Thanks to the unrelenting rise in the stock market since 2009, there's now a trend on social media to share your 401k balance, especially if it's over a million bucks. Yes, being a 401k millionaire is now a real status thing!

Despite the distastefulness of bragging, just the fact that more people are talking about saving for retirement via their 401k is a good thing. There are a record number of 401k millionaires today.

Make no doubt about it. Being a 401k millionaire is very impressive. With the maximum contribution limit at $22,500 for 2023, it will take a while to become a 401k millionaire with such a low contribution maximum.

When I was first able to contribute to a 401k in 1999, the maximum contribution limit was only $10,000. Check out the chart below for details.

Sadly, if I would have stayed at my job until age 40 in 2017, I could have become a 401k millionaire. Alas, I left in 2012 at age 34. It wasn't until mid-2021 at the age of 44 did my rollover IRA grow into $1 million.

When You'll Become A 401k Millionaire

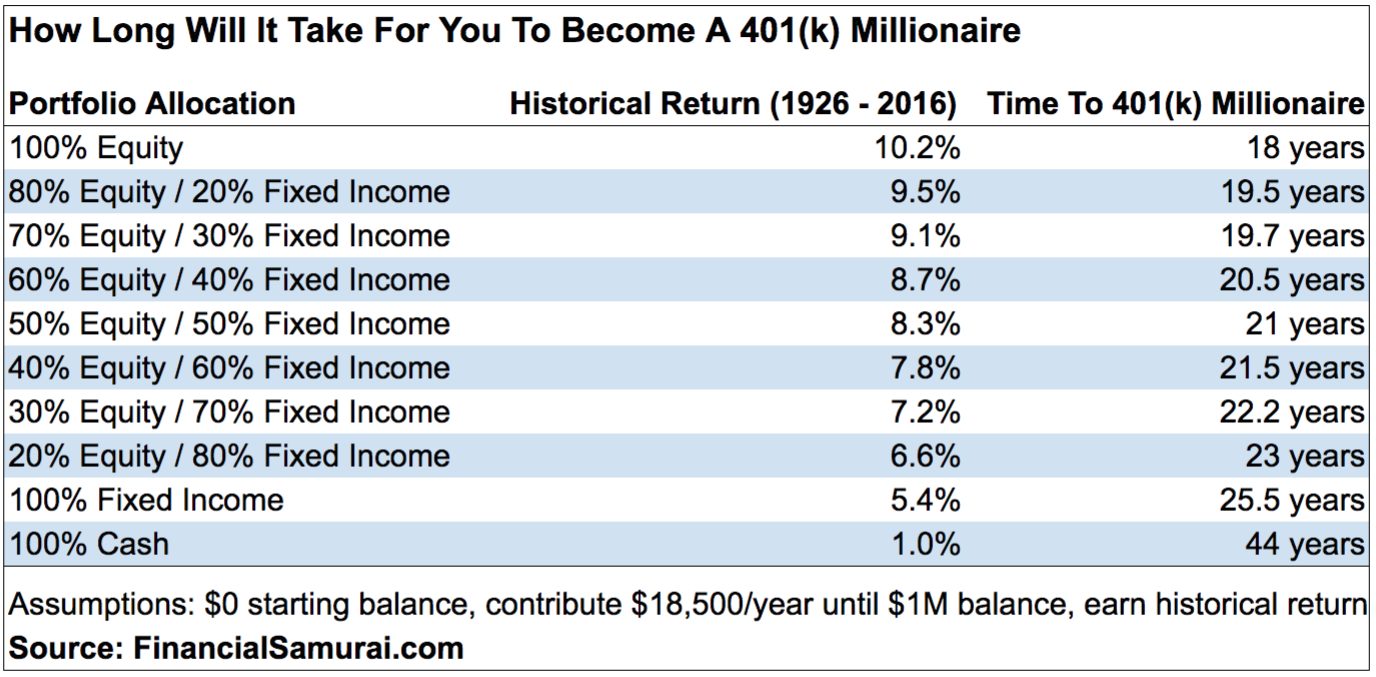

Given we know the various portfolio returns based on asset allocation in my post, How Much Investment Risk You Should Take In Retirement, one can simply do a little math to figure out roughly when someone will become a 401(k) millionaire.

The assumptions to 401k millionaire status are: if they are starting with $0, max out their 401(k) this year and every year after, and return the average annual return of the portfolio composition since 1926.

Here is the time it would take to become a 401k millionaire:

100% Equity Allocation (10.2% historical return): 401(k) millionaire in 18 years.

80% Equity / 20% Fixed Income (9.5% historical return): 401(k) millionaire in 19.5 years.

70% Equity / 30% Fixed Income (9.1% historical return): 401(k) millionaire in 19.7 years.

60% Equity / 40% Fixed Income (8.7% historical return): 401(k) millionaire in 20.5 years.

50% Equity / 50% Fixed Income (8.3% historical return): 401(k) millionaire in 21 years.

40% Equity / 60% Fixed Income (7.8% historical return): 401(k) millionaire in 21.5 years.

30% Equity / 70% Fixed Income (7.2% historical return): 401(k) millionaire in 22.2 years.

20% Equity / 80% Fixed Income (6.6% historical return): 401(k) millionaire in 23 years.

100% Fixed Income (5.4% historical return): 401(k) millionaire in 25.5 years.

100% Cash (1% assumed return): 401(k) millionaire in 44 years.

Related: I Could Have Become A 401k Millionaire By 40 Had I Kept My Job

401k Millionaire Chart

If you prefer a handy dandy chart, the below chart shows when you will be a 401k millionaire based on various portfolio allocations and historical return assumptions.

It is my opinion that everybody who starts maxing out their 401k for the next 20 years will become a 401k millionaire.

If you're unsure about the right portfolio allocation, you can see my proper asset allocation of stocks and bonds by age. My guide provides a risk-appropriate way for you to invest your public investment portfolio to help you achieve financial freedom.

Of course, historical returns cannot guarantee future returns. But after a 10-20 year period of investing in your 401k, your average annual portfolio return will likely begin to mimic the historical averages. Further, if your company provides a generous 401k match or profit sharing plan, then it is likely you will become a 401k millionaire sooner.

Calculate When You'll Be A 401k Millionaire

For those readers with more than $0 in your 401k, simply find an online compound interest calculator and input your data for your specific results. The good thing is, all the numbers above can be considered the maximum longest amount of time it will take to get to 401k millionaire status in a normal market.

Let's say I'm 40 years old with $500,000 in my 401k and will max it out every year. I've got a 70% Equity / 30% Fixed Income portfolio and expect to earn 9.1% a year based on historical averages.

Using a compound interest calculator, I'll simply input my current principal, annual addition, interest rate, plus a guess number in the Years to Grow field. When the future value equals roughly $1,000,000, you'll know about how long it will take for you to achieve 401k millionaire status.

Related: The Number Of Millionaires In The World And By Country

The Key To Becoming A 401k Millionaire Is Longevity

I worked for 13 years for two employers and got my 401k balance up to ~$400,000. But once I left my job in 2012, I rolled over my 401k to an IRA. If I worked for seven or eight more years, I probably would achieve a $1,000,000 401k balance due to strong returns and great company profit sharing. But alas, I'm not a 40(k or even a rollover IRA millionaire.

The key to 401k millionaire status is being able to work at an employer with a great 401k plan for as long as possible. The year before I left my employer, I was receiving $20,000 – $25,000 a year in company profit sharing. Not staying for a couple years longer was a 401k mistake and an early retirement regret.

Therefore, before you decide to leave your cushy job, please first calculate what you are forgoing in company benefits. The same goes for people who are contemplating leaving higher paying, stable jobs to go work for startups which may have no 401k plan or most definitely have no 401k matching benefit since most startups are loss making.

Recommended 401k Amounts By Age

Let's review my 401k savings targets by age and see when various age groups of savers may become 401k millionaires if they are able to work at a job with a 401k plan for several decades.

Based on my 401k by age estimates, older age savers (50+) should be able to become 401k millionaires around age 60 if they've been maxing out their 401(k) and properly investing since the age of 23. If not, then best of luck with Social Security, a paid off house, and hopefully after-tax investment accounts.

Middle age savers (35-50) should be able to become 401k millionaires around age 50 if they've been maxing out their 401k and properly investing since the age of 23. I'm expecting to be a 401k millionaire when I turn 50 in 2027 by contributing to a Solo 401k plan.

Younger age savers (20-34) should be able to become 401k millionaires around age 40 if they've been maxing out their 401k and properly investing since the age of 23.

Beat The Average 401(k) Balances

Although the current 401(k) balances by generation are pitifully low, you will blow past the averages because you read Financial Samurai. Take a look at the average and median 401(k) balances yourself for 2023.

Becoming a 401k millionaire just takes time and discipline. You will be surprised about the power of compounding once you accumulate a decent amount of assets.

In fact, according to the Fed, the average American household is now a millionaire! The median American net worth is only about $192,000. Don't be median. At least be average.

Treat Your 401k As An Insurance Policy

According to Vanguard and Fidelity, the average 401k plan balance is about $120,000 in 2023 and the median 401k plan balance is about $35,000. If you get to 401k millionaire status, pat yourself on the back.

The funny thing about your 401k is that it doesn't really matter if you have millions in your account. You can't tap the funds without paying a 10% penalty before age 59.5 or doing a Roth conversion and paying taxes, so it's more like a retirement insurance policy.

Further, a better goal might be to not become a 401k millionaire because that probably means you spent 18 years or longer working at a day job. What you should really be doing is building up your after-tax investment account aggressively so that you can retire well before you are 59.5.

As you've only got one life to live, you might as well figure out a way to escape the grind sooner, rather than later. Not a day goes by where I'm not thankful for aggressively building a portfolio of non-401k investments in my 20s and 30s to have the courage to leave my 401k behind.

These non-401k investments produce the passive income necessary to provide for my family of four. Once you max out your 401k, start aggressively building your taxable investment portfolio and rental property portfolio.

Recommendation To Help You Become A 401k Millionaire

If you want to become a 401k millionaire, you'v got to stay on top of your 401k. The first step is to run your 401k through Empowerl's 401(k) Investment Fee Analyzer to see how much you're wasting in fees. I ran mine through and found out I was paying $1,748.34 a year in fees I had no idea I was paying.

After discovering how much I was wasting on actively managed mutually fund fees that didn't have a perfect track record for beating their respective benchmarks, I switched to low cost index fund ETFs.

The next step is to run your 401k through the Investment Checkup tool also allows you to analyze your investment risk exposure and make appropriate adjustments.

Diversify Into Real Estate

In addition to becoming a 401k millionaire, you should also try to be a real estate millionaire as well. Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile and generates income.

Even if you are a 401k millionaire, you can't access the funds without a 10% penalty until age 59.5. Therefore, investing in real estate to produce valuable passive income is wise. Real estate gave my wife and I the courage to leave our jobs by age 35 to live more freely.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio. Just make sure to thoroughly screen each sponsor before investing.

Invest In Private Growth Companies

Finally, millionaires own businesses or invest in private business. Therefore, consider diversifying into private growth companies through an open venture capital fund.

Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

I was let go during the start of the financial crisis and rolled over my existing 401K to IRA. When I started a new job around early 2009, I contributed the max amount of about $18,500 to my 401k. With the company’s 6% matching and holding only equity indexes, my 401k account reached $1M recently at age 45. I never would have thought 15 years ago that I would become a 401k millionaire. Now that I am, it feels great. I just want to let everyone know that time is your friend. The earlier you start and the more that you contribute in the beginning, the faster you’ll reached $1M.

Sam,

I feel you have missed a few points in your initial analysis and while some where pointed out in comments, not all.

First, I may be an odd duck, but I am on track to have pretax accounts well exceeding my peak ordinary income by retirement. And compound that with your strange use of the commutative property. I think a guiding light should be not income when starting out but years of compounding. Without looking up specifics on a compound calculator….. if you expect to pay in $200k to yield, say, $1m… and even at same tax rate, say 20% to make math easier, that means you pay $20k in taxes on contributions and avoid 200-20k or 180k. This simplifies by not accounting for details, but what you ought to compare is avoided tax.

I fully agree that there is risk … who knows what tax rates will exist in the future, but I expect them to rise due to ineptitude as our debt servicing continues to grow.

You also missed another big risk: the USG siezes ALL private retirement funds. Think it won’t happen? Maybe you will be right, but Congress has been discussing it since before I was born. And it won’t be the first to do so if it does happen. With 50-80% of Americans on the road to self-destruction how else will the USG find money to send them in 30 years?

Hi Sam, I am new to FIRE community. First of all, I wanted to thank you for all of your hard work. You have shape and change so many people future and we are very greatful to you. Here is a little bit about me. I am 30 years old and married. I love my job and my goal is do part time job at 53 until 62 and fully retire. I am doing 2 jobs, 7 days a week with average of 65 hrs per week for almost 2 years. I am planning to do that for the next 11 years than move to just 1 full time job until 53. My wife is 24 years old and she is studying while working and make only 28k per year. Our combine income is average about 135k to 140k per years for the past 2 years. I had 88k of students loan and I just pay it off in 18 months by living with my parents but we are planning to buy a house around 250k to 270k at most. After tax and we have about 105k left. Our plan is to invest 10k to my 403b plan, 8k to Roth 403b plan, 11k for our Roth IRA, 5500 for our HSA and 25k for our taxable account per year and 1950 to my wife roth 401k. Our expense is around 41k per years. We contribute total of 60k per year not including any of employer matching. Our networth is low at the moment. I only have 60k in my 403b plan and 401k plan, 8k in my HSA, 14k in my roth IRA, 14k in my wife roth IRA and 10k in taxable account. I know that we suppose to max out our 403b 18500 and our Roth IRA and 50% after tax to our taxable account. I am just confuse about 50% after tax and I seem don’t understand how to calculate 50% of after tax saving to our saving account. If we make 135k per year, after tax 105k and after expense is around 41k and I contribute total of 60k per year which include our 403b plan, can you please tell me what is my after tax saving rate is? If I want to contribute 50% after tax which not including my 403b and Roth IRA, how much should I saving oer year toward my taxable account per year if I wish to do 50% after tax? By the way, our taxable account will stay with Betterment until I retire. Thanks for your help.

Financial Sam community-

I am VERY new to FIRE. Just this Jan 2018, I changed my 401k contribution to try to get the max which until this moment I thought was $18,000? I didn’t understand the post. What is equity/fixed income ratio and the other bit in parentheses?

In my career, I’ve never had access to a 401K. I hope to become a brokerage account millionaire before I become a Roth IRA millionaire. Or maybe a SEP IRA millionaire if I can get my business more profitable.

As I am an expat I can’t take advantage of a 401K. However, i get to avoid other taxes and that lets me save and invest more.

Granted the number of Americans not saving or investing is scary. The few times it has come up I noticed that a lot of my friends and colleagues have little beyond a savings account.

The biggest issue is probably not the amount of a return but a lack of participation by many.

12 more years! But I have a much bigger non 401k balance. Not revealing that though ;)

I’d be interested in computations and time horizons to becoming a retirement account millionaire–but in today’s money! That seems more relevant.

For example, becoming a retirement account millionaire after 44 years has little value. In 44 years a million will be equivalent to 300-350k in today’s money. Kind of pitiful for a retirement account.

Indeed. That’s what the younger, higher end column on the very right is for. Shoot for $5 million or bust!

How old are you and how much do you have in your 401(k)?

Becoming a 401K millionaire is a given if you start early, remain disciplined and dedicate 15% or more of your earnings to the plan. Something that isn’t discussed as often is to know when to back off on tax deferred savings plans. It’s easy to get into a situation where most of your retirement savings is subject to tax upon withdrawal resulting in less spendable retirement income than one might expect. Losing the beneficial capital gains tax treatment in a 401K plan coupled with potentially large required distributions can flip the tax efficiency math in favor of taxable savings at some point. Of course, you should always contribute enough for the free company match.

Hi Sam,

I have been enjoying the bull market for years but all the sudden it feels like dotcom bubble or global financial crisis.

I can’t help but think I should sell all my stock, take the long term capital gains tax hit on long held (10’plus year) stocks and mutual funds rather than ride this down.

Any thoughts? I appreciate crystal ball stuff is tough

Thanks

Randall

I left my employer a few years ago and then once ignored my 401K. Then suddenly a couple of years I realized it. I now manage it more. Last years’s return is 60% without putting a dollar in it. It made up with all the years that I have missed. Agree treating it as an insurance plan.

I’m a little hesitant to comment on this but if it helps encourage someone else then I guess it is worth it. I should begin by saying I am 60 and my wife is 56. Between my wife and I, we have (2) 401Ks over 1M. We had a third over a million but it pulled back to just under a million with the recent market drop. We have 3 other 401Ks that together total ~400K. We have a few other investments that are pre-tax as well, IRAs, deferred compensation, etc.

Our split of investable assets is 54% pre-tax and 46% after-tax so, nearly as much in after-tax as pre-tax. We also have over 1M in Home Equity and a little less than 7 years on our 15-year fixed rate mortgage at 3.5%, which is our only debt. We started with nothing and have built this up over the past 30+ years. The formula is straightforward. We maxed out our 401K every year and stayed invested in index funds through good times and bad. When we each turned 50, we increased to the fully allowed catch up contributions. A long horizon and the magic of compounding yielded our results. And as mentioned, we also were able to make additional regular investments to our after-tax brokerage accounts.

This sounds easy but we made a lot of sacrifices. We both worked incredibly challenging and time-consuming jobs. We only had one child who is now a Freshman in college. She was a blessing and hardly gave us an ounce of trouble which allowed us to both be involved parents and career oriented at the same time. It did involve some time management and each parent sharing the responsibility and working around our travel schedules but we managed to figure it out. It also meant turning down some good career opportunities in order to maintain a manageable balance.

My wife still works and I have been involved with startups as a second career after retiring from my primary career in 2015. Crazy as it sounds, I still worry about our investments and where we are. At this point, I think my main focus is just leaving a strong legacy and a branch of our family tree that has a chance to feed some of our future generations. I feel like our daughter is level-headed with a good dose of common sense and she will be a good steward of our future net worth in the years to come.

I guess you could say we’ve done OK with the “FI” part of financial planning but failed miserably with “RE.” Honestly, I come from a generation where it just never really dawned on me to think about retiring early. However, I take comfort in knowing that my daughter should have that option and she should also always be able to decide what she “wants to do” in life and not what she “has to do” because of money.

Retired now. I am opposite to Paper Tiger. I was good with real estate from my teens, but only woke up to investing in the stock market on my own about 7 years ago (regrettably let advisors do it for me). With real estate, owning a good house in a good neighbourhood that is certain to appreciate, and is also easy to rent (e.g. near a university) to good quality tenants has been my strategy. Rent a suite in the basement to pay the mortgage, keep working up the ladder every 10 years as your equity increases, don’t worry too much about paying the mortgage off, and never be out of the market. This is tax-free capital gain in Canada so it’s a no brainer. Friends who live in smaller communities have much nicer bigger newer houses but sacrifice liveability (my opinion) and lower COL. Yes, I do find it cheaper and healthier to live in a coastal city. No commute, no need to run expensive vehicles, lower utility costs, lower property taxes, better climate, and better, cheaper food.

Paper Tiger – You’ve done really well.

From what you’ve written, it appears you have several 401Ks from prior companies. It was mentioned to me years ago that a 401K has fewer options upon the passing of its owner. You might consider consolidating the 401Ks of companies you’re no longer working for into an IRA. If anything happens to the holder, it can be converted to a stretch IRA by the beneficiary.

I’ve done this with all my 401Ks and have only one traditional IRA statement to look at instead of multiple 401K accounts.

Just a consideration.

Thanks Jim, I agree and I’m looking at that and other options to simplify and make managing things a bit easier.

Between the 2 of us our 401k represents no more than 25% of our portfolio, as you say it’s mainly an insurance policy which we will start tapping at 59.5 to smooth out the taxable income.

We also spent a large part of our careers working in an overseas division which didn’t offer a 401k but instead a generous pension benefit which a total present is hard to quantify into our net worth.

Retired at 56. My contributions to Canadian equivalent of 401k (RRSP) were also less because I had a defined pension (by choice). Any certain income (pensions) is worth a fortune. See Sam’s post on valuing pensions. An insurance policy that allows you to take more risk in other savings.

My policy has been to maximize any tax-sheltered investments and defer tax as long as possible even if I pay more later — as insurance as Sam says although I never thought of it in those terms. But you do not know what your income or assets will be when you FIRE so in that sense maximizing RRSP is insurance in case other sources of income fail.

Good sh*t, Sam. I feel better having read this. :-) I’ve been pretty diligent about socking away at least a percentage equal to the max match my employer gives. Oh, and I’m glad I’ve stuck with the low cost equity set and avoided the cash option. Man. That’s terrible.

Funny. The single most powerful little tool our community has at its disposal (aside from such great blog posts) is that little compound interest calculator. Can’t tell you how often I’ve visited that thing over the years.

You are so right. The ability to look into the future and project finances — even if only understanding compound interest. There is no guarantee of anything but figuring out the possibilities is very motivating.

In Sam’s chart showing getting to $1M after 18 years (100% equities), may I point out that the $1M will double tax-free in the next 7 years (using rule of 72 — 72/10.2%) without further contributions. That is the amazing thing about compounding — and why starting as early as possible makes a vast difference to the outcome. To most readers and commenters of this blog this is elementary but to others not always.

Another possibility would be to withdraw half the profits to live on every year after year 18, e.g. $51,000. and let the rest compound at 5%. Other cash flows for FIRE could be rental of a basement suite in the house, and eventually pensions/social security. The rental and pension income are sure and stable (increasing slightly over the years), and the investment income could fluctuate.

As someone aiming to retire at 60 (I like to enjoy a nice lifestyle and do not wish to aggressively save post tax target 20%), I’m a bit confused about Sam’s comments above regarding the intent of the post. I plan to have about $2M in 401k at that point, and whatever we have in home equity and after tax investments as well. In all likelihood, 401k will be our largest accounts.

I feel like retiring at 60 will be winning, coming from my background of blue collar folks who never retired at all or were constantly worried about losing everything.

If you are happy with your plan and see high likelihood of the plan succeeding, then you’ve won. Congratulations.

One piece of the pie. All those who are able should be taking advantage of a 401(k) as part of their overall plan. I will keep my balance off social media!

Nice article. My taxable account inflow is much more than 401(k). At some point I need invest more into my 401(k). For now I am quite happy with my distribution of money. For me 1 million is yet another number. More than assets I am worried about cash flow and income. I assume a modest returns of 3-4% for my computations. Better to be cautious and overshoot :-)

I shoot low as well. Given where we are valuation wise at this time, that is a really good idea. That way, anything over 3 or 4% is a bonus. I did take an overweighting to EM equities. The valuations are incredibly low. They have had a run up already so I got a bit lucky but I still think it is early days for that reversion.

Im probably the only anti 401k person here but that is because my w2 job does not match so I dont get “free” money and I just cant see how the other benefits are actually benefits. I get that everyone says oh its great for tax savings, but dont you still have to pay the tax when you eventually take it out when you “retire” at some crazy old age of 60 something?

Whats the difference between paying that tax now then later? Im guessing something to do with compounding the original deposits made right?

The other gripe I have about it why in the world should I get penalized for trying to use my own money before a certain age? That just boggles my mind. Its my money!! LOL Not to mention I plan on retiring way before 60s. Probably late 40s I am thinking.

FYI – i have been able to build some decent wealth from sticking to investment properties. That is my thing but I really need to diversify a bit more.

My current plan is to build enough passive income from rental properties and allow that to get me to the point where I am financially free. So far I am making a bit over $3k per month on just cash flow. Still need a bunch more though. And yes I know its not truly passive, but its enough passive in my opinion to be happy.

Rant over! Someone please enlighten me.

:)

There are 2 still benefits

1. You would presumably be in a lower tax bracket when you retire. So, you would rather have the money coming out when the taxes are Lower and take advantage of the tax break when your bracket is higher.

2. You get complete deferral on taxes from any gains, dividends or interest earned and distributed by the funds in a 401(k). Outside of that, it is all taxable. That alone can decrease your return by a lot.

You MIGHT be in a lower tax bracket when you retire.

However a big fat 401k rolled into a traditional IRA will be subject to RMD at age 70-1/2. The RMD could very well push you into a higher tax bracket. Also, the RMD is treated as regular income, so dividends earned along with capital gains within an IRA don’t get the benefit of reduced tax rates.

Uncle Sam (the government one) will love it when I’m 70-1/2 and pay taxes on my RMD.

You also have significant protections on your 401k/IRA in the case of bankruptcy or lawsuits etc.

~T~

One of the best financial moves I have made in my entire life is contributing the maximum possible to my 401k plan. Although in the beginning of my employment I was contributing only 3%, once we were able to satisfy our emergency fund needs, we (wife and I) went ahead and start to max out our contributions. We’ve been very happy with our decision. After I quit my job a few years ago, rolled it over to an IRA account and have been managing it ever since. Wife still works and still doing the maximum contribution.

The strangest things get trendy on social media. At least it’s good to raise awareness on retirement savings because a lot of people really should be saving more!

I completely agree with Sam on this. Take full advantage of a 401(k) especially the match portion but also focus on non-401(k) assets. Up until 2009, we had all of our money tied up in my 401(k), spouses IRA Rollover, her 401(k) and $10,000 in a savings account. I realized the risk of that and vowed to increase my non-retirement assets. I was fortunate because the next 7 years were my highest earning years ever and I took full advantage of that and diversified by adding to taxable assets. Now, my taxable assets represent 31% of my overall portfolio. In 09, it was less than .05%. Both pies grew which was good news.

Still, I find it odd and disconcerting that people are bragging on-line about how much money they have. Yet another contrarian indicator.

Thanks Sam. I will never be a 401K millionaire since my current balance is only about $9000, I will not be contributing the max, my employer only contributes about $800 each year and I only have 4 years until retirement at 48. Even if I include my Roth IRA I will most likely end up with a total of around $400,000 by age 59.5. I haven’t contributed to my Roth in about 6 years and that’s okay because I am ahead of my retirement goals.

About a year ago I decided to estimate what has happened to the first $500 I invested in my IRA in 1997. From 1997 to 2008 not much happened, but it was during this time that I consistently contributed over $2000/yr, so that worked out well. My average return from 1997 until the end of 2016 was 7.2% (pretty convenient – rule of 72). My first $500 was worth about $1874 last year and is now worth about $2226.

Right now I am aggressively paying off my mortgage since that is an important cog in my retirement machine.

I am far from being a 401k millionaire since I left the workforce in my 30s, right before the financial crisis. It’s just as well since I can’t access that money anyway. Many have mentioned the Roth conversion ladder, but if you are going to early retire, hopefully you have built up your passive income to the point where you can’t do the Roth conversion tax free. There hasn’t been a year that I have been able to use the Roth conversion.

Sam,

Perfect timing. Since I have 20 more months to be eligible to retire at 55, it has been a real drag at work to pass the time. So, I need to play mental games to create milestones to distract myself to pass the time.

On the first day of the new year 2018, I actually created a spreadsheet to calculate exactly when I will reach 1M in my 401K just for fun since I was so close. I am such a spreadsheet geek. It will be in Aug 2018 at age 54. Yippee! I have been waiting for this milestone since age 30. Since Jane was laid off, she will reach 1M at the end of 2020 at age 55 if the fixed investments are 4% or greater each year.

We are 500K less than your spreadsheet for age 55 because we started 4 years late and we only invested in 100% fixed interest investments. Also, because of HCE (Highly Compensated Employees), we were never able to max out the 401K until the recent 2-4 years because our salaries were lower. We were subjected to 10% max. We still have no regrets.

Thanks for the charts which are great so that people can see what amt they will expect by investing early.

Adam

I don’t think that it’s necessarily fair to treat it as an ‘insurance’ policy when it’s such a large percentage of people’s portfolio typically. Unless you’re a high income earner, it’s tough to max out tax-advantaged accounts and build a substantial after-tax portfolio. I’m not sure I’d recommend forgoing the tax advantages when there are ways to access that money early.

That being said, if that’s what it takes to motivate you to make more money so you can build up your taxable investments, then good for you. I just don’t know that it’s realistic to expect that to be the case for many, even the financially savvy folks who read your blog :)

I am hoping to be a 401(k) millionaire in my 40’s. We’re well on our way there, and will be maxing from now on so unless the market is terrible it is basically inevitable.

Agreed. I love Sam’s advice and it is a great article, but I simply do not make enough to max out my 401(k) plus save an extra $15K/year in a taxable account.

I just started maxing out my 401(k) two years ago and feel great! I opened a small Roth a few years ago also. Beginning this year, I finally opened a taxable brokerage account and I am excited, but will invest gradually.

Everyone should find a balance and enjoy life, but these are great ideas.