Back in 2019, I spoke to representatives at Yieldstreet at the LendIt conference in San Francisco to learn more about their platform. Ah, I miss those in-person conferences. What intrigued me about Yieldstreet was their investment offerings in legal, art, marine, and supply chain finance, which I knew very little about.

Years later, I'm pleased to highlight an overview of Yieldstreet's platform and investment philosophy. It's been great to see them grow since we first spoke. They just announced they raised $100 million in a Series C offering.

Further, with stock valuations near record-highs, I've been de-risking and looking for alternative investments with my proceeds.

Yieldstreet Overview

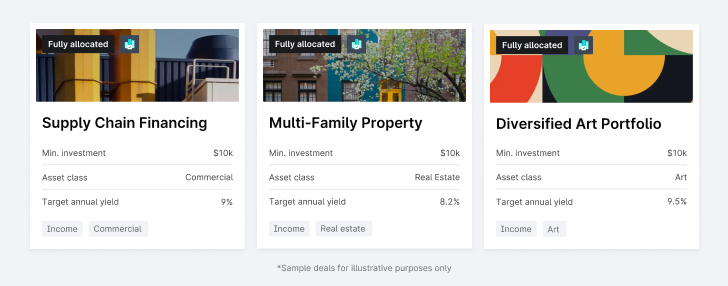

Yieldstreet is a leading alternative investing platform for non-accredited and accredited investors alike. Founded in 2015, Yieldstreet offers alternative investments for retail investors across legal, real estate, art, marine, and supply chain finance asset classes, along with short-term notes and registered fund products.

Yieldstreet members have invested over $1.5B across 230+ investment offerings, with over $855M (incl. $100M+ in interest) returned to date. Yieldstreet’s mostly debt-focused investments are typically backed by assets, such as real estate properties and portfolios of fine art pieces, which help protect principal in the event a borrower misses a required payment.

Yieldstreet aims to find investment opportunities that may offer a balance between yields that may be above traditional Treasury yields and volatility that may be lower than that of equity markets. Single offerings are aimed at generating annualized target returns between 7-15%, while Short-Term Notes target yields of 3-4%, typically with a 3-6 month term.

For those looking to learn more about diversifying into alternative investments to earn passive income streams, and to take part in investment opportunities typically only available to institutions and the wealthiest of investors, here’s an interview with Milind Mehere, Founder and CEO of Yieldstreet.

An Interview with Milind Mehere, Founder and CEO

What is Yieldstreet’s value proposition? What are the big ideas behind your platform?

Yieldstreet is taking alternative investment mainstream. We believe that access to and distribution of alternative investments are fundamentally broken. At Yieldstreet, we want to enable millions of people to generate income and put them on a path toward financial independence.

In the current environment, retail investors are stuck between getting historically low yields in savings accounts and bonds, or trying their luck in a stock market that is vulnerable to precipitous volatility. This leaves Americans with over $11 trillion in cash sitting in people’s checking and savings accounts today, earning a near-zero percent interest rate.

Meanwhile, institutional and ultra-wealthy investors have been accessing alternative strategies for decades. They've been diversifying into assets like art, real estate, and legal finance that allow them to generate returns backed by collateral for downside protection.

The way Wall Street is set up, retail investors historically have been stuck holding the short end of the stick, needing to meet high minimums and long lock up periods to get access to hedge funds or devoting their own time, resources, and risk to identifying individual investment opportunities.

Enduring companies are formed when founders try to solve their own pain points (Uber and AirBnb as the classic examples). My co-founder Michael Weisz and I personally experienced these frustrations with the previous alternative investing framework.

Just over six years ago, we began to imagine how to leverage technology to make investing in alternatives more accessible to a broader population. Fast forward to present day: we’ve built an alternative investing platform offering a broad range of asset classes and fund solutions to retail investors providing opportunities to invest from $1k to $1M+, and target durations ranging from six months to five years.

We brought in asset class heads who’ve spent their careers managing deals for institutional players. We've also built a proprietary automated tech platform to handle the onboarding, informational resources, and payment solutions so retail investors could have their seat at the table.

Can you tell me what differentiates Yieldstreet from other investing platforms?

1) One Of The Only Multi-Asset Platforms

We’ve seen other alternative investing sites pop up over the past decade. But they typically focus on just one asset class, typically art or real estate. This is a valuable service, but diversification into alts goes well beyond just one or two asset classes.

In addition to our dedicated art and real estate teams, we offer deals in supply chain finance, legal finance, consumer finance, marine finance, and even aviation finance.

In addition to creating a diverse marketplace of opportunities, our asset class diversity allows for next-generation fund creation. We can create fund solutions that combine disparate industries into single investment vehicles, in essence lowering the minimums to building alternative portfolios.

2) Investments Focus on Income Generation

Think about your stock market investments. Outside of occasional dividends, your main source of income is when you sell your stocks and attempt to time the market in the process.

Our investments target yields of 7-15% with predictable payment schedules. This allows you to regularly recoup interest from your principal for the duration of the deal. We target deals that provide the payment flexibility of traditional bonds with target yields that have the potential to rival the S&P 500.

3) Typically Low Stock Market Correlation

Our deals function in the private markets in asset classes that typically behave independently from the stock market. For an investor looking for diversification to help protect from over-exposure to the stock market, this is an important facet of a truly diversified alternative investment strategy.

What is Yieldstreet’s investment strategy? Are there any types of deals that you specialize in?

We generally seek short-term asset-backed opportunities utilizing technology, data, and our asset heads’ experience in asset-based lending to identify viable opportunities based on a number of categories specific to each investment. The Yieldstreet team then puts each and every offering through a vetting (or pre-offering evaluation) process to help mitigate risk. Since 2018, we’ve rejected over 88% of the opportunities that came our way.

Yieldstreet's investment strategy is to provide our investors with the key potential benefits of investing in alternatives: enhanced returns, current income, and diversified risks. We select asset classes that provide a combination of these benefits.

Our selected asset classes are typically asset-backed, short-to-mid duration, 7-15% target yields, low correlation with the public market, and have a proven asset manager. Apart from these criteria, we constantly keep an eye out on the macroeconomic conditions to determine our investment strategy.

For example, at the start of 2020, our outlook was that we were in the late stages of a market cycle (even before the pandemic hit). Thus, we believed an ideal alternatives portfolio in 2020 included large amounts of core income and risk-diversified investments.

These assets included real estate and private business credit as a source of added protection and current income to investors. All of these positions held up well vs. lower quality credit, or non-core hard assets, which were de-emphasized.

What specific types of assets does Yieldstreet invest in?

Yieldstreet began by primarily offering investments in asset-backed debt. But we’ve more recently expanded to offer opportunities in equities offerings and funds that allow for multiple holdings.

Across all asset types, though, a notable constant is the disciplined due diligence we continue to consistently perform. We seek out what we consider to be quality assets and endeavor to satisfy our key investment objectives:

- Producing steady, predictable income generation with our debt-focused offerings

- Investing in assets with attractive upside potential, all while seeking to avoid unnecessary risk

What has historical performance looked like for investors. How does that compare to similar investment opportunities?

Our historic net IRR is 11.42% as of March 2021, which compares with annual returns of approximately 3.5% for the Bloomberg Barclays U.S. Aggregate Bond Index and roughly 17% for the S&P 500 Index over the last five years.

Note: The internal rate of return (“IRR”) represents an average net realized IRR with respect to all matured investments weighted by the investment size of each individual investment, made by private investment vehicles managed by YieldStreet Management, LLC from July 1, 2015 through and including March 31st, 2021, after deduction of management fees and all other expenses charged to investments.

What is your take on real estate as an asset class as we navigate beyond COVID-19?

The pandemic has accelerated ongoing trends such as weakness in brick and mortar retail properties and traditional shopping malls. Hotels have been decimated in terms of cash flow amid the unprecedented global near-shutdown in travel and tourism. And multifamily high-rise city living has temporarily become less appealing than suburban units or homes.

As vaccine distribution ramps up and pandemic restrictions finally begin lifting, though, we’re likely to see people move back into big cities. Hotels are poised to turn a corner as people resume their prior travel patterns: business trips, family visits, tourism.

Malls may be a different story. They will continue to face uncertainty and many of the troubling trends that were occurring prior to the pandemic will continue to weigh on them.

Single-family rentals (SFRs) has seen a surge in demand since the start of COVID-19. I see this continuing for a number of reasons. The pandemic’s economic impacts on families have caused many to look for more affordable housing. The spike in work-from-home situations has made SFRs more appealing for families newly untethered from any office location.

We actually just launched a real estate fund early in 2021 in partnership with private real estate management firm Harbor Group International. It enables investors to participate in the potential upside of a rebound in the real estate sector.

Why should an investor invest in Yieldstreet in addition to a traditional portfolio?

It is time to rethink the old paradigm of 60/40 equities/bonds as the only effective investment strategy for long-term wealth creation. We are living through a yield crunch with Treasuries generating less than 2% interest.

Institutional and wealthy investors have dominated alternative investments and the attractive yields they are known to return for decades. In fact, nearly 90% of institutional investors globally currently invest in alternatives. U.S. pension funds, for example, invest close to a third of their assets in alternatives. Average American investors, in contrast, allocate only 6% of their portfolios to alternatives.

With Yieldstreet, we are helping you to expand that allocation across a wide range of asset classes, investment minimums and types of investments (e.g. single offerings and funds). And with our proprietary platform, we have cut out the friction and layers of people that often translates to high management fees.

Because of our stalwart focus on typically non-correlated assets that aren’t swayed by the rumblings of the stock market, Yieldstreet’s offerings can provide much-needed counterbalance to a standard equities-dominated portfolio.

The result for investors is an opportunity for an enhanced overall portfolio with potentially better returns and lower volatility – which help make for peace of mind during what might otherwise be stomach-churning stock market downturns and recessions.

How does the typical investor get started with Yieldstreet? What will the experience be like in the first weeks on the platform?

First, you should sit down and define your return goals, time horizon and the level of risk you are comfortable to take on. These could be determined by any number of factors: age, family status, current financial situation, the life goals you’re striving for, and so on.

Our platform offers resources to help investors orient themselves and get a full understanding of the alternative asset classes we specialize in. Once you’re ready, what I’ll particularly highlight here is Yieldstreet’s fund solutions, which gives someone single-allocation exposure to the kinds of alternative investment options I’ve been discussing.

Investing in our funds means adding carefully managed income-generating investments to your portfolio. You get the vlaue of Yieldstreet’s due diligence and portfolio management processes.

With all of our deals and funds, we provide consistent communications as the deals progress and return principal and interest to investors. We also encourage our investors to leverage our Investor Relations team who is standing by to address any questions or concerns they may have.

Being Able To Invest In A Fund Is Enticing

I want to thank Milind for offering a great overview of his company. As an income-seeking investor who plans to re-retire within 12 months, I'm interested in fixed-income alternative assets. It's hard for me to put new money to work in stocks at current levels. Further, I'm seeking investments that are more stable in nature.

As a busy dad who also doesn't want to spend too much time managing his money once the economy opens up, investing in a Yieldstreet fund is intriguing. It's nice that experienced professionals will stay on top of my money once I've decided on my asset allocation.

For those interested in diversifying their investments with alternatives, I encourage you to check out Yieldstreet's platform.

For alternatives, I also recommend taking a look at CrowdStreet and Fundrise, my favorite private real estate platforms. For most people, investing in a diversified fund like the ones offered by Fundrise is the way to go. But for those who want to build their own select portfolio, CrowdStreet is an attractive alternative.

Disclaimer: As with all investments, there are no return guarantees. Please do your due diligence before making any investment. Alternative investments are illiquid compared to stocks and bonds. Therefore, make sure you are allocating capital that has a multi-year time horizon. I personally limit alternative investments to 20% of my investable assets. Further, I like to invest in a diversified fund rather the individual investments if I don't have an edge.

Subscribe To Financial Samurai

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience.

Does anyone here have experience with structured and/or short term notes on Yieldstreet?

Maybe I missed it, is this a good option for young investors (25-45) whom are still in the growth stage?

I still favor equities as I don’t want to run a business or manage real estate, either on the side or in retirement. And I do tend to invest in mutual funds, rather than individual stocks, as this lets me use someone else to keep an eye on things day-to-day — someone with an established record through good times and bad. In truth, with funds, I’m really investing in the fund manager.

Invest for the long term and volatility is more of a friend than an enemy. You will likely be rewarded for putting up with it. Just don’t sell when you are down as you don’t want to lock in your losses. Nor should you invest in leveraged funds, as that may force you to sell at inopportune times.

If you are drawing on your portfolio in retirement, then you may want to keep about 3 years worth of withdrawals in something like bonds, where volatility is traditionally rather low, so you will have something to sell without taking too much of a loss, while the market is down or recovering.

If you are not drawing on your portfolio, then you may only wish to only hold three years worth of RMDs (after you hit age 72) in funds with low volatility (and, inevitably, correspondingly low returns).

Your mileage may vary.

Bravo! 100%

Really great article. I always appreciate you finding these different types of investments, and giving information on things that aren’t “traditional” to normal investors. I totally agree that the stock market is not worth putting more money at these level. Thanks for sharing another interesting product!

Sounds good, but what’s the downside? That part got left out of the article.

Sure. Liquidity, as you need to invest over years, not weeks, days or months.

And of course, risk assets can always lose money. If you invest in a fund, there will be a management fee of 1-2%.

For me, I love to tie up money for the long term to compound. And I also don’t mind paying a fee for professionals to stay on top of my money in a fund so I don’t have to.

I’m surprised to hear the average American investor has 6% in alternatives. I would have thought that percentage would be much lower.

Helpful Q&A. YieldStreet has an intriguing value proposition. I like how they are making alternative investments more accessible.