Much has been said about inflation hurting society. As people's buying power decreases, life gets more costly. Heck, the Fed seems hell-bent on causing another recession to contain inflation.

However, as I look at the historical price changes of some of our most important consumer goods and services, I can't help but think combatting inflation is straightforward, even with trade wars potentially boosting the prices of foreign goods.

Further, for the average household, perhaps the negatives of inflation are overblown. Sure, we all know food, gas, andutility prices are higher. However, these costs are counteracted by higher wages as well.

Other than these three recurring items, inflation doesn't seem that bad. Further, I'm not sure these three items make up a large portion of the average American's budget. Maybe what’s most annoying is being reminded such recurring items are more expensive.

Let's first take a look at an inflation chart of various goods and services to understand how prices have changed.

Inflation Of Various Consumer Goods And Services

Check out this great inflation chart that shows the changes in price for major US consumer goods and services, and wages.

Since 2000, the following consumer goods and services have risen the most in price:

- Hospital Services

- College Tuition and Fees

- College Textbooks

- Childcare and Nursery School

- Medical Care Services

- Housing

- Food and Beverage

- Housing

Wages are up but unfortunately, families are hit hardest by inflation. Hopefully, relief is on the way with inflation heading back down in 2024 and beyond.

Since 2000 the following consumer goods and services have declined the most in price:

- Televisions

- Software

- Toys

- Cellphone Services

- Clothing

I bought a LG stackable washer dryer for my rental property last year and it cost $2,075 after tax, stacking kit, and installation from Best Buy. I was pleasantly surprised as this is the same price as it was years ago. Too bad college tuition and medical expenses are zooming higher.

Straightforward Solutions To Combatting Inflation

It's likely the price change trends for the items above will continue for the foreseeable future. Therefore, the straightforward solutions to combatting inflation are to:

- Not go to college

- Attend community college or a state college

- Stay in great physical and mental shape to decrease your chances of receiving medical services

- Eat less and / or substitute cheaper foods

- Don't buy a new car because the average new car price is absurd

- Drive your existing car for as long as possible

- Not have kids or have fewer kids

- Buy a house with a fixed-rate mortgage

- Own stocks (S&P 500), real estate, and other risk assets that tend to increase in price faster than inflation

- Relocating to a lower-cost city or country like Canada, Portugal, Mexico, or Thailand to save on healthcare and college tuition expenses

Battling inflation is pretty simple right? Unfortunately, it's not that easy and many people are experiencing a silent recession as a result.

Get Richer From Inflation Instead

If you do the above, you likely won't feel the negative effects of inflation as much if at all. Instead, you will likely feel good about inflation because your income is likely inflating at a similar or faster rate.

Inflation generally acts as a tailwind for real estate owners as it helps push rents and property prices higher, while mortgage rates stay fixed. This powerful combination is why real estate is my favorite asset class to build wealth for the typical person. Over a 10-20-year period, the wealth gains from real estate are usually incredible.

Inflation also tends to boost corporate profits as companies can often charge more for goods and services faster than their increase in expenses.

So long as you are working in a competitive industry and investing most of your cash in risk assets that have historically beaten inflation, you'll likely end up wealthier with the help of inflation.

But Counteracting Inflation Is Not Easy

Of course, not all of you will completely agree with all the above-listed items to combat inflation.

I suspect some of you may balk at not going to college, going to a state school (the horror! I went to one), eating less, and not having kids the most. Further, if you have kids already, it's not like you can just return them!

Hence, let's discuss these items in a little more detail. Everybody has different opinions. We must weigh the costs and benefits of each compared to the clear benefits of saving money.

The more you desire to save money, the more you will agree with the solutions and vice versa.

Defeat Inflation By Not Going To College

Nowadays, paying full college tuition truly feels like a ripoff. When everything can now be learned for free online or be learned from reading great books, it's baffling why going to college still costs so much.

Plenty of students are going to college for four years and paying six figures for tuition only to graduate with no job or a job that doesn't require a college degree. Being overeducated and underemployed are terrible for your finances. The danger in paying full freight to go to college has never been higher!

As a public college graduate, I'm telling you things will be OK if you choose to go the less expensive route. The key is to network and be aggressive when applying for various opportunities to get your foot in the door. Once you're in, nobody cares where you went to college. People care about performance.

Yes, college graduates tend to earn more over their lifetimes than do those who only went to high school. However, please be sensible about the amount of time and money you are willing to spend to go to college. The internet makes learning far quicker than 30 years ago. Yet, it still takes four years for the average person to get a degree.

Take Advantage Of Online Resources

One of the main reasons why I consistently write on Financial Samurai is to offer free personal finance education to anyone who wants to learn.

I also firmly believe if you read Buy This, Not That and subscribe to my weekly newsletter, you will have more financial knowledge than 99% of the population.

Of course, I'm biased. However, I've got the 28 years of experience and the bank account to back up my beliefs.

Then there is the plethora of free online courses (MOOC) from plenty of major universities as well. Finally, going to community college for a low cost or free is another great way to save on education. Take advantage.

Unless your family is already rich, it may be better to skip college and pay directly for courses you want to specialize in. For example, you can go to a coding boot camp where you only pay after you get hired. Or you can become an apprentice to someone in the vocational trades.

Teach Your Kids Everything You Know

I asked my son what he learned the other day. And he told me about some things he had learned two years earlier when we homeschooled him.

This was when I realized all we parents have to do is teach our children everything we know! If our kids learn everything we know, then they might be able to do what we do for a living.

If we are college graduates, there's actually no need to spend $500,000 on college ten years from now if we spend time teaching them. We just have to dedicate more time to them.

As a graduate of The College of William & Mary, a liberal arts school, I should be able to teach my kids everything from history to Mandarin. As a graduate of UC Berkeley's Haas School of Business, I should be able to teach them about cash flow statements, marketing, and organization behavior.

If we are unable to teach our children anything we learned, did we really learn anything? In a meritocracy, we need to teach useful skills.

Eat Less, Don't Waste Food, Stay In Better Shape

I'm not sure why these recommendations to counteract inflation may be controversial. Surely, eating less will save you money. Staying in better shape will increase your chances of living a more comfortable and longer life.

Once we learned in 2020 that the people who died the most from COVID-19 had the most comorbidities, most of us decided to exercise more and eat healthier. We rationally feared dying earlier from a virus, so we collectively did something to improve our odds of surviving.

Unfortunately, American health care is outrageously expensive. We spend the most per capita yet do not have the highest life expectancy in the world.

If the rising cost of food is unbearable, we will eat cheaper foods and ration our food more carefully. We also won't waste as much food.

According to FeedingAmerica.org, each year, 119 billion pounds of food is wasted in the United States. That equates to 130 billion meals and more than $408 billion in food thrown away each year. Shockingly, nearly 40% of all food in America is wasted.

Food waste in our homes makes up about 39% of all food waste – about 42 billion pounds of food waste. Let's say 16% of our food gets tossed in the trash every week. If we ate 100% of the food we purchased a year, we would easily counteract 16% annual food inflation.

Saving Money By Not Having Kids

Not having kids is a non-starter for many folks who want kids.

But if you don't have kids, you won't have to save for their college tuition, pay for childcare, buy college textbooks, get as big of a house, get as large of a car, buy as much food, buy as many plane tickets, and pay as much in healthcare expenses!

Not having kids is one of the best ways to combat inflation. You can't purposefully decide to have a lot of kids then be upset by how much they cost.

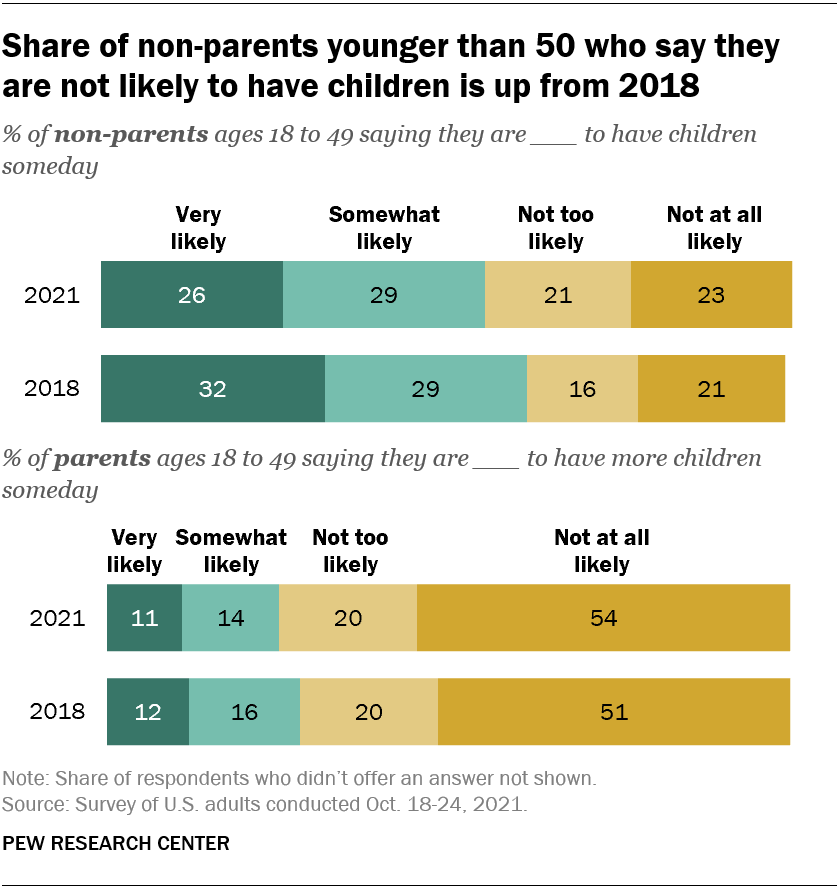

According to Pew Research, some 44% of non-parents ages 18 to 49 say it is not too or not at all likely that they will have children someday, an increase of 7 percentage points from the 37% who said the same in a 2018 survey.

Meanwhile, 74% of adults younger than 50 who are already parents say they are unlikely to have more kids. 17% of respondents say that won't be having kids for financial reasons.

If such a large percentage of the child-bearing population is deciding not to have kids or not to have more kids, then inflation may not be as insidious in society as we think.

Life Is Pretty Affordable Without Kids

Without kids, our cash flow would be much higher. But we are dual unemployment parents (DUPs) by choice, which makes raising a family much more difficult in an inflationary environment.

First, we wouldn't have bought another house 2020. The 1,920 square feet, three bedroom, two bathroom house we bought in 2014 would have been plenty for the two of us. We had already downsized in cost by about 40% from the house we lived in from 2005 – 2014.

Second, we wouldn't have all these childcare, preschool, and kindergarten expenses. Preschool in San Francisco costs $2,000 – $2,500. If we keep both kids in language immersion grade school, our annual tuition expense will be about $96,000 a year after taxes. I should just teach my kids Mandarin and move to Taiwan!

Third, our monthly healthcare premiums would likely be about $500 cheaper. We currently pay $2,300 a month for a family of four.

Fourth, I may have kept our Honda Fit that I leased for $225/month. I loved Rhino because he could fit in 20% more parking spots. Instead, we bought a safer car for about $60,000 after taxes. The Honda Fit's crumple zone was tiny and it felt like the doors were made of cardboard.

Retiring early with kids is at least two times harder than retiring early without kids. I clearly understand why many parents try to work until after their kids graduate from college. The costs keep on coming.

Thankfully, most parents love their kids so much that the added costs of having them feel worth it. Further, once you have kids you will be more motivated to earn more money. But that doesn't mean parents won't complain how expensive kids are.

Life Sometimes Feels Cheaper When Inflation Is High

During the bull market, life felt cheaper because our investments were rising far greater than our costs. When the bear market hit in 2022 (and again in 2025), we obviously felt the opposite way. Eventually, risk assets will start appreciating again, making living with high inflation easier.

Besides not having children or having fewer children, owning our primary residence is probably the easiest way to combat inflation. Once you have your living costs fixed, everything else doesn't seem as painful.

We have options to reduce our household burn. We don't have to send our kids to private schools. Instead of taking an Uber home we can take a bus. There's no need to eat a $78 dry-aged rib-eye when a $10 cheeseburger tastes just as good.

So long as we are regularly investing our cash flow, fixing our largest expenses, and living within our means, we should be net beneficiaries of inflation.

As I said, combatting inflation is straightforward. But due to human nature, keeping our costs down is not easy.

Reader Suggestions

Investing in real estate is my favorite way to beat inflation long term. Real estate rides the inflation wave through capital appreciation and rent growth.

Check out Fundrise, my favorite private real estate platform to invest in residential and industrial properties mainly in the Sunbelt. Fundrise manages over $3 billion for nearly 400,000 investors. Sunbelt real estate is a beneficiary of the great demographic shift to lower cost areas of the country.

In addition, one of the most interesting funds I'm allocating new capital toward is the Fundrise venture product. It invests in:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% is invested in artificial intelligence, which I'm extremely bullish about. In addition, the investment minimum with Fundrise is only $10. Fundrise also provides a lot of transparency and lets you see what they're investing in before you become a shareholder. In contrast, most traditional venture capital funds have a $250,000+ minimum and require capital commitment upfront before they launch or reveal current holdings.

I've personally invested over $300,000 in Fundrise real estate and venture capital to diversify and earn more passive income. Above is my investment dashboard split roughly 50/50 between the two.

Subscribe To Financial Samurai

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter. Everything is written based off firsthand experiences.

Listen and subscribe to the Financial Samurai podcast on Apple and Spotify. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Hi Sam,

You asked on your podcast what listeners are doing to reduce inflation’s impact. Partially to answer your question and partially to organize my thoughts around this here is a long answer as to what I’ve been up to.

About 6 months ago, I decided to address what I think of as, “the squeeze”. Loads of things were going up in price and my salary was pretty much steady. I had ideas, but putting them into practice takes time. I was driving a lot for work as a home health nurse and the extra charting time and the commute were eating into my free time. So counterintuitively, I needed to quit my job. Strange, but true. It’s a tight labor market especially for nurses and I was pretty sure I could do better. I quit, then spent some time enjoying life, finishing projects and dropping our household expenses.

We had planned some home repairs and we got those done while I was off work. It was great, because I had time to plan out what we were doing and get bids. To paint our houses interior and do some minor staining and repairs ranged from 8K to 15K. We live in the Bay Area and my husband works full time. If I had been working I’d likely have gone for the higher bid, reasoning at least it would be a good job. These home repairs were different, because I and had time to talk to each painter and interview them about their methods. The answers the 8K bidders gave made me feel comfortable hiring the lower end team.

We also got our floors refinished, a stinky job due to the varnish that took 10 days to dry. We couldn’t sleep in the house at the time, so we camped out in our driveway sleeping in our campervan. There was low level teenage grousing about this decision, but 3 months later we love how it turned out, and we paid 0 dollars in hotel fees, so zero inflation, just like your door dash noodles.

We also bought, and didn’t buy furniture. Originally we were playing on sofa, coffee, table and two chairs for the living room. Instead we edited what was already there. A process that took a few weeks. We pulled a large rug out of the attic (we had stored it when we got a puppy), discovered one chair, that we pulled from another room was plenty and made the seating area larger so the old coffee table no longer felt crowded. So out of everything we had planned we bought one very nice, brand new couch. As a bonus for taking our time the living room now has an area for stretching that I love to sit in to read and drink my coffee while I limber up for the day.

While all this was going on I was checking the employment sites and found what looked like a good fit for me on indeed. I applied and now have been working for the past 3 months at a hospital 1 mile from my home. This got ride of the commute, I can bike or car share with my teenagers and it also go rid of the after hours charting I had to do. More free time, less wear and tear on the car and we remain a 3 car, 5 person family, which is pretty luxurious, but there is no teen car, which we had been considering as mine had been used for work at the old job and I needed access to it on most days.

There’s three other categories we’ve seen large increases in. For us they were utilities, food and entertainment. Utilities we addressed by putting up solar panels a year ago adding a nest thermostat, and adjusting our watering schedule. Utilities are still high, but there’s little left we are willing to do about it.

Food and entertainment are linked for us. We largely gave up restaurants during the pandemic and got very into cooking. Those skills have now been transferred. I’ve been entertaining myself and others by working my way through our cookbook collection. The farmers market, by foot or bike is a regular destination, and to unwind after work my husband and I go to the dog park. On Mondays we alternate who’s cooking with a neighbor and do a family dinner with all the kids. Other pastimes are hiking,I’ve got a group I go with on Mondays, my day off; board games, and movie watching, with popcorn and friends. Going to our kids volleyball game, attending concerts on the lawn at shoreline amphitheater camping and sailing dinghys in the bay are my seasonal activities. All are fairly cheap and low inflation.

Not to say we don’t manage to spend money. My husband and I are both flying on separate trips to Colorado in the next month to ski and hang out, I’m guessing I’ll spend 500 for 4 days and he probably closer to 1K as he’s going skiing, but in general I can keep everyone fulling entertained over the weekend for under 100 bucks.

This all works because we’ve made an effort to arrange to have free time. We can’t cook homemade nightly and have weekends free together when I’m working full time. We wind up with grocery delivery charges, eating out and Sunday’s full of errands. Most people developed some hobbies and skill during the pandemic, I’d say your readers should look to fall back on those to combat inflation. Look at how the savings rate rose during that time. That’s a clue that expense drop when we are home.

Thanks for the podcast it’s fun to listen to.

Incredible feedback. Thank you for sharing! So cool you got to save money camping in your backyard.

Enjoy the skiing!

Just your book and am looking forward to reading it. I was reading your e mail about the fury of your thoughts on going to college. I have to say that you were spot on. From watching how college education has changed, I really believe that college today is a total waste of time. The stats coming out on students in high school and grade school are proving that. Students as a whole cannot think for themselves. They are totally lost without having a phone in their hand.

What they study is being taught by the same people who are continuing to dumb down our kids today. Generally speaking a kid would be better off being a nurse, carpenter, plumber or painter or even a welder.

The schools are not turning out the quantity of well learned taught students. For example when I read about Warren Buffett and how much he reads, and how he used to go through the Moody stock books of over 20,000 pages I find it incredible. But today no one actually looks up anything, they just google it. All this talk about self driving cars is unbelievable. A driverless cab is not for me or most people. I could also go on and on but what good would it do. There is real pleasure in learning and a good feeling of achievement when you accomplish something.

There are always going to be students who are highly motivated and will excel in school. But believe me the figures you showed how much people with college education make over a lifetime versus highschool grads does not ring true with me.

The idea that you don’t have to take college boards and compete for a spot in college is absurd. This idea that everything is not fair for some people versus others, or you were raised in a poor family, or did not get the opportunity that others got. I am sick of hearing it. You have to get up and get out there and bust your ass. I have been around the world through the years, and there is not place you can become successful like you can here. If you put in the work, you will succeed. The opportunities are really unlimited.

But Mr Samurai, you are spot on. For most people it is a 4 to 7 year delay to the real world.

Enjoy your musings on financial advice and am sure I will enjoy it as well as learn something new.

Bruce

I have been living all your suggestions all my life and I am feeling the effects of inflation. But of course I will be fine. I live alone in a condo and my mortgage payments are to my mom lol. I suppose you are writing for people like me who actually have finances that they can samurai-ze. SNAP benefits have ended. Please donate to your local food bank. Not everyone has these options. The food banks do great work.

Sam,

No hate here…. I have 3 sons, I spent a ton of money on private school all the way through HS, I live in South Orange County, California so private school is NOT cheap. I made them take over the path of their own lives upon 8th grade graduation, plan on HS, College and beyond. They had to decide where they were going to attend HS and sell me on it, if I agreed then I would fund it. After that they are on their own. I also paid for each of them in HS to go get an aptitude test at Johnson O’Connor (best $750 you will ever spend). My oldest is a Quantitative Biosciences Engineering major at the Colorado School of Mines. Second son got an academic scholarship at USD where he is in the honors program majoring in real estate and finance, but has decided due to the recession to get his ESQ and MBA as well. My youngest son decided to skip college and get his California Real Estate License at 19 and is in a cubical cold calling apartment owners to see if brokerage is his future, if not he can always go to college later. Life is a journey not a destination, I left HS 4 months before graduation, went to college but could have gotten a more powerful degree out of a box of Cracker Jacks. In my 20’s I bounced around the country chasing women and trying to find myself, struggling into my 30’s failing over and over, but in my late 30’s, 40’s and 50’s I averaged over $1M per year income. So, I have a bachelor’s degree, but survived on eating Cheerios or 49 cent tacos and Taco Bell for dinner into my 30’s, but my cumulative income is probably over $30M, so far. I agree with you, college is not for everyone, and many should not do it at all. Find your passion and where your gifts can shine, and the Johnson O’Connor Research Foundation is great to help people to avoid heading in the wrong direction.

I admit not reading all the comments so apologize if this was already said. One thing missing in the equation is status/mating. If an (male) electrician and museum curator both make $150k, the curator with the doctorate is considered “higher value” and has better mating opportunities. The electrician would have to make substantially more to compensate for loss of prestige from not possessing a college degree.

It all comes down to choices, and everyone has to make them. Anytime you write an article that shows thought and foresight so many people are threatened and take it personally. It isn’t a reflection on them, it is simply questioning things.

Everything can’t be a priority much to the chagrin of many people. Some may want the six-figure annual college experience but just because they are admitted to a certain college doesn’t make it the best choice. As you’ve stated, plenty of community college and state universities with much more reasonable tuition.

I know lots of people who seem to think they deserve to have as many perfectly healthy kids as they want, have a certain amount of brain power, take expensive vacations every year, live in a large house, have healthy retirement savings, have college savings for all their kids, have plenty of family time and earn the money to do this. Very few achieve this and the only way to do this is to have high paying jobs and plan out everything in great detail and have great luck when it comes to healthy kids, their health and brain power. It essentially requires being in the top 1-5% for the coastal areas, or top 1-15% for the other areas. In other words, not middle class or upper middle class. This is a wealthy lifestyle. And one unhealthy kid/spouse can easily cost a family $200K a year or more in expenses.

With the internet being blindsided by a low paying career after spending six figures a year in college is no longer a legitimate excuse. If someone earns $40K a year in their fifth year of working and owes a $150k+ student loan debt then their own bad judgement is what got them there. When I hear people lamenting about the low pay in their industry I’m thinking that water is wet, and why did you go into the industry fully understanding the crappy pay and somehow expecting that you could have everything you wanted in spite of the facts? And even worse are the ones who spend a fortune on college, have student loans and are shocked that they are struggling financially because they are in a low paying field.

And as for those degenerates who have children to take care of them in old age? Good luck with that, most children will be too busy working and saving to take care of anyone else well into their 70’s because those working are well aware that social security may not exist or may be reduced for their generations. Should have saved the money for your old age instead. Your children don’t owe you anything. Perhaps the parents should have considered buying the first houses for their children instead? After all, you’re the reason they exist. They didn’t ask to be born.

The first point – don’t go to college. We need more tradesman, skilled workers doing manual work and craftsmen. The pay is very reasonable, even good in many cases. The hours are better than some “white collar” workers. The wage disparity may also be viewed as less than calculated as individuals could be earning an income during the four years of college while not incurring debt and putting that money to work for themselves.

Your suggestions were all common-sense ideas and did not seem controversial at all.

Thank you

I am surprised there the concept of relocating to lower cost of living areas of the country (or world) is not getting more love. Let’s stick to the US for a minute – many of those costs that have grown the most since 2000 are nearly the same anywhere in the country before taxes – cost of healthcare, cost of college and textbooks (caveat if you live in a state with inexpensive state school), medical care, cars, etc. However, a lower cost of living state should help considerably on housing prices, childcare prices, and let you keep more of your income from lower taxes. Some of those other life decisions that are addressed – no college, no kids, etc. – can be made to further reduce exposure to cost increases, but can be done from any state.

FS, you continue to inspire and make people think. Even those who attack you. I don’t agree with everything here either, but they are surefire bets to beat inflation.

Having kids is a choice and how much we spend on them is mostly a choice, too. They are as expensive (mostly) as the money we put into them. But who wouldn’t, right?

I am a fan of college, but public education is failing boys (or private parents are) along with absurd college tuition (it really is the overhead… cut administration, increase class sizes) causing a crisis that need not be. Won’t get into it, but simply – paying out of state tuition or private college is dumb – even if you can afford it you keep driving up costs (ie. inflation) for others.

Finally, I will happily mention inflation killers that most want not to hear (personally hate higher interest rates) higher taxes, pro-immigration, less govt. spending (1990s?), let SS run out of excess money (force retirees back into labor system), de-monopolize healthcare (HMO – healthcare monopoly organization), hell, if we a. let the IRS collect taxes they should be collecting and b. broke up more monopolies, costs would drop dramatically.

I understand your article is micro and my fixes are macro – and way too liberal for most folks – and I don’t even like all my fixes but both ways work.

Still, sad that we cannot have a decent college system here – as Jordan Peterson says – it is the opportunity to “learn to learn” and it should be taken advantage of. Instead we parcel it out and ruin some poorer folks with the loans. DOES NOT have to be this way.

Eff inflation – thanks for showing us how to slice through it. Rambling’s done

Grocery shopping more often saves us from wasting a lot of food. With less on our fridge we see what we have more clearly. We freeze leftovers if we don’t eat them all. Leftovers produce great lunches also. When people eat out they often want a doggie bag to avoid waste; leftovers at home need to be treated as just as valuable. All the food in your fridge is money.

“ All the food in your fridge is money.”

Great saying! I’m gonna use it!

We installed a solar panel array in very early 2022. We maximized the size of the array to create an income producing asset on our property. It generates 3x what we use in a year. It was a total inflation play. I expected energy costs to go up as well as solar panel/installation costs.

Just last month we received a letter from our local coop apologizing that rates will have to go up 10% this year. I was very excited because it is inverted for us, we will be getting a “raise” on our excess solar energy sales.

Now we have an asset that actually benefits from inflation, and an energy offset that should last 25+ years (warrantied at 95% efficiency for that long), but we also avoided a major downturn in almost all asset classes with the money we put into the solar project.

Very savvy!

I got to look into this as well as we bought our home with Tesla solar panels. But we don’t have too many panels. Maybe it’s time for an upgrade.

This article and podcast is nuts. Are you really arguing that listening to a bunch of podcasts and reading a bunch of books is equivalent to college? Are you really trying to get people to family plan based on today’s inflation numbers? If you have a kid your education philosophy will turn them into a robot. But it turns out everyone has access to any information at all times so what additional value are they bringing to the table? The intangibles decide your career path and success level. No amount of reciting facts and knowledge can replace that.

I’m definitely a nutty guy, encouraging people to read more, listen more, and teach their children more beyond what they learn in grade school.

I believe in the importance of learning practical knowledge and the why of things.

What is it you do for a living and where did you go to college? Do you not plan to spend more time teaching your children?

Some people just don’t have the means to afford college. They go into tremendous debt and end up with in practical knowledge and jobs that don’t pay well.

And yes, I admit attending state college like I did or community college to save money is very controversial and not for everybody.

Becoming an apprentice, like many do in Europe is the more affordable and viable solution for many.

Here is the podcast episode on the subject.

I listened to the podcast. I typically like your shows and articles and think you bring a lot of value to the average person. I have a bachelors and masters from a state school. My issue is that the methods you suggest “to beat inflation permanently” are life altering decisions. Your deliberation to home school your children is based on the idea that you can teach them more information than a school can without debt. There are many intangibles that college provides including social skills, confidence, a network, problem solving, and a safe place to fail among many others. In my opinion these traits contribute more to success than any amount of book reading can. I agree that 4 year college isn’t for everyone, but to make the decision based on your single financial metric is crazy.

Perhaps you have a more holistic view on these things, however the way it was presented can be dangerous for some people.

Thanks. Let me rethink my thoughts and re-listen to see how I can deliver my message better.

I didn’t realize my idea of providing supplemental education and homeschooling would be controversial. Many of my European friends have said being an apprentice is more common. I’m also a big fan of practical knowledge and investing the money that would have been spent going to college. Perhaps it’s b/c I wasn’t a great student and don’t remember much from college too.

Maybe I should keep my ideas to myself from now on, especially if they are controversial. For some reason, I don’t find different or new ideas offensive. I’m always curious and excited to explore new ideas. And I was excited about this homeschool epiphany.

I also realized if our education is so valuable, then why not spend more time imparting our education value on our children.

What is your level of education and do you have children? What do you plan to do for their education? It would help to understand where you are coming from. thx

Maybe Sean is the typical American who doesn’t speak a second language and has never traveled outside of the country?

Being shocked about skipping college shows very low awareness about the rest of the world. Even in the United States, only about 37% of adults have a college education. About 66% of high school graduates to go to college.

I would love to also know more about Sean’s background. I do think it’s a great idea to teach our kids as much as possible because we really only have 18 years before they can do whatever they want.

When I came to America in 1991, I was surprised at how it was normal to only speak English, never live abroad, or never travel abroad.

Since birth, I had moved around every 2-4 years to a different country since my parents worked in the foreign service.

But I’ve learned to adapt and try to better understand other points of view. Let’s see what Sean says.

I hope more people who are upset at what I write or say, can share more about their background so we can understand better.

“The intangibles decide your career path and success level”…. Love this BS

This guy has a masters. He should go on and get a PHD… Pile High & Deep. Sam you are right

The school system is failing in teaching life skills. Not basing education on financial pay back is the biggest scam of education. Financial Literacy in school education are failing miserably on every level. Additionally, your wrong… if more kids would just listen to podcasts and study blogs from Sam, they will live a much happier, fuller, successful life.

Good article Sam. I’m getting a bit burned out hearing about all the inflation news over the past year. I know it affects everyone differently. My family’s personal inflation plan below:

Housing – 30 yr fixed at under 3%. Although the purchase price was hard to swallow when we bought in 2021 I know in time this will ease.

Food – Grocery trips every 3-4 days to make sure we avoid food waste. I find it’s easier to plan meals for a few days and not over buy. Bi-monthly Costco trips for bulk purchases. Eating out once every other month and only one coffee shop visit per month. Any eating out is always with friends for the social benefits. Otherwise, we cook at home.

Kids – No kids planned in late 30s but that decision was made prior to inflation creeping up.

College Tuition – PSLF planned to eliminate very high student loan balances in a few years.

Savings – Trying to stay close to 50% long term savings in index funds 60% US Stocks, 20% International, 10% REITs, 10% Bonds.

Healthcare – Diet and lifestyle changes over the past couple years will hopefully help avoid some of the biggest long term health problems as we age.

Vacations -Any “vacations” over the past year and a half have been to visit family which cuts down on hotel costs. Or we go camping or staycations.

Areas where we have felt inflation the most are mainly grocery prices and home repair services.

“College Tuition – PSLF planned to eliminate very high student loan balances in a few years.”

That’s exciting you will be able to get your student loan balances eliminated with PSLF! I hope it goes through for you.

Good call on vacations to see family, and thereby, saving on hotel costs. That was me in 2021 when I visited my parents in Hawaii. And when we go to Tahoe, we go to our vacation rental, which we paid off. We try to go when it’s vacant.

There is an ongoing trend of bashing of higher education and college which is really misguided. It is very important to state again that the higher your education the higher your median lifetime earnings and salary will be on average. Here are some reported median lifetime earnings based on education level:

less than high school – $1.4 million

high school diploma – $1.8 million

bachelor’s degree – $2.8 million

master’s degree – $3.2 million

doctoral degree – $4 million

Employers and payors really value education/degree level, specialized skills, and hard work. These features are also very important for success as an entreprenour. Trade skills and training are critically important and needed and can pay very well, but higher education can help here as well even a 2 year community college or trade school.

While there has been a trend towards devaluing higher education, try telling that to all the workers who recently lost their jobs in the tech job field bloodbath. I think people with higher degrees will certainly be fairing better. Regarding cost, community college is a great option for a cheaper education. As a society we also need a more educated population which will help people make more informed and balanced decisions. So I dont think we should be recommending that people skip out on education.

There does seem to be a growing trend to demerit college attendance. But I think the trend is warranted b/c of what colleges continue to charge when everything can be learned online for free. If colleges took 2-3 years and cost 50% less, that would be more reasonable with the times.

There’s no doubt more education tends to increase earnings. But check this out. What if instead of spending $200,000 to attend college today, you only earn $1.8 million as a HS graduate in your career. Then you invest $200,000 for the next 30 years at a reasonable 6% compound rate of return? You would have $1.15 million, for a total earnings of $2.95 million. That’s more than a Bacheror’s degree.

See: Private Or Public College And The $1 Million Opportunity Cost

Sam you are absolutely on to something. So let’s say you have

4 kids and you spend 150 k on each. Say some go to junior college, others might get a scholarship or possibly start a business. I have done exactly this with my kids. They can keep and invest the difference. So much of what is taught in college is useless…i am over the “college experience argument” would love if you did an analysis of best college options to maximize returns…

Hey Sam,

I think you’re got the question of children all backwards. Your posts, including this one on inflation, often talk about all the things you’re going to do for your kids, and how much it’s going to cost you in time and money for all those years of parent sponsorship.

It wasn’t that long ago that Americans had big families so parents could put their children to work on the farm. The more hands the better!

Let’s bring back that child work ethic!

I proposed a deal with my kids when they were freshmen in high school — we’d pay for food, housing and college as long as they promised to pay us 20% of their wages as an adult until they were 50 years old. The math works great — and what a boon for me and my wife’s personal finances! If each of my three kids averages $100,000 per year for 18 years, that’s $60,000 of passive income for us annually, more than $1.6 million of payback for all the child-rearing costs. Plus, since it’s a percentage of their income, it will be inflation adjusted as their incomes increase over time!

That to me seems like a much better way to combat inflation than not having children. In addition to the cash flow, you also get all the family benefits of love, happiness, and togetherness that children often provide.

Great article again Sam, it is so amazing in this country that we have so much food that we burn it up in our gas tanks everyday. Corn based ethanol is destroying food everyday and raising food prices for people around the world. Imagine what would happen if we didn’t burn our corn for fuel, but instead sold it on the International market. That would be the end of world hunger I think.

In America most of the calories we consume are empty calories just for the taste of something and not necessary for our health or survival. In fact as you said our lifestyles in America are actually taking years off our lives because we eat and destroy way too much food.

My food costs have decreased dramatically during this inflationary cycle because I eat at home at exclusively and I shop the ads at the grocery stores to get deals on the foods I eat the most. I haven’t paid full price for any food staples in years.

I buy milk in half gallons and freeze them for later use. I get them for 1/2 off every 3 weeks or so from the local grocery store.

I buy bread from a bakery that sells $1 loafs of bread on Mondays, they are over $3 every other day of the week for some reason. Bottom line the way to beat inflation is to be smart and not overspend on anything. Most Americans could stand to drop a few pounds and the more expensive food gets the better it might be for all of our long term health.

As always I love the website and the great articles. Keep up the good work Sam!

Great initiative and mindset Bryan. Thanks for sharing.

With your attitude, I know you were going to do great financially and anything else you want to do!

I considered myself lucky for not seeing high inflation from 2002 – 2020, but post pandemic changed everything. I have a 10+ million net worth, but still feel the pain of inflation.

Inflation can have a significant impact on the middle class, reducing purchasing power, increasing the cost of living, impacting savings, reducing job security, and increasing debt. It is important for the middle class to be aware of the impact of inflation and to take steps to manage their finances accordingly, such as saving more, investing wisely, and being mindful of spending habits.

I was wondering what you think of this idea. The reason why the fed cares so much about inflation is because to keep having inflation is really, really bad for mortgage companies and banks (concentrated interest groups). It’s great for us homeowners, as our fixed monthly payments stay the same number of USD, and we get paid more dollars (thought the same value).

Looking forward to your response.

If you believe that inflation isn’t a problem, you are out of touch with the average family.

Inflation is a problem. I wonder whether it’s worth tanking the economy though to get it closer to historical rates.

What are some suggestions on how you would combat inflation? And how have you changed your lifestyle due to inflation?

Why do you think so many people like to attack but offer no solutions themselves?

I think teaching our children, all that we know is a good idea. If we could help them accelerate college credit, even better. Perhaps the main problem is that parents didn’t do well in school and can’t remember anything. And the education they have it’s not necessary to do their jobs.

Not sure. It’s hard to write about a topic, see various points of view, and try to give advice. If it was easy, perhaps more people would write articles and books.

I always try to encourage people to share their advice and thoughts because we all have something to learn. But I am also entertained by some commentary as well. Projecting one’s thoughts is a natural phenomenon.

I highly recommend your kids take college credits in high school if they are at least above average. Both my boys did and they are only top quarter percentile and average ACT scores. My youngest got his AS degree when finishing HS. It will take him 3 years to get his EE degree while commuting to a state school. Having internships and having a good work ethic are more important in my opinion. Once in the door with the first job, not many care where you went to school.

I love the “teach your kids what you know” idea.

My family has always been this way; there’s no reason to reduplicate effort. I can do computer stuff (and by extension, electrical and other tech). I end up doing that for the whole family. And a lot of times it ends up rubbing off on the ones that ask me how to do it themselves.

One of us gets access to something, and the rest can specialize elsewhere. Maybe it’s a variation of what you have presented; specialize then share? Either way, it just makes sense to share the gifts downward; and your knowledge isn’t really any different than the house or the stock portfolio.

I love this idea. Yes, you can combat inflation in a very straightforward way.

I disagree with the whole “kids are soooo expensive” nonsense, though. Every time I see one of those calculators I just have to laugh, because they’re so niche.

That’s like saying, “Modern life is just soooo expensive” with my brand new iPhone, two new SUVs, designer clothing, expensive vacations, and myriad subscriptions to services that only marginally improve my life, if at all.

Yes, all kids need care, food, shelter, clothing, and transportation. But as a full-time caregiver, I don’t pay anybody to do it. I can make food for a lot cheaper than buying it (and it’s delicious!). I can fit 3 kids in a bedroom, easy peasy, even teenagers, and I know because I do it. As far as clothing goes, buy high quality for discount prices and then hand them down the line. Lots of families used to travel in two small cars if they had too many people for just one vehicle. You can also live somewhere with public transportation, let your kids ride the school bus, and buy high quality used vehicles.

Teach your kids skills instead of paying someone else (art or music lessons? I have the internet and a brain! I can do this!), spend time together as a family instead of shuffling everybody to ridiculously expensive extracurricular activities, and LIFE IS GREAT AND CHEAP.

If you don’t make a ton of money, your kids can get plenty of help for college. They can get summer jobs and work as high schoolers and save their own money for college! They can get skills or build small businesses to help them pay their way through college! Or they can go to less expensive trade schools and make great wages. At school, the hardest-working students who were the most responsible were the ones whose parents couldn’t afford to pay a dime for their education–they really got their money’s worth out of those degrees.

Love the website, BTW.

“ Teach your kids skills instead of paying someone else (art or music lessons? I have the internet and a brain! I can do this!)”

Great attitude!

We tried having our three year old sleep with our 5 1/2 year-old last week on a vacation. It didn’t work too well as our three year old kept on waking up our 5 1/2 year-old, and are 5 1/2 year-old got super frustrated! Lol

Luckily, it was a free extra bedroom for him to sleep in, and he was so much happier.

Maybe when our daughter turns four years old, she will finally sleep through the night.

That’s an interesting experience! My kids have slept in the same room since they were 2 years old and 2 months old, then 15 months later we added the third. They will often stay up chatting or secretly playing card games, and many nights I’ve had to do the, “Go to bed now! I mean it!” routine, but they’re best friends because my three kids hang out every night before going to sleep.

They’re all teens now, and to give them more space in the bathroom they share we’ve given them the master suite in our last two houses.

I just wish people realized how cool and exciting being creatively purposeful with our money is!

Hi Sam, my car insurance from a major national provider just increased 42%. When I questioned my agent by email he responded in minutes with what I am assuming was a copy and paste word tract from the corporate office justifying the increase. My five year old European SUV costs more now to insure than when it was new. Agreed it’s not going to cripple our budget but I do believe ten years from now all our insurance costs will far outpace inflation rates.

Interesting datapoint. That’s a massive increase for sure.

Might be time to shop around for car insurance. Every two years is the recommendation for all types of insurance.

But if car insurance really going up that high, that could be great for reducing pollution and traffic.

Fewer cars! What could be better?

I wonder if anyone had thought of how many people work in the automotive industry? Suppliers, manufacturers, dealership employees, mechanics, etc. car washes, auto parts stores, aftermarket firms, the list is long and varied.

Is five million a lot? And are we ready to see those jobs and the related economic activity they support decline?

Do you happen to be in the car business Ron?

Businesses will adapt and evolve. That’s the way it’s always been in capitalism.

Agree wholeheartedly with Sam. Drop your current insurance carrier and explore other options. I shop around every couple of years for home, landlord, auto, and umbrella insurance and always end up saving. For example, just buy switching insurance carriers on my home policy this year I saved $2k/year. From my observations, insurance carriers tend give you good rates to join, then jack up rates over time. I think they prey on the public’s reluctance to shop around and be lazy and just accept the increased rate. Also, I recommend having the highest deductibles possible to keep rates lower.

Bingo. It’s like companies counting on users, losing or not using their gift cards.

Consumers need to shop around.

Inflation sucks. But I find that mindful substitution helps to combat inflation:

– Start off with community college and a couple years later, transfer to a University.

– Buy store brand foods INSTEAD of name brands.

– Buy store brand clothes INSTEAD of name brands and use hand me downs from friends and family for your kids if possible.

– Cook more INSTEAD of eating out.

– If your parents live with you see if they may help with childcare INSTEAD of taking your kids elsewhere.

Make sure to invest the difference.

Price inflation for goods and services is a consequence of currency debasement and this process will continue indefinitely. Unfortunately it more negatively effects the less well-off working class. Suggesting people to give up going to the best schools, have fewer/no children, eat cheaper and less nutritious food just strikes me as being tone deaf and a poor solution that sounds like it mostly benefits the well off in this country.

The real problem with inflation and currency debasement is that it prevents people from saving and forces people to monetize assets that are generally risky and/or overvalued (e.g. stock markets, housing, etc). Housing is a particularly good example as most people use their house as their savings account. At the current 30-year mortgage rates, a family would need 20% down and ~$120,000 gross income to afford the average American home (~$360,000). The average annual salary is $65,000 – So who exactly is buying the average American home? Unfortunately income inflation hasn’t kept pace with goods/services inflation. Inflation is basically theft that benefits a small percentage of the population and it is necessary for a Keynesian economic system to function. Expect cyclic periods of high inflation to continue for the rest of our lifetimes… it won’t be substituting junk food for fruit.

As I said, straightforward, but not easy.

Do you suggest people who are suffering the most from inflation to have more children, eat more, and pay for private school?

Why is it tone deaf to try to substitute foods and only have children when you can afford them?

We had children late because we didn’t feel we could comfortably afford them. I find that to be a rational and responsible decision. Do you have children?

I’m not sure if you properly argued housing as a particularly good example. Who is buying them? 66% of Americans own homes. 40% of homes are owned without a mortgage.

Inflation inflates away the real cost of debt. Therefore, the majority of Americans are benefitting from inflation.

It’s tone deaf because you are well off, semi-retired, and are significantly less effected by elevated levels of inflation; in fact, the goods and services you use to live your semi-retired lifestyle are made possible by the working class who is most hurt by this particular situation. Asking them to sacrifice more of their happiness and health to maintain your standard of living, and not even acknowledging it, is tone deaf.

“Do you suggest people who are suffering the most from inflation to have more children, eat more, and pay for private school?”

No, I suggest that they do what they need to do to make ends meet in this environment. This article is proposing to solve the inflation problem by asking working class people to change their lifestyle habits. Perhaps it’s big government and currency debasement that are causing these problems, no? Why not focus on the root cause of inflation instead of asking people to make more sacrifices?

“We had children late because we didn’t feel we could comfortably afford them. I find that to be a rational and responsible decision. Do you have children?”

Agreed, we made the same decision. No children here. This is also a losing proposition longterm as nations need a significant level of population growth to support the aging population which continues to expand do to technological advances in medicine. Japan is a good example of this problem.

Yes, I a could have argued the housing point much better but its a broader connected topic. The general point I was trying to make is that inflation prevents savings in cash and forces people to monetize other asset classes which creates bubbles (i.e. the current housing market). Now that the Fed is forced to fight inflation with rate hikes, the rates on the 30 year mortgages make the average home unaffordable for the median US family income of $65k. So, who is going to buy your home when its time to sell? Basically, either 1) The fed reduces the rates back to ~0% and makes housing/mortgages more affordable and inflation soars 2) Wages increase roughly 2X to afford a mortgage at these rates and inflation soars due to increase broad money supply 3) Construction of new cheaper homes floods supply with cheap affordable housing or 4) The prices of homes decrease ~50% from current valuations, rates stay up, inflation somewhat under control. 5) Some combination of all these things.

Take home message: Your home is not a savings account. It is a risky asset like a stock and like a stock it’s all connected to inflation which can not be controlled by not having kids or eating cheaper foods.

Got it. I understand the desire to have the best of everything, even if we can’t afford it. But I do believe people have the power to adapt to combat inflation because I believe most people are rational.

Given you believe you are not tone deaf, what are some specific solutions you have to combating inflation.

I even welcome a guest post to help me shine a light on my blind spots.

If you can share some background about your age, and where are you are on your financial journey, that would be helpful. All I know from you is that you don’t have kids.

Here’s a good post you might enjoy:

Spoiled Or Clueless? Try Working A Min Wage Job

Got it. I understand the desire to have the best of everything, even if we the government can’t afford it. But I do believe the the people of this system will eventually realize it doesn’t serve them. There are basic freedoms that are non-negotiable despite what the media tries to tell us what to think.

See what I did there?

Anyway, I think it’s great you publish dissenting opinions. It will be interesting to see if my comments are deleted in a day or two – as has happened before.

I would consider writing up a dissenting piece to this article. You know my email…

Best.

Sounds good. Please feel free to highlight exactly what we disagree on and some solutions to combating inflation, and what your situation is. I really think it’ll help the discussion.

And I promise I won’t criticize you or attack you at all. I do want to become more in tune. Thanks.

Peter, you seem really agitated, yet you provide no solutions.

I suggest understanding about counterfactual thinking. It involves imagining how the circumstances of our lives could’ve unfolded differently.

You can blame the government and currency for your problems. Or you can take action. At the end of the day, you reap the results.

@Peter – Reading your post, I do empathize with you but you’re taking a counterproductive perspective here. Blaming “Keynesian economics” or “big government” for your personal financial situation misses the point here.

If Financial Samurai posted articles just pointing out the problems our economy or society faces, without any suggestions about how to mitigate them as individuals/households, then that would be a waste of time for personal finance readers. Sam is providing practical ideas for people to try and better their situation. This article then asks readers to share their own suggestions, too. If Samurai’s are “tone deaf” then what are yours?

Take home message: Stop playing the blame game. You got to snap out of that kind of thinking. We can all agree with you that life isn’t fair for X Y Z reasons. Still, it’s up to us to find opportunities despite that. Sam is trying to help us with that and he’s doing it for free.

You’re tone deaf because you sound uneducated and unable to see another person’s point of view without making verbal attacks.

It’s obvious you are a renter and are falling behind financially versus your peers. Blaming the government and other macroeconomic factors is what struggling people do. People who take on challenges and find solutions move ahead.

His guidance isn’t saying buy junk food instead of fruit. But skipping the junk food and unhealthy goods in order to use those funds to buy produce is a smart option. And budgeting for raising kids and waiting to have kids until you’re financially secure is beneficial in multitudes of ways for the parents, and child(ren).

So no, Sam isn’t tone deaf by any means. You’re doing things your own way to make the best of things and there’s nothing wrong with that. And there’s nothing wrong with what Sam’s suggesting either.

Keep a positive outlook and show support for others. It will change your life!

Hi Sam, inflation isn’t affecting us as much as it is for most people. We are empty nesters with our house paid off. I am retired, spouse will retire at the end of the year. We live on much less than spouse makes, so should be ok. Our groceries and utilities are where I see the most inflation. I expect our property taxes to take a big jump when the reassessments are done in our city later in the year.

Hi Sam. I remember you used to say something like, “have children, and money will follow.” I can only agree with this motto. My wife and I are expecting a second child, which gave us a strong motivation this year to earn more money, mainly because we enjoy going on vacations abroad as a family and want to maintain our quality of life. As a result, we both landed higher-paid jobs this year that will help us navigate the higher cost of living that the second child will bring. I wanted to add this thought to say that children are not only a financial liability but also motivate you to earn more and take more risks.