College is expensive and will only get more expensive over time. If you can get good college financial aid in terms of grants and scholarships (free money), as opposed to bad financial aid (loans), attending college will be much more affordable.

We've already talked about the different ways for us to pay for college. Now let's discuss how we can get others to pay for college for us! Plenty of Americans game the college financial aid system.

After all, roughly half of working Americans don't pay federal income taxes and society is fine with this reality. Why not let others subsidize our children's college education as well? A better-educated public creates a stronger nation.

There is so much free money out there, we might as well learn how to game the college financial aid system. Colleges have been gaming us for decades by charging astronomical tuition, creating waitlists, discounting tuition for its most coveted students, ranging in financial aid collusion, and giving preferential treatment to wealthy donors and certain races. In addition, families have to pay non-refundable application fees while knowing their chances of acceptance is low.

Going to college needs to be affordable because colleges will not guarantee you a good job after graduation. The last thing you want is to graduate under employed or unemployed with heavy student loan debt.

Gaming The System Is What Rational People Do

Gaming the system sounds bad, but it's not illegal. I didn't say cheat the college financial aid system. We should all understand the ins and outs of any system in order to legally take full advantage of the benefits.

Examples of gaming the system:

- Multi-millionaires who game the health care system by getting subsidized health care.

- Retirees who game the system by doing a backdoor Roth IRA and then move to a no-income-tax state to save on taxes.

- Savvy people who get ahead by simply reading great books because most people don't read books anymore.

- Tenants who gamed the housing system in 2020 and 2021 by not paying rent because government passed new laws prohibiting eviction.

- Students and politicians who claim to be another race despite only being 1/1024th of that race.

- Rich families who donate millions to get their kids in school, then hook them up with the best jobs due to their extensive networks.

If you haven't thought about gaming the complicated college financial aid system, then maybe you don't care enough about setting up you and your children for a better life!

One of the biggest financial misconceptions about applying to college is that only poor or middle-class families get grants and scholarships. In fact, there are plenty of millionaire net worth households with six-figure incomes getting free money for college.

The Income And Asset Threshold To Get Free Financial Aid

If your household earns up to about $300,000 a year and has $200,000 in assets or less per child outside of tax-advantaged retirement accounts, your family should be able to get college grants and scholarships. Bloomberg came out with an analysis and puts the income cutoff for scholarships at $400,000. These thresholds will increase with inflation each year.

In some expensive cities like San Francisco and New York, families who earn up to $500,000 a year per child and have up to $1.5 million in assets per parent are receiving financial aid!

If this wealth profile fits your family, then this article should benefit your family immensely. If you make more or have more outside your tax-advantaged retirement accounts, getting free college money based on need will be difficult.

You’ll need to go the merit route, which may be more subjective.

How To Game The College Financial Aid System To Get Free Money

Laurence J. Kotlikoff's book Money Magic provides nine ways to lower the Expected Parental Contribution (EPC) figure on the FAFSA application, thereby increasing a family's chance of getting free money. Kotlikoff is a Boston University professor.

- Contribute as much as possible to retirement accounts to limit the amount of your regular assets. If possible, arrange with your employer to receive more of your compensation as retirement contributions.

- Use your regular assets to pay down your mortgage. FAFSA doesn't include home equity. However, certain individual colleges may incorporate home equity in computing a student's financial need.

- Use regular assets to buy durables and personal collectibles, including easily resellable jewelry, which aren't included in your child's financial need calculation.

- Make your child's grandparents the account holders of 529 plans, education savings accounts, and other college savings plans, since these assets will otherwise lower your child's financial need.

- Defer taking capital gains on regular assets, which will factor in the government's FAFSA income calculation.

- Save within whole-life or universal-life insurance policies. The cash value in these policies is generally not included in student-aid calculations.

- Defer withdrawals from retirement accounts, which would raise your FAFSA-measured income.

- Keep assets out of your child's name. Your child's assets and income will limit their aid.

- Defer getting married if this will lower your child's calculated aid by increase your assets.

Look Poorer On Paper Matters

The goal of these nine strategies is to reduce the amount of income and assets in both the parent's names and the child's name attending college. The poorer both parties look, the greater the amount of good financial aid your family could receive from a college.

Let me touch upon a number of these strategies, including the missing obvious 10th strategy: make less money for at least two years before your child attends college.

What Is FAFSA?

The FAFSA is the Free Application for Federal Student Aid. It is a tool that schools use to evaluate students’ financial strength on a consistent set of metrics by calculating an Expected Family Contribution (EFC). It is based on the parents’ and student’s income and assets. Filing the FAFSA is an annual event for families of college students, starting in fall of senior year of high school.

To get the most amount of good financial aid, you want to get the lowest EFC amount possible. The difference between EFC and Cost of Attendance at a given college is your financial need. Starting in 2023, EFC will be referred to as Student Aid Index (SAI).

Your financial need will then largely be provided for by the university that accepts you or your child. The more the university wants a student, the more money the university will provide. Strategically, many universities will classify aid as “merit aid” to make prospective students feel better about attending.

If a student demonstrates exceptional financial need, then the federal government will step in and offer a Pell Grant. A Pell Grant is free money in the amount of $7,395 for the 2023-2024 academic year.

Parent Income on the FAFSA Is The Most Important Variable

The higher the parental income, the higher the EFC, and the lower the financial aid.

Parent income is calculated as Adjusted Gross Income, which means you have to add back all of your untaxed income, whether that’s your 401k contributions or tax-free interest, or a Roth IRA distribution.

You get an income protection allowance that’s roughly equivalent to the federal poverty level (FPL) for a family your size, and you subtract your tax liability– federal, state, and payroll taxes. It’s the most heavily-assessed at 47% for most families. That means that another $1,000 of income will raise your EFC by $470.

To game the college financial aid system, your household should earn the lowest AGI possible for at least the prior two years before your child attends college. In other words, your first FAFSA income year is when your child is a sophomore in high school.

If parents can earn lower income for four years before their child attends college, that's probably safer. Hence, if you've ever thought about retiring early, taking a lower paying job, or simply taking a long sabbatical, the years before your child attends college makes sense.

During this time, you can also consider doing a Roth IRA conversion since you'll be in a lower tax bracket.

Parent income treatment on the FAFSA

Adjusted Gross Income

+ Untaxed income

– Income protection allowance

– Taxes paid

= Available income (AI)

- Rate between 22% – 47% of AI | $1,000 more income can translate to a $470 increase to your EFC/SAI

Parent Assets On The FAFSA Aren't As Impactful

Curiously, the government doesn't believe a high income translates into having lots of assets. Given the long-term median saving rate is in the single digits, the government knows the average American isn't a good wealth accumulator.

As a result, only 5.64% of your assets is considered available to contribute to paying for college. In other words, if you have $100,000 in a brokerage account, it is expected you'd contribute only $5,640 of it toward college.

Given the low 5.64%, it's still wise to save for college and your financial future. Every $1,000 you have in savings only adds $56 to your EFC, which means you come out ahead by $944. But if you want to game the college financial aid system, then you want to focus your savings in a retirement account.

Derivative thought: This low savings expectation of 5.64% by the government, improves the probability Social Security will be there for all of us in retirement. The government believes the average American is so bad at saving money that it must take care of us for social stability.

Assets That Count In The FAFSA Calculation

Reducing your income as close to $0 for two-to-four years before your child enters college is the most important way to game the FAFSA. Reducing the amount of recognizable assets you have on the FAFSA is the second most important way to game the system. But it's much harder to do.

Below are the assets that count in the FAFSA calculation. Knowing what's included will guide you toward how to spend, save, and rebalance your assets accordingly.

- Checking / savings

- All 529s owned by the parents (which sadly isn’t enough to pay for college)

- Brokerage / taxable accounts

- Investment property equity, 2nd home equity, vacation home equity

- Vested stock options

- Trusts for which you or your children are beneficiaries

- Your elderly relative's bank account where you are joint owner

- Cryptocurrency

- UGMAs (Uniform Gift to Minors Act) and UTMAs (Uniform Transfer to Minors Act)

5.64% of the total gets added to the FAFSA | $1,000 more of assets translates to a $56 increase to your EFC/SAI

Assets That Don't Count In The FAFSA Calculation

Here are the assets where you should accumulate as much as possible.

- Retirement accounts such as 401(k), IRA, Roth IRA, 403(b)

- Cash value of whole life insurance

- 529 owned by grandparents

- Small business you own – not an asset so long as you or your directly-related family owns more than 50% and the business employs less than 100 people

- Family farm you live on and operate

- Your primary residence

Please note, the value of a college degree is also positive. A college degree is a valuable asset that can and should be included in your net worth calculation. Here's how to calculate the value of a college degree.

Student Income And Assets Treatment On The FAFSA

Now that we know what parents need to do to game the FAFSA, it's time to look at what students can do to get more free money.

The government will use 50% of a student's reported income (above the protection allowance) when calculating EFC. Meanwhile, student assets count at 20% of their value, so an extra $1,000 in your student’s bank account will increase their EFC by $200.

Having your son or daughter take on a summer job before college will increase their EFC/SAI. Your children owning taxable brokerage accounts will also increase their EFC/SAI.

Therefore, perhaps think twice about making your children millionaires before 20. Maybe encouraging more YOLOing is a better strategy to enjoy life more and get more free college money.

The Ideal Wealth-Building Strategy For Kids Before And During College

Despite what I just wrote, the Roth IRA isn't factored into the EFC/SAI calculation on the FAFSA. Therefore, all the more reason to open up one while your children are young to game the FAFSA.

Encourage your children to earn up to the maximum Roth IRA contribution amount each year and fully fund their Roth IRA. If the student income allowance is more than the Roth IRA maximum contribution, you might as well shoot for that amount.

This way, none of the student's income or assets will count toward FAFSA.

Student Income Treatment On The FAFSA

Income (net of taxes)

-$6,800 allowance

50% of the total gets added to the FAFSA | $1,000 more income results in a $500 increase to EFC/SAI

Assets: no allowance.

20% of the total gets added to the FAFSA | $1,000 more income results in a $200 increase to EFC/SAI

The Net Price Versus The Sticker Price Of Attending College

Thankfully, the majority of private university students do not pay the sticker price due to financial aid and merit award. More college are also calling financial aid merit aid to woo students to matriculate given merit sounds better.

One of the reasons why colleges keep their tuition prices is high is due to signaling. The idea is that the higher the price, the higher the perceived quality. It's called the “Chivas Regal Effect.”

Some families would happily paying $48,000 a year in tuition after a $10,000 “merit scholarship” versus pay the full sticker tuition of $45,000 a year and receive no merit scholarship at a comparable university.

A Good Financial Aid College Cost Calculator

Chances are high if your household makes $100,000 or less per child, your child can get financial aid. To see how much your family is expected to pay for college, check out Myintuition.org, a helpful financial calculator for colleges. It has a number of schools to choose from.

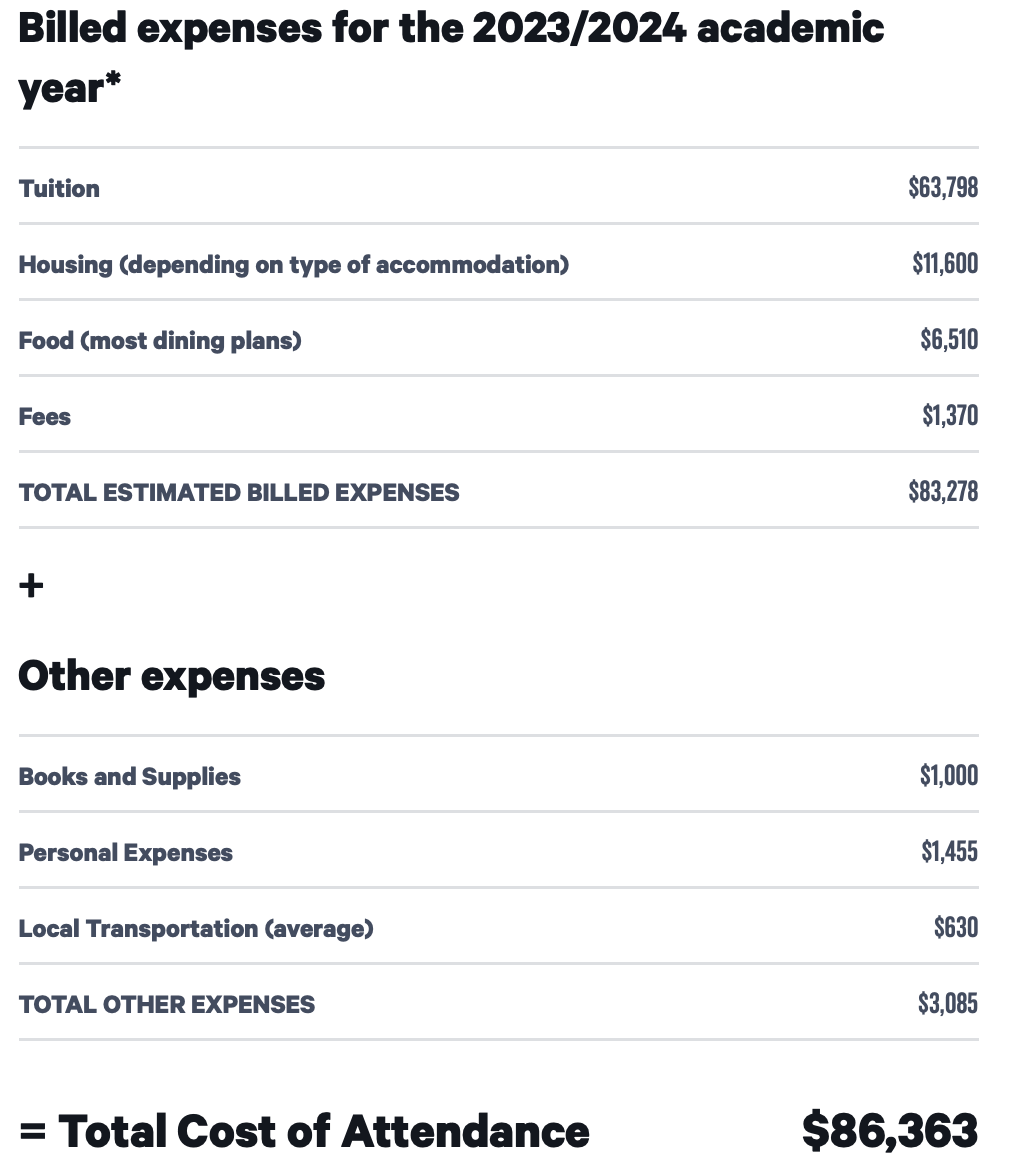

Boston University Cost Example: $86,363 All-In

- If parents have a combined income of $50,000 and $0 assets, the cost to attend BU will be at most ~$8,500, down from $86,363.

- If parents earn $100,000 annually and have $100,000 in the bank, BU's maximum net price is ~$30,000, down from $86,363.

- If parents earn $100,000 but have all their savings in a 401(k), BU's maximum net price is ~$17,000. Not bad!

Hard To Get College Financial Aid If You're Mass Affluent Or Rich

I highly encourage you to play around with the Myintuition.org financial aid calculator for different schools. You'll soon discover that if you are part of the mass affluent class who reads personal finance websites and saves aggressively, good financial aid is hard to come by.

Take a look a this other example of an out-of-state student wanting to attend my alma mater, The College of William & Mary.

With a middle-class household income of $135,000, $10,000 in cash, $500,000 in a 401(k), and $350,000 in taxable brokerage accounts and a 529 plan, the household is expected to only get $4,700 in need-based scholarship. I'm not a fan of borrowing for college. And the $1,900 aid is in the form of student employment, which is not financial aid.

The key “problem” with this profile is the family's $350,000 in non-retirement investments. If the family's non-retirement investments was $0, the family would get $1,9740 more in need-based scholarship (free money). After seven years of maxing out a 529 plan, sadly, I don't think a 529 plan is enough to pay for college.

Reduce Your Non-Retirement Investments As Much As Possible

To prove how much having assets outside of your tax-advantaged retirement accounts hurt, take a look at the below example. The family makes a handsome $250,000 a year and has an impressive $3,000,000 in their 401(k).

With only $10,000 in cash and $0 in a taxable brokerage account, no 529 account, and no investment properties, this multi-millionaire family will receive a $29,250 need-based scholarship!

What To Spend Your Non-Retirement Assets On To Look Better On FAFSA

To get your non-retirement investments and cash down to $0, use them to pay down debt: credit card balances, auto loans, and your primary mortgage.

Given your primary residence isn't included as an asset in FAFSA, if you've ever wanted to buy your forever home, consider doing so by your child's sophomore year in high school.

Big expensive homes are the easiest way to spend down non-retirement assets. Although, strategically, the best time to buy the nicest house you can afford is when your kids are young. This way, more people can enjoy the home for longer.

Below is an example of a $4.5 million house that will easily suck up a lot of a family's non-retirement assets. We're talking a $2 million down payment and $18,605 a month in housing expenses.

Parents should also accelerate as many necessary expenses before filing the FAFSA as well. Expenses such as a new roof, exterior and interior painting, home remodeling, and replacing an old car are all considerations for spending down non-retirement assets.

If you've always wanted that $550,000 Ferrari SF90 Stradale, your time has come! YOLO baby! Although be careful, some schools will ask you what car you drive. So you best get a second beater car so you don't have to lie.

Imagine living in a $4.5 million house and driving a $550,000 car and getting free need-based money for college. Now that's gaming the college financial aid system!

How To Really Game The FAFSA – Extreme Strategies

So far we've discussed legitimate ways families can look poorer on the FAFSA to get more free money for college. Now let's look at three extreme strategies to gaming the FAFSA. Here's advice from reader Michael:

1) Get divorced (on paper) and place the children in the home of the parent with little-to-no income. Strategically, this is the best way to game the FAFSA. Alternatively, parents should consider never getting married in the first place, especially if they are estimated to pay a marriage penalty tax.

2) Have the child get married before college, which should qualify them as independent from parents so family assets and income aren't counted at all. This FAFSA manipulation strategy is harder to do since most states don't allow marriage until 18, and 18 is when most students are eligible for college. However, the college-bound student can get married first and then take a gap year.

3) Identify as a certain demographic group that is underrepresented based on race, sex, or gender characteristics. We are free to express ourselves and identify however we see fit nowadays. There's a graying of identity today with a push more toward diversity, equity, and inclusion (DEI).

Who Reviews The FAFSA?

Just like with filing your taxes, the college financial aid system is largely based on the honor system. You have to put down your assets and your income to the best of your ability. Then the college financial aid administrator reviews your FAFSA.

Some families will fudge the numbers and hide assets to increase their chances of getting free money. The colleges can’t verify everything. Only about 33% of FAFSA applicants go through a verification process.

If your application gets selected for verification, you must upload tax documents like W2’s and 1040’s for both you and your kids. If discrepancies are suspected with savings accounts or assets, you might be asked to verify this information by uploading yours and your kid’s bank statements.

What If There Are Discrepancies Or You're Caught Lying On The FAFSA?

Failure to supply verification documentation can result in the loss of financial aid. If you have a discrepancy with the stated financial amounts on your FAFSA and the documents you uploaded for verification, be prepared to explain the reason. Mistakes are common.

However, if you lie on your FAFSA and there are major discrepancies discovered, you may face serious consequences.

To start, The Higher Education Act of 1965 states that anyone caught lying on the FAFSA is subject to penalties up to five years in prison and a fine of $20,000. Additionally, any financial aid that was provided as a result of the fraudulent information will be owed to the institution that the student is enrolled in.

Finally, you will likely get your college admissions offer rescinded. Therefore, think carefully before you decide to cheat the college financial aid system.

Perhaps Feel Fortunate You Can't Get College Financial Aid

If you read Financial Samurai, then I expect you to eventually have an above average net worth for your age. It should be relatively easy to do given the government only expects the average American household to save 5.64% of their income.

By the time your kids go to college, the vast majority of you will likely also make above the median household income of $75,000. You will have found ways to get paid and promoted faster than the average person. You will also have started side businesses and worked side hustles to bolster your overall income.

Finally, I expect you to generate a noticeable amount of passive investment income by 50. After all, you've been aggressively building your taxable portfolio and rental property portfolio to have more options.

With this type of wealth profile, it’s too hard to game the college financial aid system to get free money. Sorry, you're too financially healthy!

Your likely only hope to get good college financial aid is through merit scholarships. Hence, best to save as much as possible and encourage your kids to do well in high school. The more money you have to pay for college, the more options you will have and the likely easier it will be to get in.

Life is a game. We better understand the rules if we want to win. Here's my conversation with a high school principal and college admissions podcaster on how to increase your chances of getting into college.

Perspective Of A Poor Student Who Attended An Expensive Private University

Let me also share a very insightful perspective from a graduate who received a full ride at Boston University. Her household only made about $18,000 a year. Although, that's reported income since she said her dad was a drug dealer.

For those of us lucky enough to earn or have too much to qualify for good financial aid, it's good to remember that not everybody is as fortunate.

Life is a game. We better understand the rules if we want to win.

Plan To Pay For College Better With Boldin

If you’re serious about financial planning to pay for college, check out Boldin. Boldin is one of the most powerful financial planning tools I've come across that helps families save for college, buy a house, plan for retirement, and more. They offer a free version and a PlannerPlus version for just $120/year—far more affordable than hiring a financial advisor.

Boldin takes a comprehensive approach to financial management. Instead of solely concentrating on stock and bond investments, Boldin tackles a wide range of real-life financial scenarios we all encounter. One of the biggest challenges families face today is finding the best way to save and pay for college without jeopardizing their retirement plans.

Also, for 99.99% less than the cost of college, pick up a copy of Buy This, Not That, my instant Wall Street Journal bestseller. The book helps you make more optimal investment decisions so you can live a better, more fulfilling life.

Join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

This whole process is really discouraging. We have 4 kids, and one just graduated from college in Dec. He only got loans due to FAFSA. Our taxable income is around 126K. Kid number is getting the same deal. We just got an offer from the less expensive college on her list, and our portion is $17K a year. We have $4000 in her college savings and no extra money. We live paycheck to paycheck like many people, live in an older home, drive used vehicles, and have no real assets other than retirement. Savings and checking below $1000. Yet there seems to be no help for us. She got $29K in scholarships, but we can make up the $17K outstanding after small loans offered from FAFSA.

Getting a divorce on paper sounds like a great idea. That would be perfect for our situation. However, I don’t think Mrs. RB40 will go for that. Unfortunately, I don’t think we’ll get much financial aid.

I just reread this post as college financial aid is top of mind. Like you, I like the theoretical challenge of “gaming” the system–it doesn’t mean I’ll do something just because I can get away with it.

After doing some additional research on my own, I am now satisfied I have no hope of financial aid primarily due to my assets, not income, unless I sell my non-retirement stocks and real estate, buy a mansion, start a car collection and live mortgage free. That actually doesn’t sound too bad.

An additional tidbit I found was in the case of divorce, only the parent who provides greater financial support to the student files the FAFSA. If the other parent owns a 529 plan, it is not reported on the FAFSA. savingforcollege.com

Yeah, the asset situation is the catchall for folks who want to try and game the system and lower their income during the financial aid process. Parents can lie, but if they are caught, their kid’s prospects will decline dramatically.

“An additional tidbit I found was in the case of divorce, only the parent who provides greater financial support to the student files the FAFSA. If the other parent owns a 529 plan, it is not reported on the FAFSA.”

How is greater financial support determined? Whoever pays more I guess?

Are you saying it would be wise to transfer the 529 plan, which could be large, to the parent who supports less, to increase financial aid chances?

Yes. As it is, all 529 money is in my wife’s name as they only allowed one account owner. In a divorce, I would provide primary support; I hardly have any income but I could sell some stock to support our my kid. Of course my wife would hire the best divorce attorney money can buy to minimize her alimony and child support payments. ;-)

Oh wow, so she’s the breadwinner. Nice!

“The assets held in a grandparent’s 529 account have no affect on a student’s financial aid eligibility, but when the grandparent withdraws the funds to pay for college it is reportable on the following year’s FAFSA as student income. This will drive up the student’s Expected Family Contribution (EFC), and higher EFC means less financial need.

One way to get around this issue is to wait to withdraw the funds until after January 1 of your grandchild’s sophomore year of college. If the student will graduate in five years, wait until after January 1st of the junior year to take the distribution.”

From https://www.savingforcollege.com/article/before-you-open-a-grandparent-529-account

When I spoke to my financial advisor on this issue, they mentioned that saving in grandparents name actually may be worse off for FAFSA than saving in parents name because child’s income counts as a higher % than 520 in parent’s/child’s name.

Thoughts?

I am commenting your post so late but I hope this added comment can help readers.

You only mentioned about FAFSA but for most of top 200 private schools (I think your readers want their kids go one of them), they want FAFSA and CSS Profile. CSS Profile is the one that will ask everything (houses/retirement acct/all saving/car…) you have and that will determine financial aid for the family.

Schools that look at FAFSA only (mostly State/Public schools), if your income is very low but live at $1mil (equity of home/no mortgage) home, you can get financial aids. Not for schools that look at CSS Profile; they are very different and will give very little/non-financial aid.

Great feedback. I’ll look more into the CSS and include it in the post.

Sounds like there is really no escape on the CSS, unless you lie. But can CSS really find out all of your assets?

Going through this process right now…and the CSS is MUCH more detailed than FAFSA, with many more questions about finances.

Please tell me more! Is there a simply nowhere to hide assets?

This is my first time dealing with it, so I’m far from an expert on it, and there are probably workarounds, but it is harder for sure. Some things that CSS asks for that FAFSA doesn’t: small business valuation, home equity, grandparent contribution (529 or not, they just ask if grandparents will be paying towards college fees), records of any trusts, detailed financial info for both parents if divorced, non-qualified annuities, and medical expenses. They request you upload all tax return forms via a system called IDOC, including business/corporate returns. Apparently it uses a different methodology than FAFSA to compute aid (Institutional Methodology vs Federal Methodology).

Some of the same basic workarounds still apply – decrease income, decrease balances on investment accounts, increase retirement savings.

What if you have $10 million in real estate to your name? Can they really find all that? Maybe do what super wealthy people do and assign an agent-lawyer to each property to shield the original owner’s identity.

They asked for the value of all real estate holdings. I thought about transferring ownership of our little vacation cabin to my mother’s name, like I did for the 529s, but didn’t do it for this year. May do it for next year.

Got it. Tax returns are what they will request to see and help verify assets.

But your primary doesn’t generate income and same for indented properties. Hmm.

I’m not sure it makes sense to put the 529 with the grandparent as account holder. It works for the 1st year FAFSA calculations but when money is withdrawn to pay for university, it counts as student income on the 2nd year FAFSA.

smartasset.com/investing/saving-for-college-with-a-coverdell-esa#:~:text=Coverdell%20ESA%20and%20Financial%20Aid&text=Overall%2C%20it’s%20best%20to%20keep,Federal%20Student%20Aid%20(FAFSA).

I was looking up the rule for Coverdell ESA but I think the convention holds.

Also as a divorced parent, I still need to include child support and alimony paid to me in my income. It’s feeling pretty hard to game this… :D

You don’t use the grandparent’s 529 until later years of college to “hide” it longer.

This changed in with the new FAFSA in 2024. Grandparent contributions from 529s no longer count as student income the following year.

“The updated FAFSA does not require students to report cash support manually. That means a grandparent-owned 529 plan will not have any impact on need-based financial aid eligibility. Some have now referred to this as the “grandparent loophole.” With the new form, the amount of a student’s “total income,” which includes untaxed income, will come directly from federal income tax returns via the IRS Data Retrieval Tool (DRT). So, a student’s total income amount will only consist of data that comes from the federal income tax return.”

https://www.savingforcollege.com/article/new-fafsa-removes-roadblocks-for-grandparent-529-plans

Nobody ever advised us to put 529s in the grandparents name! Had no idea this was a way to game FAFSA. Rather we have had grandparents contribute money to OUR 529s in the kids names. Is there any way to transfer 529 ownership to them before the kids go to college, or is it too late?

I have same question! Is it too late to transfer 529 to grandparents if my son is a junior in high school. I saved 93k and I make 350k a year. I am debt free and I already told my 4.3 GPA son no Ivys since no merit scholarships.

350K is over the cutoff of my $300k income max analysis. Doesn’t hurt to try and change name to grandparents if I trust them.

But he should still apply to the Ivies to minimize regret and saying “what if.”” He could still get scholarships.

See: Median income for Ivy graduates

What’s not clear to me is how one could get more of their assets into retirement accounts and OUT of taxable brokerage accounts. With the annual 401k/IRA contribution limits we have had to put much more into taxable investments and now have about 2x LESS in those accounts compared to taxable investment accounts, with a rising Senior in high school. My wife also had a banner year in 2022 with her company getting acquired with an accelerated option payout. Now we are both actually unemployed and living off severance payments for a while, but on paper made a lot in 2022 (7-figures) and have over 7-figures in FAFSA assets. Are we screwed when it comes time to fill out the FAFSA form? We have kind of resigned to being destined to pay full price even though we certainly don’t feel rich.

Yes, if you make over $1,000,000 and have over $1,000,000 in FAFSA assets you aren’t getting anything.

Please note my $300K/$200K threshold in my post.

Do you mind elaborating on why it’s difficult to afford even the most expensive college at $83,000 a year with your income and assets? Do you folks not plan to work again?

The one thing you forgot to mention is to have the child take several gap years; start their own business, travel the world, etc. and come back to start college the year they turn 24. This way they will get a free ride bc no/low income and considered an independent adult. And if they are super successful making too much money without college well then even better!

Not a bad idea at all! However, one of the concerns is starting college so late and delaying life. Things like settling down, starting a family and all that stuff.

And when you see your peers graduate college and make money, you might start feeling pretty anxious that you are so far behind timewise and moneywise just to get some free financial aid. But definitely something to consider for sure!

True, every kid is different and matures at different rates. A big indicator is HS grades – if the kid is not getting merit scholarships then there’s a good chance they won’t do well in college. Dropout rates are extremely high and most kids don’t graduate in 4y and switch majors and flail around. My boys were not ready for college at 18. My oldest took gap years and worked, went to community for a few years and his company paid for it. He transferred to State at 23 and graduated at 25 and paid a few thousand for his degree. People need to stop paying full sticker price!

This actually may not turn out the way you’d hope. The FAFSA is really hard on independent students. You may have greater access to federal direct loans, but you may actually lose out on free money like Pell. Of course there are many nuances to this but being independent is not always better. Plus, if they are independent and no/low incomes like you stated, then who is supporting them?

Wouldn’t the easiest of strategy be having a small company that owns and manages all the non-retirement asset if small business own by parents are not counted in FAFSA calculation?

I will have to do more research to understand that better, if that is in fact a legitimate approach.

It’s one strategy. But you will have to calculate the tax implications and the risk of those assets being in a company.

Maybe you can create a conglomerate where are you have different businesses, including rental properties as part of it.

I just think that if you are at this level of wealth, you’re not gonna bother jumping through all these hoops to try to get 20,000 a year in free money from colleges.

You wouldn’t want to do a Roth IRA conversion in a year you’re trying to minimize income, as the amount is taxable as income. Right?

Correct! Good point and thanks for pointing this out. May be tricky to do two years before kid goes to college. Best to wait during last kid’s senior year.

The amount you convert from a traditional IRA to a Roth IRA is treated as income—just like all taxable distributions from pretax qualified accounts. Therefore the conversion amount is part of your MAGI, and it may move you above the surtax thresholds.

I love getting your insight and learning more about finances. Reading your blog about planning for college came a time when we have been crunching numbers and getting nervous about having 2 kids in college. We have one at a UC and the other will be going to an IVY for a sport in the next year. Like you said, the later is need based. We have a 2 teacher income and a rental home as an asset. We fit in the category of many Americans who have not saved very much for college; about $15,000 total. We have filled out the FAFSA & did not get anything other than the federal loans (subsidized & unsubsidized) which don’t equate to very much. We’ll soon be filling out the CSE loan application for the IVY.

Any suggestions for what we should do at this point to increase our chances of getting any aide?

I know one would be to take money from our pay and put it into a 403B plan to lower our tax base. Not sure if it is worth putting our rental into an LLC. I don’t think it matters on the CSE, but may make a difference on the FAFSA. It just seems like a bit of a hassle for just 1 property.

Would love to hear your input.

Thank you! Keep up the great work you are doing!

Congrats on your children’s college admissions!

I am surprised you’re not getting good financial aid based on two teachers salaries, and not much assets outside of your retirement accounts. It is certainly worth trying to max out your retirement accounts this year so that you might qualify for more aid next year. But at this point, it’s hard to change your financials for this year given they will look at your previous years.

It’s worth reaching out to the college, financial aid officer to negotiate and ask for more. Just explain your situation in a polite manner. There’s no harm in asking since they have already admitted your son.

I am wondering the same thing about rental properties in LLC’s vs just owned in your personal names. I cannot find a solid answer anywhere. The LLC’s are personally-held businesses, but they just hold real estate and provide no other services, so it SEEMS like you would still have to report the rental real estate on the FAFSA.

I ALSO heard that the revised FAFSA rules and change to SAI, starting in 2024, will do away with the closely-held business exemption, but, again, I am having trouble finding concrete information on that too.

You can look up Table 6 of the EFC Formula Guide. There is a graduated rate table to include family business in the EFC. Family business is not fully excluded starting in 2023-2024.

https://fsapartners.ed.gov/sites/default/files/2022-08/2324EFCFormulaGuide.pdf

SEE BELOW…

The key wording is “fewer than 100 employees” and I imagine this is the case with your rental real estate

The FAFSA® also asks for the parental and student “net worth of businesses and/or investment farms.” However, at least for this FAFSA® year 2023-2024, the “small business exclusion” still applies, so you do not need to report the value of your business if you have fewer than 100 employees.

I’m wondering if there is anyone here who has taken the LCC route and it has benefited for financial aid.

I also found this which might be helpful to you too.

https://www.edmit.me/blog/how-are-small-businesses-treated-in-financial-aid-calculations#:~:text=In%20general%2C%20the%

The issue is your income and that you waited too long to make a big impact. Removing the rental from your name + make sure you do not get any income from the rental – may help. If you trust your parents you may be able to do a quit claim deed and just let them hold it for you until the kids graduate. Or you can take out a loan on the property to lower your equity to 0 but you would need to spend that money or put into an annuity or something not counted in FAFSA. But if your work income is high for FAFSA there’s not much you can do about that except max out your 401k/403b. So now the majority of your paychecks will pay for college as the kids go and you will get a 4+ year lesson in frugality (if you don’t borrow). I don’t mean to be facetious; it happened to me. After that I realized how much money I waste and started saving voraciously ever since.

Can you elaborate on why you think you wasted money? It sounds like you made good money enough to afford college without needing financial aid?

I meant I learned frugality and how I wasted so much money for years; now I am a saver rather than spender.

Hi Sam,

I totally agree with your thoughts about the obsession with college. It’s pretty much an engineered obsession. “if you really loved your kids, you’d pay for a good college!” And so we ended up with over 60% of high school graduates going to college, and college degrees a requirement for virtually any job. Sadly, it’s a sign of the time. The obsession with money you mentioned, the conversion of education and health care from more or less a public service to profit-centered corporate behemoths. It’s frightening.

When I look back on my education in Switzerland, so much was different. Almost no one went to private school. Private schools were strictly for special needs kids that could not make it in public school. After 6th grade, stratification began. Lowest parallel academic level was “Oberschule,” next level “Realschule,” then “Sekundarschule,” and finally “Gymnasium.” After two or three years of the two lowest levels, you were done and went on to learn a trade. That was lucrative because the whole trade school thing was taken very seriously. It was an apprenticeship where you got hired by a business but also had to go to trade school a day or two a week. After three or four years of that, during which you MADE decent money, you were a certified tradesperson starting well-paying jobs, while the Gymnasium academic track still had four years of college ahead of them.

The rationale behind that Swiss system was a realistic assessment of how many people in what jobs society needed. People need more plumbers or construction workers or service industry folks than nuclear physicists or mathematicians or geologists, and the educational stratification was set up accordingly. And since those on the academic track (at the time maybe 5%) weren’t able to start earning money until their mid-20s while those in trades began earning a living several years earlier, and since they were going to pay way more taxes and benefit the nation in many other ways later, higher education was heavily subsidized.

My five years at the Swiss Federal Institute of Technology in the early 1970s was, with the exception of a nominal fee (a few hundred dollars per semester) free. And since I graduated near the top of my class, my graduate and Ph.D. studies at Rensselaer Institute of Technology were completely free for me as well (ETH and RPI did have a student exchange program). In retrospect that seems almost unbelievable, but that’s the way it was.

It was more difficult for my son who was born in 1996 in the US. For him it was the now common hustle for high GPAs, AP classes, etc., etc., and whatever awards and achievements he could get in order to have a chance at a decent college. Sadly, my (okay, but not huge) income nuked his chances at getting much financial aid, and so he hunted for whatever stipends he could get. Even so, “good” colleges and universities were out of the price range, and he ended up going to his mom’s alma mater, the geographically beautiful and party-friendly UC Santa Cruz. Even so, his college fund was used up after three years, but much to his credit, the kid took an almost full-time job, paid for his own last year, and got his degree, debt-free, in video game design, the field that he now works in.

Times change, but I think the track we’re now on as nation, is not a good one. Greed is good and sanctioned, much has become unaffordable, and a college degree benefits Big Education way more than all those kids who graduate with huge debt and potentially getting a decent job. And health care…. let’s not even go there.

C

The timing worked well because I was getting divorced as my daughter turned 18. My ex was the much lower earner so we had him claim her as his dependent and she went to community college for 3 years earning 3 associate’s degrees. The tuition was low enough that I could swing it easily along with some dependent scholarship money through my employer. Since 3 years had gone by, her FAFSA lookback period would be just her dad’s income and assets which were low. She was accepted at the Univesity of Michigan as a transfer student with full tuition covered. Through her part-time work the previous 3 years, she had funded her Roth IRA and paid me room and board. I saved the room and board money which I then used to pay her rent in Ann Arbor. She will graduate this month with ZERO debt. We are both pretty proud of the way she’s managed to take a different path to graduate from a top-tier university.

Great timing! Glad things worked out well for y’all. I wish your daughter the best of luck.

How are illiquid investments like venture capital, PE, and other private placement investments that aren’t made through a taxable brokerage treated? I imagine these investments would be very difficult/labor intensive for college financial aid offices to track down. If so, the year before college applications go out, put your taxable account into a private fund that won’t throw off any gains for at least 5 years. This will lower your EFC. Worse case, depending on how much you have in your taxable account, it’s a wash if the investment is a loss because college is covered by need-based aid. Best case, college is covered by need-based aid AND your private investment returns many multiples some time after graduation. Obviously only works for one child.

William and Mary is not Ivy League but is top tier. Many other variables enter into going to college. Contacts. I made life-long friends at my live-in campus college. Growing up while learning. 18 year olds have an undeveloped brain and tend to act without considering consequences. My college had some guardrails that kept us safe.

That was before college became so expensive. Now going the first two years at a community college and then transferring to a 4 year school makes the most sense.

Great article. Very clear. I have two kids about to graduate college so too late for me with them, but I also have a five year old and two year old. We are already trying to figure out how best to save for their college so very timely! Social security plus pension plus other passive income might make it hard to qualify for financial aid, but the last category is certainly under our control.

FYI, I just retired a few weeks ago at age 55. I’ve enjoyed reading many of your articles in preparation.

Kids about to graduate college and two young kids… what a blessing!

Interesting post! Having 1 child a sophomore in college and the other a sophomore in high school, I can vouch that this analysis seems accurate based on my experience with the college /aid process.

There are some good schools a cut below the Elite that still offer merit scholarships, but they are very difficult/competitive to get. These are schools in like the 30-70 range in the rankings.

With my job we don’t qualify for financial aid. I was actually thinking late last year that if I somehow got laid off at least it would severely increase college financial aid for child #2, since this is the year that is calculated. Happy to not be laid off though as I’d like to bank at least a few more years of mega corp pay ideally before calling it quits.

I have an 11 yr daughter and I’ve been contributing to a 529 plan at Vanguard as early as I could which I’m considering winding down contributions since it’s reached $200k. I’m now thinking of opening a custodial checking account and a custodial brokerage account for her because (a) she’s starting to show an interest in making and growing her money (b) she has grandparents who are generous with cash gifts and (c) she’s frugal and responsible and I feel safe with the thought of her having access to the funds when she turns 18.

My plan is to put anything she earns (she wants to start babysitting) into a Roth and match that amount to her custodial brokerage account. She goes to school for gifted kids and picks up skills more easily than her peers and spends a LOT of her free time making digital art and 3D graphics and animation with Blender and is remarkably good at it — it’s possible she can start making a decent income especially after a few years. Any cash gift she gets will also be put in the custodial account.

It would make me happy to watch her get comfortable seeing her statements, using a debit card and writing checks, and see how interest, earnings, dividends, and withdrawals/spending increase or decrease her net worth. Hopefully it’ll help her be financially literate as an adult and perhaps even be a stepping stone to reading profit & loss statements and balance sheets. Right now dad is her piggy bank and she keeps track of how much cash she has but she seems ready for the next step.

My concern is how her custodial account will affect financial aid for college. At this rate I can see it crossing $100k by the time she applies for college. But is this a moot point since I read that “Colleges will expect parents to use up to 5.64 percent of their assets toward college” and “22 to 47 percent of parents’ available income”? My wife’s and my assets as of now are north of $10M and our earnings are around $300k/yr. We could reduce our AGI two years prior to college since I have my own business and can defer expenses and increase expenses during those two years but 5.54% of assets seems will be an issue.

I think this means our daughter isn’t eligible for financial aid and her custodial account won’t make a difference? Or am I missing something?

Correct. Your family isn’t eligible unless your $10 million is all in tax-advantaged retirement accounts and you have less than $300,000 a year in total income.

20% of student’s assets count toward contribution. So $20K out of $100K.

Curious, do you feel with your income and net worth profile that paying for college will put a strain on your finances?

thx

Thanks for confirming. I’ll open a custodial account since she won’t be eligible either way. How strange for colleges to penalize teenagers that work and save their money though.

As far as straining our finances it’s more about the ROI on paying full price. Same reason why I only buy used cars or why I’d never go to a Michelin star restaurant. My wife and I both went to ivy league colleges and it’s hard to see how paying full fare is worth it unless you care about bragging rights.

I don’t need much to be happy but it’s important to me to leave as much FU money as possible for our daughter after we’re no longer around. I’d rather increase her pile of FU money from the full cost of attending a private college compounded over the years it stays in our trust.

Makes sense on getting the best ROI possible.

How much is FU money.. the minimum for your daughter after graduation? I fear there could be too much that would demotivate or hurt a young person’s character.

We did a lot of these things, whether intentionally or not. The vast majority of our net worth is in retirement accounts and in equity in our house, and we have minimal taxable savings. More than half of our kids’ college money is in 529 accounts owned by their grandmother, and our kids themselves each have a few thousand dollars in personal savings at most. And yet my son didn’t qualify for any need-based financial aid when he started college recently — I think because our income is too high. So while much of this advice probably is good in some situations, it isn’t guaranteed to work.

How high is your income? Because parental income has the heaviest weighting for FAFSA out of the four weightings.

Earning less than $100,000 household income with no outside retirement assets provides generous financial aid.

After about $300,000… it’s very hard to get free money, even if you have less than $200,000 in assets outside retirement accounts.

I don’t want to give our exact income, but I’ll say that it’s between $100k and $200k. You mentioned that parental income has the heaviest weight on the FAFSA, and that makes sense given the outcome in our case.

To be honest, I’m fine with us not getting any federal aid. I’m actually glad to know that federal aid isn’t given to everyone, since I think that more aid just serves to drive up tuition costs. And with the money we’ve saved and invested in college accounts and a great scholarship that my son got, we are doing fine with paying for his college. Now for his younger siblings, it might be a different story. We will have to wait and see.

Ah, so your son did get a scholarship, so that’s good financial aid. Many of the colleges couch need-based financial aid as merit aid to make parents and students feel better and want to commit to the school. It’s a competitive process, attracting students!

Is working until all your kids graduate college a goal? And does that help make work feel more meaningful?

I’m trying to imagine the situation for myself, and I think the answer would be yes. More motivating to work. Then again, higher income, less financial aid.

In my son’s case, he got a competitive merit-based scholarship that covers his full tuition cost — we only pay room and board. I don’t think that need factored into it at all, though I suppose that I can’t say that with absolute certainty. He also could have gotten one of the scholarships that I regard as more like tuition discounts (e.g., the college offers $X off your tuition if you have at least a __ score on your ACT or SAT), but his scholarship made that unnecessary.

Working in order to afford college does make my work a bit more meaningful, yes. But we’re also send our kids to a private religious school for K-12, so I’m working to afford that too. :-)

Unless I’m completely misunderstanding this (which is likely because I have no experience with LLCs or small businesses), I could just start a small business where I am the only employee, and dump all of my brokerage money into it. It would open a brokerage and invest the “business’s” money exactly how I would invest it, and pay me a small salary. Kids get financial aid, then when they are done with school, I buy out my own business.

Am I getting this right?

Conceptually, kind of. But where would your business revenue come from? After a couple of years of no income, you might experience an IRS audit.

Paying yourself a salary out of your business means you would pay both sides of the FICA tax (SS + Medicare). Is paying a 15.3% tax on income worth it? See: https://www.financialsamurai.com/maximum-taxable-income-amount-for-social-security-fica/

The business would own your assets and I don’t think you can just inject your assets into your business for free without tax consequences. Then, when your business’s investments have a profit, you got to pay taxes on those capital gains. Then, you will have to pay taxes on distributions or income

So the better strategy is to have a legit business, grow it, keep the retained earnings on the balance sheet the 2-4 years before your child goes to college, and invest the business money under its own account. AFTER your kid graduates, then you can start distributing the retained earnings to you. But of course, there is a risk of having too much cash in your business as well.

Wow super insightful! I learned so much from this article – thank you! It really helps to understand how the system works. Just like with taxes. There are ways to legally take advantage of the rules IF you know what they are

Hi Sam,

My husband is a Higher Education insider. He said that in the US, the more you save for college, the more you will need to pay. You are charged according to your ability to pay, rather than the service you receive. Isn’t it the same about everything in this country? Extreme capitalism means there is no standard price that applies to everyone. If you are in a premium neighborhood, a painter will charge you trice as much as he/she charges a lower end home owner. The quality of painting is the same. Now you understand why the majority of Americans are not worried about saving: you simply don’t need that much in saving to get what you want. This is a wisdom they learned from growing up in this country. Hardworking migrants like us often don’t get it.

Don’t forget that a bunch of schools use the CSS, and many of the ways to game the FAFSA won’t work with the CSS.

I was thinking the same thing. William & Mary, in fact, uses the CSS, and at least some of the parents home equity counts as an asset.

Good to check how home equity is counted before doing anything drastic for sure.

You would think living in a $10 million house would demonstrate your family doesn’t need aid. But the system is funky that way. Each college is a little bit different.

It would be great to see this same article but for the CSS. I’ve come to the same conclusions as Sam on the Fafsa but haven’t figured out the CSS yet.

As concerning as how to pay for college is, (and it is), someone should talk about how colleges are gaming the system. In CA, a a former teacher, we were told to tell kids they needed a 3.0 to apply to the UC system and then certain requirements. In reality, a student needs well above a 4.0 and even then he acceptance rates have dropped so much. Colleges like to accept out of state students at a higher rate since they can charge higher tuition. Some UC’s out here in CA have 100k applicants every year. That’s 7 million they are raking in just in the $70 application fees. ( not considering those that got wavers)

My daughter took far above the requirements and is graduating from high school this year with around 275 credits (220 needed to graduate) She could only get wait listed for one out of five UC’s she applied to. In the end she will go to a state school but I feel for her. She worked very hard and could have taken less AP classes and had a better balance and less stress during her high school career. I let her apply to the places she wanted. In hindsight I should have had her apply for out of state places from CA. As soon as she starts school this fall I will look into gaming the system and take my retirement pension and move out of CA myself.

You are absolutely right. Colleges are gaming the system to make more money off families, so families need to figure out how to game the system right back. Some colleges are also being disingenuous on who they let in.

I’m sorry about your daughters acceptance situation. But on the huge bright side, I’m sure she has developed a lot of grit, and a great work ethic. Further, by going to a state school, you save a lot of money like my wife and I saved a lot of money.

The $100 preschool application fee here in San Francisco is nuts. At least offer to refund part of the application fee.

I’m not convinced CA universities are admitting more out of state applicants to garner more tuition. I know 4 applicants to UCLA from WA that have 4.0 raw GPAs and are topped ranked at the school (12+ AP classes …as many as they could schedule) but were all waitlisted. The bar is just really high for UC schools now.

It’s happening at many of the state schools due to a decline in state funding. When the out of state student pays 50% – 100% higher tuition and is a good student, it’s a smart business decision.