The government is offering huge government financial support during the coronavirus pandemic. There have been multiple stimulus initiatives. The biggest are the $2.3 trillion CARES Act package signed into law on March 27, 2020 and the $1.9 trillion American Rescue Plan signed by President Biden on March 11, 2021.

Government Support Initiatives For Coronavirus

The CARES Act includes an extra $600/week in unemployment benefits due to the high number of unemployed workers resulting from the pandemic. In addition, this government support initiative for coronavirus had two rounds of stimulus checks. The first was $1,200/person in April 2020 and $600 in December 2020/January 2021.

Additionally, the CARES Act provided a crucial $367 billion in loans and grants to small businesses through the Paycheck Protection Program (PPP). It also expanded the Economic Injury Disaster Loan (EIDL) program.

The American Rescue Plan of 2021 ensures that Americans and their families can receive greater amounts of financial assistance. Those eligible for this 3rd round of stimulus checks will automatically receive an Economic Impact Payment of up to $1,400 for individuals. The amount for eligible married couples is $2,800 plus $1,400 for each dependent.

In addition, families can get a payment for every dependent instead of only their qualifying children under age 17.

All of this government support for the coronavirus pandemic is helping keep the economy afloat and lift the stock market higher.

Stimulus Checks Insights

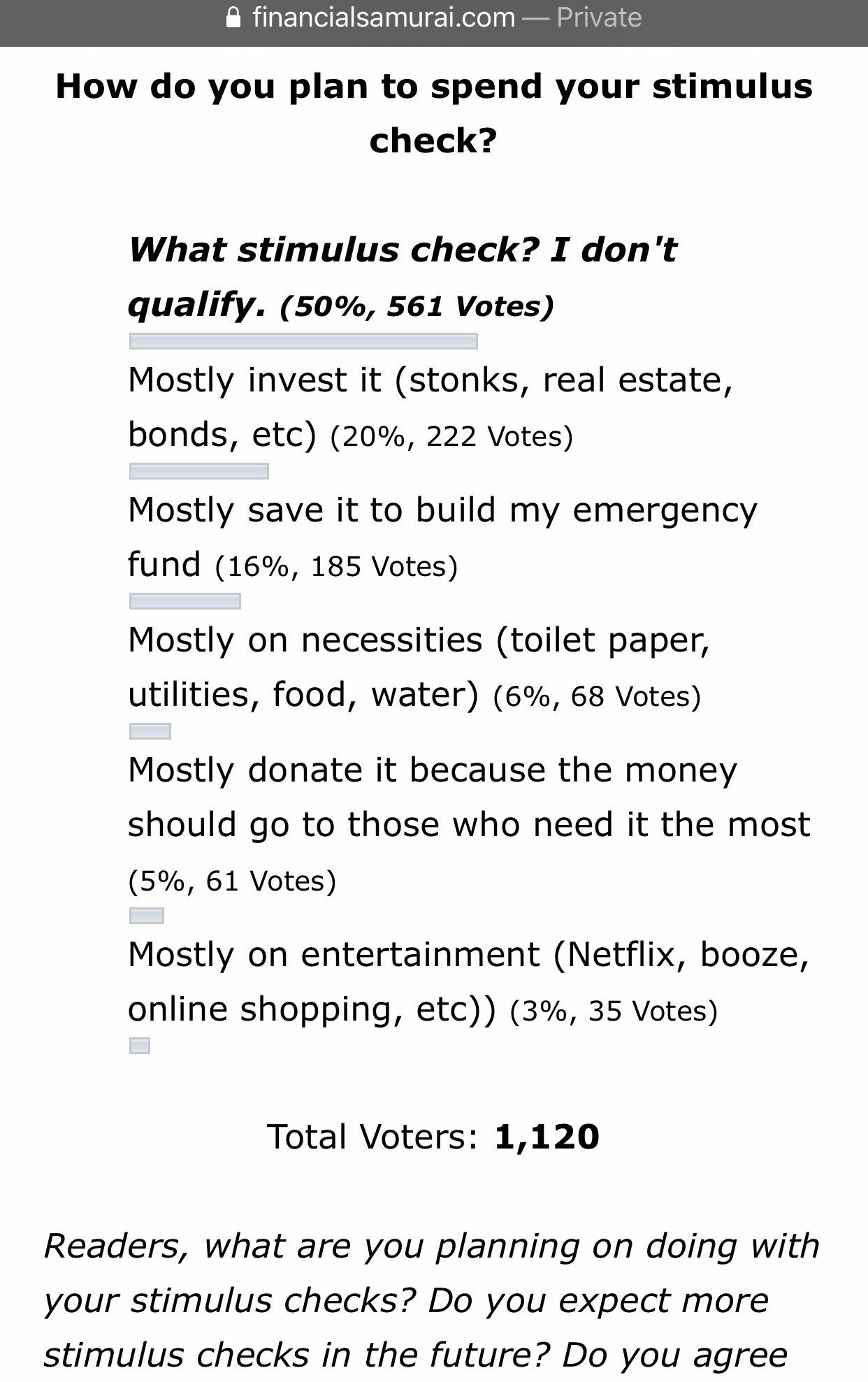

I discovered something very surprising after publishing, How Millionaires Will Spend Their Stimulus Checks. Only 50% of you are actually getting them!

Check out the results below after more than 1,100 votes. For those of you who are getting stimulus checks, most of you will be investing the money into the stock market.

Looking at the results from an investor's point of view, my initial reaction to the results was that this was another bullish sign.

Given only 50% of readers are getting checks, this means that 50% of readers are earning more than $98,000 per person. Or $198,000 per household compared to the median household income of ~$64,000. Higher income generally leads to higher wealth. And a higher net worth means there is a larger buffer to withstand negative shocks.

Then, I flipped the switch and started wondering, if only 50% of Financial Samurai Americans are getting stimulus checks, when the intent of the government is to rescue and stimulate as much of the economy as possible, this is a failure of American policy.

With half of Americans not receiving any financial support, without broader measures, the economy is at risk of permanently staying at the bottom of the ocean.

Unlimited COVID-19 Government Support

But then my optimist side kicked in believing that stronger financial health by more Americans outweighs less financial help by the government than expected. Besides, given the government has promised unlimited support, more help should be on the way.

Now, I know what critics or bears are thinking. The Financial Samurai readership is not representative of the average American. However, the internet is free and my content is free. I believe that every single person wants to build more wealth and live a more purposeful, freer, and happier life.

Therefore, it is only a matter of time before the Financial Samurai readership demographic becomes a pure reflection of the U.S. population.

Bullish, baby!

The Paycheck Protection Program Is Working

In addition to over 80 million Americans getting stimulus checks, according to the Small Business Administration, over 1 million small businesses have been approved for a PPP loan. The average PPP loan size is $239,152. These loans will be forgiven and pay for 2.5 months of payroll if payroll is kept the same for 8 weeks.

The PPP money was slow to get dispersed initially, but the funds are moving. I'd heard from many small business owners by April 17, 2020 who had already received approval and were notified funds would hit their business accounts in three days.

After the initial $350 billion of funding was exhausted, a second round of PPP loans was approved and disbursed. The process to file for forgiveness was also greatly simplified for many small business owners, streamlining the process.

More bullish signs folks.

More UI Benefits Due To Government Support For Coronavirus

Finally, although 22+ million have filed unemployment claims, this also means that 22+ million are eligible to receive an additional $600/week in unemployment benefits. For those filing in California, that's up to $4,200/month per person ($1,800/month regular + $2,400 a month EXTRA). In California, there's even a $125 million fund that will pay $500 to tax-paying undocumented workers to help them have some income through these difficult times.

In other words, almost everybody, from investors who are seeing their stocks rebound to the unemployed, is getting some financial assistance. Bullish! Just note the stimulus checks are not taxable but unemployment benefits are.

Meanwhile, many of us are now able to spend more time with our families and work on neglected projects. We can also let our minds and bodies heal from the daily grind while we also let the world mend.

Remember, each day we persevere through this lockdown is one fewer day that we have to endure. I'll discuss the implications of endless free money in a future post.

Further Reading

Here's some further related reading to help you on your journey.

- Learn How Real Estate Markets Perform During Viral Outbreaks

- This Is How To Get Your Paycheck Protection Program (PPP) Loan Forgiven

- How Is San Francisco Real Estate Doing During The Coronavirus Pandemic?

Wake Up And Insure Your Life

Given I'm stuck at home all day like many of you, I've been trying to optimize every aspect of my finances. With the coronavirus reminding me of my mortality and my responsibility as a parent, I've been doing a lot of research on life insurance lately.

For example, I learned that you can get “Key Person Life Insurance,” which is important if the key person in a business goes down. Given I write and record 99% of everything on Financial Samurai, I'm looking to get some quotes.

If you don't have life insurance, but have children and/or debt, look into getting a life insurance quote through PolicyGenius, one of my long-time affiliate partners. You can get multiple quotes from qualified lenders in one place instead of having to apply to each carrier one-by-one. Quotes are all free and are no-obligation.

Although I got screwed by seeing a sleep doctor for my snoring before re-upping my life insurance policy, I hope you won't make my same mistake. I'm now more motivated that ever to stay in shape, boost my wealth before my term life insurance runs out in 2023, and get new affordable life insurance to protect my family.

Please try and spend each week during lockdown working on at least one aspect of your finances. By the time the lockdown ends, you're going to be in much better financial shape! To start, take advantage of free online financial tools. And explore my top financial products recommendations.

Regards,

Sam, Financial Freedom Sooner Rather Than Later