Opening a Roth IRA for your kids is a must once they start generating earned income. Not only will opening a Roth IRA help build wealth for your kids, if you have a business, it will also help you save on taxes.

If you start contributing to your kid's Roth IRA young enough, there's a good chance their Roth IRA could be worth over $100,000 by the time they turn 18! If you combine their Roth IRA with a custodial investment account and a 529 account, they could have almost a million dollars by the time they turn 20!

Can you imagine having over $100,000, let alone $1 million by the time you are legally an adult? Since you worked for your money, you will likely feel like one of the richest and proudest 18-year-olds around. You'd have a massive head start to do more things that interest you.

A child can contribute tax-free money into a Roth IRA if they earn under the standard deduction. Then, the Roth IRA money can compound tax-free. If the child wants to withdraw money from their Roth IRA, they can also withdraw the money tax-free as well! What a no-brainer.

Roth IRA Introduction

The Roth IRA was introduced as part of the Taxpayer Relief Act of 1997. It is named for Senator William Roth. A Roth IRA is a retirement savings vehicle where you contribute after-tax dollars. The investments made in a Roth IRA then get to compound tax-free.

You can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. However, you may have to pay taxes and penalties on earnings in your Roth IRA.

If you take a distribution of Roth IRA earnings before you reach age 59½ and before the account is five years old, the earnings may be subject to taxes and penalties.

You may be able to avoid penalties (but not taxes) in the following situations:

- Use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

- Use the withdrawal to pay for qualified education expenses.

- You use the withdrawal for qualified expenses related to a birth or adoption.

- You become disabled or pass away.

- Use the withdrawal to pay for unreimbursed medical expenses or health insurance if you're unemployed.

- The distribution is made in substantially equal periodic payments.

Regret Not Contributing To A Roth IRA

One of my regrets was not contributing to a Roth IRA when I was a senior in college (1998/1999) and my first year of work (1999/2000). After 2000, I was no longer able to contribute to a Roth IRA due to surpassing the income limit rules.

The Roth IRA was still new back in 1998 and I was 100% focused on getting a job my senior year in college. Once I got a job, I set up my 401(k) contribution and focused 100% on not getting fired!

The last thing on my mind was opening up a Roth IRA to contribute $2,000 for retirement. I only had a $40,000 base salary in NYC. At the same time, I didn't think $2,000 would make much of a difference.

This is where financial education and parental guidance comes in. If I was forced to learn about the Roth IRA and the power of compounding, I would have contributed. But again, everyone was still learning about the new program at the time as well.

Now that I think of it, my father did tell me about contributing to a traditional IRA while I was making $4/hour working at McDonald's in 1994. However, I wanted to spend the little money I had on taking my girlfriend out to the movies.

Why You Should Open Up A Roth IRA For Your Kids

Opening up a custodial Roth IRA for your kid is a no-brainer for the following reasons:

- Get them in the habit of saving and investing early on

- Build their work ethic since earned income is required

- Teach them about investing

- Teach them about taxes

- Build their retirement nest egg

- More flexible withdrawal of funds

- Contributing with low or no-tax income

- Save on income taxes for your small business

To repeat, the money contributed to a Roth IRA can be withdrawn at any time and used for anything. Therefore, you can easily see a situation down the road where your kid might want to buy his first car or take an international trip with college friends. A Roth IRA can help pay for these expenses.

Given compound interest is one of the most powerful forces in finance, the younger you open up a Roth IRA, the better. Assuming a 6% investment return and monthly compounding, if you contributed just $6,000 in a Roth IRA, in 60 years the account would grow to about $200,000.

Perhaps most importantly, think about all the miserable people working at jobs they hate. Part of the reason why they can't leave or retire early is because they likely only started investing in their 20s. They failed to think in two timelines and properly forecast their misery. By contributing to a Roth IRA during childhood, a person could literally have a 20-year investing head start!

A Roth IRA increases a person's chance of experiencing freedom sooner. And freedom is priceless.

Rules For Opening Up A Roth IRA For Your Kids

To open up a Roth IRA for your kids and have the money count, you must follow these conditions.

1) No age minimum limit to open a Roth IRA.

There are no age restrictions for opening up a Roth IRA. Kids of any age can contribute to a Roth IRA, as long as they have earned income. That's right, even babies can have a Roth IRA if they have earned income.

2) Child must have earned income for them to contribute to a custodial Roth IRA.

Earned income is defined by the IRS as taxable income and wages — money earned from a W-2 job, or from self-employment gigs like babysitting or dog walking. A baby can earn income by being in a photoshoot.

The best way is for your child to earn income from a source other than yourself. Paying your kid to mow the lawn with after-tax money you earned from a job isn't optimal. It's not optimal because you most likely are in a much higher tax rate. You're simply making an after-tax investment like you normally would.

For example, I did a summer job landscaping with my kids. Although the job would cost $5,000 to hire professionals, my kids didn't earn $5,000. Instead, they earned some popsicles, which can't be deposited in a Roth IRA.

3) A parent or adult needs to set up a custodial Roth IRA.

Your toddler or pre-adult child (under 18) cannot open up their own Roth IRA. The adult can open one up with a major brokerage house like Fidelity, Charles Schwab, and TD Ameritrade. Opening up a custodial Roth IRA should take less than 20 minutes.

4) Know the Roth IRA contribution limits.

The Roth IRA contribution limit is $7,000 a year in 2025, or the total of earned income for the year, whichever is less. For example, if a child earns $3,000 babysitting, he or she can contribute up to $3,000 to a Roth IRA. If a child earns $10,000 in a calendar year, he can contribute a maximum of $7,000 to a Roth IRA.

Below is the historical Roth IRA contribution limits chart. The contribution limit generally goes up by $500 – $1,000 every 3 – 5 years. To repeat, the Roth IRA contribution limit in 2024 is $7,000 for those 49 and below. Take full advantage!

5) A parent can contribute to their child's Roth IRA

The great thing about opening up a custodial Roth IRA for your child is that you can also contribute to it as well. You're like the company 401(k) match, but for their Roth IRA. The more they work, the more you can contribute to their Roth IRA up to the annual limit.

For example:

- Your child earns $3,000 from a part-time job in 2025.

- The Roth IRA contribution limit in 2025 is $7,000 (under age 50).

You can gift your child up to $3,000 to contribute to a Roth IRA—even if they spend their own earnings on other things.

This is a great way for parents to kick-start long-term wealth building on their child’s behalf while also potentially teaching investing principles.

A few things to keep in mind:

- The Roth IRA must be in the child’s name, not the parent’s.

- If the child is a minor (under 18 or 21 depending on the state), it must be a custodial Roth IRA.

- The parent (or another adult) acts as the custodian until the child reaches the age of majority.

You can gift more than the child can contribute—but only the amount equal to their earned income can go into the Roth IRA for that year. This is where opening up a custodial investment account comes in play. Any Roth IRA overage can just go there.

The reality is, you can probably do whatever you want unless your brokerage electronically stops you from contributing after the limit. You just have to be OK with any potential penalties, which may or may not occur.

As always, speak to a licensed tax professional before making any decisions.

Income Sources For Your Kid's Roth IRA

It's best for your kid's earned income to come from a source other than you. Otherwise, you're basically recirculating your family's wealth.

You can pay your kid money for doing work with after-tax dollars once you've fully funded all your tax-advantageous retirement vehicles. However, this money isn't eligible for a Roth IRA contribution if he or she isn't actually don't work for your business.

A lot of parents have wondered whether paying their kids money to do household chores counts as a deduction and eligible for a Roth IRA. Sadly, the answer is no. Doing household chores is simply part of “parental training.”

Your child has to be doing actual work for your business. The child needs to be treated as any other employee or freelancer. The child also needs to also be earning a “reasonable wage.” You cannot pay them $1,000/hour to wash the dishes.

Here are are appropriate income sources for Roth IRA contributions:

- After-tax income from a person outside your family, e.g. your neighbor pays your kid to mow his lawn.

- A job at a company, e.g. your kid works a minimum wage job bagging groceries.

- Your small business, e.g. your kid makes money mixing batter for your cupcake business.

The key is to earn as much outside EARNED income as possible at the lowest tax rate possible. Given kids are mostly focused on school up until they are 18, it's hard for most kids to work too much and make too much money. That is, unless they focus on making money online. Then, the sky's the limit.

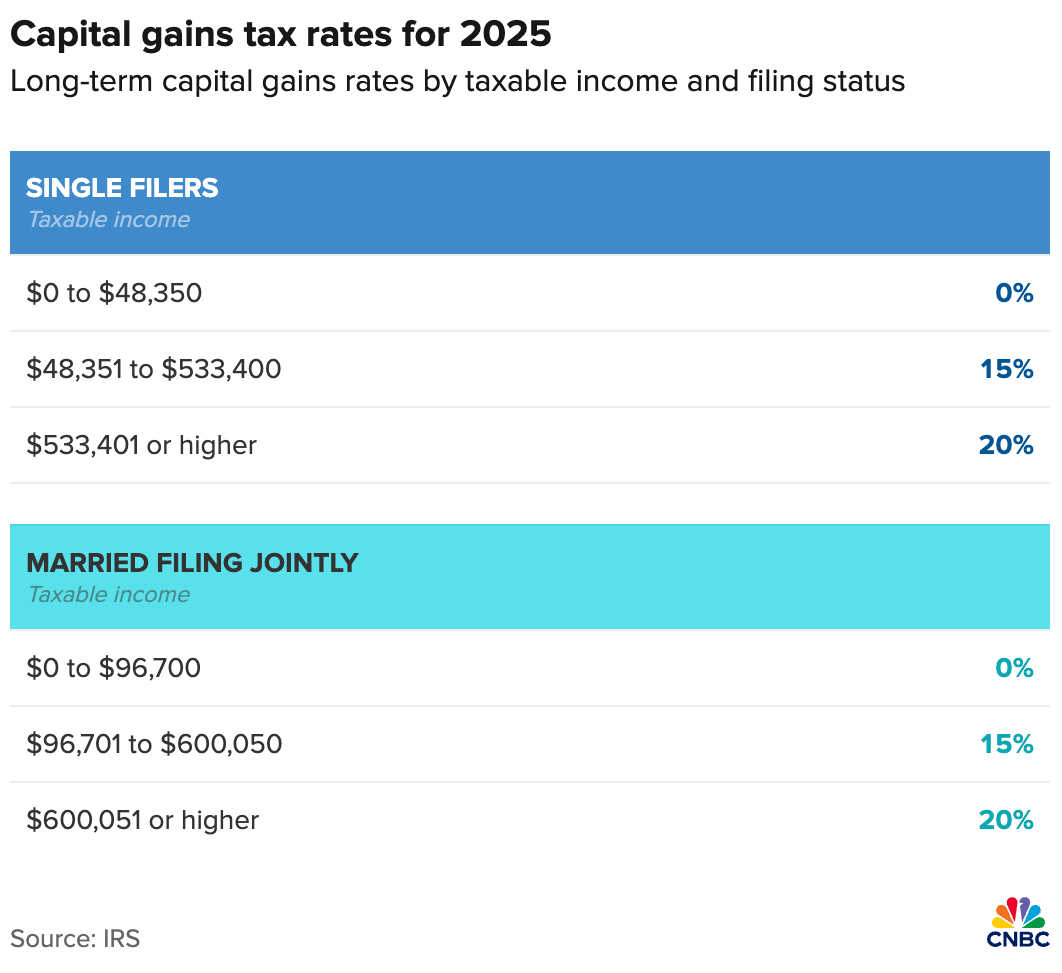

Thanks to the standard deduction of $14,600 for singles in 2024 ($29,200 for married couples), your kid can make up to $14,500 a year without having to pay any federal income taxes. Other taxes will depend by state.

Therefore, if your child can earn the maximum Roth IRA contribution of $7,000, all of it will go in as tax-free income. Those investments will then compound tax-free. Depending on the situation, all the earnings can be withdrawn penalty and tax-free.

It is also likely the standard deduction will always be higher than the maximum Roth IRA contribution limit. Therefore, there's a great chance your child could contribute up to 18 years of maximum tax-free Roth IRA contributions before working full-time. Limits may change every year, so always check.

Roth IRA Compound Growth Calculations

To help get you even more excited about opening up a Roth IRA for your kids as early as possible, let's do some compound growth calculations.

Roth IRA Compound Growth Example #1

Let's say you open up a Roth IRA when your baby is born and contribute $6,000 every year for 18 years. Your baby is a model and does other jobs over the next 18 years. By the time your kid turns 18, he or she will have $200,702, assuming a 6.2% compound annual return!

Think about how set your kid would be at 18 with over $200,000. He'll be well past the five-year limit by then. Therefore, he can use the Roth IRA however he pleases. Hopefully, you will be able to teach him restraint and let his Roth IRA money compound for decades longer.

Roth IRA Compound Growth Example #2

Let's say you open up a Roth IRA for your daughter at age 5. Age 5 is about the time when kids can regularly follow instructions and do tasks. You have an online business that requires some photoshoots, video recordings, audio recordings, and editing. You pay your child only $10,000 a year versus $100,000 if you had to hire an adult. What a bargain!

If you contribute $6,000 out of the $10,000 a year for 13 years to a Roth IRA, your daughter would have $129,300 by the time she is 18. Not only that, you can invest the other $4,000 in a taxable custodial investing account that will likely grow as well.

Perhaps even better than having $129,300+ in a Roth IRA, your daughter will have developed an amazing foray of internet skills. She could work for your business as a full-time employee, take over your business, start her own business, or work for another similar business. She'd be so far ahead of the curve compared to kids who just learn and not do.

Meanwhile, your business gets to reduce its taxable income by $10,000. If the business's marginal federal income tax rate is 32%, your business has saved $3,200 in taxes. The higher your business's marginal federal income tax, the more incentive you have to pay your child.

In a real way, paying your child from your private business is fantastic estate planning. Further, paying your child for work is much better than just gifting your child the annual gift tax exclusion amount.

Roth IRA Compound Growth Example #3

Most parents won't have their own businesses or kids who start working so early. Therefore, let's assume your kid starts earning income at age 14 at a traditional minimum wage service job, e.g. waiter. He ends up making $8,000 every summer and winter break.

You open up a custodial Roth IRA and he invests $6,000 a year in a hot tech company. With only $6,000 a year, you guys agree to invest more aggressively. The tech company stock appreciates by 100% a year for four years. By the time your kid is 18, he will have $180,000 in his Roth IRA.

100% a year for four years sounds unlikely. However, such growth rates are everywhere if you look hard enough. By the time your kid is in college, he will most likely be infatuated with investing or technology. His infatuation may encourage him to study finance or engineering. As a result, he may land a role at a lucrative finance or technology firm.

Starting a minimum wage service job at 14 will likely instill in your son a greater appreciation for money and future job opportunities. By working at McDonald's and stuffing envelopes as a kid, at the very least, I knew what I didn't want to do for the rest of my life.

See: Spoiled Or Clueless? Try Working Minimum Wage Service Jobs As An Adult

Graphic Of How A Roth IRA Can Grow Over Time

Here's a graphical image from Fidelity on of how much a Roth IRA account can grow depending on age, contribution amount, and returns. If you start contributing to a Roth IRA by age 15, there's a decent chance you'll become a Roth IRA millionaire by 65.

Now, of course, there are no guarantees to investing. It is possible to invest and then experience a multi-year bear market. However, over the long run, stocks and bonds tend to appreciate.

The average return for the S&P 500 since 1926 is roughly 10%. The average return for the less volatile aggregate bond market is roughly 5%.

Opening A Roth IRA For Your Kid Is A Must

Hopefully, you now agree that opening a Roth IRA for your kid is a good idea. The earlier the better.

Even if your kid does not earn enough income to contribute the maximum amount to a Roth IRA, still open one. Knowing the contribution rules and everything else may encourage him or her to work harder and make even more money.

You can open a custodial Roth IRA at any big brokerage firm like Fidelity, Charles Schwab, TD Ameritrade, and so forth. It took me less than five minutes to open one for each child.

You just need to input their name, date of birth, Social Security number, address of residence, and mailing address. Then, for funding, you can either link an account online or mail in a check with your child's Roth IRA account number.

Instill In Your Kids A Strong Work Ethic Too

If you plan to pay your kid for doing business work, make sure your retirement savings are squared away first. After all, you are in a higher tax bracket. Max out your solo 401k, SEP IRA, or Roth IRA first. You don't want to risk your family's financial security before your child has the ability to earn an independent living.

Although I never had the privilege of contributing to a Roth IRA, I will make sure my children do. I'm excited to put my kids to work and teach them everything about online media and investing. My kids can hopefully learn how to become great investors as well with more practice.

There is a risk that our kids could end up blowing all their Roth IRA money on useless things once they become adults. However, when you spend years working hard for your money, wasting money is harder to do. The more likely scenario is that our kids will want to figure out ways to make even more money.

The key is to start educating our children young so that saving and investing becomes a natural way of life.

Roth IRA Tracking Recommendation

Track your child's Roth IRA and your investments using Empower's free financial tools. I've used Empower since 2012 to manage my investment allocations, reduce portfolio fees, and track my net worth. The more you can stay on top of your finances, the better you can optimize.

Invest In Real Estate For You And Your Kids

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income. Stocks are fine, but stock yields are relatively low and stocks are much more volatile.

You are your kids can start investing in private real estate with Fundrise with just $10. Fundrise has been around since 2012 and manages around $3 billion for over 350,000 investors.

Fundrise predominantly invests in residential and industrial properties in the Sunbelt region, where valuations are lower and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

I've personally invested over $1 million in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$320,000.

Invest In Private AI Companies To Protect Your Kids

Finally, invest in private growth companies for the future. Artificial intelligence is clearly going to be a leading technology of change over the next 10-20 years. Unfortunately, AI will likely eliminate millions of jobs your kids could have had when they graduate high school or college. As a result, I think it's a good idea to gain exposure to funds that invest in AI companies.

Check out the Fundrise Venture, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 85% is invested in artificial intelligence, In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI! I've personally invested over $250,000 with Fundrise Venture so far as a hedge against a more difficult future for my children.

The investment minimum is also only $10 compared to most venture capital funds which require $250,000+ minimums. With Fundrise, you can also see what the holdings are before deciding to invest and how much.

Financial Samurai, is a six-figure investor in Fundrise funds and Fundrise is a long-term sponsor a Financial Samurai. Above is my Fundrise investment dashboard where I invest both in real estate and venture capital.

Related posts on Roth IRA:

Disadvantages Of A Roth IRA: Not All Is What It Seems (geared towards higher-income earners)

The Only Reasons To Ever Contribute To A Roth IRA (in addition to helping your children build wealth)

The Making Of 529 Plan Child Millionaires (given the cost of education is so brutal)

A Roth IRA Conversion Is Probably A Waste Of Time And Money

How to Open Up A Roth IRA For Your Kids is a Financial Samurai original post. Financial Samurai was founded in 2009 and is one of the largest independently-run personal finance sites with over 1 million organic visitors a month.

Do kids need to get job with 1099 misc form? Does it mean they need to pay social security and Medicare tax at 15% rate for earned money above $400?

https://smartasset.com/taxes/teens-and-taxes-what-parents-need-to-know-about-summer-jobs

Please read the article. There’s a section on 1099 work. I would also encourage the kid to fund a Roth along with their normal savings for future fun.

I see. So, the kids <18 years old will still need to pay self employment tax(Fica) which is 15%. 1099 is not a good option then.

It is all about context. Certainly a 1099 job is vastly better than no job at all. Keeping 85% of ones effort and using some of that to fund a Roth seems a great way to spend one’s time and effort as a kid. 50 yrs from now, those life lessons will pay real dividends.

Am I missing something?

Hi, Sam. I’m not sure if you’d know about this case. My son has been getting social security benefits from his mother since her passing away. Is SS money considered earned income to fund his Roth IRA?

SSi money is not earned income. RothIRAs cannot be funded with ssi dollars. Does son have an earned income job (mowing lawns, junk hauling, babysitting — doesn’t have to be a w2, but just declared income)?

I have a 2.5 year old and 3 month old and would like to open a Roth IRA for both of them as soon as possible. But the largest issue is always generating earned income. Other than bagging groceries or yard work which both of my kids are too young to do how are others generating earned income.

Financial samurai to the extent your 2.5 year old has a Roth IRA what sources of earned income is she generating?

What is your business that you started? If you tell me, I can give you some ideas.

No business. I am a normal W2 worker.

Got it. Did easiest way is to start a side business. Marketing and advertising is an important expense to grow your business.

What is the impact of financial aid if the kid racks up a large Roth IRA by the time he/she starts college?

Minimal if not zero. For FAFSA does not include retirement account balances in the EFC contribution. Institutional calculations may.

Hi

I have a single member LLC. I want to pay my daughter $10-$12K for her help around the office. She also works in a retail store and will make approximately $3K. Can I pay her as an independent contractor or does she need to be a W2 employee to benefit from not paying payroll/unemployment taxes because she is my daughter?

Thanks

Thanks for the great article! my daughter does some cleaning and yard work for my neighbor and she gets paid cash. any kind of proof/documentation that we need to ask the neighbor for saving that money to my daughter’s ROTH IRA account? Thanks.

If your kid makes less than 12k per year and it is tax free, why would you not just invest it in a brokerage account? If you put it in a roth IRA, you then must deal with withdrawal restrictions.

Sure. Because it’s better to compound tax-free and withdraw tax-free than withdraw and pay taxes.

Holding a Roth IRA for at least 5 years without withdrawing is not very difficult, especially when you open a custodial Roth IRA for a young kid.

O, missed that point about the tax free withdrawal.

Thank you!

Sam, GREAT article. Thank you for promoting a Roth. A couple points for clarity — and to be fair to you, I raced through your post:

There is a 5 yr wait time from when the account is opened to when a fee-free withdrawal can be made. If the account was opened today (12/20/2020) or opened on 01/02/2020, it was opened in the year 2020. So, in 2025 after the 5-yr wait, a no-questions asked withdrawal of any CONTRIBUTION can be made. Earnings cannot be withdrawn tax-free until the account is 5 years old or age of 59-1/2, whichever is later unless there is an allowable hardship claim (please check me on all of this — working from memory here).

Additionally, no RMDs with a Roth (so you can spend down the other forced accounts and leave this alone.)

Instead of a 529 (or in conjunction with it), building a Roth with earned income for higher ed is an option with an arguably more flexible ‘constraint’ on the money. For parents who want to ‘gift’ their children Roths, consult a tax attorney. I could see every dime the kid brings home from shoveling burgers and fries going into a Roth, and parents gifting them play money in return — but using outright gifts doesn’t seem to be covered in what I recall.

I’m in my mid twenties, and I was on the receiving end of this strategy. My parents had been contributing to a Roth IRA for a while when I was under age 18. But they kept it entirely secret.

I was quite surprised to find out at about age 22 I had 70k in a Roth IRA. That account is now over 100k.

The psychology of receiving “free” and unexpected money from parents can be complicated. For me on one had I am extremely grateful. On the other hand it complicated my self identity and my relationship with my parents.

Can you share how it complicated yourself identity and your relationship with your parents? What were exactly the negatives of receiving “free money”?

You had to earn income to be able to contribute to the Roth IRA. Did you not work for your money? Thanks for clarifying.

Sure, In hindsight, my parents were pretty organized. Their primary businesses were a small professional services business and a restaurant. A young ages, my siblings and I got do some fun things like radio ads, I think my parents then paid us earned income from the businesses and then funneled the money into Roth IRAs. We were young enough that we didn’t care about the money. As we got older, maybe 10-12+ we got to work in their businesses and they always let us keep whatever we made. We did things like clean the office on the weekend and normal restaurant help work. We would get paid. Which basically was our spending money. And then I believe they would “gift” us money equal to our earned income or the Roth limits and contribute it into our Roth accounts without our knowledge. I also think they would have a spread between what they paid us and what we got paid. Like we got $25 to clean the office every Saturday, my guess is they gave us earned income higher than that, which made it easier to get to the Roth limits. Either way they did it all without telling us and took care of the logistics behind the scenes.

I am extremely grateful for the money. I still feel like it’s hard to accept winning the genetic lottery of being born into the “right” family. Like why should I get this, I already felt like I received my compensation at the time. How much of my personal wealth do I need to save for it to be mine? Or feel like my own accomplishment. I think my parents feel like anything I accomplish is a result of them. And in most ways they are correct.

Additionally, my parents are so proud and kept busy with their businesses and their money, that it can be difficult to connect with them on a personal level. If I had the ability to change things and make my parents more available instead of having the Roth money. I feel I would rather have them more available. And I don’t think that makes sense to them.

Thanks for sharing. I can see how you may feel money guilt. Why not return some of it or get motivated to make a lot more and return some or all of it?

That’s what I did years later to pay back my parents for paying for my college. Felt like a nice accomplishment.

On the second part, the personal connection definitely takes work. Perhaps a nice conversation over wine and a meal will help chop away.

This sounds like a scheme begging to be audited by the IRS. My kids are toddlers but if what you say is legit, I could pay them both 20k each and deduct $40k from my tax bill where I pay the top rate of tax.

Why isn’t every small business owner doing this?

You have to pay your kids a “reasonable rate.” $20,000 isn’t much if your kid spends all year doing work an adult would charge $200,000 for. But I’m talking about earning the $6,000 Roth IRA limit or up to the standard deduction limit, not even $20,000.

Further, ask yourself why your kids haven’t been working all these years? Maybe they want to play instead. Or maybe it’s not in your parenting DNA to get your kids to work.

Finally, I’m sure many small business owners haven’t done the math or the research on the benefits of a Roth IRA. This is a personal finance site where we spend a tremendous amount of time thinking about how to improve our finances.

What’s your situation? From there, we can do an analysis. Thanks

I understand completely; my parents did something similar for us kids via wedding gifts, which were basically cash gifts large enough for house down payments. There are important psychological ramifications with gifting significant (or any) amounts of money that should be considered, especially when given as an adult. My siblings and I all view these gifts very differently with varied degrees of thanks and guilt.

Not really sure how we are going to do it with our kids yet, but the clock is ticking…because of feelings I have, similar to Steve, I am leery of creating large accounts or giving significant gifts. I already get comments from my wife for going overboard during Xmas time.

Steve, if and when you become a parent yourself, you will understand and it will not feel quite so complicated. If you plan on having children, consider that money for your own children one day. The psychology of saving for the future of someone you love more than anyone else in the world, a person for whom you’d throw yourself under a train for in less than a second, is not to be underestimated.

Could you make a similar Spousal ROTH IRA blog? I am looking to contribute to my spouse ROTH IRA whose had to stop working to raise kids. So no self earned income but I know the earning spouse can contribute (6k to self and 6k to spouse). However, not very clear minor on the laws.

Sam – great piece. My kids keep their earnings and I fund their Roth IRA. Great for passing wealth to your children (better to compound tax free over their lifetime than mine). Although I plan to live a long time. On a related note, you can open a uniform gift to minor account (UGMA) for your kids. Open when they young. Really good way to compound gifts to your kids. Think about the kids that turn in their savings bonds at 18. Instead of savings bonds, put that money in a brokerage account and buy equity investments and turn it into real money. Kids pay their own taxes on investments (lower rate than parents). The benefits of teaching your kids compounding, investing, savings still apply. Potential downside, the kids liquidate once it legally passes to them.

If each parent is allowed to gift each child 15K a year for a max of 30K a year tax free. Is that child (Any age) allowed to put their age limit into their Roth tax free still? IE $,000 under 49 yrs old $7,000 over 50? My step son just turned 18 and we are wanting to get him started and we are blessed to be able to gift him over the Roth limit, but we won’t as he needs to have skin in the game too.

Thank you

Big Sarge, a gift is not Roth-qualifed. It has to be earned income. If that child has a job, you’re golden up to whatever they earned after taxes or $6k, whichever is smaller, for the Roth contribution.

And something I didn’t see in Sam’s piece — there are different kinds of Roths out there. A Roth savings account exists at my credit union, but not a Roth investment account. On the other hand, I use an online bank for my Roth investment acct but my wife used a well-known online brokerage to open and fund our children’s Roths. (Sam, do you care if we use actual names of companies?)

I have a friend at work who heard about how great Roths were — moved $6k into one last year, but didn’t know she had to actually invest/trade that cash into holdings. So instead of watching her favorite ETF go up in February, plunge in March, and hit record highs a few days ago — her $6k from last year and $6k from this year just sat as cash. Understanding the whole process before plunging in has value.

We are going to do the same thing for my son who was just born. Do you think that we can have him model for our family business and charge the business a $1,000 fee. He would be on the cover of our family business card.

Seems reasonable. It may cost much more to set up a photoshoot and hire another baby to be on the picture of your business card.

I also assume your business has a web presence? Therefore, you can use the baby photos as marketing material as well.

Check with an accountant.

Thank you, for the feedback. I will check with our accountant. We do have a web presence as well.

Best!

Parents may want to consider funding some sort of earned income match to get the child’s Roth account going and growing. An immediate 100% return is a great incentive for a child to start saving for retirement. That 1st paycheck is great time to sit down and talk about personal finances and compounding interest. Great article!

This is why I love your blog – I never would have thought of doing this myself. Really smart thinking and great financial planning for your children’s future. I love the idea of teaching kids about work ethics, earning money for hard work, and the benefits of saving and investing from a young age.

I opened a Roth for my daughter at 15 years of age. As a rule she has to save 10 percent of any income she makes. After five years, a couple contributions from mom and dad, and compounding, she’s up to 30k at age 20. More importantly, she’s used to saving, knows the power of compounding, and is learning about the stock market.

It really doesn’t matter how much you start with, we started with $500, the most important aspect is just to start!

Small contributions early on really do add up! To her, $30K at 20 is like a fortune! I know just having $5K back when I was 20 felt like a huge sum of money.

Sam,

I just had my first child this year and am trying to determine the best route to save for her. I opened a 529 plan but am not crazy about it. I also have a standard savings account but I like the idea of the Roth. If my child has no earned income, is a Roth still worth considering? Thank you!

Nope, no earned income, no custodial Roth IRA contributions.

Bill, how are Mom and Dad able to make contributions? Doesn’t the money have to come from the child’s earned income?

This is a great idea, and something I was thinking about just this weekend. What about things like giving your child a small allowance and/or paying them for doing household chores? Would this be eligible? Sounds like it.

On a related note, I’m curious how you plan to teach investing to your kids. I’ve read conflicting things about having them buy stock in a company they like, which could go up or down, helping them buy an ETF/mutual fund, or just teaching them concepts, which though useful are probably not too engaging for them. Curious on your thoughts or would be great to see this the subject of a future blog post.

It is if it’s part of your business and helps your business make money.

But best to also get a different household to pay your child so the entire household net worth can grow. Teach your kids how to hustle for work around the neighborhood.

I’d just start with an S&P 500 ETF and go from there. Discuss companies they have heard of and products they like. That will more easily get them interested about investing in those stocks.

With commissions no more, it’s affordable to buy 1 share of almost any stock.

Seems like Robinhood could be entertaining for the kids!

Household chores & allowance are not considered income to the IRS, and these earnings would not be eligible for a ROTH.

Your child has to be doing actual work for your business. They need to be treated as any other employee. e.g. complete an I-9, W-4. They need to be earning a “reasonable wage.” You cannot pay them $500/hr to sweep floors.

If you pay your children for household chores, this income is not eligible, even if your home is technically your place of business. The IRS considers household chores part of parental training.

If your business is a corporation you’ll need to submit payroll taxes like you would any other employee. You need to keep a record of hours worked and taxes withheld, you’ll want to provide paystubs. If you pay your children in cash, there is no record of the income.

Your children will have to file a tax return.

Thanks for the feedback. If your child is a 1099 freelancer and makes below the standard deduction limit, your thoughts on submitting payroll taxes and filing a tax return when nothing will be owed?

I’m not sure, my accountant never addressed that as an option when I asked about this topic.

If your business is a sole proprietorship or single member LLC you can hire your children without paying payroll taxes.

If, like me, your business an an s-corp or c-corp these payroll taxes are mandatory.

If your child is working for you regularly, and I presume they would in order to earn enough to make consistent ROTH contributions, they can’t be classified as an independent contractor. You’ll also have to comply with federal and state labor laws regarding minors. I believe this means they couldn’t start working until age 14.

I’d check again with your accountant, especially on forcing a firm to hire someone as a W2 employee versus a 1099 independent contractor, especially at such low wages. Let me know what he or she says and the reasoning.

I checked with him this morning. He said they would be required to be W2 earners, a cannot be 1099’d.

I should clarify here, that I’m talking exclusively about S-Corp & C-Corp.

If your business is a sole proprietorship, a partnership where the two owners are the parents, or a single-member LLC this should be possible.

The only way to pay your kids without FICA in a S or C corporation is to set up a sole proprietorship, then pay 1099 to the sole proprietorship, and issue W2 to your kid out of the sole proprietorship, well known tax strategy.

Great article, thanks. I started Roth IRAs for two children so far. I replace their investment savings with chores and an allowance to give them spending money. They are starting to get the idea of saving and investing in their future.

Nice! Now get them to try and earn income from sources other than you. That will be a fun new challenge in sales.

Agree – fantastic opportunity for a fast start at capital accumulation!

Why aren’t you doing backdoor roths for yourself? Just wondering.

Do you see the contribution limit continuing to increase, or do you think we’re approaching a ceiling?

Yes, contribution limits and income limits for contribution should always be heading up and to the right to account for inflation.

The roth is even more flexible than 529! Thank you! But what would be the tax implication if you employ and pay your child?

Depends on how much you pay and the tax rate differential between you/your business marginal tax rate and your kid’s marginal tax rate.

Hello. I see that you had mentioned about opening Roth IRA for baby. How do you open one for infant who does not have earned income? If they can get gift from me, can they have Roth IRA account?

The income for a Roth contribution has to be from legit work – documentable. Not a gift. Hope that helps.

My son has a Roth IRA. He works for my company and makes a little over $1,000/year. That’s a small start, but it’s a great habit. Once he starts working other jobs, I’ll make sure he contributes more. I think the taxes get complicated if the kids generate a lot of earned income from your company.

How do we pay the kids? By w2 and deduct all the fed state ss?

1099 as a freelancer. But if you pay your kids a low enough income where they don’t have to pay taxes (below the standard deduction limit), they don’t have to file. Check with your accountant of course.

If you have a big business and the kid wants a FT job, then yes, hire them as a W2 employee.

I was about to ask about 1099 vs W2. Thanks for the answer.

Why pay so little? Might as well get him to work more, pay more, and deduct more.

Did this two years ago for my kids, and last year for a God child. They all have no idea. Going to be some awesome graduation gifts.

I wonder when we should tell them. Because after all, the kids are earning earned income. And eventually, they’d like to have money foe the work they do.

Baby Samurai, rocks that porkpie! Just showed to Mrs. Ceezy, she says “that is so adorable!”