The 401k investment option is one of the most widely available and consistently lucrative mechanisms to save for retirement. Many employers match employee contributions (up to a certain percentage), and all contributions reduce our taxable income. Yet, the average 401(k) balance is so low.

On average, most of us aren’t capitalizing on this incredible investment opportunity for our retirement. Instead, we are letting it pass us by without a second thought. Or, we’re only investing the bare minimum.

This combination of laziness and lack of commitment to retirement planning, makes it no wonder that the average 401(k) balance is so low.

If a 25-year-old median earner started contributed regularly to their 401(k) in the 1980s, they would have accumulated about $364,000 in combined 401(k)/IRA assets by age 60. Unfortunately, the typical 60-year-old in 2021 has less than $100,000.

According to Vanguard, the median 401(k) account balance was only about $72,000 for 55 – 64 year olds in 2021. See the chart below.

More recent data also reports that the median 401(k) balance was $27,376 at the end of 2022, an annual drop of 23%. Hardship withdrawals went up slightly, but remain a low share of all participant activity at 2.8%.

Research also showed that the average participant account balance at Vanguard was $112,572. That's a 20% decrease from 2021. With inflation still relatively high and fears of a recession by the end of 2023, that's concerning.

With the cost of hospital care services continuing to climb, more people should be fearful that the average 401(k) balance is so low. We all know that health issues increase with age. And fighting inflation may be straightforward, but it isn't easy.

Related: How To Optimize Your 401(k) For Greater Returns Using These Three Key Steps

The Average 401(k) Balance Is So Low

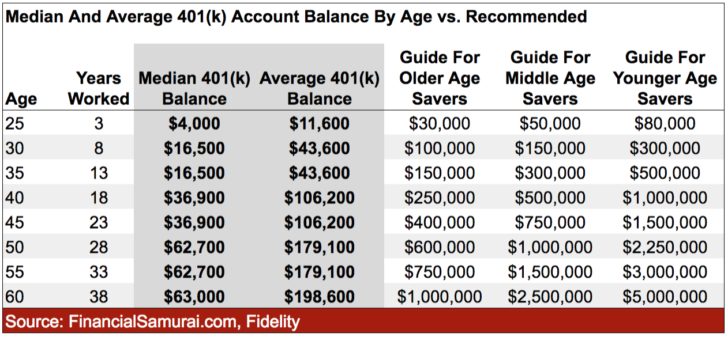

Given the median age of Americans is about 38 according to the US Census Bureau, the median 401(k) balance per person should be closer to $200,000 – $700,000 according to my 401(k) by age guide instead of these low levels.

I firmly believe that everybody who starts contributing to their 401(k) at the age of 23 should end up with $1,000,000 or more by the time they are 60 if they work that long.

The question many of us has is: why such a huge discrepancy with potential and actual 401(k) balances? This is how much you should have in your 401k by age 60.

Let's look at some technical reasons why the average 401(k) balance is so low.

Technical Reasons Why 401(k) Balances Are So Low

Four aspects of the U.S. retirement system could explain the discrepancy between potential and actual accumulations at age 60.

- First, the immaturity of the 401(k) system means that many 60-year-olds did not have access to a 401(k) plan early on in their careers. Thus, they would have accumulated less than workers covered throughout their work lives. The 401(k) was invented in 1978, but didn't really become mainstream until the 1990s.

- Second, the lack of universal coverage means that workers are not always in jobs that offer retirement plans. Therefore, workers are not always able to contribute. According to the Bureau of Labor Statistics, the typical or average 401K match nets out to 3.5%. A BLS survey found that amongst 56% of employers who offer a 401K plan (a sad statistic in itself): 49% of employers with 401K plans match 0%.

- Third, participants’ ability to tap their account before retirement means that accumulations leak out. For example, you can borrow from a 401(k) or IRA to buy a house. But, it's not a great idea. In addition, of the 56% of employers who offer a 401(k) plan, the 401k participation rate was only 69%. 69% of employees participate.

- Fourth, fees can significantly erode net returns on investments. When 401(k) fund options are limited, you could easily pay 1% in fees a year or more on your investments that can cause a massive drag on returns. See: How To Eliminate 401(k) Fees

See the chart below based on a study that shows how a $364,000 potential 401(k) account balance gets whittled down to only $92,000 due to the above four reasons.

Related: Why Investing In Real Estate Is Better Than Saving In A 401k

Contribute The Maximum To Your 401(k)

Life gets in the way of our retirement savings plans all the time. We have tuition to pay, expensive cars to fix, vacations to take, concerts to attend, shoes to buy, fancy to drive, alimony to pay, sickness to deal with and economic dislocations to experience.

But the one thing everyone should do is max out their 401(k) no matter what happens. Make your 401(k) contribution automatic by paying yourself first. This way, you lower chances of derailing yourself from building a nice 401(k) for your retirement.

Also, make sure to find out if your employer offers matching. The employer maximum 401(k) contribution limit for 2023 is $43,500.

Here's another chart comparing the median and average 401(k) balance by age and my 401(k) guidance if we continuously max out your 401(k) each year.

If the amount you are savings doesn't hurt, then you are not saving enough. At the end of our careers, we only have ourselves to blame if we come up short. The 401(k) is only one part of the new three-legged stool for retirement. The other parts are your after-tax investment accounts and your own hustle.

The only thing you can count on for living a comfortable retirement is you!

Wealth-Building Recommendation

The best way to build wealth is to get a handle on your finances by signing up with Empower. They are a free online platform which aggregates all your financial accounts on their Dashboard so you can see where you can optimize.

Before Empower, I had to log into eight different systems to track 28 different accounts (brokerage, multiple banks, 401K, etc) to track my finances. Now, I can just log into Empower to see how my stock accounts are doing, how my net worth is progressing, and where my spending is going.

One of their best tools is the 401K/Portfolio Fee Analyzer which has helped me save over $1,700 in annual portfolio fees I had no idea I was paying. You just click on the Investment Tab and run your portfolio through their fee analyzer with one click of the button.

Personal Capital is now Empower is free and secure for everyone to use.

Updated for 2023 and beyond.