If there's one generation wealthier than ours, it's the “Bank of Mom and Dad” generation. Given that our parents have had, on average, three decades longer to save and invest, it's natural that they have accumulated more wealth. For adult children in need of financial assistance, finding a tactful way to approach their parents for help is a sound strategy.

As a savvy son or daughter, one of your objectives may be to access some of your parents' wealth while they are still alive. While this may sound unkind or dishonorable, the reality is that adult children have been doing this for generations, particularly in high-cost areas of the country. Many choose to keep it discreet.

For instance, approximately 30% to 40% of first-time homebuyers in cities like San Francisco receive downpayment assistance from their parents. Similar patterns exist in other areas with high living costs. Moreover, with the substantial wealth amassed by the “Bank of Mom and Dad,” more parents are open to providing financial aid while they are still living. This isn't a coerced wealth transfer; it's primarily driven by love and, to some extent, necessity.

However, parents often fear spoiling their children and aim to instill independence rather than dependency. Let me share some strategies on how you can respectfully approach the “Bank of Mom and Dad” for financial assistance.

How The Bank Of Mom And Dad Helped One Young Woman Start A Family

At the playground one day, a bunch of us started sharing at what age we had our first child. It's a fun topic here in San Francisco since the cost of living is so high.

I went second and said, “Just a couple months before my 40th birthday.” Although I was an older first-time dad, I was not alone. Other dads chimed in and said between 37-43.

Then one mother excitedly exclaimed she had her first child at age 26. We were all intrigued by her story because her husband looked like a graduate student.

The mother said after she had graduated from Bowdoin College, her parents helped her with a down payment on a two-bedroom condominium in Cow Hollow. She didn't say how much the condominium was. But it was likely between $1.2 – $1.5 million based on the median price for two-bedroom condos in the area.

As freelance writers, it would have been hard for them to come up with a $240,000 – $300,000 down payment on their own in their early 20s. Therefore, the Bank Of Mom And Dad helped out.

Not Embarrassed Getting Assistance From Parents

She didn't sound embarrassed that her parents helped her buy a condominium at all. In fact, she said several of her friends from college had had their parents buy them condominiums or single-family homes after graduation as well.

When I got home, I looked up the cost to attend Bowdoin and it said $73,000+ a year! Well gosh, diggity. If I could afford to send my kid to such a school, then I probably could afford to come up with a six-figure down payment to help my kid live after college as well.

After all, the more you spend on university, the higher the expectations are to become a success. The last thing any parent wants is for their child to struggle after spending ~$300,000 on a higher education. What would these rich parents say at cocktail parties when their friends ask what their kids are up to? Therefore, the financial support continues well into adulthood.

The Bank Of Mom And Dad Is The Reality

Many people have wondered how young people can afford to buy their first home in an expensive city. Now you know. The equation for housing affordability is:

Salary + Another Salary + Bank Of Mom And Dad

There really is no other explanation for how someone can buy a property worth 10X or more than their annual income. I have lived in either New York City or San Francisco since 1999. Everyone I know who bought a property by age 25 had the help from the Bank Of Mom And Dad.

For example, back in 2000, my roommate's parents bought him a one-bedroom Manhattan condo a year after we shared a studio apartment at 45 Wall Street. He was 24-years-old. The condo has since appreciated to ~$800,000 from $250,000.

Meanwhile, I was stuck renting for three more years until I finally found a good deal in San Francisco. If only I had had richer parents. I would be richer today!

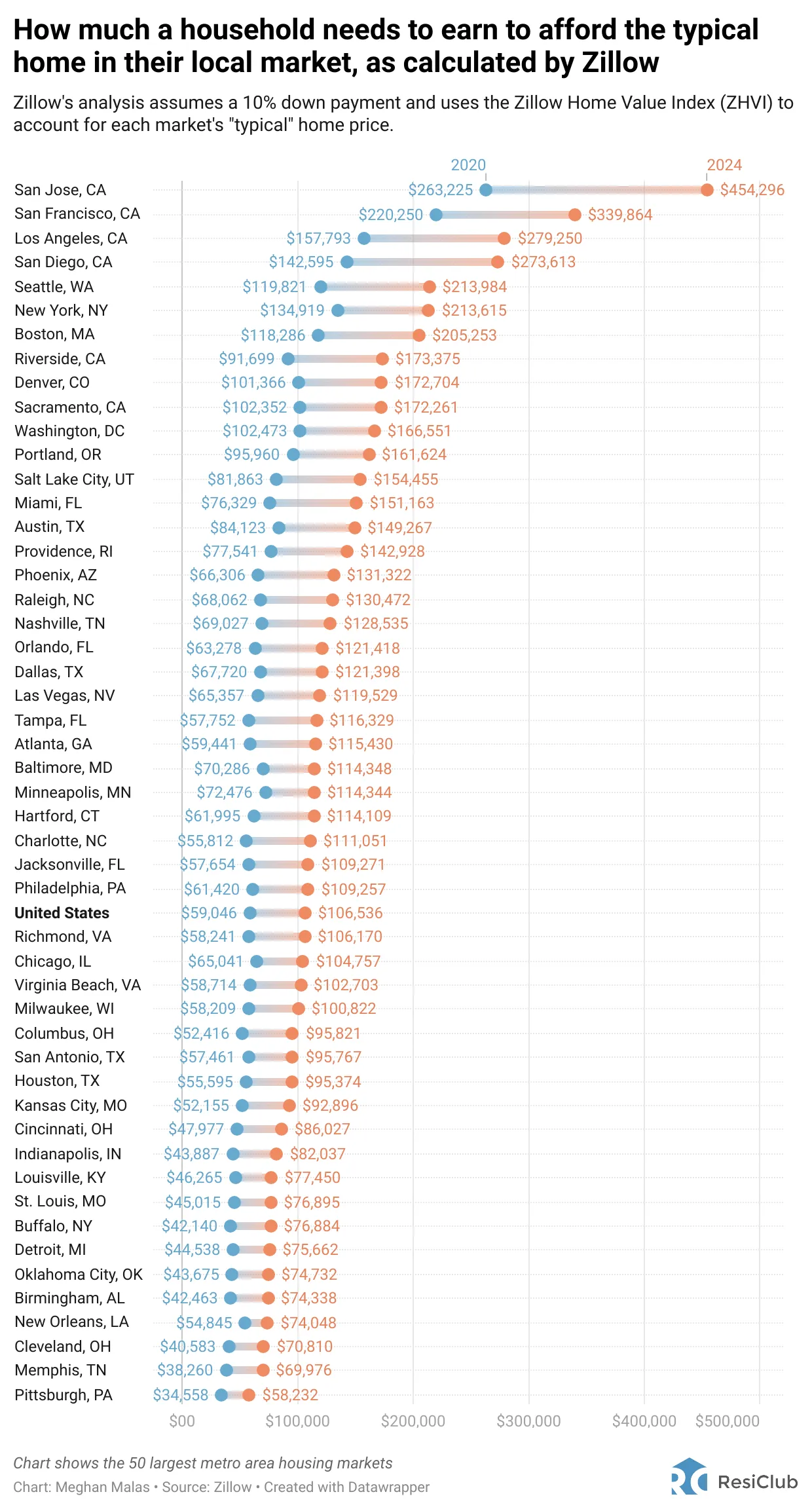

Below is a great chart highlighting the household income needed to afford the typical home in one of the top 50 cities. With the required 10% minimum down payment, many adult children need assistance from The Bank of Mom & Dad.

How To Convince The Bank Of Mom And Dad To Buy You Things

To effectively compete in today's society, we must accept reality. And the reality is The Bank Of Mom And Dad is ubiquitous. They've been able to save and invest during the greatest bull market in history. Of course they have trillions of dollars to share with their children. They want to.

If you are struggling to get ahead, you too might want to swallow your pride and ask your parents for financial help.

Here are some strategies I've learned from adult children over the years on how they were able to convince their parents to buy them a house, a car, and pay for graduate school.

1) Regularly Stay In Contact With Your Parents

When I lived on the wealthier north side of San Francisco, I had a 28-year-old neighbor whose parents had bought him a brand new $42,000 Toyota 4-Runner. He also lived rent-free in his parent's two-unit building. One of the units was rented out. I said “hi” to him multiple times a week over the 10 years I spent living there. He was often unemployed or traveling around the world.

One day he told me,

“Before I plan to ask my parents for anything, I tell them I love them very much at least three times a week for one month. Only then, do I go in and make the ask. After all, what's more powerful than love?”

It's hard to argue with my neighbor's logic. If my adult kids called me at least three times a week and told me they loved me, I'd probably give them anything they wanted!

Back in 2017, when I was considering selling my house, my neighbor actually texted me saying he'd be willing to pay $2.1 million. So you see, having The Bank Of Mom And Dad can really pay off. How many 36-year-olds without a stable job have that kind of money?

According to a study by the National Bureau of Economic Research, parents who had no contact with at least one of their children for more than a year were about 40% less likely to leave equal inheritances to their offspring than parents who remained in touch with all their kids. Therefore, don't forget to at least call your parents!

2) Plan Far Ahead Before Asking For Anything

One 28-year-old marketing associate once told me,

“You never want to just ask your parents for something out of the blue. Instead, create a year-long timeline before asking for anything. During this time, you can demonstrate your enthusiasm for whatever it is you want the Bank of Mom and Dad to buy for you.

For example, I really wanted the latest 4-series BMW coupe. But it cost $54,000 out the door and I only made $55,000 at the time. I knew my dad loved cars so I talked to him about BMWs and Porsches for a full year. Porsche was his favorite car brand and the $130,000 911 S Cabriolet was his favorite model. He may have been going through a late mid-life crisis.

When I asked him a year later if he could buy me a 435i BMW coupe, he said no problem! $54,000 seemed so cheap compared to the Porsche he wanted. We had a fun time going to the car dealership together. We went for a test drive and I let him haggle with the car salesman. It was a nice father-daughter bonding moment.”

The longer your child has demonstrated an interest in something, the more the parent wants to help. In many instances, parents have a difficult time NOT spending money on their children if they show even a hint of interest.

This desire by The Bank of Mom & Dad to help their adult children is a main reason why there are fewer self-made millionaires than you think. With so much wealth creation and love build up over the years, parents fail the marshmallow test by making life too easy for their kids! As a result, adult kids end up demotivated and depressed they can't do more things for themselves. Beware!

3) Make An Investment Pitch

One woman who had her entire $130,000 MBA tuition paid for told me,

“I created a Powerpoint presentation explaining why them paying for my MBA was going to be a great investment. In the presentation, I highlighted pre- and post-MBA salaries and the top 10 employers who hired from my school. I also mentioned famous alumni closer to their generation to make them proud.

They loved my presentation! Although I felt more pressure to land a great job after graduating, everything turned out well. I got a job in finance that paid me a $180,000 base salary plus a bonus.

Further, I'm now engaged to one of my business school classmates. Together, we make a little over $400,000 a year and will soon save up enough money on our own to buy a house. My parents couldn't be more proud. They feel like their investment paid off big time”

4) Become A Real Estate Expert

If you want The Bank Of Mom And Dad to buy you a home, you should do your best to get smart on real estate. The more you know what you're talking about, the more confident your parents will be to spend money on you.

A 36-year old woman who currently lives in a paid off $2 million, three-bedroom, two-bathroom single-family home in my neighborhood told me,

“Back when I was 28, I made an argument why San Francisco real estate was a good investment. I told my parents about the upcoming tech IPOs from Uber, Lyft, Pinterest, Airbnb and more. I showed them what happened to San Francisco Bay Area real estate prices after Google and Facebook went public. In addition, I highlighted how inexpensive San Francisco was and still is compared to other international cities.

Further, I agreed to pay the mortgage, maintenance, and property taxes so they could rest free knowing their asset was being taken care of. Finally, I rented out a bedroom to a girlfriend of mine for $1,900 a month. From a financial standpoint, we're all winning.

If I hadn't shown my parents how much I knew about the local real estate market, there's no way they would have helped out five years ago. My younger brother, who is a knucklehead, won't be getting any down payment help any time soon. He can't even pay his credit card bills on time.”

5) Demonstrate You Are Worthy

One Bank Of Mom And Dad parent who financially supports her 31-year-old son said,

“I needed my kid to show me his 5 and 10-year career and financial plans before I opened my checkbook. Growing up, he always had trouble committing to something for longer than a year. He lacked grit. I feared that if I gave him too much money, he would just quit his job and go travel the world with his girlfriend and not come back.

Before buying his condo, I made him sign a contract to follow his financial plan for at least five years before doing whatever he wanted. He agreed, and after three years, he hasn't quit his job yet. I'm hoping that as he matures, he will appreciate the value of commitment.“

At the end of the day, getting The Bank Of Mom And Dad to help shouldn't be too difficult if you are a worthy son or daughter. Every parent just wants to have a happy child who finds independence and meaning in their lives.

The Wrong Way To Ask The Bank Of Mom And Dad For Money

Now that we've learned the right way to ask The Bank Of Mom And Dad for money, let's discuss the wrong way.

As an adult child, the worst way to get your parents to buy you anything is to tell them, “All my friend's parents are buying them homes and cars after college, why can't you?” This argument reeks of entitlement! No effort or love is spent in this ask.

Your parents will likely start questioning whether they raised you right after all these years. They may even alter their wills or revocable living trusts.

Yes, we all know that hard work is not the only way to get ahead thanks to the massive generational wealth transfer. However, it's important adult children never let their parents know they are expecting anything.

Perhaps treat The Bank Of Mom And Dad like Social Security. It'll be nice if your parents help out one day, but don't count on it.

What Parents Want From Their Children

In any type of negotiation, it's important to put yourself in the other person's shoes. If you don't, you will have a harder time getting what you want. The Bank of Mom & Dad isn't just going to throw their money around for nothing.

Here's what I think every parent wants for and from their children.

- To be happy and not struggle more than they need to.

- Not take them and their money for granted and grow up spoiled and entitled

- To do what they can on their own after all these years of support.

- To not rob them of fulfilling their own potential by accepting money.

- Hope they'll stick around when the parents are sick and need help.

- Hope they'll have children of their own who be loved and cared for.

- Contribute a positive impact to society.

- Bring honor to the family like Mulan.

If you, the adult child, are incapable of taking on side jobs, working more than 40 hours a week, saving aggressively, investing diligently, and being patient with your desires, then you may mobilize The Bank Of Mom And Dad to help.

Without a strong work ethic, some luck, and the financial help from your parents, I'm afraid life might become too difficult. You might also get extremely bitter at your peers. The rich are already setting up their kids for life by buying their way into the best schools and giving them the best jobs.

Swallow Your Pride And Ask For Help

My parents weren't rich, they were middle class. We lived in a regular townhouse and drove an 8-year old Toyota Camry when I was in high school. I attended a public university for $2,800 a year in tuition because that's what I thought we could comfortably afford.

However, if I had been savvier, I would have spent more time learning all the nuances of personal finance as a young man. I would have read more personal finance books at Barnes & Noble or at the public library after school.

If I had read this post back when I was in college, I would have worked more during the summers and winters to save more money. Then I would have tried to convince my parents to help me come up with a downpayment to buy a two-bedroom Manhattan property in 2001. Today, it would likely be worth over $2 million and be fully paid off.

Perhaps most importantly, not having enough wealth delays family formation. And perhaps there is no greater reward than having your own children.

If The Bank Of Mom And Dad had helped me like it helped the 26-year-old mother at the playground, I most certainly would have tried having kids five years sooner. Alas, I can only move forward and try and help the younger generation understand the secret ways of society.

The Ultra-Competitive World Today

Wages are not keeping up with housing, college education, and healthcare costs. As a result, the average person is falling behind. Despite stocks and real estate at all-time highs thanks to a strong economy, many are actually feeling a Silent Recession instead.

Thanks to inflation, it now takes at least $3 million dollars to be considered a real millionaire today. Some even argue that having $10 million is the more appropriate level of wealth to be considered rich.

The rich will keep on getting richer. There is no stopping this trend.Therefore, I suggest doing what many first-generation immigrants do and pool together financial resources to help the next generation thrive. The Bank of Mom and Dad is strongest with immigrants trying to make it in a new land.

For more insights, here are households with a $20 million net worth. To no surprise, their lives are still not perfect.

Get Neutral Real Estate By Owning Your Primary Residence

Once you get neutral inflation by owning an affordable place to live, life is much easier to manage. If you need help from your parents, ask for help in a respectful way. Parents love their children and will do anything to make them happy. At the same time, parents want to feel proud of their children for making it on their own.

Personally, it's become easier for me to invest in stocks, real estate, and alternative investments now that I have children. Children force us to extend our investing time horizon by 20+ years. 20 years from now, we are probably going to wish we had bought more assets today. Children also encourage us to be more thoughtful about why we earn, save, and invest.

This Bank Of Mom and Dad will likely stay open as long as our kids demonstrate effort and kindness. However, our hope is that our children will be resourceful enough to figures things out on their own once they become adults. I'm trying to make my young kids appreciate the value of hard work and money by making them do rental property maintenance with me every year. This way, after 14 years, they will learn to be handy and have skin in the game.

Don't Give Your Kids Everything

We don't want to deprive them of achieving something on their own after a period of struggle.

The world is never going to be fair. Let's bolster our finances so that our children, when they become adults, won't wonder why we didn't do more for them.

Finally, if you can't convince The Bank of Mom and Dad to buy you a house, then you can always invest in real estate more surgically through real estate ETFs, real estate funds, or real estate crowdfunding.

For example, you can invest as little as $10 in a Fundrise diversified real estate portfolio as you build up more capital for a down payment. Fundrise is one of the largest and oldest real estate investing platforms today.

The single-family real estate market is booming due to lower vacancies and rising prices. It is a long-term trend that will likely last for years. As a result, I've personally invested $954,000 in real estate crowdfunding. Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds.

Related posts to The Bank of Mom And Dad:

Three White Tenants, One Asian Landlord: A Story About Opportunity

How To Convince People Are You Middle Class When You're Actually Rich

The Importance Of Feeling Consistently Uncomfortable For Personal Growth

Questions And Suggestions

Readers, have you received help from The Bank Of Mom And Dad to buy you a house, a car, or pay your bills after you became an adult? How did your parent's financial assistance help or hurt your life? Was it easy to overcome any shame or guilt receiving so much financial help as an adult? At what point should we stop helping our adult children financially?

For more nuanced personal finance content, sign up for the free Financial Samurai newsletter. More than 65,000 people have signed up so far since 2009.

Wow, the comments are very polarized on the subject. I asked my father for help scraping together money for a down payment on my first condo. He could not afford to help me and he felt a little embarrassed for it. I would have never asked him for assistance, but the idea was planted in my head by a co-worker. So many of my fellow co-workers received assistance. But they were from other cultures where money flowed more easily between the generations. I was from rural Missouri, where we are taught to not beg and to lift ourselves up. It is a nice idea, in theory, but I think this poverty mindset keeps many people from building wealth. It is very difficult if not impossible to obtain the stupefying amounts of capital necessary for a downpayment on real estate today merely by having grit and determination and a solid work ethic.

When I asked Dad in 1975 for support to continue education in a different city. Dad said NO because I would never steal your MANHOOD by questioning your ability to work for your goals. Dad was right I always made money plumbing, tutoring, work study, side chemistry analysis and MA paid $100/week teaching lab and free tuition.

How did things turn out now? I have felt the same way for a while. But now that I’m a father with a net worth beyond what I thought I could achieve, I have this urge to spend money on my children to help them. So the tricky thing is to spend just enough to not spoil them. I don’t have to give them opportunities.

Hi Sam, The bank of Mom and Dad is an evil concept. I was taught to never be a burden to my family. The four siblings in our family never asked or expected financial help from our parents. We all decided how to made our own way in the world. The wise parents say “My money doesnot know you” to their perpetual baby offspring. The ideas in the article and many comments display the reasons why society has become weak and child like. I can tell you from experience many professional parents are embarassed by their offspring. Remember 18 is an adult. Probably enough said.

Keep SMiling

Hi!

We are selling our condo in Boston and we have noticed the same thing. Parents coming in with their millennial child looking to buy her/him a condo. Very interesting!

Thank you for your great weekly newsletter!

The bank of Mom & Dad for us had a different track.

Our kids all had RE investments at an early age & they physically worked on them. Admittedly the Bank of Mom & Dad financed them @ the current AFR & ran their escrow accounts. By the time they graduated college,(student loan free), they owned their own homes that we gutted & rehabbed or built new. Again we financed the buys @ the then current AFR. Today their passive RE income is enough to also pay their principal home mortgages & taxes.

Our youngest daughter is RE aggressive & continues to accumulate investments. She’s financially independent of us but always consults us on any pending acquisition. However, the other two feel they have enough for now & know we have a trust setup for them to eventually assume our RE portfolio.

Our attorney’s Para Legal just admitted that she bought the home next door so that her son & young family could move into the original home free & clear?? Then she paid for the complete rehab of her married daughters 2800 sq ft home, again without any repayment.

She also helped finance their new cars/trucks. So at 65 she is still working as a Para Legal, having resolved herself to the fact that the kids are going to get it all anyway.

I guess we were too financially stringent with our kids, but they have learned a lot.

Thanks for sharing. It’s great to start investing in real estate while they are young!

You may enjoy this relevant post: Rental Property Maintenance With Your Kids Solves Two Problems

Sam

Good morning

I am concerned that with your Love and need to protect your children from the world of evil and disparity that you will disadvantage them in ways that you do not intend.

Your desire to set aside $750,000 for their assured Educational opportunities is unnerving to me.

I have seen multiple colleagues in my line of work who’ve paid for their children’s education just to have them decide they would like to continue another educational degree because they are no longer interested in a career of their first degree choice.

It baffles me and I have no children of my own to compare myself with their compulsion to serve their children.

What I can say from personal experiences, I was forced by local housing regulations for the poor to have to leave my family at 17 and go to work full time to pay rent to a friends mother in order to sleep on the floor to finish my senior year in high school.

I now make $160,000 plus incentives and did not obtain a Bachelor degree until after securing my current employment. My degree is relevant to my chosen profession but had no effect on my attainment of it.

I joined the military at 18 and invested approximately 15% of my first years salary into the Montgomery GI bill offered by the military in 1988.

Monthly salary was app $900.00 a month before taxes and M-GI bill was $100.00.

I used it to complete my degree in my early 40’s! Started a Masters program but got into to many disagreements with the communistic culture of universities today, so eventually got dismissed due to my own lack of necessary participation.

Encourage your children to pay for higher education and use your money for taking care of your wife in retirement instead.

I realize that a degree from Harvard will open more doors for them than a state college, as I can see how my Federal Employed colleagues are attaining their lucrative jobs based on their alma-mater rather than their capabilities.

I truly believe that with yours and your children’s ethnicity (Asian) that they could attain a degree from any large state university and by their learning Mandarin will be well suited for employment opportunities above any comparable demographic.

I appreciate everything you’ve done and aspire to do for your children but I think in the end if experience tells me anything they are more likely to rely on you providing for their long term livelihood and will not develop your work ethic and character.

I remember once when I was in high school that my fellow students were talking about getting $50.00 for every “A” achieved. I went home and suggested that to my mother as if it was a reasonable incentive for me to do well in school!

Her response was get an “F”!

I made A’s but received “B’s” and “C’s” do to the penalty’s for being an insignificant poverty member of society! (Nuances most of Society is unaware of but quite intriguing!)

Society has an enormous will to ensure the wealthiest members of society’s children will not have to ethically compete against the more capable and qualified poor!

Whatever your choices are to ensure your children’s success are what make you a remarkable parent! Not the final outcome!

Few children admire their parent’s efforts, although I am proud of being my mother’s son!

I hope when your children become self sufficient that they admire you as much as I do my mother!

Regards

Chris

I hope so too Chris! I’ve been a full-time father since 2017, and I hope they will one day appreciate my effort of always being around for them.

I plan to have them pay for some of their college tuition by working summer internships. Skin in the game is important, but I also don’t like people graduating from college with a lot of debt. So it will be a balance.

Sounds like you had a good life and a great path!

Here’s a post about community college I think you’ll appreciate. It is the anecdote to saving $750,000 per child for college education.

Considering that the costs of living, especially housing, have become completely decoupled from wages it is not surprising that more people have to rely on the Bank of Mom and Dad; when working a job no longer covers what it used to the money has to come from somewhere.

For some it is government assistance because even though they work full time, their wages still leave them in poverty. For others it’s the Bank of Mom and Dad because even though they work full time, their wages only render them ineligible for government assistance.

For others who have the jobs that pay enough for good housing and opportunities for their kids, good for them, just remember that these jobs are a lot more scarce than they used to be.

In a way, it should not be surprising. During most of history, wealth was generally inherited, not earned. George Washington, JFK, Winston Churchill, and Franklin and Theodore Roosevelt all received generous inheritances and that was considered normal during their times, so why not today?

Wow what a timely post. My son is on workmen’s comp and has been permanently injured and is now trying to get disability from SSDI with a probable two year wait.

To prevent the bank from foreclosing on his house, we (his parents) are looking at paying off the 230k mortgage and we will become the new lenders. The terms will be an interest free loan with no payment exceeding 20% of his monthly income and he won’t have to start paying anything until he begins receiving benefits. His monthly mortgage payments to us will still be half of what he currently pays. The balance will be paid off if either one of three things occur 1) they sell the house 2) 30 years after the start of receiving benefits (in which case I will be 98 years old) or 3) upon our death in which case it will be a reduction of his part of the inheritance

We will put a mortgage lien on the house for a couple of reasons. It will prevent other creditors from going after the house and it will prevent them from using the equity in the house as an ATM machine.

I had thought of just paying the house off and forget about it but I liked this idea better.

Bank of mom and dad to the rescue.

PS: we are in constant contact with our children and have very good relationships. Inheritance is the one leverage you have from them throwing you into an old folks home hehe

Looking at my family history, Bank of Mom and Dad did help people having a better life in their 20s and 30s. However, the difference does not matter when you get into 40s. Parents money lowers kids’ ambitions and willingness to take risk in life.

My grandparents got parents to buy their house in cash and annual pensions to help with nannies and other childcare costs. My grandparents were highly-educated professionals. They came from old money families. They worked hard enough to cover daily expenses, but they were not ambitious or risk-takers.

Then they lost most of their wealth in the 60’s during the Chinese Cultural Revolution. They have never recovered from it emotionally. They told all their grandkids and great-grandkids repeatedly how much they had lost.

My parents only enjoyed wealthy lifestyle before they were 12 years old. Then they were extremely poor for 20 years. They were also denied lots of opportunities to get education or career advancement for about 10 years due to their family background. They had their first full-time decent salary job in their early 30’s. Despite starting late in career and finances, my parents and all of their siblings have accumulated enough wealth to be financial independent before age 60. While their parents lamented on the loss, my parents’ generation worked towards a brighter future. They were either business owners or well-known experts in their fields. All of them did much better than their parents career-wise. They also have kept frugal lifestyle.

My parents’ generation has suffered lots of hardship when they were young. So they wanted their kids to enjoy life early. My cousins, my husband and I fit the spoiled Chinese wealthy kid single child stereotype. My parents would give me money before I feel I needed it. My parents paid all my college tuitions. I worked part-time only because I felt ashamed to live 100% on parental support. My mom bought me a condo in Shanghai all cash when I was 20. I did not know about this. I went there for a short vacation. My mom took me to the notary, then explained I need to sign the papers. My brain froze at that moment. Took me a few months to digest this. They also contributed to my house down-payment. I bought a house only when I saved enough cash on my own and got a mortgage approval. However, my parents and in-laws still gave us cash so we only took half the mortgage we planned to. They all dislike any kind of loans. I have a 6-figure professional job. I work hard enough to climb the corporate ladder. However, I spend way more than my parents. I have cousins who are close to 60 years old now who still get money from their parents. They are all good people with stable jobs. But none of us wants to start a business or inherit parents’ small business. None of us has became expert in our field get get known nationally. So my generation spends more saves less and under-achieves career-wise than the previous generation. We are still better than our grandparents generation with spendings because our parents accustomed us to frugal lifestyle when we were kids. None of us is hiring nanny or cleaning lady. My parents generation has suffered a

I only started saving more aggressively this year. With COVID, I realized that most of my spendings were not necessary. I also realized that I might not inherit most of my parents wealth or easily cash my condo currently in China by reading more on the politics in that country.

So at 37, I finally told me to live as if I get nothing from my patents. Try to invest all money my parents and in-laws give us as a cushion for the future.

I send my kids to cheap private school in Quebec (7$K a year). I plan to offer less cash to my kids than what I got from my parents. They only had one-child. I have two. So even if I am willing to spend the same amount on my kids, each will only get half.

The truth is 90% of all you ‘self-made’ egotistical people would have been nowhere without mom and dad saving your financial ass and helping you along the way. It is a story as old as the bible. Most of you couldn’t even run a lemonade stand.

As someone who had to pay for every-single-bill ever in my life having had my first job since the age of 12, I let all of you fuel my inner rage to crush you in life. And in every single way possible. I am on a mission to destroy you with success.

And just for the record, most of you are not that smart as you like to believe. Only I got no help and nobody else!

I also received zero help from my parents from the day I turned 18. It’s more common than you think among those with 7 digit NW. You should read the millionaire next door. The vast majority of kids growing up in well to do households do not do well. I don’t care if someone else had it easier than me…why would I? I’ve worked my butt off two decades and today make 10x more than my parents do at their peak.

Go You! You won the internet!

The most valued of all prizes!

Agree ! The well off do not know what they do not know. The well off are an amusing little tribe.

Can you share your age and estimated net worth?

Hi Sam, Yes age 70 and our very private net worth is the top 1%. Our wealth is the result of years of work and study. We never burdened our families for anything. The bonus families never offered comments on our life decisions. I was taught never discuss the private topics of money, politics, sex and health and never with family.

Keep SMiling

My parents have never paid a bill of mine in their life. I moved out at 18 and have been on my own since, financially independent and debt free.

I’m the oldest of 5 kids, we are immigrants from the USSR. As my parents got older they had more resources and contributed to my siblings expenses more. The ones they helped the least are the most “successful ”

My husband and I (age 36 & 40) have 3 kids and I struggle with how and what we should be helping them with once they reach adulthood. We have a bit of time to think about it as the oldest is 7 and youngest is 8 months. (They have 529s and custodial investment accounts)

Hi Sam, thanks for this article and the thought provoking discussions in the comments. It’s hard for me to imagine going through the mindful machinations via inorganic steps of telling my parents “I love you” for a certain number of times before asking for money or deliberately discuss with enthusiasm about a pricy car just to emotionally manipulate my dad to buy me one that’s half as expensive.

However, I do appreciate that you gave advice on how to demonstrate one is capable and competent when asking for financial help. After all, if I was giving my money away, I need to know that my children respected the act enough to not squander it all away.

I think we can agree that we want our children to be happy…but what is that exactly? Being in my late 30’s and financially thinking about how we want to support our 2 young children in the coming decades, I don’t know what happiness may be for my future children because I will not be them. So I don’t have the answer but there is beauty in the struggle and if we overdo it with the financial support, will we paradoxically deprive them somehow by potentially giving them too much?

In my limited world-view…hard-work, patience, and consistency are values easy to espouse, hard to practice, and I believe above all else builds financial stability. As parents, we will always be there for our children, whether it be financially or emotionally. However, I find it quite a bit harder to instill the above qualities in a human being as they are not innate qualities that someone who is struggling financially would possess.

Yes, the mindful machinations are not natural. It’s just feedback and one woman’s way of trying to solicit financial help from her parents. Hopefully, everything is organic. But that’s not reality.

One commenter wrote, “Making our children suffer is a poverty mindset,” is something I have to think more about. Because at this point, I’m ready to give everything to my children.

The one thing we should give them so much when they are young is our time. I will give my kids as much as they want.

Agreed, the most valuable commodity is time. Also agreed that we as parents shouldn’t want our children to suffer for the sake of suffering.

I suppose I’m worried about letting them skip a step by providing too much. You’re a tennis guy and so am I…no powerful forehand without proper footwork and balance. Resiliency through the lessons of life allows a person to be set up with the basic fundamentals to thrive.

Great article and timely for me as our daughter just graduated from college 2 weeks ago. Obviously, this is an individual decision and a lot depends on the maturity and mindset of the child. Our daughter is an only child, as I got married later in life, and she was born just as I was turning 41. She’s been a great kid, very responsible, hard-working, and goal-oriented. She understands the value of a dollar and appreciates the advantages she has been given. We paid for college so she is debt-free and there is still plenty in her 529 to cover grad school if she goes that route.

We intend to help get her started on the right foot. She majored in Nursing and landed a job at one of the finest University Medical Centers in the country. She starts in August. We just bought her a car as a graduation present and her grandmother put $5K in her checking account to help her with cash flow until her job starts to pay out regularly. As a nurse, she will be paid hourly and we aren’t sure what her initial hours and cash flow will look like.

We paid the first year of renter’s insurance on her apartment and car insurance and I intend to fund her IRA to the max each year. I’m assuming she will only be able to afford to fund her retirement account up to the company match so I wanted to supplement that by contributing to her IRA. If she likes her job and location and wants to buy a condo rather than continuing to rent, I am sure we will help with that as well. If she stays at least 3 years with her employer, they will pay 90% of her grad school expenses so what is left in the 529 can continue to accumulate for potential future grandkids.

My feeling is our daughter will not have the same advantages that we had as baby boomers. I doubt the markets will be as strong in her life as they were in ours and I’m concerned the government is going to work against her when it comes to investing and taxes. I also want to pass on as much as we can to help her out while we are still alive because I’m sure the government will continue to try and take what they can from us that we intended to pass on after we are gone.

My wife and I have worked hard, saved well, and invested as smartly as we could. Our retirement plan appears to be in good financial shape so we have the ability to help our daughter without compromising any of our plans. This really was our plan all along as we worked hard to be in a position to make this happen for her so we are grateful to be able to see it through and make our daughter’s life a little easier without the fear of her taking advantage of it. She has not asked for any of this help but we know she appreciates it and will use it the right way.

Thanks for sharing. It sounds like she’s a great daughter and you guys have a solid plan going forward.

I didn’t think about there being money left over from a 529 plan to pay for graduate school given the rapid rising cost of undergraduate tuition. That’s great that there is for you guys.

I can feel the love in your family! And it definitely doesn’t sound like that by helping her, she will become entitled or spoiled like some of us parents fear.

Thanks, Sam. We feel very blessed as a family and try not to take it for granted. Again, great article, and thanks for continuing to be thoughtful and responsive with your comments.

This is something I’m currently struggling with. So far my daughter has done just about everything right. She’s gonna be a senior in college and wants to go to graduate school. So far mom and dad have paid for everything. In a perfect world she’ll get a job that will pay for her masters. If that doesn’t happen we’ll probably pay for it. I would also love to help her with a down payment on a house.I understand the suffering argument, but dammit that’s what I did. Even though I have that pride that I did it all on my own I worked my ass off so I could make it easier for my kid. I think it’s case by case basis. If your kid is good help them. If your kids a asshole well then you probably are too.

Thanks, Bill

If parents help kids with big expenses, its only fair for adult “kids” to then help their elderly parents out in later life.

My parents paid for college and wedding, and gave me a few gifts of $10k over the years. They made it possible for me to pursue risks with my career that have paid off. i knew I would never starve, they always had my back. But in return I will pay for them to have a fun retirement- I pay for vacations, travel, gifts and anything that feels like a “splurge” that they wouldn’t spend on themselves. When they need help in later retirement and they’re tight with money, they’ll have it from me, no question.

This is a great callout Sam.

Thanks for the great post!

Studies I have seen, including in the Book the Millionaire next door show that the more you give/loan/supplement your children’s lifestyle the less likely they are to succeed. I have never asked my parents for more than a 10 day loan so that I could pay 20% towards a home purchase while my current home was waiting to close… I paid them back 10 days later. Borrowing or loaning money to family is way to risky, it complicates the relationship. Giving – that is simpler and may result in man/woman child rather than a full adult. But at least it doesn’t put the relationship at risk. I have never loaned family members money, I have GIVEN it when they are in dire need.

I am a believer in Warren Buffet’s quote to the effect that he wants to give his children enough money so they can do anything, but not so much that they can do nothing. That amount will vary by family/child, but I think that is a good target. For every “rich kid” that someone wants to point to who lacks work ethic or character, there are plenty of similar examples of poor and middle class kids with those same failings.

We have 2 children – 25 and 22. Both out of school and working ($70-$80K range) to build skills and help them better understand their interests and opportunities. In the next few years, they both anticipate transitioning to their own business or companies. My wife and I do not have businesses that will transition to the next generation, which puts some limitations on transferrring our wealth to our children. My wife and I currently gift each child the annual max (totaling $30K each per child) and likely will do so indefinitely. We will also use intra-family loans to use the interest rate / return on investment spread to transfer wealth, as well as other legal mechansims. We expect our children to build on our success – not necessarily financially, but certainly in terms of finding something that they enjoy doing and that is productive. If our children ever seem like they are planning to do very little with their lives or falling into drug or alcohol abuse, then we would change our approach. That doesn’t seem likely, but it happens.

Many of the folks in D.C. and elsewhere have made it clear that they hope to take much of the wealth that my wife and I continue to work hard for. I would rather my wife and I decide who gets our money, rather than politicians and others whoe feel entitlted to take it.

While this post rings true, the last couple of years for my family in particular has made me much less willing to use them as a resource.

Parents in particular both work in major covid risk industries (director of a nursing home and frontline at a meatpacking facility), and the physical toll (and generous amounts of overtime) it has taken on them has them both looking at retirement 5-10 years earlier than expected.

As a result, I’m almost looking at a perfectly backwards situation: How much money would I need to give them to quit, today, and never look back?

Only you can answer that, but sounds like a GREAT idea! Have a conversation with them. So many variables to consider.

And please ask them to negotiation a severance if they leave as it sounds like they are in their 50s and have been at their respective jobs for a while.

The question I have is when someone’s been given (and not loaned) a large amount of money from the Bank of Dad & Mom, are they embarrassed to tell others how they got their easy start or are they screaming it from the rooftops to their friends?!?

I would think most emotionally intelligent people would keep that information secret. It’s hard not to engender envy and jealousy and lose friends as a result.

After an initial unpleasant financial dealing with my dad, I resolved to never ask him for money again. Ten years later I asked him to loan me a couple thousand dollars to hold in my savings account while qualifying for a mortgage. When I went to repay the money, he said keep it since my wife and I had just had a child. I think the intermediate ten years had shown him I was now a responsible adult vs. the out of control person I had been. After that, there was no way I could refuse my brother when he asked me to do the same for him. My son is unready to act responsible with and funds given to him, so it isn’t going to happen anytime soon. As indicated in the article, showing you are responsible goes a long way towards the bank of M&D providing financial support.

As a Millennial, the graphs are dire and not surprising and illustrate why many of us are disillusioned. Add on to that climate change and the prospect of another pandemic to rival covid19 before we die.

Once Boomers die, I’m curious if we will see a sharp increase in wealth and particularly RE wealth through estates and inheritance for Millennials. Or, will various private firms and the government gobble those gains.

This post makes me think taxes on inheritance and a wealth tax aren’t so bad…

I would prefer taxes on that and less taxes while working/earnings.

The Bank of Mom and Dad for us is in form of a trust where the trust invests and owns a partial stake in the home purchase. And let me say, it hasn’t been evenly divided amongst us kids. I’m fine receiving absolutely nothing, but when one sibling is heavilly, heavilly favored by the Bank with huge down payment, it doesn’t sit well!!! Reason from what I was told was that he asked for it and that my dad would spend some time there (potential pre-retirement job for him, but it fell thru) which hasn’t happened much at all. My wife is more upset at it than I am, but I also don’t think this was fair or planned out well. It’s allowed my brother to retire before 40.

Our three kids went to college for free on merit based scholarships even though we were millionaire parents. We did not pay anything toward their grad school or med school. We have not given them any help on housing or living costs. We did give each of them a token $10,000 one time and may do that again in the future, but the idea of loaning them money sounds like one of the worst ideas. Turning a family relationship into a business transaction, it is way too big a risk. If someone is badly injured or has health problems we would have no problem stepping in but they need to make it on their own, or you truly risk turning them into weak pathetic adult babies. You’ve mentioned several of those in your area in the past. My millionaire parents were the same way, no financial help until they passed away and left a big inheritance. I’m glad they didn’t give us significant money early in my career. I achieved a lot of success and part of that was because I graduated from college completely broke and had to succeed to feed and house my family.

I wholeheartedly agree. Taking away their drive to grow, succeed, plan, and provide for themselves usually leaves them in an infantalized state.

I think we can all agree that is bad. I just don’t know if that is the default result if we help our children. I don’t think I would’ve worked less hard if I was giving some money for my down payment. I truly believe I would’ve worked harder to show appreciation to my parents and to pay them back once I had enough money. That was my mentality in high school when I decided to go to William and Mary to save money. As soon as I got enough money to pay them back I did. And luckily William and Mary it wasn’t expensive.

Therefore, it’s a case by case situation. I would happily give any amount of money to my parents if they needed it. Without them, there is no me.

I think this is part of the ladder of wealth, once you have enough it’s best to start sharing it. Take care of your retirement, then probably your children’s college, weddings, help with down payment, first car etc. . . At some point it’s an annual check for each child’s family? Why not start giving it away if your kids are responsible and your wealth is growing at a faster rate?

Not sure if it is typical but Looking back at my family tree, the men died before their wives so it was the Grammas who were giving away the money. Which I’m pretty sure increased the levels of education and home ownership.

Great post as always and great discussion. We raised our kids with the middle-ground in mind on this topic. In short, we tried to allow them to work toward a goal and enjoy the satisfaction of accomplishment, while always looking for ways for the Bank of Mom & Dad to help them out along the way. For their high school car savings, we agreed to double the amount that they earned on their own. For college, we saved for their education, but also agreed to partially “reimburse” them for the scholarships that they earned on their own. Our goal was to teach them the qualities and attributes that are needed to succeed in life while also allowing them to enjoy freedom from the debt that is crippling our younger generations today. The ROI associated with giving our kids their inheritance during their younger years is much higher than hanging onto all of our wealth until we die.

This is probably the best approach. Ironically by matching them on what they earn, you are effectively giving thier wages the purchasing power they would have had 50 years ago, back when the powers that be incentivized work instead of watching investments grow