Financial distortion can make you think you have a greater net worth than you really do. This articles talks about how to protect your net worth from financial distortion so you can asset allocate better, have a clearer investment thesis, and ultimately make more money in the long run.

Back in 2007, I invested in a private company called Bulldog Gin (11/2009 interview). A friend from William & Mary co-founded the company after several dark years in banking and asked me to invest. At the time, I was making good money as a 29 year old VP in banking, so I figured why not. I believed in his drive and I liked the idea of making gin cool like SKYY did for vodka.

Sometime over the past five years, I started believing I had invested $75,000 in Bulldog Gin at a $10M valuation. When Campari Group announced recently they were to acquire Bulldog Gin for $55M plus an attractive earn-out paid in 2021, I was pumped!

I mentally wrote off the $75,000 investment from my net worth because it was made so long ago. After about five years of zero dividends, you start losing hope your money is ever coming back.

Surprised About My Private Angel Investment

When I dug out the capitalization table from 10 years ago, I realized I had not invested $75,000 in Bulldog Gin. Instead, I had only invested $60,000. Drat. Financial distortion is the result of my bad memory. $60,000 is still a decent amount of money to invest in a private company, but overestimating my investment by 25% is a egregious financial miscalculation.

I've always wondered how so many startup companies could “miscalculate” their finances so badly. For example, in a Startup Podcast episode about the now defunct food delivery company, Bento Now, the founders said one month they spent $70,000 more than they realized. I mean, how does $70,000 just go unaccounted for? But here I was doing the same thing, given $70,000 was roughly 30% more than their budget.

The Movie Memento Is All About Distortion

If you've ever seen the movie Memento, you realize that one small lie or factual error starts compounding on itself until it becomes one monumental error. What I think happened was I had bought $2,500 in shares in an earlier round from a colleague when Bulldog Gin was valued at only $5M (I think). For some reason, I just rounded up my investment to $75,000.

Then I checked with my ex-colleague whom I bought the shares from and he said I had only bought $1,700 worth of shares! See how the errors start stacking up? Thankfully, we had a notarized document of the transaction he PDFed over.

Given Bulldog Gin is selling for 5.5X more than my purchase price, the $13,700 differential in what I thought I invested could end up being a $75,350 miscalculation to my net worth. I like to call my situation an example of financial distortion. This phenomenon is more common than we think.

It also reminds me that angel investing is hard and not recommended for the individual. It's much better to invest in a diversified private fund instead.

Financial Distortion Can Really Hurt You

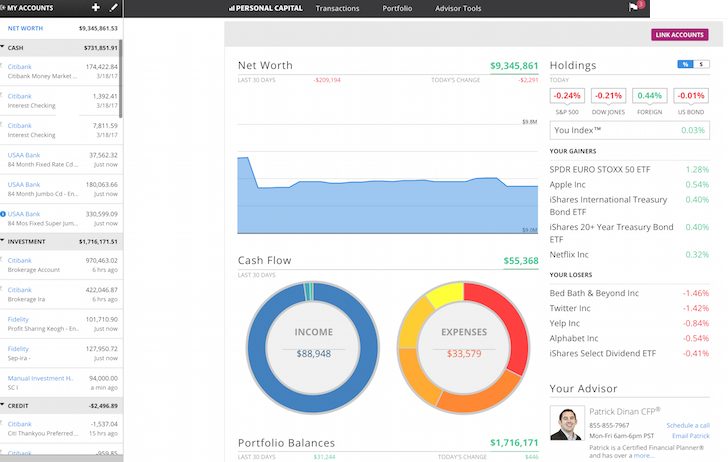

The Bulldog Gin investment is considered one financial account my Empower dashboard because it is one tax filing (K-1). Given I've got about 40 financial accounts now, the amount of financial distortion in my net worth can really add up over time if I'm not correctly tracking everything.

Let's say each miscalculation is roughly $5,000, we're talking $200,000 in distortion that can equate to potentially millions of dollars of non-existent money in the future.

Three Examples Of Financial Distortion

Can you imagine in 20 years thinking you only have two years left to go until the mortgage is paid off, but you actually have another 10 years left due to some HELOC or cash-out refinance you forgot about?

Seems impossible, but this is exactly what a relative of mine thought once she retired from her 25-year career as a $38,000 a year university healthcare administrator. She just never bothered to check the remaining principal balance in her mortgage all these years. Now her cash flow isn't going to give her the retirement she had imagined.

Can you imagine thinking you only spent $500,000 for your house because you somehow forgot to add the $100,000 in home improvement costs you've made over the years? When it comes time to sell, you'll miscalculate your profits and may very well pay more taxes than ideal.

What about your grandfather's collectibles? When a distant relative died, there was an expectation by his children that his stamp collection was worth far more than reality. There was even some internal bickering on who got to keep the coveted collection. When they finally went to an appraiser, they realized the stamp collection was worth 80% less than they thought.

It's just too hard to keep track of all your financial accounts without using a free financial tool. In some cases, you may have underestimated a positive investment or overestimated a cost. But for some reason, we tend to overestimate good outcomes and underestimate bad outcomes.

Why Does Financial Distortion Occur?

1) Basic forgetfulness.

We tend to remember the good and forget the bad. The older we get, the easier it is to forget. There are more things that have happened in a 50-year-old's life than in a 25-year-old's life. In most cases, financial distortion isn't intentional, it's just what happens when you start rounding up or down a particular financial event to cope with all the data. It should be harder to forget the cost of larger ticket items like a TV, car, or house. But it still happens all the time.

2) Ego.

We like to attribute greater amounts towards positive investments and lesser amounts towards negative investments. It's just like attributing a successful outcome to our own abilities and downplaying another person's successful outcome to luck.

When Campari Group agreed to partner with Bulldog Gin a couple years ago, I started feeling good about my investment again. As a result, I started rounding up my investment amount to $75,000 when people asked me about my private equity experience. Perhaps if there was bad news two years ago, I may have rounded down my investment to $50,000 or said nothing at all.

3) Miscalculation.

It's easy to say you made a $500,000 profit on a house purchased for $1,000,000 and sold for $1,500,000, 10 years later. The reality is there's a bunch of maintenance, interest, insurance, amortization recapture, taxation, and other selling expenses that need to be accounted for. By the time you actually get the proceeds, you're going to have much less than $500,000 in envisioned profits.

The same goes for buying a stock for $50 and selling for $100 over a 10 year period. If the stock was also paying a 3% annual dividend yield every year, your total return is closer to 135% instead of 100%.

Finally, when starting a business, we may miscalculate the cost of our time in getting everything off the ground by paying ourselves next to nothing. If you don't pay any of your employees, you can certainly improve your margins. But how long will that last until your employees flee?

Be Careful About Investing In Individual private Companies

I don't want everybody to start investing in private deals due to the success of the Snapchat IPO and this average Bulldog Gin investment. Unless you're OK with having zero liquidity for 10 years and being fine with losing 100% of your money 90% of the time, I would stick to public equity investing. I was actually considering investing $25,000 in Bento Now two years ago. And, I was going to invest $50,000 in Triggit, my poker buddies Facebook retargeting ad agency that also would have lost me 100%.

I'm disappointed in not making as much in Bulldog Gin as I thought, despite expecting to lose all my money. But the reality is, I'm probably going to make far less than a simple 5.5X multiple on my purchase valuation due to dilution, accounts payable, and company selling expenses. I'll be lucky to earn a 2.5X return after 10 years, which isn't that great due to higher risk and zero liquidity compared to the S&P 500. Then of course there is tax to pay.

Once I get the final numbers next month, I'll detail exactly how much a $61,700 investment in a gin company valued at $10M nets an investor once it closes for $55M. In the meantime, conduct a proper net worth audit to make sure all your numbers make sense today. You don't want to wake up in the future confused and disappointed.

Invest In Private Growth Companies Through A Fund Instead

Consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Wealth Building Recommendation

In order to optimize your finances, you've first got to track your finances. I recommend signing up for Empower's free financial tools so you can track your net worth, analyze your investment portfolios for excessive fees, and run your financials through their fantastic Retirement Planning Calculator.

Those who are on top of their finances build much greater wealth longer term than those who don't. I've used Empower since 2012. It's the best free financial app out there to manage your money.

“The weakest ink is stronger than the strongest memory” still holds.

Looking at the P&L for my small business last year, I definitely under-estimated the costs. This is true even though I only paid myself for the first time from the profit in the last month of the quarter. Luckily, not all of my eggs are in that basket. It did cause me to raise my prices on what I sell as of today. I had been specifically undervaluing while I build up my reputation and figured out my cost structure. My fees are going up at least 25%. Hopefully next year’s P&L is much better.

Re: Taxes, you mentioned a K-1 so I assume this was a partnership entity. If so, make sure you are able to take advantage of any suspended tax losses!

If it was a C Corp, you might be able to take advantage of the 0% tax rate on sec. 1202 qualified small business stock.

I’ve never been a fan of investing in friends’ business ventures. It complicates things, and it certainly isn’t fun to lose a friend because of a business argument. Plus, most startups don’t turn profitable and inevitably fail.

As usual, great post!

There’s an even scarier component of financial distortion: spending. Given how easy it is to swipe your credit card, so many people don’t actually know how much money they spend in a given month. My coworker admitted that he thought he spent about $200 a month on food, when that number was much closer to $600. Its awful when people feel locked in their financial situation, but can’t even name what they spend their hard earned money on.

Amazing post Sam, great read.

I was wondering if you would recommend a 17 year old who is about to attend an Ivy League school where Investment Banks recruit at whether to pursue banking or medicine from a financial standpoint, assuming he likes both equal?

Getting into medical school would be much easier than getting hired in the first place and then getting promoted from what I’ve heard, but I’m not sure if this is actually true.

Thanks for the advice!

You need to do what interests you. Medical school is a solid choice although incomes have stayed pretty flat for the last decade or so. Also, there is a wide discrepancy in the various specialty. There have been lots of comparisons (hours worked vs. pay) that argue against medicine. Most of those are by disgruntled docs that make less than their administrators / ARNPs. Anesthesiology has been great to me and I spent half my career in the military. In either field I doubt you will starve. The real trick is to avoid as much debt as possible on your education. The more you go in the hole before you begin the longer and harder the slog to get positive once you are done. My son is going to college next year and after lots of spread-sheeting we just couldn’t make the case for the Ivy league schools. He is going to a solid public school where he may even break positive while attending. If you would like to chat more feel free look me up on our department website, I’m one of the faculty.

Wow, a private equity investment that made money for you. Awesome.

Yeap, the 401k and real estate value are the two that I see the most discrepancy. You can’t just use Zillow to estimate the real estate value. They are usually way too high and you’ll have to pay a bunch of taxes and transaction fees also.

I agree that it’s hard to remember what we did just a few years ago. That’s why I try to keep better records now. Still tough.

Yes – I used to record our tax-deferred investments (401Ks, non-Roth IRAs) at present day value. It wasn’t until 6 years ago that it dawned on me that I needed to account for the fact that someday Uncle Sam was going to get his cut! It was a major “d’oh” moment for me. Now, when calculating net worth, I discount those assets by my best guess of what our tax rate will be when we withdraw.

Excellent example! We are used to not paying taxes on our 401k and believing that what we see in our 401k is what it’s worth for decades. But of course, the government will pound us when it’s time to collect. So it’s all about minimum distributions for minimum taxes.

I’m telling yah, it is better owning a business and making the same amount than working in terms of taxes. Lots more options to legally shield income.

When you own a small private company, there is also a large potential for financial distortion. Small private companies usually don’t have access to sales data of companies similar to themselves. So, some owners (the Ego examples) will just assume they can sell at a multiple as high as their publicly traded relatives. This can be a huge miscalculation, and a humbling experience when the time does come to sell. A private company is only worth what someone else is willing to pay for it. Until then it isn’t worth much more than the hard assets it owns.

Even worse is the business owner that basically takes out only a salary and has no real EBITDA to sell. Even at a multiple of five their business is worth almost nothing but they think it’s worth a million dollars. Then they don’t save anything else because the business is worth so much.

Great post Sam, a good lesson for everyone who has dreams of that home run investment. I invested in a Mason duck decoy from the 1800’s after seeing them online for thousands of dollars, the decoy I bought appraised for about what I paid for it. I’m glad I own it, true folk art.

Interesting article and I think we are all guilty of it, I think what’s the most challenging is the fact that home prices fluctuate all the time and we are most likely over or under estimating the value and a lot of people use that as part of their net worth calculations.

I wonder how many of these private equity investments you’ve made have resulted in a total loss of investment, since you say 90% of them do? Sometimes it’s nice to hear about the losing bets too to make me think not everyone around me is raking it in haha.

My biggest losing bet was my Lake Tahoe vacation property that proceeded to decline by 30% – 40% within three years of purchase. It’s supposedly almost back to even 10 years later, but that was a long road to hoe.

I’ve lost $35,000 in one stock before, and $70,000 in another stock. These losses are one of the reasons why I’ve dialed down the risk over the years.

I have one other private equity single company investment that is still surviving. Then I’ve got $250,000 with the RealtyShares Domestic Marketplace Fund and $150,000 with a Venture Debt Fund. I’m pretty much staying away from single company private investments.

The most I’d comfortably be willing to invest is $25,000 as well. So it is kinda odd that I was willing to invest $60,000, 10 years ago. It shows my immaturity and stupidity of not properly assessing risk.

Here’s a related post about my worst investment: A Vacation Property Buying Rule To Follow

Great post, Sam. It’s important to understand one’s finances. With all of the available financial technology apps these days, it’s much more transparent and easier to know what one has in their financial life.

And if there’s so many things to keep track of, maybe it’s time to reduce it and keep it simple to just a few.

I think with where financial technology is nowadays, it’s a bit easier to keep track of multiple accounts across different companies.

I think that doing your best to simply your investments can be a big help. Maybe that means going through your holdings and seeing which ones you can get rid of or consolidate. For instance, does one really need 10 index funds when 5 or 6 will suffice?

Anyways, enjoy your new-found money!!

I just had something like this on an embarrassingly small scale. In terms of overestimating the value of collectibles, I had been collecting and separating silver dimes, quarters, and half dollars and copper pennies. Of course, the pre-1982 copper pennies are the only “old metal” coins you can find. Turns out, the copper penny is only worth 1.7 cents. I didn’t think they’d be a $20 value or anything, but man was I disappointed.

As for net worth, I’ve gotta pay more attention to mine. I’ve always been more of an income investor than anything else, so net worth isn’t something I’m ever too concerned with. But some investments I have I need to remind myself exist. Like a mutual fund I have with my bank (FKINX). It’s a good chunk of change that I keep forgetting exists. I might just use that to buy a property.

Congrats on your private equity success. For the time being, I think I will be avoiding that market. Though the huge potentials do make it tempting.

Sincerely,

ARB–Angry Retail Banker

Interesting perspective on the dangers of distorting your finances. When I think about the blunders I have made when it comes to dealing with my finances I would say the bulk of them come down to an area you expanded on. EGO.

Sometimes when your keep reminding you got a certain return, or invested a certain amount, or have this much saved you really start to believe it. It is as if the thoughts of success mask over the truth.

It is easy to try and think you can take your ego out of your finances, but the truth is they are some of the most personal decisions you make and every decision or avoidance of a decision comes back to how it would affect your reputation and how you may look to the people you are trying to impress/protect/provide in this world.

Even more, you can have all the correct data in the world but if you focus on bogus statistics ex. phony growth rates with no conversations you will never be successful.

Sam, why do you think you distorted that extra 15k? Interested to find out.

Not sure beyond all the reasons I mentioned in this post.

The value of simplicity: less distortion. My wife and I have several retirement accounts, most consolidated under one institution. There is one outlier which was created many years ago through a different bank. The bank then gave custody (sorry, I don’t know the exact term) to yet another bank. End result, I haven’t gotten an update on its status in over a year!

Since I’ve been using this 2 week vacation to fix all my “projects” (budget, small painting jobs, and this errant distortion), this account will be brought back in the fold! It’s a minor inefficiency, but hopefully this will prevent a more significant distortion in the future. Thanks for the timely warning.

Congrats on your Bulldog investment! That must have been a nice surprise and also puzzling in regards to your initial investment amount.

I have a bad memory lately so I have to be quite careful with financial distortion myself. This post is a fantastic reminder!

I also have witnessed first hand how family can suffer from financial distortion when it comes to heirlooms. When my grandmother passed, my aunts had so many ideas engrained in their heads from their parents’ stories about how much certain collectibles and jewelry should be worth that had been passed down. They were in for a huge wakeup call when they tried to actually sell some of them and were offered so much less.

The heirlooms I’ve received so far are worth a lot in terms of sentimental value but not so much at all in investment value so I don’t include them in my net worth calculations.

Interesting topic…. so I have the oppose it problem. I am notorious for being conservative and not including things in my net worth. For example, even though we have over 200k of home equity, I include it as a “note” on our net worth spreadsheet. Even the calculation is conservative, which is estimated home value- 7% selling and closing costs- money owed on a tax credit received in 2008 for buying the house.

How many people actually deduct closing costs on their home equity calculations? Same thing for my wife’s former defined contribution pension plan. I didn’t know what the value was, so I never included it in our net worth. It turns out when she retired/stayed at home, it was worth about $50,000.

Honestly, I can’t even picture making a net worth mistake on the negative side, but we are all different.

Hah! Thanks for the tip about including the pension plan. I’ve always been focused on the final formula and ignored how much is actually in there as a contribution. Thanks! Mint now thinks I’m 30k richer. :)

I agree with your thoughts above. Financial distortion can a be huge problem if it goes unnoticed for an extended period of time. My husband and I track our finances very closely and, after reading some of your previous posts, are considering using Personal Capital to make life easier.

While we haven’t exposed ourselves to private equity, my husband has been investing in banks that convert from mutual institutions to stock institutions. I plan to write a blog post about it in the future, but it is similar to the Bulldog experience you discussed above. In short, we open certificates of deposits (normally 1 or 2 year term) which pay a small amount of interest on the deposited capital. When and if that mutual institution decides to convert to a public company the deposit holders of record have the right to purchase the IPO shares before they are sold to the public. Historical returns on the IPOs shares have been good, averaging about 20-25% in the first few days. I guess the main benefit compared to your Bulldog example is that your initial investment in the CD’s can be lower (we typically invest $1,000 to $5,000 depending on the size of the mutual bank). That investment then gives the account holder the right to buy a certain amount of shares, at which time the account holder can then decide to invest a more significant amount of money, $200-500k in the offering itself.

Congratulations on your written off investment rising from the dead.

I think you are spot on about our egos inflating/deflating the value of our investments. Luckily in these days of apps and linked accounts, anything that links is likely to be safe from the vagaries of our egos and the weaknesses of our memories.

2 areas I see for possible distortion:

1. Home and Rental Property Values: it’s easy to link your properties on Personal Capital to Zillow and get the estimated value. But this number doesn’t account for selling cost and the repair costs you will likely incur before selling etc . As you said, human nature likes to inflate the good and I realize I still use the Zillow estimate in calculating my Net Worth.

2. Accounts that you manually link on PC: I have a small GroundFloor (crowd source real estate flips) that doesn’t link with PC. Fortunately my Heartland REIT I have with Fundrise does link. **I’m glad to see your Heartland thesis came out about a month after I invested my first time with Fundrise.

https://www.financialsamurai.com/the-samurai-mask-an-interview-with-the-ceo-of-bulldog-gin/

High flyer!

I am pretty meticulous at tracking my asset value. I also have a fairly easily trackable set of assets, I’m not investing in Private equity so most of my assets are marked to market regularly. That being said we all have one big asset that falls into this category, our houses.

This is a big reason I don’t use my house in my net worth calculation, besides the fact that it does not produce income and I cant sell it to feed my family. Is the value what I paid for it? The Assessment? The comps? What Zillow says? There is no day to day market feedback on the price of my house. As such like your investment it is a source of potential financial distortion. I suspect rental properties have the same issue beyond the income aspect.

@FullTimeFinance

I just use the amount I actually invested in real estate when tracking my net worth. Even though there has been considerable appreciation, until it is real (I sell) I don’t include it in my net worth calculation.

We had a similar situation in my family. My grandparents were antiique furniture dealers and collectors, finishing their house with English and New England antiques from the 18th & 19th century.

When they eventually decided to close their house and move to a retirement community, expectations were high as to the value of many of the pieces. Disappointment was even higher when the auction happened and many of the larger items went for 20-30% lower than expected.

I think the distortion came from the insurance inventory. When it comes to assessments for insurance purposes, most assessors will place the value slightly higher than market, or at least at the high end of the possible value.

Seeing these “insurance” values collide with reality was a shock.

I found people value things for what they paid for them or what they insure them for forgetting there is a big difference between retail replacement (e.g. going out and actually purchasing another 18th century piece at retail prices) and what people will pay at an auction for such a piece which they are often hoping to sell at retail. You see it on antiques roadshow on PBS all the time, the auction estimate is usually 60-70% of the insurance estimate.

I also have a sibling who honestly thinks anything he bought, and has failed to maintained for many years, is still worth mint condition costs. Think he got it from my mother who assumed anything that was old was worth a lot of money.

I’m pretty meticulous when it comes to my finances, although as I continue to add more financial accounts I can see how mistakes could more easily be made. That’s why I love using Personal Capital. So much easier to have them track all your accounts in one place.

As for private equity, I’m likely going to have an opportunity to invest in my company’s stock in the next month or so. I’m not going to invest a large portion of my wealth in it as I understand the risks and lack of liquidity. But we have a great company that is primed to grow in the coming years.

Wow 5.5x is quite the payoff and even if it ‘s 2.5x that’s still a pretty nice return on something that you had written off. I’d look at it as money found and enjoy the return of your capital :)

2.5X over 10 years is 9.6% annually.

Exactly. Not an amazing return based on the liquidity and risk I was taking. However, it does beat the ~60% return the S&P 500 has provided since early 2007 given the markets crashed.

Now if I compare to the bottom of the S&P 500 on Feb 1, 2009, the S&P 500 returned about 222% + dividends, so the returns are more comparable.

But if I had invested in the down round during the crisis, my Bulldog investment might have been 10X optically, and closer to 5-6X when all is said and done.

This investment kinda saved me I guess, b/c once again, I bought at the wrong time (before the crash). The other purchase was my Lake Tahoe vacation property.