If you don't want to own physical real estate, you can still invest in real estate by buying public REITs, private REITs, homebuilding stocks, and Home Depot. This way, you still get to benefit from the housing market boom, but not have to deal with any maintenance or tenant issues.

Post-pandemic, I do recommend people invest in real estate to ride the inflation wave. With interest rates continuing to stay low and people and corporations starting to spend again, real estate should do well for years to come.

Invest In Real Estate For The Long Term

Real estate is my favorite asset class to build long term wealth. Not only can you borrow other people's money at a low rate to control 100% of an asset, you get to rent out that asset to pay down other people's money! If you happen to own in superstar cities such as New York City, Los Angeles, San Diego, Seattle, Portland, Denver, Colorado Springs, or San Francisco, you've seen tremendous growth over the decades.

Historically, US property values have risen by 3.5% per year, and certain geographical regions (take San Francisco) have risen at double the pace in recent years. However, closing costs (2-5% of a property’s value), the ongoing cost of ownership and the opportunity cost all combined with the commitment and headache involved have caused many to look for other ways to invest in real estate.

As an asset class, real estate investing often behaves independently of the stock market. This means it can provide diversification to most portfolios. Real estate also tends to deliver above average returns.

Fortunately, the fintech world has opened up a multitude of ways to invest in real estate without having to be a homeowner. These methods have made real estate investing possible for a new generation that doesn’t want the added headache of owning and maintaining a property.

Here are five common ways for investors to invest in real estate opportunities without having to own the physical real estate.

See: Being A Landlord Tests My Faith In Humanity

Invest In REITs

Real Estate Investment Trusts, or REITs, are companies that own real estate (commercial or residential) and allow investors to buy and sell shares of the REIT, allowing the trust to pay dividends while continuing to earn value.

Depending on their structure, they can be publicly traded or held privately, usually in the form of equity, and not debt. They usually include a large pool of cash-generating properties, with the total value in the high millions or billions.

REITs may be good options for hands-off investors, but if you’re looking to customize your portfolio or dislike some of the holdings of a REIT, there are few opportunities to customize those holdings.

See: Fundrise eREIT Review: Real Estate Crowdfunding For Non-Accredited Investors

Private Equity Real Estate Funds

Private Equity (PE) Funds pool capital from institutional and ultra high net worth investors in order to invest in an asset class (they can include oil, gas, or other alternatives, but often consist of real estate portfolios). This kind of fund is usually run by a management team, allowing investors to participate in the security of having their funds managed professionally.

Many enjoy the extra security of having someone work for them, especially when they’re a real estate expert with a proven track record. But there can be serious trade-offs: PE Funds often require high minimums ($250,000+) and their offerings frequently have long durations of 10+ years, which effectively locks up investors’ money for that period of time.

Invest In Real Estate Directly As A Minority Investor

Any investor can directly invest in a property and avoid the high fees associated with Private Equity Funds and REITs. While this method cuts out the middleman, investors are on their own to find, secure, and vet an opportunity. This is akin to lending money to a family member; it requires a lot of work and has the least guaranteed.

While it can generate a large yield, many investors opt for a more casual, passive return even if it means sacrificing a little yield. For more casual investors who are looking for passive opportunities, this often ends up being more work than expected.

Real estate syndication deals should continue to grow.

Real Estate Crowdfunding

Real Estate Crowdfunding involves many investors raising funds for an individual property or a portfolio in order to participate in deals that they normally wouldn’t have the individual capital to get into. In the past, an individual investor would not be able to gain access because the required minimum was much too high, or the project would be invite only.

Fundrise based in Washington DC, is one of the leaders in the space. Fundrise makes it easy to invest in real estate by offering diversified eREITs. An eREIT is a private real estate fund that invests in dozens, if not hundreds of real estate opportunities. For most people, investing in an eREIT is likely the best way to gain real estate exposure.

For those of you who are accredited, you can buy individual real estate crowdfunding deals through CrowdStreet. CrowdStreet is focuses on real estate opportunities in 18-hour cities. 18-hour cities tend to have lower valuations and higher cap rates. The work from trend is real. As a result, it has accelerated the demographic shift towards lower-cost areas of the country.

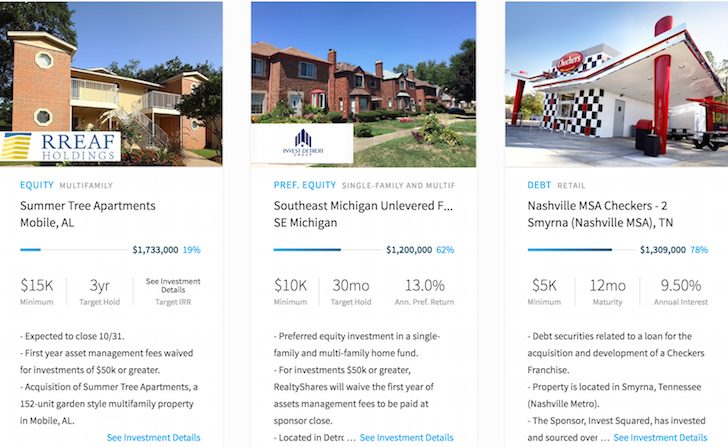

Three Main Real Estate Investment Categories

1) Single family residential property. Target 9% – 11% annual return. You are the senior debt holder (first position on lien). The investment duration is usually 6 – 24 months and income usually paid out monthly. This product is considered their least risky investment for investors and has been around since the beginning. Roughly 40% – 45% of total investments on the platform are in this category.

2) Preferred Equity/Mezzanine debt. Target 12% – 14% annual return. You provide bridge loan for sponsors and are a lower position in the capital stack. The investment period is usually 2 -3 years. Investments are mostly in commercial property. Roughly 20% – 25% of total investments on the platform are in this category. This is where I will probably focus most of my investments since I already own single family residences.

3) Joint venture equity. Target 10% – 16% annual return. You are an equity owner alongside the sponsor and take part in profits once preferred returns are hit. Typical duration is 5 years, but can be as short as 3 years. Income is usually paid quarterly once the deal is closed. This category accounts for roughly 25% – 30% of all investments.

Investing In Heartland Real Estate

I've personally invested over $500,000 in real estate crowdfunding to gain exposure to the heartland of America where real estate valuations are cheaper, and rental yields are much higher compared to coastal city real estate.

There are no guaranteed returns, but I like that Fundrise aggressively screens all their deals so that only 5% of the potential deals make it onto their platform.

Real estate crowdfunding through a company like Fundrise is my favorite way to diversify my real estate exposure, earn passive income, and focus on a specific region of the country.

About the Author:

Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at two of the leading financial service firms in the world. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $200,000 a year in passive income. He spends time playing tennis, hanging out with family, consulting for leading fintech companies and writing online to help others achieve financial freedom.

FinancialSamurai.com was started in 2009 and is one of the most trusted personal finance sites today with over 1.5 million pageviews a month. Financial Samurai has been featured in top publications such as the LA Times, The Chicago Tribune, Bloomberg and The Wall Street Journal.