In a previous post, I estimated how real estate performs at various levels of a stock market decline. In my opinion, the sweet spot for real estate outperformance is somewhere between a 15% – 25% stock market decline. This post highlights real estate outperformance examples during the pandemic.

During such a level of decline, mortgage rates tend to fall as investors buy Treasury bonds for safety. As a result, real estate demand increases because affordability increases. Further, during a stock market correction, money tends to flow out of the stock market and into real estate and other more defensive asset classes like bonds.

Once the stock market declines by ~30 – 35%, real estate price appreciation tends to stall as potential buyers rethink their decision to buy any asset, including real estate. After a ~35% decline in the stock market, real estate prices are most likely falling as people fear losing their jobs.

This post was originally written at the beginning of the pandemic in 2020. It has since been updated most months with the latest update on how properties are doing. Real estate continues to do very well and is my favorite asset class to build wealth as we get out of the pandemic.

Let's go through real estate buying life back in 2020. I'll also show you plenty of monthly real estate outperformance examples throughout the entire pandemic. Bit city real estate is back with a vengeance!

No Open Houses Are Tough (2020)

We know that forced lockdowns have hurt the real estate brokerage business as potential buyers aren't able to visit open houses and transaction volume declines as inventory gets pulled out of the market. However, please don't confuse the real estate brokerage business with real estate prices.

When the real estate market eventually opens up again, sellers should negotiate for a commission discount while buyers should ask for a commission rebate. The coronavirus pandemic might finally be the catalyst to permanently lower commissions. However, I do think a great listing agent is incredibly valuable for getting too dollar.

In this article, I want to present to you an example of how one property performed during a global pandemic and a lockdown. It's an interesting example given the final sales price and timeline of the sale.

I'll then share many more real estate outperformance examples, including ones that closed more than two months into a lockdown.

The fact of the matter is, real estate values are rising well into the pandemic because:

- Mortgage rates are at record-lows

- More time is being spent at home so the intrinsic value of a home is increasing

- Input costs are going up (lumber)

- There's a big desire for household and financial stability.

Real Estate Outperformance Examples During A Coronavirus Pandemic

One of the best types of real estate to own is a single-family residence with panoramic ocean views in San Francisco. To find such properties, you need to look for them on the western side of San Francisco in the Sunset, Golden Gate Heights, Parkside, and Richmond neighborhoods.

These are less densely populated areas with lower median home prices given it takes longer to commute downtown. With the coronavirus giving millions of people a taste of work from home life, I believe these types of properties will outperform over the coming decades.

Because real estate is my favorite asset class to build wealth, I'm always on the lookout for single-family homes that are for sale in these neighborhoods. I peruse through the latest listing online each week and bookmark various properties I find intriguing.

Related: How To Get Rental Deals And Better Tenants After COVID-19

A House In Golden Gate Heights, San Francisco

On February 21, 2020, I stumbled across a quaint three bedroom, three bathroom, single-family home with ocean views. The kitchen had been redone about five years ago with basic finishes. The bathrooms were remodeled maybe 20-25 years ago also with basic finishes.

Overall, the house has about 2,200 square feet of living space and is situated on 3,000 square feet of land. The main downside to the house is that it is one block away from a very busy street. The house was essentially move-in ready, although one could easily spend $100,000 updating the house with new windows, new wiring, and new bathrooms.

Here are some pictures of this humble abode:

The listing price was $1.495 million which is below the median home price in San Francisco of roughly $1.6 million. In other words, demand is very high at this price point. With mortgage rates so low, many dual-income couples can afford this price point if they have a 20% down payment.

The sellers set an offer date of March 6, 2020, two weeks after listing. This is customary in San Francisco as it allows the agent to host two broker tours on Tuesday and at least two open houses on two weekends. Two weeks also creates a small enough window for motivated buyers to put in an offer.

By March 6, the S&P 500 had already begun its downward descent. We had already all heard about the coronavirus when this house first came on the market on February 21, 2020.

The Final Sales Price

Guess what the final winning offer was?

How about $1.65 million for a reasonable 10% over asking during a coronavirus pandemic? Nope.

How about $1.8 million or 20% over asking as the S&P 500 and the Dow were crashing by 30%? Wrong again.

OK, surely $1.95 million, or a whopping $455,000 over asking was the winning price as the coronavirus shut down the Bay Area economy with shelter-in-place. Man, you are bad at guessing!

The property closed on March 25, 2020 for $2,088,000 or an incredible $539,000 over asking.

Besides the final sales price being 39% higher than the list price, the final sales price was also 7.5% higher than Redfin's estimate of $1,946,632. Out of all the online real estate companies, I think Redfin has the most accurate estimates.

Another interesting point is the closing date. If the final offer was accepted on March 8, due to multiple offers and counteroffers, then the winning buyer closed on the property in 17 days on March 25. Therefore, the buyer likely paid all-cash for the property.

Finally, what's also worth noting is that the buyer could have backed out of the property at any time before the closing, but didn't. This buyer held firm despite the S&P 500 closing down ~30% from its highs on March 23 before rebounding.

The buyer either had his downpayment safely in cash or Treasury bonds, had lots of surplus money, didn't care about a stock market crash, was glad to move money into real estate, or a combination of all four.

If you are looking to buy real estate, please follow my recommendations on how to invest your downpayment as the time nears.

The Strength Of Prime Real Estate

One example does not provide irrefutable evidence that real estate performs the best during a 15% – 25% stock market decline. Nor does this example prove that down 30% – 35% in the stock market means that real estate prices stall out. After all, the strength of real estate prices is often property and location-specific.

However, this example does show how strongly real estate can outperform in a violent bear market caused by a frightening pandemic. It is clear that properties in this neighborhood were significantly outperforming the S&P 500 while it was crashing. If the property's value tracked 1-for-1 with the S&P 500's decline, it would have sold for $1,365,000 instead of for $2,088,000.

If the S&P 500 was flat during the time of sale, I would have guessed the property would have gotten at most $1,900,000, or $405,000 over asking. I certainly would have not guessed over $2,000,000. Therefore, it is possible the violent selloff in the stock market pushed the value of this house even higher.

Here are some key takeaways from this property sale example:

- Look for property that is priced around the median home price for your city. A property priced close to the median or lower helps ensure the highest amount of demand, no matter what market.

- Single-family properties tend to perform stronger than rental properties since single-family properties usually don't rely on rental income.

- Find a property with a unique attribute, like a large lot for expansion, ocean views, or designed by a well-known architect.

- Proper marketing is very important to get the maximum price. Although selling fees are still outrageous, great marketing really does matter for getting top dollar.

- Neighborhoods with lower density may become more attractive given neighborhoods with higher density (apartments/high-rises) seem to have experienced a higher number of coronavirus cases.

- Don't just look at the most popular neighborhoods with the closest commute. Due to the rise of ridesharing and telecommuting, widen your search for better value.

Although the world is now filled with uncertainty, there is one certainty real estate will always provide: shelter. And when you're forced to shelter-in-place, your home becomes increasingly valuable!

More Real Estate Outperformance Examples

Here are some other recent alerts I received that also show strength in the real estate market in the SF Bay Area during the height of the pandemic.

Example #1: March 27, 2020

Below is a lovely Oakland single family home with five bedrooms, three baths, 3,130 sqft that was asking $2,595,000 on March 12, 2020 and sold for $2,810,000 on March 27, 2020. It was very nicely renovated in 2016.

Example #2: March 27, 2020

Below is a San Francisco single family home with five bedrooms, six bathrooms, and only 4,645 sqft that sold for a whopping $9,500,000 on March 27, 2020. Although the final sales price wasn't over its $9,500,000 asking price, the sales price is about $460,000 over Redfin's estimate price. I bet the new owner is probably going to put in more than $1 million for renovation.

Outperformance Example #3: April 14, 2020

Here's another example of a single family home in Golden Gate Heights that sold for 10% over asking. It was listed on Feb 28, 2020 and closed on April 14, 2020, well into the pandemic. It is completely renovated home without a view. But it is very well done and worth the price.

More Real Estate Outperformance Examples In April 2020

Below are four more examples of homes that closed on April 21, 2020, well into the coronavirus pandemic and lockdowns. This first home below closed for $255,000 over asking. Remodeled home up in the coveted Golden Gate Heights neighborhood, but no view.

Here's a much bigger house in the Forrest Knolls neighborhood that sold for $230,000+ over asking. Closed on April 21, 2020. You get more bang for your buck when you purchase a larger home. The house hasn't been remodeled in a while.

Here's a lower priced how that originally asked $1,295,000 on February 28, 2020. It finally closed on April 21, 2020 for $1,820,000, or an impressive $525,000 over asking. That's 40.5% over asking folks. The house is on a standard 2,500 sqft lot with only 1.5 bathrooms. The home hasn't been remodeled in 30+ years, but it does have views. View homes are always going to command a premium and hold its value.

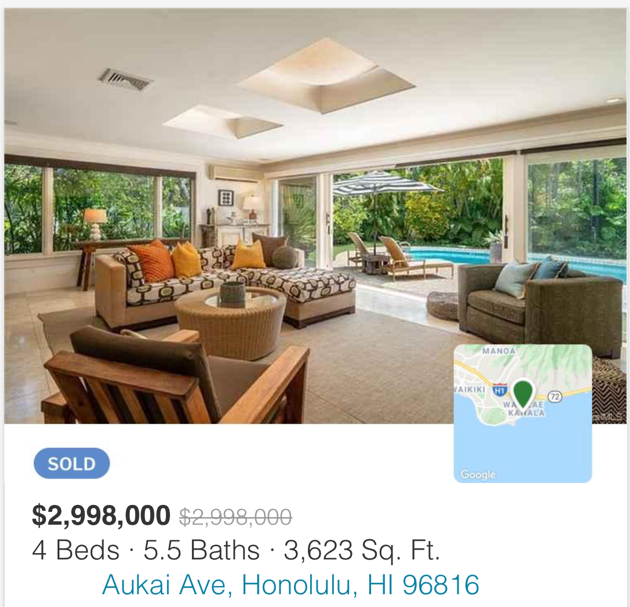

Surprised A Luxury Honolulu Property Sold

Below is a home in Kahala, Honolulu that I visited a year ago. It is in a great location on a corner lot 1.5 blocks away from the beach. I was considering buying the home, but it was dated. I was thinking it would be on the market for another one or two years, ultimately dropping the price down to $2.6 million or so.

Therefore, I am very surprised this home sold for asking at $2.998 million. In San Francisco, homes that are on the market for over 1-2 months definitely get haggled down.

A Very Nice Over-Asking Sale

Below is property that was listed on April 10, 2020, almost a month AFTER lockdowns began in San Francisco. At $1,975,000, it is priced about 25-30% above the median home price in the city. But it is still priced below $2 million, which is the magical “affordability” threshold where most dual-income buyers can afford to buy.

The property closed 38 days later on May 18, 2020 for $2,325,000, or $350,000 over asking, or 17.7% over asking. The property is in a good, quiet area in San Francisco. But $1,147/sqft is a top tier valuation and the property doesn't have some amazing unique attribute. It's a typical 3/3. And maybe that's the point. A typical 3/3 single family home in the low $2 million price range is highly desirable for a family. At least it has all three bedrooms on one floor, which is rare for the size.

Here's another example of a 3/2, 1,531 sqft, lightly remodeled home selling for $330,000 over asking to $2,225,000 on May 19, 2020. The property was listed on April 27 for $1,895,000. It's only 1,531 sqft folks. Come on.

Real Estate Outperformance Examples In May, 2020

Here's an example of a 5/3.5 single family home that sold for $405,000 over asking. It closed on May 21, 2020 after being listed on April 30,2020. The offer must have been all cash given the quick 21-day close.

This is a pretty cool property that's great for a family because it has four bedrooms on one floor and a play area in the attic. In addition, there are two tennis courts across the street, a playground, and a nice field! I could definitely see us raising our two kids here.

On the downside, the roof looks old, you've got to walk up a lot of steps to get to the front entrance, and the kitchen and bathrooms are dated as well.

Real Estate Outperformance Examples In June, 2020

Below is a nice 5 bedroom, 2.5 bathroom,2,750 home in the Inner Sunset that closed escrow on June 19, 2020 for $3,276,000. The list price was $2,849,000, so the sales price was $427,000 or 15% over asking!

The house is nicely remodeled and is walking distance to Golden Gate Park, the shops on Irving and UCSF Parnassus and even Cole Valley and The Haight. Personally, I'd much rather be up in Golden Gate Heights with panoramic ocean views and away from so many people.

Real Estate Performing Strongly In San Francisco In July 2020

Here's a handsome 4 bedroom, 3.5 bathroom, Ashbury Heights home that sold for $3,895,000 on June 30, 2020. It's got 2,878 square feet with nice renovations. $3,895,000 is $100,000 over asking and $1,353/sqft. The home was sold for $2,625,000 in 2017.

Below is a gorgeous 4 bedroom, 4 bathroom, 2,810 sqft single family home that sold $200,000 above asking to $4,900,000. It is an amazing hom due to the views and finishes. It has everything a family would want, at least my family of four. Too bad it costs $4,900,000! It closed on July 17, 2020, well into the pandemic.

Real Estate Outperformance Examples In August 2020

Here are other great properties in San Francisco that are pending or sold way above asking:

258 Sussex St., 2/1.5, 1,193 sqft sold for $1.625M on August 10, 2020. Ask was $1.398M.

95 Anzavista Ave, 4/3, 1,970 sqft, sold for $2.1M on August 12, 2020. Ask was $1.975M.

Real Estate Strength In San Francisco In September 2020

910 Lawton St., 3/2/, 2,100, in contact for $2.299M and will likely sell for $2.32M by September 20, 2020.

150 Rivoli St., 4/3.5, 2,986 sqft, sold for $4.8M on September 4, 2020. The original list price was $4.995M on August 2, 2020. However, getting $1,607/sqft is still a massive price point for Cole Valley.

22 Taraval is a 4/3.5, 2,902 sqft home that sold for $2,825,000 on September 10, 2020. The asking price was $2,695,000. Nice looking home in San Francisco’s west side where the air is better and the neighborhoods are less dense. Taraval is a relatively busier street at that section.

Below is another example of real estate doing really well in San Francisco. Here is a regular 3 bedroom, 2 bathroom, 1,992 sqft home on the west side of San Francisco selling for $455,000 over asking on 9/23/2020.

The home should have sold for about $1,000/sqft or $2,000,000. But it got 7.5% over what I think is fair value given it is a single family home with a yard on the west side of the city. There really is a great intracity migration out west.

San Francisco Real Estate Outperformance Examples: October 2020

San Francisco real estate prices continue to go up 7+ months into the pandemic. The city is slowly opening up with museums and playgrounds now open. Life is getting better and the NASDAQ is still up over 28% YTD.

The great migration to the western portion of San Francisco continues. I just rented out my 4/3 Golden Gate Heights home to a unicorn tenant: a family. Before, I only had interest from 4-5 male engineers.

Families and people in general are moving out west for more space and better value. People want to see the ocean, breathe fresher air, be away from congestion, live in safer neighborhoods, and be closer to parks.

Below is a lovely remodeled home that sold for $205,000 over asking in a few short weeks. The home closed on 10/16/2020 and is near Golden Gate Park. It has a nice backyard too.

168 Dorantes Ave, San Francisco, CA 94116 – Asking $2,575,000, sold for $3,025,000 on Oct 22, 2020. Redfin estimate is $2.85 million. Nice house, but bathrooms are from the 1990s.

452 Ulloa St, San Francisco, CA 94127 – Asking $1,795,000, sold for $2,020,000 on Oct 22, 2020. Redfin estimate $1,860,000. Decent remodel. Bedrooms are small upstairs.

San Francisco Real Estate Outperformance Examples: November 2020

Thank goodness Pfizer and Moderna have announced vaccines with their high efficacy! I think there's going to be a big rebound for big city living again once the vaccine is readily available by summer 2021. As a result, savvy investors are buying up San Francisco and other big city real estate now. NYC October YoY purchase figures are up 33% as another example.

Below is a great example of how demand for single family homes on the less dense, western side of San Francisco is hot. This 2,305 sqft, 4-bedroom, 3-bathroom, remodeled home in the Inner Sunset sold for $705,000 over asking (35%). The final sales price of $2.7 million is also 15% over Redfin's estimate of $2.338M, which is pretty accurate at $1,000/sqft IMO.

Here are even more November 2020 real estate outperformance examples.

Real Estate Doing Well In 2021

Here are more recent real estate sales price examples in San Francisco. I might as well keep this real estate outpeformance examples during a coronavirus pandemic going!

January 2021

Below is a nice 3/2 that sold for almost $500,000 over asking in January 2021.

Here's another one that sold in January 2021 in my favorite neighborhood, Golden Gate Heights. It sold for a solid $1,000+ a square foot with nice views. A very close comparable sold during the height of the pandemic in 1Q2020 for $200,000 less. Therefore, San Francisco home prices on the west side of the city are up about 6-7% from the 2020 bottom.

Here is a $530,000 overbid for a classic single family home in the inner Richmond district on February 11, 2021. The final home sale is $341K over Redfin's estimate.

February 2021

Here is a nice home in the Forrest Hill neighborhood that closed on February 23, 2021 for $611,000 over asking. The closing price is more than $330,000 over Redfin's estimated price. I suspect Redfin and Zillow will likely be updating their algorithms aggressively in 2021 and beyond.

March 2021 San Francisco Real Estate

Hope reigns supreme as of March 2021. A quarter of Americans have received the first shot of the vaccine and vaccine supply continues to ramp higher. The stock market is at all-time highs. Real estate demand is also at all-time highs.

I'm seeing a significant real estate online pricing upgrade cycle because the pricing algorithms from Zillow and Redfin simply cannot keep up. There are so many bad pricing estimates now it's getting comical. Use the bad pricing estimates to your advantage!

Here are more examples. A charming 2/2 was admittedly underpriced at $1.395 million asking. But still sold for $465,000 over Redfin's online pricing estimate! $1.71 million is a fair estimate given the size of the house. Supposedly, there were over 100 showings for 69 Idora Avenue.

Also check out 65 San Lorenzo Way. It asked $3,100,000 and sold for $3,700,000 in March 2021, about $120,000 above Redfin's estimate.

May 2021 San Francisco Real Estate

If it's not obvious by now, San Francisco single family homes are in high demand. My favorite home in my favorite neighborhood went up for sale at the end of March 2021. It was listed for $3,100,000 and finally sold for $3,525,000. The great thing about this house is the lot size. It's got a huge enclosed front yard for the kids to play. It also has a wonderfully landscaped backyard.

The home has views, 4 bedrooms, and 3.5 bathrooms. I was going to buy the house if it miraculously had no buyers. Alas, there were 11 offers.

But it is not a perfect house to raise kids in a big city. Only half of the house has updated electrical wiring. Most of the windows are still the original. There is not deck off the living room or bedroom floors. Finally, if you have two young kids, you may want a fifth bedroom for guests, au pair, or an office. Also, 2,781 square feet is smaller than the house we bought in 2020 for much less.

All the same, the below house is a trophy house. It just needs about $150,000 in work and a year of time to make it better. The buyer is a young couple. It's nuts how so many people can buy expensive homes in San Francisco. I guess the NASDAQ up 43% in 2020 helps!

Here's another interesting overbid of $4,999,999, or $1,199,999 over asking. It's as if the seller was nice and didn't want the buyer to have to overpay at $5,000,000. Psychologically, paying $4,999,999 feels better than paying $5,000,000. This 5-bedroom house closed on May 14, 2021.

Here's Redfin's estimate, which was 20% off. The San Francisco single family housing market continues to be red hot. IT seems like some people are taking some profits from equities and crypto to buy real estate, which is smart.

But online real estate companies like Redfin and Zillow are seriously behind in their pricing algorithms. Inflation is too powerful of a force to ignore, which is why getting at least neutral real estate by owning your primary residence is probably a good idea.

Here's another nice west side single-family home that closed on May 28, 2021. It closed for $1,335,000 over asking to $4,250,000. It's a nicely done 5-bedroom home that has been recently remodeled. The house was clearly underpriced. However, fair market value is closer to $3,850,000 in my opinion.

But Redfin estimated the house to be valued at only $3,243,000, or a whopping $1,006,974 below the sales price. I've never seen Redfin get their estimate so wrong (~30%) before. Therefore, it's clear these homes are making new highs.

July 2021 Real Estate Outperformance Examples – Breakout!

Finally, I'm seeing big consistent breakout pricing in three-bedroom, two-bathroom, single family homes in San Francisco. Here are the latest three in Golden Gate Heights, my favorite San Francisco neighborhood.

1909 11th Avenue sold for $505,000 over asking to $2,300,000 on July 12, 2021. It is a standard three bedroom, two bathroom home with 1,983 square feet.

1838 11th Ave, San Francisco, CA 94122 is another 3/2 single-family home (1,845 sqft) example that listed for $1,650,000 and sold for $2,300,000.

1972 10th Ave, San Francisco, CA 94116 is another 3/2 single-family home (1,986 sqft) example that listed for $1,595,000 and sold for a whopping $2,450,000 on July 30, 2021.

This is the type of breakout pricing I've been waiting for.

I highlight this home because it s a typical middle class home for a family of up to four. Further, it is similar to the home I bought in 2014 in Golden Gate Heights for $1,240,000.

The main differences are that my home has panoramic ocean views on both levels, a luxury master bathroom, a huge deck, a hot tub, and land all around it for kids to play. I invested about $120,000 in remodeling my place for an all in cost of around $1,360,000.

Given 1909 11th avenue sold for $2,300,000, I've got to believe my house could sell for at least $2,400,000. This would mean a 100% gain in six years, and a 74% gain in six years after factoring in remodeling costs.

August 2021 San Francisco Real Estate Outperformance

It feels like the real estate market is finally slowing. However, there are still some major overbids occurring. Below is the biggest price for a house this size I have ever seen.

177 Belgrave Ave,San Francisco, CA 94117 was listed for $2,995,000 on August 5, 2021. The house is only three bedrooms, two bathrooms, and 1,920 square feet. It got over 14 offers, 7 of which where all cash.

The final price was $4,600,000, or 53% over asking! This is an incredible price that has never been seen before. The house also is a fixer and needs a lot of work.

The lesson from this house is to buy view properties in major international cities. The demand seems to always be huge for these type of properties.

November 2022 Real Estate Outperformance Examples

There are some big wins and some price cuts happening. One big win is 610 Ortega, which was priced at $4.35 million and sold for $4.635 million. This is the highest price point in the Golden Gate Heights neighborhood I've seen.

2024 Real Estate Outperformance Examples

After a slow 2023 due to a large increase in mortgage rates, bidding wars are back in San Francisco. So much wealth. has been made in technology that people are spending their money on nice homes again. There is tremendous pent-up demand for San Francisco real estate due to a pause in buying in 2023.

My favorite real estate outperformance example is 150 Santa Paula Avenue in St. Francis Wood. It has 5 beds, 3 baths, 3,585 sqft. Asking price of $4,795,000 and sold for $5,705,000, or $910,000 over asking (19%). The seller received a preemptive offer only one week after listing, so there was actually no bidding war.

The house sits on a large 8,659 sqft lot, which is extremely rare in San Francisco. For a family with children and dogs, this enclosed yard is special.

This is my favorite house because I bought a similar forever home in 2H 2023. However, my home sits on an even larger lot that's usable.

2025 Real Estate Strength In San Francisco

2025 continues to be a strong real estate market in San Francisco, largely due to the rebound in tech stocks and the growth of artificial intelligence. OpenAI, for example, raised another $40 billion at a whopping $300 billion valuation in 2025! That's up another 100% from a year prior. Incredible.

I know the San Francisco housing market is hot because I sold my old home, which I turned into a rental. I got a strong preemptive offer, which I countered twice, and ultimately got to my aspirational sales price.

I then took about 65% of the proceeds and bought the stock market dip. The rest I'm investing in Treasury bonds and private real estate deals. It's important I reinvest the proceeds in a way that mirrors the risk profile of my home.

I'm a fan of investing in private real estate in the Sunbelt region where yields are higher and valuations are lower. These investments help me diversify away from my expensive San Francisco real estate holdings.

Real Estate Weakness And The Mortgage Market

Condos in SOMA and Mission Bay are in lower demand because inventory is so high. Those are not neighborhoods where people have traditionally lived. They are new neighborhoods that have been manufactured more recently to be close to work.

There is continued tightness in the mortgage industry, which borrowers and buyers need to be aware of. Only people with the best credit and the strongest financials are getting mortgages.

Anybody looking to sell now, more than two months into a lockdown, is a motivated seller. I would not overbid on a property. Instead, follow my real estate buying strategies during this pandemic.

Be Patient With Real Estate Opportunities

If you're looking to buy a single family home, hopefully you can find some deals in this market. Unfortunately, I'm not seeing many as sellers pull their listings, causing an even greater shortage of inventory.

Many savvy buyers are looking to buy San Francisco real estate before an inevitable V-shaped recovery in 2021/2022 once there is herd immunity. I'm very bullish on big city real estate now. It's smart to buy before the herd comes rushing back!

In an unexpected move, mortgage rates surged higher and how average about 6.5% for a 30-year fixed-rate mortgage. As a result, the real estate market has come to a standstill. Buyers are getting squeezed and are not as motivated to buy with a potential recession. Meanwhile, sellers, with their sub 3% mortgage rates, are not motivated to sell.

I suspect San Francisco real estate prices will come down by 5% – 8% from their April 2022 highs. As mortgage rates come back down by 2-3% by mid-2023, I expect demand to pick up again.

The ideal time to buy real estate or a move-up home is coming. Be patient.

Real Estate Recommendations

If you're looking to invest in real estate, take a look at Fundrise, one of my favorite real estate marketplaces today. You can diversify into real estate for as little as $10 into one of their funds, instead of leveraging up with debt to buy a single property.

Although past performance does not equal future performance, Fundrise returns has shown relative stability during the previous two flat to down markets in 2015, 2018, and 2022. I think real estate is going to be a winner in an inflationary environment. Stocks are too expensive for my tastes here.

Although past performance does not equal future performance, Fundrise has shown relative stability during the previous two flat to down markets in 2015 and 2018. I think real estate is going to be a winner in an inflationary environment. Stocks are too expensive for my tastes here.

With remote work and work from home trends booming due to the lockdowns, lower cost areas of the country should benefit. I've personally invested over $1,000,000 so far in real estate crowdfunding to diversify my investments and earn rental income 100% passively.

Fundrise is a long-time sponsor of Financial Samurai and I've invested over $300,000 in Fundrise so far. Our investment philosophies and styles are aligned.

Seeing the list vs sale price at 434 Vicksburg is what convinced me of two things (1) this real estate market remains strong, for the right properties, (2) as a result, there are likely good buying opportunities elsewhere in the city as it emerges into recovery. As a result, am getting into the home buying market during what looks like an opportune time.

One of the possibilities everybody’s thinking about is buying before the vaccine. Because once there’s a vaccine, we could see a tremendous rush back or a massive uptick in interest in big city living that would drive price is much higher.

There haven’t been many opportunities to buy San Francisco real estate a good value. There is more opportunities now but opportunities are fading for good properties. Bad properties are always going to be difficult to sell.

I’m impressed 434 Vicksburg, at only 1560 ft.², got $2.25 million.

I currently live right around the corner, so I know the neighborhood well. Like Jersey and Elizabeth St, Vicksburg is highly sought after. This house is a mere 30 second walk from the 24th St shop strip. The price per square foot is mid $1400s, which is high but not unheard of in Noe Valley. A year or so ago a condo in the building next to ours set the price per square foot record in the same territory. Assuming some modest upgrades, this house will hold its own. Had I been in the market back in May, I may have seriously considered it. As it is, about to close (I hope) on a nice single family home at the inner/central Richmond boundary. Getting 2000+ livable square feet and a 3000 square foot lot in the process for about the same price.

Cool. Enjoy! During this time, you’re really going to appreciate a nice house with more space. I really love love love living in a larger home, especially since we added a new member to our family.

The west side of San Francisco and neighborhoods in general should hold up well.

Where is all the demand going to come from? As prices rise, fewer people can buy and more want to sell – it just seems that a lot of articles talk about huge demand post-vaccine as a certainty. There are a lot of reasons there may be less demand: work from home means you can go anywhere (and 10-20 percent pay cut actually is a good deal!), high taxes causing out migration, ripple effects in the economy that hit tech (see SAP, plus HPE is moving to Texas, etc) etc etc

I’ve also seen some seemingly believable data that in general larger homes are selling, so prices are up (but price per sq foot is not). Rates + low supply certainly has a positive impact on prices but it’s not infinite.

And – the slowdown in condos must hit the broader market – those condo sellers will not have as much to spend when they upgrade.

Sure, prices could continue to rise, but it doesn’t seem to be a certainty. And without better data on number of offers (which I admit isn’t available), we could be in a situation where seller’s are PERCEIVED to have all the power and there’s at least one buyer per home who will pay that price (given low supply). But if confidence wanes, maybe that doesn’t happen?

Over here in Oakland I’ve seen more than a handful of homes sell for less than they sold for in 2017, 2018, 2019 – or some that have appreciated just in line with inflation. I think that’s called a ‘narrative violation’ but it’s happening, and if buyers no longer believe that “you can’t overpay in the Bay Area” (because some people clearly did) do others just let sellers name their prices?

We were looking at a home here that was sitting for 2+ months, had a price reduction (but only to get interest, the sellers did not actually change their price expectations), and the expectation was to sell it about 100K under the comps. But- the home needed $50K+ to fix the foundation and another $50K to upgrade the kitchen and a bath (which were roooough). Why not just buy the home down the street that is ready to go and avoid the trouble/risk! It’s pending now so maybe someone just couldn’t wait to buy and gave in? But that seems different than 10 people lining up to make offers.

Contrarian opinion.

Hi Sam,

I’m looking to buy about 2 acres of land in Portland, OR. We’ve had my eye on a 2 acres lot listed for $395,000. It’s way overpriced because it has no utilities. We’ve been looking at it and getting up to speed on permitting and building since it went on the market in September 2019. We cannot pay cash, but instead, want to get a home equity loan on our condo which is paid off to buy the land and then get a mortgage to pay for land development and construction. Do you think it’s a bad time to do this right now? We were thinking of offering $300,000 which is on the high side given comparables.

How do you feel about buyers in the current market? We are buyers and have been contemplating a move to Oakland/Piedmont area or Orinda/Lafayette. We are happy in our 2 bdrm rental in the mission bay with our toddler and are hesitant to pull the trigger due to the uncertainty. Do you see prices dropping? Is there any advantage to purchasing now?

Thanks!

I’m personally looking for deals right now, but I can’t find any. I’m looking for the seller who sold stocks at SP 500 2,260.

Same, we saw 1 property that took an offer off market under asking in oakland as the shelter in place started, now the agent is regretting his seller take that offer (we would have offered more). Other than that, almost seems like pricing has not skipped a beat, only the frequency of it has slowed.

Financial Samurai, I notice that you own two condo rental properties and often discuss that you wish you had bought another condo in NYC. Most real estate investors have advised that I not buy a condo for an investment but rather buy multi-families. Can you please explain why you have chosen condos? The cap rates and control are lower with condos but is it the ease of ownership you like? Thanks.

I have one rental condo in SF that I bought in 2003. As my first property, it was what I comfortably could afford at the time. My other property is a 2/2 condo in Lake Tahoe. I bought it for lifestyle reasons as I didn’t want to maintain it.

I do think buying a two-unit or four-unit building would have brought me more wealth, as I ended up buying a single family home in 2005 with space I didn’t need. But I still sold it for a handsome sum in 2017.

This article should help: The different types of real estate to buy

And this one on buying and managing rental property.

Long time reader of your site and this particular item peaked my own interest as a landlord/investor myself. I have been analyzing sales in San Fran, LA, San Diego, etc that have closed in the past week and it appears the vast majority of sales are going for over asking price. San Francisco in particular appears to have the highest percentage, some I’ve seen over 20% and they’re selling quickly! I believe it is too early to tell how this will play out, but perhaps this can be a tell that real estate is being used a hedge in these uncertain times. New purchases may start do decline as banks tighten their lending requirements, however low supply from lack of construction since the last recession may in fact save real estate from a large downturn this time around.

There is definitely a rotation into real estate from Stocks. Then you look at tech stocks like Netflix at all time highs, so people have the money. And people are also working up that stocks can lose value overnight where is a lease with real estate, they can have a place to live and enjoy life.

I have closed a home on April 3 2020 in Austin. I got interest rate 2.75% fixed for 30 yrs, so i went for it. Lot of people discouraged me by pointing real estate will go down 40%-50%. One thing people doesn’t realize is that 2008 crash was fueled by mortgage and financial. It is not a system failure in 2020. I highly doubt RE will go down in high demand markets like Seattle, SF bay area, Austin , Dallas. For me , Buying luxury home should be in good school district , low crime rate area. Rental property should be closer to public transport and closure to major employers.

Amazing rate. How did you get the 2.75% fixed? Did you buy any points?

Nope. I just got lucky when i locked the rate on March 03 2020. Thanks to my amazing loan processing officer, I didn’t buy any points. In fact, paid closing costs around $2k (for under writing, loan processing,appraisal ,credit report, attorney fee, escrow fee) which is common.

Still lots of listings and pending/selling properties in Seattle…except for our South Lake Union condo, which has been on the market for almost 3 weeks now. Going to do a $20k price reduction to see if anyone bites, but if no offer after that, we will probably just wait this out =/

Dude, that’s not a single family house. That a town house. Or in Baltimore we call them row houses.

Single family home does not have a shared wall.

When I was in SF 18 years ago I rented a room for $400 at this old German lady’s house. It was a real free standing house with at least 10 foot clearance from adjacent neighbors. It was 4 bedrooms, not sure how many square feet. It was in Twin Peak, pretty foggy area, but my room does have an unobstructed view to the ocean on a clear day.

I wonder how much that house is worth now $2.5, 3 mil?

You think the house has now appreciated by another 20-45% just a week or so later? Maybe, given the stock market is rebounding, but I doubt it.

Real estate is worth significantly lower today. You just don’t know it yet. Even Zillow and others pulled out of all pending contracts in their iBuyer programs. Even they know Real estate will now be worth significantly lower than before the pandemic. As many many people and companies across the country will stop paying their rent and mortgages, it’s a little reckless to say real estate outperformed during a pandemic.

It’s fine to have an opinion. That’s why we have a market and you were welcome to sell all your risk assets in March. However, these are real-time examples during the worst of the sell-off so far.

I understand if you are scared right now given all that’s going on, but to deny these examples of outperformance doesn’t make sense. They are closed transactions.

Will know soon whether 18th Ave had a buyer using mortgage

Either way – likely had the cash needed out of the market before or shortly after the offer

It says market was decent going into this – still hard to read current market

Interesting thing looking at some of the recorded sales and owner / loan records in SF – some are buying the house getting the mortgage while working for a big name like Linkedin, Facebook, then jumping to a private venture backed firm (riskier)

Hey I read your article on real estate and the Coronavirus. Had a few comments and thought maybe you would get a chance to respond. I’m from NYC and real estate here seems almost impossible to break into. My neighborhood average for a single family home is 1.2 million. At 20% down you would need well over 100k for a down payment plus the millionaire tax and no more SALT deductions. With the Coronavirus in full effect here I was interested in it’s impact on real estate and came across your article. On average there are anywhere from 10-15 deaths per day in each neighborhood in each borough. There is no way to tell if everyone is Coronavirus related or not because of the lack of testing. Who is going to test the deceased that were not tested when they were alive?

With that said the amount of deaths plus the growing unemployment, I would have to think that real estate would take a major hit. I would estimate almost half of the small business that have closed will not reopen when this is over. I just can’t see the owners overcoming not having a business open going on three weeks now. I would think this would cause many people to either pick up and leave, leaving a large hole in the rental and sales market. With so many deaths happening I could also see many homes going into foreclosure or estate sales. This would make the amount of homes available greater then demand. I would be interested to see if you think that real estate would take a major hit with how the Coronavirus is unfolding in NYC.

People at work were laughing when I told them about the Coronavirus back in January. I had the foresight to stock up on goods when the first cases hit California and Washington. Next thing you know you could not find a mask, sanitizer or toilet paper in NYC. I hope my foresight is right with the real estate market. People in the city are still not taking this as serious as they should be and I think this will last a lot longer then the governor or mayor think it will.

Th PPP is a game changer in my opinion. It makes me more confident that 2H2020 will see a recovery.

I want to buy a mountain view property in Tennessee pigeon forge area. I want to get a 400ks for les than 200k. Which will be possible in the next 9 months to 2 years

Sounds great! Keep us updated. It’ll be awesome for so many folks to get bargains if they happen.

I’ve been waiting 4 years for a beach property in Hawaii.

Hi Sam,

can you comment on Fundrise and what seems to be difficulty with withdrawing any money, even requests made prior to the pandemic issues and business closures? I was willing to pay small fees to withdraw the money to help with the purchase of a small business. Your thoughts please? thanks, Daniel

Good question. During temporary market disconnects, many private investments prohibit withdrawals to not negatively affect the entire portfolio. Having “bank runs” is not good for business, as huge redemptions create forced selling situations not based on fundamentals.

With Fundrise and other private real state investments, it’s better to invest in 3-10 year increments with money you don’t need. The illiquidity is actually one of the benefits of private investments because there are fewer investors who freak out and panic sell. Fundrise performance has been pretty solid during stock market downturns.

Hopefully nobody has to sell any of their passive income investments during a downturn. That is what the emergency fund is for. With the CARES Act, stimulus checks, and higher unemployment benefits, hopefully the majority of people can get through this 2-3 months self-imposed economic closure and come out fine.

I’m not touching any of my passive income investments. Just adding to dividend stocks initially since they’ve already been beaten up. Real estate is drastically outperforming stocks so far.

Never really thought about this, informative article! I figured during a crisis like this people would want to stay liquid and not lock their money up.

San Diego – The fewer contracts that signed in late FEB or early MAR are still selling with the same appreciated gains seen in the last year.

Bottom Line – It’s too early to make a judgement call. The next 4-12 weeks will be more of the telling story. And maybe much longer than that. Some mortgage payments are allowed up to 12 months deferral due to the pandemic.

I see 2Q as a write-off for many industries. It is a potential for buyers to take advantage, which is probably the same as in many industries. I will be aggressively looking.

Maybe they are buying, to stop making payments lol

(My first post) I would like to buy a place if the prices drop however, I am in a rent-controlled 1bd. apartment w/garage parking in a great SF neighborhood and pay $980.00 mo. I have managed to save and invest over the years and have about $725,000, 1/2 in stock market now. Should I even be thinking about buying at my age (50).

Depends on your needs. $980/month is cheap. Hard to give a rent-controlled apartment up. But also hard to live so frugally for so long with your one and only life. What’s your income security like?

I always enjoy spending up on a house since I spend so much time in one.

Income security was great until recently but still pretty solid. I forgot to mention my partner of 10 years is paying $1,400 so combined it’s $2,400. A 1 bd. is too small for both of us but doable if nec. But you’re right! I would want to buy to improve quality of life and enjoyment NOT primarily as an investment. I like the carefree lifestyle of renting but I could get a speed freak neighbor from hell again!

Gotcha. Your partner is extra security then. I would look for deals during 2Q. It’s easy to do online and there is no downside.

I’ve never regretted spending up on a better life. It gives me max joy to replace old windows, update a bathroom, play with my son in our little backyard etc. If my house goes up in value in 10-20 years, great. If not, it’s fine b/c I enjoyed living in it and not paying rent.

Although, paying property tax is very painful!

Property tax in SF is horribly painful! Bought my first house a year ago. A single family in the excelsior. I’m surprised you include the excelsior in the worrisome section of your map. I’m betting on it being a hot neighborhood in years to come due to its relative affordability, proximity to the peninsula, and having mission Street running through the heart of it. I’m guessing the gentrification that’s happened along Mission St in the mission and Bernal will continue south. But who knows. At any rate, this is where I could afford to buy a SFH.

Earlier this year we got loan approval with the intention of buying a condo in Kakaako. I had been following the market there closely and I noticed that as long as it’s the right building condos will sell as soon as hitting the market. $3 million no problems. Since the turbulence started in earnest in early March I am noticing there is not a lot selling, those that have been sitting stale on the market for an extended price are not reducing, however I’d say a good 10% of those that were listed have been wtihdrawn from the market.

No harm submitting a lower offer and seeing what happens.

https://www.financialsamurai.com/spray-and-pray-the-cheapest-way-to-invest-in-real-estate/

Sam- appreciate this article. I live in Fairfield County CT and have purchased a new home, and was about to list mine last month. Then the virus hit and really shut down the brokerage side of things. I am hoping the market bottomed and that you are right with real estate and that in the next couple months what would have been the spring market picks back up again. I’m a bit worried though about getting what I thought we would. Was going to list for 1.45 and still may- its the median home price or maybe 50K above in my town.

I also have been noticing and when I read some of your other articles over time that the renatl market might not be a bad idea. Rent for a year and then list next spring. Or who knows if we get enough for it keep renting – however there may be better opportunities in the heartland or areas where I could buy for a much lower price point and have a much higher cap rate.

Any thoughts on delaying the sale and renting for 1-2 years?

You purchased a new home and now want to list it? Or you want to list your old home?

Don’t know your finances, so unsure what to say. I don’t think 2Q2020 is the time to list since the market is frozen and there will be vultures trying to get a great deal.

I purchased a new home, larger space for growing family, in same town that we will be moving to in June. I have my old (current) home that I was looking to list and sell. Still may list at the end of April / early May to sell but also just thinking about listing it to rent.

I do think there is a chance that the suburbs get more of a bid from folks leaving the city. But … not super confident in that short term.

This article is insane! We aren’t in a typical recession; this is a full blown economic depression. Real estate prices are set to follow Japan in the early 1990’s as the US is now caught in a liquidity trap. Large cities like NY and SF are becoming a public health nuisance; landlords have no idea if they will collect rent from tenants. Unemployment is projected to reach 30% within a quarter; don’t try and catch a falling knife or you’ll get stabbed.

I appreciate your negative outlook and I would be concerned if there wasn’t more negativity frankly.

It was very scary for me to buy about $600,000 worth of stocks in mid-March, but I held my nose and bought on the way down after writing my stock market bottom analysis post.

The goes for buying real estate now and hunting for opportunities during COVID-19. I’m aggressively trying to find the real estate seller equivalent to the stock seller who sold when the S&P 500 collapsed to below 2,300.

Dan, did you end up selling your stocks and other risk assets in 2020?

I see you are still very bearish real estate in my other post, even though real estate prices have sword since the pandemic began.

Single family houses are an emotional purchase and hence the price would be disconnected from reality at the start. I’m quite bearish with this pandemic and wrote a post on how bad it can get and why.

I’ll be happy if my prediction does not come true cause it means we have weathered this better than I anticipated; and that’s a win for all.

Yep, the vast majority are bearish, so that is the default assumption. But the interesting thing is, not many people seem to be hurting, yet. Are you?

I’m looking for the positives and what might come out of it.

Sam, anyone who says they are not hurting would be lying. It’s only a question of bearable pain that they prepared for. I’d be ok with maximum 1500 levels on S&P. Lower and would be bleeding.

I was waiting for everything to cash, I am making dough now.. I serve the poor. High and middle class will come down for the next year or two… time to make some money.

We put our house on the market in Atlanta 9 days ago – only two showings last week and nothing in a week. We live in Buckhead, in a great school district, and normally our house would have sold quickly (although Atlanta is never a crazy real estate market). We’re under stay at home orders and although real estate is exempt, I don’t think people are wanting to go into houses right now.

Makes sense. Thanks for the color. I’d pull it and relist once stay at home is lifted.

Tulsa, OK

Listed our primary residence last week, and within 4 days we had 10 showings and 2 offers. Median in this area is around $250k, ours sold for $375k (under contract this past weekend). Very desirable neighborhood with large lots, and walking distance to nice country club.

About to list our previous residence, which has been rented now for 7 years. Area median is $215k and we will list for $245k. Newer neighborhood with neighborhood park and swimming pool. Similar homes have been selling in 2-3 days max over the past 2-3 weeks. We expect to have a contract on it quickly.

With rates low and inventory fairly low, most things seem to be moving quickly. Houses over $500k seem to be moving a bit slower.

Thanks for the datapoint out of the Tiger King’s state!

So is it a good idea to buy REITs now to hedge against the traditional S&P?

Publicly traded REITS are not a good hedge against stock market volatility/downturn. Publicly traded REITs are often even more volatile.

Private eREITS are a much better hedge. But doesn’t have the same liquidity.

See: https://www.financialsamurai.com/how-does-real-estate-get-impacted-by-a-decline-in-stock-prices/

Sam,

Your definitely correct about the utility of real estate. My wife has been on me for the last couple years to upgrade from our current house. She wanted a bigger kitchen, nicer bathrooms, and more space. I, on the other hand, am more than comfortable in our paid off average house simply because its paid for. No matter how much shit hits the fan we got a place to live. Over the last few days she has remarked how grateful she is to have our “average” house.

There’s nothing like a pandemic to make us realize how fortunate some of us are.

Thanks, Bill

Cool. I definitely hear you on the joy of living in a nice house. I’m frugal on many things, but not when it comes to upgrading where I live.

Sam,

Here is a recent closing example. Just closed this morning on my house in Columbia S.C. I live outside Seattle and everything is still rocking here, rentals and sales. I have 5 houses here, 4 rentals and 2 just rented yesterday.

Tim

Did you sell or buy in SC? Is Seattle rocking or Columbia rocking?