You've learned about the 20 best cities to buy real estate in America. Now let's look at the 20 worst cities to own investment property in America.

Buying real estate is a big commitment whether it's your primary residence or a rental property. You want to make sure you're buying a gem, not a lemon, that's also in an ideal location.

As an investor, it's also important to know which are the worst cities to buy real estate in America. If you're not tied to a particular area, it's best to avoid areas that are on the decline.

Overall, the real estate market is doing very well. Mortgage rates continue to stay low and economic growth is recovering post-pandemic. I'm bullish on the housing market over the next several years. However, not all housing markets are the same. Therefore, let's do an analysis of the worst cities to buy real estate based on various factors.

What Determines The Best And Worst Cities To Buy Real Estate?

How does one determine what makes the best versus the worst cities to buy real estate? When it comes to investing in real estate, you must focus on the following six items.

- Employment growth

- Population growth

- Demographic trends

- Interest rates / mortgage rates

- Valuations / cap rates / net rental yields

- Inventory

The worst cities to buy real estate are those with terrible job growth combined with bad migration trends and expensive valuations.

The main demographic trend I see is a moving away from expensive coastal city real estate markets towards inexpensive real estate markets in the heartland of America.

Therefore, the worst cities in America for real estate investors tend to be overpriced and have cap rates below the risk-free rate of return. The worst cities to buy real estate also have growing inventory and negative demographic trends.

Let's look at some specific examples. Below is a list of the 20 worst cities to own investment property in America. I've looked at job growth and demographic trends in the analysis. For reference, I am a 20-year real estate veteran with properties in San Francisco, Lake Tahoe, Honolulu, and multiple commercial properties all over the South and Midwest.

The 20 Worst Cities to Own Investment Property

Here's the 20 worst cities to buy real estate from bottom to top.

20. Portland, Oregon

- Population growth: 2.9%

- Employment growth: 2.3%

- Increase in home values: 1.1%

- Rental yield: 4.7%

Portland used to be cheap. But thanks to the boom in Seattle and SF, there's been huge spillover. The average home listing price being $469,000. Based on a median rent of $1,848, it’d take over decades for rental income to pay off buy-in.

19. Corpus Christi, Texas

- Population growth: 0.8%

- Employment growth: -0.9%

- Increase in home values: 3.4%

- Rental yield: 7.6%

Despite being in the heartland, the biggest drags on Corpus Christi are weak population growth, stagnating home values and employment that declined year-over-year.

18. San Diego, California

- Population growth: 2.2%

- Employment growth: 2.2%

- Increase in home values: 7.1%

- Rental yield: 4.4%

San Diego’s 4.4 percent rental yield is one of the worst in the study, and it would take close to 23 years for rental income to pay off a property. San Diego is experience surging inventory.

17. Cincinnati, Ohio

- Population growth: 0.1%

- Employment growth: 1.1%

- Increase in home values: 7.5%

- Rental yield: 6.6%

Like many cities in America’s “old Midwest”, Cincinnati has had to deal with stagnating, if not outright declining, population and employment growth.

16. San Francisco, California

- Population growth: 2.0%

- Employment growth: 1.8%

- Increase in home values: 9.8%

- Rental yield: 4.1%

Another of the worst cities to buy real estate is San Francisco. The median home price is San Francisco is a nation leading $1.6 million. With cap rates at 2.5% or lower, San Francisco is terrible for income generating properties.

I personally sold my property in 2017 because it simply wasn’t worth managing anymore. Besides, I got $2,740,000, or 30X annual gross rent for my property! I proceed to reinvest $550,000 of the proceeds in real estate crowdfunding in the heartland of America with 4-5X higher cap rates.

15. Boston, Massachusetts

- Population growth: 2.1%

- Employment growth: 1.6%

- Increase in home values: 7.5%

- Rental yield: 4.4%

Boston also has a steep buy-in, $725,000 being the median price for all homes. Even with fairly expensive median rent of $2,629, the rental yield is a mere 4.4 percent. At that rate, it’d take you 23 years for rental income to pay off.

14. Wichita, Kansas

- Population growth: 0.4%

- Employment growth: 1.0%

- Increase in home values: 5.5%

- Rental yield: 6.1%

Population and employment growth are abysmal, although rental yield is decent. Principal appreciation is likely not happening here. Wichita’s $886 median rent is the third lowest in the study.

13. Baton Rouge, Louisiana

- Population growth: -0.5%

- Employment growth: 0.7%

- Increase in home values: 9.9%

- Rental yield: 7.1%

With negative population growth, Baton Rouge real estate prices are now falling.

12. Virginia Beach, Virginia

- Population growth: 0.3%

- Employment growth: 0.7%

- Increase in home values: 1.6%

- Rental yield: 6.2%

All the figures are terrible, except for the rental yield. With only a 1.6% increase in home values, prices look like they will be going negative. Virginia Beach is definitely one of the worst cities to buy real estate.

11. Los Angeles, California

- Population growth: 1.4%

- Employment growth: 1.3%

- Increase in home values: 8.7%

- Rental yield: 4.3%

The median home price is approximately $800,000. Even with a median rent of $2,881, it takes a long time to pay off and suffers from one of the lowest rental yields.

10. Louisville, Kentucky

- Population growth: 0.5%

- Employment growth: 1.3%

- Increase in home values: 5.5%

- Rental yield: 5.6%

Now we're half way through the list of 20 worst cities to buy real estate. Louisville is #10. Low rents makes it take nearly 18 years to pay off the price of the average property.

9. Pittsburgh, Pennsylvania

- Population growth: 1.4%

- Employment growth: 1.3%

- Increase in home values: 8.7%

- Rental yield: 4.3%

Pittsburgh made the worst list mainly because of its decline in population and weak rental yield. Home values increased significantly year-over-year, but Pittsburgh’s median rent of $1,135 means the payoff is low.

8. Buffalo, New York

- Population growth: -1.1%

- Employment growth: 1.6%

- Increase in home values: 15.2%

- Rental yield: 10.9%

With negative population growth, Buffalo is in trouble. Rent median is just $898, but the rental yield is attractive.

7. New Orleans, Louisiana

- Population growth: 0.9%

- Employment growth: 0.8%

- Increase in home values: 2.5%

- Rental yield: 5%

With yearly hurricanes, terrible population and employment growth, and not high enough rental yields, New Orleans is a pass. There is not great sustainable industry to drive income growth.

6. Anchorage, Alaska

- Employment growth: -0.1%

- Population growth: -0.3%

- Increase in home values: 0.5%

- Rental yield: 6.7%

The weather is terrible, and the days are short during the winter. Despite favorable tax policy, the city has seen very little employment growth, which could be related to the city’s outright decline in population.

5. Chicago, Illinois

- Population growth: -0.6%

- Employment growth: 0.8%

- Increase in home values: 3.0%

- Rental yield: 5.9%

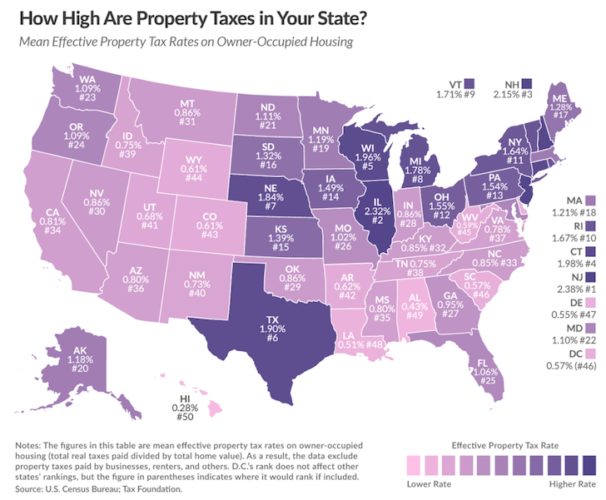

Now we've reached the top 5 worst cities to buy real estate. Chicago comes in at #5. Property prices have gone nowhere for 10 years, and probably won't go anywhere for many more years to come. The State is mismanaged and property taxes are the nation's highest.

4. Honolulu, Hawaii

- Population growth: -0.1%

- Employment growth: 1.6%

- Increase in home values: 3.7%

- Rental yield: 4.4%

The market is dead in Honolulu. I started looked at properties there since 2016 and many are still sitting on the market three years later. Tourism has slowed and there is no high paying industry in Honolulu. Honolulu is my favorite retirement city in America, but you need to have already made your money before moving there.

The median price for a home in Honolulu is now roughly $920,000 as of 2021. As a result, it's hard to make the numbers make sense. Therefore, Honolulu is one of the worst cities to buy real estate from a profitability standpoint. However, perhaps with the work from home trend likely permanent, more people will move to Hawaii and buy real estate.

Related: If You Can Make It In Hawaii You Can Make It Anywhere

3. New York, NY

- Population growth: 0.5%

- Employment growth: 1.2%

- Increase in home values: 7.8%

- Rental yield: 3.2%

Prices have been declining in New York, NY with a surge in inventory. With a median home price of $848,000, it’ll take you quite a while to pay off your property with rental income. Based on a median rent of $2,279, it’d take more than three decades to pay off the price of the home.

The average price of a Manhattan apartment fell 4 percent during 4Q2018, to $1.93 million, while the median price fell 5 percent over the last year to $1.1 million.

2. Milwaukee, Wisconsin

- Population growth: -1.5%

- Employment growth: 0.8%

- Increase in home values: 10.7%

- Rental yield: 9.3%

Despite a solid 9.3% rental yield, it’s undermined by weak employment and population figures. Besides, it's cold as hell for 4 months a year and hot as hell for 3 months a year.

1. St. Louis, Missouri

- Population growth: -2.2%

- Employment growth: 0.9%

- Increase in home values: 6.0%

- Rental yield: 6.9%

St. Louis suffered from the biggest decline in population from 2016 to 2018. Although a relatively cheap city, it's getting hollowed out and there seems to be no stopping the population decline.

The Worst Of The Worst Cities To Buy Real Estate

I would strongly avoid all coastal city real estate in 2021 and beyond. It takes bout 3-5 years for real estate cycles to bottom out. Here are the worst five cities to own investment property in my opinion:

1) NY, NY

2) Honolulu, HI

3) San Francisco, CA

4) St. Louis, MO

5) New Orleans, LA

Owning physical real estate is a young person's game. It is a serious pain to manage property issues like leaks and cracks. It's also sometimes difficult to manage tenants who can often times be late. The older you get, the less you want to deal with real estate.

The desire for pure passive income is why I think real estate crowdfunding is a very attractive way to gain real estate exposure around the country without taking massive single asset risk. Instead of spending hundreds of thousands or millions on one property, you can buy pieces of a property for $1,000 – $10,000 each.

I've done some detailed research on the best cities to buy property if you want to have a look and put your money to work.

The Best Real Estate Crowdfunding Platforms Today

The best real estate crowdfunding platforms today are:

1) CrowdStreet is based in Portland and connects accredited investors with a broad range of debt and equity commercial real estate investments. CrowdStreet is great because they focus primarily on 18-hour cities (secondary cities) with lower valuations, higher net rental yields, and potentially higher growth.

2) Fundrise, founded in 2012 and available for accredited investors and non-accredited investors. I’ve worked with Fundrise since the beginning, and they’ve consistently impressed me with their innovation. They are pioneers of the eREIT product.

Both of these platforms are the oldest and largest real estate crowdfunding platforms today. They have the best marketplaces and the strongest underwriting of deals. Sign up and take a look around as it’s free.

As always, do your own due diligence and only investment in what you understand. I’ve personally got $810,000 invested across 18 different commercial real estate projects around the country. My current internal rate of return is about 15% since 2016.

The 20 Worst Cities To Buy Real Estate / Investment Property is a Financial Samurai original article.

About the Author Of The 20 Worst Cites To Buy Real Estate

Sam worked in finance for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income.

He spends time playing tennis, taking care of his family, and writing online to help others achieve financial freedom too. In addition, he owns properties in San Francisco, Lake Tahoe, and Honolulu and has $810,000 invested in real estate crowdfunding.

Sam started Financial Samurai in 2009 and has grown it to be one of the largest independently owned personal finance sites in the world. You can sign up for his free private newsletter here. Worst Cities To Buy Real Estate is a Financial Samurai original post.