The average percent of income donated to charity by levels of income is sadly very low across the board. According to several of the largest charitable foundations, the average income donated to charity ranges from just 3% to 5% of annual gross income.

Not surprisingly, the average percent donated to charity is the highest for lower income households. But the absolute dollar amount donated to charity is highest for the highest income households.

Donating money is a very personal decision. There is no right or wrong amount. Anything more than 0% is good in my eyes.

Doing your own taxes helps you think more about such topics as giving. You start wondering whether you've given enough or too much. You look for answers to figure out what is the norm and proceed to adjust within the band. Furthermore, you input different charitable scenarios to see how your tax bill changes. It's all very educational and thought provoking.

The Average Percent Of Income Donated To Charity By Income

Below is a chart from the National Center for Charitable Statistics. It shows that people making between $45K-$50K donate the second highest amount to charity at 4%.

Households making $100,000 – $1,000,000 donate the least amount of their income to charity at between 2.4% – 2.6%.

Households making $10 million or more donate the highest amount of their income to charity at 5.9%. This is great to see as one would think once your adjusted gross income is over $10 million, you have plenty of disposable income to spare!

The households earning $200K – $1,000,000 are likely crunched the most because of taxes. Therefore, it makes sense these households would donate the least to charity.

However, once households earn a top 1% income of $1,000,000 or more, the average percent of income donated to charities increases. Finally, with such a high income, households feel more comfortable donating more.

Deciding How Much To Give To Charity

We now know the average percent of income donated to charity is between 2.4% to 5.9%. If you're looking to be more charitable, let's use other people or institutions as a guide.

How Much Government Leaders Donate To Charity

Back when Joe Biden was Vice President, he donated $4,820 to charity, or 1.44% of his $333,182 salary in 2009.

Meanwhile, Obama donated about $329,000 to 40 different charities, or roughly 6% of his $5.5 million 2009 income (largely from books and royalties). Obama also donated $1.4 million of his Nobel Peace Prize proceeds to 10 different charities as a straight pass through.

In other words, Obama donated $1.723 million out of a potential $6.9 million in income, or roughly 25%.

Now that Joe Biden is President again, let's see how much he will donate, especially now that he's a deca-millionaire.

What Religion Recommends Donating To Charity

The Bible refers to Jacob promising to give a 10th of what he receives back to God. “And this stone, which I have set for a pillar, shall be God’s house: and of all that thou shalt give me I will surely give the a tenth unto thee.”

Buddhism discusses alms giving to monks and nuns as a way to spiritually connect, show humility, and support the community. Although in Buddhism, there is no exact percentage figure suggested to donate to charity.

Therefore, donating roughly 10% of your income to charity a year is what many religions recommend.

If you want to have maximum impact and donate more tax-efficiently, consider opening up a donor-advised fund. There is a double taxation benefit for the donor.

How Much The Super Rich Donate To Charity

Warren Buffet pledged 85% of his entire US$100+ billion fortune to the Bill & Melinda Gates Foundation. His rational is to give it away to people who will live longer than him, and who know how to give better. In Warren's case, he is giving away almost his entire net worth, which still leaves billions more to be passed down to others in his immediate circle.

Do you really want to donate your money to an inefficient government? Heck no! Which is why if you've been fortunate enough to accumulate more than the estate tax threshold per person, I highly suggest spending and giving more aggressively while alive. Paying 40% of you estate to the government is such a waste.

How Much The Poor Donate

Perhaps the poor doesn't pay a large absolute amount in taxes, but the poor do contribute a healthy amount to charity.

The 2000 Social Capital Community Benchmark Survey shows that households with incomes below $20,000 gave 4.6% to charity, higher than any other income group.

Households earning between $50,000 and $100,000 donated 2.5 percent or less. Only above income levels of $100,000 does the percentage rise again.

Stuck In The Middle, Paying High Taxes

It would be great if all of us amassed billions of dollars like Warren Buffet. Then we could give away billions and still be rich.

Unfortunately, many households are stuck in the middle. Middle-income and upper-middle income households can often pay a hefty amount in income and other taxes. Such households may have mortgages, car payments, and student loans. Then there is the expense of children.

If you're making $200,000 – $250,000 and already paying a 32% marginal federal income tax, a 8% marginal state income tax, and a 7.65% FICA tax on your first $137,700 of income, the propensity to donate income to charity likely declines.

The Give Nothing To Charity Ideology Due To High Taxes

Then, when you find out that roughly 44% of Americans pay no income taxes (too old, too young, or too poor), then your desire to donate to charity might decline even further.

Given tax revenue is used to build social programs, one could logically assume that paying taxes is a form of charity. The charity is just not being redistributed as efficiently as most would like.

As America heads towards a bigger government, the omnipotent government should be responsible for supporting charitable organizations and eradicating poverty.

It's pretty clear that when given a choice, most Americans would want more Social Security benefits, more subsidized healthcare, more unemployment benefits, student loan forgiveness and more.

If you go visit Singapore, for example, you won't see poverty on the streets. That's because their benign dictator system has ensured that all people live a reasonably comfortable life.

The government provides subsidized housing, has a central provident fund (social security), solid infrastructure, and a flat tax system. The government is doing its job in ensuring that everyone has at least a certain standard of living.

If we are relying on the government to fix our problems, we should also lean on the government to eradicate poverty and more. The percentage of Americans paying no income tax is now more than 50%!

Joe Biden announced another $1.9 trillion stimulus package in 2021 to help middle-class and lower-income households. The new stimulus package calls for providing $2,000 in stimulus checks, $600 a week in enhanced unemployment benefits, and more. Further, Joe Biden wants to cancel student loan debt of $10,000 for everyone.

Who is going to pay for all this stimulus? Taxpayers. Hence, expect capital gains tax, income tax, and other tax rates to all go up in 2022 and beyond.

A Solution To The Redistribution Of Redistributed Wealth

To help alleviate poverty and help society, may I suggest one final simple solution.

Those who pay no income taxes at all donate more to charity. Perhaps a minimum donation percentage is 5%, half of what the Bible suggests.

To suggestion helps prevent people from not paying taxes and not donating to charity. By increasing the breadth of charitable contributions, more people benefit. Further, it feels great to give instead of only receive.

Perhaps a simple donation formula for everyone is: 20% (Avg. effective tax rate) – An Individual's Effective Tax Rate = How Much To Donate. Of course, if your existing effective tax rate is already higher than 20%, you should feel good that the government is utilizing your income for the greater good.

Generate More Income Through Real Estate

Real estate is my favorite way to build more wealth and income because it is a tangible asset that is less volatile, provides utility, and generates income. If you're interested in increasing your passive income and donate more to charity, real estate is an attractive asset class.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms that are free to sign up and explore:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Recommendation To Build More Wealth

If you want to donate more of your income to charity, then you should track your income and wealth more carefully. Do so by signing up with Personal Capital. It is a free online platform which aggregates all your financial accounts in one place. The better you can track your wealth, the more you can optimize it.

Personal Capital's best feature is its Retirement Planner. It uses your real expenses and income to calculate what your future retirement cash flow will look like. There is no rewind button in life. Plan accordingly!

I've used Personal Capital's free financial tools since 2012 and have seen my net worth skyrocketed since then.

Related: Keep Your Donations A Secret: Giving Is A Personal Matter

Photo: Mumbai Beach at base of Queen's Necklace, SD. The Average Percent Of Income Donated To Charity is a FS original post. Sign up for my free weekly newsletter below and buy my instant Wall Street Journal best selling book, Buy This, Not That, to build more wealth.

Everyone should give. I don’t care how poor or rich you are. Keeping it all to yourself is selfish. Giving builds character, makes you happier, and what you sow, you will reap (or lack thereof). There is always someone who is way worse off than you. Count your blessings and open up your pocketbook.

Instead of giving a percent of your income, another way that I personally find makes more sense for me (although either way is valid; it’s whatever works for you) is to set aside a percent of my budget for charity. So instead of charitable giving being treated as an additional “tax” on your income, it’s just another expense. I set aside 10% of my annual expenditure for charity.

I feel that this especially makes sense for the FIRE community, since during the accumulation phase there is such a large difference between income and expense. If I were to currently give 5% of my gross income to charity, it would be about 40% of my annual expenditure! (I like giving to charity, but I don’t think I’m selfless enough to give away almost as much as I spend on myself.) And when I hit my FIRE number and retire, I also don’t want my charitable giving to drop precipitously or even go to zero. The idea of giving significantly less when I retire despite being wealthier than before doesn’t make much sense to me.

However, if I budget charity as an expense, then my annual charitable giving would stay relatively consistent (and increase with inflation) throughout my life. And including it as an expense when I calculate my FIRE number means that I don’t forget to account for it in my retirement planning. And when my finances fall on hard times (stock market crashes, or my passive/part-time income dries up for any reason), having this 10% cushion built into my expenses makes me feel much safer about retiring so early. While I would love to never encounter this situation, during difficult times it is the easiest discretionary spending to cut without imposing hardship on my family or forcing me out of retirement.

That makes sense. To incorporate charitable giving as an ongoing expense.

I guess most people try to reduce expenses, hence why many don’t think about it this way.

I was trying to figure out why I didn’t give more myself. And it is exactly as you say. As I give more to the taxman, I feel like I don’t want to give more to charity. It’s really sad, but I have college tuition, property taxes (over 1k month), state taxes, and high medical deductibles. I am going to write an extra check, but it really should be more.

I think I have covered charity by paying school district taxes of more than $6000 a year.

After trumps tax reform the above $6K are not tax deductible anymore as I am above the $10K threshold.

I don’t have kids to use any of that so effectively I am donating to my neighbors kids education.

I suggest that people should not look at others income and assume how much they should be donating.

I wonder how many of us give to charity as a salve to our conscience for not being more charitable to those in need? How about we donate a proportion of our most valuable resource – our time. Why not make it mandatory for companies to allow employees to take half a day off each week, with full tax-free pay, to donate our time to accredited charitable organisations?

By cutting out the bureaucracy 100% of our time would go to where it is needed most. And we’d all get a sense of true contribution!

I appreciate your heart in the right spot here, to give this topic serious thought and consideration and taking the time to reply. Your proposal is that you should get paid in full by your employer to work a half day per year at a charity. It could be argued that isn’t charity from you. If our time is that valuable (not arguing that point), another approach is to put our time to highest and best use, make the money and be generous with our pocket book. I started, years ago, by setting aside $300/month and segregated it into a separate account (because I just couldn’t decide where to give). After a while, there was $3k in that account and because I didn’t feel like it was “mine”, it was easy to start to donate. I’d also set aside $1k here or there as modest lump sums came in (annual bonus, tax refund, etc). Then after years of that, I read “The Life You Can Save” by Peter Singer and accelerated my path. That year my wife and I gave about $10k and i asked myself “what if” we set a goal of increasing that $10k per year “forever”? We’re not that many years in, but just completed the $30k year and have set aside almost half of 2024, which is the $40k year. I now consider my charitable giving to be one of the reasons I’m on this Earth. It is slowly reshaping who I am. Every year, we don’t know where it’s coming from, but so far, it’s fallen into place (and looking hopeful for 2024). I guess we’ll see if I’m F.O.S. in 6 years when it is “supposed to be” $100k. I truly can’t imagine! But I’m energized by seeing how it might be possible!

The problem with socialism is it makes people feel like the government is stealing their money – and for the poor, it makes them feel entitled to the contributions.

Free charitable giving is far better than socialism. For the giver, it is something you choose. You know who you are giving it to. If you are the recipient, you know it is a real gift that the giver wanted to give.

As always thing is more complicated.

Your goverment can easily eradicated poverty in your country and do it better than personal charity. However, this requires competent goverment.

On the other hand, when goverment spends money on charity, you have no controll where does it go. It can go to ogranizations that you would not like to fund, because they act against your morals.

Also, when it comes to helping other countries, your goverment may be unable to do as much as international charity organizations, because international organizations are often more powerfull than most countries.

As to socialims, don’t be a libtard. Communism =/= Socialism, and there are many types of socialism, some of which work very well, much better than liberalism, which the USA people love so much. Before Trump got elected, the EU was had bigger economy than the US, and it only changed after he was elected. It’s only because of his good policies that it changed, but US is still plagued by many problems, like the lack of decent medical care*

*US overpay for their services, and don’t even get the best treatment at the hospitals, europe pays much less, and has better hospitals. Inflated prices don’t mean good standarts of living, and many prices in US are inflated, which makes US poorer than it’s GDP would make it.

If you want to know how realy rich your country is, you should compare things like crime, poverty rates, average life expectancy, food prices, food quality, access to communication(railroads, roads, etc.), Internet Access(which is better in the EU than in USA, I know, I’m from Poland, my internet is better than majority of USA people, and it’s very cheap too), and many other aspects. GDP, even per-capita, isn’t great reflection of wealth.

Another fact is that US education is crap, and you have more than university 50% graduates from universities being Immigrants. Yep. US education is based on brain drainage from less wealthy countries. And guess what, it’s not gonna last forever, since the rest of the world is catching up. Even Europe has that problem, but it’s education is still better than the US.

I assume you’re from the US because of the way you speak. Pardon me if I’m wrong.

Still Liberalism is as bad as Communism. Communism kills you, Liberalism lets you die on the street. That’s the only difference.

My wife feels compelled to donate 10% of her income, while I’m comfortable at 3%. So as a household it probably ends up between 4-5%. She gives exclusively to church causes, while I give almost exclusively to St. Jude.

[…] Giving ($18,000): $18,000 equals 3.6% of the family’s gross income, which is inline with the average donation percentage by income. They each give $7,000 to a charity they strongly believe in, and also give $2,000 a year each back […]

[…] The Average Percent Of Income Donated to Charity Can Improve […]

I like your giving formula, but I think the % should be about 33% not 20%. I do not have the research in front of me, but I understand if one added the Jewish Tithe with their taxes during the period of the Kings they were giving about 33% of their income. I use a similar formula to determine my annual giving, but I do not count my pre-tax IRA contributions as I will give out of that money when I retire. I do attempt to bring in all the taxes – state, local, federal, sales, Vehicle fees, etc. and oddly enough my charitable giving ends up around 10% using this system most years.

If I donate $1.00 to the government to help the poor if a single nickel gets to the poor I would be surprised.

“you should feel good that the government is utilizing your income for the greater good……”

BAHAHAHAHAHAAAAA!!! THAT’S SUCH BULL$HIT!!!

I always think it’s a good idea to do a lot of research on a charity before giving. I’m very skeptical of this charity, as I think providing milk to malnourished children is not a huge help – once humans stop breastfeeding, our bodies naturally stop producing lactate, which is required to break milk down. In our western society, we continue drinking animal milk, which ‘tricks’ our bodies to continue producing lactate. However, most children in the poor parts of the world who don’t have access to milk as children are lactose intolerant, and won’t be able to drink or benefit from milk. Also, animals require a LOT of food for sustenance – think about how much grain/grass a cow would eat in an average week. In countries where famine and drought are the way of life, producing enough crops for the humans is hard enough, let alone having another HUGE appetite to fill. The milk a malnourished cow would produce is not ‘gallons a day’, and without access to large amounts of clean water, the animal will most likely perish from disease or malnutrition. I’d like to see some evidence that this type of giving is actually helping communities…

I’m just getting my feet on the ground financially, I’ve only been in the work force for less than 3 years now. I haven’t given much my whole life really (most I ever donated in a single year was about $100) but now I’m giving more. I’m starting off small, just 1% of my after-tax income. But I play on giving a higher percentage of my income each year.

Charity? are you kidding? My taxes go to build the roads and bridges I use for work. They create the infrastructure of my city. They go to support my local schools and public universities that educate my children and support the creation of my future employees for my business. Taxes support services I need in an emergency like the Police and the Fire Department. If they’re national taxes they go to support these same items in other states as well as defense which keeps our country competitive and keeps my assets at least somewhat safe. Taxes are used to protect my well being with programs like the FDA. My taxes go to support everyone else in the community and society. Charity? do some homework bro. These items are worth it.

So how much did you pay in taxes in 2011? We can compare with mine.

I think if one pays up to $40,000 in Federal Taxes a year, that’s fine. But more than that? I don’t think we’re getting anything more in return.

I have to disagree with Patrick. Paying taxes so the government can build a soccer field at Gitmo for inmates is not worth it. Paying taxes so the government can use 43 cents on the dollar to pay interest to China is not worth it. Paying taxes for drone strikes which often kill women and children is not worth it.

Patrick makes a very good point,

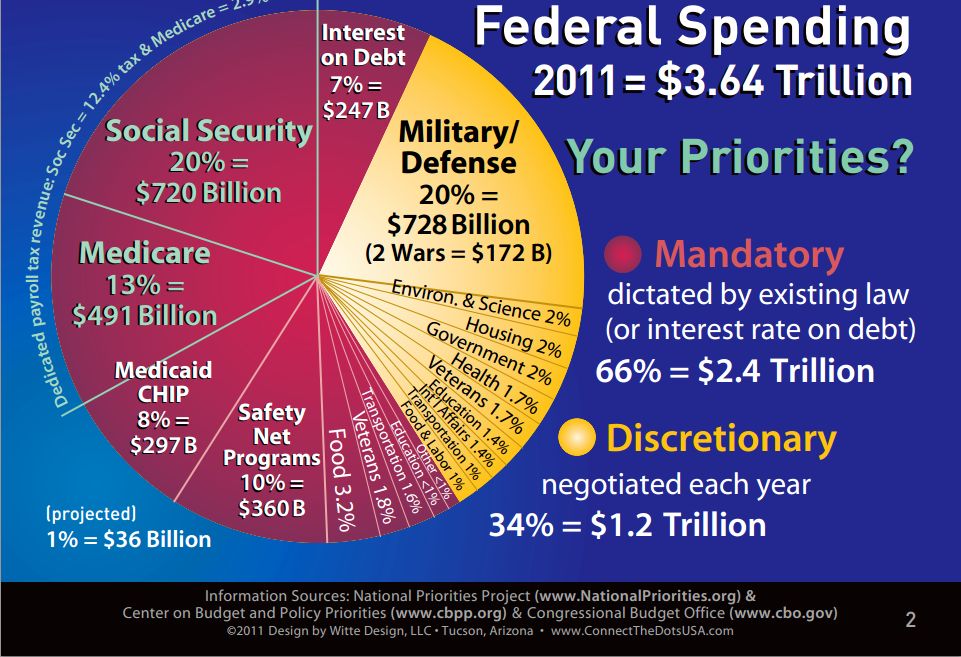

Taxes directly benefit those who pay taxes. Taxes are more like burden-sharing or Mutual aid than charity. 55% of the 2011 budget was spent on defense, social security, and medicare/CDC/health services.* These expenditures directly benefit the citizens that pay for them. An additional 12% is spent on education, agriculture and food safety, transportation/infrastructure, government, international affairs, scientific research, and labor regulation. These expenditures also benefit those who pay for it. 7% of the budget goes to debt repayment which doesn’t directly benefit anyone but also doesn’t even resemble charity. These expenditures account for 74% of the budget.

The remaining 26% could possibly be considered charity but I have some major reservations. First, paying for Medicaid (13%) and other social safety net programs (10%) might be considered charitable, but only if you have never and will never take advantage of these programs (Medicaid, Unemployment, Disability, TANF, SNAP, etc). The remaining 3% goes to veterans services (e.g. the VA). Some may see this as charity, I see it as an obligation. If we send our soldiers into harms way–whatever the reason–we are obligated to support them when they return home and to support any recovery they might need.

So a generous perspective on ‘taxes as charity’ could allocate, at most, 26% of taxes as being charitable (if the person in question never took advantage of social safety net programs). A strict perspective would not count any taxes as being charitable. A moderate interpretation would probably lie somewhere in between.

BTW,

Bill – I didn’t see the soccer field at Guantanamo itemized in the breakdown of the 3.64 trillion dollar budget or the 139 million dollar Gitmo budget.** I do see that over half of the inmates currently at Guantanamo have been officially cleared for release but continue to be held indefinitely.***

Also, I don’t like spending 7% (247 billion) of the budget on interest payments (foreign and domestic) anymore than you do, but do you see a better realistic alternative? Reducing national debt and the deficit are important and pressing issues. But most of the national debt is not foreign owned. In 2012, China owned 7.5%, Japan 6.9%, The U.K. 2.8%, and all other countries own a combined 12.7% of U.S. national debt. The remaining 68.6% is owned by U.S. citizens, the U.S. government, and the U.S. Federal Reserve.****

Sources:

*

**

***

****

Sam, I don’t understand your point: “My fear is that it becomes more difficult to give more if you are making much more due to how much you get taxed.” Seems it should be just the opposite!!

If a poor person who pays no taxes gives $100, he has given $100 of what would have been his to charity. If a person with a marginal tax rate of 45% gives $100, he is only giving $55 of what would have been his to charity because $45 of that would have gone to taxes had he not donated it. So it is really much easier for a rich person to donate.

Also, even for people who do pay taxes, at the lower income levels, they may not own a house so they may not be itemizing deductions, in which case they can’t deduct their charitable contributions. So if you are not itemizing, if you give $100, you are giving $100 of what would have been yours.

Remember – No matter what you are taxed, the more you make, the more you make. Sometimes you seem to imply that people who have low income and pay little or no taxes are somehow better off than people with high incomes and high taxes.

It’s cool. As a student, I don’t think anybody would expect you to give much of anything at all! Instead, it’s really just time and maybe knowledge eg blogging and sharing your knowledge.

Just wait until you make lots of money and pay lots of taxes! You’ll certainly feel like it’s giving!

Sounds good Tim. Stay on the righteous path!

My fear is that it becomes more difficult to give more if you are making much more due to how much you get taxed.

My husband and I have worked up to 10% of gross over the past few years, primarily because we believe in giving as a spiritual discipline (we are Christians), and also because we believe we are already rich. Sure, we’d like more, but it’s crazy to think how little folks in much of the world, and US, have compared to us. We give, because the money isn’t really ours to begin with. Also, because giving is a discipline – you need to build it up routinely.

We’ve found there are some tax benefits to giving, obviously, but the reason you give is just that: to give. Sure, we give wisely, and this takes time and our own personal energy investment (personal involvement in many things we give to). But it is possible to build wealth and to work toward financial independence while giving away a good bit of income. Your article suggests they are at odds. I don’t agree with that.

Having expenses like tuition and medical bills without subsidies make a difference. You’d be surprised how much kids cost when they start driving and go to college. You don’t get any breaks if you are in that “between” area.

I start out with 10% of my net income but I also give 10% of anything that comes back from taxes. In addition, I volunteer my time to charitable organizations because often that is more beneficial for them than the cash it would require to hire someone to do the job.

That’s a great amount Latisha! Keep it up!

@Tim @ Faith and Finance

@Sunil from The Extra Money Blog

@Kay Lynn @ Bucksome Boomer

@eemusings

@JT McGee

@Melissa

@harvestwages

@Kevin Yu

@Miss T @ Prairie Eco-Thrifter

Hey guys, thanks for your feedback. Sounds like everybody is in the 1%-10% range. With some giving more if including non-cash donations. My range is about 2%-3.5%.

Ha! Not suggesting anything at all mate. I was curious to know, so after some research, this is what I found.

I guess the Democrats vs. Republicans giving debate is a whole other topic! A lot of it is tied to religious reasons.

I didn’t used to give much at all and felt like I couldn’t afford it. Once I started planning where every dollar went, suddenly I could give regularly.

My percentage is 3% now, but will increase next year when the last non-mortgage debt is paid.

From the very first job I had out of college, I have set aside 10% of all base / bonus to charity. That has increased through the years as I have made more money. I still give a fixed percentage today, though I do not track it. In addition, there are several instances of one offs, i.e. Katrina, Japan, etc.

Great point Max and I agree. The stats may show otherwise, but as Sam mentioned we don’t know what happens post 200k. Aside from the financial mechanics, there is a huge psychological component that goes into giving more as you make more. I can tell you that is true from my own personal experiences

When you make more than $200,000, and definitely more than $380,000.. you start thinking “what the hell, I am paying more in taxes than I am saving! the government should use my tax dollars, and is using my tax dollars to redistribute the wealth and help others. Why am I going to give more.”

I think in order to make it a complete comparison we should try to factor in the time and expertise some people donate to charity as well. As a student I know I donated hundreds of hours to charities. I may not have a lot of extra money (although I had very little income, so as a percentage, I might have been on the low end of your average) but the time I donated would have definitely been worth a lot more than most people give. If someone donates their unique skills as a professional or tradesman, this is obviously even more valuable.

Time definitely is valuable, no doubt about it. In fact, often I argue that time spent is more valuable than money spent b/c it helps put perspective in each of us.

Good point Sam!