There's one big risk of peer-to-peer lending you might not be aware of. And that's how addicting peer-to-peer lending can get!

When I log into my P2P account to figure out where to dole out my next $1,000 tranche to borrowers, I feel a little bit like President Biden handing out money to his supporters. The only difference is I'm figuring out how to allocate my own money, not my neighbor's money to build wealth.

They say money is power, but I never experienced such intoxicating power until I started investing in peer-to-peer lending. P2P lending lets me help decide the fate of someone's desires or well being.

When I invest in the stock market or in private companies, I don't feel empowered because I'm a minority investor with no say. In fact, I'm losing control over my money as I entrust others to do a better job at making a return on money than I can.

On a personal level, having money is empowering because money buys freedom. Freedom to do whatever was my main motivating factor to save so aggressively during my career. I never thought of making money so I could have power over other people like our great politicians.

Now that I've tasted what it's like to be a sugar daddy over peer-to-peer lending, I'm afraid of what I might become!

Big Risk Of Peer-To-Peer Lending

You folks know that I dislike all politicians from every single party. They say they want to do the people's work, but we all know that politicians are in it for themselves. Why else do you think Presidential and Congressional salaries are not effected by a sequestration? They voted in a way that no matter what happens, our politicians won't get financially affected.

The same thing goes for years of allowing our politicians to conduct insider trading on legislation that is in their hands for so many years. Why do you think there are so many examples of politicians abusing their power by misappropriating campaign funds and taking advantage of interns? Power is addicting! This is a big rest I don't want coming over me.

To be able to decide the fate of someone's life is strangely alluring. One of the P2P platform borrower's profiles said they needed $20,000 to upgrade their outdated kitchen and bathroom. The borrower had a 680 credit score, two delinquencies, and a $18,000 revolving credit balance. You know what I did? With one swift click of a mouse button I moved on to the next borrower. Denied! I thought to myself as I began to grumble out one of those slow descending evil laughs.

I then stumbled across a woman who wanted to borrow $10,000 to consolidate her debt. She had a 780 credit score, no delinquencies, and wrote a lovely description of how she plans to start a new life as a nurse practitioner. Of course I raised my default lending amount of $100 to $250 and clicked the Invest button. Ahhhh, how gratifying it is to help a young lady fulfill her dreams and lower her financial burden.

If I'm not careful, I could probably spend at least two hours a day combing through borrower profiles on Prosper. Two hours would be half my committed daily work allocation during retirement, leaving me with hardly any time to write, read, and interact with folks online.

Luckily, my money is not infinite and my long term CDs don't start expiring until next year. Hopefully by the time money becomes liquid again, I'll have conquered my addiction to P2P lending.

Fight The Big Risk By Being Honest With Yourself

It's been an absolute pleasure researching the ins and outs of P2P lending. I'm just surprised to discover how fun it's become to have money again. When you are surrounded by people who are financially stable, you don't think much about your own wealth. There's no giddiness factor like you had when you were a child anymore. It's when you go into the marketplace and read hundreds of profiles of people who want to borrow thousands of dollars for a variety of reasons where you start feeling rich and powerful.

P2P lending has opened my eyes up to a largely unknown world of people who spent too much, borrowed too much, want too much, or simply got unlucky in life. P2P lending almost fulfills everyone's critical eye and compassion at the same time. I'm hooked.

With every new investment, it's good to start small and work our way up. We might get lucky in the beginning and start thinking we know more than we know. If this happens, I encourage everyone to remind themselves that luck early on can be incredibly damaging later on.

Just be warned, if you have addictive tendencies like smoking, drinking, gambling, and eating lots of bacon, you may want to limit your initial investment amount to something small. Don't let a small risk turn into a big risk. Making money with money is already tempting enough!

Invest In Better Passive Income Investments

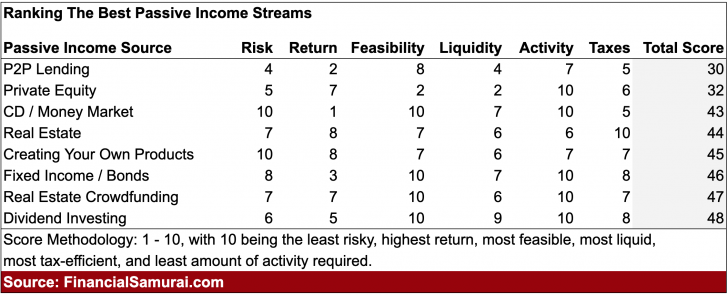

Although P2P lending is one way to generate passive income, it's actually last on my list of best ranked passive income investments.

Instead, I would look towards investing in dividend value stocks, rental properties, and real estate crowdfunding properties for passive income.

Real Estate: Favorite Asset Class To Build Wealth

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income. Stocks are fine, but stock yields are low and stocks are much more volatile. The -32% decline in March 2020 was the latest example. However, real estate held steady and appreciated in value then.

Given interest rates have come way down, the value of rental income has gone way up. The reason why is because it now takes a lot more capital to generate the same amount of risk-adjusted income. Yet, real estate prices have not reflected this reality yet, hence the opportunity.

Take a look at my two favorite real estate crowdfunding platforms that are free to sign up and explore:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends.

I've personally invested $810,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Stay On Top Of Your Finances Like A Hawk

One of the best way to become financially independent and protect yourself is to get a handle on your finances by signing up with Personal Capital. They are a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize your money.

Before Personal Capital, I had to log into eight different systems to track 25+ difference accounts (brokerage, multiple banks, 401K, etc) to manage my finances on an Excel spreadsheet. Now, I can just log into Personal Capital to see how all my accounts are doing, including my net worth. I can also see how much I’m spending and saving every month through their cash flow tool.

A great feature is their Portfolio Fee Analyzer, which runs your investment portfolio(s) through its software in a click of a button to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was hemorrhaging! There is no better financial tool online that has helped me more to achieve financial freedom. It only takes a minute to sign up.

Finally, they recently launched their amazing Retirement Planning Calculator that pulls in your real data and runs a Monte Carlo simulation to give you deep insights into your financial future. Personal Capital is free, and less than one minute to sign up. It's one of the most valuable tools I've found to help achieve financial freedom.

About the Author:

Sam began investing his own money ever since he first opened a Charles Schwab brokerage account online in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college on Wall Street. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate. He also became Series 7 and Series 63 registered.

In 2012, Sam was able to retire at the age of 35 largely due to his investments that now generate over six figures a year in passive income. Sam now spends his time playing tennis, spending time with family, and writing online to help others achieve financial freedom.

Sam…thanks for posting your experiences on P2P investing. Like you, I have been looking for alternatives to CDs and IBonds. It seems everything has a season. My Ibonds which I purchased in 2001 have returned 4-6% annually. Not as much as I predicted as it’s taken 12 years to double, but sooooooo safe and easy. No worry or stress.

With interest rates now so low, I have finally joined Prosper. I am estimating an overall 9% return after all is said and done with minor defaults, etc. Fortunately, I have the time to review each selection and shy away from any deliquencies, past or present. At age 76, I have lost a sizeable amount in the stock market focusing on short term instead of a 30-40 year window.

We have been retired for 20 years, or over 30 years if one counts leaving the public arena for my own business of professional travel. It’s been outrageous! Most important advice…eliminate all debt and live within your means. As full-time RVers now, we are able to live on $2000 a month. Absolutely amazing! We have wonderful experiences camping in the American West, much of the time on free public BLM land next to trout streams. One doesn’t have to be a millionaire to have a millionaire lifestyle.

Sounds good David! Happy RVing. I might have to do a cross country trip one day.

I love the idea of p2p lending and having participated as a lender, I concur there is some high you get delineating those worthy of your money. Its a great, organically formed free market solutio. But, I doubt any individual will rival the same screening capability of a bank. Case and point – despite my severe scrutiny mixed with a moderate acceptance of risk, my actual yield was 0.7% (that’s 7/10 of 1%) – my online savings is higher than that. 89% of my interest earnings were eaten up by principal charge-offs despite the fact that over 60% of my investments were in low-risk rated borrowers (AA and A). At the end of the day, I’m pulling all my money out of p2p lending and putting it in the stock market. At least there’s a more real potential for reward with the risk. I don’t believe enough p2p borrowers treat your direct loan money with the same seriousness they would treat it had it gone through a bank, to make p2p a profitable venture. but, that’s not to say it cant be done. Best of luck if you chose to pursue this investment vehicle – you’ll need it.

Quid…interesting comment and reflections on your P2P experience. How many loans did you have?

My understanding is that if you have at least 400 loans at $25 each, loss is minimized and profitability is increased. Most reviewers I have read are getting at least 9% on average. I do have funds in Prosper. Too early to give my results as yet.

As to the stock market. Yes! If you have 30 years to give to Index Funds or Dividend Paying Stocks. The market giveth and taketh away in the short term. Good luck!

I read all the other articles about P2P by you. Looked at other forums and did my own reading outside of here. I had heard of P2P lending before, but I never really looked into it because I sort skeptic about the whole thing. But I am going to give it a go, probably start off very small though.

Keep us posted about any good or negative progress that you have with P2P lending.

ap999 – read my below post, i would caution against p2p investing and recommend a more established method like mutual funds.

Sam, how is your P2P portfolio doing so far? Have you continued to put in $1K a month and have you seen any defaults or slow payers yet?

You bring up a valid point why investing in peer to peer lending is becoming so popular – it’s addicting. It’s also a lot more fun than watching my index fund cruise along, but not quite as much fun as “eating lots of bacon”.

I’m glad I found this blog. This has been on my list of things to do, but I have not really read anything motivating to consider it. I have always played with futures and options. I am actually going to join using the link above. Hopefully I don’t get carried away with it. I don’t have 2 1/2 hours, not even an hour to spend on it. :-)

Haven’t tried P2P lending yet, but have always been interested in this as an investment. I wonder what is the time/payout ratio compared to say researching stock investments or real estate?

Sam,

I just joined Rock The Post. Have you heard of them? Crowd funding for start-ups sounds pretty interesting.

Cheers,

Marcel

Sam,

Ever since starting out on my own earlier this year (only 23), I’ve found you’re blog very useful and it has taught me a lot about personal finance. If you’re in the bay area, I’d love to pick your mind over dinner or drinks sometime. I’ve been kicking ass on Prosper. I prefer Lending Club more because it interfaces with Mint.com whereas Prosper does not (that may not be their fault, but I don’t care). Also, I find it easier to deduce how my money is performing from Lending Club’s dashboards than Prosper’s. Would you mind updating your post, or making a new one, about net worth allocation by age to include peer to peer lending? In previous posts IIRC, you had mentioned investing 10% networth in p2p even though you had also previously mentioned that p2p lending is great at putting your money to work for you.

My current distribution of net worth is roughly 40% equities, 40% high yield CDs, 20% P2P, thoughts?

Also, am I really not supposed to be investing in equity until 27…?

~Nick

I recently investigated some P2P lending sites but not for the reasons that most people here investigate it. I wanted to borrow! Specifically, borrow enough to get an all-cash deal on an inexpensive rental.

I saw the 5% rate that they promised over a 5 year period and thought I’d sign up to see how it worked. I ran some basic numbers. If everything worked out, I’d only have a tiny cash-flow for 5 years and then, bam, I’d own it outright. No mortgage needed. The 5 year mark would also coincide nicely with my FIRE plans.

First off, they ran my credit *without telling me* that they were doing it. That pissed me off since every time this happens, it hits my credit score. Then I find out that the limit for me is only around $4k – totally not enough for what I was wanting. It was irritating because I thought I would be trustworthy for more than just 4k. I guess I was wrong.

Undaunted, I thought “Ok, I’ll borrow 4k, pay it off the next day, then see if I can up my limit”. Well, I didn’t do that and I’m glad I didn’t. First of all, that’s just not how I roll. Secondly, after reading more, even if I got to the maximum, the limit on all of these sites is around $35k. Even that is not enough, I’d need at least $40-50k to get one of the rentals I was thinking about.

At that point, I stopped my investigation, but I’m still keeping an eye out for ways to accomplish this. My next step is to see if I’m able to maybe get two joint loans of 25k apiece, link them or reference them to each other somehow and do it that way. I’d want to be totally up-front with the entire deal – maybe I’d publish a monthly update or do a newsletter or something.

My guess is that if I were able to get something like this going, I’d either have all of the money within a matter of hours OR I wouldn’t get a dime. Ha!

QUESTION: If you saw a deal like this on the P2P site, how many of you would help fund it? And how much would you put in? I know, it’s not a fair question, since the quality and location of the rental is highly variable, but I’m just taking an informal poll.

Jason, good to hear you’ve found out that P2P is not the place, or is not yet mature of a market enough to borrow $40,000-$50K. Perhaps one day, but not today.

As a lender, I wouldn’t lend you the money at only 5% for you to speculate on property that may or may not work. At 5%, I’ll be lending for folks looking to pay down debt, not get into more debt. That’s just me.

Interesting – I would have thought that you’d be up for it. But I do see the point of funding only consolidation-type loans.

What if the property mgt. company had a good multi-year track record for the property and gave a 60-day rental guarantee (if they couldn’t find a tenant within that time, they’d start paying the rent themselves?).

The gears are still spinning as to how to structure this deal so people feel it’s not overly-risky and it’s a win-win for everyone. I think once something like this gets going and has some track record behind it, it could be a strong contender for investment dollars.

“P2P lending has opened my eyes up to a largely unknown world of people who spent too much, borrowed too much, want too much, or simply got unlucky in life”

Surprised you are just seeing it now since you write a personal finance blog?

I don’t know anybody who has spent recklessly. Perhaps folks just don’t mention it here. Most people I know save, invest, and spend within their means. I do know some unlucky folks who got the short end of the stick. Luck is fickle. Do you know a lot of people who spend too much and don’t save?

Amen Sam. I am so truly fascinated with this entire asset class. It is far more enjoyable than my previous investments: an IRA mutual fund. The market volatility was brutal to my daily sanity. Peer to peer lending, in contrast, is so consistent it’s almost refreshingly boring at times.

Darn it, now I am intrigued by P2P lending! I have been familiar with it, but never seriously considered participating. It would feel nice to know you are really helping someone, even though you will ultimately benefit, assuming you get your money back.

I wish I could click through government profiles and allocate where I want my taxes to go like you can with P2P lending.

Not a fan of bacon, but I do have a chocolate problem…

I haven’t invested yet. I have been researching and I think it might be a wise idea to start avoiding those loans that are going towards debts (like credit card consolidation). That being said, mortgage or business loans might be wiser since the money is going into new incomes or a house. But that is what I have noticed on Lending Club.

Mike – Generally speaking, business loans are some of the biggest under performers on the platform. How have you been doing your research? In looking at Lending Club’s statistics page, you will simply see, that since inception credit card and debt consolidation has return 11.40% versus 7.02% for business and 9.87% for home buying.

One important thing to realize about the listed purposes of the loans is that they are self-reported. People can do anything with they money that they see fit.

What is the point of life if not to be unique?

Don’t read the profiles to stave off addictive tendencies! Feeling the power can consume you as you not only make money but help decide someone’s fate.

I didn’t realize you make the decision on each loan. I thought you pooled money for certain identified risk pools. I can see how you may feel rather powerful. How do you feel if the borrower defaults? I think the power would go away fast! Can you throw him/her into collection?

KC – You absolutely have the ability to pick any loan you choose. Invest $10,000 and hand select the 400 loans, at $25 each, that you desire. There are pooled and automated options in place for those not interested in doing the selections themselves.

How to feel when a borrower defaults? Make it a part of your expectations up front. Given a sizable account, you will experience late loans and defaults. In the case of late loans and defaults, both Lending Club and Prosper have internal and external collections measures in place. However, as Sam has said above, if someone decides to borrow and run there isn’t much you can do. Additionally, you are looking at a relatively low collection rate not unlike other unsecured debt (read: credit cards). That is where diversification is key in peer-to-peer lending. As seen on Lending Club’s site, no one with over 800 notes has ever suffered a net loss.

I feel like I’d read most profiles and be like “you don’t need more debt, you need to grow up and take care of your responsibilities!! Stop borrowing like a moron and get yourself out of debt!!” But, like the Nurse Practitioner one, I could see that being beneficial.

I don’t like lending money at all, but if I did, this would be the avenue I’d choose to do it in. Not too personal so that I don’t feel like their Master, but personal enough that I can choose who will get the money to use wisely.

Also, I haven’t read much about it, but what is the recourse on a defaulted loan?

There’s not much recourse on a default, hence why you need many loans for diversity, and why I like to screen a lot of the loans myself. Your P2P provider will send warnings, but at the end of the day, if the borrower wants to welch, ruin their credit score, and never borrow money again, it’s their choice!

Hi Sam. Longtime reader first time commenter. Love your stuff first of all.

I’ve been investing on LC for a few months now. I have to say it’s an awesome alternative investment. However, I have admittedly felt guilty sometimes too. Why? Because I am afraid of lending money to people who already mired in debt due to current and deep rooted lifestyle problems. I wonder if many of the defaulters are people who were well-intentioned at the outset when seeking debt consolidation, but in fact they really have no chance to repay their debt with their current lifestyles. If that is the case, then aren’t we as lenders only furthering their delusion and compounding (no pun intended) the problem instead of forcing them to face their debt problems head on? Just my thoughts.

This is a valid concern, and banks manage this risk of unsecured debt with a product called a “credit card.” I hope everyone can break even on this fad.

I have a real bias towards those who borrow from P2P to consolidate their debt to a lower rate. That’s a no brainer use of P2P borrowing imo, and if I can lend at a higher rate than 3X the 10-year treasury yield, then I’m all for it. A win-win.

Don’t feed the ones who never learn.

Sam,

I’ve been a casual reader of your site, and think it’s great. Just wondering if you’ve heard of kiva? It’s micro loans, interest free to developing parts of the world. It works similar to prosper but you don’t accrue interest. While not a real investment strategy, this post made me think of it. You should check it out, http://www.kiva.org

Definitely heard of them and a great organization to boot. Great way to donate to charity. I studied emerging markets microlending in Brazil and India during business school. One book is called, “Fortune At The Bottom Of The Pyramid” by CK Prahalad. Check it out.

Sam, I can totally see why this would be addicting!! It’s got to feel great to help people when they need it. This sounds like the eHarmony of loans with getting to read through everyone’s profiles, haha. I think if I joined prosper, I would definitely look for borrowers who need help with debt consolidation since its something I believe in. :) Have a great weekend!

“The eHarmony Of Loans,” good tag line!

It does feel good to help folks. Just not the ones who have 30 defaults in the past 24 months and need money to remodel their kitchen!

But Sam – They NEED 12 burners, a wine fridge, and a pizza oven. ;)

I can see how it can get addicting being able to pick and choose who you want to give money to and who you want to flat out deny. I wonder if bank lenders have the same feeling when they are reviewing applications. If I had to do that for a living I wouldn’t want to meet the applicants because I’m sure that personal element would make it that much harder to deny people vs just looking at cold, hard stats. Some people aren’t very rational with their money, ex trying to borrow 20-30 grand for home remodeling when they are delinquent on multiple accounts. Even if they were being ridiculous I wouldn’t want to tell them face to face that they’re denied.

It’s not very addicting nor glamorous to decline, just like the hot girls don’t care about denying the nerds who ask them to the prom.

And yes there are sad stories but it’s not our job to be a charity, it’s to protect the capital and safety of the institution for the current customers and owners. You have the right idea untemplater, if someone isn’t responsible with money before they ask for more, not a good idea to put more in the black hole.

I usually just send an email saying thank you but I’m not able to help you at this time. And some sort of credit disclosure goes out.

Not really feeling the power trip, but it’s a nice way to diversify.

Holy smokes can I relate! For me it is less about the story of each loan, but the fascination with the underlying numbers behind borrowers and the tracking of my investments. Nothing like watching the growth right before your very eyes! Beats watching the grass grow, thats for sure!

#unabashedlyaddicted

Addicted lenders, UNITE!

It’s a big chore for me to reinvest. Lately it’s been more difficult to find the right loans. Seems like borrowers are slowing down a bit. I’m going to try Lending Club soon because they are bigger and I want to compare the two.

Lending Club’s size is an advantage for them. I reinvest each month & have never had a problem finding loans that meet my investment criteria.

Unless one is a whale with hundreds of thousands or millions of dollars to invest, I think both LC and Prosper are large enough for 99% of the people out there.

I know the feeling! Regardless of their comparisons as investment vehicles, I enjoy investing in P2P loans more than the stock market. Knowing that in some small way my investment is going to help someone else improve their life or achieve a goal is much more satisfying than simply buying another share of Apple and hoping their next product is a hit.

The illusion of control is intoxicating isn’t it?

Or, we can buy companies like Coca Cola which produces more sugary drinks that kills more people than the best WMD ever! At least they got a nice dividend.

I’m curious, do you also invest with Lending Tree, or, have you considered it? I’m just starting to invest with LT, and wonder how that compares to Prosper.

I think you are referring to Lending Club. Lending Club is an equally reputable P2P company and currently a majority of the market share in the US market. While I can’t speak to Sam’s decision to choose Prosper over Lending Club, I have been investing with Lending Club for four years and have had nothing but success over that time frame with an internal rate of return north of 10% during that period.

At this point I would say both are viable options for investment, and now have assets with both Prosper and Lending Club.

Cool. I’ve only got time for one, and since I met the folks at Prosper for lunch a couple times (both based in SF), I figure I’d just go with them.

That’s cool but the S&P has returned 13% in the past year and you don’t have to waste your precious retirement on power trips.

Based on other posts Sam has done, I’m guessing he does P2P lending in order to vary his investments. In years that stocks do poorly, P2P will still deliver interest and returns. I also don’t think it’s fair to characterize this type of investment as a “power trip”–it’s a great way to bypass the huge banks, both for borrowers and lenders.

But the power, it feels so good!

BTW, you check the 10-year yield as of 4/26/2013? 1.67%, a 35 basis move lower. Check out VUSUX during this time frame when you asked why I was buying bonds “at the top” a month ago. As you can see, bonds have rallied aggressively since this time. I do like your hindsight conviction though. Any thoughts on where to invest now?

You’re the one who first posted about hindsight: “Investor returns average around 9.28%.” And that is good to learn that you made some money in 1mo, but how does that compare with the 52 week high, is it even possible for that fund to ever hit or even break its 52 week high ever again? This is my foresight conviction on bonds. Stark contrast to S&P.

And now you’re advocating buying deeper into the pool? Where’s the upside?

You wrote Feb18: “Last Fall might have been the top of the bond market, who knows? If we rally 30% in bonds to reach the peak again last fall, I’d say that would be a mighty fine return. Feel free to suggest a net worth allocation recommendation for me.”

30% rally?? Are you serious? You are lucky to get 5% ever again. Maybe you added a “0” accidentally?

Here’s what I wrote Feb18:

“My viewpoint on the market is to get as much money as possible to retire early. Earnings are good and I think will continue to be for sometime as so many marginal competitors went under/purchased during the greatest recession and therefore my allocation is 100% equities, 60% domestic, 40% Asia ex-japan. “

I think we are speaking different languages, but I want to help you understand the terms.

* 9.28% is the blended average return for P2P lending investors over a 1 year time frame, not one month. The default time from for investments is usually one year. Your assumption on a one month return is good feedback that I should probably clarify as I don’t want to leave any person behind. Assuming a 9.28% one month return is a 100%++ compounded annual return. I never thought someone would assume this, so thanks for your feedback.

* A yield move from 2.05% to 1.67% is a 19% drop (0.38/2.05). If we go back to the all-time 10-year bond low yields, you can see a 30% drop. The 5% you are thinking about is the interest yield. I’m talking above the MOVE, which is what I’m trading on. If the 10-year yield rises to 5%, that is a bond market collapse.

Hope this clarifies the terminology. Can you share your investment background again? It will help me understand why there’s such a big miss in our dialogue. Thanks

Yes, I will try and be more precise. I was making 2 different points of comparison on RETURN.

For a 1 year time period:“Investor (annual) returns average around 9.28%” with P2P, while the S&P has returned 13% in the past year.

The 1mo return I referring to was your bond position VUSUX. I misunderstood your meaning of 30% rally which typically refers to the bond price, not the yield DROPPING 30%. The yield is not directly related to the RETURN as we can see with the performance of VUSUX. I was also speaking about my conviction about what your maximum return with be on your position started 1mo ago, which won’t be more than 5%, and it looks like you’ve already hit 4% so probably running out of steam.

My investment background is rolling the dice.

At the start of the year, did you know the markets would beat a 9.28% return? I didn’t. I only predicted 8.8%. Kudos to you if you did. As you can read in my net worth allocation posts, I’m into diversity because I don’t know the future. Why not invest in real estate though? With a 7% rise in home prices, your 20% equity would be up more than 30%.

Rolling the dice is a great strategy to build long term wealth.

I try and roll the dice with about 10% of my net worth.

The question is always, what next? It’s easy to forecast the past. I’d love to read any investment pieces or forecasts you have and learn from you.

Love your investing strategy of rolling the dice! Have you made a lot of money so far with this strategy? When I made my first million dollars, I took a big gamble. Now that I have much more I keep things conservative now. How did you make your first million?

I like P2P lending because a portfolio of over 100 loans actually made money during the down turn.

You don’t know the return will be 9.28% for 2013 on P2P, and the point is that the risk with P2P is not presented clearly here, but if you want to look at historical returns, the S&P has outperformed P2P since either Lending Club or Prosper were created. The P2P returns are already dropping while the risk isn’t dropping as fast.

My investment background (what I interpreted as formal training, education, and professional experience) is different from my wealth-building strategy, which I posted here.

I just gave you my forecast on bonds, which is different from yours and that’s why I’m trying to learn from you if there is something I’m missing. My forecast for those under 50 years old is to sell any and all bond funds you may own if you want to avoid losing money.

I know exactly how you feel. The power to judge and influence individual borrowers is intoxicating. I log in a few times per week to choose new borrowers and I love it. I always want to add more money to my Prosper account, bur I have to remind myself that I’ve chosen my particular asset allocation foe a good reason, and I should become over invested in such a risky asset.

P2P is not something I’ve gotten involved with yet, but I think it’s a really interesting concept. I like the idea of being able to help people while getting a decent return, but I also struggle with the concept of facilitating debt. Just out of curiosity, in your example above, was any part of your decision driven by helping someone making “good” debt decisions vs. someone making “bad” debt decisions, or was it purely business? I would personally worry that I would not only get addicted, but that I would start making moral decisions that wouldn’t really be in the best interest of my money. That may not be a bad thing if you have the money to spend, but probably isn’t the best idea if the money truly needs to be invested well.

Absolutely. One variable I base my lending decisions on is whether the borrower is borrowing for wealth building reasons, or whether they are being a knucklehead.