Taxes are and will be your largest ongoing liability. Therefore, it's paramount to take steps to lower your tax liability as much as legally possible.

Here are smart tax moves to make each your to help you achieve financial independence sooner, rather than later.

1) Donate To Charity

Tis the season for giving back, and in the case of charitable donations, it's also a chance to get yourself a tax deduction. Keep in mind there are guidelines you have to meet in order to claim deductions on charitable donations. The government doesn't allow deductions for items in poor condition, nor is going to give you a tax break if you donate your car to your best friend. So here are several things to keep in mind:

- You'll need to itemize deductions and file Form 1040.

- The charity organization must be qualified with the IRS and actively tax exempt. This excludes political candidates and organizations, as well as individuals.

- Used items such as housewares and clothing must be in good condition or better for them to be deductible.

- Donated vehicles can be deducted at fair market value if you meet certain requirements. For example, the charity must sell your car well below market price to a person in need, or the organization must make major repairs to increase the car's value. Alternatively, you could qualify if the charity will use the car for purposes such as delivering meals to needy individuals.

- If the total of your non-cash contributions is greater than $500, you'll need to file Form 8283.

- You'll need a written record of all cash donations with the date, amount, and charity name. So keep your cell phone bills for text donations and any relevant bank statements.

- If you donate $250 or more in property or cash, you'll need a statement from the charitable organization detailing your gift and if any services or goods were given to you in exchange.

- And if you receive goods or services for a donation, you can't deduct your entire contribution. The value of what you received must be less than your donation, and you can only deduct the difference.

- If you are volunteering and performing services for a charity using your car, you can deduct mileage at 14 cents per mile. Since that's a really low rate, which hasn't been increased in many years, you're likely better off using the actual variable costs of gas/oil.

- Travel expenses can be deducted if you go on a trip with a qualified charitable organization and you're “on duty in a genuine and substantial sense throughout the trip” per the IRS.

- Donations of property are generally deducted at fair market value based on what they would sell for on the open market.

- You can avoid capital gains on appreciated stocks held over a year if you donate them to a charitable organization. The amount you can deduct is determined by the stock's fair market value on the contribution date.

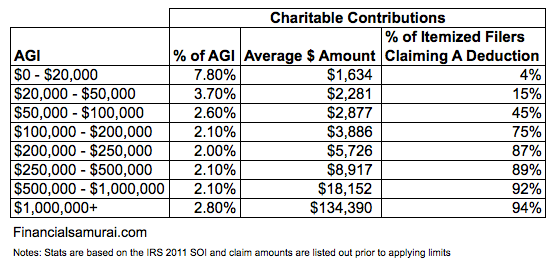

Here are some statistics on average charitable contributions based on income for individuals claiming itemized deductions. It is heart warming to see the sub $20,000 group give away such a high percentage of their income. Perhaps at this income level, it's all about giving and helping each other out to survive.

Here's another chart by the National Center For Charitable Statistics, 2013. It's interesting to see a dip in charitable contributions at the $200,000 – $250,000 mark. I believe this dip correlates well with my target $200,000 – $250,000 ideal income mark because at this level, your income is optimized to return the best amount based off taxes and deductions. It's great to see those who make more than $10 million give almost 6% of their income away. That's at least $600,000 a year!

2) Capitalize Losses On Bad Investments

If you own securities or property that have been declining and you're below your cost basis, consider liquidating before year end if you don't anticipate a recovery. Losses on property held for personal use can't be deducted however, only investment property losses can be written off. And you'll also need to look at the net of your capital losses and gains, because if your gains are higher than your losses, you'll owe money on the difference.

Property owners with a adjusted gross income of $100,000 or less may deduct up to $25,000 in rental real estate losses per year if they “actively participate” in such income. You actively participate if you are involved in meaningful management decisions of the property, and have more than 10% interest of the property. Once your income is above $150,000, the losses are phased out.

Note that you cannot deduct rental losses to your active income (e.g. day job income). Rental losses can only be deducted to passive income. Related: Mortgage Interest Deduction Limit And Phaseout

Unfortunately for stock investment losses, you're still only allowed to deduct $3,000 a year in capital loss deductions. I've had losses of $50,000 or more before that will take over a decade to deduct! At least you can carry over unused losses into the next year and so on. $3,000 isn't a huge tax break for the year if you qualify, but every bit helps when you're on a mission to pay less taxes.

3) Deferring Income And Itemized Deductions

It's good practice to anticipate and prepare for changes to your income in the upcoming year. If your income is likely to go down next year, you'll want to take as many deductions in the current year as possible. You can make additional contributions to your 401k before year end if you haven't already maxed it out, and pay out charitable contributions you were planning on paying next year in the current year.

If you time things right, you could also use your credit card to your advantage when making a donation because deductions are based on the date your card is charged, not the date you actually pay off your credit card bill. So you could make a donation in late December to benefit from a deduction in 2018, and not have to pay your credit card company for the charges until January 2019.

Business who are cash-method taxpayers, not accrual based, can defer taxable income to the following year by sending December invoices at the very end of the month. The reason this can work is the business won't receive payment for those invoices until January or later, and the business' taxable income isn't captured until the date the cash comes in. Companies and sole proprietors can also reduce taxable income in the current year by charging business related expenses in November or December that they'd normally take in Q1 of the following year.

If you're not subject to AMT, you can also consider paying property tax installments and state taxes in 2018 that aren't due until 2019. Accelerating these payments can help you benefit every other year and lower your tax burden for the current taxable year if your income will be dropping next year.

You can also try asking your employer if they can pay your year end bonus in the following year if you want to defer income. Back when I was working in finance we had the option to defer our entire year end bonus until some later date. I never took them up on the option, but in retrospect, I should have since I had some a lean year in 2013 a year after I left my job and no more lump sum severance check that was paid in 2012.

In 2017, I sold my San Francisco rental house for a healthy $2,742,500. As a result, I was catapulted into the top marginal income tax bracket. I therefore REDUCED my income from freelancing and my business to almost zero for the remainder of the year and boosted expenses.

4) Review Your Flex Spending Account (FSA)

Make sure you don't lose any money in your flex spending account if you haven't spent as much as you anticipated yet this year. Check with your employer if your plan is eligible for a rollover of unused funds until the following year if you don't have any other expenses you can claim before year end.

On the other hand, if you've already run out of funds in your 2014 flex spending account but have things like medical work or fillings to do at the dentist, try to postpone them until next year if they aren't urgent. That way you can save on taxes by allocating enough funds in your 2018 flex spending account to cover those expenses and can get the work done in early January.

5) Consider Revising Your Withholding

Even though you probably submitted your W4 to your employer ages ago, you can still file a revised form to make adjustments to the remaining pay periods left in the year. If you anticipate you haven't withheld enough taxes so far this year, you can increase your withholding to help reduce penalties and fees when you file your taxes.

Check if you've already paid 100% of your tax liability this year. If so and your AGI is less than $150,000, you should be able to avoid being charged a penalty. But you'll need to have paid 110% of your current tax liability in the previous year to avoid getting dinged if your AGI is above $150,000. This safe harbor method is generally the easier option to avoid paying a penalty because the alternative is to have withheld 90% of your previous year's tax liability, which can be difficult for freelancers and independent contracts to calculate.

It's also important to note if you are earning both regular W9 wages and 1099 income, bumping up your January 15th estimated tax payment to compensate for being under paid in previous quarters doesn't work. Each quarter is treated separately with estimated taxes. However, withheld taxes on paychecks are treated as if they were paid throughout the whole year.

6) Review Your Retirement Contributions To Date Against The Annual Limits

* The maximum 401k contribution limit for 2018 is $18,500. The article has a graph I created on how much you could have in the future if you methodically maxed out your 401k.

Even though this is the season of giving, don't forget to pay yourself first. Take a look at how much you've contributed to your retirement accounts so far to date, and consider making additional contributions to the maximum. If you only have one retirement account that is already maxed out, check if you're eligible to take deductions from opening additional accounts. You may not qualify if you have a high AGI, but it's always good to know what your options, especially if your income is likely to decrease in the future.

Related:

Here's When You'll Become A 401(k) Millionaire (2018)

How Much Should You Have In Your 401(k) By Age (2018)

You're Losing Money If You Don't Know The Rules

Taxes are painful and boring as hell, but they are a must. I'm pretty sure practically every one of us is paying more taxes than we should because we don't know 100% of the rules.

I will be owing a relatively large tax bill because I've been receiving my gross contracting salary every month and I haven't been paying quarterly estimated taxes since this my first year. I plan to spend three hours organizing all my expenses throughout the year in order to minimize my tax liability. Travel, meals, entertainment, vehicle expenses, electronic equipment, legal and accounting fees, solo 401k, and conference costs will all be deducted on my Schedule C. I'll then do my taxes myself and run some different income scenarios.

We don't know exactly how much more or less we'll make the next year, but we can make educated guesses. If you so happen to make much more the next year than expected, you should still feel good despite the additional taxes to pay. It's all about forecasting a realistic income scenario and managing your expenses accordingly.

RECOMMENDATIONS

Manage Your Finances In One Place: I recommend signing up for Personal Capital, a free financial management tool online that helps you track your net worth, analyze your investments for excessive fees, and manage your cash flow. I ran my 401k through their 401k Fee Analyzer and found out I was paying $1,700 a year in fees I had no idea I was paying!

They’ve also come out with their incredible Retirement Planning Calculator that uses your linked accounts to run a Monte Carlo simulation to figure out your financial future. You can input various income and expense variables to see the outcomes.

Tax Savings Recommendation: Start A Business. A business is one of the best ways to shield your income from more taxes. You can either incorporate as an LLC, S-Corp, or simply be a Sole Proprietor (no incorporating necessary, just be a consultant and file a schedule C). Every business person can start a Self-Employed 401k where you can contribute up to $54,000 ($18,000 from you and ~20% of operating profits). All your business-related expenses are tax deductible as well. Simply launch your own website like this one in under 30 minutes to legitimize your business. Here's my step-by-step guide to starting your own website.