Bad pricing estimates by Zillow and Redfin are commonplace. Despite starting in 2004, Zillow's estimates are especially unreliable. However, you can use bad pricing estimates to your advantage when buying or selling property today.

Over years of comparing the two, I've noticed Redfin's pricing estimates are more accurate. Further, Redfin is much quicker to update the final sales price of a home after it goes pending. But even Redfin has some pricing issues as well.

In fact, Zillow's online pricing estimates are so unreliable, even Zillow doesn't trust its Zestimates! In November 2021, Zillow announced it would write-off $500+ million in losses and shut down its iBuying business. The reason? They admitted their Zestimates were unreliable.

Zillow's stock has cratered from its highs. Unfortunately, so has Redfin since it's in the same space. If you can't really trust Zillow's and Redfin's price estimates, then what is a seller or buyer supposed to do?

Suggestion: If you want to invest in real estate passively without all the remodeling and tenant hassle, check out Fundrise. Fundrise is my favorite private real estate platform that invests predominantly in residential and industrial commercial real estate in the Sunbelt, where valuations are lower and yields are higher. I've personally invested over $300,000 in Fundrise to diversify. The investment minimum is only $10, so it's easy to dollar-cost average in.

Different Ways To Get A Home Appraised

Zillow and Redfin's pricing estimates are only one source for estimating the value of a property. Asking real estate agents who recently bought or sold homes in your neighborhood to give you their pricing opinions is another way. It's also free and you get to learn what they are seeing.

Paying for a professional home appraisal is another common method. The appraiser also uses recently sold comps and does cost-to-rebuild and price per square foot calculations. But even these paid appraisals are sometimes done with errors.

Ultimately, to come up with the most accurate price for a home, you have to do your own due diligence. Triangulate all information available to get an accurate pricing estimate. This way, you can buy or sell more confidently.

Let's explore why Zillow and Redfin pricing estimates can be so off. Then, we'll discuss how we can use their bad pricing estimates to our advantage when buying or selling a home.

Why Zillow And Redfin Are Frequently So Off With Their Pricing Estimates

Zillow and Redfin's pricing estimates can be very off for the following reasons:

- Zillow and Redfin often have incomplete data about your property

- Savvy homeowners are not updating their property's features after a remodel to keep the property tax assessor's office at bay

- Savvy homeowners are actually downgrading their property stats online

- Their algorithms can't update quickly enough in a rapidly declining or rising market

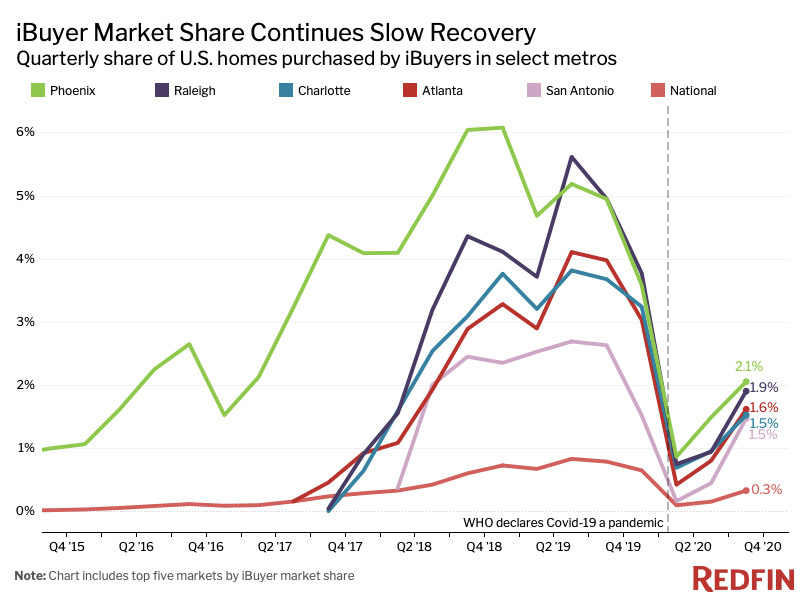

- Zillow and Redfin have entered into the business of buying and selling homes (iBuying aka instant buying)

- Incorrect home square footage size

Let's first talk about the last point and why it's hard to fully trust Zillow and Redfin's pricing estimates.

Zillow And Redfin Are (Were) Your Competitors (iBuying)

Zillow and Redfin are publicly traded companies that aim to increase their profits every year to appease shareholders. As a result, they must continue to expand into new markets.

For example, roughly 70% of Zillow’s revenue still comes from fees real estate agents pay for customer leads and apartment leads. About 8% of its revenue comes from fees banks pay for mortgage leads. While ~18% comes from advertising based on recent earnings results.

Given such a huge concentration in revenue from real estate agents, diversification is rational. No longer do Zillow and Redfin want to make money mainly through real estate advertising and lead generation. They want to use their vast databases to buy and sell homes for a profit.

Zillow And Redfin Gaming Home Prices

Therefore, it behooves Zillow and Redfin to try and buy homes for as low of a price as possible. This way, they can try and make as big of a profit margin as possible when it comes time to sell.

At the margin, Zillow and Redfin are incentivized to keep their online pricing estimates artificially low. The reason is because they are marketing that they will buy your home based off of their pricing estimates.

Obviously, Zillow and Redfin can't have their pricing estimates be too egregiously low. Because at some point, the public will wise up and stop trusting Zillow and Redfin's pricing estimates altogether.

However, I'm not sure if the public has wised up yet. Hence, there's an opportunity to use bad pricing estimates to our advantage when it's our turn to buy or sell.

Ultimately, Zillow shut down its iBuying business in 2022 because it couldn't even trust its own housing price forecast.

Related: Institutional Real Estate Investors Are Buying Up Rental Properties

Who Would Sell To Zillow and Redfin?

Now that we understand Zillow and Redfin are our competitors, who would want to sell to them? People who either don't know better, don't want top dollar, or want an easy sale. This is fine if that's what you want. But, if you're selling to Zillow or Redfin without all the facts, this is a suboptimal financial move.

Pitching peace of mind is a smart way to get platform users to sell their homes to Zillow or Redfin. Selling a home can be very stressful, as I found out back in 2017. Even though it took a reasonable 45 days to sell my home, I was still very frustrated with the process.

Guaranteed Purchase Price Offer

To expedite a sale, Zillow will offer a guaranteed purchase price (below market) so you don't have to go through the anxiety of selling your home. Selling a home takes work. You may want to hire an agent, stage your home, market your home, negotiate with a buyer, and wait for the contract to close.

Contracts can sometimes fall through. Zillow and Redfin cut out the middle-people and provide greater assurance your home will get sold. That said, you still don't know for sure whether Zillow or Redfin will go through with their offer until the money is in your bank.

In a strong real estate market, it is better to test the open market to potentially create a bidding war rather than sell directly to Zillow and Redfin. You can first test the waters with a “pocket listing” that internally markets your listing within a brokerage. Then you can open it up to the MLS. Or, you can try and sell the property yourself.

In a weak real estate market, selling directly to Zillow or Redfin may make more sense if you are presented with an acceptable price offer. Contracts in a weak real estate market tend to be more at risk of falling through. However, Zillow and Redfin aren't stupid. In a weak real estate market, they will offer you an even lower low-ball price.

I suggest first trying the traditional way of selling your home first. If that fails, then you can consider selling to Zillow, Redfin, Opendoor or other iBuying firms.

Savvy Homeowners Make Their Properties Look Worse Online

Another reason why Zillow and Redfin often have bad pricing estimates is due to user input. All homeowners can claim their homes on Zillow and Redfin and customize the data.

One of the costs of owning real estate is property tax. Therefore, as a homeowner, your rational move is to try and keep your property tax bill as low as possible for the duration of homeownership.

The first way you can do so is to fight the property assessor's office every year. I did so for three years in a row during the Global Financial Crisis and won. I was able to lower my property tax bill by $3,000 – $4,500 a year. In the fourth year, I lost because the real estate market had finally begun to recover.

The second way to fight your property tax bill is to make your home look as small and as bad as possible online. Every property assessor goes online to check your home's pricing estimate on Zillow and/or Redfin nowadays. I know this because I've had multiple conversations with several property assessors who always do an online check.

Make Your Home Look Like Trash

In the name of privacy, safety, and saving money, you should debase your home online.

Go into your home's Zillow and Redfin profile and remove some bedrooms and bathrooms. Reduce your home's square footage as well. Price per square foot is a key valuation metric Zillow and Redfin use. If you don't want to lie, then you can just remove the square footage amount altogether.

Take down all the fancy marketing photos of your home if they are still up. Either have generic Google Street View pictures of your home's exterior or upload some crappy photos of your home. The property assessor's office will see them all.

There is no shame in trying to make your home look as crappy as possible. You are fighting to lower your taxes from a property assessor's office that has historically raised property taxes during recessions.

Further, as a stealth wealth practitioner, your goal is to look as poor as reasonably possible. Protecting your family from burglars and murderers is your responsibility!

With new customized data, your Zillow and Redfin estimates should go down. The next time the property assessor looks at your home's online pricing estimate, s/he will think twice about jacking up your home's value.

Once you want to sell your home, you must update your home's online records to its most accurate extent. The data must be accurate since you must accurately represent yourself to potential buyers. Otherwise, the buyer may back out or ask for monetary incentives.

Zillow And Redfin Pricing Algorithms Will Need To Catch Up

Unless Zillow and Redfin want to see their reputations decline, they will have to improve upon their bad pricing estimates. Otherwise, its users will stop trusting Zillow and Redfin and go elsewhere. Losing trust will also hurt their iBuying business.

Despite the pandemic, we are in a housing bull market. If you are obsessed with tracking real estate like me, you will realize Zillow and Redfin's pricing algorithms are behind the times. Many homes are selling for above asking and above Zillow and Redfin's own estimates.

Here are two examples of some very off pricing estimates. I've decided to use Redfin's pricing estimate because Zillow's pricing estimates tend to be even more off.

Example #1 Of A Bad Pricing Estimate

A 3-bed, 4-bath, single family home sold in February 2021 for $3,425,000, or $630,000 over asking. Given the square footage is not listed, chances are high the home is under 3,000 square feet.

Here's where it gets interesting. Some of you might be thinking that the home was obviously underpriced to get such a high price. However, I'm not sure $2,795,000 is that underpriced for a home that is probably close to around 2,800 square feet. This is where we should compare the final selling price of a home to an online estimate.

Redfin's estimate for the home is $3,011,416, or $413,584 less than the actual sale price of the home. Being off in price by ~5% is within a reasonable range. But being off by 14% is really bad. Data gets thrown out left and right after such a huge margin of error.

It seems as if Redfin's pricing algorithm lacked sufficient data (square footage of home not listed) and isn't properly forecasting the future. As demand for single family homes surge across the country, Redfin's pricing algorithm is still stuck in the past.

The other theory as to why Redfin's pricing estimate for this particular home is so bad, despite collecting so much data about homes since its founding in 2004, is that Redfin is purposefully keeping the price estimate low. Perhaps Redfin tried to buy the home for about $3,000,000 in order to resell it for a 14% gross profit.

Example #2 Of A Bad Pricing Estimate

Here's a nice 4-bedroom, 3.5-bathroom Mediterranean-style home that sold for $4,000,000 on Mach 4, 2021. The selling price was $705,000 over asking, or 21.4%.

Listing the home for $3,295,000 seems a little low for a home that is 3,627 square feet. Although anything over $3,000,000 is a lot of money, using a price per square feet of $1,000 is a good rough barometer in this neighborhood. Can you guess what Redfin's estimate is?

Redfin estimates the home is worth $3,502,272 or $497,724 less than what the home actually sold for. I'm guessing that Redfin's algorithm decided to lower the price per square foot given you tend to get better value per square foot the larger the home you buy up to a certain point.

Therefore, we can't fully frown upon Redfin's $3,502,276 or $965/square foot pricing estimate. That said, Redfin's price estimate is once again 14% off from the actual $4 million sales price.

Redfin has a full year's worth of home sales data since the lockdowns began in March 2020. If Redfin's data scientists had read any one of my articles since the pandemic began, it would know that real estate prices have been robust.

So what's really going on here? Redfin has to either admit that despite having so much data, its pricing estimates still aren't reliable. Or, Redfin is purposefully low-balling its pricing estimates in order to buy homes at a discount to market.

I've got endless more examples of bad pricing estimates, but I'll stop here.

How To Use Zillow And Redfin's Bad Pricing Estimates To Your Advantage

If you are a buyer in a competitive real estate environment, you've got to be preapproved for a mortgage, put together a fantastic offer, write a convincing letter, and hope for the best.

You may use Zillow or Redfin's pricing estimate to your advantage by highlighting it in your offer. For example, let's saying you were making an offer on house example #1 that sold for $3,425,000, but had a pricing estimate of $3,011,416.

You could offer $3,051,416, which would be a very enticing $50,000 over Redfin's pricing estimate. Although it's risky to bid $255,000 over the asking price, you and your real estate agent know the market well. You also know that Redfin is a competitor and is underestimating the price of the home you want to buy.

In your real estate love letter, you could explicitly highlight how you are offering $50,000 more than the Redfin estimate to make the seller feel great for choosing you. At the very least, the seller should keep you in contention in a multiple offer situation.

Of course, if the seller receives a $3,425,000 all-cash offer with a 15-day close, your chance of winning is slim. However, not all home buying situations will be as competitive.

Your goal is to estimate the true market value of a home and subtract it from the artificially low Redfin or Zillow estimate. This difference is your pot of gold or “instant equity.”

In a soft real estate market, you simply do the same but in reverse. Find homes where the Zillow and Redfin estimates are much lower than the actual market price. Then offer a price better than the artificially low Zillow or Redfin estimate and capture that economic spread.

You can even getting into contract with contingencies. If you do, buying the home will feel like you got a free call option.

Always Do Your Due Diligence

Hopefully, none of us are naive enough to take Zillow and Redfin's pricing estimates as gospel. However, I bet there are people out there who do. After all, both firms have been around for over 15 years.

Now that Zillow and Redfin are our competitors, we must use some of their pricing estimates to our advantage. As always, bargain hard and run the numbers over and over again before any transaction!

Invest In Real Estate Passively

Real estate is my favorite way to achieving financial freedom. It is a tangible asset that is less volatile, provides utility, and generates income. Stocks are fine, but stock yields are low and stocks are much more volatile.

I believe we are in a real estate super-cycle thanks to positive demographic trends. Further, as interest rates come back down, the value of rental income and real estate in general goes up. During times of uncertainty and chaos, real estate becomes one of the best asset classes due to its stability and income-generation abilities.

To invest in real estate passively, check out Fundrise, my favorite private real estate platform. With an investment minimum of only $10, it is easy to dollar-cost average into private real estate. Fundrise has been around since 2012 and manages about $3 billion for over 350,000 investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

I've invested $300,000 in Fundrise so far to diversify and earn more passive income. My goal is to diversify my expensive SF real estate holdings and earn more 100% passive income. I plan to continue dollar-cost investing into private real estate for the next decade.

Fundrise is a long-time sponsor of Financial Samurai as are investment philosophies are highly aligned.

A Discussion With Ben Miller, CEO of Fundrise About His Real Estate Outlook

Here's a podcast episode I did with the CEO and co-founder of Fundrise about getting past the bottom of the real estate cycle with brighter days ahead.

Use Bad Pricing Estimates By Zillow And Redfin is a Financial Samurai original post. The real estate market is now in transition from big price increases and aggressive Fed rate hikes to the start of rate cuts. Always be vigilant when buying property.

Given this article talks to Zillow and Redfin having inside information. What do you make of Zillow’s recent announcement of pulling out of the market of buying houses. Claiming to my dismay the following.

1. They overpaid for 3/4 of the homes they purchased

2. They can’t predict 6 months out on pricing changes. (This I think is a interesting point that I am really surprised they disclosed)

My conclusion is that at the very least Zillow has torpedoed their own value in providing estimate values on real estate and big picture they may have put FUD on the other sites that provide the same service.

Look forward to your follow up to this.

I have an investment property in Atlanta (tri-plex) walking distance to Emory University. This past March I refinanced from a 5.375% 30 year to a 3.5% 30 year. The Home Comparison Appraisal Approach came in at 775K and the Investment Appraisal Approach came in at 890K. Zillow, over the past 6 to 7 months has the “zestimate” at 502K. Talk about a discrepancy. It’s quite odd as the properties used as comparison when appraised in March, have actually increased in value.

So true that Zillow wants to influence and control home market values. Zillow, owned by Microsoft big buck players, power addicted junkies who control market values to be low then ask people if they would like to sell their suppressed valued home to….guess…..Zillow! Ethical criminals.

San Francisco is really not the place to evaluate facts driven estimate models. The average age of housing is quite old, but there is huge variation in the quality of upkeep for these houses built in the 20s, 30s, and post WW2. Some have the original electrical! Lots still have knob and tube, and some have been refurbed to modern wiring. Redfin doesn’t know that. Nor does it know the condition/age of the roof or furnace, or even the paint job. More modern builds in the 21st can be built to contractor grade, or to the 9s at Architectural Digest specs. And I’m sure, Sam, you’ve seen the wide and hilarious range of quality for garage conversions of unwarranted space. Unpermitted work can be to code, just wanting to avoid the misery of the DBI, or it can be 7′ tall with uneven floors.

If all you know is the original age of the property, the square footage, the bedroom and bathroom count, you’re not going to be able to reliably hit to < 10%, or even 50%. They can attempt to estimate the market demand based on listings, time to sell, number of clicks, though they're trailing the trend. But that's distorted by the wide range in underpricing strategies. They also don't know which properties are creampuffs, completely turnkey. That commands quite a premium in SF – people don't want to deal with the hassle to legally (or not) redo rooms like the bathroom or the kitchen. At best, this is a 2-3 month inconvenience, and in the worst, can be years.

Redfin seems particularly sensitive to interest rate moves, esp when there are limited comps. What I don't care for is that they revise the entire price history- what they said in January last year should be static, not raised or lowered based on how they read it this year in June. Zillow takes the coward's route and gives multiple ranges.

In our market, a good agent and/or contractor type (or that knowledge) can tell you what a property is reasonably worth, but that still won't necessarily tell you what people will or will not bid. I'm ok losing out to unreasonable bidders.

My recent purchase in West Portal involved bidding lower than I otherwise would have because we researched the big lien the selling agent blew off as a silly misunderstanding and confirmed that the seller owed her daughter well over a million bucks for not giving her the inheritance her father intended. She could not be one of the SF sellers with a lofty target that just chooses to delist and try again next year. We dropped the bid 65k as a result. If I had listened to my agent, would have gone down another 60, but my wife was rather attached to the property and I thought that offer might not even get a counter.

“ What I don’t care for is that they revise the entire price history- what they said in January last year should be static, not raised or lowered based on how they read it this year in June. Zillow takes the coward’s route and gives multiple ranges.”

So Redfin and Zillow don’t look bad. Revisionist history.

So what happened to your West Portal bid?

Data is everything nowadays. Hard to believe that companies that have been around that long don’t have good analytics. I think you’re onto something.

Redfin is finally upgrading some of their home values and showing an upward swing in the pricing graphs. They are still about 10 months late.

Hey Sam thanks for all the great articles. I would love your input. I am in my late twenties and I am saving up for a house but instead of leaving my cash portion of my invest in a savings account what do you think about leaving it in Verizon? Verizon is obviously an extremely steady business paying out a 4% dividend yield (3% after – tax). Why not leave cash in a utlity like stock like Verizon instead of collecting 0% and losing money with inflation?

Depends on your timeline. Yes, Verizon is a low volatility steady dividend payer. I own AT&T for the yield, which is crushing tech stocks recently!

Check out this post for more: https://www.financialsamurai.com/how-to-invest-your-down-payment-if-youre-planning-to-buy-a-house/

In general, if you Google a question and add Financial Samurai at the end, a post on the topic should come up.

Here’s my newsletter as well.

Our home is on the market right now. The Zillow estimate has been volatile lately, but still pretty high. We listed $10k under ($475k) the Zillow estimate considering the condition of the home. One of those “cash for homes” companies gave us an offer equal to the Zillow estimate, inspection and appraisal waived, but they have a 3% “fee” reducing our net by $14k. (There’s also a representing buyer’s agent that requires 2% commission as well, so there’s no savings there.)

All in, it’s effectively a lowball offer. Thankfully, we got another above-asking price offer from real humans the same weekend.

Ah, always the secret fee they don’t make clear up front. Good to know! So 3% + 2% = 5%, which is still the standard commission.

But you know these firms are trying to lowball to make a bigger profit.

I am in Colorado. We sold our primary residence last October. Zillow had our value at about 10% LOWER than what we sold the home for (we actually ended up with 3 full price offers on our home 3 different times in the span of weeks, but that’s another story). I solicited the assistance of a realtor/friend to help negotiate the purchase of the home we bought, and list/sell our previous residence.

During the listing process, I questioned his ask price. It seemed high due to my research (Zillow, comps, etc) I’m extremely appreciative that I let him “drive” with our offers on the new home, which we managed a 3% discount and the sell of our listed home, 10% HIGHER than Zillow, along with my love letter to our sellers home and 30/30/3 rule, we scored a very nice home, in an exclusive community that we LOVE!

I will always use a realtor. This same guy, helped get me into my rentals a decade earlier. Today, those rentals pay my house payments.

Very good! Glad Zillow didn’t hurt your final sales prices as the market dictated the price with 3 full offers. A great rental agent can definitely help get top dollar, even though the cost to sell is high.

Where will you go now and what will you do with your proceeds?

You left out additional “price estimation tools” that are available on realtor.com (see Home Value section of a listing) — Quantarium, Collateral Analytics and CoreLogic. These estimate providers specialize in analytics, modeling only — and hence don’t share the same biases as Redfin or Zillow (this doesn’t necessarily make them better or more accurate).

Thanks for including. However, you gotta pay for those right? Redfin and Zillow will win on marketshare for online pricing b/c they are free.

Great post Sam. I’ve been thinking about the same thing and I couldn’t agree more!

I wonder how much Redfin is keyed off the assessed value. I live in Washington DC and I would tell you the assesed value can be 20-60% off the market value. I bought our house 2 years ago for 1.9m and gutted it putting in another 800k (modern architect). Wells Fargo appraised it for 2.8 for our HELOC. DC assessed value is 1.85. Redfin value is 1.9 (2 years later with houses down the street going for 250K over asking in this crazy market).

20% – 60% off is huge, and embarrassing if so.

Try and use the lower online assessment to your advantage in terms of property taxes.

Ibuying will take the fat out of real estate and ultimately make housing affordable. Every time a homeowner goes to sell, they have to account for the 6% agent commissions and other fees in a real estate transaction. Inflating the price of a home by 6% for commissions that bring no value to the home owner is insane. But people pay it over and over. Ibuying will eliminate this fat and only sell the home. Not sell the home and buy the agents a BMW in the process. OpenDoor is the future.

Agents making huge commissions is like paying $9.99 per trade at a brokerage. It’s going to be gone soon in favor of a flat fee.

Technology compresses prices and keeps inflation in check. That is one of the benefits of Amazon’s success and other online retailers.

Hopefully. But Zillow started in 2006 and has done next to nothing in lowering commission rates since. Why? Because its main source of revenue comes from real estate agent advertising and lead generation. Therefore, it can’t or won’t try to hurt their main customer’s business.

Redfin has done a much better job in pressuring selling rates down, which is another reason why I prefer Redfin.

Expect Zillow and Redfin to rationally try and capture any agent commission costs for themselves by offering prices below market to purchase.

A reminder to all sellers. Commissions are negotiable and w/such low inventory and so many agents I use it to my advantage. When I list any of my flips or rentals in this current sellers market that’s what I do when a buyers agent comes in w/any offer. With offers exceeding list price With so many buyers and no inventory what buyers agent won’t take a point to a point and a half off. Either they make a sale and look great in front of their client or not. Let’s be honest, in this market agents aren’t doing any extra marketing. Some pictures, for sale sign and upload on MLS.

A good reminder! Always negotiate the fee.

Can you name another sales job with commission rates under 10%? Listing, then marketing, and then selling, and THEN closing a property sale is A LOT of work. Not least is the VALUE of my network of buyers. ALLL for less, often far less, than 6% because that 6% or whatever it may be is often split with another agent, bringing it down to 3%. What other sales job pays as low while requiring SO MUCH WORK?? Re-evaluate your stance.

I agree, depending on the price of the home and the market, it definitely is a lot of work. But for higher-priced homes, I don’t think it should be a flat out 5% commission. The percentage should decline as the price of the home increases.

I respectfully disagree – my list of contacts is worth the money. As well, the costs of marketing increase depending on the value of the home and come out of that commission. I understand how in a market like San Francisco where nearly everyone is buying multi-million dollar homes it may seem like the commission is exceptional but across all markets I assure you it is commensurate with the cost of living and doing the job. Even in a hot market like San Francisco. There is a lot of competition and until this boom one works very hard indeed to sell even one house per month. I live in the PNW and our market is hot right now as well but it certainly has not always been so. And the sheer volume of competition – their are SO many realtors out there competing for the same sales. We earn our income is all I’m saying.

Yes, like in most situations, competition is fierce.

It’s great to be the listing agent in such a situation.

Things are also rational. If you have enough business at the current commission structure then great. And if one isn’t, lowering the commission may spur more business (for trying to get a listing) etc.

I do think there would be more sales volume / inventory if commissions were lower.

A commission point is not the deciding factor when purchasing a house. It will have very little influence overall but again – I love even having this conversation and I thank you.

Also, how different are the profits realized by investors who are flipping houses or simply buying and selling wisely? Should profits on high-end properties be capped as well? I think not. I read your site because I aim to pivot into property investment for the long haul – and I expect to profit. Thank you for the conversation and the insights you offer – I respect and rely on your perspective as I learn and grow my business and investments.

A lot of people out there including myself believe realtors make too much commission on a sale. It discourages people from selling, which is bad. Redfin is trying to change that even further this year, and kudos to them. My suggestion is that realtors’ commisions should be a fixed fee dependent on the county and 1% of the sales price on top of the fixed fee. The goal of that is to make the realtors representing the very high end areas of a county make a lot less on a sale while not disrupting the realtors’ earnings on the lower end properties.

Anyone who resents paying rock bottom sales commission in comparison to any other legitimate service professional who works for commission is literally ridiculous. If Redfin is indeed “doing something about it” it is merely so that they can undercut the industry by taking over sales themselves. And if you think they will give you top dollar you’d be wrong. You pay an agent commission because they will get you the most money possible for your property.

You will lose more money allowing Redfin or any other bulk buyer to buy your property than you will pay an agent for WORKING to make you money.

TB12

Good morning

My wife and I used a service called Help u sell.

It saved us nearly $10-15,000.00 on the closing costs.

The agents unanimously will show the house but discourage their clients from it!

However in a Hot market there will eventually be a buyer who will purchase.

It just takes a little more time to sell because you are literally working against the entire Real Estate Agent network in your community.

Sales people and Recruiting agents by nature are required to speak out of both sides of their mouths in order to get the highest commission for themselves.

In a hot market they do very little work because they are continuously writing contracts as the homes are selling so fast.

Maybe Sam should promote the individual Sales companies to his readers so they can increase their RE properties profit margins by removing at least one agent fee.

I think we still paid the buyers agent fees?

Regards

Chris

Sam – you seem really bullish on SF real estate however as a fellow Bay Area dweller I’ve noticed condo prices and home prices generally falling since 2018 and currently barely above 2016 prices.

Also there are lots of articles about out migration from the Bay and from SF. SF school districts are increasing hostile to children.

I have noticed that the price of homes in more affordable areas and suburbs increasing but I don’t know if I would lump SF in with that. Maybe over the next few years while we recover from COVID but not now.

Happy to be proven wrong. Or maybe in the 2.5-3m+ range things are looking good?

The median single family home price is now around $1.95 million, a record. Further, I’ve tracked a lot of homes for sale during the pandemic. They’ve all moved up on average 10% since early 2020.

There are so many examples, I stopped tracking in May. But they just keep on coming.

See for yourself: https://www.financialsamurai.com/real-estate-outperformance-examples-during-a-coronavirus-pandemic/

Big city living is making a huge comeback. SF his the highest or second highest vaccination rate in America and people feel safe here. As a result, businesses are growing again.

At the same time, I’ve also invested heavily in the heartland of America to diversify.

Let’s see… according to Redfin my house is worth 12% more than what local comps (and my own estimate) claim. According to Zillow, it’s 18% higher. Maybe it’s an SF thing?

Perhaps it’s time to sell and utilize their high estimates to make you a bigger profit?

Bad pricing estimates go both ways.

I think in his bullishness on SF real estate, Sam is simply overlooking the possible difference between price and value. Assets have intrinsic value but the market regularly overprices assets. I am sure he would not buy Tesla at nearly $900 per share, but somebody absolutely did. With the amount of easy wealth creation in the last 12 months, especially from tech companies based in NorCal, I’m surprised he continues to use SF as an example for anything other than a distorted RE market.

I use San Francisco because that is the market that I know best given I live here. But if you check out other cities, single-family home demand is quite robust. Where do you live and do you own or rent? It would be great if you can share some insights from where you are.

When tens of thousands of people have seen their company stock or investment portfolio grow by 20% to over 40% in 2020, you better believe that a lot of money will be going into SF real estate over next several years.

But everything is rational. And if people want to rent, that’s great too.

I get that you know the SF real estate market best, but gleaning insights from one city that has unique trends obviously has it’s downsides. To answer your question, I live in West Los Angeles, and I own a home, own/operate a handful of websites (totaling about 5M in visits/mo in profitable niches like personal finance), and am in my early 30s. I also have a background in investment banking, although I didn’t make it all the way to New York or Goldman Sachs. I couldn’t deal with the culture so I went the entrepreneurial route very young.

Yes, single-family home demand is robust. It was also irrationally robust in 2004, 2005, 2006, and 2007. I would also say that everything is not rational. Naturally, most people don’t think they are making stupid decisions in the moment and all people think they are making the best/right decision, but we obviously know that the reality is quite different.

In fact, I would say the average consumer is irrational. I’m sure it’s been awhile, but have you had a conversation with the average American? Maybe you don’t experience or see it much, but how many consumers do you know complain about not having money or not being able to get ahead, but have the newest iPhone, eat out regularly, have expensive cars (relative to their incomes), etc. I imagine you’ve noticed irrational or even biased thinking among your successful and highly intelligent friend/network. What people state as principles versus how they act or what they do are often at odds.

Anyway, this is neither here nor there. The point is, few company stock have gone up as much as tech stocks have, especially in the last few years. Also, tech companies tend to reward all their employees with stock upon employment and regularly at every review. What percentage of JPM, H&J, Walmart, or Verizon employees do you think actually own meaningful stock? If you know the saying “easy come, easy go”, that should explain the overbidding you see in the SF market. Unfortunately, both the Federal Reserve and the federal government have continued to support these inflated asset prices. In a country where we tout “free markets” and “capitalism” like it’s the backbone of this country, we really don’t have either. We have socialism for large corporations and capitalism for the little guy. We have market intervention every month (with the Federal Reserve buying billions in mortgage-backed securities and trillions in other aid to the financial system). These prices are not indications of value or utility, but simply an example of a manipulated system that continues to encourage aggressive buying/investment. It is for this reason that, as you’ve mentioned in the past, every man/woman who has made a few thousand dollars in the stock market thinks himself/herself a day trading genius.

Long story short, this is a manipulated “market” that won’t end well. Fortunately, this country is so wealthy that it takes a long time for the cracks to really bring down the house. But can you imagine…the Fed’s balance sheet was less than 1T in 2008, prior to the Great Recession. Now it is close to 10T. The national debt is over 100% of our GDP and we both know all this spending is not going to result in a 24T GDP in the next few years. Any rational American would be thinking: I need to make and save as much money as possible before this party ends, because when it does, there is no saving this country.

Thanks for sharing your thoughts. It’s always good to be cautious. And I do have my 30/30/3 home buying rule people should follow.

I’m excited about the 30 to 39-year-old cohort that will be buying homes for the next 10 years. The demographic trend is pretty strong.

Hopefully, readers can focus on the main point of this post: to use bad pricing estimates to ones advantage and capture the difference in true market value as economic profits.

“When was the last time I spoke to a normal American?” I’m speaking to you right now. Unless you think you’re abnormal?

Like you, there are so many Americans in their early 30s who own multiple properties, own stocks, etc and are doing well, especially after a great 2020 with the NASAQ up 40%+ and the S&P 500 up 18% or so.

Some made it on their own. Some made it with the help from the bank of mom and dad. Either way, they made it.

With your bearish view, have you been selling some of your assets or plan to sell soon? And do you believe you are unique in your financial situation?

Since I started this website in 2009, I’ve noticed many people say they are doing well, but then say that other people are not doing well. Perhaps we are a greater portion of “other people” than we realize.

TheRealist!

Seriously you stole the best moniker reference I imagine for myself in my beliefs!

Regardless of your theft of my own imagination, I must say Wow!

This is so far the single best post I have read as of yet on the Financial Samurai site!

Semper Fidelis for America!

Love your reference to the exuberance of 2004-2007!

I sold 2 homes in 2 years and cleared $350,000+ due to frenzied buyers!

One is currently appraised by Zillow at -35,000 below the sale price I received in 2006.

The other last sold at -$34,000 (In 2017) below the sale price I received in 2004.

However, Zillow currently has it appraised at $78,000+ and Redfin has it appraised at $60,000+ over my 2004 sale price which is approximately ($95,000-113,000 above the current owners purchase price)

Chris

I’m 31. At the beginning of 2020, I had $350,000 worth of company stock. It grew by 3X. I have at least 1,000 colleagues with an equal amount if not much more. Then I’ve got my house and other assets.

There is a lot of wealth out there that was made last year. I wouldn’t underestimate it.

Would you say that is a normal occurrence? Tripling your net worth in a year is a sign of an unhealthy or manipulated market. No one is underestimating the amount of wealth created in the last 12 months. Don’t forget, I live in West Los Angeles, which is among the wealthiest parts, so I see immense wealth all around me. My point is to highlight that this type of wealth creation is unhealthy for a society and is not sustainable. At some point, much of this paper wealth will disappear.

TheRealist!

“Roaring 20’s”

The once in a hundred years financial crises (Storm) is coming due in “2029”!

America needs to Hunker down!

I really enjoy your perspective on these discussions.

Chris

Thanks for this article. Any thoughts on the accuracy of their rent estimates?

i would expect them to be a lot closer to the mark on rents, because that is really about usable space and bedroom count and the location relative to work or school. Those facts are fairly accurately known. They don’t care that the roof needs to be redone in 5 years, and will only pay so much more for a redone bathroom versus the one from the 80s. Those sort of intantables matter a lot to someone who is going to own it for the long haul.

Dang. Heading to Zillow now to take a look at my houses profile. I had no idea assessors are using Zillow/Redfin for guidance!!

Awesome article, Sam! As a 27 y.o. aspiring first time home buyer in Southern California who peruses RF & Zillow daily, but lacks the context of translating online marketplaces to real world home transactions, this was very useful perspective. Thanks.

Oh wow I had no idea Zillow and Redfin are getting into the real estate buying business. That sounds nuts. I can see the benefits for them, but that doesn’t sound good for homeowners at all. Hopefully anyone considering selling to them will find your post before pulling the trigger!

Just had an appraisal to drop PMI. According to Zillow our house was estimated $410-430k. Redfin $395k.

Appraisal came back 396k FWIW

Redfin is WAYY behind where prices are at in here in Charlotte area in the last three months, at least 10% behind or more. Zillow is more varied, with some over and some under but more underpriced, especially on the low end. I have used both of their estimates, as well as realtor.com estimate, and recent transactions in the last 2-3 months in the same neighborhood (and sometimes nearby neighborhoods if similar age/size/quality). Right now, nearly everything is closing well over all 3 of those sites for any house under $600k.