I've been using Empower's free financial tools, previously know as Personal Capital, to track my net worth, manage my cash flow, and optimize my investments since 2012. Let me share with you the most thorough and honest Empower review about their free financial application.

From 2013 – 2015, I was also a consultant for the firm. Therefore, I have intimate knowledge of their people, their technology, and their product. I still keep in regular contact with all the senior management here in the SF Bay Area.

It's my belief that Empower is hands down the best free financial tools platform you can find online. It helps you manage your finances and achieve a more secure retirement. I've tried everything from Excel, to Mint, a plethora of other financial apps, and nothing comes close to Empower's tools.

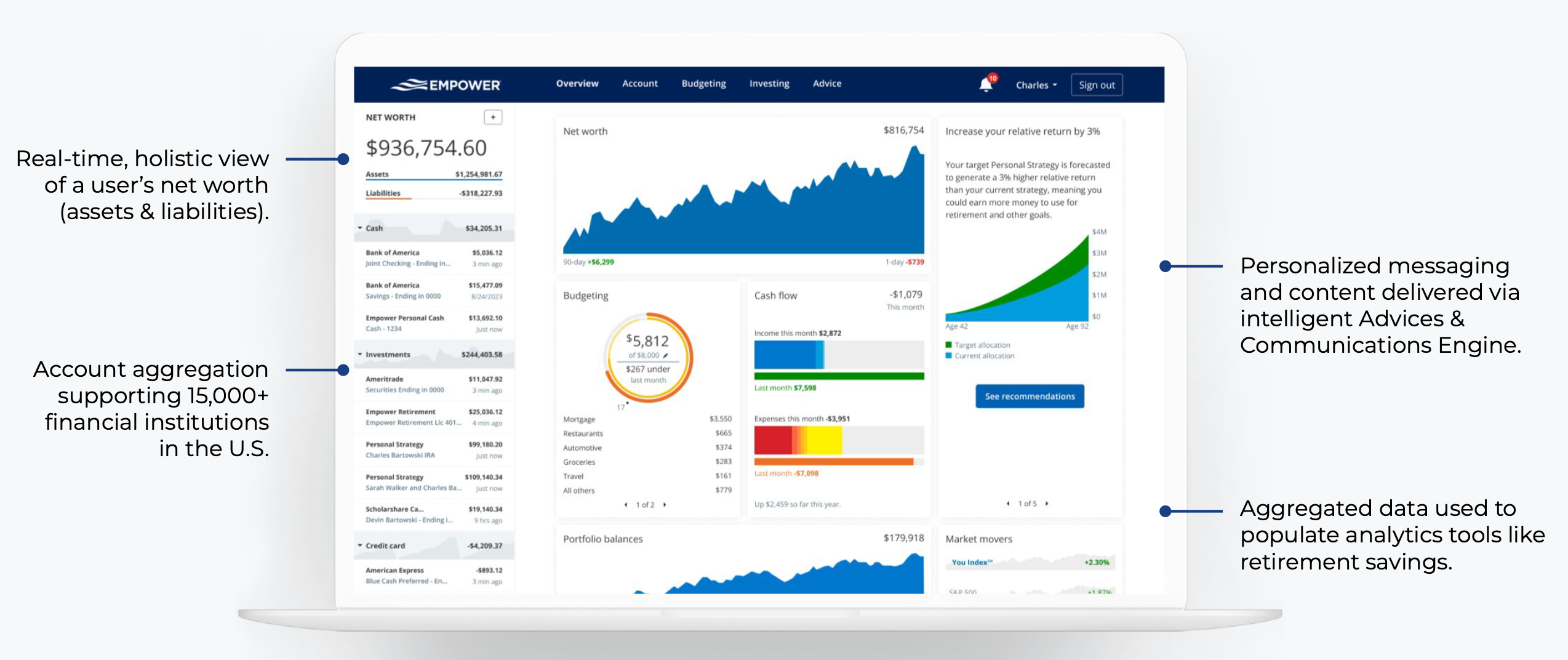

With the Empower Personal Dashboard, you can do the following things for free:

- * Automatically track your net worth

- * Analyze your investment portfolios for excessive fees

- * Analyze your investment portfolios for proper asset allocation

- * Track and manage your income and expenses

- * Run various retirement planning calculations to ensure a better financial future

Empower currently has $2 trillion plan assets administered and $300+ billion in assets under management. And over 18 million Americans trust Empower with their finances to create the future they want. This amount is a testament to their money management capabilities and product offerings.

Their competitive advantage is that they built their company from the ground up with technology at its core. As a result, they are much more flexible in tailoring offerings to meet consumer demand. Let's move onto the detailed Empower review.

Free financial checkup: If you have over $100,000 in investable assets, you can receive a free financial analysis from an Empower advisor by signing up here. An annual review is always worthwhile as your asset allocation can shift significantly over time, and your financial situation may evolve as well. We all have financial blindspots that are worth recognizing to build more future wealth.

Empower Review 2025

Let me share some of the reasons why Empower Personal Dashboard is the best free wealth management tool today. I've been using Empower to keep track of my wealth since 2012.

1) Simplicity And Less Financial Stress

Before Empower, I had to log into eight different financial institutions to track over 30 different financial accounts ranging from brokerage accounts, money market accounts, CD accounts, checking accounts, IRA, and my 401K.

My finances were a mess, and I'm sure your finances could use some organization as well. Now I can just log into Empower to see how everything is doing in one place. Their technology has made such a positive impact on my finances, I became instantly motivated to write this Empower review to help as many other people as possible.

It's important to have a holistic view of your overall financial health so you know where to allocate resources.

2) Easy To Review Your Net Worth

Gone are the days where you have to use an Excel spreadsheet to manually update every single asset and liability line item to calculate your net worth. Empower Personal Dashboard updates your net worth automatically as soon as you log in because all your accounts are linked. They provide a pie chart of your assets as well as gives you a historical chart of your net worth progression.

If you cannot find an account in their database, you can simply add it yourself. Empower will also conveniently e-mail you a weekly snap shot of your latest net worth along with how the markets did, upcoming bills, latest insightful blog posts and accounts that need your attention. Below is a sample headline snapshot.

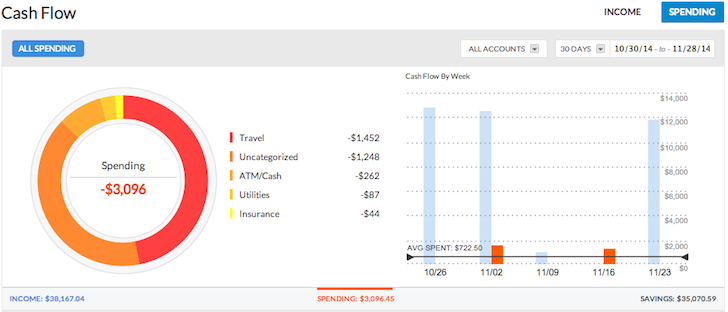

3) Easy To Track Your Cash Flow

Budgeting is personal finance 101. By tracking your income and your spending like a hawk, you will be able to save a lot more money than if you simply tried to guess everything. Think about all the times you withdrew cash from the ATM machine and had no idea where all the money went a couple days later.

Aggregating all your accounts allows you to see where all your money is going. In the example above, this entrepreneur brought in over $38,000 in income and spent only $3,096. Now that's great cash flow!

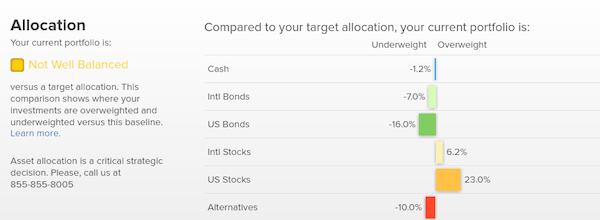

4) Helps You Balance Risk

With so many accounts, it's often hard to see exactly what's going where. For example, so many people were too overweight stocks before the financial crash in 2009. With Empower Personal Dashboard, you can easily see where the imbalances are in your net worth. You can then make smart adjustments.

With so much volatility in the stock market, investors may be too overweight equities and too underweight bonds. Fortunately, this Empower review shows you how their wealth management tools can help investors with their portfolio allocation.

The Investment Checkup tool analyzes your portfolio's holdings based on size, style, and sector. Empower Personal Capital excels for those who have assets in the stock market. Personally, I like to maintain a 20%, 30%, 35%, 10%, 5% split between stocks, bonds, real estate, alternative investments, and risk-free investments like CDs and money markets.

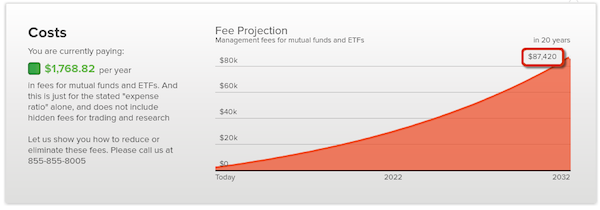

5) Helps Reduce Investment Fees

One of my favorite tools Empower Personal Dashboard provides is their Portfolio Fee Analyzer. I ran my 401K through their fee analyzer and discovered that I am paying over $1,750 a year in management fees.

I had no idea that my Fidelity Large Cap Growth fund cost $1,200 a year due to a 0.74% expense ratio compared to sub 0.3% for my Vanguard Funds. As a result, I found a similar Large Cap index fund instead and am now saving $1,000 a year.

Without Empower, I would have spent over $87,000 in excessive fees over the next 20 years. Take a look at my example below. Portfolio fees are a serious problem which will rob you of your retirement wealth if you are not careful. Don't let ignorance rob you of your financial well being. Check out my post on how to reduce 401k fees with Empower Dashboard.

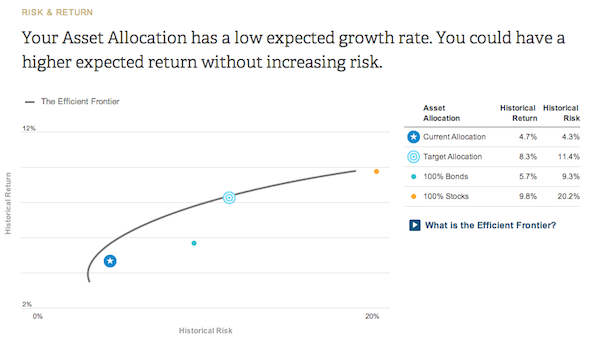

6) Shows Your Portfolio's Investment Efficiency

Based on your risk tolerance and investment objectives questionnaire, Empower Personal Dashboard will give you an idea of where your current allocation is on the Efficient Frontier Curve. The Efficient Frontier Curve is the best returns for a certain level of risk. You want to be on the curve and not above or below.

7) Recommends Specific Dollar Amounts To Invest

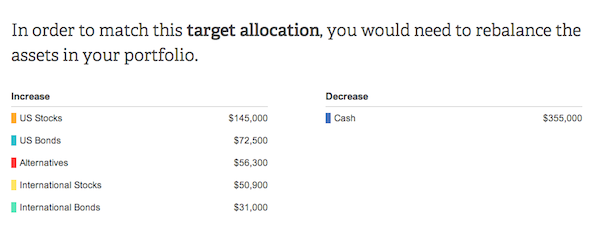

Financial advice is useless if there is no actionable advice. Empower will recommend the specific dollar amounts to invest or reinvest in each asset class to get you to an optimal asset allocation. When I engineered my layoff in 2012, I was focused on having the appropriate asset allocation to sustain my retirement.

In this example below, the investor is too overweight cash and underweight US stocks, US bonds, and international stocks. In order to get to his recommended target allocation the investor needs to increase stock holdings by $282,500 and bond holdings by $72,500.

The fun part is figuring out which index funds to invest in each category. All investment related charts and analysis can be found in the Investing tab.

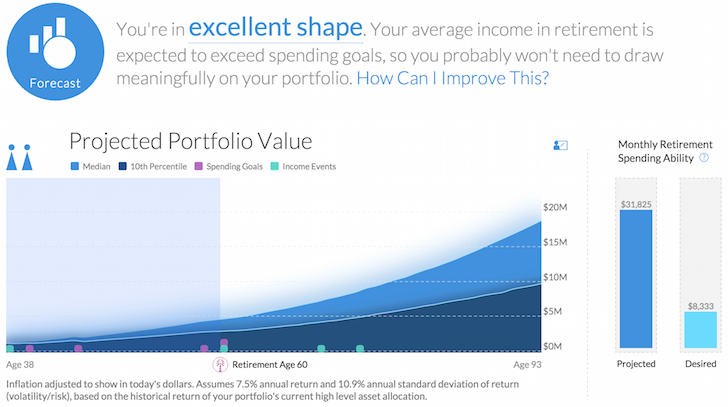

8) The Best Retirement Planning Calculator

Empower Personal Dashboard has the best retirement calculator on the market. It uses real data and Monte Carlo simulations to come up with the most realistic financial scenarios for your future.

Other calculators simply ask you to guess input values to then come up with your financial future. The problem with this method is that we often underestimate how much we are saving and spending!

You can input different life events such as a wedding or home purchase in your cash flow statement. The tool will then recalculate your financial future to see how you'll do. Everybody should give it a try.

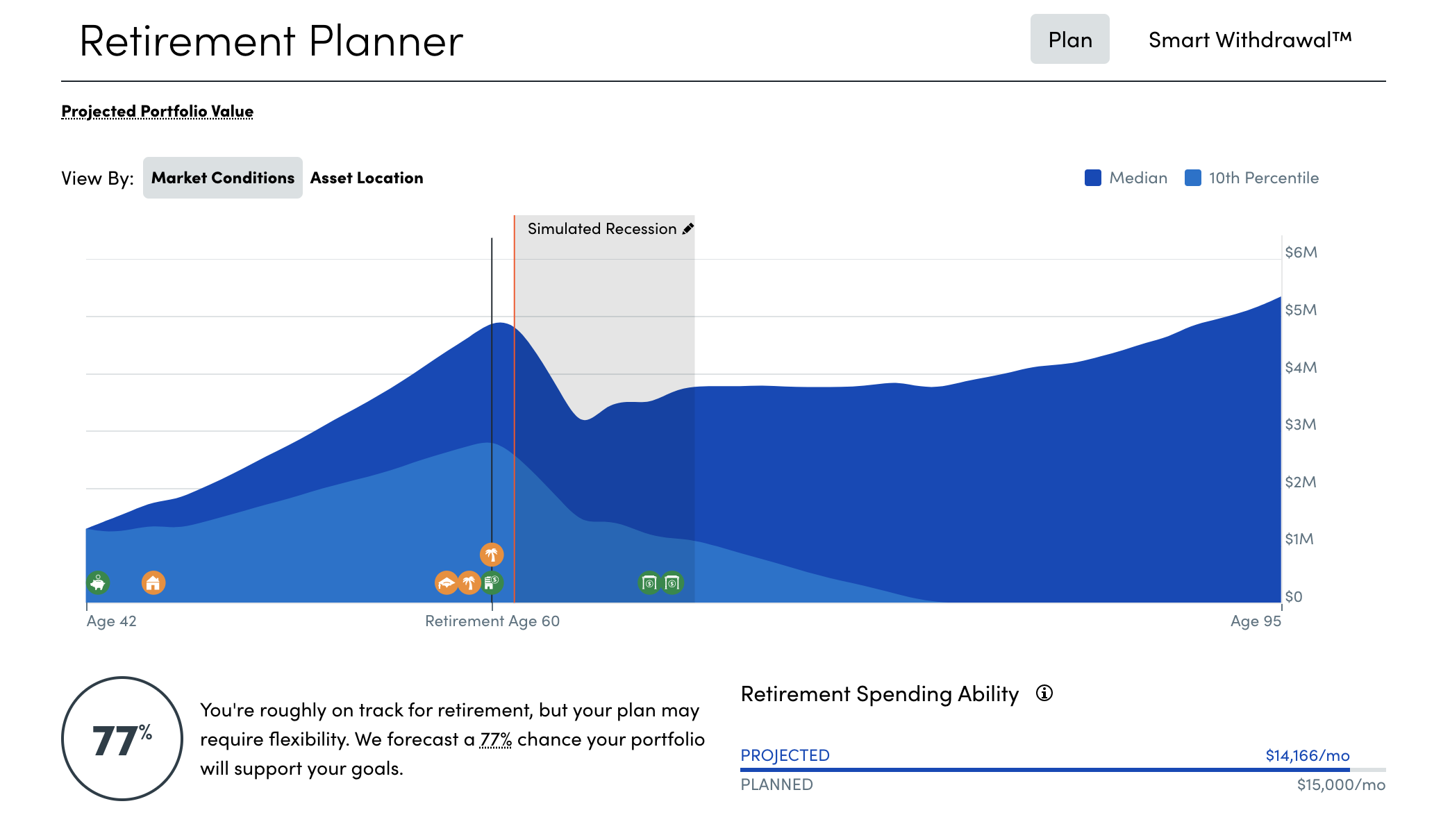

9) Free Recession Simulator

After the global pandemic began, Empower came out with its Recession Simulator. It provides users and clients the ability to view how their current portfolio would have done during past recessions. The idea is to allow users to see what might happen if the next recession is like the past.

Below is an example of the Recession Simulator at work. Notice how the Projected cash flow is short about $800/month in retirement if the simulated recession plays out according to the variables.

If you believe the variables (duration of recession and depth of decline), then you would try and save more or change your investment style. Thanks to aggressive Fed rate hikes, another recession could occur in the next 18 months. The yield curve is the most inverted since 1981.

10) Free Financial Checkup With An Empower Professional

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can also get a free financial check-up from an Empower advisor by signing up here. It’s a no-obligation way to have a seasoned professional, someone who reviews portfolios every day, take a closer look at your finances.

A fresh set of eyes can uncover hidden fees, inefficient allocations, or opportunities to improve your plan. I’m confident you’ll walk away with new insights about your retirement readiness, just as I did with my free Empower financial review. It’s a great feeling to know you’re on track or that you’ll likely be fine no matter what happens next.

More Great Empower Features

If the above features weren't enough for this comprehensive Empower Personal Dashboard review, here are even more great features and accolades.

Award Winning Technology – Lauded by MacWorld as the Best Financial app on the web.

Easy To Use – All you've got to do is sign up, press the “+” to link all your desired accounts, fill in the respective user names and passwords and everything will get downloaded on the Empower Personal Capital dashboard. The more accounts you link, the more comprehensive picture you will receive of your finances. It only takes a couple minutes to sign up.

E-mail updates – Every week you'll get an e-mail update of your net worth, the latest Personal Capital news, and a snapshot of the markets. You can also subscribe to Empower's The Currency blog to gain insights.

Tax Loss Harvesting – Empower practices tax loss harvesting and tax location for their clients. Tax loss harvesting alone gains up to 1% in after tax return a year.

Smart Indexing – Smart Indexing aka Tactical Weighting is the practice of investing in equal weighted sectors or styles. In bull markets, one sector can grow to an outsized percentage, such as during the dot com bubble or the financial bubble. When the market corrected, people lost a lot of money. But if they practiced Smart Indexing, by constantly staying disciplined with equal weightings in the sectors, they would have outperformed.

Free Portfolio Review With An Advisor – If you want to get a free 1X1 session with a portfolio advisor, you can. Simply click this link, sign up, link your accounts and ask for a free session. It's worth $799 for free. There's no obligation to sign up and use Empower Personal Capital to manage your money after. It's always good to get a second opinion.

Leverage Empower For Free

This Empower review demonstrates how helpful it is to leverage free financial tools. When you know where your money is going and where it's being invested, you gain a tremendous amount of confidence in your financial well being.

One of my biggest goals on Financial Samurai is to help everyone achieve financial independence sooner, rather than later.

You may not be wealthy now, but just knowing you've got your finances in order and have a financial plan tremendously increases your chances of financial success.

Once you are financially secure, you free to do whatever you truly want. Get a handle on your finances by signing up with Empower for free and aggregating all your accounts. The financial management tools are free and takes less than a minute to sign up.

I spent 13 years meticulously tracking my own finances to achieve financial freedom at age 34. If I discovered Empower earlier, I think I would have reached freedom even sooner!

I hope you enjoyed this Empower review. I've spent the past nine years using Empower's free tools and analyzing their new offerings over time.

Free Financial Analysis Offer From Empower

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can get a free financial check-up from an Empower financial professional by signing up here. It’s a no-obligation way to have a seasoned expert, who builds and analyzes portfolios for a living, review your finances.

A fresh set of eyes could uncover hidden fees, inefficient allocations, or opportunities to optimize—giving you greater clarity and confidence in your financial plan. I've spoken to an Empower professional before and they helped me see that I was paying $1,400 a year in fees I had no idea I was paying.

Empower Review 2025 is a Financial Samurai original post. Everything written on Financial Samurai since 2009 is based on firsthand experience. Join 60,000+ others and subscribe to my free newsletter here.

I’ll admit, the new Empower layout takes some getting used to after years of using Personal Capital’s classic design. That said, I’m starting to see some real positives with the change. The platform is clearly evolving with a longer-term vision — better integration of banking, retirement, and investment tools all in one place, plus enhanced security and data visualization capabilities.

While some favorite features now require an extra click or two, I suspect the redesign is paving the way for even more powerful analytics and customization down the road. It’s encouraging to see Empower continuing to invest in improving its tools instead of letting the platform stagnate. I’m looking forward to seeing future updates that merge the best of both worlds: Personal Capital’s simplicity with Empower’s innovation.

Hi Sam,

Thank you for all your articles, it really helps me focus and reorganise my thoughts.

I’m from Singapore, non-American btw.

Are both Fundrise or Empower suitable or relevant to me?

Hope to have your kind advice.

Thank you!

Regards,

JC

Hi Sam,

I really want to try them out, but the 1st ask for my phone number, brought this disclaimer up: (I really, really hate spam calls :( )

“By providing your phone number and clicking Next, you agree to receive marketing calls and text messages to the phone number provided, including those made using auto dialers, prerecorded voice messages, and other electronic means. Consent is not required for purchase, and you may opt out at any time. Message and data rates may apply.”

What has your experience been?

Thanks in advance,

D

I haven’t had a phone call from them in over 10 years. I think I had one or two phone calls in the beginning, but I didn’t pick up because my phone is always on silent.

But I did sign up for a free consultation to review my portfolio. I thought it was helpful to see where I could optimize.

Does Empower/Personal Capital allow you to designate certain money-market funds (MMFs) or certain brokerage accounts as “cash equivalents”? For example, some of the competing offerings (like Quicken for example) treat positions in MMFs as securities rather than cash, which makes it more difficult to ascertain one’s cash position.

Would you recommend using their wealth management services or are there better options?

Yes, if you don’t know where to start and have no experience investing, Empower is a lower cost way to start investing in a risk-appropriate way.

You can also do a free trial appointment / analysis first.

I have used Empower for a few years and is a useful tool. My only complaint is. They don’t track dividends from Fundrise.

There are many private funds and private investments one needs to manually input. But that’s not bad given Empower tracks the majority.

Going in to manually update once in a while is good b/c it forces you to check up on your net worth and make sure your net worth allocation is correct and your cash is being properly utilized.

Really impressed with the financial software that i have used for the last couple of years. It presents an unbiased look at your overall financial picture that gives me a “warm and fuzzy”. No financial counselor trying to pitch schemes that you cant determine if it’s in your best interest or theirs. I did attempt to do the mgmt part but got a little leary when i found out they control most every aspect and only inform you when they make moves. At the end of the day, i like having more control.

Thanks for the review Sam! I am in the process of trying out the free stuff and I scheduled a “Free Portfolio Review With An Advisor”. I noticed that you haven’t talked much about that part of their offerings.

What do you think about their paid account management? Do you think they are likely to save a customer enough in fees and get enough better returns to justify the fee?

No problem. It’s worth going through the free portfolio review with an advisor. I did one before and thought it to be an elucidating experience. I didn’t go ahead with the money management part b/c I enjoy managing my money myself.

I’ve been paying Personal Capital to manage my portfolio for about 3 years now. As far I can tell the “Smart Indexing aka Tactical Weighting” sounded like a good tweak to the investment strategy but in practice is very rarely used. I recently got my first email that they were trimming back on the Energy sector.

So I’ve been using PC for the last few years. Except all of a sudden the Cash Flow tracker has stopped working. Not only has it stopped working but all of my cash flow data for the last 5 years is gone too. So I can’t even compare my cash flow last year to this year.

What’s up? Is anyone else having this issue? This was one of the best features of the platform and now that it’s gone, I’m considering finding something else.

That’s weird. I can clearly see my historical cash flow data. Could be just you. Contact their tech support. But it sounds like it’s on your end. You can also check out NewRetirement as a great retirement tool as well.

is personal capital available to be used in canada? I currently track my own finances and net worth via excel, but would like something a little more streamlined, as well as being able to see everything in one place.

It’s not unfortunately.

Are their retirement management services still solid? My wife will probably retire this year and I think their rate is 0.89% and they’ll also offer up advice for me as I continue to work. Just curious if anyone uses them and if there is any feedback? Thanks!

I think Personal Capital continues to improve and has the best offering yet. They are running a cool promotion that I tried before. Once you sign up and link your accounts, you can request for a free portfolio consultation with a fiduciary advisor. S/he will go through your objectives and you portfolio. It’s a no obligation consultation worth over $700.

You can sign up here.

i switched from quicken to PC in march 2019 and i’ve been quite happy since. PC is a great place to consolidate all your accounts and categorize them for budgeting and tax reporting. i miss the canned quicken reports, but i am able to export from PC to excel and generate my own custom reports without too much effort.

recently, i discovered that there were missing transactions when i import data from my accounts into PC. after emailing PC support (i used their ‘submit a request’ link), a real human being got back to me with a solution. they were able to manually ‘sync additional transactions’ and all my missing transactions magically appeared. 5 stars for PC support!

when i asked for details, PC support showed me an new ‘manual refresh’ button that appeared near the upper right of each account screen (it looks like a ‘sync’ button). apparently, you can only click this button once a week (at most), but it does work. this appears to be an undocumented feature, but i’m glad it exists.

p.s. i have my own investment adviser, so i don’t need to use PC’s investment services. but i certainly like their price: free!

Interesting on the manual refresh. I have several accounts I’ve manually inputted, such as my venture debt and real estate crowdfunding investments.

Using PC’s free tools is a no brainer. Feels good to track my net worth all in one place, especially when I do year-end and beginning of the year planning.

how do you feel about this type of language on all banks / brokerage sites??

>> If you choose to share account access information with a third-party, “bank/brokerage” is not liable for any resulting damages or losses.

this has been the primary reason I’ve not used aggregator accounts like PC

Is there a way to mark transactions as “reviewed” in Personal Capital? I review transactions weekly to make sure that they are categorized correctly and also manually transfer them to YNAB which is my budgeting tool .

I use a custom tag on each transaction called “processed” in Mint that I can check off so that I don’t waste time looking at transactions that I’ve already reviewed & transferred the previous week.

I used to use dates ranges , but sometimes a transaction will be imported with a date before my last review. rare, but it happens. So date ranges don’t work.

How do you link Personal Capital to your Fundrise / Realty Mogul accounts, though? Is there anyway to do that?

I just link manually and update once a month or quarter.

I really really want to love Personal Capital but it straight up doesn’t work with USAA (where I have the majority of my accounts). I have tried for weeks but it will not sync correctly.

Has anyone with USAA figured out a solution?

I have a USAA credit card account and a USAA mutual fund account. Both link fine.

It also seems to not work with Alight Solutions (LockheedMartin), Empowerment and I routinely have to again enter passwords for Fidelity. I like PC but it can be frustrating. It also has different categories (AFL is listed as a mid cap Vs a large cap) than normally used by the industry and several funds show up in Uncategorized.

[…] I had no idea I was paying! There is no better financial tool online that has helped me more to achieve financial freedom. Check out their newly launched Retirement Planning Calculator as well. It is interactive and based […]

Do you think Personal Capital is better than Betterment or Wealthfront and why? The fees are higher, but it seems P.C. isn’t so “cookie cutter”?

Hi Jon,

It’s a different target demographic really. Betterment and Wealthfront are 100% algorithmic advisors i.e. there is no human to get advice from and speak to about retirement savings, college savings, tax planning, outlook on the market, etc. That, to me is valuable b/c I’ve gone through multiple up and DOWN cycles in the market.

Robo-advisors are thriving now because anybody can make money in a bull market. It’s what happens when things aren’t as rosy that makes having some human advice very helpful. The roboadvisor fees are very attractive though compared to alternatives. It’s not a bad way to diversify a portion of you investing assets.

Regards,

Sam

To date, would you recommend having both Personal Capital and Wealthfront at the same time since you promote them both?

Thanks, Sam.

Theresa

I would recommend Personal Capital for their free financial tools. They really have the best finance tracking software on mobile and laptop. There’s no downside since it’s free.

I like Wealthfront because it’s fee is lower at 0.25%, and it will build a custom portfolio for you. But you just won’t have anybody to speak to. They are building some tools to help you visualize your retirement and travel future too.

It all depends on how much hand holding/advice you need. Both are a good solution. Part of the problem is that so many people don’t know how or where to start. These two firms can help.

Sam

[…] Capital was seeded with $2 million in 2009 by CEO, Bill Harris and grew into one of the leaders in the financial technology space with over $120 million in […]

[…] a social media / content manager job, I was very hesitant in the beginning. I actually went down to interview Bill Harris, the CEO during the summer, but never really thought much about actually going back to work at the time, […]

Just talked to PC Advisor… The good thing is that all you need is to give them $100,000 to manage in their account for 0.95% fee… Than, for all of your other accounts (your employer 401k, fidelity 529, any other account- they will set up your portfolio and tell you what funds to buy/ sell/ when etc for free.. Seems like a pretty good deal to me…

Totally agree with you that the brand needs a face. I believe it’s the missing link for many of these online advisors. Either a prominent money manager or someone from the academia world!

Stephanie

I just checked the 401k Fee Analyzer and my estimated annual fees are 0.48%, not bad!

Not bad at all! Pretty easy and cool tool huh? You can analyze each portfolio individually if you have multiple portfolios.

Hello FS

could you do a consult ? Recently retired after selling business..

BTW, Sam if you talk to them again (or when you do), the could make some improvements around their tagging of transactions to categories so the software learns my spending habits – i.e., can if i tag an amount as something specific (not initially intuitive) could the software remember that assignment (based on dollar amount, payer/payee, and date), and add budgeting functionality.

Spent a good amount of time working with their advisers and frankly I haven’t gotten much information from them that I couldn’t of gotten from blogs or fidelity.com anyhow. And I don’t know (particularly) much about personal finance, but I am semi-fluent. The advisors seem to know the same if not a bit less than I. Either that or they are instructed not to advise beyond reiterating the company’s overall investment approach to asset allocation. I’m thinking I could save half a point by just allocating my funds to equal weighted domestic/intl ETFs… with nearly identical results.

Sam I presume you do not use their service other than for tracking purposes…?