Your goal as a homeowner is to enjoy your home and minimize costs as much as possible. If you can convince the property assessor that you live in a dump, then all the better! Unfortunately, in a rising property price environment, minimizing cost becomes much more difficult due to rising property taxes.

When things are going swell, it's easy to get lazy about reducing expenses. But I encourage you to continuously manage your burn rate while figuring out how to maximize income. In the event of the next downturn, you'll be that much more prepared to weather the hurricane.

The Property Assessor Slaps My Face

A long time ago, I spoke to someone who used to work in the property assessor's office. She said,

“Homeowners are lazy. We love them for it. When the market is going down, we keep our property value assessments the same because homeowners seldom ever appeal. Even if they do appeal, we have ways to nullify their appeal with so many loopholes, they will have no idea what hit them! And when property prices are rising, of course we'll raise taxes to the max!“

Hearing this insight really pissed me off. It helped solidify my belief the government is like a Black Hole, where not even light can win. Something had to change. So I wrote a post providing guidance on how to lower your property taxes for anybody who cared to try.

From 2007 – 2010, I made it my mission to contest my property taxes by meticulously tracking the comparables that sold around my neighborhood. With my appeal form containing details of cherry-picked comps that sold for less, the assessor's office had no choice but to make some adjustments during the downturn. FTW!

LOWERING PROPERTY TAXES AGAIN IN 2015 – 2016

The purchase and rental market is strong in many major cities around the country. So it was with great surprise that at the end of 2014, I noticed my neighbor across the street sell for a surprisingly low $626/sqft compared to the median selling price of ~$1,000 – $1,200/sqft.

I was pumped!

The sale across the street is a two bedroom, three bathroom single family home. It's not that attractive, but attraction is in the eye of the beholder. My house is a three bedroom, two bathroom single family home with a bonus room and full bath downstairs. According to my latest property tax bill, my house is being valued at $869 per sqft.

Isn't $869/sqft lower than the current selling price average of $1,000 – $1,200/sqft you ask? It is, but thanks to Proposition 13, because I bought my house 10 years ago, the city cannot increase the value of my property by more than an inflation index a year (1%-3%). Prop 13 is part of the reason why folks who many years ago bought mansions for $100,000, are paying much lower property taxes than houses bought today, but worth only a fraction.

Whatever the political arguments are for or against Proposition 13, the law is the law. As far as I was concerned, the city over valued my property by $243/sqft ($869 – $626 comp), an overcharge of roughly $5,000 a year thanks to this latest direct comp sale.

So Hard And Confusing To Reduce Property Taxes

Armed with indisputable evidence that I was overpaying, I attempted to appeal. Here's what happened:

The city makes it very difficult for a normal functioning person to figure out how to appeal online. They purposefully make the sfasr.org website hard to navigate, while putting in a long trail of intra-links before a property owner can finally get through. Everything gets buried.

If the SF Assessors website was a startup looking to make a sale, they'd get NO SALES.

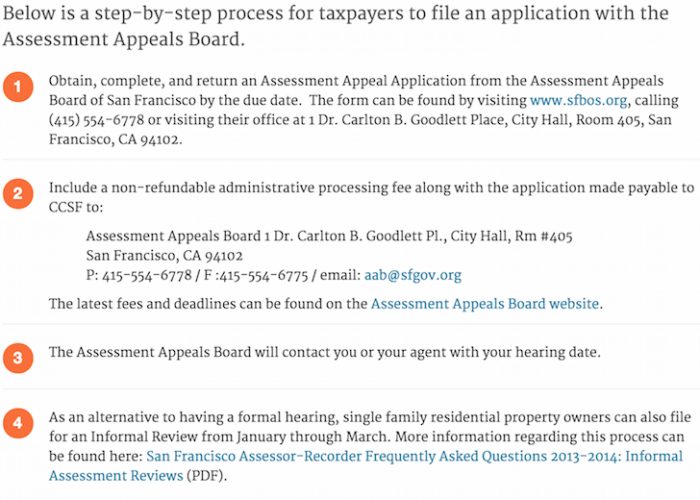

Once you go to this URL address: https://sfasr.org/property-information/homeowners/contest-your-assessed-value, you'll find this snapshot.

Holy shit! Notice how you've got to now FIND the damn appeals form by clicking another link at www.sfbos.org. Once you get here, GOOD LUCK! They make it so confusing that most people just give up, just like the SF assessor's office hopes. The more people who give up, the less work they've got to do. The less they have to do, the more property tax revenue the city gets to keep.

Once you're able to find the appeal form, you've got to wait for a specified window in order to appeal after you do all your research. For example, the window to file an appeal for 2H2014 property value assessment is July 1 – September 15 (right now). If you don't appeal within this window, you've got to wait another six months to appeal, by which time they can easily tell you that your data is stale!

More Hoops To Jump Through By The Property Assessor

Then the assessor's office confuses you even further by saying there is an Informal Review Project, which is free, but an application form must be filled out with details of comparable sales. The Informal Review Project is DIFFERENT from the Changed Assessment with the Assessment Appeals Board. Going this route requires a non-refundable $60 fee. Here's where I currently am.

I followed up with a Principal Appraiser regarding my free Informal Review Project appeal, and this is what she said.

Your property was included in the Informal Review Project and the value was reviewed for 2015, but no reduction was deemed warranted when compared to other similar homes in the area.

The house at Neighbor's Address would actually not be considered a good comparable sale for your property because it originally was a one story home of 1,300 sqft. The basement was converted to living space to add additional square footage, and the property lacks a garage. This is considered inferior to your home, which is two stories on top of a built-in garage.

Between now and September 15, 2015, you have the right to file an appeal with the Assessment Appeals Board, although I do not think you have a case for a reduction.

Just Can't Win Against The Property Assessor

In other words, after going through the maze to successfully file an appeal in 2015, I'm being denied because the principal appraiser believes a single family home that sold directly across from my existing home is not a good comparable? What kinda of voodoo logic is this?!

The Principal Assessor uses the argument a home that was ONCE 1,300 sqft decades ago, and is NOW 2,600 square feet is not a good comp to my 2,100+ sqft home? Huh? Who cares what the house once was. What matters is what it is now. A butterfly is no longer compared to a caterpillar once it is a butterfly.

Anybody who has ever refinanced a home gets to see the detailed appraisal report. In the appraisal report, there are areas for adjustments. For example, because the home across the street from me doesn't have a garage, perhaps the appraisers subtracts $50,000 from the value of the property. Because the house is 500 square feet larger than mine, perhaps the assessor adds back $200,000 in value etc.

In other words, adjustments are made all the time when assessing the value of a property because no house is exactly alike.

Voo Doo Logic By The Assessors Office

With the assessor's reasoning, basically NO property across the street or on my block can ever be a comparable comp because no house is like mine. There are only two single family homes on my street. The rest are two unit condos.

Because it takes time and will cost me $60 to take the next step in the appeal process, I don't think I can continue. In my mind, I think a house directly across the street from me that is within 500 square feet in size is obviously a fair comparable to use. If they don't agree during my free appeal stage, they probably will disagree even further when it's time for me to fight the power in person!

Forget it. The city wins again.

The government will take advantage of you because it writes the laws. Don't pay your taxes? Then pay a fine or go to jail.

People who don't pay property taxes don't realize that voting on more government projects paid for by homeowners simply raises rents for everybody. There is no free lunch.

I'm afraid there's not enough homeowners willing to fight their property taxes because times are good. I guess we'll have to wait until another downturn for homeowners to start caring enough about their expenses again.

Invest In Real Estate Wisely

If you don't have the downpayment to buy a property, don't want to deal with the hassle of managing real estate, or don't want to tie up your liquidity in physical real estate, take a look at Fundrise, one of the largest real estate crowdsourcing companies today.

Real estate is a key component of a diversified portfolio. Real estate crowdsourcing allows you to be more flexible in your real estate investments by investing beyond just where you live for the best returns possible. For example, cap rates are around 3% in San Francisco and New York City, but over 10% in the Midwest if you're looking for strictly investing income returns.

Sign up and take a look at all the residential and commercial investment opportunities around the country Fundrise has to offer. It's free to look. I've personally invested $810,000 in real estate crowdfunding to diversify and earn income 100% passively.

Shop Around For A Mortgage

Check the latest mortgage rates online through Credible. Credible has one of the largest networks of lenders that compete for your business. You can get free, no-obligation quotes in minutes. The more lenders compete for your business, the lower your rate. Mortgage rates continue to be near all-time lows. Take advantage.

Absolutely love this blog Sam. Been reading for a year.

Total late bloomer with financials, but better late than never. I sold all my possessions to pursue my life long dream of surfing the north shore and pipeline. Got the ‘shot’ to share with the kids and grandkids. Wouldn’t change a thing and it gave me the hutspa to negotiate much better contracts.

Anyways, I know you consult as well from your writings on here…did you start posting great articles and it grew naturally from there? I’m sure you had a content strategy and schedule.

Either way, you are a financial samurai no doubt and I’ve learned enough from your site already that there’s no need for a reply, especially since it’s an older post.

In hindsight, I’ll probably be upset this was my first comment on your blog but I’m free flowing and on my phone so here it goes.

Thank you.

P.s. I’ve signed up for the emails at least twice but never get updates, not even in junk folder. Am I doing something wrong, or you should double check that system is all good. No matter, I type the url direct.

Hi Alan,

Sounds like you are having a good time on the North Shore! Congrats!

Glad to hear you’ve found my content useful. I don’t have a particular strategy. I just like to mix things up and throw in timely articles as well.

My e-mail feed is here, to receive my posts in your inbox. Maybe you signed up for my quarterly newsletter instead?

Mahalo!

Thanks, been back from the islands for a while now, it’s a framed photo in my office. But, I’ll tell ya, I really could have used a good mango connection while there. They are not easy to come by!!! No kidding.

I’m sure that’s what happened now that you mention it newsletter/email subscribe. I’ll give it another shot.

And yes timely seems to work very well for you and others. Thank you for the response. See ya on the web.

Just finished getting supplemental tax bill appealed successfully, but it took 3 YEARS. Property was purchased in 2012 and am just now getting a refund. Nice to have the prop 13 basis lowered but there is no reason it should have taken that long (other than the govt not wanting to refund any $ until as late as legally possible.)

A single sale, even across the street, while helpful is not compelling enough. You would need at least three comparables to support a request for a reduction in property value. Given where the market is I think you’re fighting an uphill battle. I’ve received numerous reductions and found San Francisco County to be fair and generally in tune with what is happening as far as value is concerned.

Where are you based?

I’m getting reinvigorated to try again. If they are happy to accept houses sold on other blocks that are superior, but have lower p/sqft, so be it then.

I’m in Glen Park. All SFH’s are up 15-20% just in the past two years. It is virtually impossible to get any property tax reduction in this environment because there are just no comps to build any sort of a case to the county for consideration.

If you look hard enough, you can find the bomb shelter like comp, at least one, to help your case. Just find the fixers!

I don’t know why one low direct comp isn’t good enough.

A word of caution if you choose to use fixers as comps. The Assessor’s office in now using information from the MLS which will surely indicate the condition and other nitty gritty detail to provide their best comps, or to discredit your “comp”. In the past, for some strange reason, they weren’t armed with this data.

https://www.sfassessor.org/news/assessor-recorder-chu-announces-access-instant-real-estate-data-through-mls

Good stuff! Good to know about this stuff. Individuals are more nimble than organizations, so we can use this advantage to try and win our appeals. But as organizations get smarter it will be harder, as is the thesis of this post.

I had no idea that you could petition a property tax assessment! I am able to save on property taxes because I live in my unit in a city with many units that are rented out. There is a substantial ($1000+) deduction for owner-occupied units, which cuts my property tax bill nearly in half!

I hate prop 13.

When I live in a townhouse and share a wall with a neighbor who has an identical unit, and I pay literally 10x the property tax he does, it’s not fair.

Challenging assessments and getting a mild reduction because you out in some extra effort is one thing. Paying 1/10th the amount for no reason than you’ve lived there longer is legalized theft. The fact that you can transfer your reduced taxes to others is abuse.

I don’t hate much. I hate prop 13.

Gotta love the government! But, in 30 years, when you are old and no longer working, you will probably appreciate prop 13.

It’s all about paying your dues now, and then reaping the benefit as we get older no?

I filed an appeal a during the housing crisis, and it was no hope. They didn’t decrease it at all. Citing my house was the biggest one in the neighborhood, so there isn’t any comparison. Granted, the comps in the area is base on how much a house could be sold for, not how big it is.

However, after many house was on foreclose, they must have realized people are struggling with bills, so they did lower my taxes, which helped. But to my dismay, they’ve just increased it back up this year. Hummm … Voodoo logic sounds about right.

That’s the thing. It is WRONG for the city not to lower your property taxes due to lower assessed values in a housing crisis. That’s pretty much stealing.

Now that the markets have recovered, you better believe they will jack your rate up as much as possible!

What?! You’re not appealing because it costs $60? I’m not sure how it works our in SF but at some point in the appeals process (if not the next step, then the one after), it should go to perhaps a hearing…and an independent hearing office will make the decision. So I don’t think it makes sense for you to back down now, especially since it’ll make a good article in the futre.

This is the last line in the e-mail the property assessor wrote me,

“Between now and September 15, 2015, you have the right to file an appeal with the Assessment Appeals Board, although I do not think you have a case for a reduction.”

In other words, she is telling me explicitly, and somewhat nicely to F OFF, even though I have a direct comp!

It’s not so much the $60, but the time… it takes time finding the form, filling out the form, going to court, etc. And they know this, which is why the City will win.

But maybe I will appeal gosh darn it! It sucks being taken advantage of. I just need a couple more comps… which are hard to find honestly.

Don’t forget about “Equalization”. This method of appeal is quite successful in rising markets. you can’t “cherry pick” your comps, but you CAN show the assessed value of comparable properties and if yours is significantly higher, they will lower yours to be in line.

The key here is it can’t just be ‘one neighbor” you have to show the pool of like houses in your ‘hood and show how yours is higher to the closest comps significantly.

Won’t work for me in SF, b/c equalization is a much higher value since I bought 10 years ago.

Therefore, cherry picking is the only way to go now in a rising market environment. I didn’t purposefully cherry pick this example. I just noticed the neighbor across the street sell for a surprisingly low price so I took action.

I haven’t appealed for several years b/c I realize prices are going up.

Our assessor generally undervalues homes. I just assume this is to avoid complaints and petitions, which are inefficient. If a home has sold recently, the sales price is the assessed value, and that’s pretty much the only time the appraisal is fair market value as the assessed value stays there for several years until it adjusts up by less than the increase in home values. The easiest way to see this is to look at recent property tax information of homes for sale on Trulia and compare those figures to both asking and eventual sales prices. Almost never would a seller accept an offer for what they are paying taxes on. My area also doesn’t have quite the incentive to overestimate property values that the Bay Area does–home values are much lower relative to incomes and subject to fewer market fluctuations. (I live in the rural upper South).

Rural upper south….. like Virginia or North Carolina?

That’s really nice they are so nice!

I don’t know why they wouldn’t have as much of an incentive as the folks here in SF. More revenue is always the incentive!

My wife used to do this for a living but for much larger portfolios of both commercial and residential properties. So far she has one every appeal to reduce the tax basis of our rental property.

Sometimes she has to go to a hearing, but still ends up with some sort of concession. This last one will save us about $500 for the year.

Cheers!

Hmmm… now I’m wondering if I should spend the $60, and another several hours to go appeal in person! $500 a year is decent.. and with this property, it could be a couple thousand a year.

At the very least, another good post to write about the experience like when I went to traffic court!

I am not familiar with how things work in San Fran, but given how democrat it is, it may work similar to Chicago.

In Chicago, there are 3 large law firms that will appeal your taxes. Coincidentally, one firm has the president of the Illinois senate as a partner, the second firm is owned by the chairman of the Illinois Democrat party, and the third firm is owned by a Democrat alderman, who is Chair of Council’s Committee on Finance in Chicago.

Good luck to anyone who files their own tax appeal….

It worked from 2008-2010 (3 years). Then it stopped… so I took a break. Then I tried again this time, and got rejected.

It baffles me that a direct comp across the street is not considered a comp. It’s a “heads they win, tails you lose” situation right now.

I normally encourage everybody to fight for their rights until the bitter end. But based on my experience, I think resistance is futile when national headlines are for rising property prices, even though you have proof that things might not be as good as expected.

I bought a house last year and both my property taxes and insurance spike after not even a year. My insurance went up appreciably and when I called my carrier they said business got more expensive in my state (NJ). I want to file an appeal for my property taxes, but I heard you get “put on a list”, so it gives me some pause. Any thoughts there?

You can appeal, but in this environment, I would put your chance at success at under 5%. I appealed with a direct comp across the street, and they gave me voo doo logic and said it doesn’t count.

If you can get 3 or more direct comps that show that your property isn’t worth what the city/state says, then go for it!

The only real way to appeal is to use a law firm that does it for a living. They know the ins and outs of the process and can get you savings (its a bit of a scam). Especially since most of them work on commission, in that they only get paid if they save you money. Typically they will get 25% of the savings, or less depending on the firm and deal you strike. But that is the most effective way to reduce your tax burden.

That’s not true, b/c I successfully appealed three years in a row during the downturn.

However, I think you made a good compromise. I’m going to ping one of those property lawyers on commission and have them submit for me. I’m happy to split half the savings with them!

Check this out from an article highlighting what an ordeal it is to appeal

“Zisser, a lawyer who spoke animatedly with his paperwork strewn across a table in the downtown Olympic Club, bought his home in 2005, near the height of the market, for $604,000. But in 2009, even after the housing market had collapsed, the San Francisco Assessor-Recorder’s Office placed its value at $653,000.

Zisser won his appeal — his 2009 assessment was revised to $572,000, then later lowered to $565,000 for 2010 — but he said the process took about 40 hours of work to research, file paperwork and shepherd his case through the system.

“Dragging people through this is ridiculous,” he said, noting that he is still waiting for refunds.

He is not alone: 6,600 assessment appeals were filed in 2009, and another 5,500 in 2010.

Phil Ting, the city’s assessor-recorder, who is also a candidate for mayor, said he hoped fewer than 5,000 property owners would appeal their 2011 assessments. Value estimates are being mailed this month.”

You have to change your insurance once a year – when you get complacent they use this as an excuse to jack your rates for the same very reason as you stated.

I do this like clockwork. Change all my insurances annually.

Very interesting!

Do you really have to change your insurance once a year? What is the reason?

I do call my insurance co once a year to get a complete run down on what I actually have insured. Net worth changes year to year, and getting proper coverage is important.

It is totally crazy how confusing the city websites are. It’s like navigating a maze to find the info and forms you need. Sometimes the links don’t even work or the info is outdated. The business related sites are just as bad as the property ones.

Their excuse your neighbor is not a comp is such BS. And how annoyinf they charge a fee to go further with an appeal. I wonder how many people who work in the assesor’s office are property owners themselves. They sure act like frustrated renters who have it out for anyone who owns.

Trust me, if the SF Assesor’s Office was a company, that would get NO SALES on their website because nobody would be able to figure out how to check out!

It is the starkest contrast between a lean startup with a minimal about of cash to survive, and a government run agency.

Ha!

Very timely article. I just filed an appeal on a condo I own which was assessed 70% higher than purchase price (2012). Prices surely are higher, but wow what a whammy to have the tax bill go up by almost $2k by the end of this yr.

I did appeal, but am not very hopeful. Finding low comps was tough within a few miles. My real hope is that on the next lease expiration I will be able to raise rent enough.

Where are you located Ravi? 70% is HUGE!