Canadians and French people are very rich. In fact, Canada and France are estimated to be two countries that have the fastest growing number of millionaires by 2025 according to Credit Suisse.

Canada and France's estimated millionaire growth rate is 3X faster than America's estate millionaire growth rate. As a result, it's worth doing a deeper dive to see what's going on. Americans seem to be working too hard and not enjoying life enough.

American Millennial Generation Is Doing Well

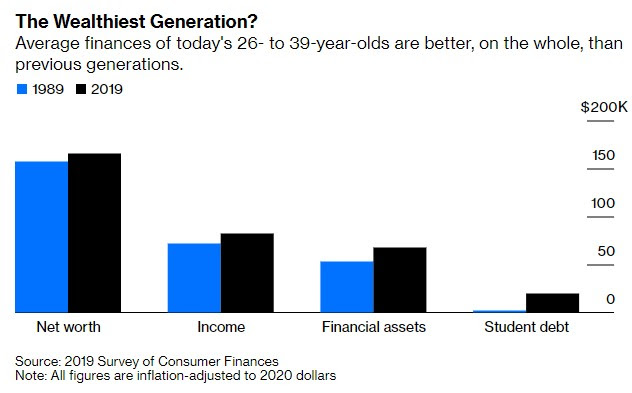

The latest Survey of Consumer Finances shows today's 26-to-39-year-olds are better off than the previous generation at the same age. Here's a chart that Bloomberg put together comparing 1989 and 2019, inflation-adjusted in 2020 dollars.

The only negative is the current generation has more student debt. However, with interest rates so low, debt forgiveness, and a student loan payment moratorium, having on average ~$17,000 in student debt isn't so bad.

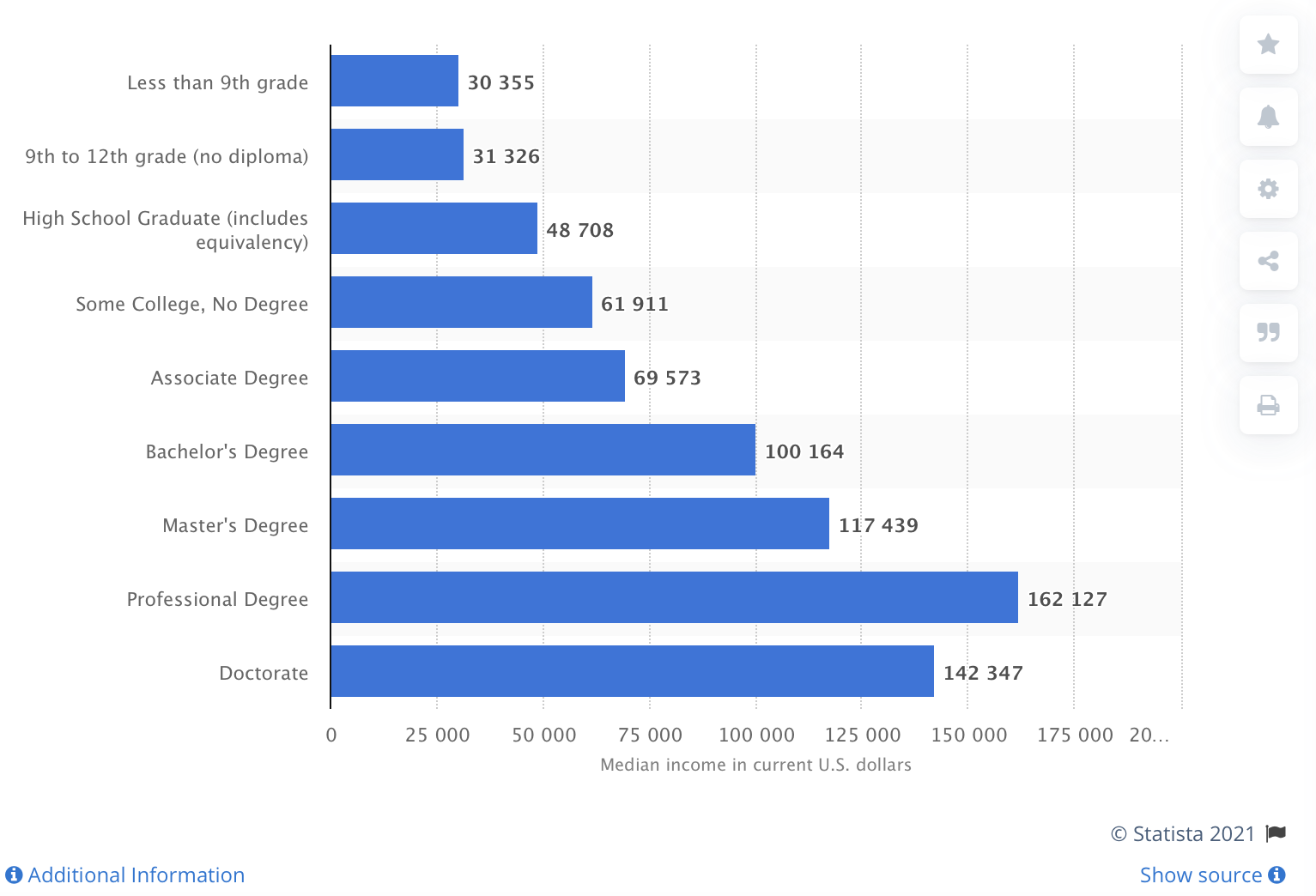

After all, getting a college education is an investment in one's future. With a $100,000 median household income for college graduates in America, $17,000 in student debt is quite manageable.

Below is a chart that shows the median household income by educational attainment. From the people I've met, the stories readers have shared, and the data from the Fed, it sure seems like Gen Xers and Millennials are doing fine.

The Countries With The Most Millionaire Growth

If you read my detailed analysis of Credit Suisse's Global Wealth Report, you'll notice a section on the countries with the estimated fastest-growing number of millionaires by 2025.

The top six include: Poland (+98%), China (+92.7%), India (+81.8%), Denmark (+82.4%), Canada (+77.2%), (Brazil +74.4%), and France (+70.1%).

China, India, and Brazil on the list are understandable, given their much faster forecasted GDP growth rates. However, Poland, Denmark, Canada, and France are harder to understand. They are also all service-heavy economies.

Why Is Plans Forecasted To Have So Many Millionaires?

Poland's millionaire growth has to do with the mindset, grit and education of Poles. As you may or may not know, the country has gone through systemic change in the last 30 years and is being heavily influenced by the West, particularly the US.

After the collapse of communism, the spirit of entrepreneurship has become very strong. It also helps that many young people graduating from world-class universities in Poland come out of those schools debt-free!

There are also negligible real estate taxes with most of the millennials receiving free homes from their parents. When you add it all up, becoming a millionaire becomes much easier without the heavy burden of debt as in the US for example.

Now let's focus on Canada and France. They provide a couple important takeaways for Americans.

Why Is Canada Forecasted To Have So Many More Millionaires?

A big part of Canadian household wealth growth can be explained by the massive housing boom it has experienced so far. The average net worth in Canada is relatively large.

Canada's housing market makes the United States housing market look quite tame. However, to expect a continued housing boom until 2025 seems aggressive. There will be a nationwide revolt if so.

Few Americans are moving to Canada to get rich. However, plenty of Canadians are buying up U.S. property (consistently the #1 foreign investor) and vying for U.S. jobs because we pay better.

Are the commercial banking and oil & gas industries strong enough to build that much wealth for the country? We shall see.

The main takeaway I have from Canada's expected surge in millionaires is there's a real possibility the U.S. housing market could go bonkers like Canada's housing market.

If so, the median U.S. home price would be 50% – 100% higher than today's ~$370,000 median level. Of course, an upcoming post will take a deeper dive into this subject.

Why Is France Forecasted To Have So Many Millionaires?

As for France, the country is famous for its 35-hour workweek, long boozy lunches, and great work-life balance. And yet, France's estimated millionaire growth rate in five years is 70.1% versus only 27.8% for the United States.

The French also have higher income tax rates than Americans. In France, you pay a 30% marginal income tax rate between €25,711 – €73,517, a 41% marginal income tax rate between €73,517 – €158,222, and a 45% marginal income tax rate above €158,222.

Therefore, it sure seems like we Americans are working too hard for our money. Or maybe the reason why Americans are working so hard is because our tax rates are relatively low. Once our tax rates go up, it's natural to work less and smell the roses more.

Given the French have higher taxes and are expected to grow their millionaire count at 3X the rate of America's millionaire growth count, perhaps American should kick back more. If Americans take it easier, we will pay even less in taxes. We should also have more faith our investments will make us richer over time.

The pandemic is a perfect example of investors getting much richer during one of the most tumultuous times in history.

Millions Of Millionaires And Growing

The bottom line is that there will be millions more millionaires in our lifetimes. Adopting a positive money mindset is important for growing your wealth. So is surrounding yourself with like-minded people who also want to grow their wealth.

The Canadians and French are so rich because they have good infrastructure, a supportive government, a relatively small population, and are already quite wealthy! It's easier to get richer if you already have a good amount of capital.

If You Want To Become A Millionaire

If you want to become a millionaire, you can subscribe to the Financial Samurai newsletter for free and get all my posts via e-mail. Financial Samurai has been around since 2009 and is one of the largest independently owned personal finance sites with 1 million visitors a month.

And yes, I was able to become millionaire by 30 back in 2007. Here is my millionaire story if you're interested. Thanks to becoming a millionaire relatively early on, I was able to retire in 2012 at age 34.

My key source of funds are my diverse investment income streams. Once you have enough passive investment income to cover your desired living expenses, you're free!

Regards,

Sam, Financial Freedom Sooner Rather Than Later