The 529 plan is one of the best was to save and invest for your children's college education. Although you contribute after-tax dollars, your investments get to compound tax free. When used for qualified educational expenses, there are not taxes. Let us dig deep into the recommended 529 plan amounts by age.

The appropriate 529 plan amounts by age will help ensure that you accumulate enough to pay for your child's college education comfortably. At the same time, the right 529 plan amount by age will also ensure that you don't over-invest if you don't want to.

Thankfully, starting in 2024, 529 plan holders of over 15 years can now roll over $35,000 worth of their 529 plan into a Roth IRA. As a result, this option has increased the value of a 401(k) tremendously. More people should be contributing to a 529 plan.

Given parents are investing for an expense that might not occur for another 10-18 years, it's easier to invest in a 529 plan during times of turmoil. You want to have the right about in a 529 plan by age so you don't overfund or underfund the college savings account.

I wrote this post because I was beginning to worry that I was contributing too much to my daughter's 529 plan.

Investing In My Daughter's 529 Plan

Originally, I had only planned to invest $15,000 into my daughter's 529 plan in 2020. I was nervous about the stock market after a 10-year bull run. However, the stock market started selling off in February and March 2020. Thus, I decided to contribute more to her plan.

See my historical 529 contributions below.

The stock market kept on tanking until I ran out of the maximum bullets allowed. By the end of March 2020, I had ended up superfunding $75,000 into my daughter's 529 plan. After making a stock market bottom prediction in March 2020, I put my money where my mouth was and bought.

Wanted To Superfund But Couldn't

If I had contributed more, I would have violated the superfunding rule. The super funding rule allows families to front-load five years worth of contributions ($90,000 per donor/$180,000 per couple for 2024, $95,000 / $190,000 in 2025) without having to file gift taxes, while protecting their lifetime gift and estate tax exemption.

The world felt like it was coming to an end in March 2020. So, my wife and I decided to have her dollar-cost-average into our daughter's 529 plan by $15,000 a year for the next five years just in case the recovery would take years. In retrospect, my wife should have also super funded my daughter’s 529 plan in 2020 since the markets recovered handsomely.

When the stock market began rebounding in April, so did both of our children's 529 plans. Today, our son's 529 plan account is about $420,000, and our daughter's 529 plan is worth about $350,000. Our daughter is two years and eight months younger than our son.

This is when I began to wonder what is the appropriate 529 plan amounts by age. I was beginning to feel like we had over-contributed to our daughter's 529 plan since she is only 5. However, thanks to the likely incessant rise in college tuition, continuing to contribute to a 529 savings plan makes sense.

Why A College Degree Is Getting Devalued

One of the most important things all parents and kids who want to attend college should know is this: Partly due to the coronavirus, the value of college has declined.

While this decline in value has been ongoing for years and started well before COVID-19 arrived, with tens of millions of people sheltering in place for months, the depreciation has accelerated.

A student or parent should not have to spend the same amount of tuition for classes that are being taught online instead of in the physical classroom. An important part of the college experience is in-person networking to build lifelong connections and friendships. Moving online impedes this invaluable opportunity.

It is already too late for many of us who spent big bucks and many years getting our college degrees. However, it is not too late for our children to make wiser educational and financial decisions about their higher education.

If we do nothing, then we will be creating another generation of massively indebted and highly dissatisfied college graduates who are unable to find meaningful work. Debt and a lack of meaningful work hurt relationships, delay saving and investing, delay or eliminate family formation, and create deep levels of dissatisfaction.

We all know some messed up, angry people. They could have had better lives if they weren't so burdened by student loan debt and had more enjoyable occupations.

Key Points On Education:

- Online education devalues a traditional college education.

- It is nonsensical for a student to still have to spend 4-5 years before being awarded a college diploma when the internet has made research, learning, and communication much quicker.

- Unless you are already rich or receive grants, paying full private school tuition is fiscally unwise because data shows that there is no discernible income difference between both types of college graduates from private or public schools.

- Even public school tuition is becoming too expensive given a consistent decline in state-supported funding. No type of education is increasing in value.

- From a financial standpoint, it's more beneficial to learn everything for free online, develop skills in a high demand field, take an apprenticeship, and get to work sooner after high school.

Recommended 529 Plan Amounts By Age Framework

To come up with my recommended 529 plan amounts by age, we must make several assumptions. I will provide three columns to address these assumptions. Then you can follow the column that most closely matches your situation and beliefs.

529 Plan Assumptions:

- You are a rational parent who likes to take advantage of tax-advantageous accounts to potentially grow your investments quicker. You believe that if you are going to invest for your child's education, then you might as well invest in a 529 plan where the contributions compound tax-free.

- The contribution range per year is between $5,000 and $30,000. The range takes into account contributions from single parents, dual-income parents, grandparents, and rich relatives.

- The compounded return range is between 0% – 7%. This range accounts for bear markets and lower returns as child gets closer to attending college. Lower returns are due to a greater shift to bonds.

- The goal is to pay for between 50% – 100% of college expenses when the time comes. The percentage range takes into consideration parents who do not have as much money or have lower investment returns. The lower percentage also accounts for parents who want their children to have more skin in the game.

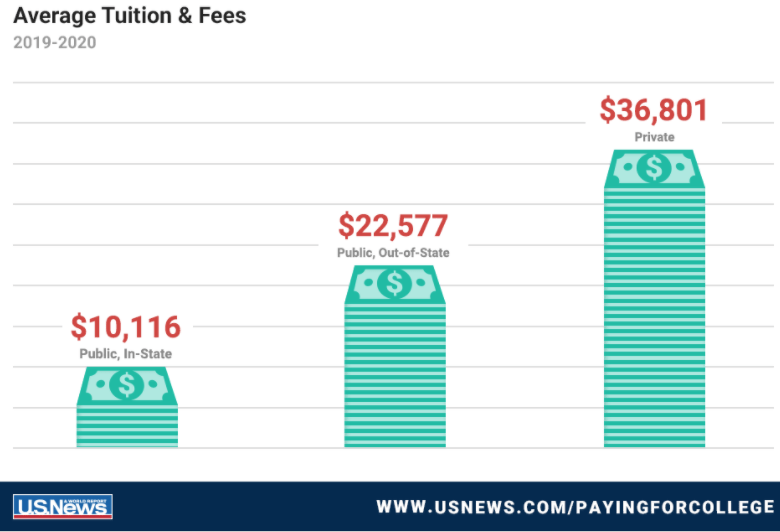

- For 2020, the average public tuition & fees cost is ~$10,500 a year for public-instate, ~$23,000 a year for public, out-of-state, and ~$37,000 for private universities according to US News & World Report. Expect these tuition figures to go up by about 4-5% a year forever. For 2025, the average tuition is at least 15% higher!

More 529 Plan Assumptions:

- College tuition and expenses will increase by an average of 3% a year. This is despite the value of college declining. It is very hard to stop momentum, especially due to growing international demand.

- Some of the 529 plan may be used to pay for grade school tuition and expenses. As of 2020, $10,000 a year can be used from a 529 plan per student per year for private, public or religious elementary, middle, and high school tuition.

- Financial support for education stops at 25. Age 25 is old enough for a child to have started and finished a Master's degree. It is also old enough for the adult child to get on the path to financial independence. You plan to spend down 100% of the 529 plan after 25 years.

- Contributing too much is an inefficient use of funds because the money could also be spent on living a better life. That said, you can now roll over leftover 529 funds into a Roth IRA thanks to Secure Act 2.0. As of now, the lifetime conversion limit is $35,000, which makes contributing to a 529 plan even more valuable.

Now that we have these assumptions in place, let's look at the recommended 529 plan amount by age.

Recommended 529 Plan Amounts By Age

Below is my recommended 529 plan amounts by age separated into three columns. Each of the columns accounts for the type of school your child plans to go to and how much financial aid your family will receive.

For most new families, I suggest focusing on the Medium (Bravo) column.

Low Column (Alfa) – Lowest Recommended 529 Plan Amount By Age

The Low column simply assumes a $5,000 contribution per year with 0% growth. This conservative assumption helps to account for several bear markets during the initial 18 years. The goal is to have saved $100,000 per child by the time he or she begins college. Starting at 18, the parent uses $20,000 a year to pay for college education expenses.

Those who should follow the Low column:

- Parents who have older children already (10+)

- Parents don't believe strongly in the value of a college education

- Child will go to a public university, community college, two-year college, or potentially no college

- Child is a genius or a talented athlete and will get tuition subsidies from universities

- Guardians have a family business

- Parents have many children and cannot fully fund all their 529 plans

Medium Column (Bravo) – Medium Recommended 529 Plan Amount By Age

The Medium column assumes a $15,000 annual contribution every year until 18 with a 6.2% compound annual return. The goal is to have saved $500,000 per child by the time he or she begins college. After age 18, $100,000 a year is to pay for college until the 529 plan goes to 0 at age 25.

Those who should follow the Medium column:

- Parents or guardians have a newborn or children under three

- Guardians or parents only plan to have one or two children

- Parents believe a college education is still valuable

- Child is of average intelligence and athletic ability

- Guardians or parents want to hedge against a continued rapid increase in college tuition

- Parents or guardians have a family business

- Parents tend to be more financially conservative

High Column (Coca) – Highest Recommended 529 Plan Amount By Age

The High column assumes a $30,000 annual contribution every year until 18 with a 7% compound annual return. The $30,000 comes from a combination of two people always contributing $15,000 each.

The two people can be both parents, one parent and a grandparent, two grandparents, and so forth. After 18, $200,000 a year is used for college tuition until the 529 plan is spent down to $0 at age 25.

Those who should follow the High column:

- Parents have a newborn or a child who has yet to be born

- Parents plan on only having one or two children

- Child is of below average intelligence and athletic ability

- Child insists on going to the most expensive private school

- Parents are very wealthy and are willing to make their children 529 millionaires

- Parents believe college tuition will inflate much faster than 5% a year

- Grandparents have enough money to superfund their grandchildren's 529 plans to help reduce their estate

- Parents who want to use the 529 plan as a generational wealth transfer vehicle

Follow Each Recommended 529 Plan Amount Column Based On Your Situation

Each column represents the appropriate amount based on your goals and your child's educational goals. All columns are great goals to follow. The amounts should align with your goals and beliefs.

If you’re behind, contribute more. Or convince a grandparent or relative to contribute more. If you’re ahead, throttle your contributions and use your money for other purposes.

It would be irrational if you save based on the Low column but have a child who is one year old and you want him to go to the most expensive university in 18 years without any grants.

It would also be irrational to follow the High column if your child is already 14 years old, is brilliant, and will likely get a free ride to any school she chooses.

Whichever column you choose to follow, make sure the numbers align with your current financial situation. Understand your child's intelligence and work ethic. Know your beliefs about higher education.

Related: Recommended 401(k) Amounts By Age

529 Plan Amounts By Age Goals For My Children

My wife and I are aiming to save up to $500,000 per child by the time each turns 18. In other words, we plan to contribute a combined $15,000 a year and hope for roughly a 6.25% compound annual return. Our goal is inline with the Medium (Bravo) column.

Worst case, if our children are not smart enough to attend an in-state public university or don't get grants from a private university, then we are looking at between $100,000 – $125,000 a year all-in per child.

The cost is based on a 5% compound inflation rate for the next 15-18 years. $500,000 per child in a 529 plan will be able to cover this realistic worst-case scenario.

Unfortunately, it seems like the cost of four years of a private university will cost closer to $750,000 in 2036, when our son is eligible to attend. As a result, contributing to our 529 plan may not be enough to pay for all of college.

Pay Attention To Your Children's Abilities To Determine How Much To Save

As our children get older, we will have a better idea of their intelligence levels and work ethic. We can then adjust our contributions accordingly.

My wife and I have always been of average intelligence. Therefore, our children will likely have the same level of intelligence. We cannot count on instilling in our children a strong ethic, no matter how hard we try.

Whether you follow my Low, Medium, or High 529 plan savings amounts by age, know that investing in a tax-advantageous account for your children is better than not investing in one.

Using A 529 To Transfer Wealth

Ideally, you want to save just the right amount in each 529 plan. But if you end up saving too much, you can always just reassign the beneficiary. The beneficiary can be reassigned to your grandchildren or someone else for generational wealth transfer purposes.

Finally, in addition to building a large enough 529 plan for your kids, consider also opening up a custodial Roth IRA. By putting your kids to work, they can contribute to a Roth IRA likely tax-free.

The money will then compound tax-free over time. After five years, your child can then withdraw the money tax-free to spend on whatever they want!

If you start your kid's Roth IRA early, I'm sure they will be ecstatic when they become adults.

New 529 Plan Rollover Rules Due To Passage Of Secure 2.0 Act

Before the Secure 2.0 Act was passed, families were hesitant to open or further fund 529 plans out of fear the leftover funds would be trapped unless they take a non-qualified withdrawal and assume a penalty.

Money withdrawn from a 529 plan must use for qualified educational expenses. If not, you’ll pay ordinary state and federal income taxes (at the beneficiary’s tax rate) on the money, as well as a 10% penalty.

Now, the penalty can be waived if your kid wins a scholarship, gets into one of the U.S. military academies, receives support from an employer or for several other reasons – but that’s just the 10% penalty. You’ll still need to pay the tax bill.

Conditions Of Rolling Over 529 Into A Roth IRA

With the Secure 2.0 Act, there's a rollover allowance that starts in 2024 and comes with several limits. First is that the amount rolled over can’t be more than the Roth contribution limit, which is $6,500 this year. You also can’t roll over more than $35,000 total in the beneficiary’s lifetime. You also can’t roll over contributions or earnings from the past five years.

Another condition is that the 529 plan must have been open for at least 15 years. Experts are unsure whether changing the account beneficiary requires a new 15-year waiting period. Also unclear is whether withdrawals of earnings from 529 plans transferred to a Roth account will be subject to the rule that requires earnings to remain in the Roth account for at least five years.

However, the rollover contributions aren’t subject to the Roth IRA income limits of $150,000 for single filers and $236,000 for joint filers this year. Families who’ve contributed to 529 pre-paid tuition plans – where they purchase tuition credits at the current rates – haven’t had to deal with the issue, since those plans refund only the contributions, which are made with after-tax money.

Diversify Into Real Estate To Fund College Education

It's too bad parents can't invest in real estate in a 529 plan. Real estate is my favorite asset class to build wealth given the combination of rising rents and rising capital values. This combination tends to build tremendous wealth over time.

That said, you can invest in real estate through a REIT, private real estate funds, or physical rental properties. Personally, I've invested in all three as real estate accounts for 48% of my net worth. Stocks make up 30% of my net worth.

Since 2016, I've been investing consistently in real estate crowdfunding. I want to take advantage of lower valuations and higher rental yields in the heartland of America. With more people relocating to lower-cost areas of the country, I believe the heartland will see multiple decades of growth.

Take a look at Fundrise, my favorite real estate crowdfunding platform. Fundrise has diversified private real estate funds that provide 100% passive income and diversification. For most people, investing in a fund is the easiest way to gain exposure. I've personally invested $300,000+ in Fundrise and Fundrise is a long-time sponsor of Financial Samurai.

Also take a look at CrowdStreet, a real estate platform that focuses on individual deals in 18-hour cities. If you have more capital, you can build your own select fund with CrowdStreet. They've got a great platform with very intriguing deals. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

Join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Instead of a 529, dump extra cash into the backdoor mega IRA. Same after tax contributions with no taxes on gains. Same as 529 without the restrictions.

How about the restriction of waiting until 59.5 to withdraw penalty-free? Kids might be in college before a parent is 59.5. Withdrawing contributions is OK, but not profits.

I do like the mega Backdoor Roth IRA though. But primarily for one’s retirement.

Yeah, 500k per kid is nuts. No thanks.

Im reading this post a little late, but good god what do you people do for a living that you can afford: mortgage, retirement savings, daycare, car payments, and daily living costs, and still put 15k into a 529??. I have a doctorate degree, earn >150k/year, and live well below our means, im struggling to put 3k per year into college savings.

Unfortunately, getting a PhD might be the problem? It takes a long time to get and a lot of 22-23 year old college graduates are making $80,000-$200,000 all in out of school.

Hence; the head start and higher starting pay puts them way ahead.

It feels like getting a PhD now is more a luxury for those who can afford to get one. I considered getting one in 2012 and decided I couldn’t afford it!

This didn’t answer the question. Getting a PhD is required for certain jobs, so I fail to see what that has to do with the economic reality of people being able to (or even wanting to) put away $500k per child. For one, it’s a bad economic sense for anyone outside wage-earners making a very high income, and secondly, it’s important for kids to gain access to scholarships/grants + share some of the cost (even if it’s a small portion of the overall bill).

The 1/3, 1/3, 1/3 shared funding rule is a good starting place for people mapping out their children’s college plans. One can tweak that to meet their financial realities. For our situation, my wife and I plan on meeting ~50% of our girls’ college tuition + expenses if they choose to attend an out-of-state college. We will fully cover their costs if they stay at a public in-state school, but they’ll need to bear a higher cost if they attend a private school.

If you can’t get a scholarship to get a PhD, you shouldn’t get a PhD. Once you have a scholarship, you shouldn’t need to worry about living expense and tuition for a PhD.

“A lot of 22-23 year old college graduates are making $80,000-$200,000 all in out of school” is not an accurate statement. Sure, there are some who are making that but it is definitely the minority and not the majority.

I didn’t say a majority. I said a lot, which is vague. But if you compete in the top tier; plenty grads do in tech, finance, and consulting. This is especially true in big cities.

Hi! This is so helpful. Thank you. Is there a reason only you superfunded your daughter’s account and not your wife? I am having a hard time understanding whether the 529 account should be a joint account where both my husband and I contribute to or we should have two separate 529 accounts for my daughter. Thank you.

Long time Samurai reader, first post.

Something is off for me about this article. I’m 100% onboard with 529s, I have one for each of my 2 kiddos. From the dollar amounts listed in this article, it appears we are suggesting parents pay for 100% of their kids college.

This is insane to me – from a message standpoint. What message are you sending your kids when you pay for 100% of their college? Kids who don’t have to think (or learn) about large-sum decisions (spending $10k per semester or year on tuition, books, housing, and how to prioritize that over partying, etc.) have no clue what to do once they graduate college. They are the ones scratching their heads on why they cannot get a job because they didn’t learn any adult decision making.

I myself graduated with $30k in student debt and it taught me lifelong valuable lessons on how to prioritize my personal finances, ask/request for loan payment forbearance when needed, etc. I plan on paying for ~75% of each child’s college tuition, they need to pay for the rest.

When made clear to the student that they will be responsible for “some” of their college tuition, it acts as a perfect motivator to get better grades in hopes for a scholarship in their latter years of college.

No worries. You should definitely do you. If 75% is what you think is appropriate, go for it. Some might think anything more than 50% is insane, as your kids will take their education and money for granted.

I’m conservative and like to have amounts saved for future expenses. When the time comes, then I can decide how much to pay, if anything.

Check out this post: Use A 529 Plan As A Generational Wealth Transfer Tool

I just came here to perhaps gain a sympathetic ear.

I recently realized the expense ratio for vanguards 529 100% VTI is 0.12% and the California (my residence) soclarshare program offered through TIAA following the same index has an expense ratio of 0.05% half of vanguard.

My faith is in vanguard is for them to cut their fees eventually. And I just don’t want to go through the headache of the paper work to switch.

Many states have Max limits on 529 plans and ban additional contributions if the account exceeds certain levels; the account can grow but no more $$$ can be added; please check this

I agreed that most people will probably never achieve these goals, but the numbers are not far fetch if you are the type who hope for the best but plan for the worst

1. Kids may change majors and require more years in school

2. Kids may need to law school or medical school

3. Save it for grand kids

The thing is, if your kids want to go to university, the figures have to be achieve one way or another.

It could be through taking on debt, parents paying, or working part time. Of course your kid could get scholarships because she is a genius. But we shouldn’t count on that.

I’m certainly not going to.

As a grandma if I were to put a one time $15,000 in my two year olds 529 account and let’s say that was the only money he had in there how much would that be do you think by the time he is 18?

You should of bought Bitcoin during March 2020! You would have been able to buy approximately 11.54 Bitcoin with an avg price of $6,500. If held until today, it would be worth over $761,0000. If you sold, you would pay long term capital gains taxes, which would still net you approximately $500,000 and no additional contributions would have been necessary for your daughter’s college education.

Just another point of view.

Shoulda! But bought $250,000 worth of equities instead that is up over $200,000. See: How To Predict A Stock Market Bottom Like Nostradamus

Also bought $10,000 of HUT when Bitcoin was at ~$30,000. Ethereum miner. See: How To Invest $100,000 Today

Better than nothing. The thing is, it’s a bull market, so everybody is winning. S&P 500 up 23%+ YTD.

For point 1, the kids should get their own scholarship to cover their poor decision making.

For point 2, the kids should get their own scholarship, or they carry the student loan, and make sure they can pay the loan off. Otherwise, no.

For point 3, yep, but what if your kids don’t have kids? And why isn’t that your kids should save for your grandkids?

Piggybacking on my last comment – it’d be much more useful if you had age on the rows, and different types of higher education on the columns (2 year college, 4 year public, 4 year private, bachelors + masters, etc.). Each element of that matrix would be the value in the account such that the guardian would no longer have to make contributions to fully pay for their child’s education, given ROI assumptions (e.g. 7% for age 0-10, 5% for age 11-15, 3% for age 16+) and expected tuition increases.

I’m trying to FIRE after all! I want to know when I can quit my job, and one of the big metrics would be to know that my child’s education is fully paid for.

Mario, it’s actually kind of scary that you aren’t able to read the analysis and think through the chart. I would encourage you to teach your children how to read and go through things comprehensively.

One part about achieving financial independence is being self-sufficient. If you really need this much handholding, I don’t see how you can ever get there.

FIRE is more than money. It’s also about self-sufficiency.

Saying a 529 account should be between $95k and $1M by age 18 isn’t the most helpful advice. Hell, I could have come up with that without the pages and pages of pretext.

Let’s just boil it down to, “If you don’t have much money to spare, contribute a little. If you have a lot, contribute a lot.”

My kids are 2 and 4. I can’t exactly tell if they’re going to be geniuses or want to go to the most expensive college in the country. But thanks for letting me know my older son’s account should have between $20k and $143k.

Mario – Did you not see the chart in the post that shows the recommended 529 plan amounts by age? If not, it’s in the middle of the post. Or perhaps you are trying to respond to another commenter?

At any rate, thanks for your feedback on how to make this post more clear.

Also check out: Using A 529 Plan For Generational Wealth Transfer Purposes

Am I missing something? If I’m reading the 529 by age chart correctly, when the child reaches 18, depending on the alpha, bravo, or charlie strategy, the recommended account value is $95k-$1M. That range is simply too wide to be useful, especially when planning for young children where your conditions are impossible to know.

Ah, I see what you mean. I would take it a step further and read the sub sections of the Alpha, Bravo, Charlie columns to understand the context and where you and your child find yourselves.

If you’d like, I can copy and paste the wording in this comment for you to make it more clear.

What am I missing here?

Your article says “For 2020, the average public tuition & fees cost is ~$10,500 a year for public-instate, ~$23,000 a year for public, out-of-state, and ~$37,000 for private universities according to US News & World Report.”

So if I do some simple math, and figure 4 years of college, we are looking at $42,000 for public in state, $92,000 for public out of state, and $148,000 for a private university.

Why are you killing yourself trying to save $500K for each kid?

Because there’s more to college expenses than tuition and some kids aren’t going to college for many years e.g. a 1-year old.

Got to always look ahead. Tuition inflation has historically run between 4-5% a year.

MIT’s annual tuition this year is $55,510 with their estimated total costs per year being around ~$77,000. Round that up to $80k and 4 years we’re looking at $320k. 4-5% increases per year and $500k isn’t looking too crazy in a decade or so.

Indeed. I would certainly bank for $500,000 all-in for college expenses in 10 years. Got to save!

I understand your community college and State School points. I agree with them.

But what percentage of the population do you think are able to pay for these suggested guidelines?

In my personal experience (mid 30’s) Most people starting to have kids-

1) Are just finishing paying off their own student loan debt

2) Just started taking on a mortgage in a crazy over inflated housing market

3) dealing with Daycare costs (2 kids is average $2,500 a month)

4) 401k’s, Personal Investments, Savings

This just seems extremely unrealistic… $30k a year per child starting early to mid 30’s? An income bracket association would make more sense… not simply saying based off how much a parent values education.

Completely agree. Maybe I’m insecure, but my wife & I have 2 kids (7y & 2y) & we’re upper middle class & relatively simple. I’ve put money in the mkt to help for college (not 529 bc it ties it down more than I think is worth (love to hear different POVs).

Thanks for this post! I’m looking into superfunding next year due to some RSU growth. I like the idea of set it and forget it, and after freaking out about the cost of college (see here: hereverycentcounts.com/2020/09/how-the-hell-am-i-going-to-pay-for-college.html) I realized I need to do a lot more than the standard $500/month that is recommended per kid.

If all works out, I’ll superfund my 2 year old and newborn’s accounts next year ($75 each) and then do the $15k per year going forward from my husband to catch any drops in the market.

So far I have $35k in my 2 year old’s amount, and $44k to split between my kid being born in January and my future kid (who is ~ -2 or -3.) So next year I’ll try to do $140k between kid 1 and 2. At least gets us closer to their college education being taken care of. A little closer…

Financial Samurai & Other readers,

Thanks for this post FS. I have a question on contribution. I am (husband) is the OWNER of my kid’s (beneficiary) 529. Its with Utah 529 plan. Its not a joint ownershipt and its only one owner (not many 529 allow joint, quick check on Utah 529 doesn’t say one way or other). I have a question on max contribution to this plan.

I follow that I (Owner of the plan & Father of the beneficiary) can contribute – 15K/year (without needing to file gift tax exception or others). Can my wife (Mother of the beneficiary, but the owner of the plan) can also controbute to same 529 plan – another 15K/year.

Sound simple – strightfwd – allowing both parent (each 15k) to contribute, but I have no means to confirm this anywhere. I am not trying to get any State tax benefit or anything like (we live in Tax free state), so need to complicate if wife working or any like that.

Don;t want to open another 529 plan for the same beneficiary – just to allow my wife to contribute to the max 15K/yr. Appreciate if you or any of your readers can provide some input here.

Thanks

Richard

I have the UTah 529 plan as well and I pay my wife’s part of 15K by transferring as a gift from her account (or our joint account). You can do that via the manage gift link for your kids Utah 529 online account .

I am using UTMA accounts instead of 529’s for my children’s college saving. Is this a mistake? Was told at around 14 y/o I should switch them into 529’s. UTMA allows for great investing flexibility.

Numbers seem out of reach for most folks. After paying the bills/mortgage, funding our own retirement, taking care of parents, etc. there isn’t that much left for most folks. Super funding the 529 is a pipe dream for most folks. I take issue with the bullet point that parents don’t value education.

This is the problem with education. Parents can’t afford the college education for their children, and this results in massive student debt.

Hence, I highly recommend going the public school route or community college for two years, and then transferring.

Related posts:

Public Or Private? Depends On Your Fear And Guilt

I’d Rather Have $1,000,000 And Go To Public School All My Life

Hi Sam,

Do you believe a disruption in higher education is occurring and will be accelerated due to COVID-19? I do. The unsustainable increases in the cost make alternatives like online education or a hybrid of online and in-person make increase the value not to mention starting at community college and transfer to a 4 year university more cost effective. As you mentioned, the value of college is declining and is ripe for disruption which is already happening (not a matter of if).

I do believe so. At least, college tuition should slow down in increases.

I’m becoming a firm believer that college is slowly becoming irrelevant. I’d rather just teach my kids what they need to know in work, business, and life while they go to grade school.

Related: Why Online Business Valuations Will Skyrocket

These savings rates seem a bit like overkill. Scholarships, grants, etc night eat some of cost. You can also continue to pay directly for part of it out of pocket while they are in school.

Don’t get me wrong, It’s great you are shooting for $500k per kid, but have you calculated the odds that they actually need anywhere near all of that?

Completely overkill. We can do all the math we think makes sense here, but some plans won’t let you put in more money once an account gets to ~$250k. I get that the price keeps going up, but it’s extremely difficult to see how $500k per kid will somehow represent 50% of a child’s education.

Hi Sam,

Why fully count on a 529. Have you thought instead about taking out a HELOC, HEL or 2nd mortgage on one of your properties that are paid off? This way the tenants are effectively paying for your college whilst you maintain an appreciating asset.

Cheers

Chad

I like to separate my investments and have each investment serve a specific purpose as tax-efficiently as possible.

Getting into debt to pay for my children’s education is not something I want to do. I like to focus on building more wealth instead.

Great piece on 529s. I’ve been working in the 529 Industry specifically for 17 years now and can tell your readers to fund your 401k and Roth IRAs (assuming you qualify) first. You and your kids can borrow for college, but you cannot borrow for your retirement.

With COVID-19 there are so many factors at play now so nobody knows what the future of college will look like. I personally have two kids and try my best to save as much as I can for each child after I fully max out my 401k and pay for other competing financial priorities. Last year I was able to put in $17k in total and this year I’m at $15k thus far. Similar to Sam, I wanted to take advantage of the market correction so I’ve been funding more than usual. However, if the market starts to shoot up again, I may put extra cash towards my primary residence (3.5% interest rate) as opposed to investing more in a 529 Plan where equities may be overvalued.

My goal is to target around $300-350k per child and I’m a little behind schedule but catching up quickly. You definitely don’t want to overfund, but if you do, you can always leave the $ for a future generation, shift it to another family member, or take it out and pay taxes and a 10% penalty on the earnings only (not ideal). Heck, why not spend some of it in your golden years and go back to college yourself!

All the best to you and your readers.

529 Guy

$300-$350K per child is a great goal. I definitely will reassess my contributions once the 529 plan gets over $300K. Perhaps by then, college tuition will start going down (doubtful) and I’ll stop contributing to try and get to $500K. But I bet, in 10-15 years, $500K won’t seem as much.

I have looked into the optimal 529 contribution for years and I’m still not sure there is a clear answer. To me, it’s less about the criteria mentioned above and more so about risk tolerance in the event the funds cannot be used for education and must be withdrawn with penalty. It appears you determined to save $1.0 million combined for your two kids. That’s great, but what happens if something happens and only one child goes to school? Half of your savings are now susceptible to penalties and any potential tax savings are lost. I understand the point of the IRS requirements here, but it essentially “scares” me into not saving as much as I otherwise would. Thoughts on this fear and obviously you think the risk is worth it.

I wonder how schools will look like after this pandemia, my daughter who is 11, her school is already planning on half school days at home, half school days on campus. They will keep only half of students on campus at any given time, at least until an effective vaccine comes out.

I don’t have any children yet, but I should probably get started with researching 529 plans.

I was also thinking with the rise of online classes, the rising cost of college, and the decreasing value of college degrees that if I were to have kids then I encourage them to pursue careers without requiring a college education, such as a web developer

Call me crazy- but I’m not planning to save anything specifically for my child’s college/university. We have funds available if she truly needs help in the future- but it’s better to have her on her own and think from the very start she will need loans/subsidies/bursaries/scholarships.

You don’t need to be above average intelligence to get that money, you just have to put in the work and apply. And, no, I don’t feel guilty about this. “If the money is legally available, take it.”

I wouldn’t be too worried too if I was Canadian given the average acceptance rate is between 40% – 60% for the top 5 universities in Canada, and the cost is so much cheaper.

But if you want to compete in America, it is much, much harder to get to the top given the average acceptance rate is between 3% – 8% for the top 5-10 schools.

My financial advisor cannot answer this for me: I am 57, single parent by choice of an 8 year old. I’ll be 67 when he goes to college. My state offers only a tiny tax credit for 529 contributions, so disregarding that, isn’t a Roth IRA a better option for me to use as a savings vehicle for college costs? I have only the one child, no nieces or nephews, and any grandchildren are too far into the future to consider (almost 50 years till any grandkids would be going to college, most likely). It seems to me that 529s assume parents will be too young to access retirement accounts without incurring early-withdrawal penalties. What do you think? What would you do if you were me?

My understanding is that the 529 is essentially a Roth with a small state tax benefit in some states that you can use for education only. So if you can max out your 401K, Roth IRA and then fund anything extra in the 529? For me it is hard to balance that with purchasing a home and paying down the mortgage (as encouraged by the FS earlier post!). :)

I agree with your thinking Sue. I am in the same situation and I will be over 60 when the kids reach college age. My retirement accounts give me more flexibility than a 529, especially if the kids decide not to go to school or get scholarships. Also keep in mind that the FAFSA (Federal Student Aid Application) requires you to submit your 529 balance and reduces your child’s benefits accordingly. Another point, I work at a community college and there are many, many scholarships that go “unawarded” because students don’t apply for those scholarships. Most community college students could attend for free if they worked at applying for all the free scholarships.

Since you work in a community college wouldn’t your child be able to attend for free? My brother in law went to college tuition free because his mom worked for the college (same with his siblings, they actually got to pick from a few different colleges ) He went to Arcadia which is in the Philadelphia suburbs

Yes they will be able to attend community college free and the major state universities at a huge discount if i continue working that long. But, hopefully I will be retired at that point. I need to see if that benefit continues into retirement.

Hi Sue – Here’s my detailed answer to your question between a Roth IRA and a 529 plan.

https://www.financialsamurai.com/roth-ira-versus-529-plan-for-college/

I don’t think $6k (or $7k, in your case) is enough yearly saving to pay for both retirement and school. The higher contribution limit for 529 is important. Of course if you have retirement covered and don’t plan to save more than $7k / year for college, then I’d agree with that assessment.

We fall into the Alfa column. My take is I got $200 a month for the first two years I was in college, and paid for the rest through grants, loans and working. Sure, I’ll contribute more than my parents did, it’s more expensive, but I want my kids to have skin in the game. I have three examples in my wife’s immediate family where they have degrees they aren’t using that were 100% paid for by Dad. Gotta put skin in the game, or risk not having the drive to make yourself successful.

Paying for college is probably the hardest thing plan. There are so many variables. My wife and I settled on saving 50-55% for a public instate university through 529 Plans. If our kids don’t get scholarship etc, we will cover the rest through our salaries and from brokerage account investments. While we don’t get the tax benefit, we would rather have flexibility.

I also have my doubts of about the future cost of college. Texas Universities tuitions on average grew 2.6% last year. I can’t imagine those higher estimates of 5% are sustainable.

I hope you’re right the tuition doesn’t grow faster than 5% a year. I’ve seen many cases where tuition is growing by over 5% a year.

Tuition growth is simply unsustainable. How about some tuition cuts!

I feel comfortable in my framework on the $500,000 savings goal per child in 15-18 years after doing the math.