just ask your parents for a more realistic FS annuity example, or ask one of your many readers who are FS for a more realistic example.

True, but I mention how the Foreign Service pension has declined. And people are free to use a lower probability rate or higher discount rate to value their pension as a result.

If you’d like to share an income example based on numbers of years served and the resulting pension amount, I’d love to hear it. thanks

Pension calculations have changed considerably since your parents retired.

30 years would only get you 40% of your high three average. 1.7% for the first 20, 1% for each additional year. However, one does collect social security unlike your parents which makes up some of the difference. The old system was much more beneficial.

Depends what agency you have retired from they are all different..

Sample I’m retired MTA RATE is 2% 20-30years and 1.5% over 30 years

So with 30 yrs service you get 60% final adverge ,

With those that pay less i would get 401/457 for xtra gravy….so start early but it never too late..

Social will be higher if your earnings are higher too…But remember enjoy the journey too…Live Everyday Till you hang you hat up

Financial Samurai, to continue the feel-good factor of placing a value on a pension into retirement, would you run your calculation each year, say, following an indexed increase in the monthly pension, or would you suggest keeping the pension value as it was on the day the pension commenced? Thanks

Since I’m retired military (enlisted), I didn’t have a 401K or TSP to contribute to. I’ve been receiving a military pension for 15 years (avg $30K/yr). To catch up, I’ve invested every pension dollar in stock index funds. I’ve also contributed to my company’s 401K and a taxable account. This approach has worked wonders. My financial situation is great. I’m 56 and hopefully can continue to collect my pension for 30+ years. Fingers crossed.

“… but in 33 years, $1,800,000 will buy just $678,000 worth of goods and services today using a 3% annual inflation rate.”

Can you explain how you got this? (1,800,000/678,000)^(1/20)=1.05, or 5%.

I’m doing a quick annuity factor calculation, and at 4% interest and 7% inflation it looks like a present value of $1,800,000 will fund a benefit of $65,878 for 20 years. Did you get $33,900 assuming 0% interest and 7.5% inflation?

I went the other way and inputted $678,000 present value, 33 years, and 3% annual growth to equal $1,800,000. http://www.moneychimp.com/calculator/compound_interest_calculator.htm

Just used this to help answer so real questions from real people who are contemplating retirement. Thanks for sharing the ideas, Sam.

Apologies if you answered somewhere, but I didn’t see it…

How exactly is the “rate of return divisor” calculated? e.g. where does 0.0255 come from?

Cheers!

Jesse

I am 55 years old. I plan on retiring in 18 months. My pension will be $64,500 per year with no COLA. I am very healthy and would project living to 90. How do I figure the value of my pension to include in net worth? I am estimating approximately 33 years of drawing this pension

Thanks

We got 4 pensions in various California pensions (UC, 2 Calpers, county level). Never thought to calculate the true value of these. Mind boggling they would be worth this much. Let me add to this that in public service, we don’t pay for much work expenses at all as it’s extremely low maintenance and don’t need to join the clubs to drum up business – unless you’re a politician of course. I missed calpers pepra deadline by like 2 months and joined public service spring 2013… ugh! Would have been classic member and getting 100k more a year then what’s now permitted re salary/cap limits. If I only knew at age 33 when I joined public service. My only regret.

My husband is 6 yrs older than me, so I’d like to retire at 62 at 2% (in 2042) but 67 at 2.5% final comp cap limit would be much more lucrative for me (earning 3.5k more a month post taxes). We will have plenty in deferred compensation I think by that time (62 and 68) projecting 10 mil in our 4 deferred compensation and Roth IRAs wouldn’t have to ever touch. Debating still on age to retire (62 v. 67)… can’t buy time that’s for sure and afraid I’ll miss golden years w hubby if I don’t retire at 62. What do you think?

I am not a financial guru but am early retired but my wife is not. She really enjoys (maybe even loves) what she does. She plans on working for another 20 to 30 years which she also will be paying off her part of the mortgage. I really wish she would retire earlier than later because I except the cost of travel will increase significantly for us when we get older- ie first class tickets and hotels instead of economy premium currently. The increase will just be to travel more comfortably the older I (we) get.

If I read it right, you will have $10 million you won’t even need to touch by 62 why you retire. I like to golf, ski, travel and hike. I am going to assume every activity gets more difficult the older you are- recovery wise. If your husband likes to watch netflixs and order take out and is a homebody (nothing inherently wrong with that) than you can pull off working late. If you want to travel and do activities, retire earlier. The one regret I have that will not be fulfilled (maybe) is an around the world cruise that we can afford financially but she cannot (or chooses not to) afford is the year to cruise the world. By the time we have the time, I will be 80.

Take the time if you feel you have enough money. But only you can decide. If I had $10 million in the bank, I would definitely try to sway my wife to take a year off from her job to do that travel anytime before 80.

Your foreign service example is only valid for those who started prior to 1986. I started in 1988 and retired in 2014. Under the current system you receive 1.7 percent for the first 20 years and 1 percent for each additional year. So 30 years only gets you 44 percent. Obviously 44 percent of 120k is much less than 85k as in your example. Under the new system one also gets social security and a 401k match but I would have much preferred the older system that your father retired under.

Yep. Still though, not bad either way!

I totally agree! Continuance of govt subsidized health care is another huge perk.

I couldn’t find a way to add a reply other than to reply to just one of your comments. You probably are aware that Forbes has published through one of its columnists a pension valuation spreadsheet. It includes the value of a pension according to existing interest rates as well as the value according to “regulations”. If you can’t find it, I would be happy to send you, Sam, the version i downloaded last year. I am not able to send it to every reader but you may want to post it.

I have a cash balance pension plan. I worked 35 years , average salary 80,000, 4%

I am 55 years old. I am a black male. what is the value of my pension?

Pensions pay a defined payment until your death and may or may not have a death benefit for your spouse. I had a co-worker that died 3 months after retiring, his $4,000 monthly pension was paid for 3 months. Theoretical value of that at your rates would be about $2 million, but it paid him $12,000.

The way to value a pension is what it would cost to buy it. They are available for sale all over the place, so are high commission terrible products, but you can buy no commission Immediate Income annuities with our without death benefits for you or your spouse.

As an example I looked at what income I could generate by purchasing a immediate income annuity with no death benefit and it pays about 5.4% With Minimal death benefit it pays 5.3%. Full benefit pays 4.5%.

Value will depend on age and life expectance, they above are for 63 year old male retiree. Older retirees would get higher rate because of lower life expectancy.

My suggestion would be to value pensions using a 5% rate and could go higher for elder readers.

This is the truest apples to apples comparison of a pension (which most often leaves nothing when you die).

I have a state pension waiting for me that is worth 58.8% in March of 2022. In a year and 3 months(my date is March) my best 3 years at this point will be about $118k. If I wait, my percentage goes up to 63.8% and then to 80% the following year, which will max me out. So, I’m looking at around $70k/year if I retire in March of 2022. I would like to retire. I’ve had enough. From what I’ve read in your article, it looks like I should be ok. The only debt I have is a new truck that is into its third year of a 60 month plan. No credit card debt and just paid my last mortgage payment. Wife has a good 401k as well. I’m burned out and want to retire. My question is this: Is it foolish Not to wait and get to 80%? One other question is in regard to your article. It’s says towards the end of the article that you should hang onto your cash cow as long as you can. What exactly are you talking about in regards to this?

Joe,

When you say if you “wait” you pension goes up by 5% and then jumps to 80% the following year. How long would you have to “wait” which I assume means continue working or are you saying delaying drawing on the pension?

The 80% vs 58.8% is really significant and, depending on how much longer you would have to work, would probably be worth it.

Safe Withdrawal Rate is 4%, based on your investment keeping up with inflation. As Greg Lee says (sept 18, 2019) multiple income by 25 to get principle amount. But without a COLA you miss out on keeping up with inflation. With inflation at 2% and added tax at 2%. The factor is more like 1/6% (16.7x) or 1/8% (12.5X).

So for every $40K passive income (I like $40K as it translates to $1M):

in a brokerage: $40K*25=$1,000,000

in a pension $40k*16.7 = $666,667

in a pension $40k*12.5 = $500,000

Hi Sam what is your view on federal veterans disability payments in terms of value and stability compared to pensions? The payer is the federal government, and if the ratings are static there is no reexaminations, and after 20 years it cannot be taken away under any circumstances. Would it be wise to factor it into any savings calculations? Thanks

Chris – the value of a VA disability payment should be considered the same as a pension, although there is no survivor’s benefit (in most cases). If you’re getting 100% VA disability payment, it is ~$40k/year (depending on number of dependents). It is tax free, so it’s value is even more than a regular employer pension (which are all taxed at the federal rate, and state rate in some states).

I am wondering if a health benefit associated with a pension adds to the value of that pension. IE: Is a health benefit part of a QDRO? I am possibly facing divorce and both of us have pensions. His is bigger than mine by about $700; mine has the health benefit. I am in California – pensions are CalPERS.

I am just trying to put a good finance package/offer together for a divorce that does not involve attorneys or actually having to file a QDRO since we both have our own pensions.

It certainly does!

My family of 4 now pays $2,500/month for unsubsidized healthcare a month!

Thanks for your reply. So, a health plan is calculated into the overall valuation on a QDRO?

In a similar situation. How would you calculate the value of a pension with health plan included?

It would logically be worth even more. Take the premiums you would have paid for the health insurance plan and divide it by a reasonable rate of return.

Here’s a related post: Getting Your Money’s Worth For The Health Care Insurance Premiums You Pay

Great post. Not a lot of posts on this topic because the US has shat on the working class!

All i need is enough to cover all housing and living expenses. I’ll get a “low stress” leadership job for the benefits and pay.

The correct way is to calculate the net present value, but you have to make an assumption of the number of years the pension will pay out.

Yes, but who’s gonna know how to do that? If you still need to make assumptions, then you might as well go my way. It is more intuitive and easy.

The bottom line is that you cannot really know the true value of any pension because you do not know how long you will live. Any method used is, at best, an estimate. I do believe that your method is more accurate for those who live beyond their actuarially determined age of death.

Indeed. Life is one big calculated bet. Make the most of it every day!

Related: No Need To Win A Financial Argument, Just Win!

This formula greatly exaggerates the value of a pension. It only calculates a principal amount needed to generate a monthly interest payment while maintaining principal. For that to be true, the retiree would still have that amount in his estate at death.

A better way to calculate the value of a pension is to use the amount of payments multiplied by the number of payments based on life expectancy. This will be much less than this rosy picture painted here (but still very nice).

What I would really like to see is someone calculate the value of the Federal Employee Health Benefit for retirees after age 55.

This post needs more attention.

1) The value of the pension is actually worth less because you don’t get to keep the principal capital being used to generate your yearly pension – the annual pension payments stop when you die. With money invested in defined contributions for example, you get to keep (or pass on) the principal capital that perpetually generate the yearly income after you die. You have the option and access to the $X million that’s generating your passive yearly returns and YOLO’ing the initial capital on hookers and booze whenever you want.

2) Pension-based jobs are significantly underpaid especially in the public sector. I’ve made six figures with a pension at public sector position (IT related) but my equivalent private sector colleagues average about 20-30% more in salary, and probably double (100%) if I were to move down south. When deciding between a public/private sector job, you could pick the private sector job (which has no pension) and invest the increased amount of salary in the S&P500 which would likely generate a greater return than the pension offered at the public sector. The man difference is the risk of job loss and work/life balance at the private sector job is probably worse

“1) The value of the pension is actually worth less because you don’t get to keep the principal capital”

As you point out, you can pass on capital in a portfolio, however, from your personal perspective, on death, you don’t get to keep the capital wherever it is, i.e. you can’t take it with you!

Also, for most government pensions, you CAN pass the pension on to a beneficiary. This is not being calculated in. As you said, whether you go private or public, you can’t take it with you when you die. However, you do have the option of passing your pension on to a loved one. Some options allow you to pass it on to a beneficiary for the rest of their lives as well (for a reduced monthly pension for the pensioner).

Something worth highlighting in and among those receiving pensions where (and this is the critical point) the retiree did NOT contribute to Social Security during the years they worked toward said pension; yet DOES accumulate either in post-retirement or otherwise, enough Social Security Quarters to obtain Social Security benefits. They will become subject to the dreaded “Windfall Elimination Provision” or WEP for short. This affects many (but not all) teachers, law enforcement officers, State employees and those under the older CSRS Federal retirement system. In other words, if a pension comes from one of the above sources yet no FICA taxes were paid during those earning years…. then sadly, the retiree will most likely be hit with the WEP. Many a person planning for their retirement ASSUMED that the information gleaned from their SS projected benefits review is accurate and cranks those numbers into their overall retirement financial health formula. But does not realize that SS factors those “lost years” i.e. Zero earnings years right along with actual FICA based earnings years. The retiree becomes shocked later when they find out that their actual SS benefit gets cut about 40 to 50 percent! Read ALL the verbiage on your SS projected benefits statement and this fact will reveal itself. HR resources often failed to realize this part of the SS law which began around 1983 and did not educate their employees accordingly. Even today, one can read tales of misery and woe regarding the surprise WEP penalty and its evil twin the GPO (Government Pension Offset) That’s why sites like the Financial Samurai here are so helpful in cutting through the government mumbo-jumbo so that people can make informed decisions regarding their financial future and financial security.

Thank you Sean. Very good point that often not understood.

As a California Teacher for over 33 years, I can NOT collect any Social Security worth mentioning. Also, If my husband dies I cannot receive any of his Social Security even though he has paid in full. I almost feel I have to subtract what I could have received in Social Security and then recalculate the benefits of 84,000 a year. Not complaining. I will be able to retire at 60 as I have planned instead of 67. Also, my health insurance is paid for my husband and myself until 65. it has been a good and meaningful life. No regrets.

Who the hell are you to say “Not bad for someone who made a decent, but unspectacular $90,000 year for the last four years of his career”.

The average salary for someone 55-64 is $51.714 so I think $90,000 a year is a damn good salary.

Would you like me to change the adjective to make you happier? Happy to do so if you can share more about your situation. thanks

There is an easier way of valuing a pension with a COLA. Multiply the annual pension amount by 25. This gives the amount of the pension portfolio which would be required to give this payout according to the 4% rule.