Have you ever thought about getting away from it all and retiring in Hawaii? My parents retired in Hawaii 17 years ago and I'd love to join them. They live a simple life with a paid off house and a government pension after serving for over 25 years in the U.S. foreign service.

I've actually had this dream of retiring to Hawaii since I left my finance job in 2012. But every time I try to escape San Francisco, it pulls me back in.

First, I had to wait for my wife to join me in early retirement in 2015. We had made a pact that once she turned 35, if our finances were still on solid ground, she could also leave the corporate world behind.

Both of us quitting the money was mentally hard. However, we spent the next couple of years traveling internationally until we had our son in 2017. As new parents, we found comfort in familiar doctors and a support network of friends. Therefore, we decided to stay back in SF.

Then, in 2019, we miraculously had our daughter and failed at early retirement again. Once again, we found it prudent to keep home life stable for the sake of everyone. And of course, in 2020, the pandemic began and we found ourselves stuck in San Francisco.

Despite all that has happened since I left my job in 2012, I still have a desire to retire to Hawaii while my children are still young. Hawaii is one of the most family-friendly states in the country. Further, it would be nice for my children to know their grandparents better.

The Benefits Of Retiring In Hawaii

For background, my grandparents on my father's side were born and raised in Hawaii. Their parents came over from China to start a new life in the early 1900s.

My grandparents were both school teachers. They bought a property when they were in their 30s and raised three children. My grandfather also served in World War II after the Japanese attacked Pearl Harbor. He received the Congressional Medal of Honor posthumously, which brought great honor to our family.

I've been going back to Hawaii since 1977. I just haven't been able to settle there due to work and family life. If you're curious what it could be like to retire in Hawaii, here are some of the benefits.

1) Less Stress, Happier Life

On a scale of 1 to 10, I'm usually around a four in terms of stress. But every time I step off the plane in Honolulu, my stress level drops down to about a two.

There's something magical about Hawaii that makes so many of your worries melt away. I think it's the constant ocean breeze and the sweet scent of plumeria blossoms that relaxes you along the walk through the open-air concourse to baggage claim.

It's not a surprise that Gallup named Hawaii the happiest and healthiest state in the country in 2019. In 2020, Wallethub also named Hawaii the happiest state in the country as reported by CNBC.

Unlike the extremely capitalistic culture found in cities such as New York City and San Francisco, Hawaiians are much more laid back. Instead of talking about joining the next startup or closing the next deal, Hawaiians have a greater focus on enjoying day-to-day life.

2) Ohana Means Family

An integral part of Hawaiian culture is the care and nurturing of family, or ohana. It is not uncommon to have multiple generations under one roof.

If you have children, you will feel more welcome in Hawaii. Everywhere you go, whether it's to a nice restaurant or to the mall, things are set up to make experiences more family-friendly.

3) Ranked Tops For Healthcare

As a retiree, access to quality healthcare is paramount. Luckily, Hawaii is consistently ranked as one of the top states for healthcare. In fact, US News ranks Hawaii #1 for Health Care Access, #1 for Health Care Quality, and #6 for Public Health.

Hawaii is also one of the most health-conscious states in the country. With good weather year-round, endless access to public beaches, and numerous parks, Hawaiians take their health very seriously.

World Population Review ranks Hawaii as the third healthiest state in the country. NBC news reported Hawaii was the second healthiest state during the 2020 pandemic.

If you want to get healthier, retire in Hawaii. You can't help but focus more on a healthier diet and more exercise when it's infused in the culture. Experiencing less constant stress is also wonderful for one's mental health.

4) Tremendous Diversity

As of 2025, Hawaii has a population of roughly 1,440,000 people. What's unique about the Hawaii population is that there is no majority – everyone is a minority.

In the latest Census, 25% of Hawaii residents claimed multi-ethnic backgrounds (two or more races), far more than any other state in the USA (the second highest is Alaska with 8%).

The racial composition of Hawaii is roughly:

- Asian: 37.3%

- White: 25.2%

- Two or more races: 24.6%

- Native Hawaiian or Pacific Islander: 10.3%

- Black or African American: 2.2%

- Native American: 0.4%

And here's a historical table on race and ethnicity for Hawaii by state and county compared to the entire US:

As a minority living on the mainland since 1991, it has sometimes been a struggle for me to fit in or get ahead in the workplace. As a result, I've built up a rental property portfolio and started a small business just in case my children also lack the same opportunities I never had.

If you are a minority or appreciate racial diversity, you will appreciate the population of Hawaii. It just feels nice to have my kids go to school with more people who look like them.

5) Some Decent Tax Advantages

Hawaii ranks as having one of the lowest property tax rates in the country at an average of only 0.28%. In comparison, New Jersey has an average tax rate of 2.38% according to the Census Bureau.

If you happen to have a Federal pension, it is exempt from state income tax. Finally, the equivalent sales tax rate is a reasonable 4% – 4.5% versus 7.25% – 8.25% for California.

Unfortunately, Hawaii has one of the highest state income tax rates, topping out at 11% if you make over $200,001. If you make between $48,001 and $150,000, you must pay a state income tax rate of 8.25%.

However, coming from San Francisco, tax rates in Hawaii are lower. Therefore, if you want to retire in Hawaii, it's best to come from a higher tax state.

6) Longer life expectancy living in Hawaii

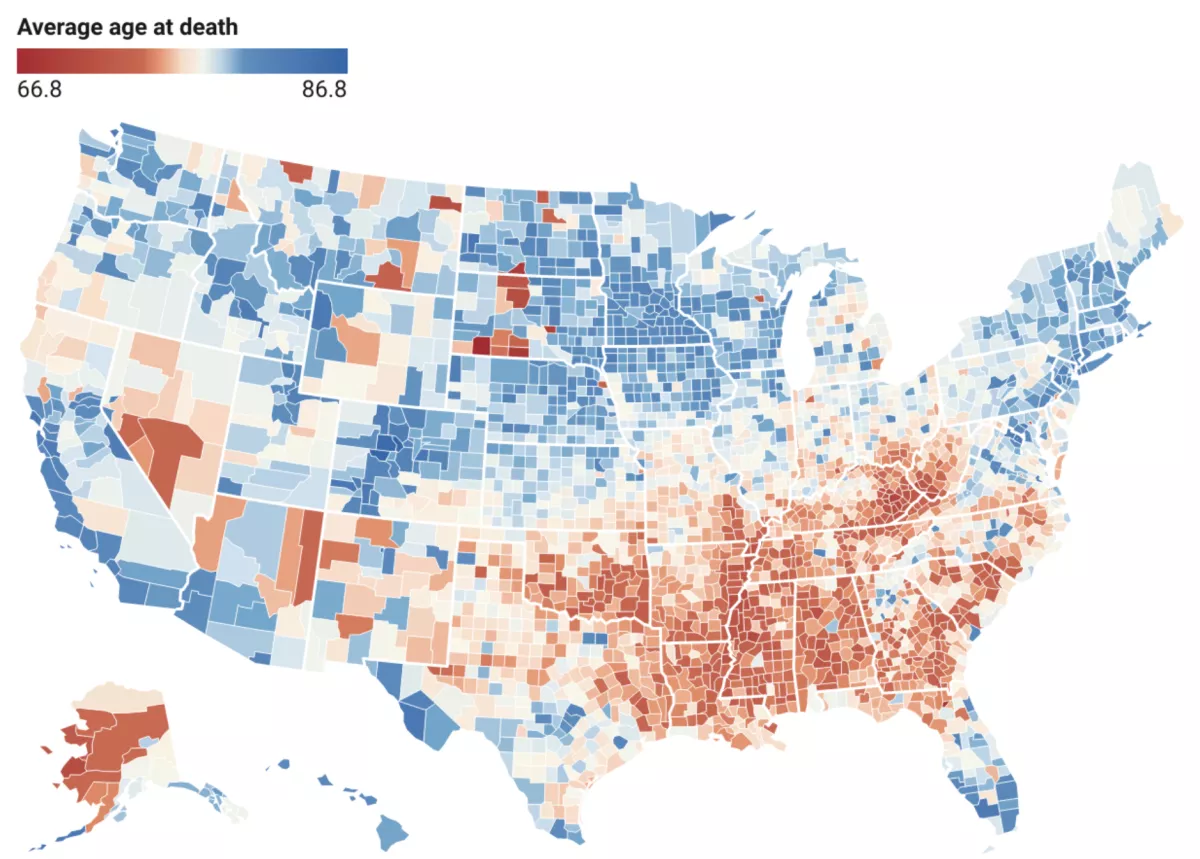

Perhaps the biggest benefit of retiring in Hawaii is a longer life expectancy. Hawaii residents can enjoy a 10-20-year longer life than residents in the southeastern states like Mississippi.

Cons Of Living In Hawaii

Before you get too excited, let's take a look at the downsides of retiring in Hawaii. It's always good to weigh both sides before relocating or making any significant lifestyle change.

1) High cost of housing.

As of April 2024, the median single-family home price in Honolulu is about $1,050,000. Meanwhile, the median price for a condo on Oahu, is currently $535,000.

If you want to retire in Hawaii and save money, consider buying a small condo or rent, rather than purchasing a single-family home. The average rent for a 594 square foot apartment is roughly $2,042, according to RentCafe.

If you follow my 30/30/3 rule for home buying, this means your household would need to earn $350,000 or more to comfortably afford a median-priced home! Unfortunately, the median household income in Honolulu is only about $88,000. If you stretch your household income to 5X, then you will “only” need to make about $210,000.

2) Expensive produce and gasoline.

According to the Hawaii government, about 85-90% of Hawaii's food is imported. Not only does this mean higher produce prices, but it also means more potential disruption in food supply if there is a storm or a global event.

According to a report by the Missouri Economic Research and Information Center, Hawaii’s grocery prices are some of the highest in the nation. The study used a national index of 100 and Hawaii ranked at 196.3, while comparatively, California ranked at 138.5, Washington at 111.3, and Oregon at 134.6.

For example, a gallon of whole milk on Oahu can be $8.99 at Safeway. Local Hawaiian mangos are amazing, but they can cost up to $7 a pound.

Further, if you like to drive a lot, traffic in Honolulu is congested. In addition, Hawaii is ranked second-highest in America for gas prices. The average price per gallon is roughly $4.57 for regular gasoline as of Q1 2025 compared to $3.03 nationwide.

3) Island fever can make retiring in Hawaii hard.

The main island of Oahu is only about 597 square miles. It takes about 4 hours to drive around the entire island. And it only takes about 45 minutes to drive from Waikiki on the South Shore to Haleiwa on the North Shore.

Although Oahu does have a population of about 1 million, it still feels like a small island. You may find yourself bored of the same food, the same activities, and the same people after a year.

Hawaiians are a very tight knit community. They are welcoming, but you must show utmost respect for the islands and the Hawaiian culture. Otherwise, you will be an outcast. If you're not careful, you could get really lonely retiring in Hawaii if you don't already have friends and family.

Finally, with the pandemic making air and ship travel less appealing, you may also feel more trapped on the island than usual. For example, my mother usually flies back to Taiwan twice a year, but hasn't since the beginning of 2020.

4) Racism against white people and non-locals.

If you are a white person, you may experience some racism from local Hawaiians. But the racism is like the racism minorities feel on the mainland all the time. So if you aren't used to being discriminated against with some pokes and slights, it may feel uncomfortable.

To protect yourself, you must respect local culture and local people. Read as much as you can about the history of the Hawaiian islands and how the kingdom fell.

5) Not a great place to make money

If you decide to come to Hawaii to retire, please make sure you really plan to retire. Due to its laid back culture and heavy focus on tourism, Hawaii is not a great place to make money. Wages are often 20% – 40% lower in Hawaii than they are in the mainland.

Instead, it's better to have money before you retire to Hawaii given things are so expensive. You can always consider the Barista FIRE lifestyle in Hawaii to keep busy and cover the gap. For example, I've thought about working at Coldstone Creamery to make $15/hour and get subsidized healthcare insurance.

Related: If You Can Make It In Hawaii, You Can Make It Everywhere

How Much Money Do You Need To Retire In Hawaii

Given the cost of living is high in Hawaii, you need a lot more money to retire in Hawaii than almost every other state except for maybe California, Connecticut, and New York. Retiring in Honolulu is relatively cheaper than retiring in San Francisco, Westchester, or New York City.

The amount of income you need to retire in Hawaii will depend on your expenses. The median household income in Honolulu is about $95,000 as of 2025. Thus, having $95,000 in annual retirement income is a good start.

To generate $95,000 a year in annual passive retirement income would require having invested capital of between $2,375,000 to $3,166,667 in invested capital, assuming a 3% to 4% safe withdrawal rate.

In other words, you want to aim to be a millionaire if you want to retire in Hawaii. That said, if you are happy to live off $47,500 a year and have a pension and/or Social Security, you can cut the capital amounts in half.

Why We Want To Retire In Honolulu, Hawaii

Although Honolulu is expensive, it's a place I've been going back to for over 45 years. Honolulu just feels like home. With my parents in their 70s, I'd like to spend as much time with them as possible before they are gone.

Further, moving to Honolulu from San Francisco will actually save us money! The median San Francisco home price is about $1,800,000, or 65% higher than the median Honolulu home price.

If we move to Honolulu, we would sell our San Francisco home and pay cash for a similar-quality home that is around 40% cheaper. We would then reinvest the house savings into real estate crowdfunding, dividend stocks, and REITs to boost our passive income for retirement.

In essence, Honolulu is the perfect geo arbitrage strategy for us to reduce living expenses while also improving our quality of life. Instead of needing $300,000 a year in passive investment income to live the retirement lifestyle we want in San Francisco, $200,000 is probably plenty in Honolulu.

Our latest plan is to retire to Hawaii when our son starts high school. We'll have to switch schools anyway, and our kids should be old enough to both remember and appreciate Hawaii. Until then, paradise awaits!

Real Estate Investing Recommendations

If you want to retire in Hawaii, you need both income and wealth. I think one of the best ways regular people can build wealth and generate more passive income is through real estate.

Take a look at Fundrise, my favorite private real estate investing platform. Fundrise was founded in 2012 and manages over $3 billion with over 350,000 investors. The firm focuses on single-family and multi-family properties in the Sunbelt, where valuations are lower and cap rates are higher. For most investors, investing in a diversified private real estate fund makes the most sense.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside. Crowdstreet is a solution where you can build your own select real estate portfolio. Just be sure to do your own due diligence before investing in individual deals.

Personally, I've invested $954,000 in private real estate since 2016 to diversify my exposure and earn more passive income. Both Fundrise and CrowdStreet are affiliate partners of Financial Samurai, and Financial Samurai is currently invested in Fundrise funds.

Join 60,000+ others and sign up for my free newsletter to follow our journey to retiring in Hawaii. I started Financial Samurai in 2009 to help achieve financial freedom sooner, rather than later. Over 95 million people have visited Financial Samurai so far!