Dear Financial Freedom Seeker,

I spent 13 years working in one of the most high-powered, fast-paced, and stressful industries in the world. By the time I was 27, I was promoted to Vice President where the typical VP promote is 32-33. In 2009, I started Financial Samurai which has now grown to about 1 million organic visitors a month.

At 30, I led a region responsible for generating tens of millions of dollars in yearly revenue. The very next year, I was promoted again to Executive Director. During this 13 year time period my income increased by more than 10X, leading to the financial freedom I now experience today as I saved and invested most of it.

I want you to achieve in five or ten years what the typical person takes 15 years, 20 years or perhaps never to achieve. As you grow older, you'll realize time becomes more precious because you have less of it. This is why you've got to make the most of your opportunity right now.

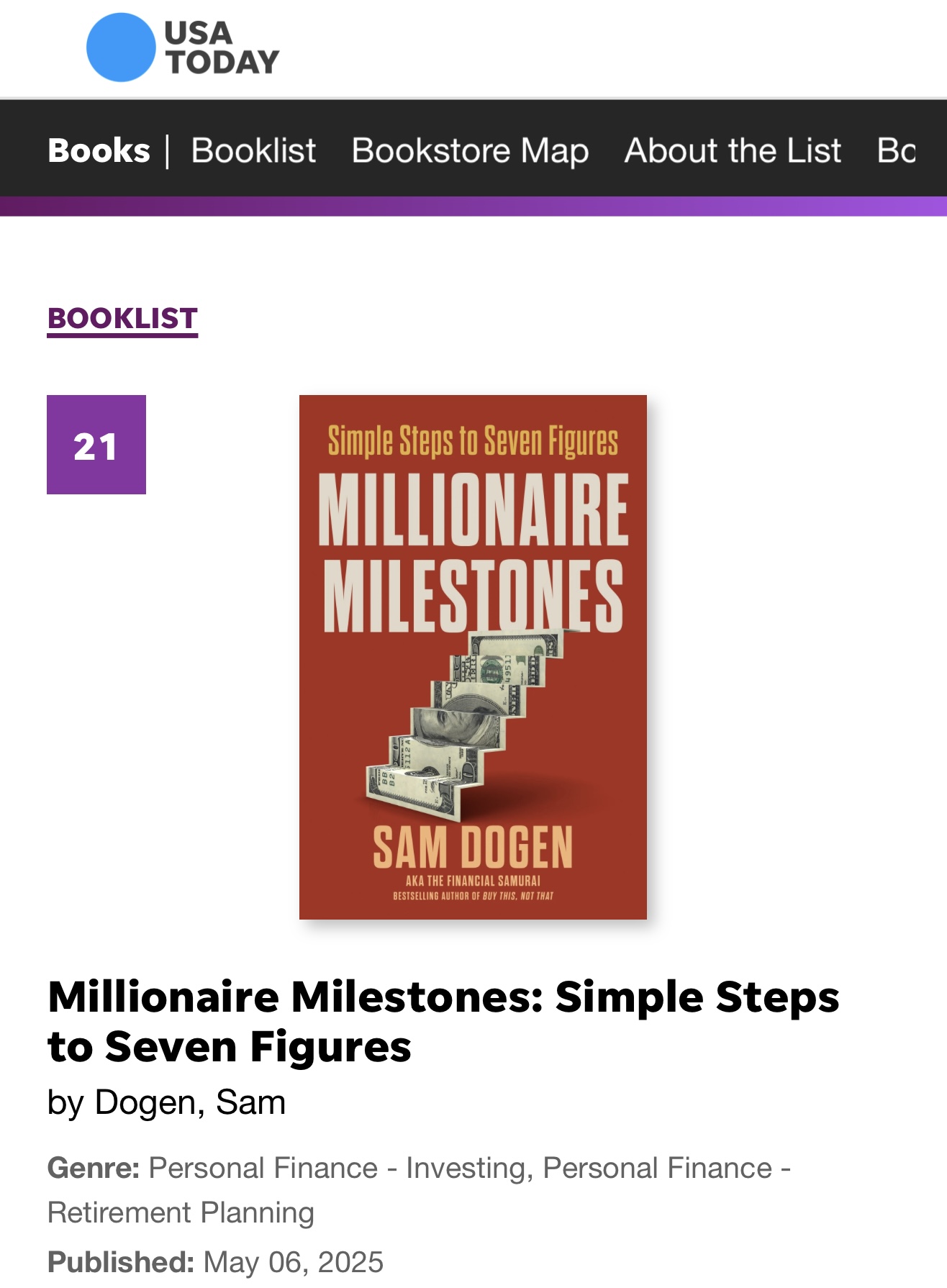

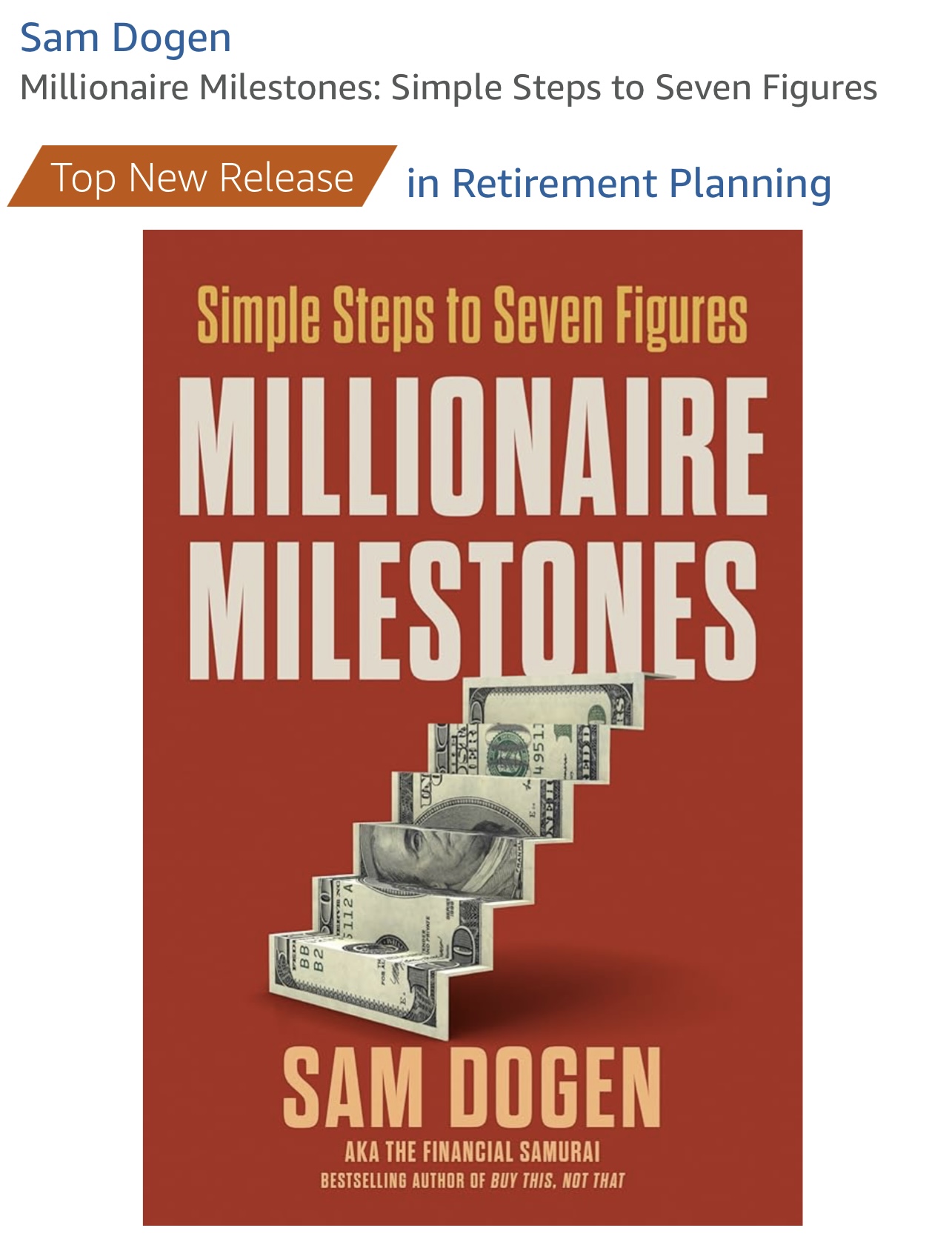

Note: I'm doing a promotion to celebrate the launch of my new USA TODAY best seller, Millionaire Milestones: Simple Steps To Seven Figures. Details down below if you want to give people the gift of financial freedom and get an objective financial consultation from me.

My Financial Background And Journey

I know what it takes to get ahead in a brutally competitive world. I came from a middle class family and attended The College of William & Mary, a top state school with no rich uncle to help get me started. I then went on to receive my MBA from UC Berkeley in 2006 while concurrently working brutal banking hours.

In 2012, I retired early with a $3M+ net worth at the age of 34. Today, my net worth is well into the top 1% largely due to coming up with an investment game plan and sticking with it. Further, I’ve been able to build a successful lifestyle business that brings a lot of meaning and joy.

If you are the smartest person in the room and have no social skills, you will not succeed. If you have incredible social skills, but lack substance, you will eventually fail. If you've accumulated a million dollars but don't know how to invest your money except in a 0.1% savings account, you're not maximizing your returns. It's important to cultivate all your skills and your knowledge to get ahead. I will help you get there.

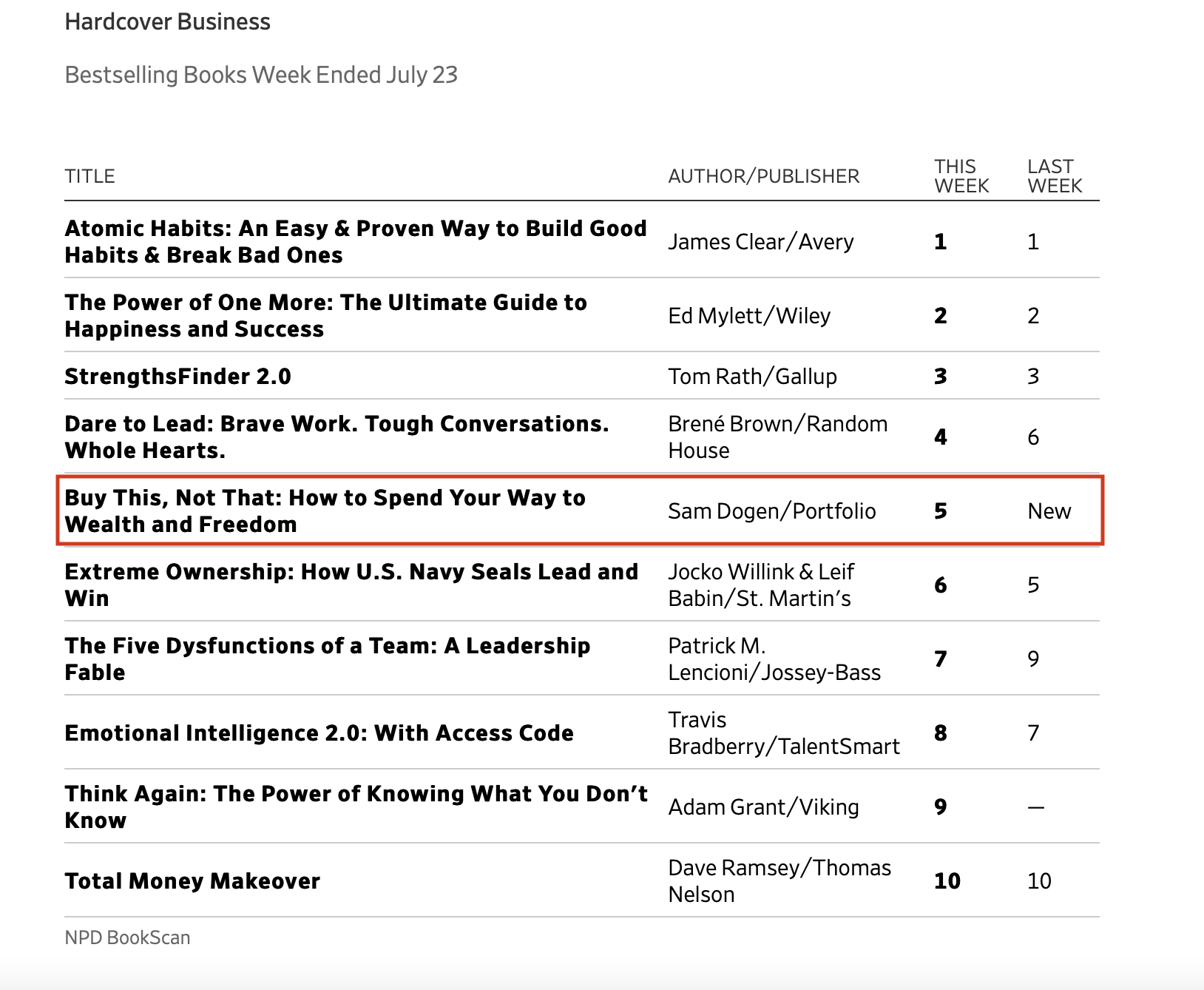

The key to never saying, “If I knew then what I know now,” is to consult with someone who's been there. Find a friend, mentor, relative, parent, or professional coach. Whatever you do, find someone today to avoid the many land mines of tomorrow. In fact, one of the reasons why I wrote my WSJ bestseller, Buy This, Not That is to help people make better financial decisions and minimize regret.

My expertise revolves around contract negotiations, business negotiations, real estate, retirement planning, investment portfolio construction, passive income, and career planning. If getting into business school, getting a promotion, negotiating a severance package, building multiple streams of income, selling a business, or finding ways to maximize your returns are things you care about, I'm the coach for you.

CAREER & PERSONAL FINANCE SERVICES

At the moment, I am mainly focused on helping people negotiate a severance package. However, I'm open to consulting on other topics.

* Maximizing Severance Agreements: One of the biggest tragedies I witness all the time is long-time employees quitting their jobs out of frustration, fear, or false hope. Any type of spontaneous action is an assault against one’s long-term financial health. Pursuing your dreams is fine, but to do so and give up tens, if not hundreds of thousands of dollars in potential severance is a tragedy. One person I know gave up on over $400,000 in potential severance because he failed to understand the linkage between his departure and various losses in his contract. Others simply don’t know their employment rights or do not know how to negotiate.

After a month of negotiations, I engineered my own layoff with a severance package equal to six years worth of living expenses. And, after working with dozens of clients, I wrote a 245+ page book (6th edition for 2025 and beyond) teaching you how to engineer your layoff.

* Contract Negotiations: Let's say you are a great employee and are getting bid away by a competitor. You like your job and don't want to change, but the other offer is extremely tempting. How do you maximize your situation? As one of the top performers at my firm, I received bids away practically every year for the last 10 years of my tenure. I will teach you how to maximize your competitor's bid without hurting your relationship with your existing company. I will also help you negotiate getting a raise with your existing employer. There is a very delicate balance between earning what you are worth and putting a target on your back.

* Building A Real Estate Portfolio. Real estate is my favorite financial asset today. Property prices have come down since the crisis while mortgage rates have dropped to historical lows. In many parts of the country, you can purchase property with an immediate return due to the positive spread between rental yields and mortgage rates. The best deals are had by the best negotiators with the most promising terms. Afterward, it's about maximizing income. I have built a multi-million dollar property portfolio over the past 10 years.

* Analyzing Your Investment Portfolio. Stocks and bonds are an integral part of your wealth accumulation strategy. I have spent the past 13 years in the investment business and during this time period I have built a $1 million dollar+ portfolio. I will review your investment portfolio and advise on whether your asset allocation is appropriate with your risk tolerance. My advice comes from my own framework I've created about the proper asset allocation of stocks and bonds by age. I was Series 7 and Series 63 registered and have an MBA from a top 10 school with an emphasis in finance.

* Building An Online Business. For those of you who have a presence online or who are considering taking the leap, I've spent the past 7 years and 12,000+ hours learning how to develop sustainable online income. I've managed to build a multiple five figure monthly online income stream for the past four years from nothing. I'll teach you about affiliate income, negotiating prime sponsorships, building a community, ranking well in search engines, content marketing, and the use of various advertisement platforms. At the very least, strengthen your brand by registering your name online!

* Selling A Business. After dedicating years of your life to building a business, you might want to sell it. I will help you think clearly about whether you should sell your business, strategic options you might not be thinking about, and how to get the best deal possible.

* Putting Together A Long Term Retirement Plan. Retirement takes careful planning. You don't want to end up short. Nor do you want to end up with too much money. I want to help you build multiple income streams, optimize your tax strategies, and get you in the right savings mindset in order to reach financial independence. I currently earn roughly $380,000 a year in passive income. I'll teach you how to replicate my framework to produce your own.

* Getting Your Book Published. I am a Wall Street Journal bestselling author of Buy This, Not That. I will help you navigate the labyrinth of book publishing to help you build more credibility. I also wrote the bestselling ebook, How To Engineer Your Layoff and have a brand new book for 2025 – Millionaire Milestones: Simple Steps to Seven Figures.

The Ideal Financial Samurai Consulting Candidate:

* Someone who is willing to invest in him or herself and no longer wants to make excuses.

* A parent who wants what's best for their children and recognizes the importance of a long-term investment. If you spend hundreds of thousands of dollars on your child's college education, but s/he cannot find a reasonable job, then you are not maximizing your return.

* A late bloomer who recognizes time is limited and wants to do everything possible to get back on track.

* Someone looking to build a real estate investment portfolio and wants to know how to analyze a property, get the right tenants, reduce turnover, and borrow at the right price and duration.

* Someone who wants to build diverse passive income streams to have more optionality in doing other things.

* Someone who has worked at their job for 5+ years and who is looking to profitably quit their job. You don't want to leave money on the table, yet you also don't want to burn any bridges.

Cost And Format

A la carte (One Session): $1,850 per 1.15 hour session. The 15 minutes is there as an extra buffer to get to know you better and not feel rushed during our session. Before our session I'll review your application and ask you followup questions to maximize our time together. We'll then go over your specific issues and come up with action items to achieve your goals. Within 36 hours I'll send you my notes and written action items for you to follow. We'll then wrap with any final questions.

Samurai (Two Sessions): $3,500 for two, 1.15 hour live consulting sessions over a one month time frame. The one month time frame is used to assess your situation, set up an action plan, help you execute the action plan, and review your progress. In addition, you will have free e-mail correspondence opportunities between live sessions.

We can either speak on the phone or over Google Meet video.

All information between us is 100% private and will never be shared with anybody, ever. I will spend time understanding your story and coming up with a game plan before our first discussion. I will then send you my action plan after each call because without action, there is no point.

Special Promotion To Celebrate My New Book

To celebrate the launch of my instant USA TODAY best seller, Millionaire Milestones: Simple Steps to Seven Figures, I’m offering a special BONUS for new consulting clients.

You will receive up to 50 hard copies of Millionaire Milestones, worth $1,650 retail after tax and shipping, for free, if you sign up for one or two consulting sessions.

You can then share the books with family members, friends, colleagues, and organizations. You can also elect to receive less copies as well, it's up to you. I just want to get as many people reading and focused on personal finance as possible.

If you’re ready to gain an objective perspective on your finances and move closer to financial freedom, fill out the form at the bottom of my consulting page to get started.

Once the inventory of books runs ou, the promotion will be over until my next book comes out in 2027. Simply fill out the form below and follow the instructions. Giving the gift of financial freedom through a book is a wonderful feeling.

Finally, if you run a business, sole-proprietor or freelancer, you may be able to deduct the cost of the consulting expenses. I will send an invoice of services rendered if requested. You also have the option of donating books to eligible charitable organizations to qualify for a tax-deductible contribution.

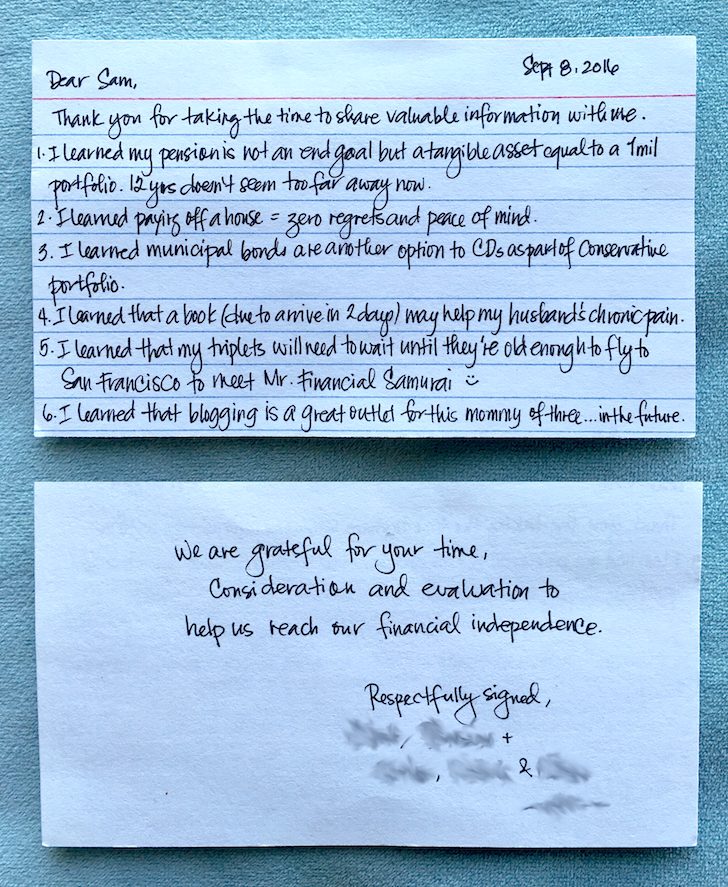

Financial Samurai Consulting Testimonials

Consulting client Z on March 1, 2025:

The impact Sam has had on me and my wife is immeasurable and will likely compound over time. While lots of value can be derived from reading Buy This, Not That and FinancialSamurai.com articles, nothing beats getting specific and relevant guidance directly from the source. Sam put a tremendous amount of time and thought into our specific consultation and I am excited to follow the plan he's outlined for us.

Before meeting with Sam I was unsure how much money was needed to retire, if we could ever generate enough wealth, and how much time it might take to reach those goals. After meeting with Sam we are thrilled to learn we are on the right track, what to do next, and realize how much sooner we'll likely reach financial freedom.

Thanks Sam for your wisdom and guidance.

Client Limitation / Requirements

Due to time constraints and my commitment to providing the highest quality service, I’m limiting the number of clients to four per month. I only want to work with individuals who are truly serious and determined to get ahead.

You may have noticed that this page is not advertised or linked anywhere on Financial Samurai. That’s intentional—partly due to overwhelming demand and partly because I want to manage how much I work. Most importantly, I prefer to work with people who are familiar with my content and motivated enough to seek out my help on their own.

Before you consider becoming a client, please take the time to read more about my background, listen to several podcast episodes, and read at least five articles on Financial Samurai so you can be better acquainted when we finally speak. I publish about 150 articles a year, so if you've been reading Financial Samurai for this long, you're good to go. This way, you'll know who you'll be speaking to and my philosophies as best as possible.

Please fill out some basic information so I can understand more about you and what you'd like to accomplish. The more details you provide, the more I will analyze and help you set a course of action. All information is private and I will get back to you within 72 hours after you fill out the form. (Make sure you scroll down to the bottom of the form and click submit).

Please also email me at financialsamurai AT gmail DOT com to say that you've filled out the application.

Thanks for your interest!

Please make sure to scroll down and answer all six questions and click submit for the application to go through. Then e-mail me. If you'd like to take advantage of the Millionaire Milestones promotion, please say so as well.

To Your Financial Freedom,

Sam

I’d like a1:1 consult please!

Sure! Fill out the form and I’ll get back to you. Thanks.

[…] Consulting: I’ve launched Financial Samurai Online Services. The main service is offering personal finance consulting, career advice, severance negotiation, […]