As a shareholder of Tesla only since 2H2018, I wanted to share my thoughts on whether to buy, sell, or keep holding Tesla stock. The share price has risen meteorically, especially after Trump won the presidency again. But it’s volatile and now correcting after disappointing 4Q2024 deliveries.

Since Elon Musk was instrumental in supporting Trump’s election, it’s likely that Trump’s policies will favor Tesla. This bodes well for holding Tesla stock. But the path will not be smooth due to hyper competition in the electrical vehicle space and the potential for no more tax credits.

However, with Tesla’s advancements in robotics, new models, battery infrastructure, autonomous driving, and AI, combined with a Trump administration’s potential for lower taxes, stronger trade protections, and deregulation, Tesla stock is positioned for growth. These factors create a favorable environment for Tesla and other high-growth assets.

Beyond Tesla, I’m also actively investing in private AI companies like OpenAI, Anthropic, and Databricks through an open-ended venture capital fund. AI has enormous growth potential, and I believe we’re only scratching the surface.

For those interested in AI exposure, check out the Fundrise venture capital product, which targets promising AI growth companies. So many private companies have the potential to become the next great growth company like Tesla. I've invested $160,000+ in Fundrise venture so far, and will keep dollar-cost averaging since the minimum is only $10.

For background, I reached financial independence in 2012 at age 34 with a $3 million net worth. I used to work at Goldman Sachs and Credit Suisse for 13 years, where I cut my teeth in equities. I helped pioneer the modern-day FIRE movement in 2009, when I started financial Samurai.

My Tesla Stock Ownership History

I bought Tesla stock in 2H2018 after I met Elon Musk at a wedding. At the time, there was all type of media hoopla about him being unstable, smoking marijuana on Joe Rogan, sending out missive Tweets, and so forth.

I wanted to see for myself whether Elon was indeed unstable, or a stable genius. In the end, I decided he was the latter. The media was blowing things way out of proportion. I bought 300 shares in multiple tranches between $280 – $310.

The stock did well and then started to plummet in 2019. When it recovered to the $400 – $420 level, I decided to sell half my shares and lock in a 30% gain. At the time, I felt good because I was down about 30% at one point. In retrospect, selling was a mistake.

Related: Should I Buy Tesla Stock? Advice From A Professional Investor

What Should I Do With My Tesla Stock In 2024+?

If you're lucky enough to own Tesla stock before the incredible ramp up in price in early 2020, you may be wondering what you should do now? Buy more? Sell Tesla stock and take some profits? Or just hold?

In general, I don't recommend any one stock position be greater than 20% of your entire portfolio. Therefore, if your Tesla stock is greater than 20% of your entire portfolio, I recommend taking some profits down to 20%.

But if Tesla stock is well under 20% of your portfolio, I suggest riding the shares out and buying this latest dip in 2025. The ride will be extremely volatile, but here are some reasons why:

In 10 years, there is a chance that Tesla extends its electric vehicle lead, lowers production costs, builds an autonomous global transportation network, becomes a power conglomerate, creates new efficient modes of transportation, turns into the next Amazon, and also becomes highly profitable. Just in case Tesla does reach all these goals, I don't want to miss the electric bus.

Do you really want to miss the electric bus if Tesla becomes the next $1 trillion market capitalization company like Microsoft, Amazon, Google, and Apple? I don't think so. It's kind of like not investing in artificial intelligence today. Yes, valuations seem frothy, but AI is going to be a game changer.

Clearly, Tesla stock is priced to perfection. Any execution missteps or earnings misses will cause the stock to tumble. Heck, the stock could easily correct 30% on no news one day given how quickly the share price has risen.

Bullish Case For Tesla Stock

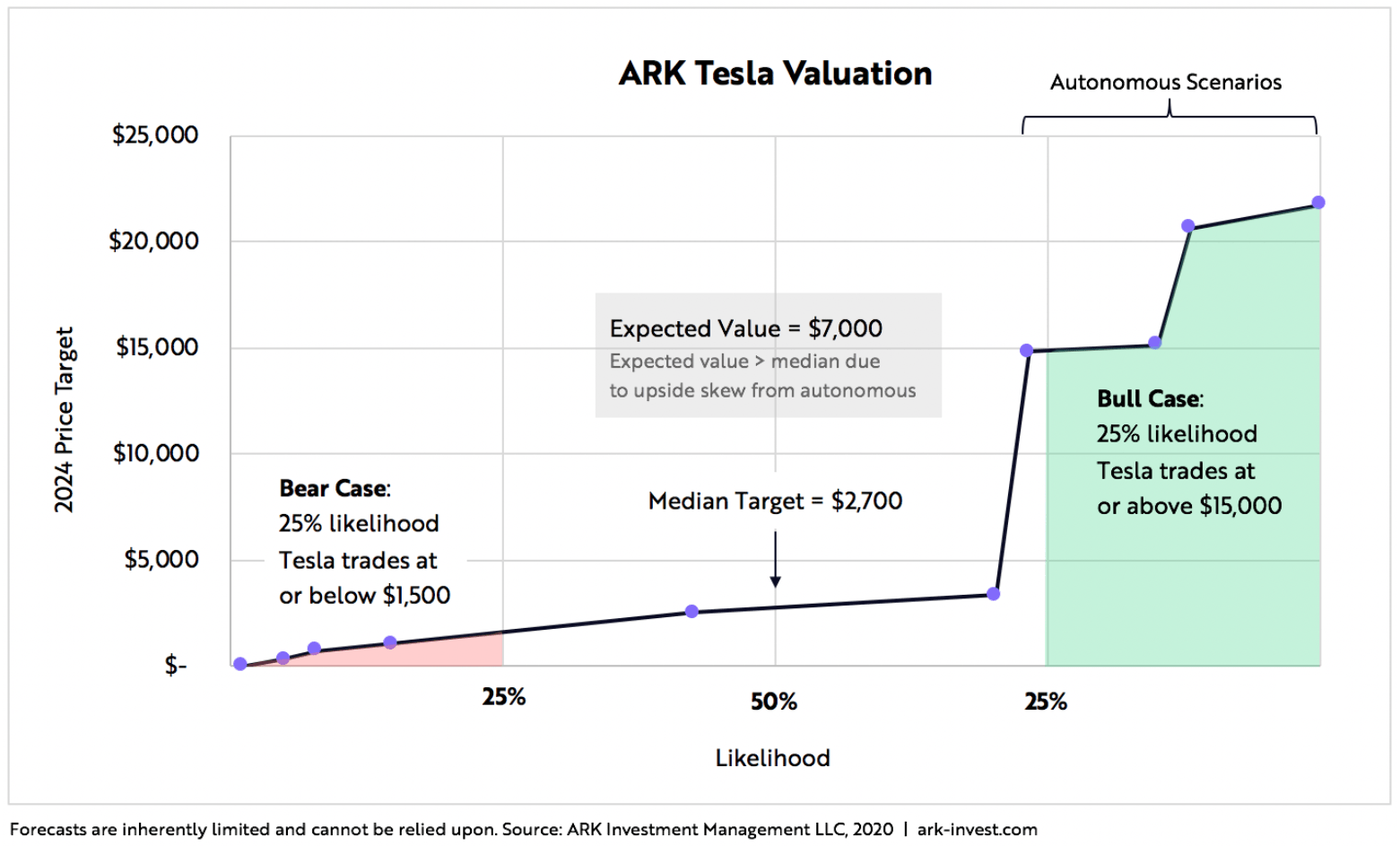

If you want to look at the Bear Case and Bull Case for Tesla stock, take a look at ARK Investment's projected model for the company. Even in a bear case, it looks like Tesla is more than a double from here.

If you're not in Tesla at the moment, I think it's worth buying at least 1 share in a correction. Just in case Tesla does become even half of these projections. Teslas latest sales and delivery figures for 2024 came in stronger than expected and there will be a new exciting lineup of cars from the new Model Y and X to an upgraded Cybertruck with new colors and features to the Roadster.

When investing, it's important to invest in an entrepreneur and leader who is brilliant and constantly looking into the future. I think Elon Musk is one of the best people to look and plan ahead.

I'm hoping Tesla corrects so I can buy more. If not, I'm just going to hold onto my 150 measly shares. Let's see what Elon has in store for the world.

Diversify Your Investments Into Real Estate

Stocks are very volatile compared to real estate. And Tesla stock is especially volatile. Therefore, if you want to dampen volatility and build wealth at the same time, invest in real estate. Real estate is my favorite asset class to build wealth.

The combination of rising rents and rising capital values is a very powerful wealth-builder. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $954,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for all investors to invest in private real estate around the country. Fundrise has been around since 2012 and has consistently generated steady returns during tough markets. For most people, investing in a diversified real estate fund is the easiest way to gain real estate exposure.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Both platforms are sponsors of Financial Samurai and Financial Samurai is an investor in Fundrise.

About the Author:

Sam worked in investment banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments. They now generate roughly $300,000 a year in passive income, most recently helped by real estate crowdfunding. He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009.

Financial Samurai is one of the most trusted personal finance sites on the web with over 1 million pageviews a month. To achieve financial freedom sooner, join 60,000+ others and sign up for the free weekly Financial Samurai newsletter.