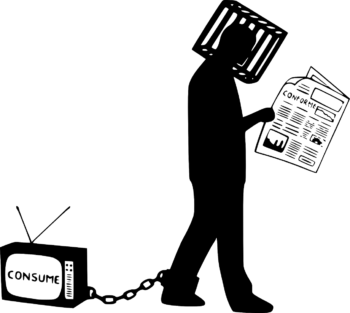

The worst type of debt is consumer debt. And most consumer debt is paid for using a credit card. With the average credit card interest rate in the mid-to-high teens, consumers with revolving credit card debt are often stuck in a negative death spiral.

One reason why consumer debt is so bad is due to people buying things they really don't need: a fifth pair of designer jeans, another luxury watch, every electronic gadget imaginable, and so forth.

But egregiously high credit card interest rates are the main reason why consumer debt is the worst type of debt for your finances. If you keep revolving credit card debt, you will likely stay poor forever.

Let's take a look at the current average credit card interest rate.

The Average Credit Card Interest Rate

According to the Federal Reserve Bank Of St. Louis (FRED), the average credit card interest rate is a whopping 17% in 2019.

The average credit card interest rate has stayed relatively flat in 2020/2021, despite the Federal Reserve slashing rates to 0% – 0.25%. This means credit card companies are earning an even higher profit margin.

If you want to know what financial highway robbery is, this is it folks. Credit card interest rates are at their highest level in 25 years despite treasury bond yields coming down during this time period.

Not even the great Warren Buffett has outperformed the average credit card interest rate in his illustrious investing career. Therefore, if you hold revolving credit card debt, pat yourself in the back for beating Buffett, but in reverse!

Below is the average credit card interest rate by credit score and type of credit card according to Wallethub, a credit card lead generating site. Their data shows the average credit card rate is even higher than the data from the Federal Reserve Bank of St. Louis.

Average Credit Card Interest Rate By Credit Score And Card Type

The average credit card interest rate has risen about 4.6% since mid-2014. Directionally, it has followed the fed funds rate higher. However, the fed funds rate has only increased by 2.5%, meaning that credit card companies are earning an even higher spread on consumers.

Do you really want to let credit card companies make 3X more off you than the prime rate? Of course not, unless you like getting mugged in a dark alley every month.

Remember, stocks have historically returned between 8-10% a year since 1926. But from 1999 – 2018, the S&P 500 only had a 5.6% annualized return. Even the best performing asset, REITs, only showed a 9.9% annualized return for the 20 year period.

You have no business outperforming the best asset class over a 20-year period by 7.1%.

Treasury Yields Collapsing

What makes an average 17% credit card interest rate even more nefarious is the fact that treasury yields have been plummeting since 2018.

You can see from the chart below that the 10-year treasury bond yield is still close to an all-time low.

Credit card interest rates should be plummeting along with treasury bond yields, but they are not because they are tied to the fed funds rate and the Fed is behind the curve. Therefore, stay away from credit card debt and refinance your mortgage instead.

The strength in the bond market is telling us that economic growth is expected to slow. Yet, credit card companies continue to press higher, as if they're trying to squeeze every last drop out of the consumer before everything goes to hell.

The Fed cutting rates has historically been a signal for rough times ahead. Yes, credit card rates should drop a little bit, but not nearly as much as you hope. Please make sure all your finances are in order.

Avoid Credit Card Debt

You're never going to reach financial freedom if you have revolving credit card debt. Your debt will likely grow faster than you can pay it off because average wage growth is only about 2% a year.

If you must buy things you don't need, at least make enough money from your investments to pay for such goods. This way, you'll always be winning before splurging.

Finally, the easiest way to potentially make money off usurious credit card interest rates is to buy publicly traded credit card companies like Visa (V) and Mastercard (MA). If you can't beat them, join them, right?

Just know that Visa and Mastercard are already up about 40% (!) for the year. If the economy turns sour, these companies will probably underperform the S&P 500 as default rates shoot up.

There are also plenty of credit card and personal loan lead generation startups you could join as well. But if you do, I'm not sure how good you'll feel coming into work each day.

Refinance Your Credit Card Interest Rate

If you have revolving credit card debt, now is the time to refinance to a lower rate personal loan interest rate. The spread between personal loan interest rates and credit card interest rates is the largest its been in 20 years according to the data below.

Check out Credible for some competitive personal loan rate quotes for free. Credible is a multi-lender marketplace that enables borrowers to receive competitive loan offers from its vetted lenders.

For further suggestions on saving money and growing wealth, check out my Top Financial Products page.

In addition, if you enjoyed this article and want to get more personal finance insights and tips, please sign up for the free Financial Samurai newsletter. You’ll get access to exclusive content only available to subscribers.

I think a personal finance class should be incorporated into high school curriculum across America and is a required class. One of the topics in the class should be the high cost of interest rates on credit cards and then providing more inexpensive alternatives (ie HELOC financing).

My dad always drummed into our heads that debt is the devil. He said to only use debt (mortgage) to buy a house. More advice: If you need a car, find the safest, most reliable one you can afford and pay with cash. And of course, if you have a credit card, pay it off in full each month. Advice I have lived by after all these years (I’m 50+). Thanks, Sam, for preaching the same thing. It helps people stay out of financial trouble and keep more of what they earn. You rock!

Hi Sam: Note the hyperlink under the text “make enough money from your investments” has some extraneous characters in it, causing it to fail to load.

As to your question, maybe it was tongue-in-cheek but no, I don’t see any good way to save people from themselves in a free society.

I have 3 credit cards but don’t know the interest rate charged by any of them. Which is a luxury of sorts.

I’m 33 and have never paid a dime in CC interest in my life. If you can’t afford it now, then wait until you can. So many of my friends buy crap they can’t afford, then blame others (the CC companies, the businesses, ‘Capitalism’, etc), instead of their poor decision making

I paid CC interest on maybe one billing cycle in my life because I forgot to login and pay off my balance. I hope I never have to do that again. We are rewarded with points etc. because of the spending habits of others.

My dad taught me the basics when I got my first card.

1) Make absolutely sure it has no annual fees.

2) Make absolutely sure it has a grace period so that no interest is due if paid off when the bill comes.

3) Make absolutely sure you pay it off every bill.

My dad liked that word “absolutely.”

4) He also cautioned against ever having anyone else’s name on the card and, if this was not possible, make sure any shared card have a very low limit.

5) Every couple should have at least one for each of them and one that is shared.

6) Try not to have too many of them at once.

When my first wife and I were divorced, she maxed every card, even ones I wasn’t on. And guess what? A judge will just lump them altogether and apportion out “marital debt” however they wish. This is also when I got to learn who the good guys and bad guys were.

Some of them were royal you-know-whats and some of them were genuinely noble and helpful as hell. Those that were the latter still have my business and have no doubt profited mightily from it in the intervening decades. Completely unrelated, I cut up my Best Buy card and burned it once they were paid off.

Snazster – here in Texas, the girl will take the guy to the cleaner every single time we walked down the divorce road.

We need to amp up our game by making adjustment to your father 4th commandment.

4. If you cannot find a girl that you don’t have enough trust to put her name on the credit card – DO NOT MARRY HER!

It will be a long and lonely and poor life (at least in Texas) for any man who live without trust in an intimate relationship!

Yep, but 50% of all marriages end in divorce. The other 50% end in death.

It took me fifteen years to find one that I’m pretty sure will be in the latter category. Heck, I trust her more than I trust myself.

My dad also said it’s just as easy to love a rich one as a poor one, but that’s not really a principle most of us can operate by.

This article was great, thank you. It would’ve been even better if you got a little more into the best ways to get out of credit card debt if you already are in debt.

Here’s an article: https://www.financialsamurai.com/steps-to-get-out-of-massive-credit-card-debt-thanks-to-lifestyle-inflation/

Credit cards are treacherous waters. Cash back incentives, points, travel miles, are all ploys for all of us to spend. Frequently on crap. Actually overspend on crap.

Credit card companies are smarter than all of us. I have not been able to talk the wife out of our Costco visa. It is the only card we use. We don’t carry balances. But I despise it.

I guarantee we overspend because of the credit card by 10%. 10% that i would much rather put into our ROTH and post tax brokerage accounts. And we budget and track all expenditures.

Nothing beats cash and budgeting for true control over your income.

Credit card debt is some of the worse debt. I try and pay off all my credit card debt every month.

Credit cards can also have great benefits for people who pay off their debt every month and don’t get charged interest, such as travel points, cash backs, and other point programs.

Visa (V) and Mastercard (MA) are processing companies, right? They aren’t going to get hurt too much with defaults. The underlying banks will be the ones to write those off.

It’s pretty amazing how much money the credit cards are making. I didn’t know the credit card interest rate diverged so much from the treasury rate. That’s predatory, but consumers don’t seem to care. I guess it’s party time for the banks.

Ah ha! That’s why they can offer such great signup bonuses.

Visa and MasterCard are the card issuers. Companies such as First Data/Fiserv are the transaction processors.

But Joe is right in that they don’t hold the debt or charge the interest rates. The underlying or sponsoring banks do.

Why are people getting into credit card debt when interest rates are so high?

Lack of cash flow. Low income. Spending too much. Thinking they need a car or expensive home/apartment. Losing job. Attending college an extra year. Going back for a masters degree. It’s easy to have happen, and takes discipline to not let it happen by keeping costs low relative to income.

Should we implement more regulations on who is allowed to get a credit card in order to save people from themselves?

No. People can make their own decisions.

Wow that is an insane spread on the prime rate and the average credit card interest rate. Robbery. I think there are a lot of consumers who don’t fully understand the side effects of interest payments on their credit cards, which is sad and a serious risk to their financial health. Thanks for raising awareness!

It was interesting to see the rise in credit card rates, but I’d disagree that credit card debt is the worst debt. While more expensive than student loan debt, at least credit card debt is potentially dischargeable in bankruptcy whereas student loan debt follows you to the grave. Still, all in all, excellent insights.

Can you expand upon the mindset of getting into debt to have the out of not paying back your debt in bankruptcy?

Student loan interest rates are under 6%, which is more in-line with the prime rate and fed funds rate. So in my opinion, they are not nearly as egregious. I don’t like student loan debt, but the asset being acquired has the potential to improve one’s earning’s power and net worth over time.

Sam –

Creditors ONLY think about the likelihood of default and rights of recovery when issuing debt. Why shouldn’t borrowers think about the same thing?

Comparing debt is not a black-and-white comparison of rates alone. A well-informed person SHOULD look at what rights the creditor has — everything from the rate to the scope of recovery rights to pre-payment penalties, etc., and (as you suggest in your question) you should look at what you’re getting for going into debt.

But, bankruptcy happens. Not just to people who irresponsibly buy expensive watches. The number one cause of bankruptcy in this country is healthcare expenses.

Now, you said college interest rates are relatively low but “the asset being acquired has the potential to improve one’s earning’s power and net worth over time.” Didn’t you just write about how a degree is a “depreciating asset”? That was a thought-provoking blog post, and your point was “is it worth it?”

But part of the analysis (which you failed to mention) is whether it’s worth it to get into hundreds of thousands of student loan debt when you have no ability to renegotiate the debt since it’s never going to go away until you pay it. It’s one thing to buy a $10,000 watch on a credit card where you can walk away if you become homeless or have a huge healthcare expense that forces bankruptcy and it’s another to go into $300K+ worth of debt to get a bachelor’s degree where the loan will be waiting for you when you leave the courthouse.

By the way, the same analysis can apply to other debt. If you buy a house, the purchase-money mortgage is non-recourse. If you default on that loan, the bank can take the house and that’s it. But, if you refinance the loan it becomes a full-recourse loan (different states vary on this, but that’s how it is in California). It’s the very same house, but the bank now has different rights. And indeed, it makes sense the bank’s interest rate will be lower on a refinance loan because the bank has greater rights of recovery. They’re better protected.

That, of course, is one reason credit card interest rates are so high–defaults are high, the cost of recovery is expensive, and they are subject to discharge in bankruptcy. Why do you think Chase just forgave all that credit card debt in Canada this week?

Now, with a potential economic storm approaching, as you note in your post, doesn’t it make sense for debtors to consider the different types of recovery rights in the event they are forced to default? Again, I’m not advocating that people do not repay their debt — indeed, I don’t believe in debt and tell my children to avoid it (except for a modest mortgage and short-term care loan if they really need one) — but for those willing to rack up debt (of whatever kind) they’d better think about the other side of the equation, and not just the “interest rate,” when taking on the debt.

I think you bring up an interesting point on the knowledge aspect of the debt. How many of us really understood debt or how much college cost (or the true cost of that debt) at 18?

I’d say though that payday loan debt is arguably the worst. I understand where you’re coming from though that in the event of unforeseen circumstances you can’t escape student debt. I do think that all student loan debt should not accrue interest until you are no longer in school.

Zen Master – technically you have the financial knowledge of the upper epsilon of the population, the master/manager tier. I would take “Zen” out of the title because knowledge comes with responsibility.

The entire population within the boundary of the bankruptcy law pays for the cost of the person who made the financial mistake and worst of all many of them INTENTIONAL – no different than ROBBERY resulted in MANSLAUGHTER.

There were real deaths after the financial meltdown in 2009!

Personally, I have met few people in my life time who have used the bankruptcy strategy to take enormous risks and did come out financially above the general population – using other people money to make you wealthy is entrepreneur 101 (LEECHES).

From your response – you have the knowledge, yet you are on the right side of the MORAL shade. So do not advocate for bankruptcy to just anyone especially the young mind, just in case, some of them may grow into the GENIUSES who make 2009 financial meltdown possible.

There is nothing wrong with consumption, but 95% of the population does consume safely and properly.

A frog found a warm bath and decided to sit and relax in it. As time goes on, his biology is conditioned to the warm water and he no longer sense pleasure. He tried to find the thermostat and increase the warm bath temperature.

The warm bath was designed such a way that any frog who experienced the bath have no adjust the temperature – only the frogs who have financial investment in the bath business have the control.

He looked around and requested other frogs to turn up the water temperature and paid each one of them with a fair market price.

After awhile, the frog noticed the hot steams streaming up and the water surface tension showed sign of boiling.

He realized he was slowly boiled to death. With panic, he asked other frogs to turn down the temperature. No frogs answered his request – financially, he had used up his earned dollars and no one is willing to give him a charity.

The frog died!

Take FS advice on consumer debt!

If you have to consume, use CASH – it is a financial trick to recondition your financial mindset.

Otherwise, you are slowly giving others the control of your life and worse the life of your family!

There is a reason credit card companies offer you a low introductory rate and that is to hook you in in the hopes that you will have a large balance when the rates reset to these high numbers.

The only way you can beat credit card companies is to get points/cash back from purchases and pay off the entire balance each month.

Too many people also treat available credit card balances as a pseudo emergency fund. This could get them in serious trouble if things go sour.

What you say is very true but I have still taken advantage of a few of these offers from time to time. Recently, I had to replace part of my roof tiles and a company was offering a 0% rate for 18 months for a one-time participation charge of 3%. So a 10K bill with the payments spread out over 18 months cost me $300. I simply put the card in the drawer and didn’t use it for anything else. I considered this offer well worth it and this is the only way I use a credit card beyond paying off the others I use on a monthly basis.

This is a lot cheaper than a Home Equity Line and I’ve also found that once you do this a couple of times with the same card, they keep making you other good offers and terms. To me, this is a smart and cheaper way to use their credit.

We did this, as well, to help out with renovation costs for our house. The risk we took was that we could sell the house before the credit card bill was due…scary. The bill is due in October; the first contract fell through, but we hope to have a second close in September. That’s a little close — and closer than we planned — but we should be ok. If not, we’ll pay the credit card bill off with a HELOC; interest on that is only 5.75%, versus the credit card.

We also got a $300 credit just for opening the cc account. Which also helps.

But do I agree with carrying a balance all the time? No way…particularly with purchases you really don’t need. Wanting, that’s different from needing — so you’ll come out a lot better in the long run by gradually saving the money for the purchase — then charging the purchase (thus getting cash back) — THEN paying it off when the bill comes due.

Good post!

I cannot believe how high these interest rates are for people who use credit. And lot of people do use it. This world is in a serious need of financial education!

– Financial Nordic

There will always be people with credit card debt. People think of credit cards as free money. And no interest rate is going to change that, unfortunately.

I’d take credit card debt in an emergency over payday loans. However, I’m planning on tapping my home equity before the recession to stockpile my cash while the house has a high value.