I'm a late adopter, which is why I haven't thought too much about artificial intelligence (AI). I'd rather have early adopters figure out all the kinks first so I can better spend my time using the technology.

However, at a kid's birthday party one Saturday, a dad, who works in finance, came up to me and asked how my book was doing. I told him in a nonchalant way that it was doing fine. Then he asked me when my next book was coming out. I told him probably sometime next year.

He responded in astonishment, “I didn't know you were writing a second book! I had no idea!”

I told him with a shrug, “I guess my publisher thought the first book did well enough to give me a second chance.”

Then he let out a real zinger, “I'm sorry you're writing the book. Aren't you worried about AI?” Then he caught himself by saying out loud, “I don't know why I said that.”

Normally, people will say “congratulations” or “tell me more.” Instead, he implied that I was wasting my time and that struggling writers will make even less money than we already do.

Then he went on to tell me about his Hawaiian vacation, how he's enjoying his finance job, and more. I'm happy for him. But now you get a sense for why I'm seriously looking to go back to work.

Main Way To Prevent Artificial Intelligence From Hurting You

Now that I go to all these playdates and regularly interact with working parents, I now second-guess whether being free is really the best thing for my family. Instead of spending more time with my kids perhaps I should be spending 40+ hours a week making more money! My daughter will finally be going to school time in September 2024, leaving me with a great big void to fill.

Given the conversation, we might as well discuss how to protect ourselves and benefit from artificial intelligence. It seems there's a bit of worry mostly amongst knowledge workers that artificial intelligence will eventually take their jobs.

And if artificial intelligence does replace them, then there may be even fewer well-paying jobs left for our children. This will result in more anxiety for nonparents and parents alike.

Hence, the number one solution to prevent the AI revolution from destroying your livelihood is getting so rich you and your children no longer need jobs! That amount is likely $20+ million for a family of four.

One way I plan to get rich is to invest in private funds, like the Fundrise Innovation Fund, which invests in AI. This way, I'm hedged if AI does very well. The investment minimum is only $10 and I plan to invest a total of $500,000 in funds that invest in AI over the next three years.

We probably have five-to-ten years until AI starts noticeably eliminating knowledge-worker jobs. As a result, we had better save and invest as much as possible now.

But telling you to accumulate generational wealth, or $10+ million, is not very helpful or feasible for most people. Instead, here are some more feasible strategies on how to benefit from artificial intelligence.

How To Benefit From Artificial Intelligence And Get Richer

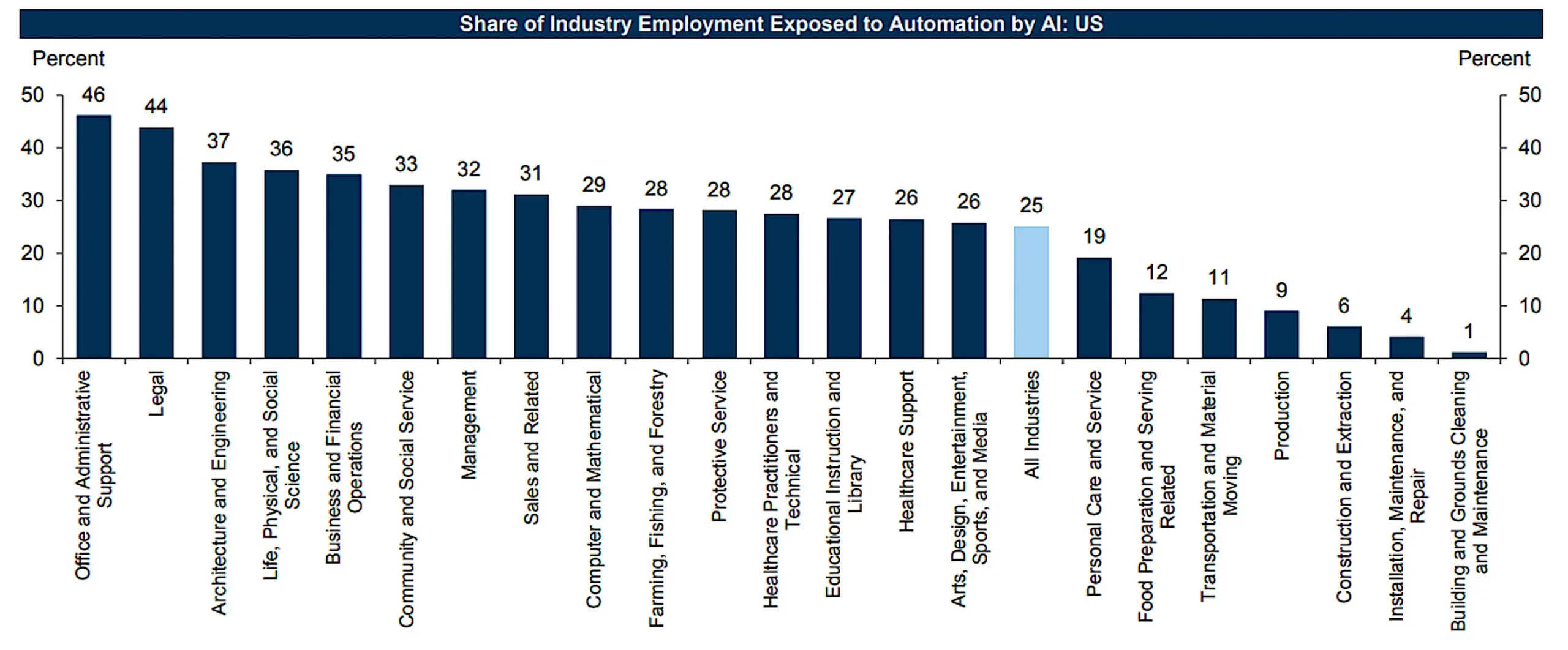

The first thing we need to do is understand which jobs are most at risk and least at risk due to artificial intelligence. From professors Ed Felton (Princeton), Manav Raj (U Penn), and Robert Seamans (NYU), here's a list of occupations sorted by language modeling exposure score.

Jobs Most At Risk Of Getting Eliminated Due To Artificial Intelligence

It's sad to see that so many teaching jobs are most at risk. Learning online has definitely gotten easier over time thanks to technology and multimedia. However, I've found that the best teaching is done in person where the teacher can adapt to the student's needs and teach nuances.

AI can act as a tutor and help teach fundamental math, reading, and writing. But I would think for higher levels, a human teacher would be more effective. But maybe not!

If you plan to spend big bucks going to college, please major in something that leads to an occupation not at risk from AI. Even better is to study topics that can help you leverage AI. It feels like a liberal arts degree may be more at risk than a STEM degree. Although, people with liberal arts degrees may have more flexibility with their occupational choices.

I can see how proofreaders and copy editing jobs (#54) are most at risk due to AI. Personally, I'm excited to plop a draft of my post into an AI editing tool that fixes all my typos and grammar mistakes. This will save my dad and my wife 0.5-1.5 hours of time every time I write a post.

It's nice to see that author, writer, blogger, podcaster, or vlogger are not in the top 62 most at-risk occupations due to AI! But when is AI going to help investors consistently outperform the S&P 500?

Jobs Least At Risk Of Getting Eliminated Due To Artificial Intelligence

To benefit from AI, you would simply look at the most at-risk occupations and utilize AI to enrich yourself or your business in these fields.

For example, you could use AI to teach you English, law, philosophy, chemistry, history, biology, anthropology, archaeology, communications, and business. Then you can utilize AI to do your PR, marketing, and fundraisers for your business. Finally, when you're all frazzled, you can use AI to be your mental health counselor.

On the flip side, below are the jobs least at risk due to AI. Any jobs that requires building, customization, or service are relatively safe. You can't have AI come to your house and replace your carpet. But you can have AI draw a layout and come up with different floor designs.

To see the entire 774 occupation list, download the report, Occupational Heterogeneity in Exposure to Generative AI.

Acquire The Necessary Skills To Work At Jobs Impervious To AI

Now that we know which occupations are the most and least at risk of getting eliminated due to AI, we can rationally acquire skills that will enable us to do jobs more impervious to AI. However, many of these “impervious jobs” are labor-intensive and not scalable.

To make more money off AI, one possible solution is to become a business owner of jobs that are relatively more impervious to AI.

For example, instead of me teaching tennis and getting paid by the hour, I could own a tennis academy that employs tennis teachers. I would provide the infrastructure and do all the marketing, branding, and customer acquisition. In turn, I would earn a percentage of each tennis teacher's hourly earnings, e.g. $30 out of $120.

AI cannot teach someone tennis well. You can watch all the YouTube videos you want and you will unlikely become a great athlete or musician without in-person training. However, business owners can use AI to help with marketing, branding, course planning, and customer acquisition.

In general, it is much easier for an entrepreneur to utilize AI for the business' benefit rather than for the employee. Business owners have so many tasks that can be automated or helped by AI.

Invest In Companies Leading The AI Revolution

If you can't beat AI, you can join AI by investing in companies that will benefit from AI. The easiest way to do so is to identify publicly-listed companies and invest in a basket of them.

An analysis by JP Morgan found that interest in artificial intelligence, driven by ChatGPT and other large language models (LLM), has driven more than half the gains in the S&P 500 in 2023. And in 2024, artificial intelligence continues to drive the majority of gains in the S&P 500 and the NASDAQ.

These artificial intelligence companies include Microsoft, Google, Amazon, Meta, Nvidia, and Salesforce. These companies also have some of the largest market caps and the largest balance sheets. Therefore, you can easily purchase stock in these companies. I personally own all the above names except for Salesforce.

You know Google isn't going to sit idly and let Microsoft dominate the AI search landscape. But it is unclear how much AI will account for Google's operating profits given the company is so large.

Given it's hard to tell who the winners of AI are, you can also buy the entire NASDAQ index through an ETF or index fund. This way, you're assured to have some higher beta AI exposure rather than just owning the S&P 500, which consists of only some of these large-cap companies.

Personally, I'm also investing in private AI companies before they go public, to diversify and potentially earn greater upside. The main way I'm doing so is via the open-ended Fundrise Innovation Fund, which has about 90% of its exposure to AI companies.

Invest In Private Companies In The AI Space

After owning publicly-traded stocks with AI exposure, the next step is to invest in private companies in the AI space. This is a much riskier strategy given most of us have no edge. I'm not a fan of angel investing in individual companies.

However, I am a fan of investing in private funds with plugged-in general partners. Yes, we have to pay a higher fee to participate. But I am glad to pay a fee to gain exposure to an industry in which I have no expertise.

The main strategy is to invest with the best venture capital firms in the world, e.g. Sequoia, Benchmark, Kleiner Perkins, Accel, Bessemer, Khosla, Menlo, Greylock, GGV Capital, Founders Fund, Lightspeed, Canaan, and others. Many of them are based in the San Francisco Bay Area.

Not only will you gain exposure to private AI companies, you'll also gain exposure to companies operating in multiple sectors. To increase your chances of investing in winners, you'll have to invest in as many fund vintages as possible.

For example, I thought I was going to benefit when Figma was sold to Adobe for $20 billion. However, the Kleiner Perkins fund I invested in had no Figma exposure. The fund vintage before did.

I'm certain all the top venture capitalists are looking at as many AI startups as possible to invest in.

Invest In Real Estate Exposed To AI-Related Companies

After investing in public and private companies exposed to artificial intelligence, the next way to benefit from AI is to invest in real estate. Not any real estate, but real estate in cities where the largest AI-related companies are based.

Some of the largest companies in the world with AI exposure are:

- Amazon

- Apple

- Microsoft – (owns and controls OpenAI worth ~$86 billion)

- Meta

- Tencent

- Intel

- Alphabet

- Tesla

- Nvidia

- Oracle

- Cisco

- IBM

- AMD

- Micron

- Baidu

- Rockwell Automation

- SAP SE

Cities With The Largest Artificial Intelligence Exposure

Based on the list of companies above, you'd want to invest in real estate in:

- Seattle, Washington

- San Francisco, California – I decided to buy a new forever home in 4Q 2023 as I expect AI to drive San Francisco real estate prices higher

- Santa Clara, California

- San Jose, California

- Cupertino, California

- Palo Alto, California

- Menlo Park, California

- Burlingame, California

- San Mateo, California

- Beijing, China

- Shenzhen, China

- Austin, Texas

- Milwaukee, Wisconsin

- Armonk, New York and the New York City region

- Walldorf, Germany

All these cities, even without AI, are already quite attractive. But AI could juice their real estate returns even further. If you don't live in these cities, then you can invest in private real estate funds that do invest in these cities.

As demand for artificial intelligence grows, more jobs will be created at these companies. More jobs will lead to more demand for housing, thereby pushing up rents and home prices at a faster rate than average. I experienced this firsthand as a landlord when Google, Facebook, Uber, Airbnb, Pinterest, and many more companies went public.

As these cities gain greater concentrations of AI talent, more employees will end up starting their own AI-related companies. As a result, there will likely be even more company success stories in terms of acquisitions or IPOs.

A positive flywheel effect ends up creating more wealth and innovation, attracting even more people to these cities. People go where there is the most opportunity!

Buying And Holding San Francisco Real Estate

The people who got rich during the 1849 California Gold Rush were mostly those who sold picks, shovels, wheelbarrows, and jeans. In contrast, most of the 300,000 miners went home with nothing after betting everything.

When I arrived in San Francisco in 2001 for my banking job, I marveled at the growth of the tech and internet sectors. After all, I worked at a firm that helped take many of these companies public.

However, because I was in the wrong industry, to increase my participation rate, the only things I could do were to buy tech stocks and own as much San Francisco real estate as I could afford. Making the techies work for me as a shareholder felt great.

The people who've gotten rich off internet and technology have now lived in the Bay Area for decades. They've grown roots, built networks, and raised children. As a result, I expect a continued outsized attraction of capital and talent with regard to AI in the San Francisco Bay Area.

I'm bullish on San Francisco Bay Area real estate long-term as I expect it to be one of the greatest beneficiaries of the AI boom. Although work from home is more widely accepted, the greatest developments come from in-person collaboration.

As a result, I'm buying single-family homes on the west side of San Francisco in neighborhoods such as Golden Gate Heights, Forest Hills, West Portal, Parkside, and St. Francis Wood.

Artificial Intelligence Is A Long-Term Trend Worth Betting On

If you want to get rich, you must identify and invest in long-term trends.

You will inevitably lose some money along the way. There will also be times when your investments skyrocket to the moon, but you won't cash out at the right time. However, with the proper net asset allocation, your returns could outperform over time.

Artificial intelligence is surely a long-term trend that will change the world and enrich many. It may be too late for old folks like me to gain skills to work at hot AI companies. Landing a job at AI companies may be too competitive for most folks as well. However, we can still all benefit from the AI revolution by strategically investing our capital.

Our children can also be more strategic in what they plan to study and do for a living. The last thing we want to happen is for our kids to spend four years in college only to find out their desired jobs are no longer necessary.

If AI is really going to eliminate teaching jobs in the future, then more colleges are facing an existential crisis. Perhaps in the near future, the cost of college will finally come down. Or maybe getting a college degree will only take two years instead of four plus years.

Make Sure You Build A Brand

Finally, we can leverage tools such as ChatGPT to make our lives easier. In fact, ChatGPT wrote this entire post! I'm kidding.

When artificial intelligence is finally able to write all my posts in the standard I want, it'll be great! I'll just spend more time traveling and playing tennis because I've built up a strong brand in the personal finance space.

I've had thoughts before about who will take over my writing and podcasting once my wife and I are gone. Maybe our children, maybe not. Hopefully, when the time comes for us to go, AI will be so great that Financial Samurai will live on forever!

Investing In Private Funds That Invest In AI

Personally, I'm investing in private funds like the Fundrise Innovation Fund and several Kleiner Perkins Funds that are actively investing in AI companies. The Kleiner funds are through connections and invite only with a $200,000 investment minimum. But the Fundrise Innovation Fund is open to anybody and has only a $10 minimum.

The Innovation Fund, has a 25% investment in Databricks, one of the premier AI data companies today. In addition, the Innovation Fund invested 6% of its fund in Canva, the most popular design company that is taking marketshare away from Adobe.

Not only am I investing about $500,000 into various funds that invest in AI, I plan to also look for AI jobs in San Francisco. All the big ones, like Anthropic and OpenAI are based here. And then there are dozens of other AI companies looking to hire as well.

And if I fail to get a job in AI, at least I will have the rejection letters showing my kids that I tried! But hopefully, even with the rejections, what will happen is my $500,000 investment will 10X so that my kids are hedged.

Here's my conversation with Ben Miller, founder and CEO of Fundrise, about artificial intelligence and the creation of his Innovation Fund for all to invest.

And here's a follow up conversation I had with Ben Miller about investing in artificial intelligence.

Reader Questions

Is your job at risk due to artificial intelligence? How you protecting yourself from artificial intelligence? How are you benefitting? When do you think people will start losing their jobs due to AI in mass?

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

There’s no such thing as Artificial Intelligence… it’s an oxymoron. But ultimately, I think the robots will be very good at analyzing data points and terrible at making any intuitive connections about them. So, I sincerely doubt the job bust will be as big as so many guess. A robofessor might spit out everything you need to know about subject x, it can also identify learning styles, cognitive strengths and weaknesses, etc… but it can’t care whether you grasp the information or not. It can’t make a personal connection with you. There’s only so much annoying, soulless interaction people will put up with and I think banks and insurance companies have already thoroughly mined the vein. Also, the tech sector is at least 6x overvalued and the US stock market at large is trading at least 1.5x higher than makes any reasonable sense. This party won’t end tomorrow, but it will end and I think a lot of the stupidity around AI will go with it. But who knows? Getting things disastrously wrong is also something humans beat machines at historically speaking.

I am 74 and have been hearing most of adult life that technology and robots will replace humans resulting in massive unemployment. Hasn’t happened and won’t happen. Jobs and professions just change. Some types of Manufacturing jobs declined but technology related jobs flourished. Instead of massive, permanent unemployment, employment is near an all time high.

how will ai affect sales and trading division (global markets ) in banks?

will there be lesser headcount for analyst, associates, vp , directors?

will people be retrenched or will certain desks be totally gone?

since it is on a downtrend, how should they hedge against in long term?

I believe that artificial intelligence has the potential to greatly benefit society. It has already revolutionized various industries, such as healthcare, finance, and transportation. However, we must also be cautious about the ethical implications of AI. As AI systems become more sophisticated, there are concerns about privacy, security, and algorithmic biases.

I, for one, am extremely concerned about AI and how it will change our society and economy. I appreciate you writing this article. I work in the tech industry and have been involved since the ’90s, so have seen a lot of changes. I’ve not seen a technology change move as quickly as this one.

Sure, AI is a tool, and a business-bending one at that. It can be used for good and truth, or for greed and deception. I believe it needs strong guardrails.

However, while we can make the tool work for us, that doesn’t address how this will affect the lives of millions of other people in our societies and communities who may not be able to take advantage of it. That is what keeps me up at night.

Yes, the speed of AI adoption seems to be much faster than anything else. Good thing you have been saving and investing for around 30 years!

I just wonder about AI and how it will affect our children. Hopefully our children will get the right education and harness AI to their advantage. That’s what I plan to do right now for myself.

I want to use AI to be my personal coach for fitness and all sorts of educational topics.

Yes, I think about my daughter (in high school) and the impact on her. I’m going to do my best to guide her through this. It will take a lot of time and attention, I think.

AI will be great for you on the fitness and educational efforts! I’ve experimented quite a bit, so far, with fun and mixed results. If you cook, try having it write a recipe for you, or improve one you already have. Pretty fun.

I would imagine universal income will become the solution that keeps society and the economy from collapsing…but am I missing something? Why has that not come up in the post or the comments? Otherwise, I agree. Focusing on real estate and investing in AI is obvious for those fortunate enough to do so.

I do not have much AI anxiety. I have been working in various technology fields since 1980 and I can’t tell you how many times I have heard “end of the world” stories, “this will be the standard network protocol” stories, etc. As Gates said “we overestimate technology in the short run and underestimate in the long run.” I see AI becoming another wonderful tool for already smart people plus a huge productivity enhancer for more repetitive jobs leading to ever greater achievement at a likely faster pace. There’s nothing wrong with that! We also know very well that morally corrupt people will try to use for awful purposes, but I wish we cared more and had more fear about guns than AI!

Good lord, Sam, two posts in a row both hitting where I live. This is going to be a bit long.

I’m an IT worker, primarily because it leverages my ability and inclination to learn new things constantly and apply them. In 2007 I read a rather brilliant paper called “Projecting the Impact of Computers on Work in 2030” by Stuart W. Elliott. It was prepared for the Workshop on Research Evidence Related to Future Skill Demands, Center for Education, National Research Council, May 31-June 1, 2007 and it was available at the web site for the National Academy of Science.

In it, he predicted what he called “Occupational Displacement” ranging from 30% to 60% sometime around the year 2030, specifying why, which occupations, and what could be done about it, which was primarily revamping educational processes in such a radical manner that I was pretty sure it would never happen. Your charts in your post probably evolved from his.

Given that the new college grads in 2030 were just being born then, and are now sophomores in high school, I don’t think I was wrong in thinking that we, as a society, would do next to nothing to get ready.

So, given that society isn’t going to save itself from some enormous disruptions. I decided to see what I could do on a more personal basis. I felt at the time that my profession gave me some personal protection, notwithstanding that I firmly intended to be retired before 2030. So I looked at my kids and other younger relations and encouraged them to choose career paths that should be among the last to go (although I did not encourage them to be politicians and/or predatory lawyers, the two occupations I believe have the least probability of occupational displacement anytime soon).

2030 is seven years away, but there is nothing sacred about that number. A five-to-ten year window may actually be optimistic, even at the lower end, so far as when things get serious. Looking at some of the mass layoffs lately, even at Amazon and Google, it may already be starting.

I once read a long time ago, that if a black box took away your job, get a job building black boxes. That’s great advice on a personal basis but not so good for most people. For example, there are, or were, around six million people in the US that drove trucks, cabs, buses, forklifts, and so on. Eventually there will be perhaps a hundred thousand engineers and programmers specialized in self-driving vehicles. Most folks are not going to beat one in sixty odds, especially when you consider that an unemployed 45 year old truck-driver, that started operating a rig right out of high school, may not be well suited for such a career change. Meanwhile, truck stops, short order cooks, mechanics, body shop workers, car insurance salespeople, DMV folks, etc. will all be occupations occupied by less people.

But I determined that income and wealth inequality would only continue to increase until eventually there was a big rip in the middle that would pose an almost insuperable barrier to anyone on the wrong end of it. The lower end, of course, being the wrong end. Being dead broke is no fun and prevents you from fulfilling responsibilities, I’ve been there. So, as you’ve found yourself, the solution seems to be to get wealthy enough to be on the upper side of that split.

And you need to start ASAP. Let’s face it, if income inequality becomes large enough, the only folks with enough upward mobility to move from the lower to the higher will be some few in the entertainment industry, star athletes, the exceptionally gifted, lottery winners, and some who the ones on the upper end find unusually attractive.

So this made me think of Peter Lynch, possibly the patron god of smart investors. He advised investing in things you were familiar with, and in industries that you knew were going places (or at least not going away). Well I knew IT and I knew AI was going to get a lot bigger.

So I invested in AI. I was of rather limited means in 2007. I now own chunks of fourteen of the seventeen companies you listed, some directly, some through mutual funds that angle in their direction, and some through both. I never knowingly invested in Facebook, just couldn’t understand how it was valuable, nor Tencent or Baidu (they are Chinese, and I saw the handwriting on the wall at least fifteen years ago), or SAP (I’ve worked on SAP at places trying to implement it). Love that Rockwell Automation, though. Investing in AI and tech has let us reach a point we could live quite comfortably indefinitely, even without pensions, social security, and other entitlements. Conversely, we could also do the reverse, and never touch the accrued savings, or its earnings.

But we have several kids, and grandchildren are stacking up. You probably cannot ever get complacent, no matter how well invested or diversified.

I do believe we are looking at a future with a large percentage of the population becoming permanently unemployable, as GDP will continue to go up by leaps and bounds (providing we don’t let the unemployed have so little that they can’t afford much of anything beyond basic necessities). Real estate values will likely crash if we are too parsimonious with the dole or the UBI, or whatever it will be called.

I think ‘real’ teaching will eventually be done almost entirely by AI tutors, who will remember every question the child ever missed. Meanwhile, children will still attend a more limited school, primarily to ensure social interaction, physical fitness, and life skills. I think the nature of university level education will change just as radically, and become much more affordable. It would hardly surprise me if the top 100 or so universities essentially drive all the others out of business through long distance programs and branch facilities for doing labwork and such.

You listed eight locations in California, and two in China, to invest in real estate in. You may be right about the California ones, but I theorize I can always avoid a few opportunities, as there are always others. Further, as AI becomes more ubiquitous, I do not trust it to remain concentrated in a relatively few specific locations.

Artificial intelligence will likely change the world at least as radically as the printing press, the industrial revolution, electronics, and the internet, and it will likely continue the trend of doing in half the time of the breakthrough before it. The internet, as the mass public knows it, has been around for just about 30 years this year.

I invested in a couple of Cathie Wood’s ARK funds a couple years back. They’re not doing so great now, but I’m hoping long-term I’ll benefit from the AI usage companies within these funds.

She believes Tesla is going to $2,000. As a long time shareholder, I hope she’s right. Alas, she is probably wrong as other manufacturers take market share and Elon became too distracted.

But good highlight in Cathie Wood focusing on AI.

I think AI that truly replaces highly educated jobs is much further off. They were talking about how Virtual Reality was going to take over the world in the 80s. And people still don’t really wear those headsets and we aren’t even close to a Star Trek holodeck experience we all were promised.

I think it will take atleast 30 years of iterations of AI before they truly take educated people’s jobs away. Public School is still a babysitting service for the general population… It also teaches kids how to interact in the world with peers. A robot can’t provide that service.

What will most likely happen is all those professions will use AI tools to do their jobs better and more efficiently.

But, I would say only the top 10% of kids can learn full-time from an AI device. Every other kids would find a way to cheat or slack off and come out of the experience dumber.

“ What will most likely happen is all those professions will use AI tools to do their jobs better and more efficiently.”

This is probably right. I plan to use AI to help me with editing, formatting, and idea generation if I run out of ideas.

Regarding the slowness of adoption, I think adoption rates are getting quicker and quicker each year. Remember, there was a time not too long ago when we couldn’t do video calls from our phone? That was Star Trek revolutionary.

I’m an auditor and have found that ChatGPT has been able to save me hours of work. I don’t think the profession will go away but I do think that there will be a reduction in the number of auditors since many of the reviews performed can and have been automated. Sometimes it’s just a matter of how much money the organization wants to spend to use the AI tool versus having a human perform the task. As AI/software costs come down, there will be more reason to use AI.

As a long time FS reader, we’ve been encouraged to predict the future so I’ve been preparing for this moment. I remember Sam making a point in one of his prior articles that people will always need a place to live so real estate is a good investment. It doesn’t matter that I’m not as smart as those that are in the “right” profession, I can still survive by renting to them. I like how this article adds a bonus element by suggesting we invest in real estate in cities that would be the biggest home bases for AI.

Great to hear ChatGPT is helping you save time. Time, after all, is our most valuable commodity.

Investing / selling picks and shovels really is the best way for the average person to benefit from any new frenzy.

We know for sure, there will be some AI companies that will get huge. But even if we can identify them, that doesn’t mean, we will have the access to invest of them as private companies.

As a result, I have allocated a portion of my investments to venture capital.

How do you use chargbt for auditing? Thanks

Sam. off topic but are you worried at all about losing the money you put in treasuries due to a default. i’m starting to get a bit nervous.

No. I’m actually going to take advantage of 3-month treasury yields.

Thoughts on AI?

I agree with investing in AI but don’t think I’ll be able to guess the right winners so I just DCA into QQQM.

I have been using Live2D, ChatGPT and AI generated voiceovers to make YouTube videos.

One problem with AI is accountability. Who is there to blame if something goes wrong. If AI CAN teach a child to read, but in the end the child can’t, who do you blame. With a human teacher, such a person would be reprimanded/fired.

Hence, using AI as a tutor may be better than the main teacher. However, using AI to teach a massive population with no access to a highly qualified teacher is better than no education at all.

There are millions of school children in the US not reading proficiently or at grade level. I would challenge you to find a single teacher who has been reprimanded or fired. There is very limited accountability in education.

You make a good point!

So if AI can help supplement teaching kids to learn how to read, that’s a huge win!

This article discusses the impact of artificial intelligence (AI) on jobs and offers some strategies for preventing the AI revolution from destroying livelihoods. The article suggests that the best way to protect oneself and benefit from AI is to get so rich that one and their children no longer need jobs. The article goes on to present a list of jobs that are most and least at risk of being eliminated by AI, as well as feasible strategies on how to benefit from AI. The article concludes by urging readers to acquire the necessary skills to work in jobs impervious to AI. – Written by ChatGPT (Not Kidding)

Thank you for the overview of my post! Amazing. Go AI!

With interesting and new technology like AI and ChatGPT, how often is it that the large existing companies (i.e. Microsoft, Google, etc.) are the big winners as compared to the up-and-coming businesses that nobody has heard of? While big companies have a lot of money to pour into R&D, they also sometimes face uphill challenges with bureaucracy, complacency, and not wanting to cannibalize any of their existing business. I’m sure there are examples of both cases. Do you have any insight?

All about weighing probability of success versus returns. Microsoft sure is performing well, and it’s a giant.

I bought some Microsoft months ago after openAI took off, but I just sold it today after it shot up 7%. Mostly sold because I hate Microsoft and ALL their products. Everything they make is full of bugs and outdated, and just doesn’t work very smoothly. Their programmers suck, so I don’t think they will really figure out how to best capitalize on their openAI investment, they just got lucky. Bill Gates is a copycat who just ripped off Apple’s operating system.. I don’t think he should be regarded that highly. Microsoft always blames it on third party software, but perfect example is the Xbox.. sole proprietary console and you still get the “ring of death”.. where it just bricks.. just crap hardware and crap coding…

Windows software is also designed intentionally to become more and more bloated over time on a given PC so that is slows down so much that you have to buy a new PC. Its a pretty big scam. The EU blocked software that does this, but its in every Windows machine. I have apple iMacs or MacBook Pro’s that continue to work perfectly for about 10 years. Windows PC’s become almost unusable after 3-4 years.. just so lame.

Good news is that if there is a up-and-comer with a better AI, the big boys can just make them an offer they can’t refuse.

So far, my investment thesis on AI assumes the following:

1. LLMs are commodified.

2. Only differentiators are

a) data curation

b) compute infrastructure

3. Radical wealth ($T, not $B) comes only when new markets are created, situations where today’s disrupters become tomorrow’s incumbents.

So:

If AI merely becomes a feature bolted onto existing products/services, 2 above (Facebook, Google and Amazon, MS) will accrue most of the value because their incumbent clients will only see incremental profits on existing business models.

If true, it’s ironic that one of the most transformational technologies ever won’t radically alter the equity markets.

If you want dry, soulless, boring, definition-type articles, then AI has its benefits for writing.

But if you want humor, entertainment, storytelling, fascinating insights and advice based on personal experiences, emotion, and imagery, it takes a real person and a talented writer to get that not a robot.

I admit it still freaks me out whenever I see a car drive by with no person in it. They’re everywhere in my neighborhood. I heard one of them got in a standoff with a Muni bus and refused to move. Glad I wasn’t on the bus at the time!

There are lot of benefits of AI but many aspects of it still make me uncomfortable. I guess new things just take time to get used to. But I certainly don’t want robots taking the place of human teachers and other things.

As far as editing work goes, programs like Grammarly are helpful but definitely not perfect. It still has errors all the time and doesn’t understand certain nuances. It’s a helpful tool to utilize, but it doesn’t replace a human imo (yet).

It’s completely understandable to feel unsettled when you see autonomous cars without drivers. It’s a new and rapidly evolving technology that can take some time to get used to. It may take time for us to get used to these changes.

Hi, my name is J I have been reading your articles for some time and I am glad that you wrote about AI. I am already writing my articles on my blog using AI and I was wondering if we can discuss more.

Feel free to share your AI posts. I’d love to check them out.

How is the online traffic to your posts coming along? If great, you can give me some tips so I can kick back more!

Cool, thanks.

Here is one of them. All AI< just needed to review, edit and wala.

https://smartfinancialgoals.com/smart-financial-cd-rates/

If you want to talk more, I could give you some tips, just email me and I can email back etc…

Organic Very cool. Are you see the traffic come? I’m thinking a I can be used for plain vanilla definition posts, like “what is a 401(k)?”

Here’s to know why not write some of the content yourself as well?

What AI program do you use to have write your work?

Jasper AI it does not plagiarize like ChatGPT, but there is a small cost every month. Yes, I am seeing traffic starting to roll in more as well. I just did a post on godaddy versus Bluehost. But, of course I have to wait for the googlebot crawl budget to hit my site.

By chance, do you know how I can check when my site is crawled by google?

Almost forgot, if you like, I can give you tips on how I tell Jasper to do what I need it to do for free dude, we are all trying to help each other. If you like, just email me and I can give you my tips how I do it.

Interesting they would put Clergy and Therapists on the at-risk list, as if these occupations were merely about informing someone how to improve their life and not about an interpersonal connection.

Imagine, Kelvin! I am going through therapy after my husband passed. Now, I am imaging how an AI would replace human interpersonal connection. Can an AI reach out to a tissue box, wait for you to wipe your tears, and reconnect to share its loss and other individual’s loses in the past and how they overcame their grief and start a healing journey.? Mhh, I am here waiting for that day when an AI will be able to accomplish and supersede human.

The more parents peacock about how great their lives are, the less happy they likely are.

If you are content and happy with your life, there’s no need to brag about how great things are, unless asked.

I the better mindset is definitely to utilize AI to our advantage. Anybody freaking out about artificial intelligence has not thoroughly thought things through as you have.

Being in the right place at the right time is half the battle. And I think networking with the right people in the right place will pay huge dividends.