There is a science to getting the right amount of life insurance to protect your family. If you get too much, you'll end up paying too much in life insurance premiums. If you get too little, you might leave your loved ones underinsured and in more pain than necessary.

As a Financial Samurai, my general rule is to get about 10% more than you really need. This way, you are covered for growing expenses and surprise expenses you move through the unpredictability of life. Term life insurance is very affordable. The peace of mind it provides is wonderful.

For example, who could have correctly predicted a coronavirus would shutdown most of the world's economy in 2020? Getting life insurance during the time of COVID-19 is possible. But it would have been better to get life insurance before a deadly virus spread across the community.

Let me share with you some considerations in order for you to get the right amount of life insurance.

Calculating The Right Amount Of Life Insurance

There are certain key variables to consider when calculating the right amount of life insurance:

1. Your Liabilities

Your liabilities are the number one variable you must calculate and add up to see how much life insurance you should get. Here are common liabilities you need to tally that need to be covered in case you die:

- Mortgage

- Credit card

- Personal loans

- Student loans

- Car loans

- Revolving credit card debt

- Children expenses up to 18

- College tuition expenses

- Your non-working spouse

- Elderly parents

- Funeral expenses

- Your age

Once you add up all these expenses, you will have a great idea what is the likely MAXIMUM life insurance you need along with the duration.

2. Your Assets

Now that you've calculated your liabilities, it's time to calculate your assets. These assets include:

- Primary Residence

- Rental Properties

- Stocks

- Bonds

- Private investments

- Cash

- Jewelry / watches

- Cars

- Business equity

- Alternative investments

- Royalties

Your goal is to add up your assets and subtract them from your liabilities. In other words, your goal should be to calculate your net worth. An easy way to calculate your net worth is to link all your financial accounts with Personal Capital, the #1 free wealth management tool. Personal Capital will then calculate your worth.

Once you know your net worth, you can make a better decision on life insurance. If your relatively liquid assets can easily cover your liabilities, then you may not need as much life insurance as you think.

For example, if you have $500,000 in mortgage and student loan debt, but have $1,000,000 in stocks and bonds, you don't need a $500,000 life insurance policy. However, if you don't want your surviving family to have to liquidate your investments, you maybe still want to get a life insurance policy.

3. Your Lost Income

Your ability to generate income is your main wealth generator. If you are incapacitated or die, your income will take a hit or disappear.

To calculate the amount of life insurance coverage you will need or would like based on your lost income, take your annual income after tax and multiply it by the number of years you think they will need support for.

For example, if your spouse is a stay at home parent, and the kids aren't going to graduate college for another 10 years because they are still in the 6th grade, consider getting at least 10 years of life insurance + 10%, or 11 years.

The Main Specific Expenses To Focus On For Life Insurance

If you have no kids, no dependents, and you have no mortgage or other type of debt. Life is pretty easy. You likely don't need life insurance. It's practically impossible to retire early with kids.

But if you are like many people who have found love, can't buy a home with cash, and have kids, then life insurance is a post.

The Cost Of Your Kids

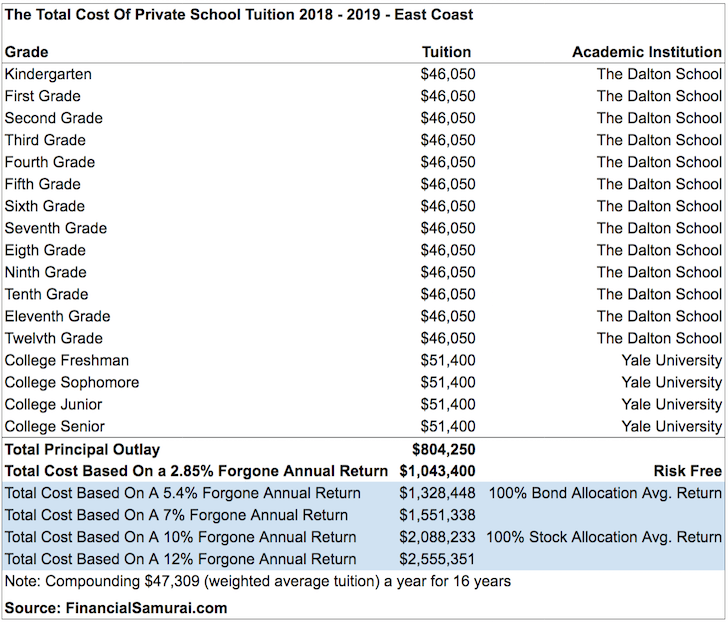

In a big city like NYC, SF, or LA, it can easily cost $25,000 a year to raise your kids. If you expect to send them to private grade school and then private college, you can bake in $1,000,000 per child.

If you live in an 18-hour city where expenses are lower and you plan to send your kids to public schools, then you can cut the expense down by 75%, or to $250,000.

College tuition has been rising at 3X the average rate of inflation for decades. Hopefully, your kids will get scholarships and/or have the wisdom to attend a reputable public school over an expensive private school. But you won't really know for sure.

Kids are expense, no doubt about it. Your goal is to calculate how much your kids will cost to raise + 10%. Based on this amount, you can make a life insurance determination to cover the entire cost for peace of mind.

Mortgage Debt

Despite interest rates plummeting to all-time lows and homeowners taking advantage by aggressively refinancing their mortgages to save money, you still have to take into account your mortgage debt and all other debt. I personally used Credible to help me refinance to a 7/1 ARM at 2.625% with no fees. Check them out for free, competitive mortgage rate quotes.

Generally speaking, mortgage debt will be the largest debt amount for all families to payoff. Therefore, you need to also add your debt to the estimated cost of raising your kids to adulthood.

Your Funeral Expenses

The last thing you want your surviving loved ones to deal with are coming up with your funeral expenses. Unfortunately, the average cost of a funeral is around $7,000 – $15,000, depending on where you live. Funeral expenses are necessary to respect your passing and gather other friends and loved ones.

Probate Court Expenses

Probate court happens when you don't set up a revocable living trust. Probate court can cost 3-6% of your assets to analyze and administer. Probate court is also public record.

Let's say you die with $1 million in assets. Probate court will chart $30,000 – $60,000 just for your surviving kin to gain access to those assets if you don't have a revocable living trust. Please talk to an estate planning attorney today and set one up if you want to save headache, save money, and protect your privacy.

Term Life Insurance Is Inexpensive

Some insurance agents pay push you towards a whole life insurance policy for its “cash benefit.” I wouldn't do it, unless you are very wealthy and will leave an estate higher than the maximum estate exemption limit.

If you are under the historical estate tax exemption limit, then absolutely get term life insurance. It's cheaper and provides what you need. The best age to get life insurance is about age 30. And the best term duration to get is a 30-year term policy. Life gets more complicated after age 30. You can always cancel in the future.

Work Life Insurance

Before getting a term life insurance policy, check with your company to see what type of group life insurance they have. Usually, you can purchase up to 5X your annual salary in extra life insurance for a nominal sum each month that is automatically deducted from your paycheck.

If, for some reason, the term life insurance policy and your work life insurance policy is not enough, you can always get a supplemental life insurance policy or add to your existing one if your life insurance provider allows this.

Getting supplemental life insurance may be necessary if and when the following occurs:

- New baby. When you are expecting a little addition to your family, it is very important to add the new member into your calculation.

- New mortgage. If you and your family are moving to a new house that is more expensive, you will probably have a bigger mortgage.

- Loss of one income. If your partner decides to become a stay at home parent, you need to calculate this loss of income into your life insurance needs.

- Illness. Illnesses can come out of nowhere. Especially for elderly parents who are more susceptible.

Get The Right Amount Of Life Insurance

The right amount of life insurance depends on you getting the above calculations as close to reality as possible. I would encourage you to always add a 10% buffer to your calculations as well.

The easiest rules to follow in order to get the right amount of life insurance are:

- All your liabilities + 10%

- The total cost of raising children to adulthood + your liabilities + 10%

To get affordable life insurance, check online with PolicyGenius, the #1 life insurance marketplace where the largest and most reputable life insurance carriers compete for your business. You can get multiple quotes all in one place instead of trying to apply to each carrier one-by-one.