Launched in 2008, Wealthfront is the only

Why is Wealthfront leading the pack among younger investors? After all, automated online investing isn’t a revolutionary thing anymore.

It's because Wealthfront was the first to bring online investing mainstream, and they clearly have their finger on the pulse of the industry. Technology is part of Wealthfront's DNA, and it's always best to go with the original.

If you are looking for an online investment platform without having to worry about sales calls, Wealthfront is the opportunity that you are looking for.

Wealthfront Company Overview

- Total Equity Funding: $200 million in 6 rounds from 35+ investors

- Headquarters: 900 Middlefield Rd, Redwood City, CA 94063

- Founders: Dan Carroll, Andy Rachleff

- Categories: Fintech, Financial Services, Wealth Management

- Founded: Wealthfront launched its service in 2011.

- Contact: support@wealthfront.com

- Employees: ~138

To be frank, Wealthfront has been very quiet since 2019. Sounds like they've got their head down and are focused. Or, they may have a liquidity crunch.

Wealthfront: Latest Features And Company Update

When it comes to Fintech companies, I always focus on innovation.

Specifically, are they answering the call of investors by developing a set of tools that truly meets their needs in this era?

That’s one of the reasons why I do business with Wealthfront. Their tools are cleverly designed to take advantage of software to do the heavy lifting.

The process is quick, easy and innovative. And, they keep rolling out new products and features.

Here's the latest from Wealthfront.

No Cost Financial Planning

In late 2018, Wealthfront became the first

For example, here's what you can expect from using their mobile app:

This is very different from other services that only offer planning to clients who open an investment account first, charge a premium for it and deliver it through a call with a CFP.

Automated Investment Management

Wealthfront offers more than just a personalized investment experience through diversified and balanced index funds. It also offers the broadest suite among all robo-advisors of tax efficient passive investment products.

These strategies known as PassivePlus®, which traditionally have only been available to the very wealthy, are grounded in academic research and made possible through implementation in software.

Wealthfront didn’t invent these strategies, but its team of PhDs led by renowned economist Burton Malkiel and technology has made them available to a newer generation of investors.

Wealthfront’s new PassivePlus® investment features include:

- Tax-Loss Harvesting: Available for no extra cost to all taxable investment accounts, daily ETF level tax-loss harvesting takes advantage of movements in the markets to capture investment losses, which can reduce your tax bill. Wealthfront is the only service to publish actual performance data on its tax-loss harvesting service.

- Stock-level Tax-Loss Harvesting: Available for no extra cost to taxable accounts over $100,000, Stock-level Tax-Loss Harvesting is an enhanced form of Tax-Loss Harvesting that looks for movements in individual stocks within the US stock index to harvest more tax losses and lower your tax bill even more.

- Risk Parity: Available for an additional 0.03% to taxable accounts over $100,000, Risk Parity is an alternative methodology to allocate capital across multiple asset classes, much like Modern Portfolio Theory (MPT), also known as mean-variance optimization. Historically, Risk Parity has generated better returns for a given level of portfolio risk than the more common MPT.

- Smart Beta: Available for no extra cost to taxable accounts over $500,000, Smart Beta is an investment feature designed to increase your expected returns by weighting the securities in the US stock index of your portfolio more intelligently.

Wealthfrontoffers its investment services through a range of account types, like:

- Individual, and joint and Trust non-retirement accounts

- Roth, traditional, SEP and rollover IRAs

- 529 College Savings Plan accounts

Wealthfront Path

Launched in 2017, Wealthfront Path is a free automated financial planning experience for all clients to better plan for their financial futur.

Many clients don’t know what their financial goals should be, and even more don’t realize that the goals they’ve set with their current spending and saving patterns are actually unattainable.

Wealthfront built something more personal, connected and instant than any financial advisor could ever be. Path takes advantage of their team of PhDs to analyze your past behavior from connecting to your financial accounts, showing you what’s possible for your future.

As your financial advisor, it’s Wealthfront’s job to sometimes be the bad guy and tell you that you can’t necessarily afford the lifestyle you want. So Wealthfront designed Path to first assess your basic financial health, before we let you imagine what’s possible.

They start with your needs before they get to your wants and wishes for one simple reason: If the foundation is shaky, then the rest is irrelevant.

Path let’s you:

- Financially plan for your future

- Explore “what if” scenarios

- Highlight how much you need to save to reach your goal by a certain date

- Highlight how much you can spend to still be on track

- Model your investment forecasts

- Home Planning

Lending

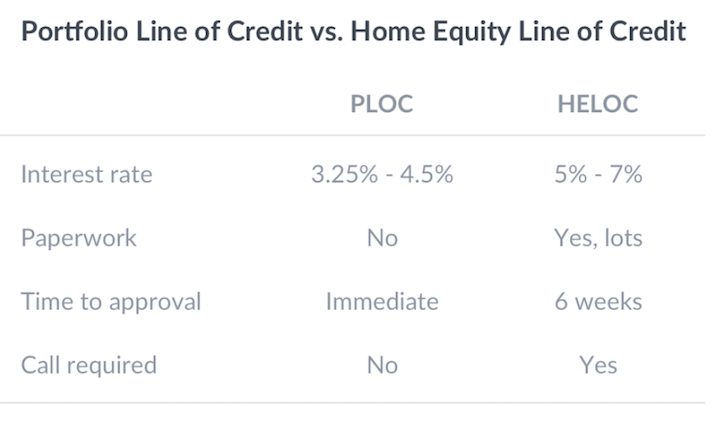

If you have $100,000 invested, then you’re automatically enrolled in Wealthfront's Portfolio Line of Credit (PLOC). For those looking for lower interest rates and a much smoother approval process, a PLOC is perfect.

In most cases clients can get their money in less than 24 hours.

Wealthfront is able to keep its rates below most home equity lines of credit because the PLOC is secured by clients’ diversified investment portfolios. Interest is accrued until the loan is paid off and clients are able to pay back their PLOC on their own schedule.

Related: Wealthfront Portfolio Line Of Credit

Wealthfront Continues To Lead

After more than a decade working in the financial services industry, it’s clear to me that Wealthfront has revolutionized the way everyday people can get better wealth management services.

While investing isn’t necessarily hard, it can also be tough to start, especially among younger people who are used to everything being instantly available at their fingertips.

Before, you’d have to come up with at least $1 million to have the privilege of paying a 2% – 3% fee each year ($20,000 – $30,000!) to have someone manage your money. Now, you can pay just 0.25% and start with just $500 with Wealthfront.

You can sign up with my link to get the first several thousand managed for free. It’s worth signing up to at least see what their sophisticated algorithms will suggest as an ideal model portfolio. Once you have the data, you can build the portfolio yourself.

Frankly, I think Personal Capital is the best digital wealth advisor for most people I like the hybrid approach of having a Registered Investment Advisor AND a digital algorithm help manage your money.

Related: Personal Capital Latest Assets Under Management

About the Author: Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at two of the leading financial service firms in the world. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate.