Wealthfront, a leading robo-advisor, features the Wealthfront Portfolio Line Of Credit. Wealthfront was the first Robo-advisor to offer a personal banking service. This line of credit lets Wealthfront clients stay invested in the market while still meeting their liquidity needs as they arise.

The Wealthfront Portfolio Line Of Credit is also faster and more convenient than a HELOC. In addition, it's also better than what private wealth managers offer because the rates are lower.

Wealthfront's Portfolio Line Of Credit: How It Works

The Portfolio Line of Credit is available for any Wealthfront client with an Individual or Joint Wealthfront account valued at $100,000 or more.

What's great is there’s no set up. If you’re an eligible Wealthfront client then you already have access. Just simply request the cash (up to 30% of the current value of your Wealthfront account). Then, Wealthfront will send over the money. You can receive your Wealthfront Portfolio Line Of Credit as quickly as 1 business day!

In addition, there are no hidden fees. Just pay the interest on the amount you borrow.

Why The Wealthfront Portfolio Line Of Credit Is Great

With the Wealthfront Portfolio Line of Credit you can get cash when you need it, for whatever you need without compromising your long-term goals. This is another service unique to Wealthfront. You’ll benefit from:

- Low Interest Rate: Your line of credit is secured by your diversified investment portfolio, so current rates are as low as 3.25-4.5% depending on account size.

No Application: If your account is eligible, you have a line of credit. Simple as that. No paperwork, credit checks, or application process. Just request the cash (up to 30% of the current value of your Wealthfront account) and we’ll send it over (you’ll receive it as quickly as 1 business day)!

Complete Flexibility: Borrow the amount you need, when you need, for whatever you want. Repay on your own schedule.”

My Opinion Of Wealthfront's Portfolio Line Of Credit

If you absolutely need money, the Wealthfront Portfolio Line of Credit is a decent way to go since you don't have to sell your investment positions. It's when people liquidate their investments, pay transaction fees, and never reinvest, where they get in trouble over the long-term.

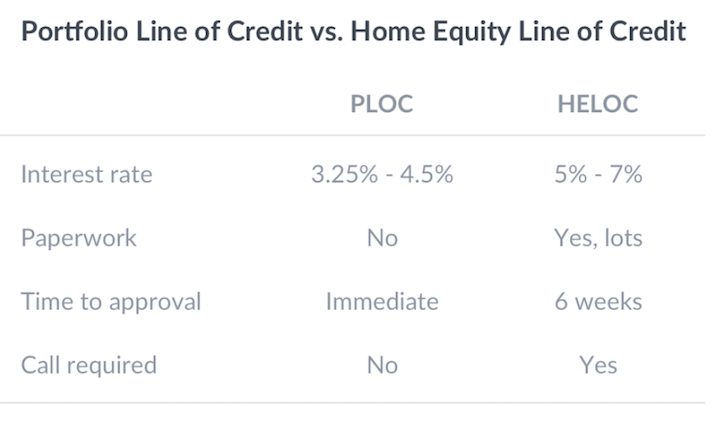

Here's a chart that compares Wealthfront's Portfolio Line of Credit to a Home Equity Line Of Credit. The paperwork involved really is a royal PITA for a HELOC, as is the waiting time.

Refinancing a mortgage, taking out a new mortgage, or getting a HELOC continues to be one of the most painful processes today due to intense government regulation post financial crisis.

Investors with more than $100,000 can borrow up to $30,000 at annual interest rates of 4.5 percent, or less.

See: What It Took To Finally Refinance My Mortgage

An interest rate of 3.25% – 4.5% is not bad compared to the 10-year bond yield (risk free rate) at ~2.5%. And the rate is certainly better than the egregious 15% – 30% rates credit card companies charge. Even compared to P2P lending at 7% – 10% for prime borrowers, Wealthfront's Portfolio Line Of Credit is attractive.

It's smart that Wealthfront is trying to generate a new income stream for its business. Their low cost robo-advisory service only charges 0.25% for assets over the initial free $15,000. Therefore, they've got to run $10B in assets under management to generate $25M in revenue to cover their operating costs. They're currently managing around $6B in AUM.

From a client's point of view, it's nice to know you can tap your wealth so easily if necessary for some unforeseen emergency.

However, I highly recommend minimizing the temptation to borrow money from your investments because it might turn into a crutch. Instead, focus on saving aggressively and generating passive income streams instead.

Your number one goal as a financial independence seeker is to invest early and often. Allow your investments to compound over time.

Wealthfront As An Investment Solution

Wealthfront is a good way for anybody to get started with low cost investing, especially those who are cashed up and who have no idea where to start.

A lot of people nowadays don't know where to start when it comes to investing. Wealthfront takes the confusion out of investing with its simple questionnaire and automatically invests in a risk-adjusted portfolio of Vanguard ETFs for you.

Wealthfront is the original robo-advisory founded in 2011. They are based right here in the SF Bay Area where I've resided since 2001. Let's discuss the basic investment philosophy of Wealthfront and the large majority of wealth advisors today.

Modern Portfolio Theory

The efficient frontier is a concept in modern portfolio theory introduced by Harry Markowitz and others in 1952. If there are two portfolios that offer the same expected return, investors will prefer the less risky one. If the price is the same, wouldn’t you buy the exact same house with panoramic ocean views over the one with a view of another building? Of course you would.

In Modern Portfolio Theory, everything is RATIONAL, which is why I’m such a big fan. Everybody here wants to improve their personal finances, which is why none of you are on Buzzfeed killing brain cells. Nobody here thinks they’ll have guaranteed employment for life, which is why you are building as many income streams as possible.

Unfortunately, there are a lot of irrational people out there who believe they can get ahead without putting in the effort. I’ve even met some C students who think they deserve A lifestyles. No wonder credit cards are such big business. They allow consumers to realize their delusions.

According to the Efficient Frontier chart below, optimum portfolios trac

Wealthfront Model Portfolio Examples

Now that you've got a basic idea of Modern Portfolio Theory, let's look at some sample Wealthfront model portfolios based off some specific answers given during the sign up process. The sign up process only takes several minutes because it's free, and there are only 5-10 multiple questions to answer to access your recommended model portfolio.

Example #1: 18 – 35 year old

Let's say you've recently graduated college and are just starting to build your retirement nest egg. You contribute to your IRA or 401k at least up to the company match, but you also want to invest after-tax dollars efficiently to one day buy a car, a home, or go to graduate school. So you wisely sign up for Wealthfront for free to see what they have to offer.

Based on your situation, Wealthfront may classify your risk tolerance as a 10. You've got nothing to lose, and only upside as you grow your earnings. With a risk tolerance of 10, notice how you have 95% of your asset allocation in stocks and only 5% in bonds. Historically, stocks have returned between 6%-8% a year versus bonds at only 3-4% a year.

Example #2: 35 – 55 Years Old With Family

The older you get, usually, the more responsibilities you have. You may have a spouse or children who depend on you. You may also have a mortgage that needs paying off. The good thing about being older is that you generally are making more money and have more savings in the bank.

Therefore, it's probably prudent for you not to take as much risk as someone who has no dependents and a much smaller amount to invest.

Below is a sample Wealthfront investment asset allocation for someone with a risk tolerance of 5. Roughly 70% of the portfolio is weighted in stocks, with the rest in bonds.

Example #3: 50 – Retirement Years – Protecting Your Assets

During the latter part of your career and life, your investment portfolio should be at its largest point if you've been consistently saving and investing. Your number one priority is to protect your principal at all costs because your ability or desire to work won't be as high as when you were younger. Therefore, it's natural to have a lower risk tolerance.

With a risk tolerance of two, Wealthfront will construct for you a portfolio consisting of 52% stocks and 48% bonds. You don't necessarily have to be over the age of 50 to follow this asset allocation. As a 40-year-old early retiree, I've chosen a 50/50 stocks/bonds asset allocation because I've already accumulated “enough” money to comfortably live off my dividends forever.

The great thing about Wealthfront's investment portfolios is that you can can manually change your risk tolerance number to see how the model portfolio changes. A lot of people may think they are more risk tolerant than they really are. The more recessions you've been through, generally the lower your risk tolerance because you can see how devastating a correction can be to your wealth.

In 2008-2010, I lost 35% of my net worth that took 10 years to build. I've now aggressively build up multiple income streams and a very diversified net worth in order to never experience that type of decline again.

Make Your Contributions Automatic

One of the keys to building long term wealth over time is to make your investment contributions consistent and automatic. Wealthfront has an easy feature where you simply link up your checking account and tell them to contribute X amount every week, two weeks, month, or quarter.

Time in the market is much more important than timing the market. You want to have your returns compound month after month, year after year until you build a portfolio so large that small percentage gains can mean big returns. For example, I've currently got a roughly $2 million public investment portfolio. If I can just return 5% a year, I'll earn $100,000. Not bad!

Types of Accounts Supported

- IRAs

- Roth IRAs

- SEP IRAs

- Trusts

- 529 College Savings Plans

- Taxable (Joint and Trust)

- Non-profit accounts

- Wealthfront cash account

Other Great Wealthfront Features

Automated Portfolio Rebalancing

Portfolio rebalancing keeps your allocations amongst stocks, bonds, and different sectors in balance over time. This is key to ensuring diversification. This feature is done with software automatically on a daily basis to continually buy some assets when they are low and sell others when they are high. No longer do you have to worry about constantly ensuring you have a properly balanced portfolio.

Automated Tax-Loss Harvesting

Each year, you are allowed to take capital losses to reduce your taxable income in that year. The amount you can write off depends on your income level, but the number most often referred to is $3,000. Financial advisors usually review your portfolio near the end of the year and will sell some losers to help you meet this deduction. Wealthfront offers this feature to all clients at no added cost.

Tax-Optimized Direct Indexing

When it comes to optimizing earnings in taxable accounts, Wealthfront focuses on Tax-Optimized Direct Indexing as a way to improve the results of tax-loss harvesting while also keeping fees at a minimum. Here’s how it works: Instead of using ETFs or Index Funds to invest in U.S. stocks, Tax-Optimized Direct Indexing directly purchases up to 1,001 individual securities on your behalf.

This strategy allows you to fully take advantage of the advanced tax-loss harvesting opportunities available through the movement of individual stocks – a move which will hopefully lead to greater gains overall. Combined with their Daily Tax-Loss Harvesting service, Wealthfront believes it could add up to 2.03% to your annual earnings.

Tailored Transfers

Tailored Transfers are a key component of our Portfolio Review and a service that no other advisor — robo or human — offers. If you want to switch advisors or move your brokerage holdings into a diversified portfolio, you typically have to sell all your holdings and move in cash. This means you will more than likely have a large tax bill. Instead of selling your holdings, we will directly transfer them into a diversified portfolio tax efficiently, saving you that tax bill.

Selling Plan & 529 College Savings Plan

Selling Plan is another service unique to Wealthfront. It helps all employees who hold public company stock to sell their shares tax-efficiently and commission free, at a level of service previously only available to executives. Additionally, our 529 College Savings Plan is another investment account unique to Wealthfront.

Related: What Are The Newest Features For Wealthfront

Wealth Management For Everyone

After spending 13 years of my career working in the finance industry for large banks such as Goldman Sachs and Credit Suisse, it's clear to me that Wealthfront is revolutionizing the way everyday people can get better wealth management services.

Too many people are cashed up because they don't know how to invest or where to start. Wealthfront has lowered the bar so that anybody with five minutes of initiative can get started.

In the past, you'd have to come up with at least $1 million to have the privilege of paying a 2% – 3% fee each year ($20,000 – $30,000!) to have someone manage your money. Now, you can pay just 0.25% and start with just $500 with Wealthfront.

Technology and the internet is a boon for consumers. Check out the best robo-advisors today. You can also read my latest post on how to become a great DIY investor.

About the Author:

Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at two of the leading financial service firms in the world.

During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate. He also became Series 7 and Series 63 registered. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $200,000 a year in passive income. He spends time playing tennis, hanging out with family, consulting for leading fintech companies and writing online to help others achieve financial freedom.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience.