I'm bullish on real estate for the next several years. With multiple efficacious vaccines, high inflation, continued low and negative real mortgage rates, plenty of stimulus, work from home here to stay, and the desire to own income-producing assets, real estate has a bright future. Here is the latest Fundrise overview.

Fundrise is a leading real estate crowdfunding platform for unaccredited and accredited investors alike. Founded in 2012, Fundrise pioneered the eREIT asset, a private diversified real estate investment trust that enables everyday people to invest in private real estate once reserved for ultra-high net worth individuals or institutions.

As of 2022, Fundrise manages over $3.2 billion in equity and has over 400,000 active investors on its platform. This is an acceleration of assets under management and investors versus 2021. Back in 1Q2021, Fundrise managed $1 billion and had 150,000 investors.

For those of you looking to diversify into real estate passively or increase your real estate exposure, below is an in-depth interview I did with Ben Miller, Founder and CEO of Fundrise. I also had a one-hour video conference call with Ben in 2022 to provide us the latest Fundrise overview.

Not only do I appreciate the innovation that has come out of Fundrise since the company began, I also appreciate their investment analysis and annual market outlook. Their focus on market fundamentals is something I really appreciate. As you'll learn further in this Fundrise overview, their investment philosophy is also aligned with my own.

Fundrise Overview: Interview With Ben Miller, Founder Of Fundrise

Let's go over why Fundrise is one of the leading real estate platforms with over $7 billion in total assets transaction value to date. In addition, they've helped investors earn over $226 million in net dividends and that number continues to rise.

Now let me share with you my detailed Q&A with Ben Miller. This detailed Fundrise overview will help you understand why they stand out from the competition and where they're headed.

What is Fundrise’s value proposition? What are the big ideas behind your platform?

Everything starts with our mission — to build a better financial system for the individual investor — and then flows from there.

In our opinion, very few financial services companies or investment managers actually focus on doing right by the individual (with the exception of maybe Vanguard). This has been especially true in the world of private equity and real estate investing.

From the beginning, our goal has been to take really great investments, ones that have traditionally only been available to ultra high-net worth investors, and make them available to everyone through a low-cost and extremely user friendly platform.

It’s this combination of a historically strong investment asset, i.e. private real estate, with a new direct-to-consumer, online approach that really makes us unique. Until we started the company no one had ever really done that before. And a lot of the existing industry insiders actually told us they thought it was a bad idea.

It’s not entirely surprising that they felt that way. For old school fund managers, accustomed to working with only a handful of institutions that would be investing hundreds of millions — or even billions — of dollars at a time, the notion of having individuals invest $1,000 or even $100,000 at a time seemed ludicrous. They couldn’t appreciate the scale that could be achieved by leveraging technology.

It was only recently once we got large enough to the point that we were raising and investing amounts similar to what they were used to that the traditional players actually recognized what was going on, and how much potential there is in our space.

Managing Over $3.2 Billion Of Equity – Fundrise Overview

Today, we manage more than $3.2 billion of equity. With all of that having been invested by our over 371,000 active individual investors. And it’s this scale combined with our technology driven vertical integration that creates the benefit for our investors.

By cutting out layers of middlemen who otherwise typically sit between the investor and the actual real estate they’re investing in, we’re able to reduce overall costs. We pass these cost savings on to our investors. We charge much lower fees relative to other private real estate managers.

The result is the potential for higher risk-adjusted returns, which, again, gets back to our mission of empowering the individual. Here's a good chart that provides a Fundrise overview of how our business works.

Can you tell me what differentiates Fundrise from other real estate crowdfunding platforms?

Although we were one of the first groups to pioneer the online real estate crowdfunding model, I think it’s helpful for prospective investors to understand that we no longer operate under the structure that most people commonly think of when they hear “crowdfunding.”

That is to say, we do not operate a deal-by-deal, best-efforts fundraising model. Meaning, our goal is not to post individual deals and hope that enough investors will come along and opt into investing, so that the deal secures the capital it needs. Today, our model is much more sophisticated.

Although early crowdfunding innovations were important in continuing to open up access to more individuals, in our opinion, the nature of that model creates inherent limitations when it comes to sourcing the highest quality investment opportunities.

Instead, we are today — to our knowledge — the only investment platform that allows individuals (regardless of net worth) to invest directly (not through a broker or other intermediary) into a diversified pool (our eREITs and other investment vehicles) of assets that are institutional quality in nature (of a certain, size, scale, partnership quality, and risk/return profile).

Our goal was always to give our investors access to the type of institutional quality assets that private equity funds would traditionally invest in. We’ve worked hard over the last five years to accomplish the successive steps and evolutions that have gotten us to this point.

Today, investing with Fundrise is much more akin to investing in Blackstone’s BREIT than another real estate crowdfunding platform. With the exception that there are no brokers or other intermediaries. And thanks to our technology and performance tracking tools, our overall fee structure is significantly lower.

What is your take on real estate as an asset class as we navigate out of COVID-19?

Like most assets right now, the answer is, “It depends.” We generally feel that real estate as an investment is well positioned to weather the storm. We also see certain property types emerging as winners while others likely will struggle for the foreseeable future.

Specifically, hotels, traditional retail, large urban office buildings, and luxury urban apartments all have seen fairly significant negative impacts as a result of the pandemic.

Whereas e-commerce focused industrial assets, suburban housing, and relatively affordable apartments in the south and southeast, generally speaking, have fared much better.

As you read this Fundrise overview, we want to be clear that part of our core investment strategy is to always stick to fundamentals. Meaning, we aim to protect the upside while minimizing the downside. Having lived through three financial crises myself, I know that it’s always only a matter of time before the next one occurs. It’s naive at best and negligent at worst to believe otherwise.

One of the great benefits of investing in alternatives is the opportunity to anchor your portfolio to something stable. In this way, you’re ready when the really savage storm hits.

Clear Communication

We actively communicate this to our investors often. For example, here is one of our investor letters from 2018. What you should expect from Fundrise during the next financial crisis.

Fast forward two years, and in April 2020 we wrote another investor letter where we detailed how our years of planning were being tested and holding up. In the letter, we showed the way we’d designed our portfolios to serve as a fortress for our investors.

We also included a detailed stress test. Further, we broke down the financials and outlook of every property in our portfolio. This was a way to help our investors see, with increased transparency, the ways their portfolios had been carefully architected to withstand the worst.

Outperformance During Volatile Times – Fundrise Overview

Now, looking back, our portfolios vastly outperformed our very conservative stress test assumptions. Reviewing our Fundrise returns performance shows just how well positioned we were.

It’s our belief that private real estate assets — meaning investments that are actual, physical buildings like what you can access through Fundrise — will tend to provide more stable returns than stocks or publicly traded REITs.

It was interesting to watch our platform performance in 2020, in the midst of the pandemic. Fundrise’s performance was significantly stronger than the public markets. And it was also significantly less volatile.

Fundrise Overview Performance Analysis

Fundrise tends to outperform when the stock market goes through volatility. Why? Investors seek the shelter of real estate to navigate through more difficult times.

Therefore, if you expect another potential correction in the stock market, Fundrise offers an effective way to smooth out volatility. Stock valuations are extremely high in 2022.

Over time, the impacts of the government's response to the crisis will also become increasingly relevant on long-term investment performance. The Federal Reserve has undertaken an unprecedented level of financial stimulus in an effort to prevent a complete economic meltdown.

And while that has been critical in the short term, it’s almost certain to have wide ranging and dramatic implications for markets and investment assets over the next few years. The behavior of the stock market since the onset of the pandemic is just one manifestation of this.

For us, physical real estate — a hard income producing asset — is a valuable buffer to both the potential for inflationary and deflationary pressures that may emerge and skew markets in unpredictable ways.

Overview Fundrise Platform Performance 2014-2022

2014 Through 2020

Below shows the historical Fundrise platform portfolio returns from 2014 through 2020 compared to the Vanguard Total Stock Market ETF and the Vanguard Real Estate ETF. Notice the stability of returns during difficult stock market years.

Below is Fundrise's 2020 weighted average returns by objective and age of account.

Fundrise 2021 Investment Performance

With 2021 in the books, here is Fundrise's 3Q 2021 investment performance and 2021 overall performance. It was the best performing quarter of the year with some funds up double digits in just one quarter. 2021 was also the best year for performance in Fundrise's history since 2012.

Annualizing the figures blow away the performance of the average S&P 500 return of 10%. That said, 3Q 2021 was likely an outlier and growth rates should slow down.

Below are Fundrise's 2021 returns by investment plan objective. An overall 22.99% return is strong. Further, the flagship Interval Fund was up 28%, and up 40% annualized.

Fundrise Returns 2022

Year-to-date through Q3 2022, Fundrise has returned 5.4% to all clients versus -28.34% for Public REITs and -23.87% for Public Stocks.

Take a look at the chart below showing Fundrise returns for 2022 through Q3. Look at the strength of Fundrise's performance compared to public stocks and REITs during stock bear markets.

What is Fundrise’s investment strategy? Are there any regions that you specialize in?

Generally speaking, we start by looking at broader macroeconomic trends and how those then translate into physical real estate. We try to answer the questions, “What will be the primary economic drivers over the next few decades? How will they impact demand or lack of demand for certain types of properties?”

We then follow fundamental value investing principles. We look to invest in assets at a basis that is typically less than what is considered replacement cost. In other words, if we are looking at purchasing an apartment building that already exists. Then we will look at what it would cost to build a similar apartment building today in a similar location.

Let’s say it costs $100 million to build that building today. We might look to buy the existing building for $85-$90 million. This way, our basis (what we paid) is less than replacement cost (what it would cost to build the same). This helps protect us against the construction of many new apartments. Which would have difficulty renting at a lower cost than the property that we are purchasing.

A good example of these two ideas at play is our focus on acquiring and renovating affordably priced apartment communities through the sun-belt region of the country (aka the smile states). The article provides a great Fundrise overview of our investment strategy.

These areas have experienced — and are projected to continue to experience — greater than average population and economic growth as a result of their mild weather, more affordably priced housing, and relatively strong job markets.

These factors mean that the demand for reasonably priced apartments in many of these areas is outpacing both the existing supply and the new supply being built. Thus, our assets in these areas have seen stable occupancy rates and strong rent growth.

What specific types of assets do you invest in?

Similar to how we develop our strategies around what regions to target, the asset types that we aim to invest in are largely driven by our long-term macro trend philosophy.

A large portion of our portfolio has primarily been allocated to cash-flowing apartment communities. However, we’ve continued to evolve our thinking to take into consideration some of the impacts that we have seen from COVID-19.

A great example is our increased focus on last-mile, e-commerce-related industrial assets. These properties specifically serve the function of providing retailers and third-party logistics companies with the ability to make large volumes of deliveries to highly populated metro areas in very short time windows.

Of course, this whole market space has been growing rapidly for several years. However, the recent surge in online shopping due to the pandemic has only increased the already strong demand for these assets. This creates an opportunity that we anticipate will continue to grow.

Before we acquire any property and add to one of our funds, our team goes through a rigorous underwriting process. The results are a 1-2% acceptance rate of the many, many potential deals that cross our desks.

If you look at the asset updates we share with investors — we aim to send extensive updates about individual projects on a regular basis — you’ll see we specifically detail why we think an asset has a strong business plan, and we talk about why we think it has considerable security.

For example, our debt deals are structured in such a way that we are inherently insulated from short-term economic volatility, simply by the nature of how that sort of loan functions.

Why is Fundrise different from investing in a traditional public REIT?

We wrote an in-depth article on this topic to help potential investors understand the difference between investing with us versus investing in something like a Vanguard REIT index. The short answer is that Fundrise investors are investing directly in a primary issuance of non-traded private real estate.

With a traditional public REIT, an investor is buying shares in a secondary trade from another investor. This is done typically through a broker, in a publicly traded company.

This difference means a few things. First, by buying direct in a primary issuance, investors are essentially cutting out a series of middlemen and getting into the investment without all the associated costs and fees as a result. Imagine the difference in buying a new car direct from the factory versus buying a new car from a second hand dealer.

Second, because Fundrise investments are private and non-traded, the returns tend to be less correlated to the stock market. As a result, the returns are less volatile. That means performance is driven more by the actual operations of the underlying physical assets than market sentiment. Markets can be fickle and inconsistent.

Our assets’ stability can be seen in the historical returns of our platform over the past 5+ years.

What type of investor will reap the most benefit investing with Fundrise?

The simple answer is really any investor who is looking to diversify beyond the public markets. Investors who are comfortable with the long-term, inherently illiquid nature of real estate investing. And what’s great about Fundrise is that regardless of whether you're an investor with $5,000 or $5,000,000 we make that opportunity available to you.

We find that a lot of our investors come to us specifically because they want to own real estate. They understand the potential that it has to produce more stable returns over the long-term. At the same time, they don’t want to deal with the expense and hassle of being a landlord themselves.

Most investors get somewhat contradictory advice. On one hand, they’re instructed to buy and hold investments for decades, until they retire. It's wise to set those investment horizons early. But on the other hand, they’re pushed toward assets that have built-in, expensive liquidity premiums in order to provide daily trading, like stocks.

That doesn’t make sense to us.

Any institution run by professional investment managers that has a long-term investment horizon is going to have a significant portion — if not a majority of their investments in illiquid private assets. It was only a matter of time before technology made that same sort of investment strategy available to anyone in a low-cost, low-fee model.

If an investor had $10K to invest, how do you recommend they get started on Fundrise? What will the experience be like in the first weeks on the platform?

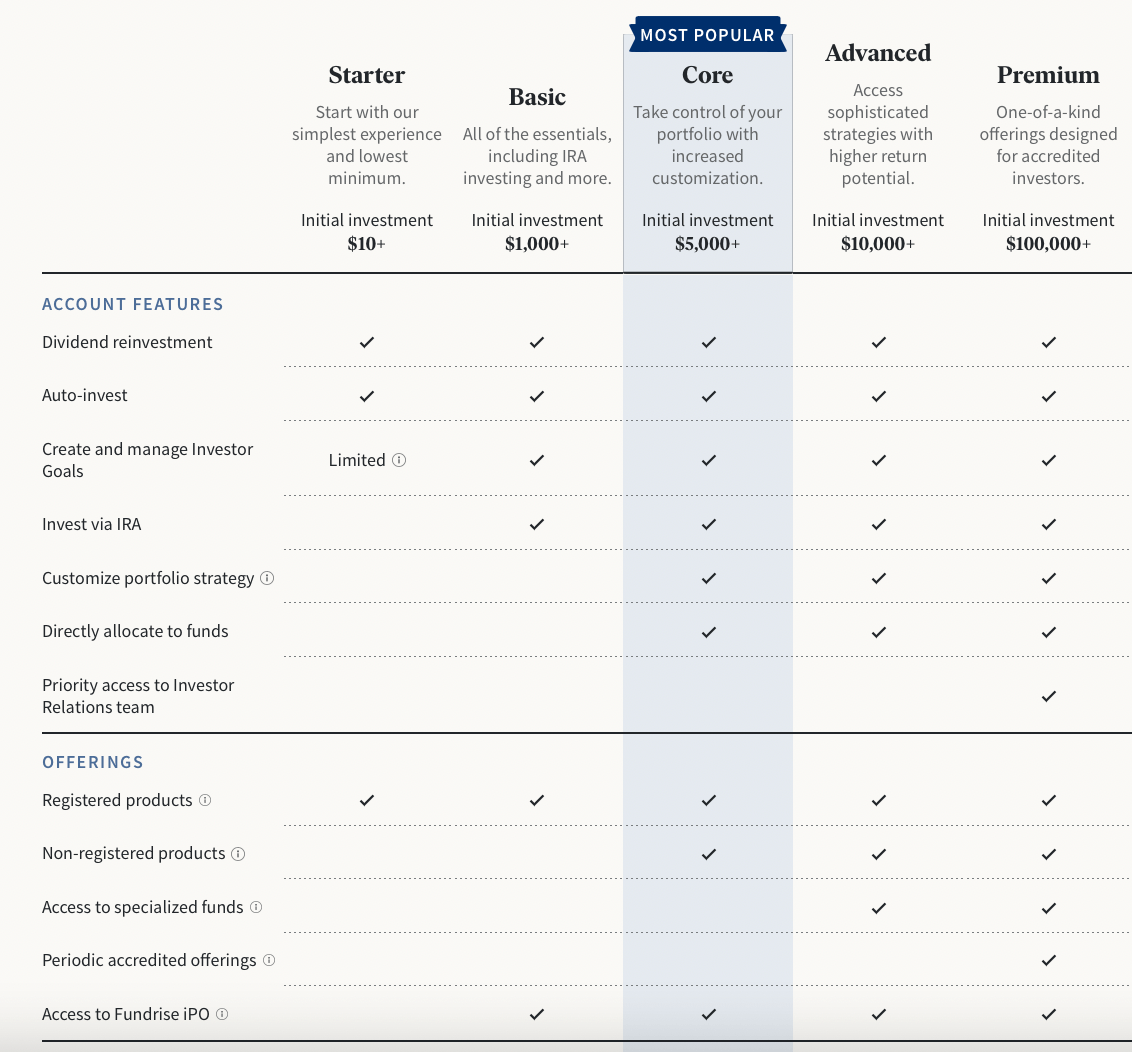

Our platform is specifically designed to handle this question. When you first join Fundrise, you’ll be asked a few questions about your investment goals. Then you’ll select an account type and investment plan that best aligns with meeting those goals over your specific investment horizon.

Our system then allocates your investment across a range of our existing funds. We automatically create a portfolio that will continue to diversify over time. It literally takes a matter of minutes to sign up. Once you join you’ll immediately be able to see every asset that you're invested in.

As we acquire new assets and add them to your portfolio, you’ll receive frequent updates. These updates keep you apprised of how your account is evolving, how new properties are driving growth, and how your portfolio is expanding across the country.

The same is true of payoffs and progress reports. Transparency is ultimately the core of our product experience. We give investors a front row seat to the dynamic nature of investing in real estate properties.

Unlike most other investments you hold, with Fundrise you’ll actually know what you are invested in. We strive to keep you updated as to how that investment is performing.

Fundrise has now existed since 2012. What has historical performance looked like for investors and how does that compare to similar investment opportunities?

We publish all our historical performance data here on the website for anyone to review. As I mentioned earlier, what we’ve been most proud of has been the consistency of our performance over time.

Fundrise is not meant to be a get rich quick investment. Our goal isn’t to recreate the adrenaline rush of gambling or trading stocks.

Some years we have delivered higher returns than the stock market and other years we’ve been lower. However, if you overlay our performance on public market analogues, the fact that these are truly different types of investments becomes quite clear. As does the value of long-term consistency, which we aim to provide.

Ultimately, we believe that our performance over this time period is likely to have been as strong if not stronger than any other asset class that is publicly available to our investors base in any low-fee, passive manner.

Our hope is that as we continue to grow, the technology driven nature of our business model means that we continue to become more and more efficient. In turn, this translates to stronger and stronger returns.

Bright Future In Real Estate Investing

Thanks to Ben for sharing his thoughts on Fundrise's value proposition and market outlook. Hopefully this Fundrise overview has given you more confidence in the platform.

2022 has so far been a terrible year for both stocks and bonds. On the bright side, real estate has outperformed stocks by over 27%. I’ve been buying I bonds, Treasuries, dollar-cost averaging the S&P 500 on the way down, and accumulating cash.

What I’ve been enjoying the most, however, is investing in real estate funds focused on the Sunbelt through Fundrise. Although prices and rents are cooling, Sunbelt real estate should be a long-term beneficiary of demographic trends, technology, and work-from-home.

I'm focused on buying assets that can generate consistent cash flow. Further, I'm also focused on reducing portfolio volatility and keeping the gains I've made in stocks so far. The last thing I want to do is go through another March 2020 decline. Therefore, I'm overweight real estate going forward.

You can sign up and explore Fundrise for free here.

Does Fundrise offer tax benefits like investing in short-term rentals?

i.e. Will investing in Fundrise reduce my taxes?

I asked my accountant and she said no, but it seems like the real answer is “it depends.”

I saw there were some comments on this already but wanted to ask a slightly different question. I understand the overall concern with redemption periods regarding Fundrise, but I think the reality is, most funds (real estate and/or VC) have similar redemption restrictions. I don’t think these are intended to be punitive but rather to avoid a “run on the bank” if you will. Disregarding the redemption aspect of Fundrise, what’s your opinion on the dividend reinvesting? The reason for the question is it appears quite a bit more challenging to reinvest the dividends quickly enough. Just due to the nature of real estate, you may reinvest but the timing of the capital being deploy may actually take some time. At this point, my holdings in Fundrise are small enough that the dividends aren’t really that meaningful so I’m inclined to just reinvest until it grows to a level I’m comfortable with, but what have you been doing / what do you recommend? Thoughts?

Great articles & podcasts! I recently invested in Fundrise’s long-term growth portfolio (80% interval fund & 20% growth ereit vii). I know you are bullish on real estate for the next 3 years. As of now, I plan to invest 5% of net worth into Fundrise. Would you recommend investing the entire lump sum all at once? If not, over what time period would you dollar cost average? Thank you!

Since the NAV are updated on a quarterly basis, I would invest as a lump sum. That basically what I did. I did not stick to their allocation but picked the funds I wanted to be invested in.

Or if you are an accredited investor, I would consider other platforms that give access to individual deals.

Thanks for your response Christophe! I eventually saw the historical NAVs and agree lump sum is probably the way to go.

Sam – considering investing in Fundrise through my LLC, any thoughts on using an LLC instead of investing as an individual?

I started to invest in various eFund since the beginning of last year. I invested in a few months and my portfolio is across ten funds. Fundrise has sent me a statement of my annual rate. I am wondering the annual return rate. For example, I might have invested Fund A, B and C in May; D, E, and F in July. How was the annual rate calculated?

Sam, been reading a lot from your site lately. Thanks for publishing! I was at W&M around same time in late ‘90s, in grad school. Go Tribe! There may be some content I’ve missed out there around my question….If investor is accredited, how should they think about allocation mix to a non-accredited crowdfunded path like Fundrise vs. accredited options/allocation? And on the accredited side, what is your guidance? Feels like on average, the extra fees on accredited side wipe out value of the targeted strategies and investors barely getting compensated for that additional risk and due diligence time. Since you are accredited and choose Fundrise, that says something but curious on how you evaluate and re-evaluate vs. accredited paths.

Hey Sam,

Do you recommend investing the emergency fund into Fundrise and liquidating if needed? Also, I see your recommendation is to invest 20% of the after tax savings into a passive income source but is that after filling up the emergency fund?

Thank you

I am not Sam but allow me to answer. Be careful with fundraise, They return from 97 to 100 of your portfolio for early withdrawal if you don’t leave your money there for more than 5 years, also, in the disclosure documents say that they might not be able to have liquidity to give you your money. Read everything very carefully before committing any money and for sure NOT your emergency fund… I have been with them since 2017. Most of what they say is true (low fees, stability, good returns) but consider investing in VNQ instead, you would get similar returns with 100% liquidity.

Great insights on the real estate market. Taking advantage of the markets currently and investing in real estate can hedge risks from stock market volatility.

Fundrise investor since 2017, happy with my returns! No concerns with the lock-up period. As you said, I actually like being ‘forced’ to keep the funds working long-term. It also helps with the lack of correlation with the stock market and public REITs.

Three questions about the future of Fundrise:

1) With the Interval Fund there will be increased liquidity and a lack of targeting to objective (growth / income / balanced). One of the main benefits of Fundrise is a lack of correlation with liquid REITs. Are you concerned this will increase correlation with publicly traded REITs?

2) Fundrise has recently offered private placements for a number of its eREITs, only available for accredited investors. That, in combination with the introduction of the large $1 billion Interval Fund, feel like steps towards favoring institutional investors. This happened with P2P lenders, where firms like Lending Club got tired of small-time investors and moved to institutional (becoming, arguably, the very bank they sought to differentiate themselves from!). Do you have any concerns about something like this happening with Fundrise?

3) Related to the other two questions, with the private placements and Interval Fund, a lot of investments will be allocated away from other eREITs. Previously, once Growth eREIT V was full, Growth eREIT VI was offered. All indications I doubt that a Growth eREIT VII is coming anytime soon given the allocation of new funds to private placements and to the Interval Fund. I’m not certain that’s a bad thing, but the lack of communication on the shifting styles makes me a bit apprehensive. Do you think Fundrise will continue to offer new eREITs, or focus all incoming funds into the Interval Fund and drop their focus on investment objectives?

My apprehension/suspicions are partly fueled by Fundrise’s treatment of the eFunds this year. In hindsight, it is clear that they planned on wrapped up the DC eFund sometime mid-2019 when they stopped acquiring assets. But they never told investors. And even after the eFund merger they never really explained what happened. Poor performance (0% return for the DC eFund) doesn’t concern me, but the delayed and inadequate communication concerns me a bit more.

Still actively investing in Fundrise, but these recent developments have left me wondering!

Howdy!

Spoke to Fundrise and here are their thoughts to your questions:

Three questions about the future of Fundrise:

1) With the Interval Fund there will be increased liquidity and a lack of targeting to objective (growth / income / balanced). One of the main benefits of Fundrise is a lack of correlation with liquid REITs. Are you concerned this will increase correlation with publicly traded REITs?

A: In short, no. The Interval Fund, like our other REITs, is still a non-traded fund (meaning it is not listed on an exchange). And while it does intend to hold a small portion of its assets in liquid real estate securities, we expect the majority of its assets to be invested in long-term illiquid private real estate assets. As a result, we expect that similar to our existing eREITs it will have relatively low correlation to the broader stock market as potential returns will be driven primarily by the underlying fundamentals of the assets actual performance.

The Interval Fund intends to pursue an investment strategy similar to our balanced objective and as a result of its potential size, is intended to provide an index-like option for investors looking to gain broad exposure to an overall portfolio of Fundrise assets. We will continue to provide investors with the ability to tailor their individual portfolio to target specific return objectives, much like some investors may choose to hold both some broad index funds as well as allocate a portion of their portfolio to specific stocks or industries.

In other words, we believe the Interval Fund will provide many of the unique aspects that have made our eREITs attractive to investors while also benefiting from larger overall scale, creating greater diversification and lower relative operating costs.

2) Fundrise has recently offered private placements for a number of its eREITs, only available for accredited investors. That, in combination with the introduction of the large $1 billion Interval Fund, feel like steps towards favoring institutional investors. This happened with P2P lenders, where firms like Lending Club got tired of small-time investors and moved to institutional (becoming, arguably, the very bank they sought to differentiate themselves from!). Do you have any concerns about something like this happening with Fundrise?

A: The short answer again is no. We started Fundrise with the mission of building a better financial system by empowering individual investors. Today, nearly all of our roughly $1.3B of assets under management comes from 150K+ individuals, in many cases investing as little as $500 dollars. We firmly believe that individual investors will continue to be the core of our business and the primary constituency for which we build our products.

To get more technical, as you are likely familiar, the majority of our eREIT and other funds are offered under what is known as the Regulation A exemption. This exemption is what allows us to make our eREITs available to individual investors regardless of their net worth but also comes with a restriction of no more than $50 million in total fundraising within a twelve month period. As a result, we will at times continue to offer investments in these eREITs via Regulation D, which does not have the same maximum offering limits but is restricted to accredited investors.

One of the great benefits of the Interval Fund is that it has no restrictions on the maximum amount that it can offer and as a result can achieve superior efficiency through economies of scale.

The Interval Fund with its low minimums, low fees, and zero penalties on quarterly redemptions was specifically designed for the benefit of our individual investors.

3) Related to the other two questions, with the private placements and Interval Fund, a lot of investments will be allocated away from other eREITs. Previously, once Growth eREIT V was full, Growth eREIT VI was offered. All indications I doubt that a Growth eREIT VII is coming anytime soon given the allocation of new funds to private placements and to the Interval Fund. I’m not certain that’s a bad thing, but the lack of communication on the shifting styles makes me a bit apprehensive. Do you think Fundrise will continue to offer new eREITs, or focus all incoming funds into the Interval Fund and drop their focus on investment objectives?

My apprehension/suspicions are partly fueled by Fundrise’s treatment of the eFunds this year. In hindsight, it is clear that they planned on wrapped up the DC eFund sometime mid-2019 when they stopped acquiring assets. But they never told investors. And even after the eFund merger they never really explained what happened. Poor performance (0% return for the DC eFund) doesn’t concern me, but the delayed and inadequate communication concerns me a bit more.

Still actively investing in Fundrise, but these recent developments have left me wondering!

A: As mentioned previously, we do anticipate that the Interval Fund with its aim for a broad and diversified portfolio along with its investor friendly redemption structure, will become a core part of our plan allocations. We feel that it may be particularly well suited for investors who are newer to private real estate investing or who may be less certain in their ability to manage periods where liquidity is not available.

That said, we will continue to offer our same three investment objectives (income, balanced, growth) with an ability for investors at certain account levels to further personalize and optimize their portfolio towards eREITs and Funds tailored to their specific return profile. Our goal being to continue to broaden the offerings we provide to suit an ever widening range of investors on the platform.

In regards to the eFund merger, while we did disclose to investors that it was under consideration as early as July, we do appreciate the feedback around providing further updates.

Thanks for the responses!

Q#1 – Interval Fund & Diversification: I generally agree. I remain a bit apprehensive about this new fund for myself, but I understand the logic of it and its appeal to certain investors. The continuation of other less-liquid funds (see #3 below) eliminates any remaining concerns for me!

Q#2 – Accredited Investors: Yep, this offering to accredited investors looks like a net positive to all investors!

Q#3 – Strategy Focuses & the Interval Fund: Understood. And answered today, with the release of the Growth eREIT VII and Balanced eREIT II. The Interval Fund has not replaced these objective-focused smaller funds.

On the eFund merger — I was well aware of the that by July 2020. But it looks like Fundrise had planned its divestment from Washington DC early in 2019. I figured this out by June 2019 after doing my due diligence. After tracking down the individual properties I found that the behavior of the eFund was at clear odds with the investment objective. Properties stated as held-for-sale for 9-12 months had been sitting for 2+ years and no properties were being acquired (last acquisition January 2019). Simply put, the Washington DC eFund apparently stopped doing what it set out to do long before the merger. The only comments about this came nearly two years later, stating that the merger was occurring to improve efficiencies. Not the end of the world, but this commination lapse eroded some of my trust in Fundrise.

But to repeat my previous comment: I’m still an investor and overall happy with both my returns and the diversification this platform offers.

Is there a reason why you currently own assets through Fundrise, but not any others through the other crowdfunding platforms you’ve written about (e.g.: FarmTogether, Vinovest, Masterworks, Angellist, etc.)? You just have a preference for real estate because that’s what you know best and understand?

I do.

VTI has made a great comeback! Definitely not a bad alternative but the lockup periods for your money is what gets me. Same with p2p lending. Either way.. do whatever works for you. I like the market with an 100% equity position

In a bull market, we are all investment geniuses :)

I like private real estate investments exactly during times of volatility and down stock markets.

Who knows how long the good times will last in stocks. I’m still bullish on both stocks and real estate for 2021+. But I’m also not chasing the stock market at these levels.

I’m diversifying and doing my best to convert capital gains to income-generating assets. The value of income has gone way up because interest rates have come way down.

Sam, much obliged for the interview with Ben from Fundrise! I always wanted to ask you, given your veteran status with Fundrise:

Do you do just direct investments into the eREITS of your choice, or do you allow them to manage your investment for you according to your designated strategy? (Balanced, growth, supplemental)

I ask because alot of reddit users seem to hate how much of their portfolios are automatically allocated to eREITS still ramping up, and thus not generating a notable return. So the advice over there is to stick with ditrct investments. Thoughts?

I invest in private eREITs and individual deals with a 5-year time horizon. Half the reason why I invest in these products is so I don’t have to think and stress about managing them. It’s hard for me to stay on top of every investment. Thanks

Sam, do you have any concerns investing in an illiquid private real estate fund like Fundrise? What about return of principle or NAV calculations. It seems that Fundrise sets the NAV and there is no true price discovery mechanism for what a share is worth. The yield is great but I also want my principle back at some point.

Hi Ed,

I don’t. I like investing in long-term, illiquid investments that compound. I like to invest knowing I can’t take money out for 1,3,5,7,10 years. It helps me move on and focus on new things. The illiquidity also prevents me from panic selling during difficult times.

Most, if not all investments, should be long-term investments. As soon as you start trading in and out of securities and such, bad things tend to happen.

All my best investment returns have been after holding for more than three years. But eventually, you may want to have some liquidity to buy a big ticket item like a house or something. So you’ve got a plan ahead for that.

See my thoughts on liquidity: https://www.financialsamurai.com/the-need-for-liquidity-is-overrated-if-you-are-financially-competent/

Hi Sam. Great article as always. I’m sure that you’ve discussed it before but what percentage of overall portfolio do you recommend to put into these alternative investments?

I currently have about 15% in alternative investments and roughly 40% of my net worth in real estate, including real estate crowdfunding. My aim is to increase it to 20% and perhaps more. I’m not going to be as aggressive as the Yale Endowment Fund, which has over 65% in alternatives. But I do what greater exposure. I really dislike volatility. Further, it’s hard to invest aggressively in stocks at these levels. Just my normal 401k/529/Roth IRA/SEP IRA max contribution will do.

Question Sam. How exactly are you even doing Roth IRAs? Aren’t you over the income limits? Also I noticed you said you’re opening one for your kid. How do I go about doing that if he is too young to work? Is there any point of a SEP IRA if you have a solo 401k? I’m trying to figure out the best way to defer my high earnings this year and the coming years. Sorry for all the questions!

My children certainly are not making more than the income limits.

Check this post that is pertinent to your topic: https://www.financialsamurai.com/opening-a-roth-ira-for-your-kids/

Thx

I had wanted to test the waters a few years ago and had begun with a small investment. Then every year I added some more to the portfolio. Now I discover that I cannot redeem the first investment without penalities after the initial 5 years because FundRise uses LIFO for the redemptions. This includes reinvestment of the distributions as well.

So if I invested $x1 in 2018, $x2 in 2019, and $x3 in 2020, and since redemptions follow the LIFO rule, I can only redeem $x3 without penalities in 2025/26. Which is fine and as expected. However, based on the emails with customer support, it looks like I will not be able to redeem $x2 in 2023/24 without incurring penalties.

If this is true, then this is not going to encourage me to put more money in Fundrise, nor recommend it to friends. I already have my son invested a small part of his investment money into this.

Best to doublecheck. If you need the money, then don’t invest that money. Keep it liquid. For me, I love to invest for the long-term 5+ years. More efficient, better returns, and less stress. So far so good after more than 25 years.

yes, their redemption philosophy slightly discourages DCA and dividend re-investment because of this.

Thanks for the interview. I’ve been a long time Fundrise customer, and their transparency and market reports are unparalleled. Their consistent returns are also great. But really, the question that popped up for me was…children’s Roth?! I didn’t realize that was a possible thing for children with no income. Say more?

Sure, here’s a whole post about opening up a Roth IRA for your children. Earned income is required and you can invest that earned income however way you see fit.

https://www.financialsamurai.com/opening-a-roth-ira-for-your-kids/

I just opened up two Roth IRAs and two custodial investment accounts for my kids. Better late than never!

Thank you Sam & Ben for the update. I’ve been investing in Fundrise since mid-2018 and have only been impressed with the team’s investment philosophy, execution discipline, and transparency in both good and bad times. They seem poised to dominate the crowd-funded eREIT space in the coming years. The fundamental strategy, innovation, and focus on using technology for simplification & fixed cost leverage will serve them well. A great example of innovation is the Interval Fund that they just announced this morning, I’m looking forward to it unveiling in the coming weeks.

I invested $100k with Fundrise a year ago, and over 50% of that investment is still sitting there earning nothing, unvested. I realize this is a LT investment, but after a year they should have investors money allocated to something.

It sounds like these funds are invested in an eREIT that is in the “ramp up” phase. Ramp up refers to the initial period after a fund first launches, during which we are focused on raising capital and laying the groundwork for future returns. While minimizing cash drag is, of course, a priority of ours as the investment manager, carefully acquiring real estate investments that meet our strict underwriting standards is paramount.

A fund typically takes around 12 to 18 months to complete ramp-up; however, the exact length may vary from fund to fund. Although returns during ramp-up may be lower, we believe it is generally the most advantageous time to acquire new shares, as it often involves purchasing shares at a lower price and participating in maximum potential long-term returns.

Once a fund progresses to the more mature phases of its lifecycle, we expect it to generate greater returns through dividend income and/or share value appreciation, depending upon the fund’s strategy.

As a reminder, our investments are intended to be viewed as long-term, with a full lifecycle that is expected to last between five to seven years.

As a result of these funds being relatively newer, and having raised a majority of their capital through the early portion of this year, these funds have held a significant cash position as the market for acquiring new assets largely paused from April through November due to the COVID-19 pandemic.

Since November, when we believe the market for acquiring real estate assets took off again, we have been actively pursuing new asset acquisitions with a strong pipeline of potential opportunities over the next several months. Because the process to source new opportunities, complete due diligence, and then close on a deal typically takes anywhere from 2-5 months for commercial real estate properties, the efforts that took place at the end of this quarter are expected to start resulting in a larger number of new assets being acquired over the next several months.

That said, as with any investment, we can’t guarantee future performance and there is a risk of loss.

You should be able to track your returns in real-time on the performance page of your investor dashboard.

Fundrise just announced this new Interval Fund that they are going to push everyone’s new/reinvest money into. Reading the fine print it will invest up to 40% in publicly traded securities. Seems like a very bad deal for investors. Why pay Fundrise 1%+ a year to buy public REITs on the stock market when I can buy them myself for free?

You can always invest yourself if you have the time, interest, and knowledge for sure.

For me, as a father of two young kids, I’m so happy to pay someone to look for opportunities full-time once I’ve made my asset allocation. In fact, 2020 has made me want to allocate more to private real estate, alternative investments, and active funds. I’m so exhausted.

How about you? What is your investment allocation and performance this year? Would love to get some background. Thanks

Here’s some feedback from Fundrise:

Thanks for taking the time to read through our new Fundrise Real Estate Interval Fund (the “Fund”) prospectus. Over the years, we have continuously pioneered new investment models, working through various complex regulatory processes to create first-of-their kind investment opportunities that are specifically designed to offer our growing community of individual investors better access to institutional-quality investments. With that said, at times each fund may hold a portion of capital in cash or liquid securities.

The Fund in particular has a legal structure which demands this. More specifically, the Fund is registered under the Investment Company Act of 1940 (“40 Act”) which stipulates, among many other things, that it must periodically make offers to repurchase 5-25% of its shares.

The Fund will offer quarterly liquidity (in the form of quarterly repurchase offers) with zero penalty or cost associated with liquidating Fund shares. The Fund is required to hold assets in liquid securities in an amount sufficient to meet its stated quarterly repurchase threshold. Although, as you read in the prospectus, the Fund reserves the right to invest up to 40% in liquid securities to facilitate these repurchase offers, in practice, it is likely that the Fund may offer to repurchase only the minimum allowable amount of 5% of its outstanding Shares and correspondingly hold an amount much lower than allowable in liquid (publicly traded) securities.

If you have any other feedback or questions, please feel to reach out to our Investments Team at Investments@fundrise.com.

Hi Sam-

I followed your advice and began investing in Fundrise earlier this year, completely based on your recommendations, and have been very impressed with the experience so far! Thanks for all your great advice… my wife and I love your newsletter and podcast!

My question is how are gains through Fundrise treated by the IRS? This will be the first year we’ve had a Fundrise account when we file our taxes, so I’m sure I’ll see for myself soon enough, but is this just considered dividend gains?

Is there any opportunity to invest IRA assets in an investment such as Fundrise so that the gains are tax free? I’m with you… I don’t think the markets have fully seen the effects of this pandemic on small businesses, government throwing free money from helicopters, and out of control government spending yet. When it all hits, I think it’s going to UGLY! I’m trying to diversify as much as I can into hard assets and income producing investments before this happens…

Thanks for all you do!

Cheers,

Greg

Depends on if you’re invested in the eREITs or eFUNDs. The former typically receive a 1099-DIV and the latter a K-1 statement.

Hi Greg,

Good to hear Fundrise has worked out well for you. The stability of the returns, especially during a volatile stock market period.

You can expect to receive one or two different types of tax documents, depending on the funds you’re invested in. You will receive a Form 1099-DIV for each eREIT in which you own shares and a Schedule K-1 for any eFund in which you own shares.

The 1099-DIV is the easiest to file.

Thanks

Greg,

You can invest in Fundrise with a self-directed IRA through Millennium Trust Company (Fundrise’s IRA partner) and can find more information about it on the Fundrise website.

Thanks, Ian!

I like the track record, simplicity of the eREIT and diversity Fundrise offers. The pandemic has taught me more than ever not to keep all my eggs in one basket. Thanks for the update!

It’s tough as well for me to invest a lot in the stock market at these levels as well. We can easily see a 10% to 20% correction.

I think you’re absolutely right about focusing more on capital preservation an income producing assets, rather than capital appreciation.

Protect the gains we’ve made so far and diversify!