Betterment was founded in 2008 and is the largest online-investment advisor with over $30 billion in assets under management (AUM). You might be asking yourself: Should I invest with Betterment? This post will provide a detailed review for 2021 and beyond.

In the past, retail investors like you and me needed $500,000 or more for a traditional wealth management firm like Merrill Lynch to even take our phone call. Now, you can have our money digitally managed by Betterment with as little as $100.

Further, with Betterment, you can pay as little as 0.15% of the assets you give them to manage a year and a maximum of 0.35%. Betterment's low management fee is incredible compared to a 1% – 3% asset under management fee by the traditional money managers.

The key to great wealth is to start investing as early as possible. Let the power of compounding over time work its magic. Too many people don't know how or where to start investing. Betterment makes investing easy.

Methodically invest as much as possible with each paycheck. You will be amazed at how much you will have 10, 20, 30 years from now on top of your pre-tax retirement accounts.

As an finance professional from 1999 – 2012, and as a personal finance writer of over 2,000 articles on Financial Samurai since 2009, let me share with you my comprehensive view of Betterment's platform.

Should I Invest With Betterment?

If you are not currently investing and need a low-cost, smart way to invest, I think you should invest with Betterment.

Betterment automatically invests your savings contributions in a customized portfolio without you having to do any research, trades, or rebalancing decisions.

With Betterment, you don’t own individual stocks or bonds. Investments are held in the form of exchange-traded funds (ETFs). The asset allocation between these various ETFs ensures that your account is not weighted too heavily in any specific asset class, company, country, or sector, which ultimately reduces overall investment risk.

Investment Choices With Betterment

When you create a Betterment account, you will be asked a series of questions to determine your risk tolerance and investment time horizon. The Betterment algorithm then uses that information to create a portfolio tailored to your preferences. If you don't like the results, you can always adjust your risk tolerance and your answers to best fit your needs.

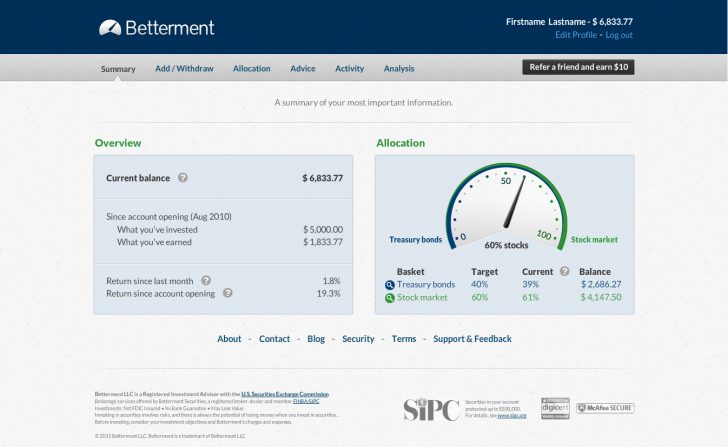

Betterment will also automatically rebalance your portfolio based on your ideal portfolio weighting. For example, if your ideal portfolio was 60% stocks, 40% bonds, the goal is to keep that asset allocation in balance. Over time, you might end up with 70/30 allocation if you never rebalance your portfolio, resulting in more risk than you originally intended. Betterment uses all available cash flows (your deposits) and reinvested dividends to rebalance your portfolio. This reduces the number of asset sales, which should reduce your tax liability over time.

As of June 2018, new Betterment customers can choose between four different portfolios based on their answers. The standard Betterment portfolio is recommended by default. New and existing clients can opt into one of the other portfolios at any time.

1) The Betterment Portfolio

The Betterment portfolio includes exposure to a variety of stock and bond index ETFs.

Stock Funds

Betterment’s investment committee has chosen stock ETFs that reflect the U.S. market and international markets. These are your bread and butter ETFs with the lowest fees and largest exposure.

Vanguard U.S. Total Stock Market Index ETF (VTI)

Vanguard US Large-Cap Value Index ETF (VTV)

Vanguard US Mid-Cap Value Index ETF (VOE)

Vanguard US Small-Cap Value Index ETF (VBR)

Vanguard FTSE Developed Markets Index ETF (VEA)

Vanguard FTSE Emerging Markets Index ETF (VWO)

Bond Funds

iShares Corporate Bond Index ETF (LQD)

Vanguard US Total Bond Market Index ETF (BND)

iShares Short-Term Treasury Bond Index ETF (SHV)

Vanguard Total International Bond Index ETF (BNDX)

Vanguard Emerging Markets Government Bond Index ETF (VWOB)

Vanguard Short-term Inflation-Protected Treasury Bond Index ETF (VTIP)

(For Taxable accounts only) iShares National Municipal Bond Index ETF (MUB)

Bonds are a great way to reduce volatility, provide defense, and generate income for your portfolio. Here's my recommend stock and bond allocation by age.

2) Socially Responsible Portfolio

In July of 2017, Betterment began offering an optional Socially Responsible Investment (SRI) Portfolio. This service is provided at no additional cost, but Betterment clients must opt into this portfolio. Existing clients can choose the socially responsible portfolio from within the “advice” tab of their account. New Betterment clients can choose this option when signing up.

The Socially Responsible Portfolio replaces the standard U.S. large-cap stock allocations listed above with a large-cap socially responsible ETF (DSI). Other asset classes are not replaced with an SRI alternative because an acceptable alternative doesn’t yet exist or because the higher fees or lack of liquidity make for a prohibitively high cost.

The SRI portfolio reflects a 42% improvement in social responsibility scores for U.S. large-cap stocks when compared to the standard portfolio, and works with all existing Betterment tax features, including tax-loss harvesting and tax-coordinated portfolios.

3) Blackrock Income Portfolio

In September of 2017, Betterment began offering two additional portfolios. The first is an all-bond portfolio designed by Blackrock to provide regular income. Blackrock is one of the largest bond money managers.

In the Income Portfolio, all stock market funds are replaced by bond funds (including lower-quality, high-yield bonds). The result is a lower risk portfolio that provides more income than the Core Betterment Portfolio.

4) Goldman Sachs Smart Beta Portfolio

Betterment tied up with Goldman Sachs, my old firm to offer the Smart Beta Portfolio designed by Goldman Sachs. This portfolio replaces the market-cap weighted indices in the core Betterment Portfolio with smart-beta ETFs designed to outperform the broad market.

This portfolio includes exposure to four factors designed to improve portfolio performance, including value, quality, momentum, and low volatility. The underlying ETF expenses are significantly higher than the core Betterment Portfolio.

Betterment Adds Custom Financial Advice

When Betterment first started, it offered no additional advice other than creating tailored investment portfolios based on your financial situation and risk tolerance. Their portfolio construction is largely based on Modern Portfolio Theory where investors are placed on the efficient frontier for maximum potential return based on risk.

Starting in 2018, Betterment now offers two personalized financial advice features for their customers.

The first feature is unlimited messaging through the Betterment mobile app. If you have any financial questions — big or small — you can securely message Betterment and receive answers from a licensed professional. The application also provides an ongoing record of every conversation that you can reference at any time.

The second feature is access to a comprehensive retirement planning tool called RetireGuide.

Betterment’s RetireGuide service uses your retirement goals to recommend an appropriately diversified portfolio. This recommendation takes into account all sources of income, your savings rate, where you live, and what you expect to spend during retirement. Betterment reviews all of your financial accounts to make this recommendation, even if they are held outside of Betterment. Here's a sample dashboard.

Betterment Helps You See Your Retirement Better

RetireGuide automatically updates with any changes in your accounts and helps you stay organized with a display of all of your retirement accounts in one place. You can also now update the age at which you expect to receive Social Security benefits and even upload a Social Security statement file from SSA.gov for precise estimates and advice.

The result is a comprehensive view of your financial progress, with personalized advice on how to achieve your financial goals and retirement goals. The RetireGuide system will recommend the amount that you should be saving in order to achieve your goals. Take a look at a sample RetireGuide output and its recommendations.

Betterment’s Tax Efficiency

One of the best features about Betterment is that it will help you optimize your tax liability through Tax Loss Harvesting. Tax-loss harvesting is selling a financial asset that has experienced a loss to reduce any taxable gains. At any given moment you might have multiple different trades and rebalances. Betterment keeps track of it all for you, which is something you seriously won't have time to do.

According to Betterment’s research, this service would have increased Betterment returns by approximately 0.77% per year over the last decade. That means this feature alone more than covers the 0.25% annual fee.

Another tax optimization feature is Betterment's Tax-Coordinated Portfolio. It optimizes and automates your asset location. It places your highly-taxed assets in your IRA or 401k accounts (tax-sheltered until retirement), and your lower-taxed assets in your taxable account. For example, Betterment will keep non-dividend paying growth stocks in your pre-tax retirement accounts and your bond ETFs in your taxable accounts.

Betterment research shows that this strategy can boost after-tax returns by an average of 0.48% each year, which approximately amounts to an extra 15% over 30 years.

Other Betterment Features

Smart Deposit: Allows you to automatically invest any excess savings that are sitting in your bank account. You tell Betterment how much you want to keep in your bank account and how much you want to invest, then Betterment uses those guidelines to automatically transfers funds from your bank account to Betterment on a regular basis. This allows you to continue building a bigger investment portfolio without holding too much cash.

Fractional Investing: Betterment can purchase fractional shares of any investment, which means that 100% of your money is working for you 100% of the time. If an ETF share costs $100 and you only have $60 available in your account, you’ll purchase 0.6 shares and remain fully invested.

Betterment Fees

Betterment has simplified its fee structure for 2019 and beyond. Essentially, clients pay 0.25% of AUM under $2M and 0.15% of AUM over $2M. If you want the Premium plan where you get access to financial professionals, the fees are 0.4% and 0.3% respectively.

There is also a minimal ETF fee of 0.1% a year on average. Other than that, Betterment charges no trading commissions, no minimum required balance, no transfer fees, and no account closure fees.

Betterment Is A Great Investing Solution

Betterment is a low-cost, safe, and effective solution to painlessly invest your hard-earned savings for a stronger financial future. Thanks to technological advances, Betterment will do all the things a traditional wealth manager would do for you, but for 1/3rd the cost. It's no wonder why Betterment continues to grow so quickly.

No longer do investors have an excuse not to invest. By simply answering a few questions, Betterment will be able to build a customized portfolio to help meet your financial objectives.

You can open a taxable brokerage account or IRA (Traditional or Roth). If you are self-employed, you can also open a SEP-IRA account. Betterment also allows you to rollover an existing employer-sponsored retirement plan (401k, 403b, pension, etc.) into a Betterment. You can let Betterment handle your retirement savings instead of a past employer. The entire transfer process can be completed online in a few business days.

Creating great wealth is all about letting your growth compound over time. At an 8% growth rate, your investments will double in nine years. In 18 years, your investments will quadruple. And in 27 years, your investments will be 8X greater!

You can sign up for Betterment here.

About the Author:

Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing. He spent the next 13 years after college working at two of the leading financial service firms in the world. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate. In 2012, Sam was able to retire at the age of 34 largely due to his investments. He spends time playing tennis and writing online to help others achieve financial freedom.

FinancialSamurai.com was started in 2009. It is one of the most trusted personal finance sites today with over 1.5 million organic pageviews a month. Financial Samurai has been featured in top publications such as the LA Times and The Wall Street Journal.