If you want to get rich you need to go where the highest paying jobs are. Highest paying jobs come from the fastest growing, economically strongest companies. Let's look at the highest paying cities in the world.

Nowhere in the world has a more vibrant economy than San Francisco. Average salaries in San Francisco have risen by 31% and by 88% over the past five years. San Francisco is the highest-paying city in the world according to Deutsche Bank research.

With company giants such as Facebook, Google, Apple, Uber, Salesforce all paying healthy six-figure salaries on average, it should come to no surprise that not only is San Francisco the highest-paying city in the world.

23-year-old college graduates at big tech companies are easily making $150,000 – $200,000 a year all-in. On the flip side, San Francisco also has one of the highest median home price in the world at $1.8 million.

Big-Time Salaries In Big Cities

In 2024, the average person in San Francisco can expect to be paid an average of $6,526 per month — that’s 42% more than the average New Yorker’s income.

New York is a little misleading comparison given NYC is 10X larger in population size than San Francisco. If you compare San Francisco with just Manhattan, pay in Manhattan is probably higher.

Zurich, Switzerland, came in second, offering an average monthly income of $5,896, although it lost the top spot this year after seeing average earnings decline by 18% over the last five years.

I've been to Zurich, and boy is everything from the food to housing incredible expensive. We're talking $10 Whoppers and $6 sodas.

New York City, with average monthly earnings hitting $4,612, was the third highest-paying city in the world. Monthly salaries saw a year-on-year increase of 12% in New York, helping the city hold onto the third spot in the ranking.

Boston and Chicago, which both offer monthly incomes in excess of $4,000, were also ranked among the 10 highest paying cities. But if you're going to try to make money living on the east coast, you might as well focus on NYC.

The 10 Highest Paying Cities In The World To Get Rich

- San Francisco, U.S.

Monthly salary: $6,526 - Zurich, Switzerland

Monthly salary: $5,896 - New York, U.S.

Monthly salary: $4,612 - Boston, U.S.

Monthly salary: $4,288 - Chicago, U.S.

Monthly salary: $4,062 - Sydney, Australia

Monthly salary: $3,599 - Oslo, Norway

Monthly salary: $3,246 - Copenhagen, Denmark

Monthly salary: $3,190 - Melbourne, Australia

Monthly salary: $3,181 - London, U.K.

Monthly salary: $2,956

It's clear that if you want to get rich, working in America is the place to be. American cities took four out of the top 10 spots. Here are the top 10 income metros in America. If you want to get rich, finding a job in one of the top income cities is a no brainer!

Best Value City To Make Money

Chicago is a surprising 5th due to the inclement weather for half the year and the relatively cheap housing. The median price for property in Chicago is only $226,400 compared to $1.8 million in San Francisco.

Yet pay in San Francisco at $6,526 is only 50% higher than pay in Chicago. Therefore, Chicago offers GREAT value.

Cities That Pay Big Bucks That Have Become Cheaper

The biggest surprises on the list are Oslo and London. These two cities have perpetually been ranked in the top 5 due to high taxes and high property prices. But Oslo lost 11% since 2018 and London's incomes were 13% lower perhaps partially due to the Brexit debacle.

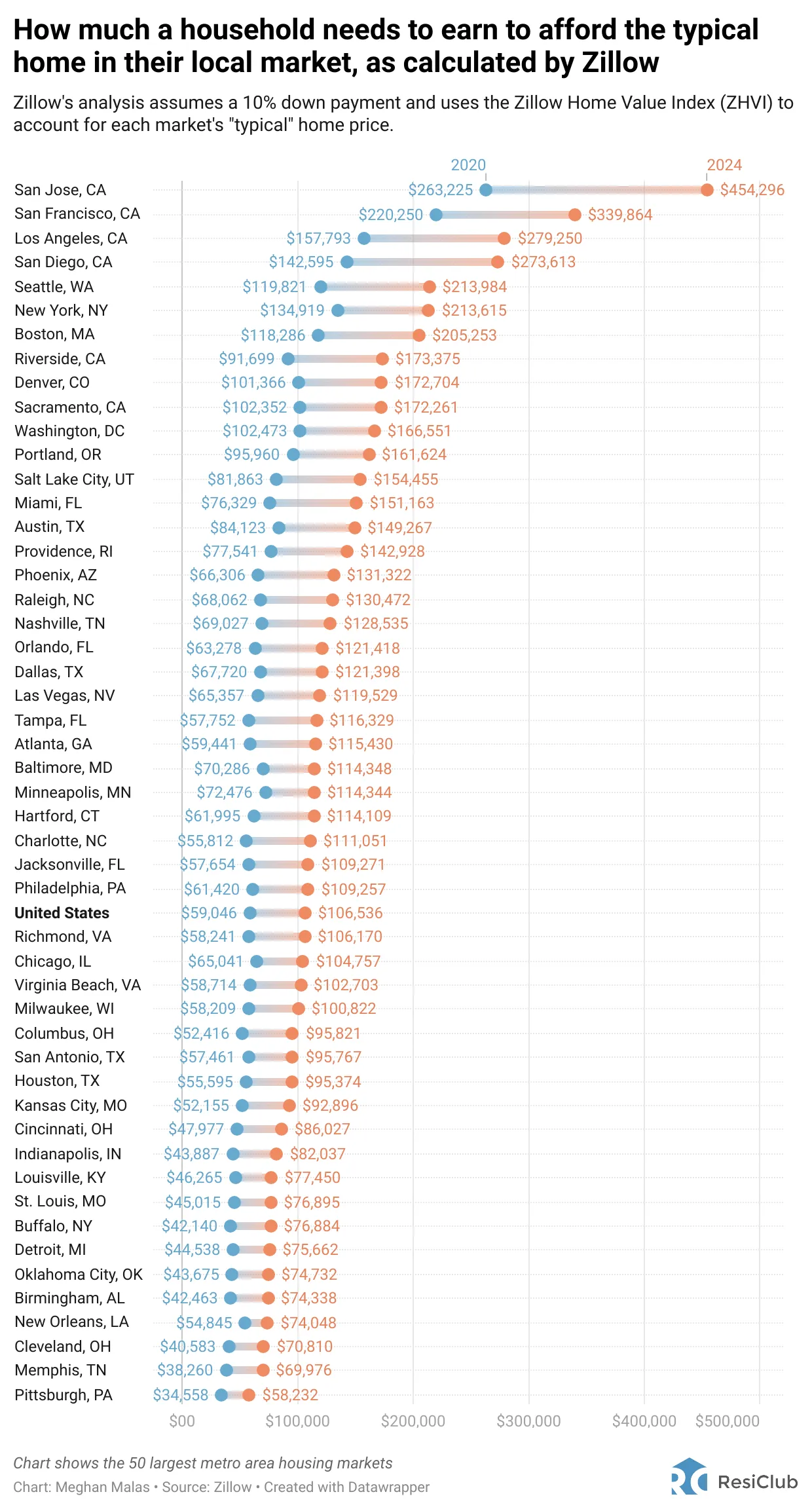

Here are the incomes required to afford a median-price home in the top 50 cities in America.

Big Cities That Got Much Cheaper

The biggest year-on-year losses were seen in Buenos Aires, Argentina, where a decline of 45% left monthly incomes at $527.

Salaries in Johannesburg, South Africa, fell by 26% and came in at $1,223 per month in 2019, while the Turkish city of Istanbul saw earnings tumble 31%, leaving residents with $433 each month.

Cities offering the lowest monthly incomes were Cairo, Egypt, where residents earned $206, and Lagos, Nigeria, where residents were paid $236 per month, according to Deutsche Bank.

These cities could be great places to retire to once you've made your fortune. Lowest monthly incomes likely means lowest cost of living.

Cities With The Highest Monthly Rent

Hong Kong is one of the poorest value cities in the world. Rent is high, yet pay is low! The average monthly income is about 50% than the average monthly rent for a two-bedroom apartment.

I've been to Hong Kong over 20 times for work and it is congested, hot, and polluted. Average earnings came in under $2,500, but rent costs were $3,685 — or 2% higher than the cost of renting a similar apartment in San Francisco. But in San Francisco, you can earn $4,000 more, or 161% a month!

The second poorest value city is Paris, given it is in the top 5 highest rent cities in the world but not in the top 10 highest paying cities in the world.

- Hong Kong

Monthly rent for average 2-bedroom apartment: $3,685 - San Francisco, U.S.

Monthly rent for average 2-bedroom apartment: $3,631 - New York, U.S.

Monthly rent for average 2-bedroom apartment: $2,909 - Zurich, Switzerland

Monthly rent for average 2-bedroom apartment: $2,538 - Paris, France

Monthly rent for average 2-bedroom apartment: $2,455

American Cities By Rent Price

Below is a fascinating chart highlighting the apartment rent index per city compared to its historical average. Even though San Francisco is an expensive city, based on its historical average, it is now 14% undervalued post-pandemic!

The opportunity to make money in big cities like San Francisco, New York City, San Jose, DC, and Boston is here.

Cities That Provide Its Residents The Highest Disposable Income

Deutsche Bank calculates disposable income as income leftover after paying rent.

The analysis assumed two working people were sharing a two-bedroom apartment, and calculated disposable income by working out the difference between average monthly earnings and half the cost of renting a two-bedroom apartment.

As I demonstrated in the previous section, San Francisco comes out on top with disposable income after rent at $4,710, which is a whopping 100% more than Oslo, Copenhagen, and Wellington, and 49% more than New Yorkers were expected to have leftover.

Again, U.S. cities dominated the top 10 list with four cities.

- San Francisco, U.S.

Disposable income after rent: $4,710 - Zurich, Switzerland

Disposable income after rent: $4,626 - Chicago, U.S.

Disposable income after rent: $3,298 - Boston, U.S.

Disposable income after rent: $3,188 - New York City, U.S.

Disposable income after rent: $3,157 - Sydney, Australia

Disposable income after rent: $2,615 - Melbourne, Australia

Disposable income after rent: $2,485 - Oslo, Norway

Disposable income after rent: $2,342 - Copenhagen, Denmark

Disposable income after rent: $2,285 - Wellington, New Zealand

Disposable income after rent: $2,075

San Francisco Is The #1 City In The World To Make Money

If you want to get rich, you should come to San Francisco. Yes, the cost of living is high, but you will get paid accordingly. I've lived in San Francisco since 2001 and have seen my wealth skyrocket due to investments in San Francisco real estate.

I missed out on the tech boom because I was too dumb to join a tech company early on. Instead, I worked in investment banking for 11 years from 2001 – 2012 until I engineered my layoff to get a nice severance package. Although bank stocks went nowhere for a decade, at least the pay was strong.

At least living in San Francisco gave me the entrepreneurial fever. As a result of seeing so many successful tech companies go public or get acquired, I decided to start Financial Samurai in 2009.

If I couldn't work in the tech industry, I might as well start my own business! Here are the other top city metro areas by income in America.

San Francisco Also Has Its Issues

Like every other city, there are problems. San Francisco has a traffic problem, a homeless problem, and a cost of living problem for those who do not make large wages. It can also be very frustrating raising a family in an expensive coastal city.

But San Francisco is clearly the #1 city for opportunity. San Francisco is diverse, accepting, and has tremendous career advancement opportunities. I'm bullish on San Francisco real estate over the long-term and I highly recommend trying to make your fortune here.

Once you've made your fortune, you can then leave and live a great life in a lower cost area of the country or the world.

Once you've made your fortune, you can then leave and live a great life in a lower cost area of the country or the world.

Buy Real Estate In The Best Cities

Now that we know the highest paying cities to get rich, it's strategically sound to invest in these cities. The best way to invest in these cities is by buying their real estate. However, if you cannot afford to buy a physical property in the highest paying cities, you still can through real estate crowdfunding.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms.

With interest rates down, the value of cash flow is up. In addition, the pandemic has made working from home more common. Therefore, it is only logical for more Americans to migrate to lower-cost areas of the country.

Take a look at my two favorite real estate crowdfunding platforms.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eREITs. Fundrise has been around since 2012 and manages over $3.3 billion for over 500,000 investors. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

I've personally invested $954,000 in various private real estate funds and deals since 2016. The long-term trend is the demographic growth of the Sunbelt / Heartland region.

Recommendation To Build Wealth

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms.

I’ve been using Empower (previously Personal Capital) since 2012 and have seen my net worth skyrocket during this time thanks to better money management.