My wife and I moved to San Francisco in 2001, and after 18 years, we finally decided we’ve had enough. Our plan now is to cash out of the tech IPO boom and move to Hawaii to semi-retire in our early 40s. Selling property now sounds like a good idea with the housing market is so hot.

San Francisco has its perks, such as wonderful food, moderate weather, diverse culture, and lots of job opportunities, but once we became parents in 2017, our outlook started to fade.

For starters, San Francisco has the lowest percentage of kids in the U.S., which means fewer family-friendly places, fewer first-time parents to interact with and fewer kids for our son to play with.

The public school system starting in kindergarten is based on a lottery system, so even if you pay property taxes, your child is not guaranteed a spot in your neighborhood schools.

Most parents are forced to pay big bucks to send their kids to private school, but even paying $30,000 or more doesn’t guarantee your child admission into the top-rated private schools. This is a ridiculous situation of social engineering that doesn't seem fair given property taxes are so high given property prices are so high.

It feels like a burden to keep working so we can earn higher salaries only to keep up with the city’s rising costs. That said, the only way to break free from this trap is to sell during the tech IPO boom.

Selling Property During The Tech IPO Boom

Our priority is to reduce our ownership burden in California by as much as possible. While my wife and I aren’t “techies,” we do own several assets that techies may want to buy.

- A two-bedroom, two-bathroom park view condo in Pacific Heights: In 2003, at 26, I purchased my first property for $580,500. To come up with the down payment, I had saved 50% of my salary and 100% of my bonus each year from ages 22 to 26. My base ranged from $40,000 to $80,000 during this time period.

- A four-bedroom, two-bathroom home in Golden Gate Heights: In 2014, we decided to buy a fixer in Golden Gate Heights with panoramic ocean views. We love living farther away from congested downtown in a peaceful and quiet neighborhood. Investment-wise, we thing the west side of San Francisco with a high density of more affordable single family homes is the best place in the city to buy property.

- A two-bedroom, two-bathroom vacation home in Lake Tahoe: In 2007, we purchased a Squaw Valley vacation property for $715,000. I thought I was getting a good deal because the seller had purchased it for $820,000 a year prior. Unfortunately, over the next several years, the property lost half its value due to the housing crisis.

A Goal To Sell Property

Our goal is to sell the properties during the tech IPO boom. After Uber’s IPO on May 10, we believe it’ll be the biggest catalyst for an uptick in San Francisco real estate demand given its estimated $100 billion market capitalization. While my wife and I aren’t ‘techies,’ we do own several assets that techies may want to buy.

If we’re able to sell to one of the newly minted tech millionaires once their six-month lockup period is over, we would reinvest the proceeds into various passive income investments such as dividend stocks, short-term treasury bonds, venture debt and private equity.Real estate arbitrage to the rescue

Cap rates in San Francisco are roughly 3% . Owning investment property in San Francisco is mostly about capital appreciation, not income generation. Think about San Francisco property more like a hot growth stock rather than a steady dividend paying stock.

Given we plan to downshift and semi-retire, we think it's wise to also shift our asset allocation from high growth to steady growth & income assets with less hassle and maintenance.

I've been following single family home sales in San Francisco throughout the pandemic. And the market is hot! As of May 2021, the median price for a single family home in San Francisco is now $1,950,000.

Our Tech IPO Cash Out Strategy For Retiring Early

- Sell our Lake Tahoe (estimated value: $500,000) and Pacific Heights (estimated value: $1,300,000) properties. After paying fees and taxes, we should have about $1,500,000 in net proceeds to reinvest.

- Reinvest 50% of the proceeds in AA-rated Hawaii municipal bonds once we move there. This will generate a tax-free yield of $22,500 (or 3%) per year in tax-free income.

- Invest the other $750,000 in real estate crowdfunding and and public REITs to take advantage of much lower valuations and much higher cap rates in the heartland of America. The heartland is seeing an influx of residents from expensive coastal city residents who realize they no longer need to be stuck paying $4,500 per month for rent or $1,500,000 for a median-priced home.

With a target 10% annual return due to much higher cap rates in heartland real estate, I expect the $750,000 invested in real estate crowdfunding to generate roughly $75,000 a year in gross income.

In other words, instead of generating only $50,000 a year in gross income a year from my existing San Francisco and Lake Tahoe properties, I could generate an equivalent of roughly $105,000 a year in gross income from the combination of municipal bonds and real estate crowdfunding.

Our favorite real estate crowdfunding platform is Fundrise. They were founded in 2012 right after the JOBS Act passed. They are the creator of eREITs, where one can invest as little as $500 and gain more focused regional commercial real estate exposure. It's free to sign up and explore.

For more specific commercial real estate deals to invest in, I like CrowdStreet. They were founded in 2014 and focus specifically on 18-hour cities where valuations are lower and rental incomes are higher. Thanks to strong demographic trends, 18-hour cities have a lot more upside, especially post-pandemic.

A 6.5% blended return on the gross capital base with no maintenance or tenant issues sounds much better to me. As a stay at home dad who wants to play tennis and write during his free time, I really don't have much time to spare.

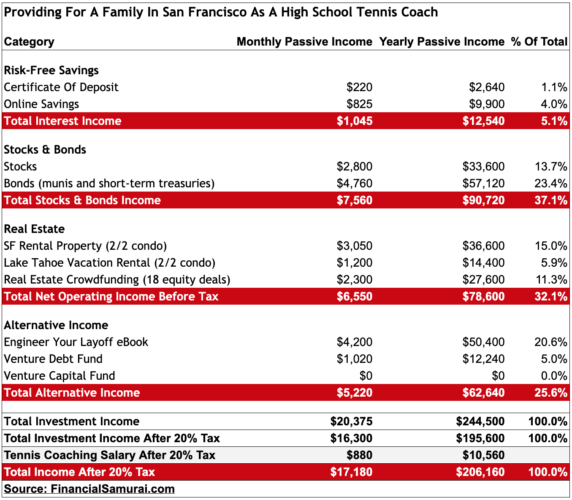

As of now, our retirement income currently stands as follows. By selling one or two of our rental properties, we hope to simplify life and boost our retirement income further.

Honolulu Is Better Than San Francisco

My goal is to re-retire under the Biden administration. My parents, currently living in Honolulu, are in their 70s. If we don’t move now, I know I’ll regret not spending more time with them later on.

Although it's not that stressful living in San Francisco since I just work from home and take care of my boy with my wife. My stress level just melts away every time we go to Hawaii.

When we move to Honolulu, I plan to continue running Financial Samurai, the personal finance site I started in 2009. I also plan to try and get a high school tennis coaching job for 3-4 months a season. I've been coaching high school tennis for the past three years and it has been quite rewarding.

My wife and I will also be working on the third edition of our severance negotiation book, “How To Engineer Your Layoff: Make a Small Fortune by Saying Goodbye.” This book really changed my life because it allowed me to confidently leave my day job in 2012 because I negotiated a severance that paid for years of living expenses.

Nice House In Hawaii

My parents want to move out of their old four-bedroom house because they find it too large to maintain. My family of three would take over the house (rent-free) and spend about $3,500 a month paying for a fully-furnished two-bedroom, two bathroom condominium downtown near all the shops and restaurants for my parents to live in.

Although $3,500 a month sounds like a lot, it’s still $2,000 (or 40%) less than what we spend on housing here in San Francisco. It's funny to think that we'll be saving money moving to expensive Honolulu, but that's one of the perfects for living in the most expensive city in America for so long.

With the remaining ~$12,000 plus a month in retirement income, we should have more than enough to live a comfortable early retirement lifestyle in Honolulu while raising children. Even private school in Honolulu is “only” $25,000 a year versus $35,000 – $50,000 a year in San Francisco.

Living in San Francisco for more than 18 years has been a wonderful experience. We got lucky buying property when we did. Unfortunately, the city is simply too family unfriendly and too expensive today. We long for the simplicity and year-around warmth and sunshine of Hawaii.

It’s time for us old folks to leave and make way for the next generation of hungry young capitalists. Here’s to a tech IPO bonanza!

Related: SF Property Owners Shouldn't Expect To Get Rich Off Tech Boom

Recommendation To Build Wealth

Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. I’ve been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.