Since writing about FIRE in 2009, I’ve favored investing in growth stocks over value stocks. As someone who wanted to retire early from finance, my goal was to build as large a capital base as quickly as possible. Once I retired, I could convert these gains into dividend-paying stocks or other income-generating assets to cover my living expenses if so desired.

Although more volatile, you’ll likely generate more wealth faster by investing in growth stocks. By definition, growth stocks are expanding at a rate above average, which means shareholder equity also tends to compound faster. As equity investors, that’s exactly what we want. Instead of receiving a small dividend, I’d rather have the company reinvest capital into high-return opportunities.

Once a company starts paying a dividend or hikes its payout ratio, it’s signaling it can’t find better uses for its capital. If it could generate a higher return internally—say, improving operating profits by 50% annually through tech CAPEX—it would choose that instead. Think like a CEO: if you can reinvest for outsized returns, you do it. You don’t hand out cash unless you’ve run out of high-ROI projects.

The whole purpose of FIRE is to achieve financial independence sooner so you can do what you want. Growth stocks align with this goal; value stocks generally don’t.

My Growth Stock Bias

I’m sure some of you, especially “dividend growth investors,” which I consider a total misnomer, will disagree with my view. But after 29 years of investing in public equities, working in the equities divisions at Goldman Sachs and Credit Suisse, retiring from finance in 2012 at age 34, and relying on my investments to fund our FIRE lifestyle, I’m speaking from firsthand experience.

Without a steady paycheck, I can’t afford to be too wrong. I’ve only got one shot at getting this right. Same with you.

Given my preference, my 401(k), rollover IRA, and taxable accounts have been heavily weighted toward tech stocks since I started Financial Samurai. Some of my growth holdings—Meta, Tesla, Google, Netflix, and Apple—have certainly taken hits in 2018, briefly in 2020, and again in 2022. But overall, they’ve performed well. Technology was clearly the future, and I wanted to own as much of it as I could comfortably afford.

I no longer consider Apple a growth stock given its innovation slowdown and entrenched market position. But it was once a core compounder in my portfolio.

My Occasional Value Stock Detours (and Regrets)

Despite my beliefs, I sometimes can’t resist the lure of value stocks. In the past, I bought AT&T for its then-8% yield—only to watch the stock sink. I bought Nike when it looked cheap relative to its historical P/E after the Olympics, but it didn’t outperform the index either.

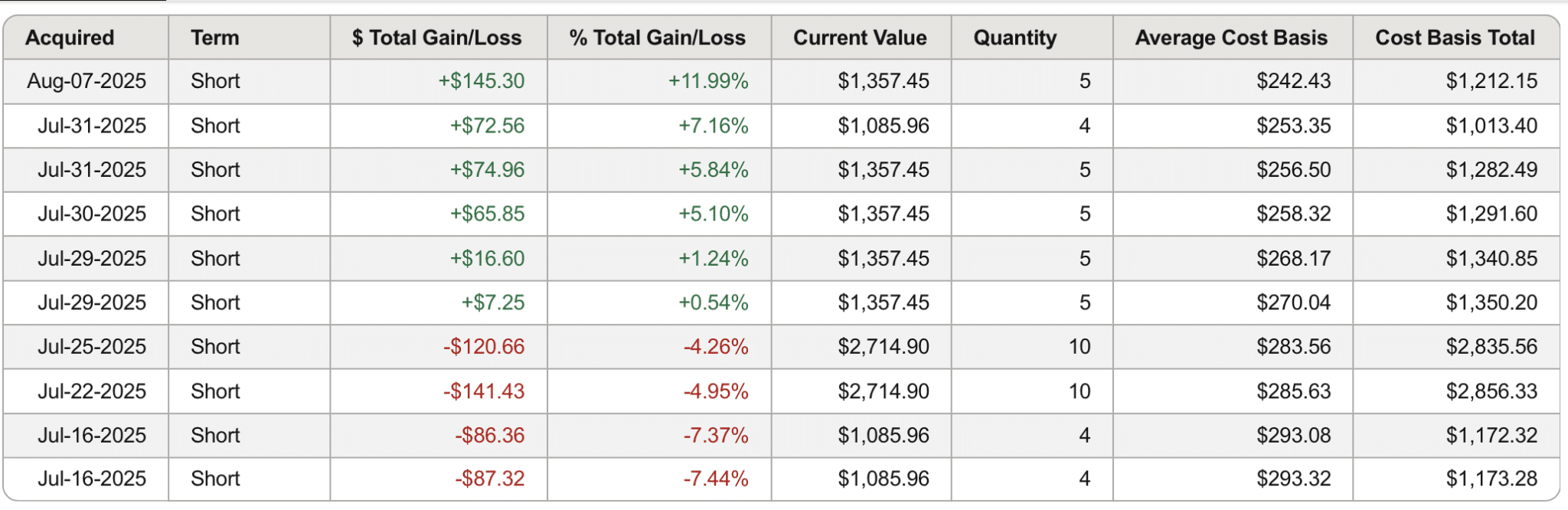

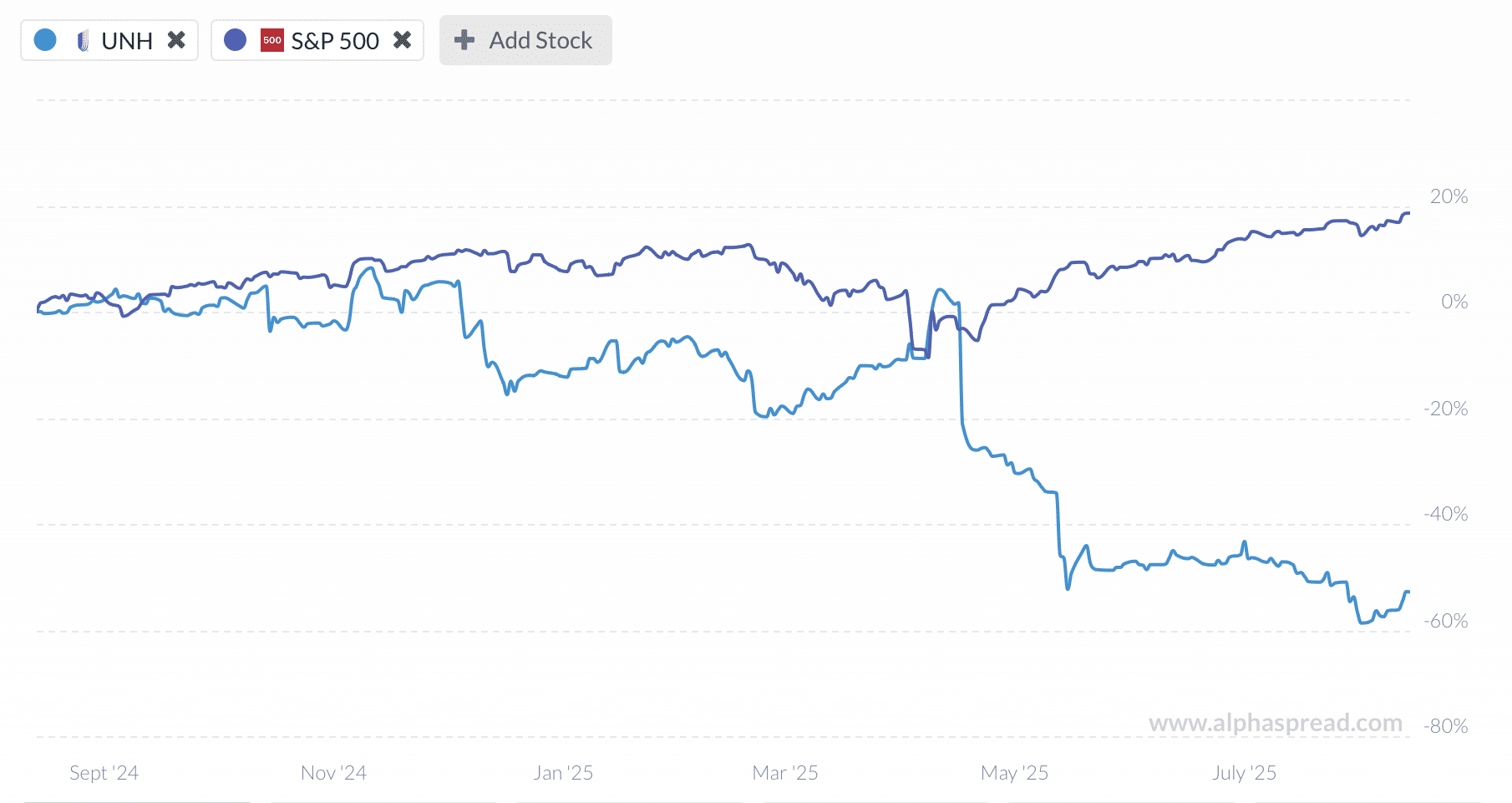

My latest blunder: UnitedHealthcare (UNH). I mentioned how I was losing $6,000 in UNH in my post, The Sad Reality Of Needing To Invest Big Money To Make Life-Changing Money. Hooray for another case study!

After UnitedHealthCare (UNH) plummeted from $599.47 to $312, I started buying the stock. I was amazed that a company this large, with such pricing power, could lose half its value in just a month. Surely, I thought, the market was overreacting to the latest earnings report and would soon realize the operational picture didn’t justify a 50% drop.

But the stock kept sliding, hitting $274. I bought more. For several weeks, UNH clawed back above $300, and I felt vindicated. Then it tanked again—this time to $246—after another disappointing earnings report. I added some shares, but by then, I had already reached my comfortable position limit of about $46,000.

To be thorough, value stocks are shares of companies that investors believe are trading below their intrinsic or fair value, usually based on fundamentals like earnings, cash flow, or book value. The idea is that the stock is “cheap” relative to its fundamentals, and the market will eventually recognize this, leading to price appreciation.

I Really Don't Like UnitedHealthCare

I have a hate, hate, acceptance relationship with UnitedHealthcare. Ever since I had to buy my own health insurance in 2015, my view of the company soured. Back then, our monthly UNH premium was $1,680 for two healthy thirtysomethings who rarely used the medical system. Outrageous.

But what were we supposed to do, manipulate our income down to qualify for subsidies? I know many multi-millionaire FIRE folks who do, but it feels wrong so we haven't. Medical costs in America are so high that going without insurance is financial Russian roulette. We had no choice but to pay.

Since 2012, we’ve paid over $260,000 in health insurance premiums. Then we finally had a legitimate emergency—our daughter had a severe allergic reaction. We called 911, took an ambulance to the ER, and got her stabilized. We were grateful for the care, but not for the bill: over $1,000 for the ER visit and $3,500 for a 15-minute ambulance ride.

And what did UnitedHealthcare do? Denied coverage. My wife spent a year fighting the usurious ambulance charge before we finally got partial relief. We were furious.

Today, we begrudgingly pay $2,600 a month for a silver plan for our family of four and still have little confidence UNH will do the right thing when the next big medical bill arrives.

So when the stock collapsed by 50%, I figured: if the company is going to keep ripping us off, I might as well try to profit from it. Big mistake so far.

Why Chasing Value Stocks Slows Your FIRE Journey

Now, let me explain three reasons why buying value stocks over growth stocks is usually a suboptimal move for FIRE seekers.

1) Impossible to bottom tick a value stock

Whenever a stock collapses, it can appear deceptively attractive. The instinct is to see tremendous value, but if the stock falls 50% and earnings per share (EPS) also drop 50%, the valuation hasn’t actually improved—it’s just as expensive as before.

The trap many value investors fall into is buying too much too soon. This is how you end up “catching a falling knife”—and getting bloodied. I was down about $10,000 at one point, or 17% from my initial purchase.

After investing since 1996, I know better than to go all-in early. Yet I still bought my largest tranche—about $24,000 worth—when UNH was around $310–$312 a share. As it continued to slide, I added in smaller amounts. By the time the stock fell to $240, I was mentally waving the red flag once I’m down about 20% on a new position. So I only nibbled instead of gorged, much like buying the dip in the S&P 500 overall.

The point: You have a far better chance of making money buying a growth stock with positive momentum than a value stock with negative momentum. Don’t kid yourself into thinking a turnaround will magically begin the moment you hit “buy.” It's the same way with buying real estate or any other risk asset. Do not buy too much of the initial dip too soon.

2) Tremendous Opportunity Cost While You Wait for a Turnaround

Stocks collapse for a reason: competitive pressures, disappointing earnings and revenue forecasts, corporate malfeasance, or unfavorable macroeconomic and political headwinds.

For UNH, the drop was a perfect storm: bad publicity, rising medical costs, disappointing earnings, and a Department of Justice investigation into Medicare fraud. After the tragic shooting of a UNH executive by Luigi Mangione, thousands of stories surfaced about denied coverage and reimbursements. Suddenly, the hate spotlight was firmly on UNH.

During the two months I was buying the stock, the S&P 500 kept grinding higher. Not only was I losing money on my value stock position, I was missing out on gains I could’ve had simply by buying the index. Opportunity cost! Another great reason to be an index fund fanatic. If I had allocated the $46,000 I spent on UNH to Meta—one of the growth stocks I was buying at the same time (~$41,000 worth)—I would have made far more.

Turnarounds take time. Senior management often needs to be replaced, which can take months. If macroeconomic headwinds, such as surging input costs, are the issue, improvement can take 12 months or longer. If cost-cutting is required via mass layoffs, the company will take a large one-time charge and suffer from lost productivity for several quarters.

By the time your value stock recovers—if it recovers—the S&P 500 and many growth stocks may have already climbed by double-digit percentages. Unless you have tremendous patience or are already a multi-millionaire, waiting for a turnaround can feel like watching paint dry while everyone else is sprinting ahead.

3) Emotional Drain, Frustration, and Behavioral Risk

Value traps often force you to watch your capital stagnate for months or even years. For FIRE seekers, that is not just a financial hit, it is a psychological one.

Watching dead money sit in a losing position can push you into making emotional, suboptimal decisions, such as swearing off investing altogether. Growth stocks are volatile, but at least you are riding a wave of forward momentum instead of waiting for a turnaround that may never come.

It is like buying a house in a declining neighborhood. You keep telling yourself things will improve. The new park will attract families. The school district will turn around. The city government will stop being so corrupt. But year after year, nothing changes.

Meanwhile, a neighborhood across town is booming. Its home values are doubling, and you are stuck wishing you had bought there instead. That opportunity cost is not just financial. It is mental wear and tear that can drain your energy and cloud your decision making.

Not only do you risk growing regret over tying up hard earned capital in a value stock that never recovers, but you also face the sting of rising investment FOMO. That is a toxic combination for anyone trying to stay disciplined on the path to FIRE.

You might end up doing something extremely reckless to catch up, like go all in on margin at the top of the market. After all, investing is all relative to how you are doing against an index or your peers.

FIRE Seekers Don’t Have Time to Invest in Value Stocks

If you’re pursuing FIRE, you don’t have time for “deep value” stories to play out. Every year you spend waiting for a turnaround is a year you’re not compounding at a faster rate elsewhere. Growth stocks, while more volatile, give you a far better chance of building your capital base quickly so you can reach financial independence sooner.

Just look at the private AI companies that are doubling every six months or even faster. I'm kicking myself for even bothering to invest in a turnaround story like UNH. Life-changing wealth is being created in only a few years with AI. There has never been a period in history where so much money has been built this quickly.

Remember, the FIRE clock is always ticking. The goal isn’t just to make money, it’s to make it fast enough to buy back your time while you’re still young, healthy, and able to enjoy it.

Chasing value traps can lock up your capital in underperforming assets, drain your energy, and delay the day you get to walk away from mandatory work. In the journey to FIRE, momentum and compounding are your greatest allies, and growth stocks tend to provide both.

Post Script: UnitedHealthcare May Finally Rebound

There’s another explanation for my stance on being negative toward value stocks. I may simply be a bad value stock investor who lacks the ability to pick the winners and the patience to hold these turnaround stories for long enough to reap the rewards. Fair enough.

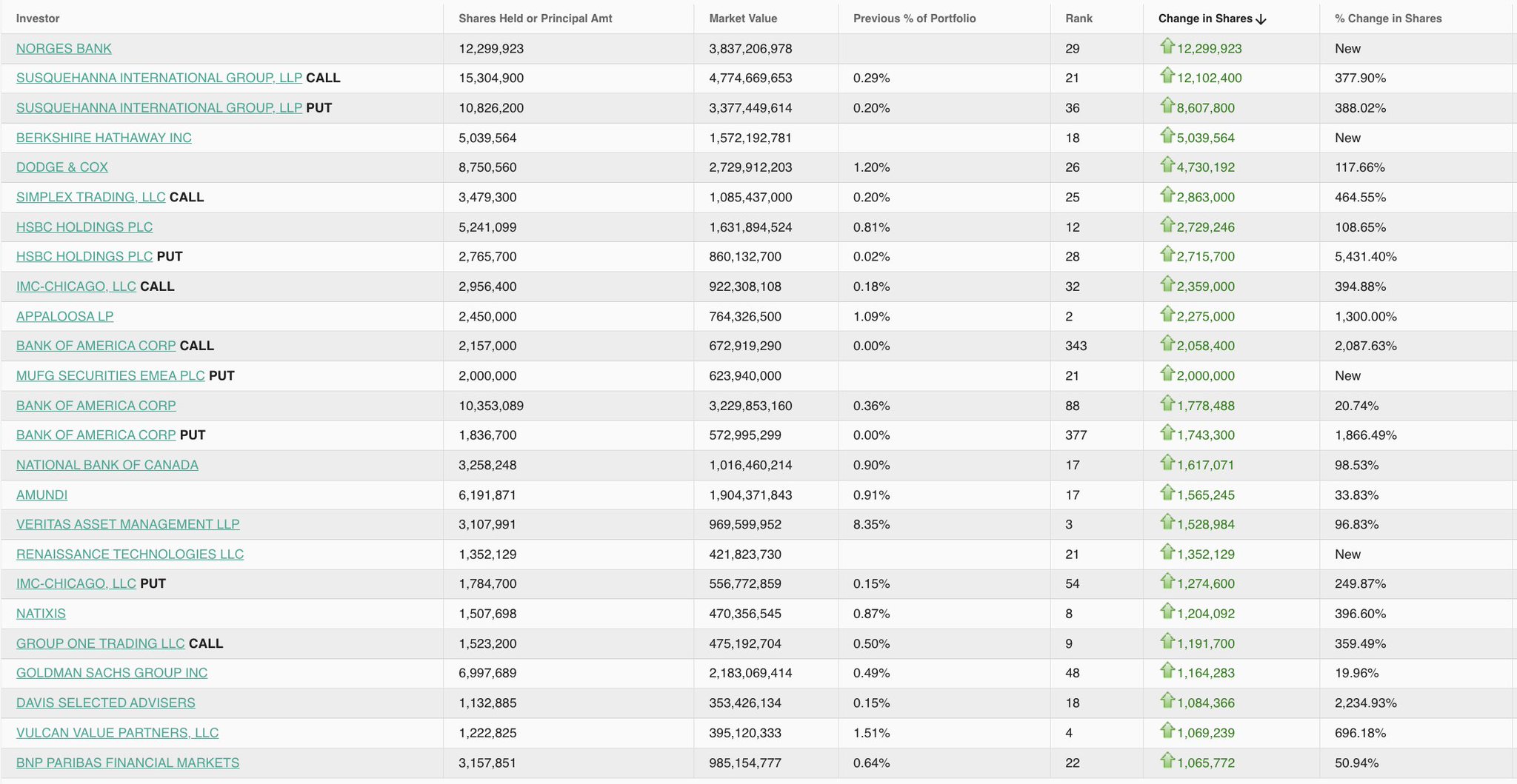

With UnitedHealthcare, though, it seems like the cavalry might be riding in to rescue my poor investment decision. After I wrote this post, it appears Warren Buffett, several large hedge funds like Appaloosa and Renaissance, and Saudi Arabia’s Public Investment Fund are all buying billions of dollars worth of UNH alongside me. Buffett was actually buying at $411/share.

Will this renewed interest from some of the world’s most powerful investors be enough to get Wall Street and the public excited again? We’ll just have to wait and see. Just don't rely on the calvary to wake up and realize what you're seeing and save you.

Invest In Growth Companies Instead

Instead of investing value stocks, invest in growth companies instead. While you're waiting a couple years for your potential value stock to turnaround, growth stocks are making significant moves to increase market share and profitable.

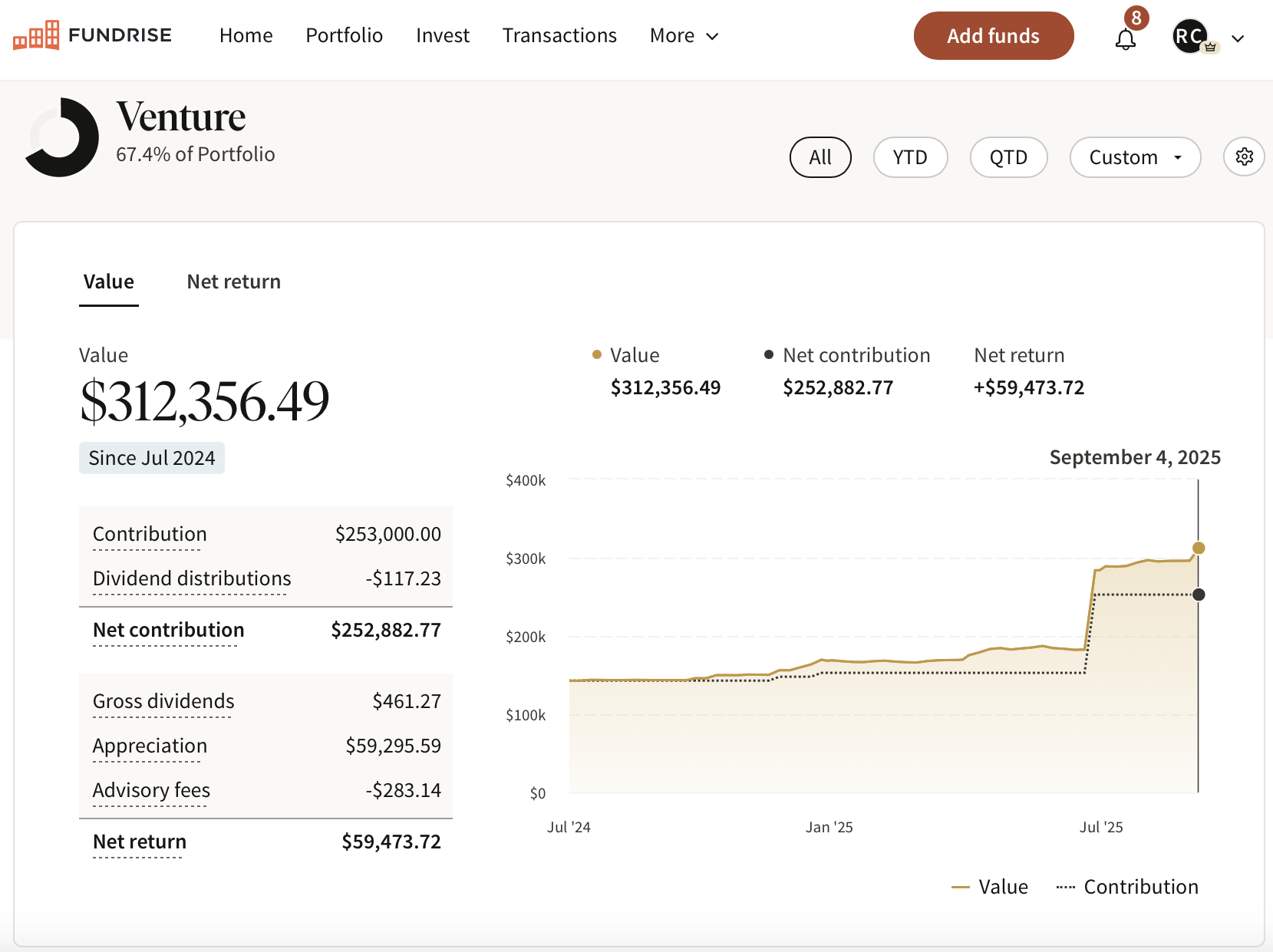

To invest in private growth stocks, check out Fundrise Venture. It invests in private AI companies like OpenAI, Anthropic, Anduril, and Databricks. AI is set to revolutionize the labor market, eliminate jobs, and significantly boost productivity. We're still in the early stages of the AI revolution, and I want to ensure I have enough exposure for myself and my children.

Subscribe To Financial Samurai

Pick up a copy of my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth than 94% of the population and break free sooner.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise. I do what I write and say, otherwise, there's no point.

My current value trap is UPS…. Don’t know how much more time/opportunity cost I want to spend on it. Ironically, I just read an article a couple days ago about dividends being irrelevant, and perhaps costly as they take away the choice of when you want to pay taxes. If I was still in an accumulation phase of my life I would probably be more pro growth, but at this point, I don’t think it will make much difference.

With the last ~15-20 years favoring large cap growth over small cap and value, all the commenters who tried picking individual value stocks are bound to have been burned. That is partially due to market factors, but I bet it has more to do with trying to pick stocks.

There is an abundance of evidence that in the long term small and value factor premiums are strong. If I had to bet, these premiums will reappear just when growth appears to be the only rational way to invest.

AI will be a great productivity and research plug-in, but marginal ROI is already following a log curve (LLM improvement increases more slowly as the investment continues to rise). Competition may drive the price AI companies can actually charge way down and commoditize it, while the true building and integration into the fabric of society/business will occur over a longer period of years. A lot of new startups are raising venture capital and selling themselves as AI-first companies, but are really just applying machine-learning algorithms developed 15 years ago to new business applications. Plus, how do we know all of the value will accrue to the “growth” companies?

Think about the paradigm shift from a totally analog world –> google search, smartphones, and computer automation. This seems like old news now, but is the transition from an already tech-centric world –> AI automation and LLMs really more significant than that was, as we are being led to believe? I wouldn’t bet the house on it, at least.

I am 2/3 total market, 1/3 SCV so either way I think I’ll be ok.

Hi Sam,

Appreciate your analysis as always, though I disagree with aspects of this one on two points.

And yes, we put our money where our mouth is with 75% in broad market and 25% in SCV. Main downside of SCV is ++ greater drawdowns.

Hi Joseph,

Great points — appreciate you sharing your perspective.

1. Totally hear you on the probability of success with market timing. That’s why I consistently emphasize that 90%+ of investors should stick with low-cost index funds. The odds are stacked against trying to outguess the market. That said, for those of us who enjoy the challenge and have some background in investing, it can be hard to resist trying to outperform — even if the probability is low.

2. On small-cap value, I agree with you that the data supports a long-term premium. IJS and other SCV funds have historically beaten the S&P 500 over very long time horizons, though with much greater volatility and periods of underperformance. It really comes down to risk tolerance and conviction. Your 75% broad / 25% SCV split seems like a smart barbell approach.

Thanks again for adding to the discussion. Always good to see different strategies backed with data.

You may enjoy this related post: Every Investment You Make Is Market Timing

I think your comment scored the most for me as I am looking at this 2.5 weeks after release.

Sam – I feel your definition of value investing is a bit off. Your examples were of “bargain hunting” and like so many, I’ve had my share of failures, going back to Dogs of the Dow type methods (hello, Kodak!). After Deepwater, I tried with BP.

Shifting from S&P500 to a dividend ETF fits what I would call value investing. And this past week, I’ve been thinking about a large cap index weighted by revenue versus market cap. 7 stocks make up 30% of the S&P – do they really have the legs to keep going? It no longer seems like index investing at this point. Shifting to revenue puts more bias towards companies with lots of cash flow (Walmart being #1), so it does become a bias towards “value.” And would essentially ignore the AI craze/bubble/future.

Though I did dabble in this as well a few boom cycles ago, and it didn’t prove out. At the time, we didn’t have quite the top heavy issue, so I think it effectively became an overpriced quasi S&P500 fund.

I’m not usually so binary but I have to agree here. There is little value in value investing. I have a portfolio of junk to prove it, as well, including T.

I’m no fan of UNH (stock or company) but we villainize insurance much too easily. Fraud and waste (Medicare and otherwise) is rampant and that f&w is directly or indirectly perpetrated by doctors and hospitals as well as individuals. It doesn’t help the stock that SC killed individual mandate (judicial overreach?)

Either way, value stocks are value traps for all these reasons (fraud, politics, etc) and more.

Not sure if Buffett was lucky, came along at right time, or really wasn’t a value investor at all. Look in g at history of his largest holdings I believe the latter.

I have enjoyed your newsletter, but I find your comments about value stocks a little too dogmatic and not nuanced and a little dangerous as advice… Particularly when tech stocks are at an all-time high. There are all sorts of strategies that you don’t discuss… For example, on UNH, when the stock tanked and options premiums exploded, I made a great move of selling puts with a strike price of 180 that have become very profitable and at the time of selling the puts, I figured if I get exercised at 180 strike then the a stock is really worth owning. Or buying your aforementioned AT&T if it’s combined with writing a call as well as selling a putt at a lower strike price, you can really maximize and already excellent dividend . Anyway, strategy should not be so black-and-white in the way you present them. Just my two cents. Thanks. Keep up the otherwise good work!

Yep, for sure. It is an almost dogmatic view I’ve held since 2009 to try and accelerate the capital accumulation.

And because tech stocks are at all-time high valuations, I’ve been forcing myself to look for value and buy relative value.

But as I grow closer to death I find I just don’t have time to wait for the turnaround anymore when there are so many growth stocks – both private and public.

To each their own I say. There are no rules or guarantees when it comes to investing in risk assets. I’m just sharing my story and the conclusion I’ve come up with.

And go UNH! If Warren bought 5 million shares at $411/share, I hope my $290/share average will play out in the next few years. And I hope he buys more!

Sam – great post. I’ve worked 17+ years at a large, diversified industrial company in the Midwest. A classic and historically well-known value stock. Your point of growth stocks, to accelerate the potential for early retirements, is spot on. How much people want to allocate to them depends on their risk appetite. I’ve only see occasionally value stock plays tied to break-ups (individual pieces worth more than sum of parts).

What changed over the years was how critical technology is to the world for growth and productivity, whether you like it or not. So much wealth creation has occurred. If one was in value stocks or just invested in DJIA indexes, you’re falling behind.

In 2019, after reading your blog for years, I looked at my portfolio, and my gut knew I was too conservative and over-indexed into industrial, blue chip type stocks. To make a step change for me and my family, I needed to re-allocate to more tech stocks. Those investments paid off, and have allowed me to upgrade to a new home. The value of those investments have been game changers. In hindsight and luck, I look back and I didn’t risk too much capital.

Never stop posting, look forward to your posts and newsletters.

Thanks for sharing your story. I think you nailed it on how the shift toward technology has transformed wealth creation over the past couple of decades. Industrial and blue-chip value stocks still have their place, but as you said, the upside is often limited unless there’s some kind of special situation like a break-up.

Glad to hear you made that portfolio shift in 2019 and that it’s made such a big difference for your family. It’s a great reminder that sometimes the biggest risk is being too conservative for too long. Congrats on the new home — that’s an awesome tangible result from your investing decisions.

Sounds like the finest steak dinner on you coupled with the finest wine if we ever meet up?! Cheers

Sam, stop by Minnesota and you have a deal!

It’s been a lost decade for many blue-chips from a stock price perspective. The sheer market caps of these tech companies is astonishing.

Translating investment returns into tangible, life improving assets for my family is one of my biggest achievements.

Sam- Wondering when to stop, if ever, with growth stock investments? I’ll never need the money in retirement (decade from now) due to pensions, so I’m fine with growth stocks to my last breath since money is for my family and philanthropy. I’m fine with the ups and downs because I know power of growth stocks over long term. Biggest issue is RMDs. Thoughts?

It’s a personal question because stocks in general have no utility unless they are sold to pay for something nice.

Investing itself can be the reward. So if you can continue to invest because you will have a pension, then you might as well. Investing is a fun challenge, and so is seeing a profit.

I will have a post on the subject next week. Stay tuned.

Growth over dividends makes sense as way to increase value to most; any opinion on holding dividend stocks over bonds/cash for daily, monthly, yearly cash flow needs while the growth stocks do their work? Seemingly more risk, but more upside optionality over a longer time frame. Thx

I am more of a growth investor over value investor if I have to choose between the two. But overall I’m pretty conservative and I haven’t made single-name stock bets in a very long time. Maybe I’d be better at it now, but I was horrible at it in my younger days and I lack the patience and interest to try and do it well today. You have a good mix of risk and stable investments imo based on what I’ve read, which I really respect. It can’t be easy making so many investment decisions year-round. Thanks for sharing your latest updates with us and best of luck with UHC.

Great points Sam! What’s your favorite growth/momentum ETF?

What about the ethics of owning United Healthcare?

I’d love to hear your thoughts on the topic. It’s a good one.

You may enjoy this related post: Investor Virtue Signaling In A Capitalist Country Is Fascinating

This is me and Lululemon right now. I like having both growth and value stocks in my portfolio for no other reason other than be exposed to the whole breadth of the rollercoaster. Makes me feel alive.

Haha, love feeling alive! I feel you on Lululemon. I’m sure you own some of their products too. I was tempted to buy it as well, but never did. I’ve got one pair of paints from the place from 12 years ago. I wanted to fit in a medium but it was way too tight, so I got a large. Expensive product and made me feel fat haha.

It’s so hard to resist investing in value stocks where you also own the product. This has consistently been my trap for decades. “If I like the product and the stock is at a 30% – 50% discount, surely, others should too right?!”

As long as one has a strong heat.

My best guess is that Berkshire Hathaway likes UNH because it fits into their business model. But white knights are not saving all the other “great values” in the stock market. Other value traps that I have purchased, Verizon, AT&T have not grown their stock price for years—at least I have the dividends and covered call premiums to help, but I will not get back the lost time spent on these positions. It reminds me of when I shop at Goodwill, I am delighted when I find a rare treasure, but it is typically junk for sale.

I have such a value stock mindset that I shorted nVidia TWICE before changing my way of thinking. I am long now, but those trades have cost me dearly.

Leaning a portfolio heavy into growth stocks starts to sound like late-stage bull market talk, right along with saying “this time is different”. But FIRE people need to invest differently to get to early retirement.

Dollar cost averaging into growth is how I minimize the psychological pain of buying these perpetually overpriced stocks.

You and I sound alike! Alas, I’m too scared to short growth stocks. Although shorting them would have been fantastic in early 2022.

Late-stage bull market talk indeed… but I’ve literally been writing about investing in growth stocks over value stocks since 2009, during the depths of the global financial crisis.

Yes, growth stocks will blow up more spectactularly than value stocks. This is why we diversify. But I will buy their next dip.

Glad Buffett joined us with buying UNH! Now if he and others would only buy billions and billions more….

It is all about risk and return though isn’t it. It is all very well to talk about Meta, Tesla, Google, Netflix, and Apple, now. Those people that bought Nokia in the early days may not be quite so wealthy now! And then we look at today. What are the next Meta, Telsa, Google, Netflix, and Apple? Most probably in the AI space. But which ones? With any new technology some leaders will emerge, and the rest will likely go to near zero.

I could easy find 50 or so AI stocks to put money into. But which ones are the 5 that will shine? Maybe I am just stupid, but I really have no idea. And therein is the issue. Yep, there are the winners (like yourself) who backed the right ones and can FIRE early. We don’t hear so much about the many others who backed the wrong ones and are now stuck in a job for longer compared to if they just bought an index fund.

Anyone could FIRE next week if they pick the right lottery numbers, and for most picking the right 5 AI stocks to achieve in the coming 10 years what we have seen with Meta, Telsa etc, has a similar probability to picking the right lottery numbers.

There are no sure things when it comes to investing. But here’s one thing I know for sure: if you don’t try to find the winners, you won’t outperform. If you try, you might outperform—or you might not. I choose to try, and I’ve always tried.

One benefit of writing Financial Samurai since 2009 is that anyone can look back at my track record—both the winners and the mistakes. My message has been consistent for over a decade: I prefer growth stocks over dividend stocks, and I still stand by that today.

If you don’t want to try picking winners yourself, you can buy a NASDAQ ETF, which is heavily weighted toward tech and growth companies. Or you can invest in multiple venture funds and outsource the winner-picking entirely.

Since becoming an operator myself in 2009, I’ve realized that spotting winners isn’t as hard as I once thought—especially with private companies at the Series B or C stage. Their growth is often obvious, and the real challenge is gaining access to invest in them. While there are never guarantees, instead of a 51% chance of making money, I see the odds at 75%–80% for some of these opportunities.

And once you become an operator, it becomes more clear when deciding between value stocks and growth stocks.

What line of business are you in?

I hear what you are saying, but I think the point you are missing the point, is that you are way smarter than most. Is your net wealth in the top 1% or 2%? If it is, and you are self-made, then you are almost certainly in the top 1% or 2% of the smartest people too. I come back to what Buffet says, and I believe he is correct when he states that for 99% the best way to wealth is index funds for the long term. And then there is the other statistic – the majority of funds managers UNDERPERFORM the market! So most so-called professionals can’t beat the market. Therefore it is my view that for the average person, with average ability, their fastest path to FIRE remains index funds. Of course if you really are one of the smartest 1% or 2% then you may well be able to outperform the market, but you better be pretty sure you really are part of that 1 or 2%.

Hi Mark – I am definitely NOT way smarter than most. I am in the middle. All you have to do is look at my SAT score from high school of 1,120 to demonstrate that (66th percentile). I took the test at least two times, and that’s the best that I could do. I tried my best to get straight As in college, and the best I could do was get a 3.72 (out of 4.0). I’m also a public high school and public college graduate (Go William & Mary!). The only thing I am above average in is effort, e.g. published 3X a week for 16 years in a row so far.

There is certainly lots of luck involved, as I’ve written in my post, Your Outsized Wealth Is Mostly Due To Luck. But there is also effort involved in recognizing the long-term investment trends, and allocating capital accordingly.

And you are absolutely right, most active fund managers and retail investors underperform the S&P 500 or index. Which is why the vast majority of our capital should be invested in index funds and ETFs. But if we invest 100% in an index fund, then we are guaranteed to underperform by a little bit.

This is why for those who want to FIRE (which is not everybody), I suggest allocating 10% – 20% of your capital in individual investments to give yourself a CHANCE to outperform. You will likely not outperform long-term, but at least you have a chance. And if you do, your life could improve dramatically.

Time will tell whether my public equity tech bets will continue to pay off, and my newish private AI company bets over the past 2 years will become liquid and cause a nice financial windfall. Everybody can make the same investments today. I hope FS will be around in 5-10 years and I will provide an update – good or bad.

I’ve owned several value stocks that *appeared* to be fantastic investments on paper, but all disappointed in reality. TELL (Tellurian) – I calculate the production compared to other LNG plants and determined it was significantly undervalued and bought lots of shares, but then the company was sold for far less than it was worth. Common stockholders got very little of the value. X (US Steel) – bought on the Nippon news – similar story. WW (Weight Watchers) – came back from bankruptcy stronger, but the creditors got pretty much everything, leaving common stockholders with nothing. Maybe I’m just bad at this, but in every instance, someone got very rich off of these same situations.

Thanks for sharing your story. I feel your pain. I hope more readers share their experience investing in value stocks.

Sometimes, they can capture lightning in a bottle, like buying Caravan below $5/share. But so often, the turnaround story gets stuck in the mud.