When everybody is getting rich but you, investing FOMO takes over! Investing FOMO is the hardest type of FOMO to conquer. If you let it get to you, you could end up losing a lot of money due to improper risk management.

FOMO stands for Fear Of Missing Out. The term is usually reserved for those who spend everything they have to buy the latest thing or experience without any regard for their financial future.

FOMO is what drives people to go into revolving credit card debt. FOMO makes credit card hawkers rich and their slaves poor. Investment FOMO is also what drives people to chase stock market bubbles and buy at the top, only to lose a lot of money in the end.

The Fear Of Missing Out is the main reason why people are unhappy, even if they are living better than 99% of the world. Investing FOMO is when you chase an investment that has already risen by 1,000%.

Those who refuse to save for retirement justify their spending by saying, “you can't take it with you.” It's true. No matter how much gold you bury in your grave, your spirit takes nothing physical with it.

But after starting my investment tracker series, I've come to realize that investing may be the ultimate case of FOMO. Spending all your money on useless things doesn't even come close. Let me explain why in three reasons.

Investing FOMO: The Hardest Type Of FOMO To Overcome

When the stock market was at record highs and highly speculative assets like crypto and meme stocks were going ballistic, investing FOMO took over a lot of people's minds. Those who got in late subsequently lost a ton of money. Perhaps the same thing is happening now with artificial intelligence.

If you lose lots of money from your investments, you're ultimately losing a lot of time. And time is the most precious asset of all.

Let me share why investing FOMO is the worst type of FOMO. The fear of missing out on a nice vacation or driving a fancy car or getting your kid to play soccer is nothing in comparison.

Why Investing FOMO Is Bad #1: Everybody is getting rich, so must I.

After violently correcting in 2008, the S&P 500 has done well since January 1, 2009. For the first four years, I, along with plenty of skeptics had our doubts about the recovery. The markets were simply recovering what they lost. But when the S&P 500 and other indices started breaching their pre-financial crisis highs in early 2013, investing FOMO really began to kick in.

It no longer felt as good to have money locked up in a 4.1% yielding CD. Instead, it was all about daring yourself to go maximum long stocks and real estate. Cash and CD savers were falling behind. I stopped seeing myself on the platform patiently waiting for the train. Instead, I was starting to run after the train as it began pulling away.

As interest rates increased and a bear market ensued, it is now easier to generate more passive income. At the end of the day, cash flow is more important than net worth.

Doesn't Matter If You're Already Rich

Even if you've reached a financial level where you don't really have to worry about money again, you won't feel good if you see other people growing their wealth faster.

For example, you could have the ideal net worth of $10 million grow by 5% in one year. That's a nice $500,000! However, you'll start feeling investing FOMO if you see someone with only a $500,000 net worth grow by 20% during the same time period.

Instead of being happy making $500,000 doing nothing thanks to a top one percent net worth, you'll start feeling bad you didn't make $2,000,000 taking the same amount of risk! Crazy right? Investing FOMO.

It's only when your peers earn a similar or worse return will you be satisfied with your performance. Even if you only made a 1% return, if your peers made a 0% return you'll feel happier than making a 10% return if your peers made an 11% return.

Investing FOMO is the only way to keep up with the rich. Otherwise, you'll be on the wrong side of the wealth gap as it continues to widen.

Just look at how investing FOMO ruined the lives of SBF, Madoff, and many more who were already rich. Greed can kill!

Why Investing FOMO Is Bad #2: The fear of never being free while you're still healthy.

The older you get, the more you'll worry about never being able to get out of the rat race. You start asking yourself, “is this all there is to life?” You'll also start resenting your job and the people you see more than your family every single day.

It's natural after doing the same old thing over and over again. As a result, you'll start kicking your savings and investing into high gear. You plan to one day engineer your layoff and live life on your own terms.

Those who are more aware are able to quantify their purchases, not only in after tax dollars, but in terms of time. For example, buying a $300,000 more expensive house because it has one more bedroom you'll never use equals at least 10 more years of work if you only save $30,000 a year.

No rational person would choose driving a Porsche and buying a mega mansion if the cost was a 20 year delay in achieving financial freedom. Stretching your finances every month is a stressful way to live. Instead, use money to help reduce stress and anxiety.

Investing FOMO gives you hope that you'll one day enjoy your freedom while still being able to walk, talk, and live pain-free. To hedge, you best try to find balance.

Why Investing FOMO Is Bad #3: The fear your children will have a worse life than you.

The amount of <40 year old angst about student debt, stagnant wages, underemployment, and unaffordable home prices is overwhelming. You don't want your kids to turn out the same way. There is a lot of angst and anxiety among parents who live in big cities nowadays. They think they need generational wealth for their kids to be OK!

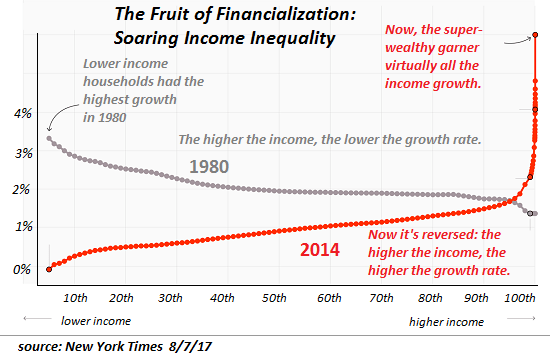

The more in tune you are with the way the world works, the more you realize the importance of investing for your children's sake. The top 1% – 0.1% have garnered the lion's share of gains over the past several decades because they've been active investors in appreciating assets.

The trend will continue as family dynasties are being formed to ensure that generation after generation of kids will have every single advantage in life. Investing FOMO makes parents want to invest more than they should based on their true risk tolerance.

Investing is one of the main ways to make sure your children don't end up further and further behind. If you don't invest, your sons or daughters will have a much harder chance of getting into a prestigious university.

They may have a more difficult time getting a sweet job because the spots will all be taken by kids of wealthy parents who buy their children's way into everything. When there are 10 applicants for one spot that all look alike, the tie-breaker often comes down to those with money and status.

Not only am I investing the majority of my income every month so that my children can have more options, I'm also working hard at building contingency plans. Contingency plans are just in case they don't do well in school, get discriminated against based on his race, get into an accident, and I can't compete in terms of donations and connections.

Why Investing FOMO Is Bad #4: You could lose tons of money!

Investing FOMO causes people to confuse brains with a bull market. Because their stocks are going up, they now think they are Warren Buffet even if they have no formal financial education.

With a feeling of invincibility, these investors buy stocks on margin. Even worse, they might buy growth stocks on margin at all-time highs. This combination can sometimes result in disaster.

One softball friend went all-in on Tesla stock on margin in 2021. He not only lost all his money, he also lost time and respect from family and friends. Many would say losing your reputation and time is worse than losing money. Thankfully, Tesla stock has climbed its way back up in 2024.

The problem with investing FOMO is that your asset allocation goes out of whack. Taking too much risk is one of the main ways investors lose a lot of money.

Lots of people lost money in NFTs, meme stocks, and more during the pandemic. Due to investing FOMO, lots more people will lose money again.

For Those Who Lack Investing FOMO

If you don't feel investing FOMO, please share with us your secret.

I've struggled with managing my fear of failure for a very long time. I always felt pressure not to be a disappointment to my parents because I got into so much trouble during high school.

Once I hit 40, after not having a job for six years, I slowly started losing some investing FOMO. But investing FOMO is knocking on its dungeon door in my head, wanting to get out!

Parental FOMO has revived my motivation to stay as fit as possible and generate as many contingency plans as possible. But boy is staying in shape hard as we grow older.

Due to Parental FOMO, I'm also aggressively building my passive income investments. This way, no matter what happens, we'll remain free to raise our children full time.

I'm envious of those of you who are able to spend freely, not chase the current hot tech stock, eat whatever you want, and not worry so much about your future and your children's future. I wish I could let go and just kind of wing it.

There's Just So Much Wealth Out There

Unfortunately, I keep getting shown how the future works because I've had the opportunity to go behind the scenes.

I'd much rather NOT know that my friend's son got into XYZ school because of a $1 million donation. I don't want to know that my other friend's daughter got a job at PYQ investment bank because they are private wealth clients with over $30 million in assets with the firm.

I'm stuck in a world where so many people I know are extremely successful thanks to stupendous careers, amazing businesses, and savvy investments. That's the problem with living in big cities like San Francisco, New York, Hong Kong, or London. They seem to attract the most gung-ho type of people.

Their success naturally pushes you to do more. If you don't want to do more, then you should highly consider getting out.

At first, getting to know extremely successful people was a novelty. Now, I often wonder, why are they STILL working when they could spend time with their kids?

Investing FOMO Reduction Plans

I took the first step of FOMO reduction by leaving Manhattan in 2001. I moved to San Francisco to live a more balanced lifestyle. NYC is the greatest city on Earth. However, it will eat you up and make you miserable if you aren't careful.

Then in 2014, I moved out of the wealthy north side of San Francisco to a middle-class neighborhood on the west side. It feels great living next to plumbers, grocery store managers, house painters, and retirees.

By 2030, I plan to take a larger step in FOMO reduction by leaving San Francisco moving to Hawaii. Life is more laid back and stress free on the islands. San Francisco has one of the lowest children per capita in the country. I think it would be nice to raise a family in a family friendly environment.

Finally, to reduce my investing FOMO, I will continue to carve out between 10% – 20% of my investable assets on individual investments. These individual investments include, real estate crowdfunding, venture debt, venture capital, and my favorite growth stocks.

I plan to keep aggressively saving and investing the majority of my cash flow because investing FOMO is hard to quit!

More Thoughts On FOMO

- FOMO may be a big reason why many delay having children.

- Children change everything when it comes to being financially responsible. There's no other option but to get your financial act together. Once you have someone with zero earnings power and little knowledge depend on you for 18 years.

- You may feel better living in a middle class neighborhood than in a rich neighborhood. In rich neighborhoods, your neighbors are always doing some type of remodeling. They also tend to drive more expensive cars, go on fancier vacations, and send their kids to private schools.

- You may experience FOMO reading personal finance sites like mine. If so, take a break, and focus on your own financial goals. They are the only ones that matter.

- Investing FOMO is natural in a bull market. But I'm trying to go the other way and pay down debt and raise cash. After such a massive bull run since the pandemic began, capital preservation makes sense.

- Due to investing FOMO, you could easily lose a lot or all of your money in speculative assets. Just take a look at FTX, the formerly second-largest crypto exchange going from $16 billion to a negative valuation in 48 hours. A lot of investors who held their crypto on the exchange lost all their money.

- To get rich, you don't have to be a great investor. You just need to be a good-enough investor and have the correct risk metrics in place. Sooner or later, you will accumulate more wealth than you can imagine thanks to good investing.

- Real estate FOMO is actually the hardest type of FOMO to overcome. The reason why is because it's a tangible asset where you can see yourself enjoying life.

Best of luck with conquering your investing FOMO everyone! May you get rich and stay rich by regularly converting some of your gains into real assets.

Diversify Your Investments Into Real Estate

Stocks are very volatile compared to real estate. Therefore, if you want to dampen volatility and build wealth at the same time, invest in real estate. Real estate is my favorite asset class to build wealth.

The combination of rising rents and rising capital values is a very powerful wealth-builder. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

The Best Private Real Estate Platform

Fundrise: A way for all investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 with about $3 billion under management and 380,000+ investors. For most people, investing in a diversified eREIT is the easiest way to gain real estate exposure.

I've personally invested over $300,000 in Fundrise to earn more passive income and diversify my investments. I've got a roughly even split between commercial real estate and venture capital, both of which I think are promising.

Commercial real estate values have fallen almost as much as they did during the 2008 Global Financial Crisis due to aggressive Fed rate hikes. However, the economy and household balance sheets are much stronger today. Meanwhile, I believe artificial intelligence will change our future, which is why I'm investing in private AI companies today. In 20 years, I don't want my kids to ask me why I didn't invest in AI near the beginning.

Both platforms are sponsors of Financial samurai and Financial Samurai is a six-figure investor in Fundrise funds.

Investing In Artificial Intelligence

My greatest investing FOMO is in artificial intelligence. It is clear that AI is going to revolutionize the world. As a result, I feel I need to stay in San Francisco for longer, the AI capital of the world.

In addition to trying to get a job in AI, I'm investing $500,000 in various venture capital funds that invest in AI companies. Private growth companies are staying private for longer, which is why I'm allocating more of my capital to private investments.

Check out the Fundrise venture product, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Compare that to most venture capital funds which have $250,000+ minimums. Fundrise also lets prospective investors see what its products are holding. In turn, greater transparency helps investors make better investment decisions.

Graphic by Colleen Kong Savage. Join 65,000+ others and sign up for my free weekly newsletter. I recap the latest money news and FS posts so you'll never miss a thing.

I don’t have FOMO Investing. I’ve already had the bad happen, getting hit by an uninsured illegal, getting a multi-drug resistant infection post-op, going bankrupt from the medical bills, and now having lifelong disabilities.

I won’t have children, but my nearest relative just had one, and they’re broke, my parents are going down the dementia path of the long three goodbyes.

So I’m the only wage earner of six. And somehow we take care of each other.

I’m not going to beat the market. I’m not going to be a 1%er. I don’t care about the Jones or the Gates. I’m happy with good enough. I’m making 5% in CDs. I’m making somewhat more in stocks. I’m not losing to inflation as fast as I was earlier. Per some calculators, I’ve got 9 more years before I can retire and 19 before I’m forced to do so by age discrimination, if my health will hold out.

I’ve had a lot of bad stuff happen, but durn it, I’m still alive so I can continue to do something about my situation. I now have to decide between paying or or waiting out student loans and the associated tax bill, or really reduce my expenses and pay the mortgage off.

I can make more money because I enjoy my day job and don’t mind spending more time at it. It’s a great break from caregiving. The infant won’t care if I’m not around and I don’t have to be there for each milestone, that’s her parents’ jobs.

The antidote for FOMO? Balance.

Moving from a faster to a slower pace city and then from less family friendly to more family friendly is a form of geo-arbitrage much less talked about in the FIRE movement than simply moving from higher to lower cost of living cities, so good call out! A key part of our FIRE plan is geo-arbitrage for all of those reasons. On the family front, our kids are much older, HS and college, but they’ll still need our support for a few more years, and it will actually be easier for us to do that by spreading out geographically, capturing some of those lower cost of living savings, and plowing it back into the “family dynasty” as you put it Sam.

It’s weird but you don’t miss what you don’t have or know. Growing up no one I knew really invested or talked about it…everything was the here and now and maybe saving to help your kids go to college, so I guess why some don’t worry about the FOMO or FIRE or just being FI it just not a goal; just do better than your parents….now I do invest like crazy and try to educate my family and friends but it’s tough dealing with mind set of “it’s not for us”…..etc. Seeing how others lived while in the military really changed my mindset and I still have a FOMO especially on a good retirement (I do have a good pension).

For me FOMO is like feeling that fear out of insecurity in seeing others do something that you think make them look cool and more relevant. In my case, I invest not out of fear but of positive thinking that I can give myself and my family a brighter future ahead. I don’t feel like my clock’s ticking as I do baby steps day by day on how to achieve my goals when it comes to my finances.

I have a little FOMO worry that I’m not investing enough right now and that I will have to work longer than I’d like. I’m trying to mitigate that fear by investing more so that I can control my life better. Seems like a good solution and prevents me from comparing myself to others.

FOMO is very true with investing. For example, in the crypto and blockchain space, you have these ICO start at a couple of cents and then skyrocket to $17. Even if you poured thousands into it, you’ll be a millionaire.

I see a huge opportunity with the ICO UnikoinGold launched by the legal esports betting platform Unikrn. Great investment opportunity and it’s a plus if you’re a gamer or watching gaming. I recommend looking into it.

U all have it wrong —never save! Saving doesn’t get you to your goals, only investing does…..in yourself, in businesses, in education, in experiences.

Fomo for saving creates miserly people who often look back and wonder what life could or should have been!

That’s why the post is called INVESTING Is The Ultimate Case of FOMO, not SAVING Is The Ultimate Case Of FOMO…

I think I understand the premise of this idea. FOMO typically has a negative intonation associated with it but this is a different way of looking at FOMO. I for sure am one who has FOMO with respect to investing and wealth building.

Good luck for your move to Hawaii!

Hi Sam,

Not sure if Investing is the ULTIMATE FOMO, but when life is a MOFO, this limited time that we are given on this planet certainly feels like a FOMO.

I know this is a personal finance site, but PF is only a part of our lives. Neither can it become the driver, nor the ultimate in our lives.

My 0.02

“comparison is the thief of joy” — Roosevelt

If you ever want to see FOMO, just go to Toronto and talk to anyone about housing.

Not falling for FOMO is definitely hard, but I think growing up poor developed my ability to ignore what other people are doing and stop comparing, out of necessity. If you can turn a negative into a positive, you can do anything.

The way I see it, everyone finds happiness in their own way. We are all different with different backgrounds. If you have to copy other people and compete with them in order to be happy, that’s a goal post which constantly moves and you will never be happy.

I’m glad I left the rat race 2 years ago and FOMO has not been a problem ever since. I love my life and wouldn’t trade it with anyone. And I know other people who are happy love their lives, and it could be completely different from my own, and wouldn’t trade it with anyone else.

Moving to Hawaii sounds like an awesome idea! Looking forward to your posts about it.

So true that avoiding personal finance sites is a good way to not have investing FOMO. Prior to reading personal finance sites, about 1.5 years ago, my investment strategy was more like this:

Hmm…let’s see how much is sitting in savings…boy that’s a big chunk now…what should I invest it in?

How was it that I was able to go for 36 years without investing FOMO? I’ve always felt like a had a comfortable life and all my needs were met. I could easily afford to travel a few times a year, have great family and friends who get together often, and I don’t have expensive tastes so there wasn’t a need to make more so I could buy the latest and greatest things. My sister on the other hand, who’s also not materialistic, is very ambitious and I think it makes her feel better to have more money in her bank account because she is very kind hearted and I think she wants to be able to take care of our parents and anyone else that may need help. Sam, you touched on wanting to provide the best for your son and I imagine that deep down you’ve probably always felt a need to take care of others too.

This article hits home. I live in a rich zip code but I live in the middle class section of that zip code. My daughters literally have friends whose parents are worth 9 figures and even in 1 case 10 figures. No way I can keep up with that. Yea, I am missing out on the 25,000 square foot house with all the amenities.

What I have found is that I listen to these people and then try to apply some of it to my situation and personalize it. One PE guy told me that the key to asymmetrical returns is to place a small amount of money into many emerging companies that have disruptive technology. For him, that probably means at least a million or more per investment. For me, it is somewhat different. I invested a decent amount in a firm that does real estate on-line. I then found a firm from Canada that trades on the OTC. I think there technology has the potential to be disruptive so I invested a tiny amount in the firm. Again, only a small % will go towards investments like these. Only 1 or 2 needs to hit big. I personalized what I learned to my situation and found that my FOMO has gone away.

The rest is just basically personalized for my situation. As for parental FOMO, that is a tough one. My 17 year old drives a 1999 Nissan Ultima that looks like it has been through the demolition derby. Her good friend, the daughter of the PE guy (a very nice person btw) drives a 5 Series BMW. He probably thinks that is roughing it for her. I learned to let all that stuff go. Teach your kids to be good people and to be good to their word while always working to improve. Show them how to be bounce off the mat after failure. That is what we should be worrying about.

While I agree with investing FOMO I think the pressure of parental FOMO is much stronger. The pressure on us that our kids to buy/see/do/have the things that their friends or classmates do (aka have a better life) can be difficult to resist. Does that make pressure that I earn and invest more to be able to make the big donation to secure a spot in the elite school, or do I accept that my child will not attend the school and make the best of the alternatives? Do I teach them resilience or attempt to make their lives better? Can I handle feeling embarrassed that they have/do/see less?

One day near a milestone birthday I looked back on my life and realized about 80% of the significant things I worried about never happened and 80% of the things that threw me off my game were things I never saw coming. The simultaneous unexpected health crisis, job and insurance loss when we worried about retirement savings and whether to expand our family. I also saw that we were able to keep on with one foot in front of the other with each crisis. Knowing the very high chances that I was probably worried about all the wrong things and could handle things if I had to greatly helped me be less afraid in general. Also hearing that we each are the average of the people we spend the most time with made me very conscious of spending less time with others who make me feel unbalanced and pressured.

I agree that parental FOMO is strong. I got an email out of the blue from a parent asking if I can include it to Son in my random hits with another parent’s son and the parent ( Who has been my long time friend, and fellow member). I guess word got around that I hit with a couple of my students, in the off-season, so other parents don’t want to miss out.

Makes sense! There’s only so much you can do for your child. So as parents, we have to figure out how much to push and how much to let go.

“FOMO may be a big reason why many delay having children.”

This is what struck me a bit. I’ve been delaying making a decision in wanting / or not wanting to have kids of my own. Never looked at it as a way of fear of missing out. In some way, that’s exactly what it is. When you have kids, you might not be able to do the things you otherwise could have done. Changes the perspective a bit. It’s about FOMO based on a comparison to a different you instead of someone else you envy, maybe.

“Escaping this peer pressure is sometimes not as easy as you think if you don’t want to become some kind of “outsider”.

This is something I struggle with a lot now. I have a nice sized portfolio of investment property. But I still work each day on my properties. I drive a beat up work van and wear paint splattered clothes.

I often feel like other people are judging me based on how I look and what I drive, I want to carry a sign with me that says, “I am not as poor as I look, in fact, I probably make more money than you”

I know the benefits of stealth wealth, and being the ‘millionaire next door’, but sometimes it is hard finding that balance between fitting in with the people who work for me, my renters and the real world and the people in the area I live.

It does create more fear to add more wealth and prove myself to these nameless spenders.

Crazy!

I live in a very rich area and I do like it but I am lucky in that I don t feel compelled to show off. The environment at the same time keeps me on my toes forcing me to make my business better–I like this but I also just wanna raise my kids too-not ready to leave Tokyo yet though….Thanks for sharing I enjoyed your post as always.

I think that FOMO is good in most cases, just like I believe that millennials are a great generation. Yes, we replace jobs and partners constantly, but that is just because we aspire for more, and looking for an environment we can thrive in.

Like Emma Stone sings: Here’s to the ones who dream, foolish as the may seem. And that’s exactly what large portion of millennials do – dream.

However, FOMO is the stock market is bad. It leads to a constant stock picking which can hurt the return dramatically, by losing the winning days of the stock. Empirically, passive investing is better most of the times, but FOMO is colliding with this thesis.

This is also a reason why I’m afraid of what Robin Hood might do to people – I love them for not taking any fees, and I think that essentially you have to look for the lesser fees, but the other side of it might be that people choose to do more actions in the market, just because they don’t have to pay for them. And money obviously changes the way people act and incentivize them to act differently.

I think the best way to deal with FOMO is focus on your own goals and try to get them accomplished. Trying to be caught up on others who are successful can lose your focus on your own goals.

When reading other PF blogs, I try to provide that knowledge that others bloggers have put out there and see if it’s something I can take to work on my financial goals.

First-time poster, read through many of your article Sam and find them very introspective and refreshing compared to the many prior fellow finance colleagues in my prior life! Fellow Cal Berkeley Grad, recovering I-banker, and FIRE guy as well..still open as I see with others to grab a drink/or meet up over the phone if easier?

FOMO? I believe in LOEN – Love of Experiencing Now. If you can figure out how, IN YOUR OWN WAY, to love and appreciate the HERE and NOW, everything else will take care of itself and you will be FREE and RICH beyond your wildest dreams. All that you chase, will elude you. All that you let go, will find you.

I have a little FOMO on bitcoin. Still haven’t touched it yet though.

I’m in Manhattan with a young family and I agree with you NYC keeps the FOMO high and is not the greatest place to raise a family. Although I never try to keep up with others and always lived way below by means, its hard to escape the environment on a daily basis. The SF Bay area is better, not much better in the rat race department, but better in general quality of life. If you really look at it, the entire US suffers from this, and in turn most of the West does. If you really want to be cynical many if not most developing nations suffer from this, specially places like India and China where a new emerging middle class is striving for the best for themselves and their children by getting ahead of the competition. To go completely off the rate race scale, it’s best to visit remote and poor parts of the world in Asia, Africa and South America where locals enjoy the basic pleasures of life on a daily basis. I agree with Mrs. BITA, the best remedy is travel. I know you’ve made it a point to travel several weeks/months a year internationally, I’ve done the same for the past 20 years. Although traveling in luxury only doesn’t work as well. Mix in with locals, hang out in residential neighborhoods, eat where the middle class eat not just fancy restaurants, take public transport. As for myself, I dream to leave Manhattan one day, being able to afford to live here is both a curse and a boon. CA (not SF or LA areas, but Central Coast and SD much better) would be awesome for me and my family, Hawaii is a fantasy! Outside the states, I think parts of Southeast Asia (Thailand, Cambodia, etc.) might be nice places to live if you could afford an expat lifestyle with good private school options.

Good points. What do you do in Manhattan and how long have you been there? Love NYC.

Are you still live in Kuala Lumpur, Malaysia for four years and know what you mean. I was in Cambodia a couple years ago and it was a wonderful place.

I’ve been here almost 2 decades and work in finance. Although I always thought of NYC as overrated, I have also recognized it as the greatest city in the world, but most certainly not the best place to live. I enjoyed NYC up until a few years ago when I started my family, as the high earnings allowed me save lot (I don’t like to keep up with my peers) while traveling internationally or escaping the city when I wanted. With little kids now, even the money, savings and travel are not enough to keep me from thinking that there is a better, slower paced, balanced place to raise my children. I’m hoping to make a move in the next few years, but transitioning into employment outside of what I do in finance will be extremely difficult leaving NY. I don’t know how I’m going to do it, but I have to try to move to the West Coast.

Cambodia is beautiful, the place as well as the people. The young kids I met on the streets and in the villages, although orphaned and poor, were filled with hope, joy and dreams. I’ve never been to KL, but enjoyed other parts of Malaysia immensely. Char kuey teow on the streets and Nyonya cuisine in Penang!

Hopefully you were able to buy a place in Manhattan over the past 20 years so the cost of living is not that bad?

Nope. I never did due to FOMO of escaping Manhattan and settling elsewhere. I have had a hard time committing, specially now with a family. There has been some tremendous appreciation in many newer gentrified areas of NYC, specially since the crisis, but if you compare purchasing a co-op in established neighborhoods and add in maintenance/taxes vs. renting and investing the cash, purchasing might have been financially better but only marginally. Co-ops are notoriously stringent and illiquid, and have rules that prevent subletting. Condos are a smaller part of the market but command a hefty premium. Besides, I’ve been happy living in a rental that has been below market by 10-30% through time due to my landlord appreciating long term reliable tenants. Yes it’s not as large as apartment as I could buy and I can’t renovate, but then its not an apples-apples comparison. My issue with NYC is not only the cost of living, it is the quality of life, the rat race mentality, congestion, schooling, no private outdoor space. No matter what you are worth or make, you have to deal with the quality of life trade-offs here. Many suburbs are very nice, but then commuting is a non-trivial issue.

When I look at successful people, I don’t try to measure against them because it’s futile. When you start comparing yourself to successful people, there will be judgement and resentment.

I do agree that we should all take a step back and look at our goals and try to concentrate on what we want to accomplish. For example, my goal is to consistently increase my net worth by 10% every year. If I achieve that, I will be a happy man. If not, I need to to find ways to improve. No need to compare to others.

I’ve been dealing with some serious FOMO lately.

Like Retire by 40 is doing, I’m considering shifting most of my investments to bonds and commodities. Similar to Dalio’s All-Weather fund.

The only thing holding me back is FOMO. I have a feeling we’re due for a correction, but what if the next two years go like the last two?

Everyone else would still be making 15% returns and I’d be sitting at ~5% maybe.

I know it’s not the smartest decision to try to time the market, but things are way out of whack to keep investing in broad stock index funds.

FOMO still give me pause, though. I feel your pain.

A good friend of mine lived in Hawaii about 10 years ago. She her kids experienced some prejudice in the elementary school there. Is that still a thing? She’s caucasian.