In a stunning turnaround, Zillow recently announced it would be getting out of the iBuying business and will shut down its Zillow Offers division. Roughly 25% or 2,000 of its staff will be let go as the company takes a $540 million write-off.

“We've determined the unpredictability in forecasting home prices far exceeds what we anticipated and continuing to scale Zillow Offers would result in too much earnings and balance-sheet volatility,” said Rich Barton, Zillow's co-founder and CEO.

In other words, even Zillow can't trust its Zestimates!

Haven't Trusted Zillow For A Long Time Already

If you've been reading Financial Samurai since 2011, you may have read my post, You Can't Trust Zillow And Its Estimates. Back then, I was befuddled by its estimates for my house. They seemed to jump between 7% – 25% on a monthly basis.

As someone who was fighting to get his property taxes lowered after the Global Financial Crisis, Zillow was proving to be unreliable.

Below was the Zestimate of my previous primary residence, which suddenly shot up by 35% in one year. Its historical graph also completely changed from one year to the next.

As a result, the property assessor's office denied my appeal for a lower valuation, even though the Zestimate was clearly too high. I had been successful at lowering my property taxes for two years up to that point.

Given the worst of the financial crisis was over by 2012, I decided to test out the market and list my property. I had just negotiated a severance and thought it might be good to economize. It was just my wife and me in a four-bedroom, three-bathroom house.

I decided that if I got anywhere close to Zillow's estimate, I would sell and rent a two-bedroom apartment. But I received no written offers 20% below the Zestimate, so I pulled the listing after 28 days. Thank goodness, because 2012 marked the beginning of a real estate bull market that has lasted until this day.

What Disappoints Me Most About Zillow

Since Zillow's founding in 2004, it has done little to lower the cost of selling a home. With technology and the internet compressing commission rates in every industry, somehow, Zillow has failed to lower transaction costs.

Just look at online brokerage commissions. They have gone to zero. For a seller to still pay a 5% – 6% commission to sell a home today with a bad real estate agent is aggressive. This is especially true since home prices have risen so much. There would be way more real estate transactions if commission rates dropped by half. For sellers, a flat fee would be even better.

So why hasn't Zillow helped lower real estate transaction costs? It's simple. The majority of Zillow's revenue comes from fees real estate agents pay for customer leads. Therefore, Zillow can't bite the hand that feeds it. The National Association Of Realtors is its main source of business.

On the positive side, continued high commission rates have encouraged homeowners to hold on for longer. The average tenure has gone from about 4.2 years in 2009 to over 8 years today. As a result, homeowners have seen their home equity boom thanks to a bull market in housing.

If it only cost me 2% to sell my house back in 2012, I probably would have sold. Although I got a relatively good price five years later, it still pained me greatly to pay a 4.5% commission.

As a new dad, I just couldn't take being a landlord anymore to that property. Further, there were upcoming maintenance issues I didn't want to deal with. So I bit the bullet and simplified life.

Don't Sell To An iBuyer

In the past, I encouraged sellers to never sell to an iBuyer. iBuyers try to pay below-market-rate in exchange for a quicker, all-cash transaction. With an iBuyer, you can potentially close in under a week. With superior data, their goal is to turn around and sell your cheaply acquired home for a profit.

In exchange for this convenience, Zillow Offers charges a service fee that ranges from 1.5-9%, with an average service fee of 7.5%. The service fee covers Zillow's carrying costs while reselling homes. Paying Zillow 7.5% to sell them your home below the market rate is ridiculous. Waiting 30-45 days to close on a regular transaction is not that big of a deal.

Instead of selling to an iBuyer, list your home on the MLS to gain maximum market exposure. You can also try pocket listing your home with a large brokerage first before going on the MLS. In a strong market, selling to an iBuyer like OpenDoor makes little sense. In a bear market, selling to an iBuyer could be more attractive, depending on the price they offer.

But Zillow's fumble shows that you can take advantage of iBuyers as well. Zillow paid above-market prices for thousands of homes and now it is trying to offload thousands of homes over the coming quarters at likely below-market prices. Buy high, sell low!

Therefore, if you're ever approached by an iBuyer, be open to what they have to offer. Because they tend to be mass buyers, they might not have the manpower to properly check whether each offer price is reasonable. Their algorithms sometimes are way off.

That said, expect less attractive offers from iBuyers going forward since there is less competition with Zillow Offers going away.

How To Profit From Zillow's Mistake And Buy Bargain Homes

Zillow actually has a page that lists all its owned properties. If you're looking to snag a deal in this strong housing market, it's worth taking a look.

If you're browsing Zillow randomly you can also look for the “Owned By Zillow” icon.

Where Does Zillow Own Homes?

Below is a snapshot of the cities and states in which Zillow owns homes it plans to sell. Zillow owns homes in 25 metro areas across Arizona, California, Colorado, Florida, Georgia, Minnesota, Nevada, North Carolina, Ohio, Oregon, Tennessee, and Texas.

The Best Cities To Look For Zillow-owned Bargains

We can now compare where Zillow is planning on offloading homes and cities that have the lowest upcoming supply and that are also up the least since the prior peak.

The most attractive cities to look for Zillow bargains are:

- Miami, Florida

- Tampa, Florida

- Orlando, Florida

- Los Angeles, California

- San Diego, California

- Riverside, California

- Sacramento, California

- Las Vegas, Nevada

- Portland, Oregon

- Minneapolis, Minnesota

In other words, these cities are in the green, lower-left quadrant where Zillow plans to get rid of inventory. Given Zillow is also in Austin, Dallas, Nashville, Houston, and Raleigh, where potential housing supply is greatest, these cities could be at most risk of a housing downturn.

That said, Texas, Tennessee, and North Carolina are still seeing strong job growth and demographic trends. Therefore, it's still worth checking out these states for real estate bargains.

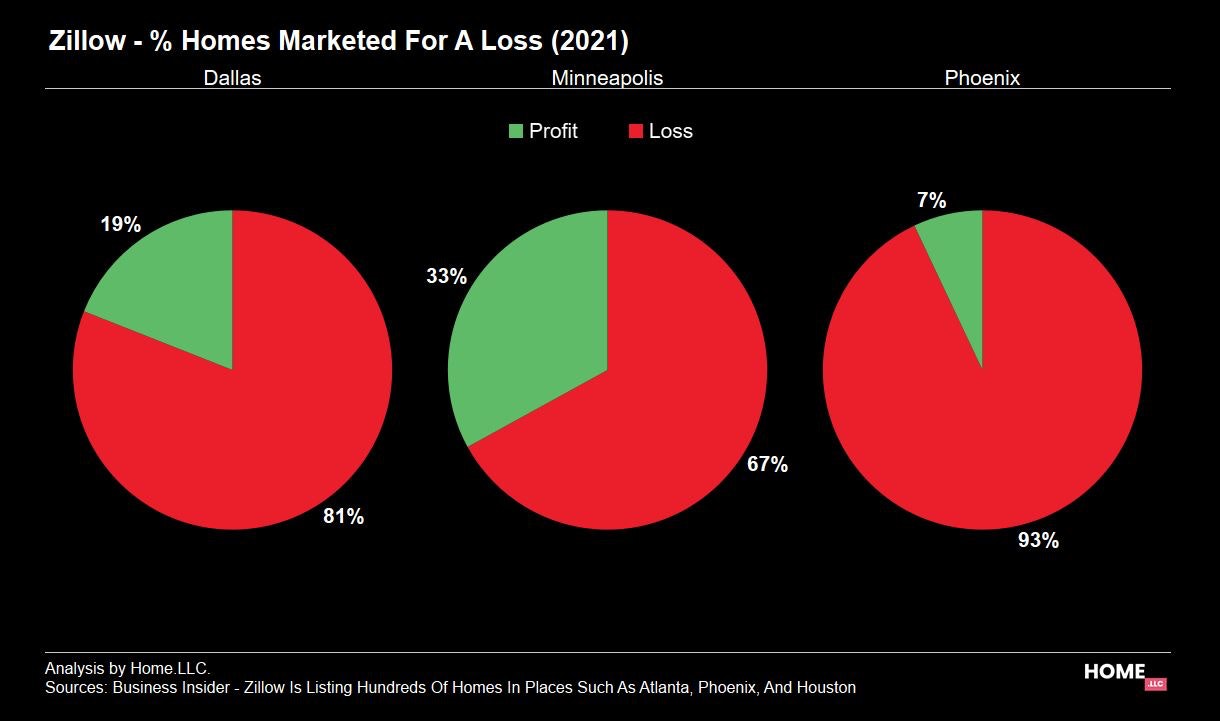

Here's a chart that shows how the vast majority of homes Zillow is selling in Dallas, Minneapolis, and Phoenix are selling for a loss.

How To Invest In Real Estate In Opportunity Cities

The first way to invest in real estate in cities where Zillow will be barfing out supply is by flying to these cities, checking out the deals, and making an offer with a local agent. You can always make an offer online without visiting the properties in person thanks to pictures, videos, and Google maps. But that’s always a little iffy if you don’t at least have someone you trust visit the property.

The other way to invest in some of the cities about is through real estate crowdfunding. You can log onto your favorite real estate platform and see if there are new deals within the desired cities above. The sponsors will have done extensive due diligence for you. From there, you can do your due diligence and invest accordingly.

From multifamily, to hospitality, to office, and industrial, real estate crowdfunding platforms like Fundrise have a good variety of deals that enable you to diversify your exposure. It's what I did after selling once expensive San Francisco rental in 2017 and investing $550,000 in 18 different deals via a fund. The fund focused mainly on properties in the Heartland.

Growing A Business Is Hard

I'm assuming Zillow got into the iBuying business because it saw other competitors get in as well. Further, Zillow was probably looking for new streams of revenue growth to boost shareholder value.

If you believe in your product, then you should certainly try and maximize its value. The same goes for deciding whether to work for someone or become an entrepreneur. If you truly believe in your abilities, you should see what you can do on your own.

In Zillow's case, it believed in its pricing algorithm, which ultimately cost it billions in shareholder value. At least Zillow tried to evolve, which is commendable. It's just that Zillow, the company, will likely go through a lost year.

As a business owner, it’s often best to focus on your core competency. Be careful of shiny object syndrome.

Use Real Estate Mispricing To Your Advantage

If there's one lesson to be learned by us real estate investors, it's that we must continue to not trust Zillow's estimates. It’s worth downgrading your property’s statistics to make it seem not as nice as it really is.

I've found Redfin's pricing estimates to be consistently more accurate. However, there is continuous revisionist history with both Redfin and Zillow's estimates to make them seem less off. For a decade, I have diligently tracked final home sales prices and online pricing estimates for homes I care about. Many of the estimates continue to be way off.

As a result, in 2019, I came up with the FS20 Property Leading Indicator to give potential buyers a signal to help them buy with more confidence. Buying or selling a home can be a nerve-wracking experience. The concept behind FS20 should still be very helpful today.

As savvy real estate investors, we need to utilize poor online real estate pricing estimates to our advantage. The way we do so is by knowing the market better than the pricing algorithms. We then exploit the pricing difference with buyers and sellers who naively still believe in Zillow.

The real estate market is inefficient, which is one of the reasons why I like it so much. Now it's time to look for some Zillow-owned deals!

Achieve Financial Freedom Through Real Estate

Real estate is my favorite way to achieving financial freedom. It is a tangible asset that is less volatile, provides utility, and generates income. Real estate is also a great play on inflation as inflation helps push up rents.

Even though you can't trust Zillow's estimates, you can trust that real estate will continue to be a coveted asset class.

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher. As the Federal Reserve embarks on a multi-year interest rate cut cycle, real estate demand is poised to grow in the coming years.

I've personally invested over $1 million in real estate crowdfunding to diversify away from my expensive SF real estate holdings. As a father of two, I also love that I'm earning 100% passive income instead of dealing with tenants and maintenance issues.

Readers, what are your thoughts about Zillow entering and exiting the iBuying business? What are some good reasons for selling to an iBuyer at a big discount and a huge fee? Are you planning on taking advantage of a Zillow deal as it offloads thousands of homes?

First time posting here but I read a lot of the articles and comments.

I have an offer for 470k on my Chandler Arizona home from opendoor . Which was over Zillow zestimate by 15k. Wife and I are bidding for new home. It’s a raffle system for new build. Not sure whether to accept the offer or maybe make this one a rental. Mortgage is 845 and rental estimate is says I could get 2350 here. Was thinking I could take the profit and help pay for my new home as I wouldn’t be able to afford it otherwise. Or I just sell high on this market and buy new home with lots of equity. Owe about 150k left. We’ve redone alot on this home so wouldn’t have a hard time renting it out. But worried then about buying in a high priced market but we need a bigger home and interest rates are low.

Tough dilemma Eric. Why not test the open market?

In general, I like to keep my homes for rental property and save up enough to buy another. Over time, you can build a nice rental property portfolio.

I think I’ll either test market and list it or keep as rental. Would you personally refi rental to get some more cash for 20% down or would you just keep as is and go with 10% down on new home? My rate on rental is already really good.

I’m not a fan of doing a cash-out refinance to take on more debt. It obviously works during a bull market, but at this stage, it’s really tough. I have too many bad memories of the 2000, 2008-2009 crashes. People losing their jobs and their homes left and right.

I agree as I don’t like debt. I’m looking at around a 600k home to purchase. So would you just go into to next house with 10% down?

Thanks for your advice and keep up the good articles!

If Zillow can’t make money in the housing market, why do you think you can? Real estate is treated more like an equity for speculation than an illiquid asset. This discussion reminds me of the retail investors that think they can beat the market returns of the S&P 500, the concept is much simpler than the execution. Good luck outsmarting the big wall street investors in this space!

I probably can’t over the long run. But it’s always fun to try! And who knows, sometimes we can get lucky, as some other commenters have comment.

Are you still 100% out of the stock market and real estate since 2019? It could really pay off if there’s a big and extended crash. I just don’t think there will be one for a while.

I’ve invested in some local micro cap stocks (high dividend yield and inflation protected businesses), aside from that I’m on the sidelines watching this spectacular melt up.

Generally, my belief of the housing market and the stock market is quite similar. to yours. The average investor cannot beat the market (efficient market hypothesis). The only people who can beat the market are those who have very niche knowledge about an industry (often cultivated over many years) or those who have very niche knowledge about a real estate metro or even more precisely a neighborhood.

If Zillow with all its capital deployed to research and buy and use volume as leverage and they pulled out during market highs? I can’t say that gives me great faith in the real estate market. However, I know what I know (a niche industry) and a RE metro is not one of them. I believe people should invest in what they know.

A big difference between RE and stocks is the perpetual tax burden aside from gains. You pay property taxes each year and if it’s on the recent high sticker price…yikes. Here in the Bay Area I know people coughing up $20k+ annually on property tax like it’s nothing. I’m not wealthy enough for that to be meaningless yet.

Hi Sam, do you plan to look for and buy any of these Zillow “deals”?

A few months ago, you mentioned about potentially purchasing a property in NYC. Did that ever happen?

Have a good weekend!

On the flip side, property owners can use Zillow & OpenDoor’s errors and overpaying to their advantage. In my area, iBuyer’s overpaying are providing great comps for owners to refinance, sell, or get out of escrow by now having 20%+ equity.

I have personally gained $175k in equity using iBuyer transactions & errors. I bought a Zillow-owned property as rental property for $275k. Listed as a 2 bed and poorly marketed, it had a bonus room that was an easy conversion to a 3rd bedroom. They also left it ugly, didn’t bother putting a fence in (it had no fence at all). I converted it to a 3 bed with 4 ft of drywall, painted the exterior and installed a fence. Then rented it out at a 3 bed rate. 6 months post purchase I got it appraised for $375k ($100k over purchase) and did a cash out refinance, pulling out 90% of my invested capital. I am also a licensed Realtor, so Zillow paid me 2.4% commission to buy myself a rental!

I now have my next primary under contract at $530k. A perfect comp down the street with a 25% smaller lot and 1 less bedroom was purchased by OpenDoor for $603k and just re listed for $625k. Their $603k purchase (plus other comps) gives me ~70k in equity upon closing.

For folks who know their market well, iBuyers have provided a windfall of opportunity and equity! I am sad to see Zillow go.

For the Zillow announcement, this surprises me given how hot a housing market 2021 has been. How much were they overbidding and did they not have employees doing any QA before the offer or while in the contingency period? They even had the favor of artificially estimating low values to deter competition for real value bids.

For the realtor discussion, change needs to happen. Realtors have too much power, make too much money (now even more money with home values skyrocketing and they get a percentage of that), and now work less (transaction time is much less than before). When I sell in two years, I am going to advertise 1% seller agent commision (which equates to a 2.5% commision of the median SFH value in my County) with $3-10k of incentives, if met. Flat fees based on Country/City make so much more sense. There is no reason why a realtor should get 2.5 times more money than a home sold 8 miles east of me just because the LAND where I live is worth 2.5 times more than the other home’s land it sits on. Don’t even get me started with the listing agents only looking to sell to their own clients (illegal but still happens), and pocketing $100k+ in less than a month’s time. Good grief. We need changes in favor of the sellers.

There are several ongoing Federal Lawsuits in progress about the commissions. Some of the plaintiff law firms are the same ones that took down big tobacco.

https://www.nytimes.com/2020/10/09/your-money/real-estate-commissions-lawsuit.html

In most hot markets today Agents do very little in the actual transaction to earn thousands on a sale. I have done 10 transactions in the last year. Both buying and selling. Every single one had multiple offers within the first 1 or 2 days of putting in in the MLS system.

Taking out some marketing money to attract buyers and sellers, the Agents are making a killing for doing little work in the actual transaction.

I would have become an agent for all of my transactions over the years, but I have to use my Brother. LOL

just saw this on twitter: Incredible

sold my house to Zillow last week for $550,000 (25%) above market and they just called to ask if I wanted to buy it back. I offered $350,000 and they accepted on the spot. Can’t make this shit up.

https://twitter.com/BillyMcFarlend/status/1456357784828715020?s=20

I think he’s making it up. :)

they thought that they can do for homes what carvana did for cars. before you can go to craigslist and find a ton of used cars. now a lot of people just sell it to carvana, vroom, shift, autonation, carmax, etc.

This has to do with convenience, and also people are becoming more anti-social so anything involving human interaction is something people are trying to avoid. i don’t always blame them given how people are these days, but there’s a whole world of opportunity creating businesses centered around people’s desire to be anti-social.

Anyhow, homes are not cars. Zillow should just be happy that this happened to them in a hot market. Maybe now they can go back to their higher margin business and learned a lesson about letting agents do the grunt work. As for what a real estate agent deserves, it may be not be 6%, but it ain’t some flat $1500 either. I recently sold a home and he agent said he’d do it for 1.5%. I told him I’d pay him 2%. Life is about incentives, and making sure people are properly incentivized is how you get things done your way.

I think Carvana is the next Zillow. I know several people, including myself, who have sold cars for thousands over KBB. And in at least one instance, that same car was later listed on Carvana for less than they bought it for. I think they are trying to build volume but are losing tons of money. Reckoning day is coming.

I think Carvana, CarMax and others will be okay because they’re making the money on financing. I recently sold my 2019 Mazda CX-5 Grand Touring to CarMax. Nothing wrong with it and I really loved the car, but the offer was ridiculous. I priced it out with no expectations, just curiosity.

Carvana: $20.2K

CarMax: $27.2K

This was interesting! The CarMax offer put me multiple thousands above what I paid two years ago. I didn’t get around to selling it as I had a trip planned so two weeks later I was offered:

Carvana: $20.2K

CarMax: $29.4K

I pinched myself a few times and got the offer verified. For reference, I was offered an identical trim-level, new CX-5 for $32,750 through Costco pricing and a trim level up at MSRP. No brainer, I sold. My old car showed up a few days later on CarMax for $30,998…$1,800 less than a brand new one!? It sold a few days later to what I presume a happy buyer that financed. The CarMax process was stress free for a seller and I highly recommend it if you can find a replacement without dealer markup.

Wow. GREAT article, thanks for highlighting all the information Sam.

One of my friends works in real estate and actually developing commercial real estate properties and he still says that Zillow’s Zestimate is pretty accurate. It’s interesting to see the other side of the coin.

I just closed on the sale of my home to Opendoor. I couldn’t believe the offer I received from them even with the 5% service charge that they take. The service charge came out to $36k. My house is very cookie cutter and easy to value and I estimate Opendoor overpaid at least $25k, if not $35k compared to comps. I’m not sure how Opendoor plans on making any money on this deal. I’m thinking about shorting the stock based on my personal experience. It was very nice to not have to show the house and deal with a realtor. Especially with a toddler in the house.

Fascinating and congrats. Can you share why you decided to sell with them versus testing out the open market? What was the sales price? A range is fine.

Open door could be a short after it’s rally today. Zillow competitor out so the idea is Opendoor won’t have to pay as much due to less competition.

Opendoor offer was $726k. I comped my house at $680k-$695k. I wasn’t planning on selling to Opendoor but the flexibility to set my closing date, not have to show my home, no repairs, and not worry about the buyers appraisal not coming in made it to good to turn down.

I actually ruptured my Achilles during escrow and was able to push back my closing two weeks so I could heal after surgery. That in itself was worth the deal.

That does sound pretty convenient! What is the fastest they could close if you wanted the quickest close?

I guessed venture capitalists temporary relief fund money losing start ups, so why can’t iBuyers temporary relief fund middle class homeowners as they try to grab market share.

You could close between 15 and 90 days. And you can adjust the date up to a couple days before close. They will also rent the house back to you but they were offering $187/day to rent back.

A rent back is a nice option to have for moving and finding a new place.

Do you plan to rent or buy another place?

We are renting a place for 6 months to figure out where we want to buy. We’re moving from Reno, NV to Knoxville, TN. Big change so I need a bit of time to get a feel for the place. Like you say though, I always look to get at least neutral on real estate by owning my primary. I usually invest in multifamily Southeast properties on Crowdstreet or through REITs for my portfolio. I get stressed dealing with owning rental property outright.

Cool cool. Good luck on your search! Instead of Knoxville, maybe see if u can get a Zillow-owned deal in Nashville! You’d conduct the ultimate arb with Opendoor, Zillow, and location changes.

I don’t know your market and I am not doubting your decision, but you can Comp yourself out of a lot of money in a hot market.

Real example. I sold one of my properties March 2021. It was a S.F. home in Boca Raton and was a rental and needed some TLC.

All the comps said to price it about $420K. Being a hot market I priced it at $495K, hoping to get $470+ and praying it would appraise out.

Got over 10 offers in the first 3 days. Sold for $515K all cash offer. Closed in 30 days. no concessions. no appraisal.

Even I was surprised at the number of cash offers. There is soooo much cash out there right now.

“You can comp yourself out”…. is very true. In a bull market, we can easily be surprised on the upside. Demand, compounding, and liquidity have a sneaky way of catching up to us.

What did you end up doing with your house sale proceeds?

Bought S.F. lots in an up and coming market. D.R. Horton et al. have recently bought big tracts in this market. 2X in 6 months but I don’t think that will continue at that pace.

Cool. It’s one of those things where if one sells, one has to buy to keep up or do better. Therefore, I like to just hold, and buy more if possible.

I find the Zillow debacle to be comical but also unfortunate, as their shareholders are paying the price for managements failure to complete proper due diligence. Regarding fees, I am shocked that the real estate industry still feels entitled to such profits. I know several realtors who believe they are worth the fees, but 3% to each realtor on a million dollar home is $60k. Do both realtors deserve $30k? Heck no! Hopefully we will see more efficiency in this market sooner than later.

This is a great article. The one piece I feel is missing is the fact that Zillow stock has plummeted from its high. Considering the value of tech stocks right now, physical real estate aside, are you planning on snatching up “cheap shares”?

I bought more Redfin yesterday, the superior platform and company that has actually helped lower transaction costs.

I can’t get behind Zillow. It’s personal! How about you?

I actually really like the Zillow platform for home searches, listing properties for sale as well as property management. Yes, it has its flaws, however pricing millions of homes is not an easy task and as you pointed out can actually benefit the wise. To me the home buying was a misstep and a setback. That being said if someone asks you how much is your car worth you respond “KBB” if someone asks how much is your home worth you respond “Zillow”. I personally picked up some shares here because I believe Zillow will right the ship. Wish me luck!

Oh wow I had no idea they are shutting it down. I’ve never trusted Zillow’s numbers either. It would be interesting to see if individuals or ibuyer competitors end up buying the majority of the properties they are trying to offload. Thanks for the insights!