A 529 account is designed to help families tax-efficiently save for future college costs. You contribute AFTER-tax money with the benefit of paying ZERO Federal and State income taxes on the profits when it's time to use the funds to pay for college. If your child does not end up going to college, you can either name a new beneficiary (different kid) or just pay the taxes on profits.

All parents should highly consider opening up a low-cost 529 college savings plan. Based on new tax laws passed in 2018, a 529 savings plan can now be used to pay for private grade school as well.

Here's a brief overview of the Wealthfront 529 college savings plan. Wealthfront is the original and leading digital wealth advisor today. They are low cost and have technology in their DNA.

Wealthfront Manages Your Money Automatically

Wealthfront uses a personalized investment plan designed specifically for college savings. It uses an investment glide path to optimize risk and return over time based on your individual criteria.

As a parent, you're already super busy due to work and raising a child. The last thing you may have time for is figuring out the best way to manage money for your child's education. It feels good setting up an auto-contribution amount each month and letting Wealthfront best manage the funds.

Save On Taxes

Earnings in a 529 account grow tax-free and withdrawals are also tax-free when used to pay for qualified higher education expenses at an eligible educational institution. Before investing in any 529 plan, you should consider whether your or the beneficiary's home state offers a 529 plan that provides its taxpayer with favorable state tax benefits.

High Contribution Limits

Contribute up to a maximum of $370,000 per beneficiary across all Nevada 529 plans (pdf of full plan details), no matter what your income level. $370,000 compares favorably to other 529 plans across states because the average maximum is closer to $300,000.

To qualify as a 529 plan under federal rules, a state program must not accept contributions in excess of the anticipated cost of a beneficiary's qualified education expenses. At one time, this meant five years of tuition, fees, and room and board at the costliest college under the plan, pursuant to the federal government's “safe harbor” guideline. Now, however, states are interpreting this guideline more broadly, revising their limits to reflect the cost of attending the most expensive schools in the country and including the cost of graduate school. As a result, most states have contribution limits of $300,000 and up (and most states will raise their limits each year to keep up with rising college costs).

A state's limit will apply to either kind of 529 plan: prepaid tuition plan or college savings plan. For a prepaid tuition plan, the state's limit is a limit on the total contributions. For example, if the state's limit is $300,000, you can't contribute more than $300,000. On the other hand, a college savings plan limits the value of the account for a beneficiary. When the value of the account (including contributions and investment earnings) reaches the state's limit, no more contributions will be accepted. For example, assume the state's limit is $300,000. If you contribute $250,000 and the account has $50,000 of earnings, you won't be able to contribute anymore–the total value of the account has reached the $300,000 limit.

These limits are per beneficiary, so if you and your mother each set up an account for your child in the same plan, your combined contributions can't exceed the plan limit. If you have accounts in more than one state, ask each plan's administrator if contributions to other plans count against the state's maximum. Some plans may also have a contribution limit, both initially and each year.

Note: Generally, contribution limits don't cross state lines. Contributions made to one state's 529 plan don't count toward the lifetime contribution limit in another state. But check the rules of your state's plan to find out if that plan takes contributions from other states' plans into consideration when determining if the lifetime contribution limit has been reached.

Jumpstart Your Savings With Superfunding

Although 529 plans are tax-advantaged vehicles, there's really no way to time your contributions to minimize federal taxes. (If your state offers a generous income tax deduction for contributing to its plan, however, consider contributing as much as possible in your high-income years.)

But there may be simple strategies you can use to get the most out of your contributions. For example, investing up to your plan's annual limit every year may help maximize total contributions. Also, a contribution of $14,000 a year or less qualifies for the annual federal gift tax exclusion. And under special rules unique to 529 plans, you can gift a lump sum of up to $70,000 ($140,000 for joint gifts) and avoid federal gift tax, provided you make an election to spread the gift evenly over five years. This is a valuable strategy if you wish to remove assets from your taxable estate.

For the Wealthfront 529 plan, you can contribute up to $70,000 ($140,000 for married couple filing jointly) to a 529 account using 5 years' worth of federal gift tax exclusions. They refer to this election as Superfunding.

Wealthfront 529 Plan Cost

For an all-in cost of ~0.43% a year in assets under management, the Wealthfront 529 plan costs less than the average cost of all plans. The all-in cost includes the cost of holding the funds, which are all Vanguard funds.

Wealthfront 529 Plan Verdict

I like the Wealthfront 529 college savings plan mainly because:

1) It's easy to set up

2) Easy to create an automatic monthly contribution that gets debited from your linked checking account,

3) The money is managed by Wealthfront so you don't have to constantly worry about how to best invest your child's college savings, and most importantly

4) Wealthfront uses the Nevada 529 plan, which is consistently rated as one of the best plans in the country.

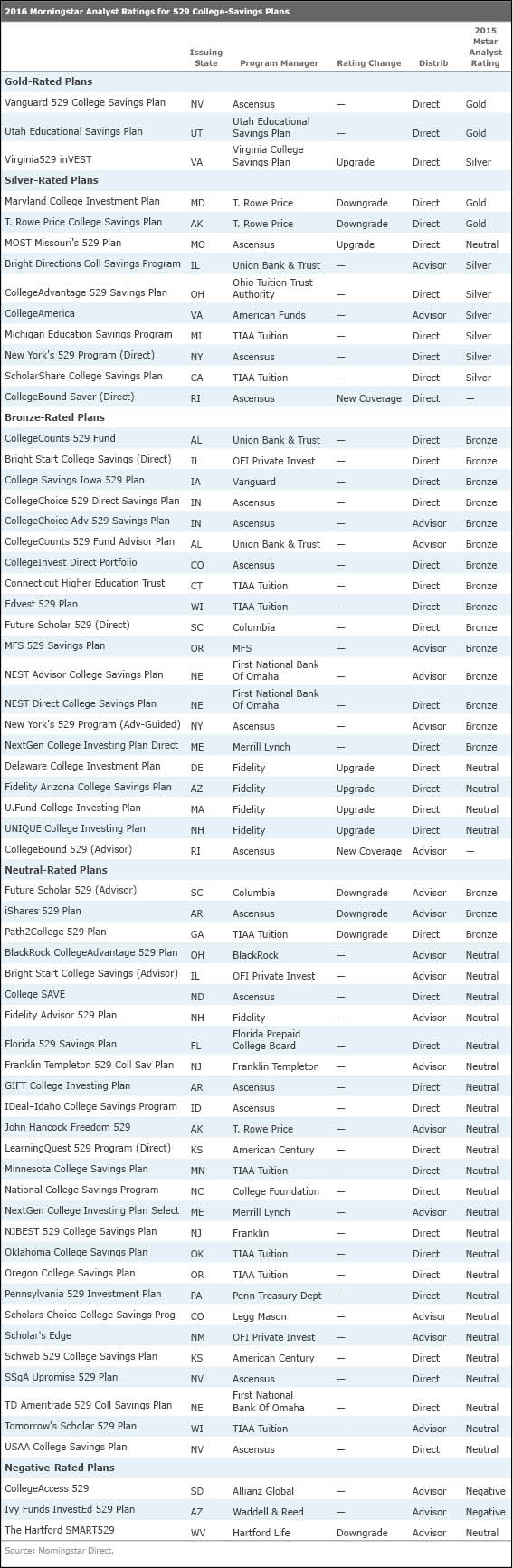

Take a look at the Morningstar analyst rating of all the plans for 2016. Notice how the Vanguard 529 College Savings Plan from Nevada is a Gold-Rated plan, along with only two others out of hundreds.

These plans follow industry best practices, offering some combination of the following attractive features: a strong set of underlying investments, a solid manager selection process, a well-researched asset-allocation approach, an appropriate set of investment options to meet investor needs, low fees, and strong oversight from the state and program manager. These features improve the odds that the plan will continue to represent a strong option for investors.

If you're going to invest money for the next 18 years in your child's education, you might as well get the best 529 plan possible. I'm very pleased that Wealthfront has thought the exact same way.

My only knock is the 0.43 – 0.46% fee since if you use Wealthfront to manage your after-tax investments, the fee is only 0.25%. I know it's less than half the industry average, but I wish it was lower. I guess this is the cost of doing business and having a digital wealth manager set everything up and invest the money for your child in a risk appropriate manner.

The most important attribute to building a healthy portfolio is to invest regularly over a long period of time. Follow your risk-appropriate asset allocation model and don't look back. If you are considering a lower cost, efficient way to invest for your child's future, the Wealthfront 529 plan is an attractive solution.

Related posts:

Everything To Know About The 529 College Savings Plan

About the Author: Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at two of the leading financial service firms in the world. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate.

FinancialSamurai.com was started in 2009 and is one of the most trusted personal finance sites today with over 1.5 million pageviews a month. Financial Samurai has been featured in top publications such as the LA Times, The Chicago Tribune, Bloomberg and The Wall Street Journal.