Owning rental properties only ranks fifth out of my eight best passive income sources mainly due to scoring low on the Passive variable. Managing tenants and dealing with maintenance issues can be stressful. However, with stubbornly high inflation and strong demographic trends, the value of rental properties should increase long term.

As inflation stays elevated, you want to go long real assets that inflate with or even faster than the national inflation rate. You don't want to get hurt by rising rents. Instead, you want to benefit from rising rents.

Therefore, owning rental properties through private real estate investing has currently moved up to my #1 passive income investment today.

To invest in rental properties passively without the maintenance or tenant headaches, check out Fundrise, a private real estate investment platform with around $3 billion in assets under management. Fundrise predominantly invests in residential and industrial properties in the SunBelt region, where valuations are lower and yields tend to be much higher. I have personally invested six figures in Fundrise to diversify and earn more passive real estate income. Fundrise is also a long-time sponsor of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds.

Own Rental Properties For Cash Flow

As a financially savvy individual, your goal should be to accumulate as many underpriced cash flow-generating assets as possible. I believe interest will head back down, once again favoring owning rental properties. With inflation elevated, you want to ride the wave of higher rent prices AND higher capital appreciation.

Rental properties will provide a one-two punch of appreciating capital values and rising rents for owners. Over time, this combination should build a tremendous amount of wealth for landlords. If you are in your 20s, 30s, and early 40s, owning rental properties should be a priority. By the time you retire, these rental properties will be likely be paid off and generating tremendous cash flow.

As a tired father who yearns to earn 100% of his income 100% passively, it's tough for me to accept that owning physical rental properties is once again the right thing to do. However, for the average person, buying more rentals building up a rental property empire is one of the most promising ways to build wealth.

Rental Properties Tend To Outperform During Bear Markets

For proof that owning rental properties is a valuable asset class during bear markets, look no further than Fundrise returns. Fundrise invests in single-family and multi-family rental properties in the Sunbelt region where valuations are lower and cap rates are higher.

Notice how Fundrise has significantly outperformed the S&P 500 and public REITs during the 2022 bear market and the 2018 correction. As a result, if you are looking to dampen your portfolio volatility, diversify, and earn more passive income, I'd look into investing with Fundrise.

Outperforming the S&P 500 index is one financial benchmark worth pursuing. It is my belief that landlords such as American Homes 4 Rent, which has over 53,000 properties, will likely continue to outperform the S&P 500.

I've also highlighted how institutional real estate investors are also flush with capital and seeking rental properties as well. The point is, a lot of capital is moving toward buying more rental properties as a long term investment.

Why You Should Own More Rental Properties

The stock market is much more efficient than the real estate market.

Stock markets are quick to fall and quick to rise. Real estate, in comparison, moves at a glacial pace due to paperwork, higher transaction costs, long-term leases, and inventory imbalances.

For example, during the 2008-2009 financial crisis, I was able to keep the rent the same for one rental property thanks to a one-year lease. By the time the lease expired and I was thinking about lowering the rent by 2.5% to entice my tenants to stay, the recession was over. Two years after those tenants first moved in, they decided to move out. The new tenants were willing to pay 10% more.

Real Estate Lags The Stock Market Performance

The lag in real estate performance is one of the main reasons why I published, Real Estate Buying Strategies During COVID-19 back in 1H2020.

As some home sellers were stuck thinking the world was coming to an end in March 2020, I made a bet the stock market would rebound. Further, I bought another rental property from a seller who put his house on the market in the spring of 2020.

The key for homebuyers is to take advantage of lagging sentiment and buy real estate from “doomers.” For example, in 2023 the S&P 500 climbed by 24%, yet rental properties were either down 5% to up 5%, depending on location. Meanwhile, the S&P 500 was up over 23% in 2024. As a result, the price performance of rentals properties lagged tremendously, resulting in opportunity.

Let's move beyond buying a primary residence and focus on buying rental properties with an example. Rental properties can lag the stock market, bond market, and the primary residence market. But not for long. Smart money gobbles up rental properties, mostly in big cities.

Related reading: We're past the bottom of the real estate market.

How To Look At The Value Of Rental Properties

We learned from my Proper Safe Withdrawal Rate post that returns are intertwined with the risk-free rate of return. With this understanding, let's review how a rental property can significantly rise in value. This rental property valuation calculation is important to understand, so review it multiple times.

Here's how to look at the value of rental properties when the risk-free rate (10-year bond yield) is at different levels.

January 2020: 10-Year Bond Yield = 1.85%

Value of rental property: $1,000,000

Net Operating Income (NOI): $35,000

Cap rate: 3.5% (NOI/market value)

Although the owner of this coastal city property had a cap rate of only 3.5%, it was still 1.65% higher than the 10-year bond yield. The 1.65% annual premium is the extra reward the homeowner earns for having to be a landlord. Let's call it the “risk premium.”

Further, for the past 10 years, the homeowner has increased his equity through faster principal appreciation than the national average. Now let's calculate the value of the rental property after interest rates decline.

End-Of-2020: 10-Year Bond Yield = 0.6%

With the 10-year bond yield falling to 0.6%, what is the value of the rental property if the NOI is still $35,000 a year?

One way to calculate the value of the rental property is by adding the old 1.65% premium to the current 10-year bond yield to get 2.25% (1.65% + 0.6%). You would then take the NOI of $35,000 and divide it by 2.25% to get $1,555,555.

In other words, if we assume the NOI and the risk premium stay constant, the value of the property has increased by 55.5%.

However, there is obviously a possibility the NOI could decrease or increase with a new set of tenants. Further, with eviction moratoriums, there could be the risk of non-payment as well. It is up to the investor to make such a calculation.

2021: 10-Year Bond Yield = 1.5%

The 10-year bond yield surged to 1.75% in 1H 2021, then went back down to around 1.5%. At 1.5%, what is the value of the rental property if the NOI is still $35,000 a year?

Let's add the old 1.65% premium to the current 10-year bond yield of 1.5% to get 3.15%. You would then take the NOI of $35,000 and divide it by 3.15% to get $1,111,111.

As interest rates rise, the value of the rental property goes down, unless then Net Operating Income (NOI) starts increasing as well. In this scenario, the rental property is still worth 15% more than it was worth back in January 2020.

With rents now increasing as we eventually reach herd immunity, the valuation of the rental property will likely increase as well. For example, if the NOI rises to $45,000, the value of the property is $1,428,000 ($45,000 / 3.15%). That's a 42.8% increase from January 2020.

2022: 10-Year Bond Yield = ~4%

With 8% inflation and the Fed determined to hike rates multiple times in 2022 and 2023, the 10-year bond yield moved up again. The thing is, the job market, and therefore, wages were on fire.

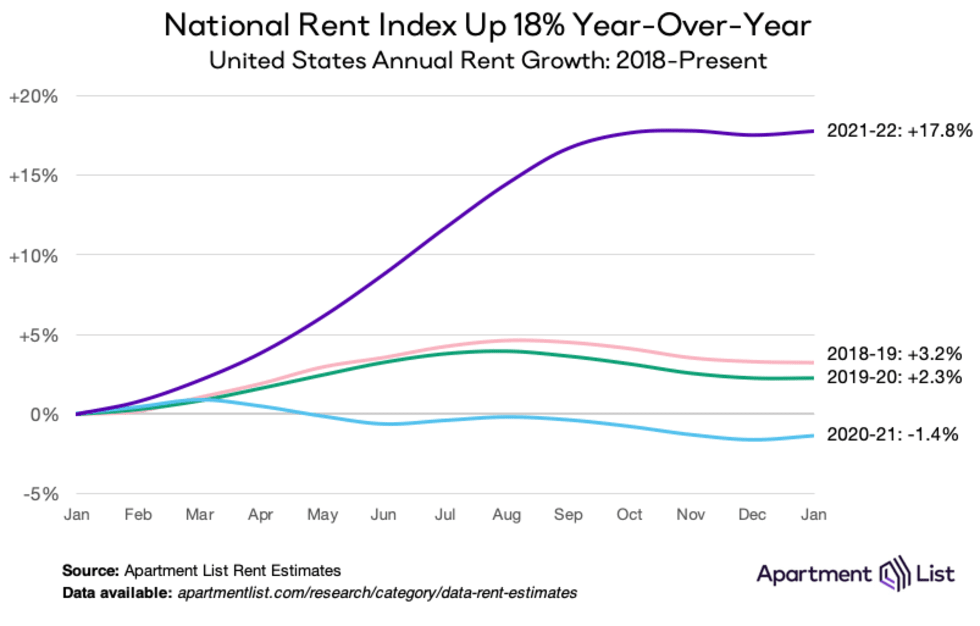

With the combination of strong income growth and low inventory, rent grew by an astounding 18% in 2021.

The thing is, as interest rates increase, cap rates increase in order to reward investors for taking on risk. Hence, if you come across this scenario, expect rental properties to decline in value over the next 12-18 months.

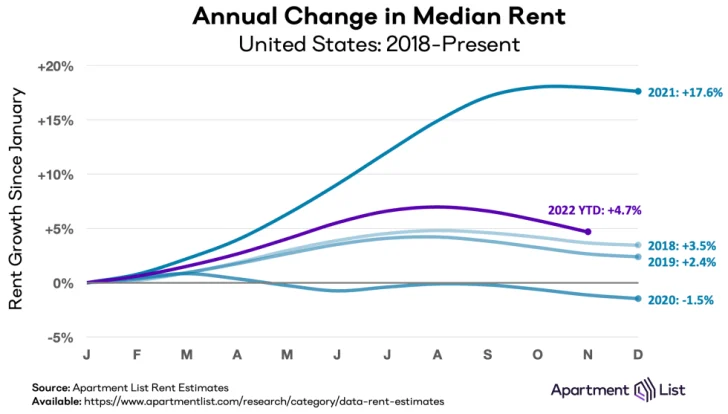

Rents Continued To Rise In 2022, But Slowed Down In 2023 and 2024

Check out the national rent growth for 2021 to 2022 according to Apartment List. Rising rents are creating fortunes for landlords.

Take a look at big city rent prices rebounding in 2021 and 2022. As a real estate investor, you might find the best value buying rental properties in big cities because they have lagged the most. However, I strongly believe people will be flocking back to big cities because that's where most of the opportunities are.

But as you can see in this chart below, rent growth is moderating in 2023.

How can you quickly and easily invest in rental properties today? Check out my favorite real estate platform—Fundrise is a strategic way to go. Fundrise focuses predominantly on acquiring and rehabbing single-family rental properties across the country. With about $3 billion in assets under management and over 350,000 clients, Fundrise is one of the leading rental property investors.

The platform is free to sign up and explore. If you decide to invest, you can get started with as little as $10, it's great!

What Is An Acceptable Risk Premium To Value Rental Properties?

As for the acceptable risk premium, this is what investors will debate the most. On one hand, there is tremendous uncertainty, which should dictate that the risk premium should increase. In other words, investors require a higher rate of return to hold a risk asset.

On the other hand, there is absolute certainty the value of cash flow has gone up due to the decline in the risk-free rate, e.g. it takes more capital to generate the same income. Therefore, the risk premium should decrease.

It is my opinion that risk premiums should stay the same at worst. It is better to own a real asset that generates cash flow in an uncertain environment than an asset with no cash flow and most of its value calculated based on earnings far into the future.

Further, the intrinsic value of a home has gone up given we're all spending much more time at home. With inventory tight across most of the nation, the risk premium for owning rental properties should stay the same or maybe even go down.

Finally, you should compare the rental property risk premium to the risk-free rate of return. The lower the risk-free rate goes, the more valuable the risk premium becomes.

For example, with the risk-free rate at only ~0.6%, a 1.65% risk premium is 2.75X the risk-free rate versus only 0.89X when the risk-free rate was at 1.85%.

The Opportunity To Buy Rental Properties

Based on my rental property example, an investor can make the case the value of the rental property has increased from $1,000,000 to $1,555,555 in just one year.

Or, more specifically, an investor can make the case that the value of the property's cash flow has increased by up to $555,555 in just one year.

Meanwhile, if you had $1,000,000 in cash sitting around, its value has declined. Inflation really eats up the buying power of cash. Therefore, you want to own rental properties that will benefit from inflation due to rising rents and rising property values.

Even though mortgage rates have increased with the 10-year bond yield, real estate investors are still facing negative real mortgage rates. As a result, demand to borrow money to buy real estate will continue to be high.

Therefore, anybody with cash will logically want to mobilize the cash into riskier assets that generate higher yields. These assets can be in the form of dividend-paying stocks, bonds, real estate crowdfunding, and rental properties.

Blue Sky Valuation

Most people will likely argue that the rental property has not gone up double digits even though we've just run the numbers. That's fine. We can say the 55% increase in value is a “blue sky valuation.” However, if interest rates stay low for a very long time, then the confidence of a 55% value appreciation goes up.

With this property example's blue sky valuation of $1,555,555, your goal is to buy the property as far below $1,555,555 minus closing costs as possible.

Of course, a blue sky scenario is a reach scenario. We shouldn't count on blue sky scenarios to make us rich. A blue sky scenario is what is possible. Be realistic with your rental property valuation calculations.

Rising rates do throttle the value of rental properties. But rising rents help push rental property valuations higher. There will be a transition period where opportunities arise for investors. Rents finally started decreasing in 2023 as the economy slowed down.

Many Sellers Don't Do The Math

The golden opportunity is when you find a seller who doesn't think through the logic above and if they have a bad real estate agent. He also thinks his city is never coming back. As the 10-year bond yield changes, you must keep updating your rental property valuations.

The seller thinks rents are going to go down even further than a worst-case scenario, rates are going to go up, and jobs will be gone for good. Sure, all these things could happen. The opportunity is betting on the degrees to which these things may happen.

Your goal is to AGREE with the seller's beliefs. Highlight as many bearish articles and anecdotes as you can find. The more you can feed into the seller's bearishness, the better price you can get. If things don't turn out as badly as anticipated and there is a tremendous rebound, you will win big.

Not only will you see a tremendous appreciation in principal values based on comparables, but you'll also be able to increase cash flow through rent increases.

You can easily see a scenario where the owner of the $1,000,000 rental may be happy to sell you his rental property for $1,030,000. He'll think, A 3% appreciation during a pandemic? I'll take it!

But as I demonstrated in my example, his $1,000,000 property is worth so much more. Below is a chart that shows how you can profit from rental properties and make a fortune.

Three More Reasons For Owning Rental Properties

Please spend more time going through my rental property appreciation example above. It is the key to recognizing your potential upside.

Besides potential rental property appreciation, cash flow appreciation, diversification, and a source of income, here are two other reasons for owning rental properties.

1) Tax-efficient income

Most rental property expenses, including mortgage insurance, property taxes, repair and maintenance expenses, home office expenses, insurance, professional services, and travel expenses related to management are all deductible in the year you spend the money.

However, the best deduction is a non-cash deduction called depreciation. You can begin taking depreciation deductions as soon as you place the property in service. Or when it's ready and available to use as a rental. Depreciation is based on the value of the building only, not the land.

Most U.S. residential rental property is depreciated at a rate of 3.636% each year for 27.5 years. In other words, if you own a $1 million rental property, each year you can take a depreciation expense of $36,360. Therefore, $36,360 of rental income can be shielded from income taxes.

2) Assets for your children to manage.

All parents should be worried about their children's futures. The ROI on a college education continues to go down. Globalization is making everything hyper-competitive. And black swan events like a global pandemic are preventing adult children from launching.

Owning rental properties for your children to manage is one solution to a potentially difficult future. Given rental properties take work to manage, parents can side-step the often guilt-inducing act of giving their children money. Adult children can also feel the pride of working to help their family and themselves build wealth. The value of real estate goes way up once you have kids.

There is no joy in inheriting a dividend-paying stock portfolio. However, with rental properties, the adult child can market the property, screen tenants, run background checks, negotiate the lease, coordinate move-ins and move-outs, make sure all insurance policies are in place, collect the rent, and maintain or improve the properties. There is a tremendous amount of satisfaction in finding great tenants at a market rate.

For parents, owning rental properties provides a triple benefit. These benefits include growing family wealth, providing your children a safety net, and giving your children purpose. If you don't want to start your own family business to help your children, building a rental property portfolio. They can manage it in the future.

3) Real estate commissions are coming down

After the National Association Of Realtors settlement on commission price fixing, residential real estate investors are all wealthier. Declining commission rates means more money in the homeowner's pocket. As a result, there is a boost to rental property owners today.

Take a look at this chart I put together. The greater the value of your real estate holdings, the bigger the financial boost you have received from the NAR settlement on price fixing. In addition, the longer you hold onto your rental properties, the greater the boost as declining real estate commissions will take time.

4) Fed Cutting Rates And Trump Presidency Part Two

With the Fed embarking on a multi-year interest rate cut cycle starting in September 2024 and Trump winning the presidency, the demand for real estate and rents may start rising again in 2025. Trump built his fortune in real estate and should enact policies to help bring down mortgage rates as he said on his campaign trail.

The economy is clearly still quite strong with a lot of homebuyers priced out due to high mortgage rates. As a result, rent pressure continues to build as well. This creates an ideal scenario for rental property owners.

What Type Of Rental Properties To Own

In an ideal situation, you want to own rental properties where you call all the shots. Therefore, owning a multifamily or single-family home is ideal.

If you cannot afford to own a multifamily or single-family home as a rental property, then the next best alternative is to own a condo. However, beware of condo association rules and the financial health of the homeowner's association.

Some condominium associations charge move-in/move-out fees, which will cut into landlord profit margins. Other condominium associations may have penalty fees for noise disturbances or trash violations.

The one benefit of owning a condo is that the association should be responsible for general maintenance and upkeep. Things such as replacing the roof, painting the walls in public areas, maintaining the elevator are the HOA's responsibility.

Know The Downside Risks Of Owning Rental Properties

Being a landlord is not for everybody. I was fine with being a landlord in my 20s and early-30s. Once I hit my late-30s, I became less fine due to time constraints.

The main downside risks of being a landlord are:

- You're a terrible marketer who can't attract tenants at market rate. The longer you take to find a tenant, the lower your NOI and property value.

- Your tenants don't pay on time or don't pay.

- The property gets damaged by your tenants or from natural disasters. You can find a great homeowner's insurance policy with Policygenius.

- Time spent dealing with tenant issues as a landlord.

- Higher property taxes. For example, the mayor of Nashville, TN pushed through a 32% property tax increase in 2020 while keeping small businesses closed.

- Your city could indeed get hollowed out as companies leave.

- You are not a people person and are also easily agitated when things go awry.

- Rental properties generate only semi-passive income, not passive income.

These downside risks of owning rentals properties is partially why I've invested $954,000 in real estate crowdfunding. Not only do I diversify my real estate portfolio, I also earn income and returns 100% passively. As a father of two kids in a pandemic, time is so precious.

Build Cash Flow Through Undervalued Assets

The value of rental properties has gone way up because interest rates have come way down. Thanks to an inefficient real estate market, investors are able to still get good deals. It's like going back in time to buy assets at lower prices.

Conversely, it is very hard to find value in the stock market today. We've all already bought our Amazons, Zooms, Teslas, and so forth. It's time to focus on buying undervalued, lagging rental properties for ourselves.

Institutional real estate investors like Invitation Homes are raising massive amounts of capital to buy as many rental properties as possible. So should we. Let's hope wealthy foreign investors don't start wising up and buy U.S. rental property as well.

Utilizing your cash hoard to build cash flow is a wise move. Just make sure not to overleverage yourself. Further, always have enough of a cash buffer to protect yourself from unforeseen mishaps.

When it comes to finance, I've always believed in the saying, if you can, you must. Although I don't want to create unnecessary burdens in my life, I must take advantage of opportunity in the rental property market. Low hanging fruit needs to be picked!

It's time to buy a nicer primary residence so I can rent out my existing property. This way, I can boost our retirement income while also living a better life.

Rental Property Investment Alternative: Diversified Fund

If you aren't an accredited investors and don't want to invest in individual commercial rental properties, you can always buy a diversified fund instead.

Take a look at Fundrise, a leading real estate platform and creator of real estate eREITs. Fundrise predominantly invests in the Sunbelt region, where valuations are lower and rental yields are higher. Own rental properties passively gets more attractive as you get wealthier and older.

I have personally invested $954,000 in real estate crowdfunding to diversify my investments and earn income 100% passively. I believe investing in 18-hour cities and the heartland is the way to go for rental properties in particular. Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is a six-fiture investor in Fundrise funds.

Love the articles, Sam! One suggestion: and finding it hard to interpret some of the real estate articles because the environment has changed so much. For example, one article 2024 talked about how low interest rates are. perhaps you can add specific dated updates for different periods of time?

Updated! Thanks for reading and pointing it out. I update my articles about every six months to try to make the data as fresh and relevant as possible for readers.

Sam – Do you utilize LLC’s for rentals, or do you cover it with an umbrella policy?

Thanks,

DF

Hi Dave – I use an umbrella policy to cover me for liability beyond my property insurance policies.

Hi Sam,

I have been reading your blog since last couple months and found the info highly valuable. I’m especially interested in rental properties. I’m wondering if you have any thoughts on north San Antonio, New Braunfels (north of San Antonio), TX, area for purchasing a rental property. I’m looking for a rental property under $290K.

Appreciate your guidance in advance.

The reason why I gave up owning rental property is simple: The IRS does not allow up to $25,000 of losses if you earn over $100k MAGI. Since property is very much overpriced ( I totally disagree with the argument it’s undervalued) Rents in major cities are declining which means the rent cannot keep up with the operating costs and mortgage. When you factor in depreciation, you’re likely to show a loss. If you’re in the higher brackets, not being able to reduce taxable income is a deal breaker for me. Now, these losses can be carried to offset the gain when sold but I cannot afford million dollar homes in cities like SF and NYC. Therefore investing in Fundrise and REITS (Tax deferred accounts) is the best option for people like me who don’t have time to manage properties on a fulltime basis and find out that owning real estate for the average person is truly an overrated and nerve racking investment. Also, the recapture rules kill you when you sell.

As much as I encourage people to look into real estate investing, it is not for the faint of heart.

For the work and stress involved, if you’re not beating the S&P 500 by a substantial margin over the long run, don’t do it. Luckily for me, the returns have been much better than expected.

I started my real estate investing career in earnest in 2013, around the time I started reading your blog. The real estate market place is far less efficient than the stock market where there are thousands of buyers and sellers each day. Agents convince sellers to do off market deals, or agents convince people to sell when they shouldn’t, or people get tired of managing the asset (even though it may be a great asset).

I agree with your assessment that real estate is a good investment, but knowledge of the specific deal is far more important when picking an asset in real estate than it is in the stock market. Developing expertise or finding trusted professional advice is difficult.

Here is my take on your landlord downsides:

– You’re a terrible marketer who can’t attract tenants at market rate. The longer you take to find a tenant, the lower your NOI and property value.

* There are strategic reasons to hold out for a higher rent sometimes, but in general the market determines the rate, not one’s marvelous marketing abilities. My goal is to maximize rent because that maximizes my property valuation and because of rent control. If I don’t get max rent now, I can’t raise it to market rent later. However, many Mom and Pops can’t bear any loss of income, so they rent below market but have low vacancies.

– Your tenants don’t pay on time or don’t pay.

* Depending upon the type of asset, tenant and regulation, you may have very limited ability to collect even if there is a judgment in your favor. By the time a tenant has been evicted in California, I’m usually out 4+ months of rent, a trashed unit and legal fees. During Covid, I’m out the rent, but I can’t evict.

– The property gets damaged by your tenants or from natural disasters. You can find a great homeowner’s insurance policy with PolicyGenius.

* No owner I know buys earthquake insurance in California because it is too expensive. We are all rolling the dice. No policy that I have covers tenant vandalism. However, I have had policies cover dog bites and tenant-caused fires.

– Time spent dealing with tenant issues as a landlord.

* I hire a management property to manage my workforce housing apartments. I have a single family home rental which I manage myself because it is in a good neighborhood.

– Higher property taxes. For example, the mayor of Nashville, TN pushed through a 32% property tax increase in 2020 while keeping small businesses closed.

* All regulatory changes, not just taxes, have a huge impact on my operations and finances. Rent control laws are becoming popular in many states which I see as completely ineffective in addressing the housing crisis. Covid has down more to lower rents than any legislation.

* Your city could indeed get hollowed out as companies leave.

– These types of changes usually take years to manifest but it’s important to stay on top of changes in the community and take action before it’s too late.

* You are not a people person and are also easily agitated when things go awry.

– Although I work fewer hours than when I was a management consultant, the peak stress levels are greater than consulting. When you get that call on a Sunday afternoon that your property is on fire, that’s worse than screwing up any client meeting. You don’t know whether your investment has gone down the drain, whether people are hurt, whether you will be sued. I had a rental house fire in January of this year–a complete gut. 9 months later, the city still has not granted me approval to rebuild because of permitting delays (partially driven by Covid).

Hi Sam, have you changed your mind onCrowdstreet? Noticed you only mentioned Fundrise and no mention of Farmland either. Would be interested to know where you’re still putting money to work. Thanks

Great article, Sam! I’m also very bullish on rental properties, and I’m still buying more this year. I live in NY and invest remotely in Memphis — I just closed on property #17 a few weeks ago. Both the sales and rental markets are very hot in the suburban areas I invest in.

Eric at Rental Income Advisors

Same. Great article. I like your logic.

Question. I’m looking to do a cash out refi on an unencumbered multi family in OC to buy another rental. Is that interest expense still fully tax deductible?

I believe so. But watch out for any deduction phaseouts. Double check with your accountant.

Thanks. Spoke to the CPA. You’re correct. As long as the proceeds are used for another rental, you can deduct the interest, pts, & related fees.

Dear Sam,

Thank you for this great article. I was wondering if you could write a future post about how to navigate this crazy house market without losing money. Last week I wanted to buy a single-family unit and I offered more than the listed price. It turned out that somebody else offered even more and got the deal. The house ended up being paid more than its real value, so it is not easy to leverage the real estate market right now to make a profit. I think that because of the current race to buy new homes in America (and the low inventory), it is very hard to make good deals. Any advice from you would be much appreciated. Thank you.

Having the same problem. My dad and I are trying to help my daughters buy a house together here in NY.

If the house needs too much work to make a full price offer, forget it. Someone else (with no clue how much the needed work is going to actually cost them) will sweep in and take it for above list price.

If the house is pretty much move in ready, a full price offer, even on the day after it went on the market, just puts you in the running. After a few days the selling realtor will always come back with: “We have many bids. We need everyone’s top offer.”

So we discuss how badly we need it and then my dad and I ante up a few extra tens of thousands of dollars cash (each) to add on to my daughters’ full price offer with a preapproved loan. And that doesn’t do it. The only time it would have, a buyer with a slightly smaller bid was offering cash, so the seller took that.

But we’ve lost five in a row. Only about one suitable home a week seems to come on the market within a 40 minute commute of older daughter’s job. We need at least a contract by December. Another few weeks of this and we will be looking at a rental for a year until things calm down, but that’s even more expensive.

It’s crazy, given that small-time landlords are being ruined nationwide by what I read is a 33% delinquency rate (with the moratorium on evictions) and a 20% vacancy rate, and they can’t even escape their pain by selling. The market is probably going to go from famine to feast (for buyers) when the moratorium is lifted. But when is that?

Willing to pay top dollar and quite a bit besides, but there have to be limits and with so little on the market, people are forgetting that, and that this is just a temporary thing.

Roofstock properties on the whole seem wildly overpriced to me. Have you looked closely into this aspect of the company? As you know, Roofstock permits you to make offers on most of the properties but their listing prices are too high.

Thanks Sam! Do like your insight on property valuations vs the risk free return. Broadly aligns property valuations to the same valuation methodology as bonds, love it!

Know you managed to predict a V shape recovery which is impressive. Do you have any predictions about us going through a second dip, for more of a W shape? Seems like we’re running out of steam in a lot of markets and industries, so a potential reason to hold off and keep the powder dry. Would be good to get your view!

I wrote in my latest newsletter that the economy is losing stem. Therefore, a second stimulus package must happen by end of this year, and I think it will. Given I think it will happen, I think stocks and real estate will continue to hold up. No double-dip.

Hope you’re making good money this year!

“There is no joy in inheriting a dividend-paying stock portfolio. However, with rental properties, the adult child can market the property, screen tenants, run background checks, negotiate the lease, coordinate move-ins and move-outs, make sure all insurance policies are in place, collect the rent, and maintain or improve the properties. There is a tremendous amount of satisfaction in finding great tenants at a market rate.”

I don’t think I’ve ever disagreed with something so much in my life (okay, that’s not true, but I still HIGHLY disagree). I’d far rather inherit a dividend stock portfolio than waste my time managing a property. Let the dividends pay my expenses so I can work less at a 9-5 job and focus on more important things in life.

Sincerely,

ARB—Angry Retail Banker

I didn’t realize you have kids now. When did you get married and have kids?

I don’t. Never indicated otherwise.

Gotcha. I’m looking at things from a parent’s perspective. Gifting a dividend-stock portfolio does little in giving an adult child a sense of pride since there’s nothing to do.

Let’s say you have a kid down on his or her luck and needing a job and something purposeful to do. This is where having a rental property portfolio comes in handy. Just giving your kid a stock portfolio isn’t going to build any grit or purpose.

I see what you’re saying, but it’s still a hard “disagree” as far as I’m concerned.

If the purpose is to give the adult child something purposeful to do, then that only works if they have an innate love of property management. For anyone else (including myself), an investment property is nothing but a burden to be offloaded ASAP. It’s like leaving behind a 9-5 job.

A dividend stock portfolio doesn’t grant them purpose in and of itself, but you know as well as anyone that money simply doesn’t do that either. It grants them the opportunity to pursue interests outside of work that would be more personally or societally beneficial if only they weren’t tied to a meaningless 9-5. Most (or at least a huge number) of jobs are bulls*** jobs that hold us back and waste our time. Having a truly passive income stream (dividend stocks, for example) allows people the financial means to obtain that purpose in their lives. Being gifted a million dollar property wouldn’t instill a sense of grit in them either. I think you usually DON’T give large inheritances if you want to instill a sense of grit, generally speaking.

There’s always the greater conversation of what a parent should or shouldn’t pass down and what sort of values it instills that I don’t want to get into. But if you’re looking to pass down to your kid something that will “give them something to have pride in” and instill a sense of “grit and purpose”, and your two choices are a million dollar rental property or a million dollar dividend stock portfolio, then hands down the best choice is the million dollar dividend stock portfolio. The dividends gives them the financial backing to go out and find what makes them happy unencumbered from a 9-5 (that’s the whole point of FIRE after all, right?); the property just gives them a miserable meaningless job on top of their existing miserable meaningless job. Again, the exception to this is if the adult child genuinely loves property management, in which case never mind and ignore everything I just said.

If not wanting to own rental properties to build wealth and earn more tax-efficient income doesn’t appeal to you, then that’s great too.

At the end of the day, you’ve got to do what you wanna do. And if you’re happy with your net worth for where you’re at right now, and that’s all that really matters.

If you eventually do have kids, I would be curious to hear if your views change or not. What I realized after becoming a father is that kids give me so much motivation to plan ahead and think about future scenarios.

Having kids likely wouldn’t change my views at all because it’s not a kids vs no kids issue, but a personal finance one.

Personally, I find dividend stocks far more efficient at building sustainable passive income (which I value far more than non-practical measurements like net worth) at a far lower level of risk and maintenance than rental properties, with the lower level of maintenance being the key factor in the context of the discussion you and I are currently having (giving them an unwanted responsibility vs giving them the financial means to pursue activities that are personally and societally fulfilling). Since the nature of these investments and my views of their benefits and drawbacks wouldn’t change depending on whether they’re owned by me, my currently 3 year old nephew, or my hypothetical children, having children would be unlikely to change my view on them. Having a child isn’t going to make me want to coordinate move ins/move outs or chase down tenants for rent.

Yep. I rented out my Florida house for a few years after I married and moved to my wife’s in New York. Even with ideal tenants and a very good local realty company to take care of everything, I found it a nuisance and was happy to eventually sell it to the tenants.

Then I took the six figures in equity and profit and put it in Amazon, which has tripled since. Usually I only invest in well-established funds, and a lot of that within retirement plans, but this felt more like found money.

Thing I notice about rich people is most of them work, even if they could afford to retire at 22 and go drink Pina Coladas carried to them on a beach until they waste away in Margaritaville.

The difference being that the rich only seem to work at exactly what they want to work at, and only as hard as they want to.

Given how many hours of my life I’ve had to sacrifice sitting behind a desk and trying to stay awake, I’ve never stopped wishing I was born rich, rather than good-looking, heh.

I think we’re losing the whole subject of the matter. Are we talking about real estate investments or raising children to have grit?

Hi Sam – Thank you for this information. Do you have a view on purchasing properties in high costs locations like NYC? Specifically I have explored buying a studio property below $400k for personal use but with the eventual goal of renting it out. For reference I am in my mid 20s and my portfolio is skewed mainly to public equities.

Is anybody able to get financing out their for rentals? Out of curiosity last week, while in the bank I asked the manager what kind of rates they are offering for rental properties for someone with excellent credit and he said they are NOT lending at all for investment properties and this is the way all banks are headed. This was at my local US Bank. He said if, “If you can find someone out there lending, you’re lucky.” Anyone else hear this or having success securing loans for rentals at this time? He also said the best rate on a primary home from them tight now is 3.5%, which is not any better than our last mortgage. Doesn’t seem to bode well for the expectations for the economy in the upcoming months.

Have you tried a community bank? I’m able to finance rental properties at 4% through a local bank where I have a banking relationship.

Try Credit Unions or local smaller banks. I’m in Washington state and know they are doing refinances on investment properties. I’m at the beginning stage of refinancing a couple of mine.

We’ve purchased 4 rentals in the past 2 months, 3.625-3.875%. Net cashflow minimum $300.

Security National Mortgage is who we go thru. Our lender focuses on investments in mostly all states.

Please read BiggerPockets before purchasing thru Roofstock…it’s not recommended for new investors.

Totally agree with Sam, rather hand a portfolio of rentals to the kids than Dividend Stocks. Granted we have property management on all rentals, but the kids can see how much faster RE is in creating wealth than stocks.

We just financed a couple of investment properties, one is prime plus 0.5 the other is prime plus 0.25. We can fix the rate anytime. Both are being used to finance more investment properties we have contracted to buy.

Both were from small local banks & it’s was 75% LTV based on their conservative appraisals.

We have been accumulating property for 35+ years & enjoy the unique niche we have developed. Fed up with constant travel, office politics & high W-2 taxation I retired early to pursue real estate as an escape from the proverbial rate race.

Two of my BIL’s are avid high income stock investors & both are still working @ 62 & 65 & the latter is convinced he will be until 70. So much for the dividend income stream.

the key is property manager. If the property generate enough income to cover the cost of property manager as a operational cost, then it is a passive income. if the owner have to do everything themselves, then they are acting as part time property manager. In the case where the property cannot afford a property manager, and the owner have to self manage, then the owner is merely discounting their own labor value and confusing that with a sustainable investment.

Not to say owner should not self manage, as long as they compensate themselves for it.

I love my rental properties – over the past ~12 years and through a series of 1031s I ended up with 2 duplexes in desirable market that attract high quality tenants. They are located in close proximity to each other and me, so they are easy enough to self-manage. I’m almost done refinancing both and the cash flow will now be enough to cover all of my living expenses when I’m ready to retire from my day job, but in the meantime, I have a couple big projects I want to finish (new roof, etc.) before I become dependent on the investment income.

I love my rental properties – over the past ~12 years and through a series of 1031s I ended up with 2 duplexes in desirable market that attract high quality tenants. They are located in close proximity to each other and me, so they are easy enough to self-manage. I’m almost done refinancing both and the cash flow will now be enough to cover all of my living expenses when I’m ready to retire from my day job, but in the meantime, I have a couple big projects I want to finish (new roof, etc.) before I become dependent on the investment income.

I went from 0 to 41 doors in about 2 years. I grew faster than I expected, and am going to digest this a bit and see what happens to the market. I’m fortunate to live in a market where you can routinely buy at a price where the monthly rent is around 1.25% of the purchase price with low taxes.

I have a professional property manager, but it’s more work than I anticipated.

Wow! That is incredible. It took me 20 years to get to four doors comfortably. I’m very impressed you got to 41 so fast!

Can you share more details in terms of how you got that much capital, how much capital did you invest, and the percentage these 41 doors are to your overall net worth? Thanks!

I had some good fortune career wise in 16 and 17 that gave me some funds to invest. Keep in mind, where I live you can get a “door” for $60-$75k, so it’s a different animal than your properties in SF. I invested a little shy of $1M and used debt for the rest, which is less than 20% of net worth. They cash flow, plus every month I have a decent balance sheet bump by paying down the mortgages.

Sounds good to me! So about $2.8 million in property for 41 doors, with a net worth of between $9 – $14 million, depending on what you mean by 20% of net worth (property value or debt).

How old are you and what do you do for a living? I think your story would make for a great post. I hope your tenants are great and won’t cause you too much trouble.

I meant 20% of net worth in RE from an equity perspective – meaning closer to $5M. I’m early 50’s and an attorney.

I’m insulated from the tenants via the property manager, but whenever you get that many people there are some treasures and a few challenges. One of the buys was a 28 unit apartment, and in retrospect that was not the best way to go about it.

I’m happy to discuss further with you. Real estate has become the thing I’m most interested in. I actually got involved thinking it would be a good way to spend my time if I burned out in the practice of law which seemed quite possible a few years ago.

Ah, gotcha. Still great. A great property manage really is key.

I plan to use one for my homes in SF if I relocate to Honolulu in 2022.

Is your philosophy to get longer term amortizations to increase cash flow? I don’t have as strong of a need for current income so i’ve gone with 10 and 15 year amortizations, thinking down the road I’ll have even better cash flow. But I’ve read experts espousing both strategies. If you’ve written on this I’d like to review it.

Also curious!

Thought I would jump in here…

We have been mentoring a young kid (26) who has gone from a 3 unit to 15 properties 47 doors in 3 years. Admittedly we are financing most of them @ high interest along with another broker who ‘sold’ him 5 properties @ 7%, 20 yr term.

He runs a tight ship & has 2 maintenance guys on W-2’s who manage everything very well. My wife does his accounting, tax prep etc.

Admittedly the properties ranged $30k-$40k/unit but the rents are exceptional.

Case in point we picked up a foreclosure, he wanted to bid $75k, my wife held him @ the asking price $59k & no-one else bid. The property had 3 distressed homes on 16.5 acres. He immediately put his guys to work & within 2 months had two rented for $1000/month each+utilities. He had 24 applicants that we had screened by a 3rd party group. To-date he has only 3 tenants behind in rents.

The 3rd unit was occupied by Covid squatters. But once they applied for financing to get their own home they paid ALL the back rent ($675/mo) to avoid a judgement against them that would compromise their conv financing hopes. It’s now rehabbed & also pulls $1000/mo. Total rehab costs for the 3 homes $25k.

He has since turned down $175k for the property but he did sell off an acre with road frontage for $10k. Conservatively the majority of his since rehabbed properties have increased in value 20-50%.

Over the last 18 months we personally dropped another $500k+ CASH in & around the same area picking up 15 units in 4 buildings that we then flipped contract for deed @ 15% 10-20 yr term.

Several of those we have mentored over the years are now living off their rental incomes.

Where is this?

I agree now is the time to buy multi-family (2-4 door) or apartments (5+). There are more of these type of buildings on the market than in the past.

That said, they are though to buy. We’re finding even when we get the right numbers the current owner will only take cash, will not provide financials tax returns, or the mortgage companies have increased their minimum loan amounts beyond the property sale price. When current owners do the first two items above it usually indicates that they don’t think the property listing price will match the mortgage appraisal, have not been reporting rental income on tax returns, or are misrepresenting the property gross in the listing. Currently working through properties 5 and 6 since the pandemic started that meet our number requirements and fall in the categories above. The current owners won’t sign a contract where we explicitly state they have to provide tax returns saying “that’s not how we do that here”.

Nothing worth having is easy.

Hey Sam, I’m a bit concerned about the risk of future govt intervention against evictions or some kind of mandatory rent forbearance, sort of like what happened during COVID. Or should we assume there will always be a corresponding mortgage forbearance if that happens again? I don’t currently own any rental properties, so I’m speaking as a newbie here, but that risk has made me hesitant about buying a rental home.

Do you think that fear is overblown or do you think there is a substantial risk there?

It’s worth baking into your risk premium and then running the calculations.

To encounter a scenario, you would calculate the percentage of renters in forbearance and estimate the chance you choose a bad tenant.

Therefore, your ability to screen for tenants is a crucial part of the equation.

This article is helpful both to prospective tenants and landlords: https://www.financialsamurai.com/tips-for-prospective-tenants-in-a-strong-rental-market/

Do you think there may be more serious political risk in the future? More than temporary eviction bans during a pandemic that will eventually (at least we’re told, lol) end.

I’ll state this as neutrally as possible to avoid starting political arguments, although even the terminology may be problematic for some people.

These are just observations of reality as I see it:

Socialism, or whatever you want to call it, is increasingly popular. Wether this is good or bad doesn’t matter. Landlords will be increasingly unpopular. They’re clearly part of the oppressor class in the view of many. They are easy scapegoats for politicians. Even our current Republican president imposed a nationwide eviction ban. I don’t recall many people, even those on the “right” questioning the constitutionality or the logic of this ban. That says something about the future I think. Who will resist eviction bans during any future state of emergency lasting months or years? How many people will make a decision to simply stop paying even if they are financially able too? Will judges and sheriffs be too intimidated to order and carry out evictions?

If I envision a future in which our nation is governed by people like Bernie Sanders and Alexandria Ocasio Cortez, it os not one where I’d want to be a Landlord.

This is once again not meant to start an argument over policy. Just to think about how policies will effect certain people/classes. If I thought the religious right was going to dominate policy I wouldn’t want to open a marijuana business, for example. If I thought a non-interventionist foreign policy was likely I’d hesitate to invest in defense stocks. If I thought the fed would raise interest rates and pursue a less aggressive monetary policy I wouldn’t hedge against dollar weakness with gold. The whims of politicians and the public they represent may ultimately mean more to any investment than the fundamentals and math.

We have major politicians in both parties supporting a nationwide eviction moratorium. We have people in the streets looting and burning while believing their actions are truly justified. Militant activists are actively and violently resisting evictions in major cities, arguably with the support of some politicians. It seems likely the political environment for landlords will deteriorate in coming years. In a worst case extreme scenario, the masses may want more than just your land and the right to live on it for free.

I do recognize these arguments could be made against investing in many different assets. Landlords just seem very poorly positioned given the shift of the nation towards socialism and the class warfare occurring right now.

Tenant-screening is itself becoming “illegal”, as most of the things worth screening over are “protected.” Places like Seattle are making it illegal for landlords to make choices at all.

Hi Sam,

I much enjoy reading your article posts, I gain good insights from many. I have read this article with interest. I know the path of investing in rental properties can work for many but in my case it was not the best.

My story, I bought a duplex in 2004. By 2009, the assessed value of the property was nearly one third of the original purchase price. I remember the day when the radio talk topics were all about ‘strategic default’ aka walk away and then see where the chips fall with the banker. Crazy times. So I stuck it out for about 14 years. Along the way dealing with needy tenants, fixing things, new furnaces, new water heater, new appliances for kitchens and laundry, mother nature wearing on exterior, constantly fixing, city playing egress window replacement card (new rules) and the list goes on. Was even able to finally leverage a HARP loan around 2011 after they relaxed the rules for rentals as the property value was still ‘upside down’; so I did manage to bring my monthly mortgage down which equated to a little more monthly cash flow. Fast forward to 2017 and the market had recovered after many years. Finally moved the tenants out in 2017 and spent many months remodeling and fixing up on the cheap with my own hands all the way. Put the duplex on the market in fall of 2018 and got eight offers over the next week and a half (good thing). Sold it to highest offer for 10% less than I paid and consider myself lucky enough given the bad timing of the original purchase. If you asked me was it worth it for me and I would say absolutely no. I stuck it out to recover best I could. Much to do with the timing – who knew the housing bubble was right around the corner…

Congrats for getting out! Yes, timing does play a big role in profiting from a rental.

What do you plan to invest in to generate the same cash flow?

Just sticking with REITs these days as to any real estate type of investment. Invested particularly in REITs with data storage and cell towers as their theme. As a long term investment these have done well for me with value increase and ongoing dividends.

Cap rates are sub 4% in most decent areas where in nice areas you are looking sub 3% for most apartment buildings. If you dig a little deeper you will see that those are massaged figures and in reality they are worse.

Used to be that a reasonable deal was when purchase price was about ten times the gross rent, nowadays you are looking at 20 times gross rent and higher.

You can’t invest in apartment buildings with such thin margins, it takes a vacancy or a bad tenant to make your property cash flow negative.

In my opinion, in real estate you make your money when you buy, hence sticking to valuation metrics that have historically made sense is important.

I don’t find that it’s a great time to buy now, this recession hasn’t started yet and with the eviction moratorium we are going to see how this plays out, some landlords haven’t been receiving rent since March and won’t get any till January, you don’t want to be that landlord.

As a landlord in SE Pennsylvania, I can tell you the rental market is very hot. Of course it takes diligence to sort through applicants but there are a lot of good candidates who are getting prices out of buying their own homes and they are spilling into or staying in the rental market. Anecdotally, I just lost a tenant in early September and had 10 applicants within a week at a higher rate than I was previously getting.

Of course, marketing and putting a competitive price on your property is key but there are so many free (and low cost tools) that it only takes a few minutes.

Rentals are definitely the path forward for me and my family. It took 7+ years to convince my wife that we should give it a try but even she is sold now. It’s not income without work but has been a great asset class for us and we will be expanding in the future.

Good to know, thanks for sharing. For the average American, building a rental property portfolio is easier and more straightforward than building an online or offline business. Buy a rental property every time you can afford one, and in 30 years, it’s hard to imagine not being set for life. Same for your kids.

I had a goal of buying one property every 3-5 years, but I ran out of steam. Instead, I enjoyed investing in online real estate more.

I had the same idea buy a property every few years but also ran out of steam or more accurately i ran into debt to income issues.

We both became father’s the same time and both thinking of relocating to Hawaii. I believe you are from Virginia I’m from dc but we both have roots in Honolulu. I sold a duplex and v1031 it into a sfh. The rental laws started to get crazy here in la. I’m trying to stay away from those rent control cities. Sf sounds like a horrible place to invest though. The rules here in la basically state that essentially the tenant is in control and you can’t ask them to leave ever without paying relocation

If you choose the wrong tenant, life will be tough as a landlord.

You really have to screen very very carefully. I just signed a tenant who is a family that makes $600K+ and works for big tech. 800+ credit score too. They should be good. But you never know.

Social capital is important. Not paying is a career risk.

My main question for the Financial Samurai is: With respect to the quality of renters, do you find that your renters today are more respectful of your rules and treat your property better today than renters have in the past — possibly due to Covid/fear of eviction/less mobility — or is the quality and behavior of today’s renter the same as usual?

What would get me to invest more in rental property is evidence that renters behave better than in the past. That is the #1 sticking point.

As always great content from you. Do you have guidance and recommendations re Opportunity Zone property investments, for managing capital gains taxes?

Good article Sam, just one small addition/clarification for newbie investors – the depreciation benefit is for the value of the physical structure and not the value of the land. Still an awesome benefit. Also (as of now) if you hold the property for life and pass to your heirs, they receive the property at the ‘stepped up’ current assessed value, and can once again depreciate the value of the structure.

I also read your linked article : “How To Properly Analyze And Value Rental Properties”. Why in your “net return” calculations/% do you not include taxes on income. Shouldn’t the income taxes be deducted as well in any net income calculation or do you treat this as a “below the line” expense for purposes of the calculation? Thanks and very much enjoy your articles!